Edited by Haitong: stickiness

Editor's note: how are the SaaS industries classified, what is the value of the cloud, and what is their valuation? Rich way Research selected "Cloud Computing part two" to reveal to you. The first part. "Rich way Research and selection | the big start of cloud computing in China and the United States! You don't know. One, two, three, four.》

1. SaaS industry classification and target

General-purpose cloud software enterprise

General-purpose SaaS enterprises usually have relatively low market penetration and share, they do not distinguish between customers' industries and provide them with general services, including CRM, HRM, collaborative OA, ERP and so on, mainly represented by Salesforce.com Inc, Workday, Servicenow.

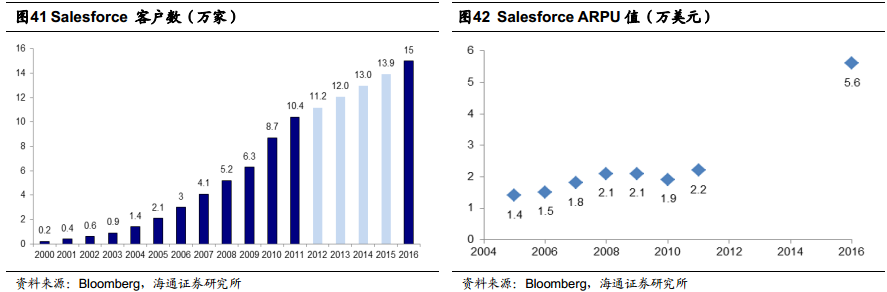

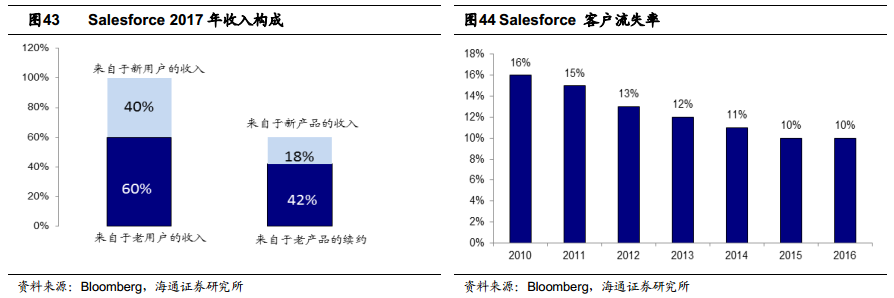

Take Salesforce.com Inc as an exampleThe company started from the general-purpose CRM, in the period of rapid development, through the establishment of a strong sales team to expand new users, through social marketing, old customer recommendation and other marketing methods to achieve the rapid increase of new customers. Salesforce.com Inc had only 1500 customers when he launched the first CRM application in 1999, and the company actively developed a huge long-tail market through sales.By 2016, the number of customers has increased 100-fold to 150000, covering companies of all sizes around the world.

In addition to continuously opening up new users, the company launches a certain number of new products every year.Sell to regular customers through cross-sellingTo urge users to upgrade to a higher version and further mine the value of stock users. In 2017, about 26% of the company's revenue came from new customers.58% of the income of old customers comes from the sale of new products.Continuously selling new products to old customers and increasing the number of modules, on the one hand, can increase revenue, on the other hand, it can increase customers' dependence on the company's products, and achieve double improvement of ARPU value and retention rate.

Vertical industry dedicated cloud software enterprises

Industry vertical software enterprises generally only provide software services for specific industries and subdivided applications. This kind of software usually has a high market penetration, and there are leaders with high market share in the field of segmentation, such as Adobe Inc in the field of graphic design and Autodesk in the field of engineering design.

Take Adobe Inc as an exampleAfter Adobe Inc's digital media business went all out to transform cloud subscription in 2013, the company's total revenue fell 7.91% year-on-year, and profit fell 65.18%. The main reason is that, on the one hand, Adobe Inc's early cloud service users are mainly transformed from original customers, and the company's traditional business is rapidly squeezed, resulting in a 26.1% drop in License sales revenue in 2013; on the other hand, Adobe Inc's annual subscription fee is lower than the Licens price, coupled with the deferred recognition of subscription revenue, which reduces the value of a single customer.

