The analysis points out that sharp interest rate cuts will help solve the problems of inflation and employment, the unemployment rate and interest rates are still at historically low levels, and corporate profits have always been strong, indicating that the resilience of the US economy still exists.

Market analysts believe that if the Federal Reserve chooses to cut interest rates by 50 basis points next week, then expectations of a recession in the US economy will be fulfilled and will inevitably cause market panic. On Wall Street, this view was opposed by some analysts and economists.

Michael Yoshikami, CEO of Destination Wealth Management, believes that cutting interest rates by 50 basis points will indicate that the Federal Reserve is ready to act and will not send a signal of economic recession.

In an interview with CNBC on Monday, Yoshikami said:

In an interview with CNBC on Monday, Yoshikami said:

I wouldn't be surprised if the Federal Reserve raised interest rates by 50 basis points. On the one hand, this would be seen as a very positive sign that the Federal Reserve is taking the necessary steps to support employment growth. I think the Federal Reserve is now prepared to deal with this situation.

Coincidentally, Nobel laureate economist Joseph Stiglitz said on Friday before the release of the non-agricultural report that the Federal Reserve should cut interest rates by 50 basis points at the September meeting because he thought the Fed's previous policy tightening was “too excessive and too fast.” He also believes that sharp interest rate cuts will help solve the problems of inflation and employment.

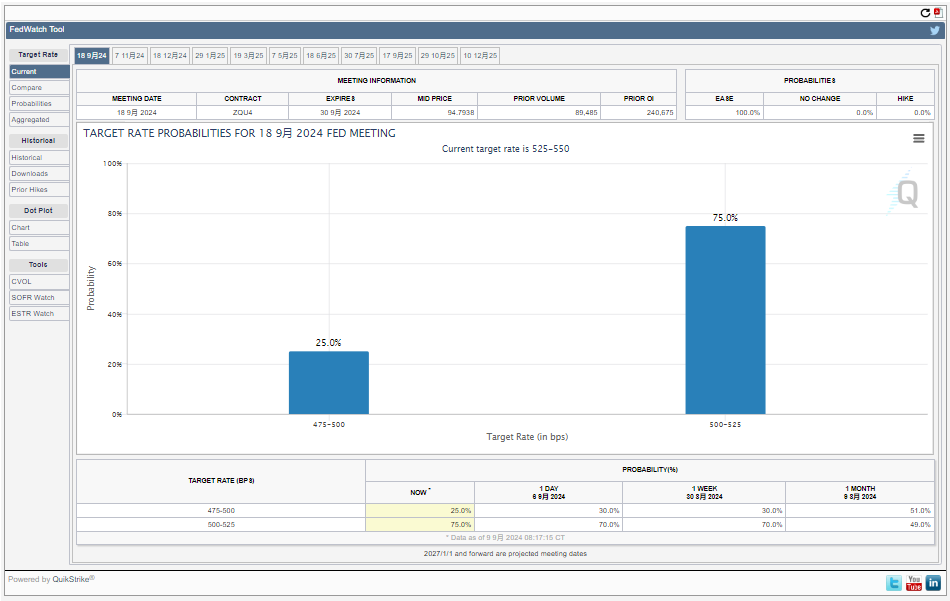

Non-farm payrolls showed mixed results in August. Although the unemployment rate declined slightly, the increase in the number of employed people was unexpectedly weak, reinforcing the view that the labor market was deteriorating. At one point, the probability of cutting interest rates by 50 basis points rose to more than 40%.

Up to now, according to the CME FedWatch tool, traders currently expect the possibility of cutting interest rates by 25 basis points in September to be about 75%, while the possibility of cutting interest rates by 50 basis points falls back to 25%.

Are recessionary fears exaggerated?

Yoshikami acknowledged that sharp interest rate cuts might heighten people's concerns about a hard landing, but he insisted that this view was exaggerated and pointed out that unemployment and interest rates are still at historically low levels, and corporate profits have always been strong.

He said that the S&P 500 index recorded its worst week since March 2023 last week, mainly because investors made large-scale profits. In August, despite a volatile start, all major indices rose, while September has traditionally been a period of weak trading.

Thanos Papasavvas, founder and chief investment officer of ABP Invest, also acknowledged that concerns about the recession have intensified. Earlier, the research firm raised the possibility of a US recession from the “moderate” 25% in June to a “relatively manageable” 30%.

However, Papasavvas told CNBC on Monday that the manufacturing industry and unemployment rate “remain resilient” and will support the US economy.

We're not particularly worried about the US economy falling into recession.

Could sharp interest rate cuts be “very dangerous”?

Compared to the above analysts, Forvis Mazars chief economist George Lagarias is more cautious and pessimistic. He said that cutting interest rates by 50 basis points may frighten the financial market.

In a situation where the US economy is mixed, George Lagarias “firmly” stands in the camp calling for interest rate cuts of 25 basis points. He believes that the current economic form does not yet have the urgency of cutting interest rates by 50 basis points. He stated:

“If the Fed cuts interest rates sharply by 50 basis points, it may send a wrong signal to the market and economy, causing the market and economic participants to misunderstand that the economic situation is very serious, causing panic. This is probably a 'self-fulfilling' prediction, leading to a real recession in the economy.”

Earlier, Jefferies Europe's chief financial economist Mohit Kumar also stated that “there is absolutely no need” for the Federal Reserve to cut interest rates by 50 basis points in September.

edit/ping

Yoshikami周一接受CNBC采访时表示:

Yoshikami周一接受CNBC采访时表示: