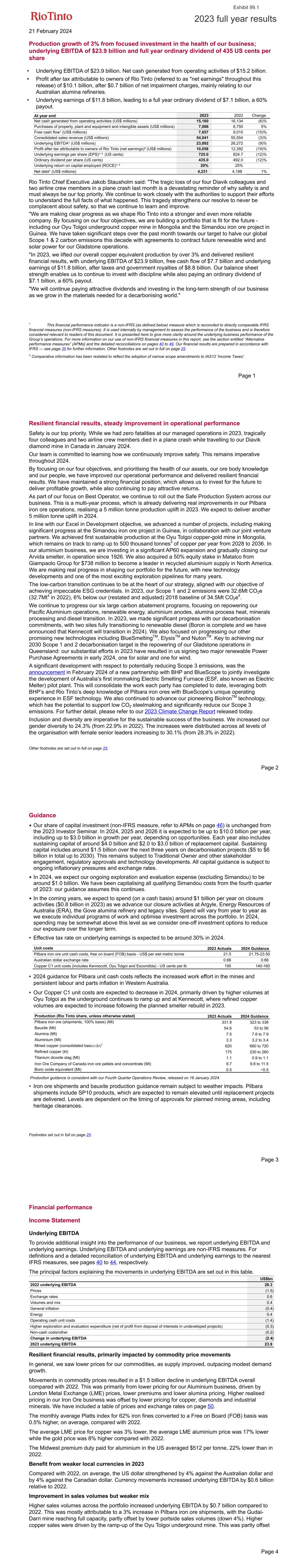

21 February 2024 Production growth of 3% from focused investment in the health of our business; underlying EBITDA of $23.9 billion and full year ordinary dividend of 435 US cents per share • Underlying EBITDA of $23.9 billion. Net cash generated from operating activities of $15.2 billion. • Profit after tax attributable to owners of Rio Tinto (referred to as "net earnings" throughout this release) of $10.1 billion, after $0.7 billion of net impairment charges, mainly relating to our Australian alumina refineries. • Underlying earnings of $11.8 billion, leading to a full year ordinary dividend of $7.1 billion, a 60% payout. At year end 2023 2022 Change Net cash generated from operating activities (US$ millions) 15,160 16,134 (6) % Purchases of property, plant and equipment and intangible assets (US$ millions) 7,086 6,750 5 % Free cash flow¹ (US$ millions) 7,657 9,010 (15) % Consolidated sales revenue (US$ millions) 54,041 55,554 (3) % Underlying EBITDA¹ (US$ millions) 23,892 26,272 (9) % Profit after tax attributable to owners of Rio Tinto (net earnings)² (US$ millions) 10,058 12,392 (19) % Underlying earnings per share (EPS)¹, ² (US cents) 725.0 824.7 (12) % Ordinary dividend per share (US cents) 435.0 492.0 (12) % Underlying return on capital employed (ROCE)¹, ² 20% 25% Net debt¹ (US$ millions) 4,231 4,188 1 % Rio Tinto Chief Executive Jakob Stausholm said: "The tragic loss of our four Diavik colleagues and two airline crew members in a plane crash last month is a devastating reminder of why safety is and must always be our top priority. We continue to work closely with the authorities to support their efforts to understand the full facts of what happened. This tragedy strengthens our resolve to never be complacent about safety, so that we continue to learn and improve. "We are making clear progress as we shape Rio Tinto into a stronger and even more reliable company. By focusing on our four objectives, we are building a portfolio that is fit for the future - including our Oyu Tolgoi underground copper mine in Mongolia and the Simandou iron ore project in Guinea. We have taken significant steps over the past month towards our target to halve our global Scope 1 & 2 carbon emissions this decade with agreements to contract future renewable wind and solar power for our Gladstone operations. "In 2023, we lifted our overall copper equivalent production by over 3% and delivered resilient financial results, with underlying EBITDA of $23.9 billion, free cash flow of $7.7 billion and underlying earnings of $11.8 billion, after taxes and government royalties of $8.8 billion. Our balance sheet strength enables us to continue to invest with discipline while also paying an ordinary dividend of $7.1 billion, a 60% payout. "We will continue paying attractive dividends and investing in the long-term strength of our business as we grow in the materials needed for a decarbonising world." 1 This financial performance indicator is a non-IFRS (as defined below) measure which is reconciled to directly comparable IFRS financial measures (non-IFRS measures). It is used internally by management to assess the performance of the business and is therefore considered relevant to readers of this document. It is presented here to give more clarity around the underlying business performance of the Group’s operations. For more information on our use of non-IFRS financial measures in this report, see the section entitled “Alternative performance measures” (APMs) and the detailed reconciliations on pages 40 to 49. Our financial results are prepared in accordance with IFRS — see page 35 for further information. Other footnotes are set out in full on page 25. 2 Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. 2023 full year results Page 1 Exhibit 99.1 Resilient financial results, steady improvement in operational performance Safety is our top priority. While we had zero fatalities at our managed operations in 2023, tragically four colleagues and two airline crew members died in a plane crash while travelling to our Diavik diamond mine in Canada in January 2024. Our team is committed to learning how we continuously improve safety. This remains imperative throughout 2024. By focusing on our four objectives, and prioritising the health of our assets, our ore body knowledge and our people, we have improved our operational performance and delivered resilient financial results. We have maintained a strong financial position, which allows us to invest for the future to deliver profitable growth, while also continuing to pay attractive returns. As part of our focus on Best Operator, we continue to roll out the Safe Production System across our business. This is a multi-year process, which is already delivering real improvements in our Pilbara iron ore operations, realising a 5 million tonne production uplift in 2023. We expect to deliver another 5 million tonne uplift in 2024. In line with our Excel in Development objective, we advanced a number of projects, including making significant progress at the Simandou iron ore project in Guinea, in collaboration with our joint venture partners. We achieved first sustainable production at the Oyu Tolgoi copper-gold mine in Mongolia, which remains on track to ramp up to 500 thousand tonnes3 of copper per year from 2028 to 2036. In our aluminium business, we are investing in a significant AP60 expansion and gradually closing our Arvida smelter, in operation since 1926. We also acquired a 50% equity stake in Matalco from Giampaolo Group for $738 million to become a leader in recycled aluminium supply in North America. We are making real progress in shaping our portfolio for the future, with new technology developments and one of the most exciting exploration pipelines for many years. The low-carbon transition continues to be at the heart of our strategy, aligned with our objective of achieving impeccable ESG credentials. In 2023, our Scope 1 and 2 emissions were 32.6Mt CO2e (32.7Mt4 in 2022), 6% below our (restated and adjusted) 2018 baseline of 34.5Mt CO2e4. We continue to progress our six large carbon abatement programs, focusing on repowering our Pacific Aluminium operations, renewable energy, aluminium anodes, alumina process heat, minerals processing and diesel transition. In 2023, we made significant progress with our decarbonisation commitments, with two sites fully transitioning to renewable diesel (Boron is complete and we have announced that Kennecott will transition in 2024). We also focused on progressing our other promising new technologies including BlueSmeltingTM, ElysisTM and NutonTM. Key to achieving our 2030 Scope 1 and 2 decarbonisation target is the repowering of our Gladstone operations in Queensland: our substantial efforts in 2023 have resulted in us signing two major renewable Power Purchase Agreements in early 2024, one for solar and one for wind. A significant development with respect to potentially reducing Scope 3 emissions, was the announcement in February 2024 of a new partnership with BHP and BlueScope to jointly investigate the development of Australia’s first ironmaking Electric Smelting Furnace (ESF, also known as Electric Melter) pilot plant. This will consolidate the work each party has completed to date, leveraging both BHP’s and Rio Tinto’s deep knowledge of Pilbara iron ores with BlueScope’s unique operating experience in ESF technology. We also continued to advance our pioneering BioIronTM technology, which has the potential to support low CO2 steelmaking and significantly reduce our Scope 3 emissions. For further detail, please refer to our 2023 Climate Change Report released today. Inclusion and diversity are imperative for the sustainable success of the business. We increased our gender diversity to 24.3% (from 22.9% in 2022). The increases were distributed across all levels of the organisation with female senior leaders increasing to 30.1% (from 28.3% in 2022). Other footnotes are set out in full on page 25. Page 2 Guidance • Our share of capital investment (non-IFRS measure, refer to APMs on page 46) is unchanged from the 2023 Investor Seminar. In 2024, 2025 and 2026 it is expected to be up to $10.0 billion per year, including up to $3.0 billion in growth per year, depending on opportunities. Each year also includes sustaining capital of around $4.0 billion and $2.0 to $3.0 billion of replacement capital. Sustaining capital includes around $1.5 billion over the next three years on decarbonisation projects ($5 to $6 billion in total up to 2030). This remains subject to Traditional Owner and other stakeholder engagement, regulatory approvals and technology developments. All capital guidance is subject to ongoing inflationary pressures and exchange rates. • In 2024, we expect our ongoing exploration and evaluation expense (excluding Simandou) to be around $1.0 billion. We have been capitalising all qualifying Simandou costs from the fourth quarter of 2023: our guidance assumes this continues. • In the coming years, we expect to spend (on a cash basis) around $1 billion per year on closure activities ($0.8 billion in 2023) as we advance our closure activities at Argyle, Energy Resources of Australia (ERA), the Gove alumina refinery and legacy sites. Spend will vary from year to year as we execute individual programs of work and optimise investment across the portfolio. In 2024, spending may be somewhat above this level as we consider one-off investment options to reduce our exposure over the longer term. • Effective tax rate on underlying earnings is expected to be around 30% in 2024. Unit costs 2023 Actuals 2024 Guidance Pilbara iron ore unit cash costs, free on board (FOB) basis - US$ per wet metric tonne 21.5 21.75-23.50 Australian dollar exchange rate 0.66 0.66 Copper C1 unit costs (includes Kennecott, Oyu Tolgoi and Escondida) - US cents per lb 195 140-160 • 2024 guidance for Pilbara unit cash costs reflects the increased work effort in the mines and persistent labour and parts inflation in Western Australia. • Our Copper C1 unit costs are expected to decrease in 2024, primarily driven by higher volumes at Oyu Tolgoi as the underground continues to ramp up and at Kennecott, where refined copper volumes are expected to increase following the planned smelter rebuild in 2023. Production (Rio Tinto share, unless otherwise stated) 2023 Actuals 2024 Guidance Pilbara iron ore (shipments, 100% basis) (Mt) 331.8 323 to 338 Bauxite (Mt) 54.6 53 to 56 Alumina (Mt) 7.5 7.6 to 7.9 Aluminium (Mt) 3.3 3.2 to 3.4 Mined copper (consolidated basis) (kt)5 620 660 to 720 Refined copper (kt) 175 230 to 260 Titanium dioxide slag (Mt) 1.1 0.9 to 1.1 Iron Ore Company of Canada iron ore pellets and concentrate (Mt) 9.7 9.8 to 11.5 Boric oxide equivalent (Mt) 0.5 ~0.5 Production guidance is consistent with our Fourth Quarter Operations Review, released on 16 January 2024. • Iron ore shipments and bauxite production guidance remain subject to weather impacts. Pilbara shipments include SP10 products, which are expected to remain elevated until replacement projects are delivered. Levels are dependent on the timing of approvals for planned mining areas, including heritage clearances. Footnotes set out in full on page 25. Page 3 Financial performance Income Statement Underlying EBITDA To provide additional insight into the performance of our business, we report underlying EBITDA and underlying earnings. Underlying EBITDA and underlying earnings are non-IFRS measures. For definitions and a detailed reconciliation of underlying EBITDA and underlying earnings to the nearest IFRS measures, see pages 40 to 44, respectively. The principal factors explaining the movements in underlying EBITDA are set out in this table. US$bn 2022 underlying EBITDA 26.3 Prices (1.5) Exchange rates 0.6 Volumes and mix 0.4 General inflation (0.4) Energy 0.4 Operating cash unit costs (1.4) Higher exploration and evaluation expenditure (net of profit from disposal of interests in undeveloped projects) (0.3) Non-cash costs/other (0.2) Change in underlying EBITDA (2.4) 2023 underlying EBITDA 23.9 Resilient financial results, primarily impacted by commodity price movements In general, we saw lower prices for our commodities, as supply improved, outpacing modest demand growth. Movements in commodity prices resulted in a $1.5 billion decline in underlying EBITDA overall compared with 2022. This was primarily from lower pricing for our Aluminium business, driven by London Metal Exchange (LME) prices, lower premiums and lower alumina pricing. Higher realised pricing in our Iron Ore business was offset by lower pricing for copper, diamonds and industrial minerals. We have included a table of prices and exchange rates on page 50. The monthly average Platts index for 62% iron fines converted to a Free on Board (FOB) basis was 0.5% higher, on average, compared with 2022. The average LME price for copper was 3% lower, the average LME aluminium price was 17% lower while the gold price was 8% higher compared with 2022. The Midwest premium duty paid for aluminium in the US averaged $512 per tonne, 22% lower than in 2022. Benefit from weaker local currencies in 2023 Compared with 2022, on average, the US dollar strengthened by 4% against the Australian dollar and by 4% against the Canadian dollar. Currency movements increased underlying EBITDA by $0.6 billion relative to 2022. Improvement in sales volumes but weaker mix Higher sales volumes across the portfolio increased underlying EBITDA by $0.7 billion compared to 2022. This was mostly attributable to a 3% increase in Pilbara iron ore shipments, with the Gudai- Darri mine reaching full capacity, partly offset by lower portside sales volumes (down 4%). Higher copper sales were driven by the ramp-up of the Oyu Tolgoi underground mine. This was partly offset Page 4

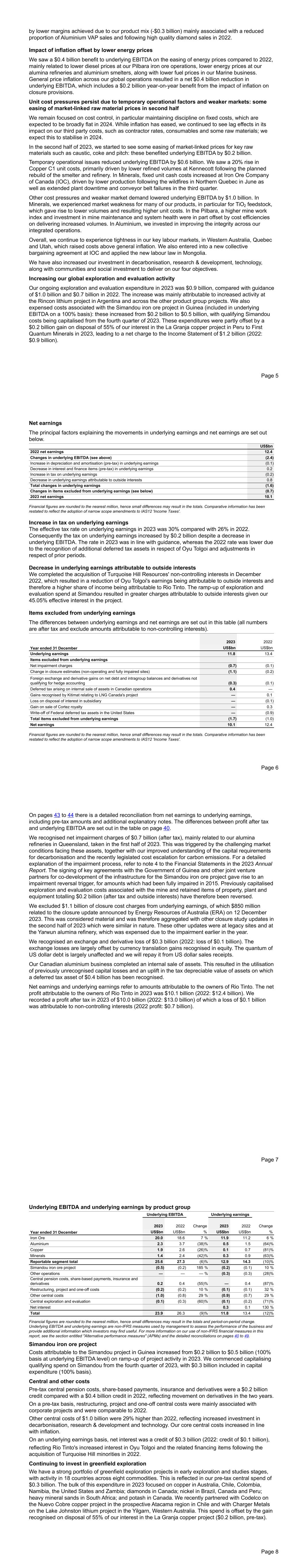

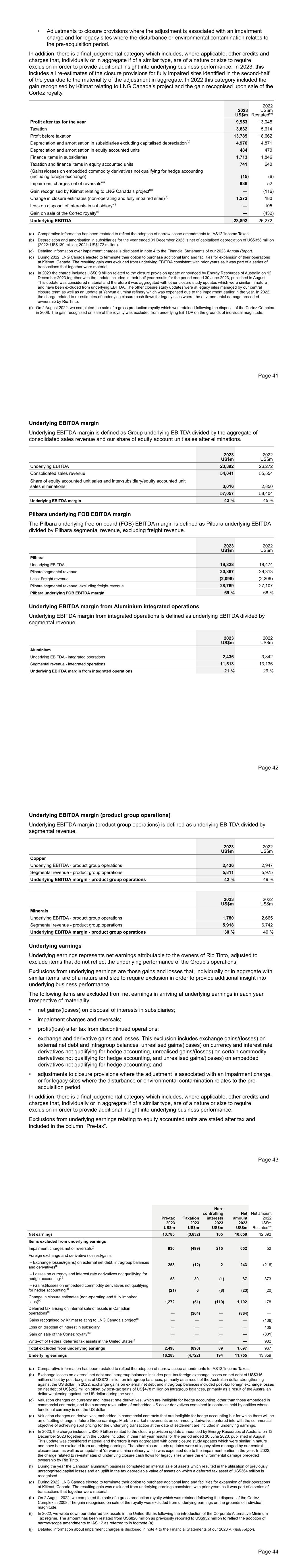

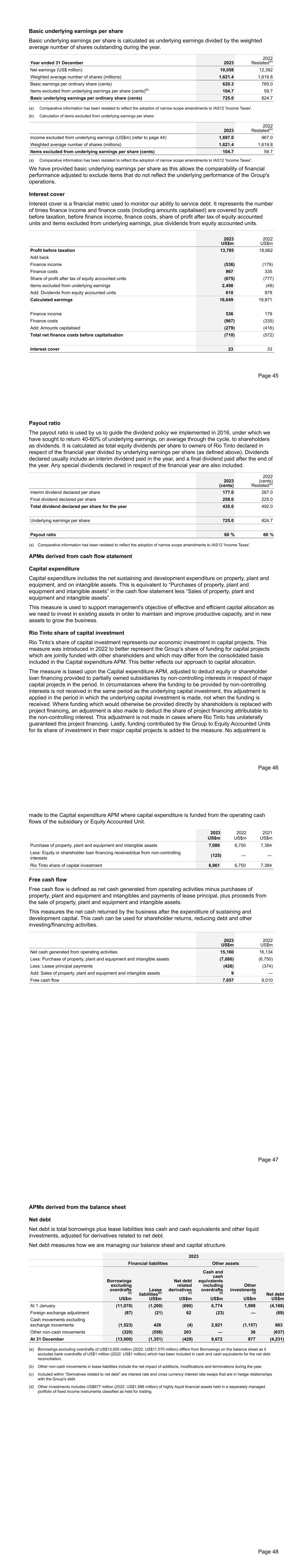

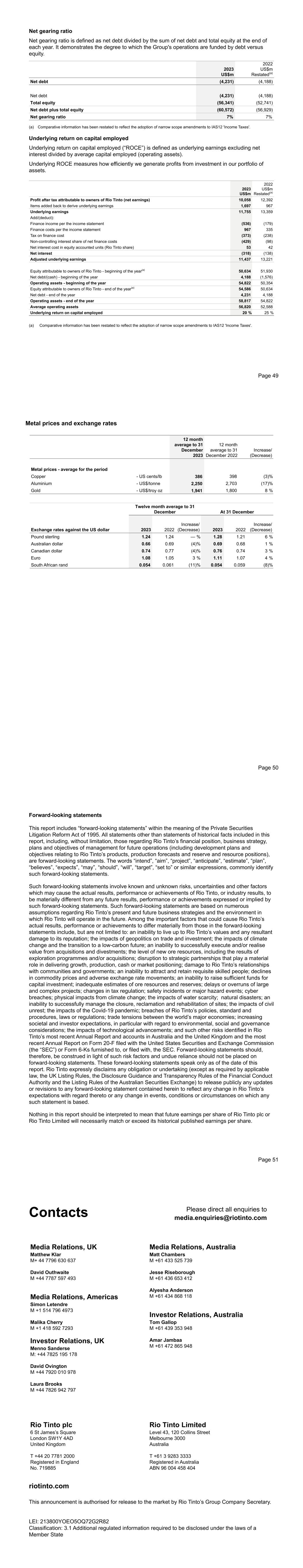

by lower margins achieved due to our product mix (-$0.3 billion) mainly associated with a reduced proportion of Aluminium VAP sales and following high quality diamond sales in 2022. Impact of inflation offset by lower energy prices We saw a $0.4 billion benefit to underlying EBITDA on the easing of energy prices compared to 2022, mainly related to lower diesel prices at our Pilbara iron ore operations, lower energy prices at our alumina refineries and aluminium smelters, along with lower fuel prices in our Marine business. General price inflation across our global operations resulted in a net $0.4 billion reduction in underlying EBITDA, which includes a $0.2 billion year-on-year benefit from the impact of inflation on closure provisions. Unit cost pressures persist due to temporary operational factors and weaker markets: some easing of market-linked raw material prices in second half We remain focused on cost control, in particular maintaining discipline on fixed costs, which are expected to be broadly flat in 2024. While inflation has eased, we continued to see lag effects in its impact on our third party costs, such as contractor rates, consumables and some raw materials; we expect this to stabilise in 2024. In the second half of 2023, we started to see some easing of market-linked prices for key raw materials such as caustic, coke and pitch: these benefited underlying EBITDA by $0.2 billion. Temporary operational issues reduced underlying EBITDA by $0.6 billion. We saw a 20% rise in Copper C1 unit costs, primarily driven by lower refined volumes at Kennecott following the planned rebuild of the smelter and refinery. In Minerals, fixed unit cash costs increased at Iron Ore Company of Canada (IOC), driven by lower production following the wildfires in Northern Quebec in June as well as extended plant downtime and conveyor belt failures in the third quarter. Other cost pressures and weaker market demand lowered underlying EBITDA by $1.0 billion. In Minerals, we experienced market weakness for many of our products, in particular for TiO2 feedstock, which gave rise to lower volumes and resulting higher unit costs. In the Pilbara, a higher mine work index and investment in mine maintenance and system health were in part offset by cost efficiencies on delivering increased volumes. In Aluminium, we invested in improving the integrity across our integrated operations. Overall, we continue to experience tightness in our key labour markets, in Western Australia, Quebec and Utah, which raised costs above general inflation. We also entered into a new collective bargaining agreement at IOC and applied the new labour law in Mongolia. We have also increased our investment in decarbonisation, research & development, technology, along with communities and social investment to deliver on our four objectives. Increasing our global exploration and evaluation activity Our ongoing exploration and evaluation expenditure in 2023 was $0.9 billion, compared with guidance of $1.0 billion and $0.7 billion in 2022. The increase was mainly attributable to increased activity at the Rincon lithium project in Argentina and across the other product group projects. We also expensed costs associated with the Simandou iron ore project in Guinea (included in underlying EBITDA on a 100% basis): these increased from $0.2 billion to $0.5 billion, with qualifying Simandou costs being capitalised from the fourth quarter of 2023. These expenditures were partly offset by a $0.2 billion gain on disposal of 55% of our interest in the La Granja copper project in Peru to First Quantum Minerals in 2023, leading to a net charge to the Income Statement of $1.2 billion (2022: $0.9 billion). Page 5 Net earnings The principal factors explaining the movements in underlying earnings and net earnings are set out below. US$bn 2022 net earnings 12.4 Changes in underlying EBITDA (see above) (2.4) Increase in depreciation and amortisation (pre-tax) in underlying earnings (0.1) Decrease in interest and finance items (pre-tax) in underlying earnings 0.2 Increase in tax on underlying earnings (0.2) Decrease in underlying earnings attributable to outside interests 0.8 Total changes in underlying earnings (1.6) Changes in items excluded from underlying earnings (see below) (0.7) 2023 net earnings 10.1 Financial figures are rounded to the nearest million, hence small differences may result in the totals. Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. Increase in tax on underlying earnings The effective tax rate on underlying earnings in 2023 was 30% compared with 26% in 2022. Consequently the tax on underlying earnings increased by $0.2 billion despite a decrease in underlying EBITDA. The rate in 2023 was in line with guidance, whereas the 2022 rate was lower due to the recognition of additional deferred tax assets in respect of Oyu Tolgoi and adjustments in respect of prior periods. Decrease in underlying earnings attributable to outside interests We completed the acquisition of Turquoise Hill Resources' non-controlling interests in December 2022, which resulted in a reduction of Oyu Tolgoi's earnings being attributable to outside interests and therefore a higher share of income being attributable to Rio Tinto. The ramp-up of exploration and evaluation spend at Simandou resulted in greater charges attributable to outside interests given our 45.05% effective interest in the project. Items excluded from underlying earnings The differences between underlying earnings and net earnings are set out in this table (all numbers are after tax and exclude amounts attributable to non-controlling interests). 2023 2022 Year ended 31 December US$bn US$bn Underlying earnings 11.8 13.4 Items excluded from underlying earnings Net impairment charges (0.7) (0.1) Change in closure estimates (non-operating and fully impaired sites) (1.1) (0.2) Foreign exchange and derivative gains on net debt and intragroup balances and derivatives not qualifying for hedge accounting (0.3) (0.1) Deferred tax arising on internal sale of assets in Canadian operations 0.4 — Gains recognised by Kitimat relating to LNG Canada's project — 0.1 Loss on disposal of interest in subsidiary — (0.1) Gain on sale of Cortez royalty — 0.3 Write-off of Federal deferred tax assets in the United States — (0.9) Total items excluded from underlying earnings (1.7) (1.0) Net earnings 10.1 12.4 Financial figures are rounded to the nearest million, hence small differences may result in the totals. Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. Page 6 On pages 43 to 44 there is a detailed reconciliation from net earnings to underlying earnings, including pre-tax amounts and additional explanatory notes. The differences between profit after tax and underlying EBITDA are set out in the table on page 40. We recognised net impairment charges of $0.7 billion (after tax), mainly related to our alumina refineries in Queensland, taken in the first half of 2023. This was triggered by the challenging market conditions facing these assets, together with our improved understanding of the capital requirements for decarbonisation and the recently legislated cost escalation for carbon emissions. For a detailed explanation of the impairment process, refer to note 4 to the Financial Statements in the 2023 Annual Report. The signing of key agreements with the Government of Guinea and other joint venture partners for co-development of the infrastructure for the Simandou iron ore project gave rise to an impairment reversal trigger, for amounts which had been fully impaired in 2015. Previously capitalised exploration and evaluation costs associated with the mine and retained items of property, plant and equipment totalling $0.2 billion (after tax and outside interests) have therefore been reversed. We excluded $1.1 billion of closure cost charges from underlying earnings, of which $850 million related to the closure update announced by Energy Resources of Australia (ERA) on 12 December 2023. This was considered material and was therefore aggregated with other closure study updates in the second half of 2023 which were similar in nature. These other updates were at legacy sites and at the Yarwun alumina refinery, which was expensed due to the impairment earlier in the year. We recognised an exchange and derivative loss of $0.3 billion (2022: loss of $0.1 billion). The exchange losses are largely offset by currency translation gains recognised in equity. The quantum of US dollar debt is largely unaffected and we will repay it from US dollar sales receipts. Our Canadian aluminium business completed an internal sale of assets. This resulted in the utilisation of previously unrecognised capital losses and an uplift in the tax depreciable value of assets on which a deferred tax asset of $0.4 billion has been recognised. Net earnings and underlying earnings refer to amounts attributable to the owners of Rio Tinto. The net profit attributable to the owners of Rio Tinto in 2023 was $10.1 billion (2022: $12.4 billion). We recorded a profit after tax in 2023 of $10.0 billion (2022: $13.0 billion) of which a loss of $0.1 billion was attributable to non-controlling interests (2022 profit: $0.7 billion). Page 7 Underlying EBITDA and underlying earnings by product group Underlying EBITDA Underlying earnings 2023 2022 Change 2023 2022 Change Year ended 31 December US$bn US$bn % US$bn US$bn % Iron Ore 20.0 18.6 7 % 11.9 11.2 6 % Aluminium 2.3 3.7 (38) % 0.5 1.5 (64) % Copper 1.9 2.6 (26) % 0.1 0.7 (81) % Minerals 1.4 2.4 (42) % 0.3 0.9 (63) % Reportable segment total 25.6 27.3 (6) % 12.9 14.3 (10) % Simandou iron ore project (0.5) (0.2) 185 % (0.2) (0.1) 10 % Other operations — — — % (0.3) (0.3) (28) % Central pension costs, share-based payments, insurance and derivatives 0.2 0.4 (55) % — 0.4 (87) % Restructuring, project and one-off costs (0.2) (0.2) 10 % (0.1) (0.1) 32 % Other central costs (1.0) (0.8) 29 % (0.9) (0.7) 29 % Central exploration and evaluation (0.1) (0.3) (60) % (0.1) (0.2) (71) % Net interest 0.3 0.1 130 % Total 23.9 26.3 (9) % 11.8 13.4 (12) % Financial figures are rounded to the nearest million, hence small differences may result in the totals and period-on-period change. Underlying EBITDA and underlying earnings are non-IFRS measures used by management to assess the performance of the business and provide additional information which investors may find useful. For more information on our use of non-IFRS financial measures in this report, see the section entitled "Alternative performance measures" (APMs) and the detailed reconciliations on pages 40 to 49. Simandou iron ore project Costs attributable to the Simandou project in Guinea increased from $0.2 billion to $0.5 billion (100% basis at underlying EBITDA level) on ramp-up of project activity in 2023. We commenced capitalising qualifying spend on Simandou from the fourth quarter of 2023, with $0.3 billion included in capital expenditure (100% basis). Central and other costs Pre-tax central pension costs, share-based payments, insurance and derivatives were a $0.2 billion credit compared with a $0.4 billion credit in 2022, reflecting movement on derivatives in the two years. On a pre-tax basis, restructuring, project and one-off central costs were mainly associated with corporate projects and were comparable to 2022. Other central costs of $1.0 billion were 29% higher than 2022, reflecting increased investment in decarbonisation, research & development and technology. Our core central costs increased in line with inflation. On an underlying earnings basis, net interest was a credit of $0.3 billion (2022: credit of $0.1 billion), reflecting Rio Tinto's increased interest in Oyu Tolgoi and the related financing items following the acquisition of Turquoise Hill minorities in 2022. Continuing to invest in greenfield exploration We have a strong portfolio of greenfield exploration projects in early exploration and studies stages, with activity in 18 countries across eight commodities. This is reflected in our pre-tax central spend of $0.3 billion. The bulk of this expenditure in 2023 focused on copper in Australia, Chile, Colombia, Namibia, the United States and Zambia; diamonds in Canada; nickel in Brazil, Canada and Peru; heavy mineral sands in South Africa; and potash in Canada. We recently partnered with Codelco on the Nuevo Cobre copper project in the prospective Atacama region in Chile and with Charger Metals on the Lake Johnston lithium project in the Yilgarn, Western Australia. This spend is offset by the gain recognised on disposal of 55% of our interest in the La Granja copper project ($0.2 billion, pre-tax). Page 8

Cash flow 2023 2022 Year ended 31 December US$bn US$bn Net cash generated from operating activities 15.2 16.1 Purchases of property, plant and equipment and intangible assets (7.1) (6.8) Lease principal payments (0.4) (0.4) Free cash flow¹ 7.7 9.0 Dividends paid to equity shareholders (6.5) (11.7) Acquisitions (0.8) (0.9) Purchase of the minority interest in Turquoise Hill Resources Ltd — (3.0) Disposals — 0.1 Cash receipt from sale of Cortez royalty — 0.5 Other (0.4) 0.2 Movement in net debt/cash¹ — (5.8) Financial figures are rounded to the nearest million, hence small differences may result in the totals. Footnotes are set out in full on page 25. • $15.2 billion in net cash generated from operating activities, 6% lower than 2022, primarily driven by price movements for our major commodities and a $0.9 billion rise in working capital, partly offset by lower taxes paid. The cash outflow from the working capital increase was driven by healthy stocks in the Pilbara, still elevated in-process inventory at Kennecott following the extended smelter rebuild and higher working capital at Iron & Titanium, reflective of weaker market conditions. Receivables also reflected a 20% higher iron ore price at 2023 year end (vs 2022) that will be monetised in 2024. Operating cash flow was also impacted by lower dividends, primarily from Escondida ($0.6 billion in 2023; $0.9 billion in 2022). • Taking into account the timing of payments in Australia, taxes paid of $4.6 billion in 2023 were at a similar level to 2022, which included around $1.5 billion of payments related to prior years. • Our capital expenditure of $7.1 billion was comprised of $1.0 billion of growth ($0.9 billion on a Rio Tinto share basis), $1.6 billion of replacement, $4.3 billion of sustaining and $0.2 billion of decarbonisation capital (in addition to $0.2 billion of decarbonisation spend in operating costs). We expect to spend around $4.0 billion each year on sustaining capital; spend in 2023 included the smelter and refinery rebuild at Kennecott ($0.3 billion) and targeted investment in asset health in Iron Ore and Aluminium. We funded our capital expenditure from operating activities and generally expect to continue funding our capital program from internal sources. • $6.5 billion of dividends paid in 2023, being the 2022 final ordinary and the 2023 interim ordinary dividends. • $0.8 billion of acquisitions related to the Matalco recycling joint venture and the Nuevo Cobre exploration joint venture with Codelco. • The above movements, together with $0.4 billion of other movements, resulted in net debt1 remaining stable year-on-year at $4.2 billion at 31 December 2023. Page 9 Balance sheet Net debt1 of $4.2 billion was unchanged at 31 December 2023 compared to the prior year end. Our net gearing ratio1 (net debt/(cash) to total capital) was 7% at 31 December 2023 (31 December 2022: 7%). See page 49. Our total financing liabilities excluding net debt derivatives at 31 December 2023 (see page 48) were $14.4 billion (31 December 2022: $12.3 billion) and the weighted average maturity was around 12 years. At 31 December 2023, approximately 68% of these liabilities were at floating interest rates (75% excluding leases). The maximum amount within non-current borrowings maturing in any one calendar year is $1.65 billion, which matures in 2033. On 7 March 2023, we priced $650 million of 10-year fixed rate SEC-registered debt securities and $1.1 billion of 30-year fixed rate SEC-registered debt securities. The 10-year notes will pay a coupon of 5.000 per cent and will mature 9 March 2033 and the 30-year notes will pay a coupon of 5.125 per cent and will mature 9 March 2053. We had $10.5 billion in cash and cash equivalents plus other short-term cash investments at 31 December 2023 (31 December 2022: $8.8 billion). Provision for closure costs At 31 December 2023, provisions for close-down and restoration costs and environmental clean-up obligations were $17.2 billion (31 December 2022: $15.8 billion). The increase was largely due to revised closure estimates following new studies at certain operations and legacy sites, including ERA, together with the amortisation of discount ($1.0 billion), which includes the effect of elevated inflation for the year. This was partly offset by a revision of the closure discount rate to 2.0% (from 1.5%), reflecting expectations of higher yields from long-dated bonds, which resulted in a $1.1 billion decrease in the provision. $0.8 billion of the provision was also utilised through spend in 2023. Page 10 Our shareholder returns policy The Board is committed to maintaining an appropriate balance between cash returns to shareholders and investment in the business, with the intention of maximising long-term shareholder value. At the end of each financial period, the Board determines an appropriate total level of ordinary dividend per share. This takes into account the results for the financial year, the outlook for our major commodities, the Board’s view of the long-term growth prospects of the business and the company’s objective of maintaining a strong balance sheet. The intention is that the balance between the interim and final dividend be weighted to the final dividend. The Board expects total cash returns to shareholders over the longer term to be in a range of 40% to 60% of underlying earnings in aggregate through the cycle. Acknowledging the cyclical nature of the industry, it is the Board’s intention to supplement the ordinary dividend with additional returns to shareholders in periods of strong earnings and cash generation. 60% payout ratio on the ordinary dividend delivers an eight-year track record 2023 US$bn 2022 US$bn Ordinary dividend Interim¹ 2.9 4.3 Final¹ 4.2 3.7 Full-year ordinary dividend 7.1 8.0 Payout ratio on ordinary dividend 60% 60% 1 Based on weighted average number of shares and declared dividends per share for the respective periods and excluding foreign exchange impacts on payment. We determine dividends in US dollars. We declare and pay Rio Tinto plc dividends in pounds sterling and Rio Tinto Limited dividends in Australian dollars. The 2023 final dividend has been converted at exchange rates applicable on 20 February 2024 (the latest practicable date before the dividend was declared). American Depositary Receipt (ADR) holders receive dividends at the declared rate in US dollars. Ordinary dividend per share declared 2023 2022 Rio Tinto Group Interim (US cents) 177.00 267.00 Final (US cents) 258.00 225.00 Full-year (US cents) 435.00 492.00 Rio Tinto plc Interim (UK pence) 137.67 221.63 Final (UK pence) 203.77 185.35 Full-year (UK pence) 341.44 406.98 Rio Tinto Limited Interim (Australian cents) 260.89 383.70 Final (Australian cents) 392.78 326.49 Full-year (Australian cents) 653.67 710.19 The 2023 final ordinary dividend to be paid to our Rio Tinto Limited shareholders will be fully franked. The Board expects Rio Tinto Limited to be in a position to pay fully franked dividends for the foreseeable future. On 18 April 2024, we will pay the 2023 final ordinary dividend to holders of ordinary shares and holders of ADRs on the register at the close of business on 8 March 2024 (record date). The ex- dividend date is 7 March 2024. Rio Tinto plc shareholders may choose to receive their dividend in Australian dollars or New Zealand dollars, and Rio Tinto Limited shareholders may choose to receive theirs in pounds sterling or New Zealand dollars. Currency conversions will be based on the pound sterling, Australian dollar and New Page 11 Zealand dollar exchange rates five business days before the dividend payment date. Rio Tinto plc and Rio Tinto Limited shareholders must register their currency elections by 26 March 2024. We will operate our Dividend Reinvestment Plans for the 2023 final dividend (visit riotinto.com for details). Rio Tinto plc and Rio Tinto Limited shareholders’ election notice for the Dividend Reinvestment Plans must be received by 26 March 2024. Purchases under the Dividend Reinvestment Plan are made on or as soon as practicable after the dividend payment date and at prevailing market prices. There is no discount available. Page 12

Capital projects Ongoing Iron ore Investment in the Western Range iron ore project, a joint venture between Rio Tinto (54%) and China Baowu Steel Group Co. Ltd (46%) in the Pilbara to sustain production of the Pilbara BlendTM from Rio Tinto's existing Paraburdoo hub. First production is anticipated in 2025. $1.3bn (Rio Tinto share)6 $0.8bn (Rio Tinto share) Approved in September 2022, the mine will have a capacity of 25 million tonnes per year. The project includes construction of a primary crusher and an 18 kilometre conveyor connection to the Paraburdoo processing plant. Construction is currently on schedule with civil work well advanced, while we continue to progress primary crusher works, bulk earthworks and mine pre-strip. Investment in the Simandou iron ore project in Guinea in partnership with CIOH, a Chinalco-led consortium (the Simfer joint venture) and co-development of the rail and port infrastructure with Winning Consortium Simandou⁷ (WCS), Baowu and the Republic of Guinea (the partners). Overall, the co-developed infrastructure represents more than 600 kilometres of new multi-user (including passenger and general freight services) rail together with port facilities to be co- developed by the partners to allow the export of up to 120 million tonnes per year of iron ore mined by Simfer's and WCS's respective mining concessions.⁸ $6.2bn⁹ (estimated Rio Tinto share) $5.7bn (estimated Rio Tinto share) Announced in December 2023, the Simfer joint venture10 will develop, own and operate a 60 million tonne per year¹¹ mine in blocks 3 & 4. First production at the mine is expected in 2025, ramping up over 30 months to an annualised capacity of 60 million tonnes per year (27 million tonnes Rio Tinto share). WCS will construct the project's ~536 kilometre dual track main line as well as the WCS barge port, while Simfer will construct the ~70 kilometre spur line, connecting its mining concession to the main rail line. Pending completion and commissioning of its 60 million tonne per year transhipment vessel port, Simfer will be able to export its ore using WCS's barge port. The Rio Tinto Board has approved the project, subject to the remaining conditions being met, including joint venture partner approvals and regulatory approvals¹² from China and Guinea. Aluminium Investment to expand the low-carbon AP60 aluminium smelter at the Complexe Jonquière in Quebec. The investment includes up to $113 million of financial support from the Quebec government. $1.1bn $1.0bn Approved in June 2023, the investment will add 96 AP60 pots, representing 160,000 tonnes of primary aluminium per year, replacing the Arvida smelter which is set to gradually close from 2024. We continued early works for the expansion of the AP60 smelter. Commissioning is expected in the first half of 2026, with the smelter fully ramped up by the end of that year. Once completed, it is expected to be in the first quartile of the industry operating cost curve. Copper Phase two of the south wall pushback to extend mine life at Kennecott in Utah by a further six years. $1.8bn $1.2bn Approved in December 2019, the investment will further extend strip waste rock mining and support additional infrastructure development. This will allow mining to continue into a new area of the orebody between 2026 and 2032. In March 2023, a further $0.3 billion was approved to primarily mitigate the risk of failure in an area of geotechnical instability known as Revere, necessary to both protect open pit value and enable underground development. Project (Rio Tinto 100% owned unless otherwise stated) Total capital cost (100% unless otherwise stated) Capital remaining to be spent from 1 Jan 2024 Status/Milestones Page 13 Investment in the Kennecott underground development of the North Rim Skarn (NRS) area. $0.5bn $0.5bn Approved in June 2023, production from NRS13 will commence in the first quarter of 2025 (previously 2024) and is expected to ramp up over two years, to deliver around 250,000 tonnes of additional mined copper over the next 10 years14 alongside open cut operations. Development of the Oyu Tolgoi underground copper-gold mine in Mongolia (Rio Tinto 66%), which is expected to produce (from the open pit and underground) an average of ~500,000 tonnes³ of copper per year from 2028 to 2036. $7.06bn $1.0bn We delivered first sustainable underground production from Panel 0 in March 2023. The commissioning of infrastructure for ramp-up to full capacity remains on target: we expect shafts 3 and 4 and the conveyor to surface in the second half of 2024, while the concentrator conversion is expected to be progressively completed from the fourth quarter of 2024 through to the second quarter of 2025. Construction of primary crusher 2 commenced in December 2023 and is due to be complete by the end of 2025. Project (Rio Tinto 100% owned unless otherwise stated) Total capital cost (100% unless otherwise stated) Capital remaining to be spent from 1 Jan 2024 Status/Milestones Page 14 Future options Status Iron Ore: Pilbara brownfields Over the medium term, our Pilbara system capacity remains between 345 and 360 million tonnes per year. Meeting this range, and the planned product mix, will require the approval and delivery of the next tranche of replacement mines over the next five years. In addition to Western Range (Greater Paraburdoo), which is under construction, we continue to progress studies for Hope Downs 1 (Hope Downs 2 and Bedded Hilltop), Brockman 4 (Brockman Syncline 1), Greater Nammuldi and West Angelas. We continue to work closely with local communities, Traditional Owners and governments to progress approvals for these new mining projects. Iron Ore: Rhodes Ridge In October 2022, Rio Tinto (50%) and Wright Prospecting Pty Ltd (50%) agreed to modernise the joint venture covering the Rhodes Ridge project in the Eastern Pilbara, providing a pathway for development utilising Rio Tinto’s rail, port and power infrastructure. A resource-drilling program is currently underway to support future project studies. In December 2023, we announced approval of a $77 million pre-feasibility study (PFS). This follows completion of an Order of Magnitude study that considered development of an operation with initial capacity of up to 40 million tonnes per year, subject to relevant approvals. Completion of the PFS is expected by the end of 2025 and will be followed by a feasibility study, with first ore expected by the end of the decade. Longer term, the resource could support a world-class mining hub with a potential capacity of more than 100 million tonnes of high-quality iron ore a year. Lithium: Jadar Development of the greenfield Jadar lithium-borates project in Serbia will include an underground mine with associated infrastructure and equipment, including electric haul trucks, as well as a beneficiation chemical processing plant. The Board committed funding in July 2021, subject to receiving all relevant approvals, permits and licences. We are focused on consultation with all stakeholders to explore all options following the Government of Serbia's cancellation of the Spatial Plan in January 2022. Lithium: Rincon We completed the acquisition of the Rincon Lithium project in Salta province, Argentina in March 2022. Development of a 3,000 tonne per year battery-grade lithium carbonate starter plant is ongoing with first saleable production expected at the end of 2024. Studies are continuing on the full-scale plant, which will have benefits of economies of scale, with the capital intensity, based on current stage of studies, forecast to be in line with regional lithium industry benchmarks. In July 2022, we approved $140 million of investment and $54 million for early works to support a full-scale operation. To date, the majority of costs have been expensed through exploration and evaluation expenditure. In July 2023, we approved a further $195 million to complete the starter plant: the increase was driven by the project now being fully defined (previously conceptual), scope adjustments to design (including column performance improvements and changes to waste and spent brine disposal facilities), rising capital costs across the lithium industry, particularly for processing equipment and from broad cost escalation in Argentina. Mineral Sands: Zulti South Development of the Zulti South project at Richards Bay Minerals (RBM) in South Africa (Rio Tinto 74%). Approved in April 2019 to underpin RBM’s supply of zircon and ilmenite over the life of the mine. The project remains on full suspension. Copper: Resolution The Resolution Copper project is a proposed underground copper mine in the Copper Triangle, in Arizona, US (Rio Tinto 55%). It has the potential to supply up to 25% of US copper demand. The United States Forest Service (USFS) continued work to progress the Final Environmental Impact Statement and complete actions necessary for the land exchange. We continued to advance partnership discussions with several federally-recognised Native American Tribes who are part of the formal consultation process. We are also monitoring the Apache Stronghold versus USFS case held in the US Ninth Circuit Court of Appeals. While there is significant local support for the project, we respect the views of groups who oppose it and will continue our efforts to address and mitigate these concerns. Page 15 Copper: Winu In late 2017, we discovered copper-gold mineralisation at the Winu project in the Paterson Province in Western Australia. In 2021, we reported our first Indicated Mineral Resource. The pathway remains subject to regulatory and other required approvals. In parallel, we continue to explore options aimed at enhancing project value, including further optimisation of the current pathway and alternative development models and partnerships. In 2023, Project Planning Agreements were executed with the Nyangumarta and Martu groups, the Traditional Owners of the land on which the proposed Winu mine and airstrip will be located. Study activities, drilling and fieldwork progressed sufficiently to commence Winu’s formal Western Australian Environmental Protection Authority approval process. The environmental approval deliverables and Project Agreement negotiations with both Traditional Owner groups remain the priority. Copper: La Granja In August 2023, we completed a transaction to form a joint venture with First Quantum Minerals that will work to unlock the development of the La Granja project in Peru, one of the largest undeveloped copper deposits in the world, with potential to be a large, long-life operation. First Quantum Minerals acquired a 55% stake in the project for $105 million and will invest up to a further $546 million into the joint venture to sole fund capital and operational costs to take the project through a feasibility study and toward development. All subsequent expenditures will be applied on a pro-rata basis in line with shared ownership. Aluminium: ELYSIS ELYSIS, our joint venture with Alcoa, supported by Apple, the Government of Canada and the Government of Quebec, is developing a breakthrough inert anode technology that eliminates all direct greenhouse gases from the aluminium smelting process. ELYSIS has started commissioning activities following completion of the construction of the first commercial-scale prototype cells. ELYSIS expects to start the first 450kA cell in 2024. Page 16