After the transformation in 2013, Adobe Inc's share of cloud service revenue increased rapidly, reaching 50 per cent in 2014. Between 2010 and 2017, the share of SaaS subscription revenue climbed from 10 per cent to 84 per cent and reached 51 per cent. In addition, the subscription model makes Adobe Inc's net interest rate and ROE show a short decline and a long increase. Adobe Inc's net interest rate was generally maintained at about 20-25% before the transition. During the transition period from 2013 to 2014, due to the inconsistent pace of revenue and expense recognition of the subscription model and the decline in single customer value, the company's net profit declined, and the company's ROE was as low as 4%.

2. The change of financial index of software company after cloud.

After the cloud transformation, the company's business will usher in a new growth space. Customers only need to pay for the first use of the software according to subscription fees, and the threshold will be greatly reduced, so it will first bring a significant increase in deferred income / prepaid accounts, and then with the recognition of income and profit in advance, profitability will significantly increase, resulting in a significant increase in net profit margin and ROE, and the company's cash flow will be more stable.

Accounts received in advance / deferred income gradually increased

After the software is clouded, the one-time Lisence will be changed to pay in the form of monthly or annual subscription, which will form a certain amount of accounts received in advance. with the deepening of the degree of product cloud, the conversion rate of customers will increase, and the amount of prepaid payment will increase synchronously.

For example, Salesforce.com Inc's revenue exceeded US $10 billion to US $10.48 billion in fiscal year 2018, deferred income reached US $7.095 billion, accounting for 67.7% of revenue. From fiscal year 2009 to fiscal year 2018, deferred income accounted for a steady increase in revenue.

Cash flow has improved significantly

The cash flow of Yuyou Network began to accelerate after 2015, with net operating cash flow of 550 million yuan in 2015, 887 million yuan in 2016 and 1.43 billion yuan in 2017, with a compound growth rate of 61.31 percent in three years. Kingdee International Software Group's net operating cash flow in 2017 was HK $985 million, which was 2.66 times its net profit. Adobe Inc is a model of cloud transformation, with operating cash flow reaching US $2.913 billion in 2017.

The net interest rate rises steadily.

The upfront investment in the cloud transformation process will affect profits to a certain extent, resulting in a decline in net profit margins, but once they begin, profit margins will gradually and steadily increase. For example, Adobe Inc cloud transformation has been successful, can clearly see the company in the software cloud after the net profit margin has a significant upward trend.

3. What is the difference in the valuation of the cloud computing industry?

Why do software companies give relatively high valuations in global capital markets

Haitong believes that another important reason for the high growth of the software / information technology sector isCustomer "stickiness"The spot consumption attribute of IT investment such as software is getting stronger and stronger. After clouding, the data is stored in cloud vendors, and their own business processes already fit well with the software, and the conversion cost is huge, so customers will be more dependent on software / information technology companies and more "sticky".

When the company's stickiness to customers is strong enough, the customer renewal rate will be extremely high, so that under the subscription model, every new customer is a driver of higher valuations. In addition, a very important point that is different from other industries is that after cloud, a new data-based business model for software / information technology will emerge in the future, when software companies will guide customers and create new requirements to help customers improve efficiency.Compared with traditional enterprises, Yunhua Software Company's free cash flow has greater certainty and sustainability, so it believes that it can enjoy a higher valuation level.

Using P/ADR to observe the valuation level of Cloud Software

ADR= (software enterprise cloud service revenue + deferred revenue * percentage of cloud service revenue) x renewal rate

Haitong believes that ADR, relative to operating income (Sales), can better reflect the most sticky part of corporate income. This part of the income continues to have high certainty, can form a stable cash flow in the future, and compared with the one-time income part of the enterprise, the large-scale effect of ADR profits is stronger.Therefore, we can eliminate the influence of the lower stickiness part of the enterprise income on the valuation by using the P/ADR relative Pamp S index, and observe the valuation level of the market for the high sticky income part of Yunhua software enterprises.

Cloud revenue accounts for the high P/ADR of relatively low companies, implying the potential premium of the market for future growth of sustainable income, as well as economies of scale and profit margins brought about by increased share. For general-purpose and vertical special cloud software companies, the market gives vertical special cloud software a higher P/ADR value, which also shows that vertical special cloud software has higher user stickiness and stronger bargaining power.

4. Risk hint

The technological development of the industry is not as expected, and the demand of the software market is not as expected.