3 minutes a day

Accompany you to make money in Hong Kong stock market!

Hello, everyone, I am the representative of Niuniu class!

Today is the 10th lecture of a series of courses "20 lectures on Hong Kong Stock Investment"!

Niu friends, please pick up the small bench and come to class together.

This section gives you the common concepts in Hong Kong stock trading: rights issue, rights issue, dividend, ADR, EDR, SDR and so on.

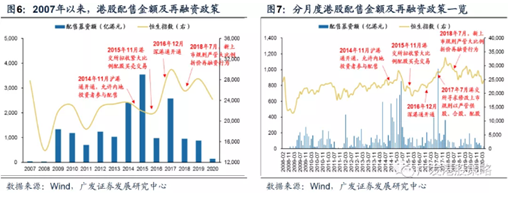

This year, the refinancing of Hong Kong stocks has once again attracted market attention.

At the industry level, the traditional optional consumption, finance, real estate, industry and other industries have more times of refinancing for the industries with higher capital demand. The placement of real estate and property listed companies is the most concentrated.

CITIC also made a statistic that as of June 19, 163Hong Kong-listed companies had initiated a total of 181times of refinancing, and 25 listed companies with a market capitalization of more than HK $10 billion were in the process of refinancing. More than 80% of the leading companies choose to refinance through placement, and they are generally public placement.

So, what does a rights issue mean?

I. what is a rights issue

In fact, the "rights issue" of the Hong Kong stock market is roughly similar to the "private placement" of A shares, that is, the issuance of new shares to specific investors.Unlike the complicated examination and approval process of A-share subscription, the rights issue process of Hong Kong shares is more flexible, so it is also more common.

The allotment of shares in the Hong Kong stock market can be divided into two types: the old and the new, and can also be mixed.

Matching the old is actually a targeted reduction of holdings by major shareholders and does not increase the number of shares in the company.

Allotment of new shares is issued by the company, the number of shares increases, after the rights issue will appear dilution effect.

What is more commonly used is the combination fist-the old and then the new rights issue.

Give me a chestnut!

$Kaisa beautiful (02168.HK) $The most recent rights issue is based on the old-to-new model:The major shareholder first sells the stock, and then the company issues new shares to the major shareholder.

The benefits are as follows:Through the old-to-new issuance mode, the allotment can be listed and traded on the same day when the shares are acquired. In fact, there is no lock-up period.

Similarly, the rights issue can be divided into the high rights issue and the low rights issue, and the high rights issue often leads to a sharp fall in the stock price.

For example, at the beginning of this year$Hong Kong Television (01137.HK) $、$net Dragon (00777.HK) $All raise money through the placement of shares at a discount from the old to the new, which has led to a sharp fall in share prices.

II. What is a rights issue

"rights issue" is one of the most commonly used fund-raising methods for listed companies, and the object of fund-raising is for all shareholders.Rights issue refers to the purchase of a corresponding number of shares according to the number of equity positions in accordance with the rights issue price.

With the recently announced rights issueCathay Pacific Airways (00293.HK) $For example, according to the company announcement, 2503355631 rights issue shares were issued at the subscription price of HK $4.68 on the basis of 7 rights issue shares for every 11 existing shares held on the rights issue record date, with a total fund-raising amount of about HK $11.7 billion.

But it's worth noting thatUsually, listed companies will issue shares at a discount, and then the stock price is bound to adjust downwards.

In detail!

If the listed company currently has 100 million shares in issue, the current share price (the closing price before the exclusion date) is HK $1 per share. The company announced an one-to-10 plan, with a "offering share price" of only HK $0.1, or a 90% discount on new shares, with a fund-raising target of HK $100 million.

Assuming that all shareholders participate in the rights issue, the shares of the company will change from 100 million shares to 1.1 billion shares (100 million old shares + 1 billion new rights issue shares) after the deregulation date. In theory, the share price should be HK $0.182 after the exclusion, down 82 per cent from HK $1 before the exclusion.

Of course, the biggest fear is that if shareholders do nothing, the stock on hand will depreciate immediately.

Existing shareholders are not willing to participate in the "rights issue", so it is best to sell the shares or sell the "rights issue" as soon as possible.Otherwise, once the deregulation day is over, you will have to watch your share price change from HK $1 to HK $0.182.

In addition, when it comes to rights issues, it is easy to think of partnership shares.Once upon a time, there was no lack of companies to confuse small shareholders by constantly partnering and "rights issue".Everyone needs to be more vigilant.

