This article is edited from GF Securities Co., LTD. 's "minimally invasive Medicine: high-value device leader, Innovation leads the Future"

Abstract: the domestic high-end medical device industry continues to be favored by the capital market. On March 12, Hillhouse Capital bought 49.986 million shares of minimally invasive medical treatment with an average share price of HK $13.51. what does minimally invasive medical treatment do?

1. Take off, domestic high-end medical equipment

Domestic high-end medical devices are developing rapidly, see the previous introduction of Futu Research and selection:Take off, domestic high-end medical equipment! Hillhouse has been laid out quietly.

According to the division of Medical equipment Research Institute, medical devices can be divided into four categories: high-value medical consumables, low-value medical consumables, medical equipment and in vitro diagnosis.

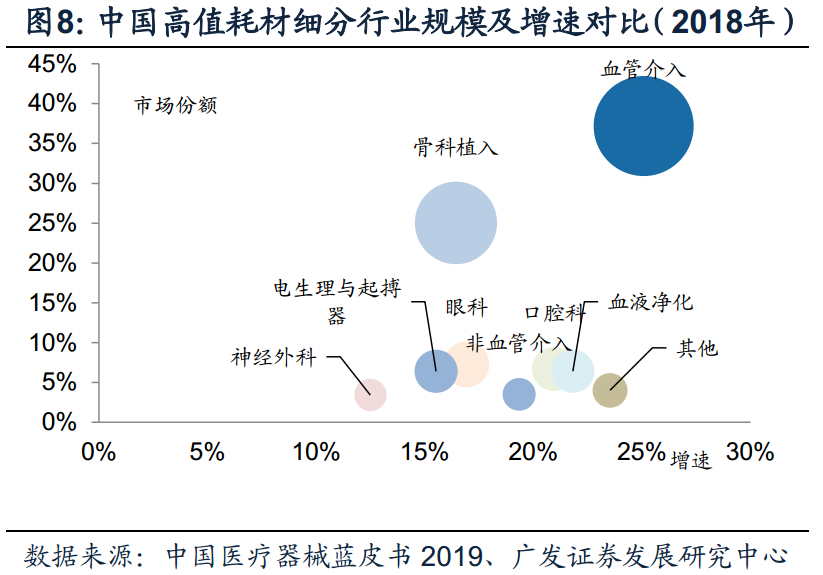

Judging from the scale and growth rate of the subdivision of high-value consumables in 2018The scale of vascular intervention in Chinese market is the largest and the growth rate is the fastest, followed by orthopedic implants.Pacing electrophysiology and other subdivision areas also have a growth rate of more than 15%, with a broad space for growth.

2. Minimally invasive medical treatment, high-value consumables faucet

Minimally invasive is a leader in the field of high-value medical devices. The three main business segments of minimally invasive medicine are: cardiovascular intervention products, orthopedic medical devices and heart rhythm management. The rest of the business includes large arteries and peripheral vascular intervention products, nerve intervention products and surgical medical devices, all of which account for less than 0.9% of the total minimally invasive medical revenue (according to the 2019 semi-annual report).

In the first half of 2019, the company's cardiovascular intervention, orthopaedics and heart rhythm management devices together contributed 89% of the revenue. The gross profit margin of orthopaedics is lower than that of cardiovascular devices, so the company's gross profit margin declined significantly in 2014, and then began to increase year by year and stabilize at more than 70%.

Cardiovascular aspectDue to the high incidence of cardiovascular disease and coronary heart disease, the number of cases of percutaneous coronary intervention (PCI) in China has increased steadily, and the CAGR from 2009 to 2018 is about 16.7%. Minimally invasive coronary stents have passed Firebird, Firebird2, Firehawk, FirehawkNova and other intergenerational products, and have always maintained a leading market position and steady growth. According to the amount of implantation, minimally invasive and Lepu remain the top two implants in China.

OrthopaedicsIn June 2013, minimally invasive announced the acquisition of WrightMedical's OrthoRecon joint reconstruction business for US $290 million (about HK $2.26 billion). The penetration rate of orthopedic implants in China is low, and the number of operations has maintained a steady growth due to the aging population and rising medical demand. The product line of minimally invasive orthopaedics is relatively complete, and the domestic orthopedic joint implant industry has a strong demand and strong growth rate. It is expected that minimally invasive orthopaedic business in China will maintain rapid growth in the future.

Heart rhythm managementCardiac rhythm management (CRM) includes general pacemaker (pacemaker), implantable internal automatic defibrillator (ICD) and three-chamber pacemaker (CRT). The global market is highly concentrated and oligopoly:

The top three from the United States are Medtronic PLC ($5.849 billion in 2019), Abbott Laboratories ($2.103 billion in 2017 for St. Joda's acquisition) and Boston Science ($1.939 billion in 2019).

Bailey and Sorin, from Europe, which had heart rate management sales of $249 million in 2016 and were acquired by minimally invasive in 2018, are in the second tier.It is worth mentioning that the acquisition of Sorin Group, micro-innovation and Jack Ma's Yunfeng fund jointly completed, micro-venture holding 75%, Yunfeng fund holding 25%.

3. Want to spin off the subsidiary company and go public independently.

On January 5, 2020, minimally invasive Medical announced that it was considering a possible spin-off of the company's non-wholly owned subsidiary, Mini Chuang Xintong, which currently holds 64.72% of the shares. ) listed separately. The heart valve business to be split this time may be included in other minimally invasive business segments (less than 0.9%).

In 2018, about 209.3 million patients worldwide had valvular heart disease, resulting in about 2.6 million annual deaths.Valvular heart disease is characterized by injuries or defects in one or more of the four heart valves (aortic, mitral, tricuspid, and pulmonary valves). A properly functioning valve ensures proper blood flow, but valvular heart disease can make the valve too narrow and hardened (aortic stenosis) to fully open or completely close (aortic regurgitation). Aortic valve stenosis is the narrowing of the aortic valve, which hinders the flow of blood from the left ventricle to the ascending aorta during systole.

China's artificial heart valve market is still monopolized by foreign companies, including Boston Science, Medtronic PLC, Edward Life Sciences, etc., accounting for more than 85%. However, with the rise of TAVR technology in the field of heart valve, Chinese local enterprises also usher in new opportunities.

TAVR (aortic valve replacement) transcatheter intervention of heart valve is the latest technique for the treatment of heart valve disease or defect. According to statistics, the final space of TAVR is 10-15 billion US dollars. Considering the repair / replacement of transcatheter mitral valve, tricuspid valve and pulmonary valve, it is estimated that the market space of transcatheter heart valve is more than 30 billion US dollars.

And in the TAVR market, or limited by access regulations, Edward, Medtronic PLC, Boke do not have related products listed in China. In China's high-value medical consumables market, TAVR is a rare "Pure Land" field without multinational companies.

The TVTCHICAGO Conference estimates that the global number of TAVR in 2025 will be close to 290000.

It can occupy the market before foreign-funded enterprises, which has greatly stimulated the innovation enthusiasm of domestic enterprises, and a number of technology-based domestic enterprises that rely on independent research and development have sprung up.

Among them, some products have been approved to go on the market.Qiming Medical, Jiecheng Medical and minimally invasive Xintong belong to the first echelon.The companies in the second echelon under clinical development include Peijia Medical, Lanfan Medical, etc., basically forming a 3N pattern.. If the listing of Micro Chuangchuangxintong is approved, it may arouse new enthusiasm in the market.

Approval of domestic interventional valve products

Edit / jasonzeng