Edited by Haitong: stickiness

Editor's note: what supports the rapid development of cloud computing, what are the differences between domestic and foreign development, and what is the core of the software? Rich way Research selected "Cloud Computing part two" to reveal to you. The second part.Fu Tu Research and selection | SaaS Company reclassifies! Tell you what the value is with Pram A.》

1. the industry is hierarchical and the demand is strong.

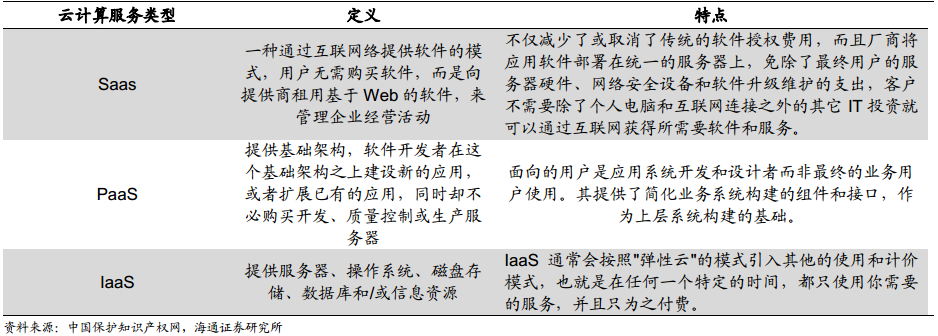

According to the order from basic to application, from hardware to software, the overall level of cloud computing is generally divided into three layers: IaaS (hardware as a service), PaaS (platform and service) and SaaS (software and service).

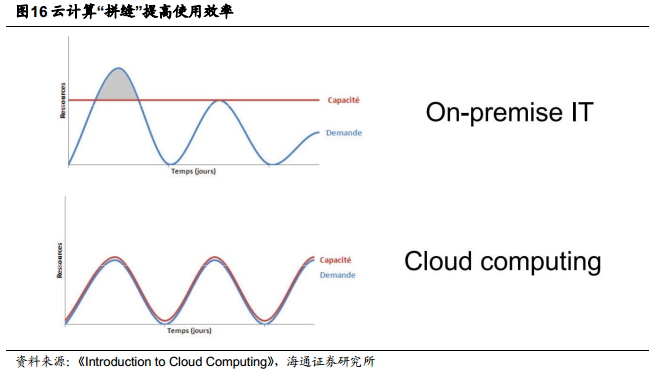

Strong industry demand, multiple driving forces to promote customers to the cloud.(1) Cloud computing technology is becoming more and more mature; (2) the rise of mobile Internet and the subsequent wave of office use of mobile devices have further promoted the application of cloud computing and SaaS software services. (3) with the huge cost savings, cloud computing can make more efficient use of servers, which is essentially "stitching" different customers' leisure time. According to KPMG, the use of cloud computing technology will greatly save enterprise costs, with a maximum saving of 61%.

2. Cloud computing supercycle US stocks are on the rise.

According to Forrestor's statistics on the North American cloud computing market, in the three-tier architecture of cloud computing, the growth rate and share of SaaS services are significantly higher than those of IaaS/PaaS cloud computing types. On the one hand, the application output of SaaS standardization has more scale effect than IaaS and PaaS; on the other hand, SaaS occupies a large proportion of the whole industry value chain.From 2013 to 2017, the overall North American SaaS market grew from US $47.2 billion to US $105.5 billion, with a CAGR of 30.3%.

Since 2013, the overall cloud software board has increased more than fourfold.Among them, the growth of "transition SaaS" has exceeded that of other indices, and the net value of the portfolio has reached 4.66, with an annualized income of 36.1%, while the net value of the "newborn SaaS" portfolio has also reached 4.19, with annualized income of 33.2%, compared with 13.8% and 20.1% for the benchmark S & P 500 and NASDAQ.

3. The rapid development of cloud computing in China in the era of mobile Internet.

According to the Statistical report on the Development of the Internet in China, as of December 2017, the number of mobile Internet users in China had reached 753 million, and the proportion of Internet users who used mobile phones to surf the Internet increased from 95.1% in 2016 to 97.5%. The proportion of mobile Internet in the United States is 57%, which is far lower than that in China, so from the perspective of mobile Internet penetration, China already has the basis to surpass the United States in information construction in the era of mobile Internet.

According to IDC, the domestic cloud computing leader Aliyun 2017 has a market share of 45.5%. According to its latest financial report, its annual income exceeds 10 billion yuan, and revenue in the first quarter of 2018 is 4.385 billion yuan.Year-on-year growth of 101%, quarterly revenue doubled for 12 consecutive quarters compared with the same period last year.Amazon.Com Inc's second-quarter report showed that AWS's net sales were $6.105 billion, up 49% from $4.1 billion in the same period last year, and the growth rate continued to be more than 40%.

4. Cloud computing industry: the core of software is stickiness

Two types of Cloud Transformation of American Software Enterprises

In the traditional mode, software companies deploy software products to multiple customer terminals within the enterprise through License to achieve delivery, while in SaaS mode, software companies deploy application software on their own servers. Customers can subscribe to software modules according to their actual needs, and usually pay for the monthly / annual subscription service fee model, so as to obtain the services provided by cloud software enterprises.

Cloud software companies in US stocks can be divided into two categories according to the scope of serving customers and market penetration.General-purpose software and vertical industry special software. Among them, general-purpose SaaS enterprises usually have relatively low market penetration and market share, and they do not distinguish between customers' industries and provide them with general services; industry vertical software enterprises generally only provide software services for specific industries and provide software services for segmented applications, with high market penetration and high market share leaders in subdivided fields.

The valuation method of American Stock SaaS Company

At present, SaaS companies listed in the United States basically adoptMost of the ranges are between 8 and 16 times Pacer S., including companies that convert traditional software to the cloud (cloud services account for less than 100%); the Pmax S multiple is usually related to the total revenue or the revenue growth of cloud services, and the profitability of the company after entering a stable development period.

Compared with unstable net profit, the stability and predictability of revenue under cloud services under the SaaS software subscription model are greatly improved.On the one hand, because most of the annual income of cloud software companies comes from the renewal of old customers, when the renewal rate is high enough (generally 80-90% renewal rate is the most ideal), the income stability of the enterprise is excellent. On the other hand, cloud software companies often strive to sign 1-3-year software subscription service contracts with customers, collect money for one year in advance, and confirm revenue month by month; the part that has received money but has not recognized income forms accounts received in advance, which is equivalent to locking in future revenue and improving the predictability of revenue.

So which companies stand out? Please look forward to the next issue of Futu Research on Cloud Computing.