What is a dividend

April 1 this year$HSBC Holdings PLC (00005.HK) $The surprise announcement, at the request of UK regulators, announced that dividends would be cancelled in the fourth quarter of 2019 and the first three quarters of 2020, while promising not to carry out any share buybacks this year.

Considering that the company did not cancel the dividend payout during the 2008 "financial tsunami", HSBC Holdings PLC's move once spread pessimism in the market, especially the psychological impact on some Hong Kong local investors who "retire with shares". For a long time, the belief in "buying shares to earn interest" collapsed.

So what is the dividend?

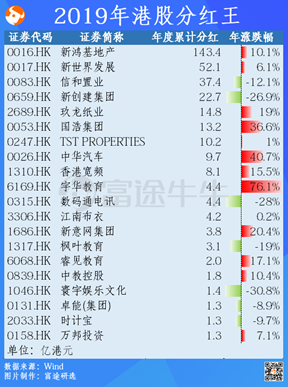

A dividend is defined as the interest on a stockRefers to the income paid to shareholders according to the dividend rate in the after-tax profits of listed companies. Sun Hung Kai Properties's cumulative annual dividend in 2019 was as high as HK $14.34 billion, making him the king of Hong Kong stock dividends that year.

In fact, there are two main kinds of returns on stock investment: earning dividends and capital gains.

Capital gains are earned by the income difference between the selling price and the purchase price, and the way to earn dividends is to hold them for a long time and wait for the company to pay dividends.

What is ADR, EDR, SDR...

DR (Depositary receipts) refers to negotiable receipts issued and circulated in a country's securities market on behalf of foreign companies (depositary receipt issuers).Each depositary receipt represents a certain number of underlying securities issued by foreign companies.

Depositary receipts have different names depending on where they are issued or traded, including ADR (American depositary receipts), EDR (European depositary receipts), SDR (Singapore depositary receipts), GDR (global depositary receipts) and so on. The depositary receipts issued in the Chinese mainland market are referred to as CDR for short.

ADR is a depositary receipt issued by an overseas company to American investors and traded on the American securities market.

More well-known ADR such as$Tencent (ADR) (TCEHY.US) $。

With Tencent ADR, investors can invest Tencent in the US stock market even if they do not have a Hong Kong stock account.. However, Tencent ADR prices and Hong Kong stock prices are not exactly the same, which is mainly due to liquidity, exchange rate fluctuations and other factors.

In addition, Tencent ADR is actually more "instructive" in some times.

Tencent's financial results are usually announced after the Hong Kong stock market closes. The performance of Tencent ADR's stock price in the evening basically reflects the view of the capital market on the financial results.

For example, when Tencent released its Q1 financial report this year, its revenue and profit exceeded market expectations. That night, Tencent ADR opened up 5.6%, indicating the market's optimism about the results.

Chinese depositary receipt (CDR) has been very popular in recent years.After more than 400 days of waiting, Science and Technology Innovation Board's first CDR finally arrived!

On June 12 this year, XIAOMI Ecological chain Enterprise No. 9 Robot successfully passed Science and Technology Innovation Board's listing review and got a "ticket" to enter the registration process.

If registered successfully after that, it will become Science and Technology Innovation Board's first CDR and the first A-share company to issue CDR in history, which is of benchmarking significance in the domestic capital market.

As a matter of fact, Hong Kong stocks also have their own HDR, including Intel, Microsoft Corp, Cisco Systems, Applied Materials Inc and other large American technology companies. InvestorIt is possible to buy US stocks in Hong Kong stocks, but what we need to be wary of is that its trading volume is very small, and the degree of activity is far from that of US stocks.

That's all for today's sharing!

Welcome to the message area for interaction!

The class representative will select 8 participants in the discussion area and give 188 Niuniu points!

A review of "hand-in-hand teaching you to invest in Hong Kong stocks":

Understand the century-old changes of Hong Kong stocks in one article!

Hong Kong Exchanges and Clearing: connecting China and the World

3 minutes to understand the introductory trading guide for Hong Kong stocks

How to get the comprehensive information of a Hong Kong stock company

Understanding the Supervision system of Hong Kong stocks from the delisting case of "National Juice"

Before investing, let's talk about the main indexes and sectors of Hong Kong stocks.

Hong Kong stocks are so popular, come and take a look at the purchase process and skills.

Lecture 11 tomorrow, "what does it mean to buy Tencent in the north and increase the position of Meituan madly in the south?" "

Waiting for you!

Let's not part until we meet again!