Whales with a lot of money to spend have taken a noticeably bullish stance on Citigroup.

Looking at options history for Citigroup (NYSE:C) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 25% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $78,830 and 6, calls, for a total amount of $215,876.

From the overall spotted trades, 2 are puts, for a total amount of $78,830 and 6, calls, for a total amount of $215,876.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $65.0 to $72.5 for Citigroup over the last 3 months.

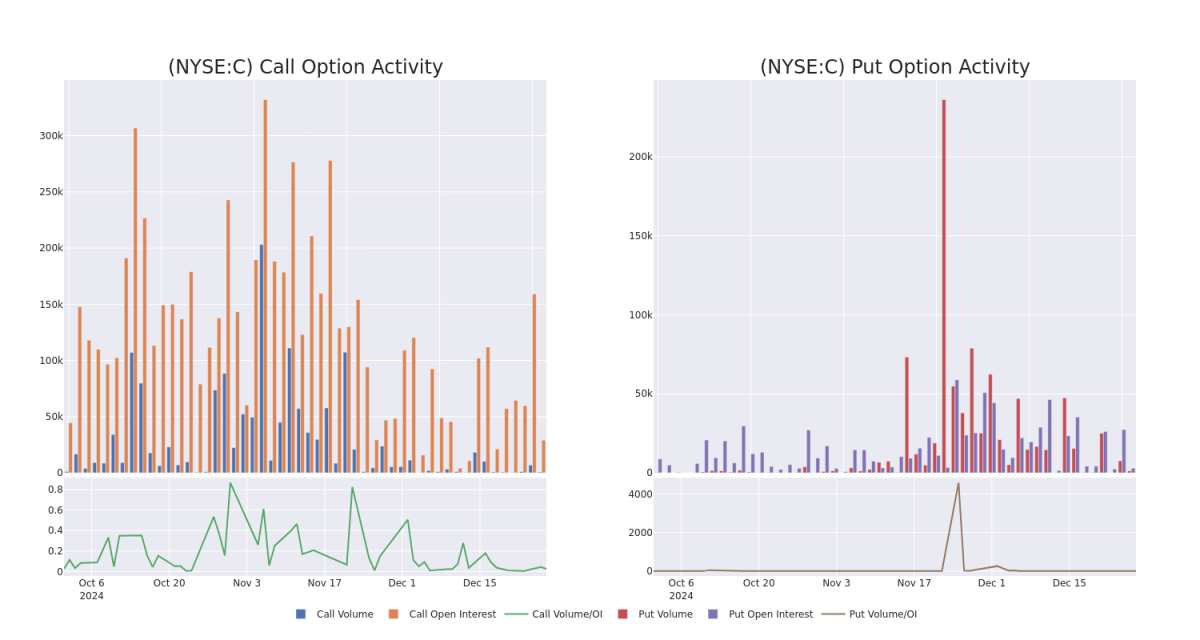

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Citigroup's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Citigroup's substantial trades, within a strike price spectrum from $65.0 to $72.5 over the preceding 30 days.

Citigroup Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | CALL | SWEEP | BULLISH | 03/21/25 | $3.05 | $3.0 | $3.05 | $72.50 | $44.8K | 9.6K | 0 |

| C | PUT | TRADE | NEUTRAL | 07/18/25 | $4.5 | $4.4 | $4.45 | $70.00 | $41.8K | 986 | 95 |

| C | CALL | TRADE | BULLISH | 04/17/25 | $3.85 | $3.75 | $3.81 | $72.50 | $38.1K | 2.5K | 201 |

| C | CALL | SWEEP | BULLISH | 01/03/25 | $6.55 | $6.45 | $6.5 | $65.00 | $37.0K | 77 | 57 |

| C | PUT | SWEEP | BEARISH | 12/27/24 | $0.38 | $0.35 | $0.38 | $71.00 | $37.0K | 1.8K | 1.1K |

About Citigroup

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank's primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

After a thorough review of the options trading surrounding Citigroup, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Citigroup

- With a trading volume of 1,002,630, the price of C is down by -0.51%, reaching $70.98.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 19 days from now.

Professional Analyst Ratings for Citigroup

4 market experts have recently issued ratings for this stock, with a consensus target price of $83.25.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Piper Sandler persists with their Overweight rating on Citigroup, maintaining a target price of $80. * In a positive move, an analyst from Keefe, Bruyette & Woods has upgraded their rating to Outperform and adjusted the price target to $82. * An analyst from Goldman Sachs persists with their Buy rating on Citigroup, maintaining a target price of $81. * An analyst from B of A Securities persists with their Buy rating on Citigroup, maintaining a target price of $90.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.