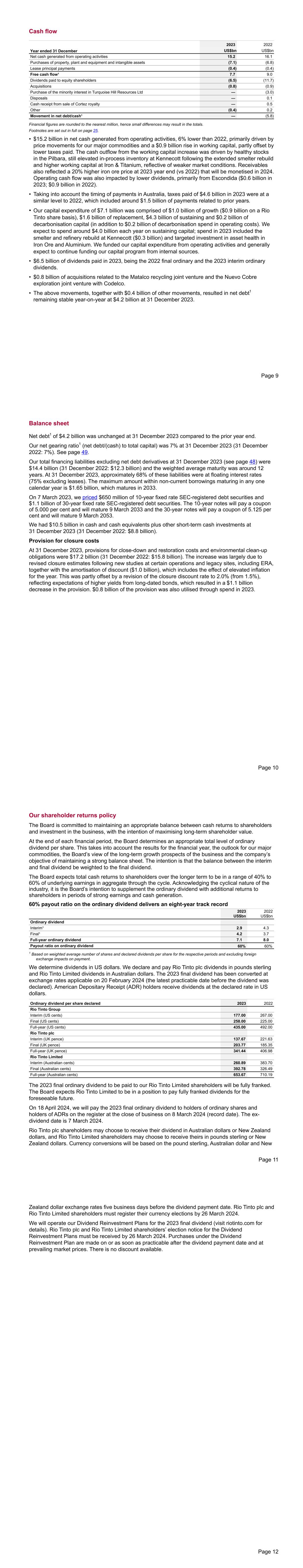

Review of operations Iron Ore Year ended 31 December 2023 2022 Change Pilbara production (million tonnes — 100%) 331.5 324.1 2 % Pilbara shipments (million tonnes — 100%) 331.8 321.6 3 % Salt production (million tonnes — Rio Tinto share)¹ 6.0 5.8 4 % Segmental revenue (US$ millions) 32,249 30,906 4 % Average realised price (US$ per dry metric tonne, FOB basis) 108.4 106.1 2 % Underlying EBITDA (US$ millions) 19,974 18,612 7 % Pilbara underlying FOB EBITDA margin² 69% 68% Underlying earnings (US$ millions)³ 11,882 11,213 6 % Net cash generated from operating activities (US$ millions) 14,045 14,005 — % Capital expenditure (US$ millions)⁴ (2,588) (2,940) (12) % Free cash flow (US$ millions) 11,374 11,033 3 % Underlying return on capital employed³, ⁵ 64% 61% Production figures are sometimes more precise than the rounded numbers shown, hence small differences may result in the year on year change. 1. Dampier Salt is reported within Iron Ore, reflecting management responsibility. Iron Ore Company of Canada continues to be reported within Minerals. The Simandou iron ore project in Guinea reports to the Chief Technical Officer and is reported outside the Reportable segments. 2. The Pilbara underlying free on board (FOB) EBITDA margin is defined as Pilbara underlying EBITDA divided by Pilbara segmental revenue, excluding freight revenue. 3. Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. 4. Capital expenditure is the net cash outflow on purchases less sales of property, plant and equipment; capitalised evaluation costs; and purchases less sales of other intangible assets. 5. Underlying return on capital employed (ROCE) is defined as underlying earnings excluding net interest divided by average capital employed. Financial performance Underlying EBITDA of $20.0 billion was 7% higher than 2022, with a 2% improvement in realised prices ($0.8 billion) and higher volumes, following the ramp-up of Gudai-Darri. Unit costs of $21.5 per tonne were $0.2 per tonne lower than 2022. Cost escalation from inflation was offset by a weaker Australian dollar and gains on derivative contracts. Higher iron ore volumes offset a higher mine work index and mine maintenance costs. Our Pilbara operations delivered an underlying FOB EBITDA margin of 69%, compared with 68% in 2022, largely due to the iron ore price. We price the majority of our iron ore sales (79%) by reference to the average index price for the month of shipment. In 2023, we priced approximately 10% of sales with reference to the prior quarter’s average index lagged by one month with the remainder sold either on current quarter average, on the spot market or other mechanisms. We made approximately 74% of sales including freight and 26% on an FOB basis. We achieved an average iron ore price of $99.7 per wet metric tonne on an FOB basis (2022: $97.6 per wet metric tonne) across our product suite. This equates to $108.4 per dry metric tonne, assuming 8% moisture (2022: $106.1 per dry metric tonne), which compares with the monthly average Platts index for 62% iron fines converted to an FOB basis of $110.3 per dry metric tonne (2022: $109.8 per dry metric tonne). The 2% lower realised price compared to the Platts index was mainly due to the lower average grades of our portfolio compared to the 62% index. Segmental revenue for our Pilbara operations included freight revenue of $2.1 billion (2022: $2.2 billion). Page 17 Net cash generated from operating activities of $14.0 billion was on a par with 2022. Benefits from higher realised prices and higher volumes offset a build in working capital to ensure healthy stocks across the system and an increased receivables balance due to strong iron ore prices at year end. Free cash flow of $11.4 billion was $0.3 billion higher than 2022, mostly driven by a $0.4 billion reduction in capital expenditure to $2.6 billion due to lower spend on replacement capital. Review of operations Pilbara operations produced 331.5 million tonnes (100% basis) of iron ore, 2% higher than 2022. Shipments, on a 100% basis, were 3% higher (+10 million tonnes) than in 2022, making 2023 the second highest shipment year on record. Improved system performance supported by a 5 million tonne uplift from implementation of the Safe Production System, and ramp-up of Gudai-Darri to its 43 million tonne nameplate capacity, offset mine depletion. SP10 volumes accounted for 47.5 million tonnes of 2023 shipments (or 14%). We continue to see strong demand for our portside product in China, with sales totalling 23.3 million tonnes in 2023 (2022: 24.3 million tonnes). At the end of 2023, inventory levels were 6.4 million tonnes, including 3.9 million tonnes of Pilbara product. In 2023, approximately 86% of our portside sales were either screened or blended in Chinese ports. In January 2024, Dampier Salt Limited entered into a sales agreement for the Lake MacLeod salt and gypsum operation in Carnarvon, Western Australia with privately-owned salt company Leichhardt Industrials Group for $251 million (A$375 million). Completion of the sale is subject to certain commercial and regulatory conditions being satisfied. The transaction is subject to capital gains tax. Page 18 Aluminium Year ended 31 December 2023 2022 Change Bauxite production ('000 tonnes — Rio Tinto share) 54,619 54,618 0 % Alumina production ('000 tonnes — Rio Tinto share) 7,537 7,544 0 % Aluminium production ('000 tonnes — Rio Tinto share) 3,272 3,009 9 % Segmental revenue (US$ millions) 12,285 14,109 (13) % Average realised aluminium price (US$ per tonne) 2,738 3,330 (18) % Underlying EBITDA (US$ millions) 2,282 3,672 (38) % Underlying EBITDA margin (integrated operations) 21% 29% Underlying earnings (US$ millions)¹ 538 1,504 (64) % Net cash generated from operating activities (US$ millions) 1,980 3,055 (35) % Capital expenditure — excluding EAUs (US$ millions)² (1,331) (1,377) (3) % Free cash flow (US$ millions) 619 1,652 (63) % Underlying return on capital employed¹, ³ 3% 10% Footnotes are set out in full on page 25. 1. Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. 2. Capital expenditure is the net cash outflow on purchases less sales of property, plant and equipment; capitalised evaluation costs; and purchases less sales of other intangible assets. It excludes equity accounted units (EAUs). 3. Underlying return on capital employed (ROCE) is defined as underlying earnings excluding net interest divided by average capital employed. Financial performance Although global primary aluminium demand rose by ~1% in 2023, falling costs and an increase in global supply led to a 17% reduction in the LME price and lower market and product premiums. Market-related costs for key materials such as caustic, coke and pitch moderated with some of this benefitting underlying EBITDA in the second half. Operating costs particularly in our mines and refineries increased year on year with a focus on improved operational stability and asset health. Overall there was significant margin compression for our Aluminium business with a 38% decrease in underlying EBITDA to $2.3 billion. Underlying EBITDA margin fell eight percentage points to 21%. We achieved an average realised aluminium price of $2,738 per tonne, 18% lower than 2022. Average realised aluminium prices comprise the LME price, a market premium and a value-added product (VAP) premium. The cash LME price averaged $2,250 per tonne, 17% lower than 2022, while in our key US market, the Midwest premium duty paid, which is 57% of our total volumes (2022: 57%), decreased by 22% to $512 per tonne (2022: $655 per tonne). Our VAP sales represented 46% of the primary metal we sold (2022: 50%) and generated product premiums averaging $354 per tonne of VAP sold (2022: $431 per tonne). Our conversion of underlying EBITDA to cash remained relatively strong, with net cash generated from operating activities of $2.0 billion. Free cash flow of $0.6 billion reflected investment in the business of $1.3 billion. Page 19 Review of operations Bauxite production of 54.6 million tonnes was unchanged from 2022. Operations saw a continued improvement in the fourth quarter, following the challenges of higher-than-average rainfall at Weipa in the first quarter and equipment downtime at both Weipa and Gove in the first half. We shipped 37.3 million tonnes of bauxite to third parties, 2% lower than 2022. Segmental revenue for bauxite was also unchanged at $2.4 billion. This includes freight revenue of $0.5 billion (2022: $0.6 billion). Alumina production of 7.5 million tonnes was unchanged from 2022, with the Yarwun and Queensland Alumina Limited (QAL) refineries showing improved operational stability. For the 2023 calendar year, as the result of QAL's activation of a step-in process following sanction measures enacted by the Australian Government in 2022, we continued to take on 100% of capacity for as long as the step-in continues. We have used Rusal’s 20% share of capacity under the tolling arrangement with QAL. This additional output is excluded from our production results as QAL remains 80% owned by Rio Tinto and 20% owned by Rusal. On 1 February 2024, the Federal Court of Australia rendered its decision in the litigation initiated by Rusal against Rio Tinto and QAL, dismissing Rusal’s case. Rio Tinto and QAL are working to understand the impacts of the decision. Aluminium production of 3.3 million tonnes was 9% higher than 2022, after we returned to full capacity at the Kitimat smelter and completed cell recovery efforts at Boyne during the third quarter. All other smelters continued to demonstrate stable performance. Page 20

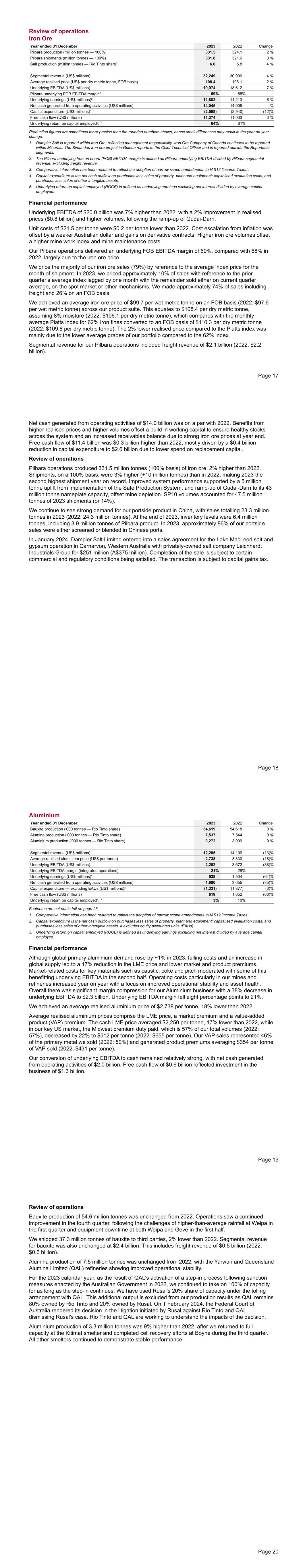

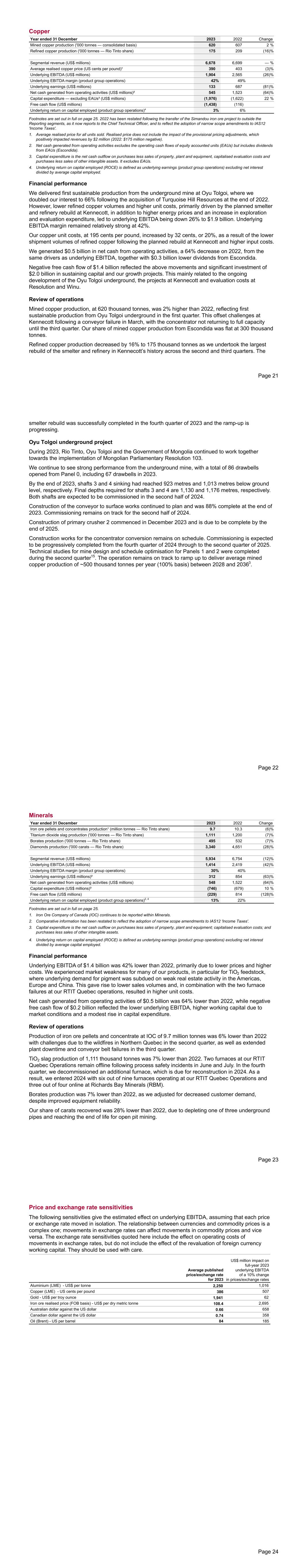

Copper Year ended 31 December 2023 2022 Change Mined copper production ('000 tonnes — consolidated basis) 620 607 2 % Refined copper production ('000 tonnes — Rio Tinto share) 175 209 (16) % Segmental revenue (US$ millions) 6,678 6,699 — % Average realised copper price (US cents per pound)¹ 390 403 (3) % Underlying EBITDA (US$ millions) 1,904 2,565 (26) % Underlying EBITDA margin (product group operations) 42% 49% Underlying earnings (US$ millions) 133 687 (81) % Net cash generated from operating activities (US$ millions)² 545 1,523 (64) % Capital expenditure — excluding EAUs³ (US$ millions) (1,976) (1,622) 22 % Free cash flow (US$ millions) (1,438) (116) Underlying return on capital employed (product group operations)⁴ 3% 6% Footnotes are set out in full on page 25. 2022 has been restated following the transfer of the Simandou iron ore project to outside the Reporting segments, as it now reports to the Chief Technical Officer, and to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. 1. Average realised price for all units sold. Realised price does not include the impact of the provisional pricing adjustments, which positively impacted revenues by $2 million (2022: $175 million negative). 2. Net cash generated from operating activities excludes the operating cash flows of equity accounted units (EAUs) but includes dividends from EAUs (Escondida). 3. Capital expenditure is the net cash outflow on purchases less sales of property, plant and equipment, capitalised evaluation costs and purchases less sales of other intangible assets. It excludes EAUs. 4. Underlying return on capital employed (ROCE) is defined as underlying earnings (product group operations) excluding net interest divided by average capital employed. Financial performance We delivered first sustainable production from the underground mine at Oyu Tolgoi, where we doubled our interest to 66% following the acquisition of Turquoise Hill Resources at the end of 2022. However, lower refined copper volumes and higher unit costs, primarily driven by the planned smelter and refinery rebuild at Kennecott, in addition to higher energy prices and an increase in exploration and evaluation expenditure, led to underlying EBITDA being down 26% to $1.9 billion. Underlying EBITDA margin remained relatively strong at 42%. Our copper unit costs, at 195 cents per pound, increased by 32 cents, or 20%, as a result of the lower shipment volumes of refined copper following the planned rebuild at Kennecott and higher input costs. We generated $0.5 billion in net cash from operating activities, a 64% decrease on 2022, from the same drivers as underlying EBITDA, together with $0.3 billion lower dividends from Escondida. Negative free cash flow of $1.4 billion reflected the above movements and significant investment of $2.0 billion in sustaining capital and our growth projects. This mainly related to the ongoing development of the Oyu Tolgoi underground, the projects at Kennecott and evaluation costs at Resolution and Winu. Review of operations Mined copper production, at 620 thousand tonnes, was 2% higher than 2022, reflecting first sustainable production from Oyu Tolgoi underground in the first quarter. This offset challenges at Kennecott following a conveyor failure in March, with the concentrator not returning to full capacity until the third quarter. Our share of mined copper production from Escondida was flat at 300 thousand tonnes. Refined copper production decreased by 16% to 175 thousand tonnes as we undertook the largest rebuild of the smelter and refinery in Kennecott’s history across the second and third quarters. The Page 21 smelter rebuild was successfully completed in the fourth quarter of 2023 and the ramp-up is progressing. Oyu Tolgoi underground project During 2023, Rio Tinto, Oyu Tolgoi and the Government of Mongolia continued to work together towards the implementation of Mongolian Parliamentary Resolution 103. We continue to see strong performance from the underground mine, with a total of 86 drawbells opened from Panel 0, including 67 drawbells in 2023. By the end of 2023, shafts 3 and 4 sinking had reached 923 metres and 1,013 metres below ground level, respectively. Final depths required for shafts 3 and 4 are 1,130 and 1,176 metres, respectively. Both shafts are expected to be commissioned in the second half of 2024. Construction of the conveyor to surface works continued to plan and was 88% complete at the end of 2023. Commissioning remains on track for the second half of 2024. Construction of primary crusher 2 commenced in December 2023 and is due to be complete by the end of 2025. Construction works for the concentrator conversion remains on schedule. Commissioning is expected to be progressively completed from the fourth quarter of 2024 through to the second quarter of 2025. Technical studies for mine design and schedule optimisation for Panels 1 and 2 were completed during the second quarter15. The operation remains on track to ramp up to deliver average mined copper production of ~500 thousand tonnes per year (100% basis) between 2028 and 20363. Page 22 Minerals Year ended 31 December 2023 2022 Change Iron ore pellets and concentrates production¹ (million tonnes — Rio Tinto share) 9.7 10.3 (6) % Titanium dioxide slag production ('000 tonnes — Rio Tinto share) 1,111 1,200 (7) % Borates production ('000 tonnes — Rio Tinto share) 495 532 (7) % Diamonds production ('000 carats — Rio Tinto share) 3,340 4,651 (28) % Segmental revenue (US$ millions) 5,934 6,754 (12) % Underlying EBITDA (US$ millions) 1,414 2,419 (42) % Underlying EBITDA margin (product group operations) 30% 40% Underlying earnings (US$ millions)² 312 854 (63) % Net cash generated from operating activities (US$ millions) 548 1,522 (64) % Capital expenditure (US$ millions)³ (746) (679) 10 % Free cash flow (US$ millions) (229) 814 (128) % Underlying return on capital employed (product group operations)2, 4 13% 22% Footnotes are set out in full on page 25. 1. Iron Ore Company of Canada (IOC) continues to be reported within Minerals. 2. Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. 3. Capital expenditure is the net cash outflow on purchases less sales of property, plant and equipment; capitalised evaluation costs; and purchases less sales of other intangible assets. 4. Underlying return on capital employed (ROCE) is defined as underlying earnings (product group operations) excluding net interest divided by average capital employed. Financial performance Underlying EBITDA of $1.4 billion was 42% lower than 2022, primarily due to lower prices and higher costs. We experienced market weakness for many of our products, in particular for TiO2 feedstock, where underlying demand for pigment was subdued on weak real estate activity in the Americas, Europe and China. This gave rise to lower sales volumes and, in combination with the two furnace failures at our RTIT Quebec operations, resulted in higher unit costs. Net cash generated from operating activities of $0.5 billion was 64% lower than 2022, while negative free cash flow of $0.2 billion reflected the lower underlying EBITDA, higher working capital due to market conditions and a modest rise in capital expenditure. Review of operations Production of iron ore pellets and concentrate at IOC of 9.7 million tonnes was 6% lower than 2022 with challenges due to the wildfires in Northern Quebec in the second quarter, as well as extended plant downtime and conveyor belt failures in the third quarter. TiO2 slag production of 1,111 thousand tonnes was 7% lower than 2022. Two furnaces at our RTIT Quebec Operations remain offline following process safety incidents in June and July. In the fourth quarter, we decommissioned an additional furnace, which is due for reconstruction in 2024. As a result, we entered 2024 with six out of nine furnaces operating at our RTIT Quebec Operations and three out of four online at Richards Bay Minerals (RBM). Borates production was 7% lower than 2022, as we adjusted for decreased customer demand, despite improved equipment reliability. Our share of carats recovered was 28% lower than 2022, due to depleting one of three underground pipes and reaching the end of life for open pit mining. Page 23 Price and exchange rate sensitivities The following sensitivities give the estimated effect on underlying EBITDA, assuming that each price or exchange rate moved in isolation. The relationship between currencies and commodity prices is a complex one; movements in exchange rates can affect movements in commodity prices and vice versa. The exchange rate sensitivities quoted here include the effect on operating costs of movements in exchange rates, but do not include the effect of the revaluation of foreign currency working capital. They should be used with care. Australian dollar against the US dollar 0.66 658 Canadian dollar against the US dollar 0.74 358 Oil (Brent) - US per barrel 84 185 Average published price/exchange rate for 2023 US$ million impact on full-year 2023 underlying EBITDA of a 10% change in prices/exchange rates Aluminium (LME) - US$ per tonne 2,250 1,016 Copper (LME) - US cents per pound 386 507 Gold - US$ per troy ounce 1,941 62 Iron ore realised price (FOB basis) - US$ per dry metric tonne 108.4 2,695 Page 24

