Refined from Soochow Securities: "thinking on the Investment Framework of Private Education Industry: a New starting Point, the Great era"

It is better to teach people to fish than to teach people to fish. Fu Tu Research has specially launched a series of articles on the research framework, which aims to work with investors."correct research ideas, understand the nature of the market, and seize investment opportunities".This paper is the fourth part of the research framework series-understanding the education industry and seizing the opportunity for bottom reading ahead.

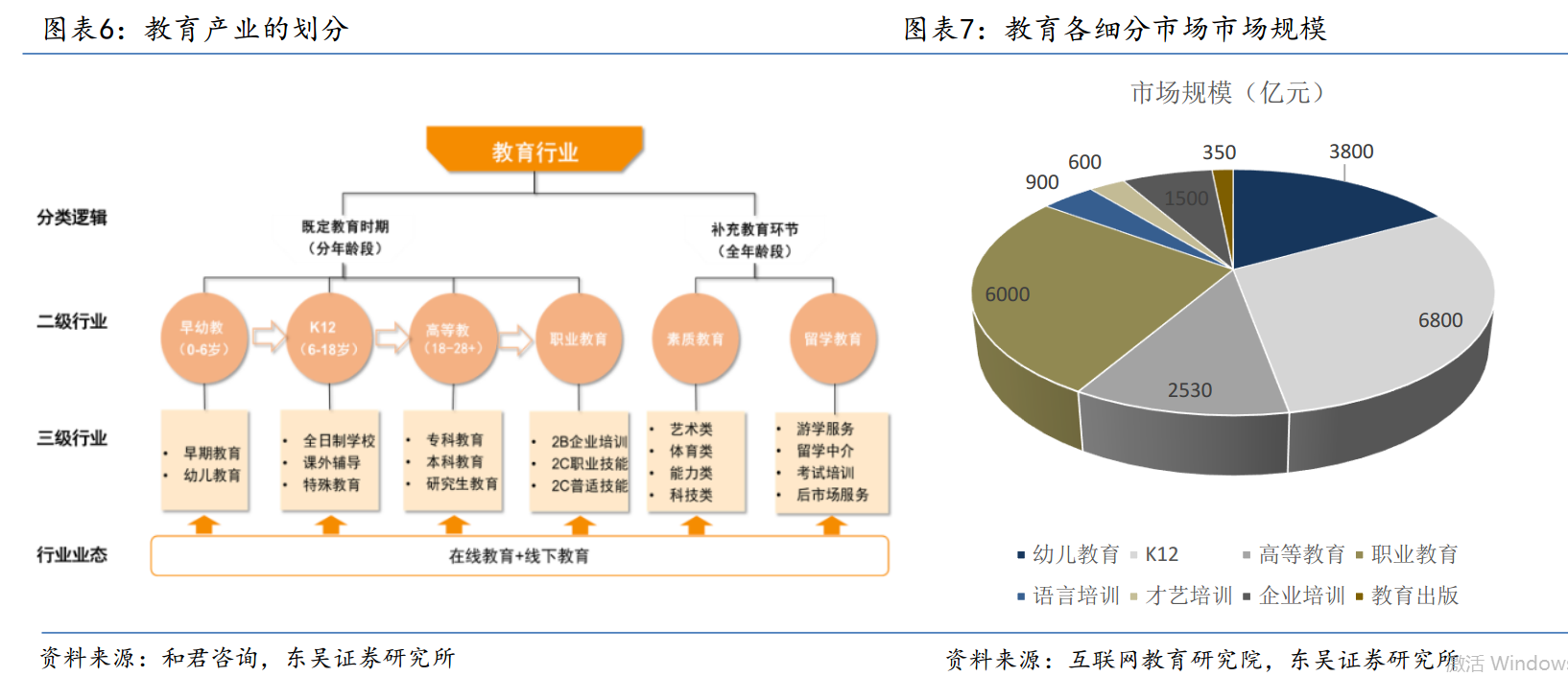

1. Industrial structure and trend of education industry

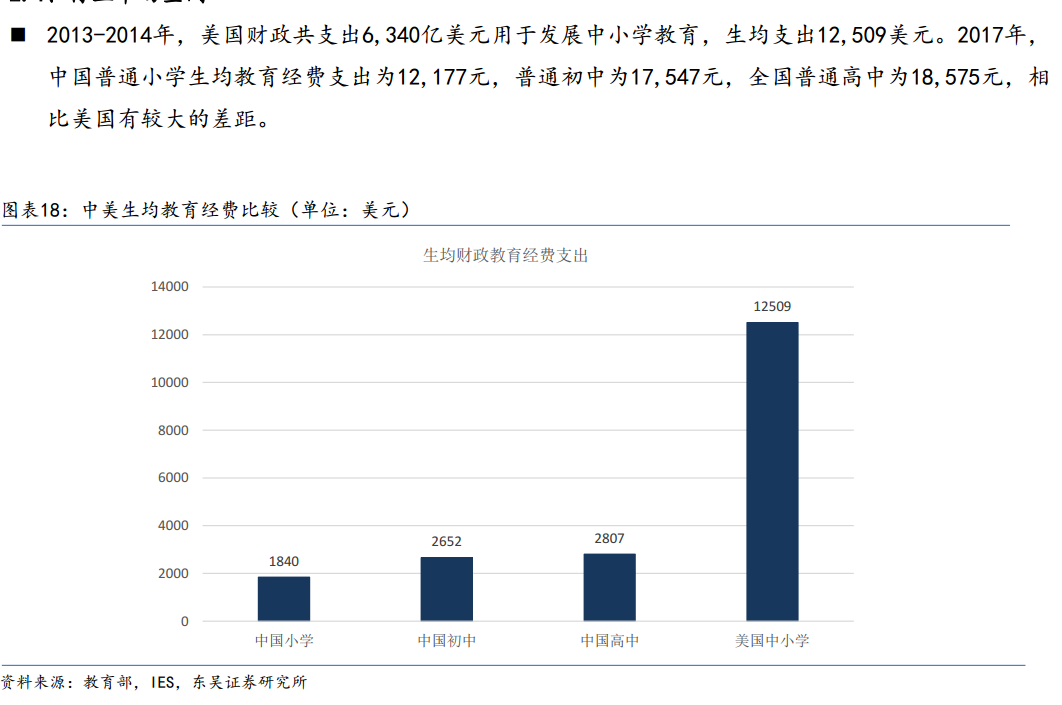

Industry market space: the per capita expenditure on education is far from that of the United States.

Asset securitization and consumption upgrading bring opportunities for market integration, and the development of industry M & An integration is closely related to the improvement of industry concentration. In the long run, online education will affect the pattern of traditional education industry from the aspects of content production, delivery means, effect evaluation and so on.

2. Industry investment logic

At different stages of the industry, the core contradictions affecting investment are also different.

The K12 training market is the best track in the long run.K12 stage training has a large market space, a high degree of marketization, a better business model and stable growth of demand, which is the best track in the long run, but other tracks are currently in the stage from 0 to 1 or from weak to strong, which have investment value.

3. The choice of specific investment targets

Look at the target: the product is king, but the model (strategy), management and technology are equally important.

Product / brand: educational service products are the king, and the differences between products and brands directly affect the profitability of enterprises.

Combination model (strategy): different business models and expansion strategies will also affect the pace of the company's expansion.

Team management: organizational structure, incentive mechanism, team management, etc.

Spelling technology: the income share of online education in the leading education industry continues to increase, and technological research and development has become an important barrier for educational enterprises.

Impact valuation indicators: there are significant differences in the valuation of subdivided areas and individual stocks.

Factors affecting industry valuation: industry track, listing location, business model, etc.

The factors that affect the valuation of individual stocks: the speed of expansion, brand influence, quality control ability and so on.

The catalysts of private education enterprises mainly come from several aspects, such as policy changes, the release of new production capacity and the rise of customer unit prices.

4. Major risks in the industry

Educational accident: the risk of educational reputation caused by poor school management is a major risk factor in the business process of enterprises.

Policy risk: from the development of private education at home and abroad, the policy has a great impact on the industry.

Post-investment management: expansion through mergers and acquisitions is an important path for private educational institutions, and post-investment management is one of the potential risk points.

Other risks.

Previous articles on the research framework: