Refined from CITIC Construction Investment: "Insurance Industry Investment Strategy report 2019: through the interest rate cycle, focus on value growth"

Insurance series research

Tuyere Industry | Insurance Series 2: five Development courses of Insurance Enterprises in China

Tuyere Industry | Insurance Series 1: three drivers of Insurance Stock Price

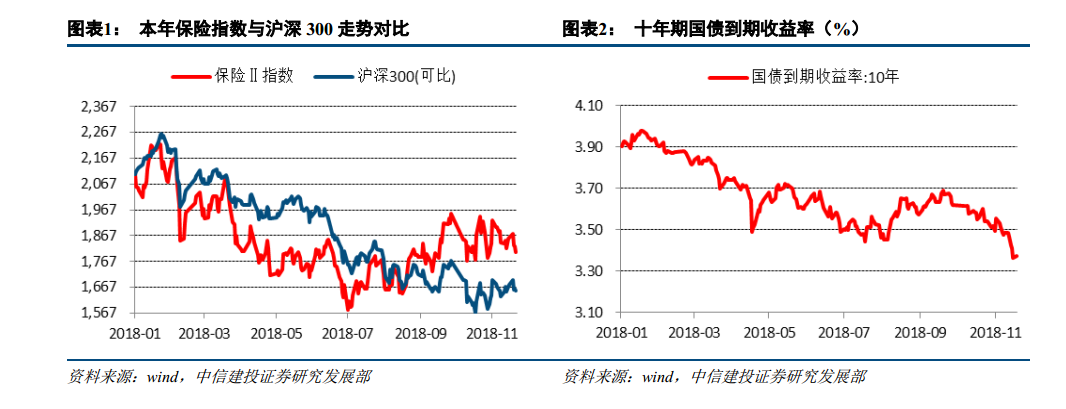

In 2018, after many negative effects on insurance stocks, both share prices and valuations fell sharply. Entering 2019, the main concern of the market for insurance stocks lies in the drag on the investment income of listed insurance companies caused by the downward yield of long-term treasury bonds.

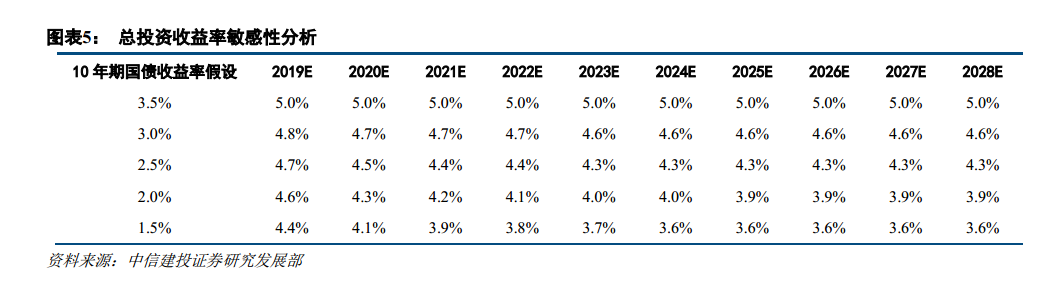

The business model of the insurance industry has changed significantly. Investment and liabilities influence each other through cash flow, and the business model of debt-driven investment is gradually deepened.The return on investment is divided into the rate of return on investment and the scale of investment assets affect the growth of value. According to the calculation of Citic Construction Investment, when the 10-year treasury bond yield is 3.5% lower than the yield center of the past 10 years, 100 basis points and 150 basis points, it will take more than 10 years and 5 years for the investment yield to fall to 4%, respectively. The decline in investment yields is slow.

The growth differentiation of the investment asset scale of listed insurance enterprises is aggravated by the proportion of underwriting profit to the premium earned and the proportion of new investment assets to underwriting profit.Ping An Insurance and China Pacific Insurance have less pressure to pay when their insurance policies expire in 2019. New China Life Insurance has the fastest increase in the proportion of long-term insurance, and the marginal improvement is the most obvious. The proportion of new investment assets with the increase in the proportion of insurance premiums and the extension of the term of the insurance policy, the phenomenon of "big input and output" of cash flow has gradually improved. At present, China Pacific Insurance and Ping An Insurance account for the highest proportion. With the gradual expiration of New China Life Insurance's "Huifubao" insurance policy in the first half of 2018, it has shown a marked improvement.

Looking forward to 2019, Citic Construction Investment believes that under the circumstances of tighter regulation and limited sales of quick return products, but the impact of the rate of return of financial products on policy settlement interest rates is reduced, the new single premiums of savings type are expected to be the same as those of 2018. The insurance premium is expected to rise by 30% year on year, and the value of new business in the industry is expected to rise by 8% year on year.. Compared with the net profit, the surplus margin can better reflect the present value of the future profit of the enterprise. Assuming that the proportion of residual marginal amortization is stable, Ping An Insurance will maintain a high growth rate of 28% in 2019.

Citic Construction Investment pointed out that the market is worried that the rate of return on investment is not as high as expected, resulting in an inflated embedded value.The sensitivity of Ping An Insurance, China Pacific Insurance, New China Life Insurance and China Life Insurance Company Limited to the rate of return on investment is 0.09%, 0.15%, 0.15% and 0.17%, respectively. In the case of 100 basis points and 200 basis points downward of the central bank of 10-year treasury bonds, the proportion of the reduction in embedded value is within the range of 5%, 10%, 11% and 20%. The impact of the downward short-term interest rate on the embedded value credibility of listed insurance companies is relatively limited.

Relative valuation method according to Gordon model, the reasonable P/EV of Ping An Insurance, China Pacific Insurance, New China Life Insurance and China Life Insurance Company Limited should be 2.13,1.88,1.75,1.63 times, which deviates greatly from the current stock price of listed insurance companies and the ratio of the current stock price of listed insurance companies to the embedded value per share in 2019.Under the absolute valuation method, assuming that 10 years are the years in which new policies are issued in the future, the growth rate of new business value is 5%, and the reasonable multiple of new business value should be 7.5. the current implied new business value multiples Ping An Insurance-0.75,China Pacific Insurance-8.6, New China Life Insurance-6.8and China Life Insurance Company Limited-7.4significantly deviate from the reasonable valuation. Citic Construction Investment believes that the value of insurance stocks is significantly undervalued.