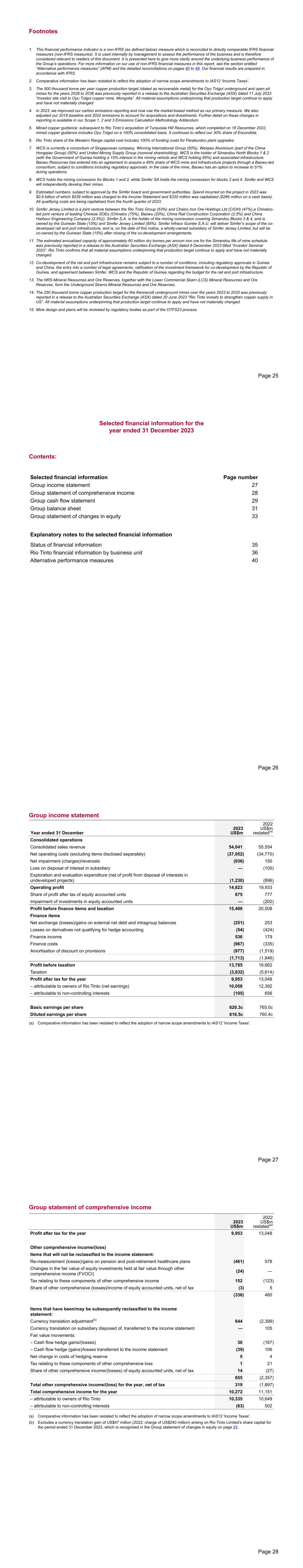

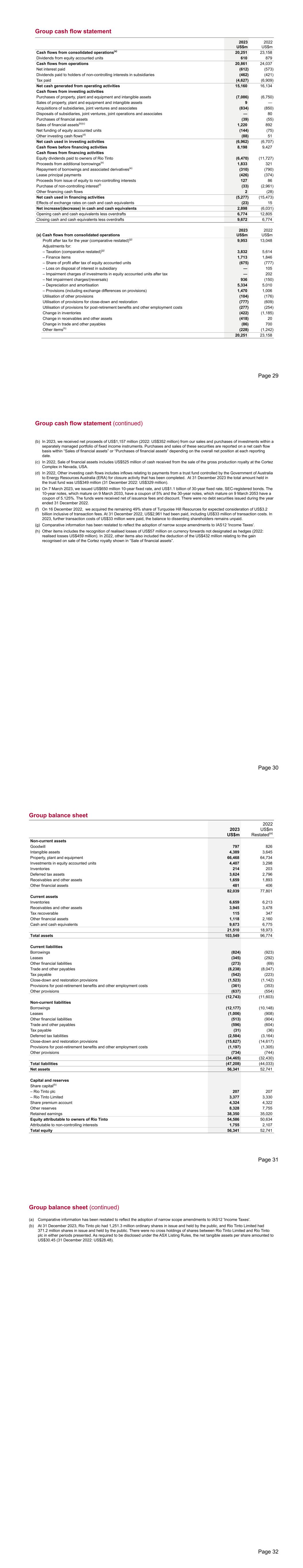

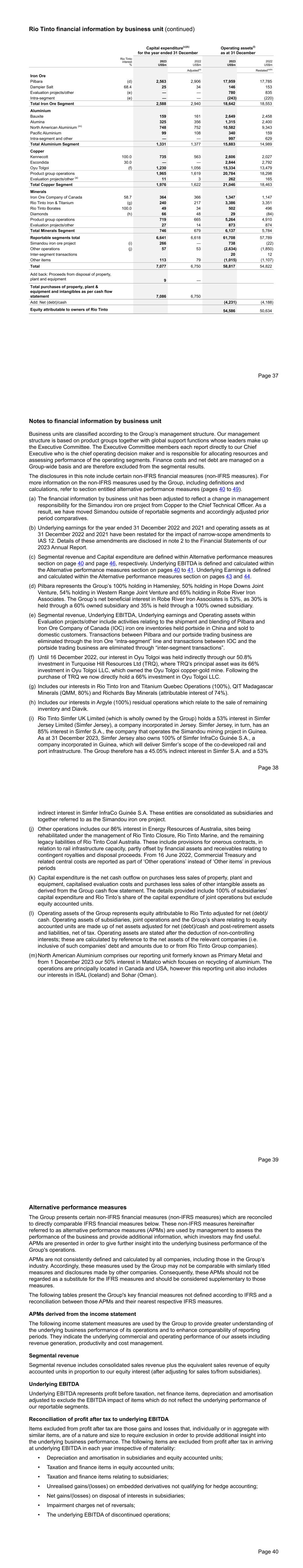

Footnotes 1. This financial performance indicator is a non-IFRS (as defined below) measure which is reconciled to directly comparable IFRS financial measures (non-IFRS measures). It is used internally by management to assess the performance of the business and is therefore considered relevant to readers of this document. It is presented here to give more clarity around the underlying business performance of the Group’s operations. For more information on our use of non-IFRS financial measures in this report, see the section entitled “Alternative performance measures” (APM) and the detailed reconciliations on pages 40 to 49. Our financial results are prepared in accordance with IFRS. 2. Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. 3. The 500 thousand tonne per year copper production target (stated as recoverable metal) for the Oyu Tolgoi underground and open pit mines for the years 2028 to 2036 was previously reported in a release to the Australian Securities Exchange (ASX) dated 11 July 2023 “Investor site visit to Oyu Tolgoi copper mine, Mongolia”. All material assumptions underpinning that production target continue to apply and have not materially changed. 4. In 2023, we improved our carbon emissions reporting and now use the market-based method as our primary measure. We also adjusted our 2018 baseline and 2022 emissions to account for acquisitions and divestments. Further detail on these changes in reporting is available in our Scope 1, 2 and 3 Emissions Calculation Methodology Addendum. 5. Mined copper guidance: subsequent to Rio Tinto’s acquisition of Turquoise Hill Resources, which completed on 16 December 2022, mined copper guidance includes Oyu Tolgoi on a 100% consolidated basis. It continues to reflect our 30% share of Escondida. 6. Rio Tinto share of the Western Range capital cost includes 100% of funding costs for Paraburdoo plant upgrades. 7. WCS is currently a consortium of Singaporean company, Winning International Group (50%), Weiqiao Aluminium (part of the China Hongqiao Group) (50%) and United Mining Supply Group (nominal shareholding). WCS is the holder of Simandou North Blocks 1 & 2 (with the Government of Guinea holding a 15% interest in the mining vehicle and WCS holding 85%) and associated infrastructure. Baowu Resources has entered into an agreement to acquire a 49% share of WCS mine and infrastructure projects through a Baowu-led consortium, subject to conditions including regulatory approvals. In the case of the mine, Baowu has an option to increase to 51% during operations. 8. WCS holds the mining concession for Blocks 1 and 2, while Simfer SA holds the mining concession for blocks 3 and 4. Simfer and WCS will independently develop their mines. 9. Estimated numbers, subject to approval by the Simfer board and government authorities. Spend incurred on the project in 2023 was $0.9 billion of which $539 million was charged to the Income Statement and $330 million was capitalised ($266 million on a cash basis). All qualifying costs are being capitalised from the fourth quarter of 2023. 10. Simfer Jersey Limited is a joint venture between the Rio Tinto Group (53%) and Chalco Iron Ore Holdings Ltd (CIOH) (47%),a Chinalco- led joint venture of leading Chinese SOEs (Chinalco (75%), Baowu (20%), China Rail Construction Corporation (2.5%) and China Harbour Engineering Company (2.5%)). Simfer S.A. is the holder of the mining concession covering Simandou Blocks 3 & 4, and is owned by the Guinean State (15%) and Simfer Jersey Limited (85%). Simfer Infraco Guinée S.A.U. will deliver Simfer’s scope of the co- developed rail and port infrastructure, and is, on the date of this notice, a wholly-owned subsidiary of Simfer Jersey Limited, but will be co-owned by the Guinean State (15%) after closing of the co-development arrangements. 11. The estimated annualised capacity of approximately 60 million dry tonnes per annum iron ore for the Simandou life of mine schedule was previously reported in a release to the Australian Securities Exchange (ASX) dated 6 December 2023 titled “Investor Seminar 2023”. Rio Tinto confirms that all material assumptions underpinning that production target continue to apply and have not materially changed. 12. Co-development of the rail and port infrastructure remains subject to a number of conditions, including regulatory approvals in Guinea and China, the entry into a number of legal agreements, ratification of the investment framework for co-development by the Republic of Guinea, and agreement between Simfer, WCS and the Republic of Guinea regarding the budget for the rail and port infrastructure. 13. The NRS Mineral Resources and Ore Reserves, together with the Lower Commercial Skarn (LCS) Mineral Resources and Ore Reserves, form the Underground Skarns Mineral Resources and Ore Reserves. 14. The 250 thousand tonne copper production target for the Kennecott underground mines over the years 2023 to 2033 was previously reported in a release to the Australian Securities Exchange (ASX) dated 20 June 2023 "Rio Tinto invests to strengthen copper supply in US”. All material assumptions underpinning that production target continue to apply and have not materially changed. 15. Mine design and plans will be reviewed by regulatory bodies as part of the OTFS23 process. Page 25 Selected financial information for the year ended 31 December 2023 Contents: Selected financial information Page number Group income statement 27 Group statement of comprehensive income 28 Group cash flow statement 29 Group balance sheet 31 Group statement of changes in equity 33 Explanatory notes to the selected financial information Status of financial information 35 Rio Tinto financial information by business unit 36 Alternative performance measures 40 Page 26 Group income statement Year ended 31 December 2023 US$m 2022 US$m restated(a) Consolidated operations Consolidated sales revenue 54,041 55,554 Net operating costs (excluding items disclosed separately) (37,052) (34,770) Net impairment (charges)/reversals (936) 150 Loss on disposal of interest in subsidiary — (105) Exploration and evaluation expenditure (net of profit from disposal of interests in undeveloped projects) (1,230) (896) Operating profit 14,823 19,933 Share of profit after tax of equity accounted units 675 777 Impairment of investments in equity accounted units — (202) Profit before finance items and taxation 15,498 20,508 Finance items Net exchange (losses)/gains on external net debt and intragroup balances (251) 253 Losses on derivatives not qualifying for hedge accounting (54) (424) Finance income 536 179 Finance costs (967) (335) Amortisation of discount on provisions (977) (1,519) (1,713) (1,846) Profit before taxation 13,785 18,662 Taxation (3,832) (5,614) Profit after tax for the year 9,953 13,048 – attributable to owners of Rio Tinto (net earnings) 10,058 12,392 – attributable to non-controlling interests (105) 656 Basic earnings per share 620.3c 765.0c Diluted earnings per share 616.5c 760.4c (a) Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. Page 27 Group statement of comprehensive income 2023 US$m 2022 US$m restated(a) Profit after tax for the year 9,953 13,048 Other comprehensive income/(loss) Items that will not be reclassified to the income statement: Re-measurement (losses)/gains on pension and post-retirement healthcare plans (461) 578 Changes in the fair value of equity investments held at fair value through other comprehensive income (FVOCI) (24) — Tax relating to these components of other comprehensive income 152 (123) Share of other comprehensive (losses)/income of equity accounted units, net of tax (3) 5 (336) 460 Items that have been/may be subsequently reclassified to the income statement: Currency translation adjustment(b) 644 (2,399) Currency translation on subsidiary disposed of, transferred to the income statement — 105 Fair value movements: – Cash flow hedge gains/(losses) 30 (167) – Cash flow hedge (gains)/losses transferred to the income statement (39) 106 Net change in costs of hedging reserve 5 4 Tax relating to these components of other comprehensive loss 1 21 Share of other comprehensive income/(losses) of equity accounted units, net of tax 14 (27) 655 (2,357) Total other comprehensive income/(loss) for the year, net of tax 319 (1,897) Total comprehensive income for the year 10,272 11,151 – attributable to owners of Rio Tinto 10,335 10,649 – attributable to non-controlling interests (63) 502 (a) Comparative information has been restated to reflect the adoption of narrow scope amendments to IAS12 'Income Taxes'. (b) Excludes a currency translation gain of US$47 million (2022: charge of US$240 million) arising on Rio Tinto Limited’s share capital for the period ended 31 December 2023, which is recognised in the Group statement of changes in equity on page 33. Page 28