附件7

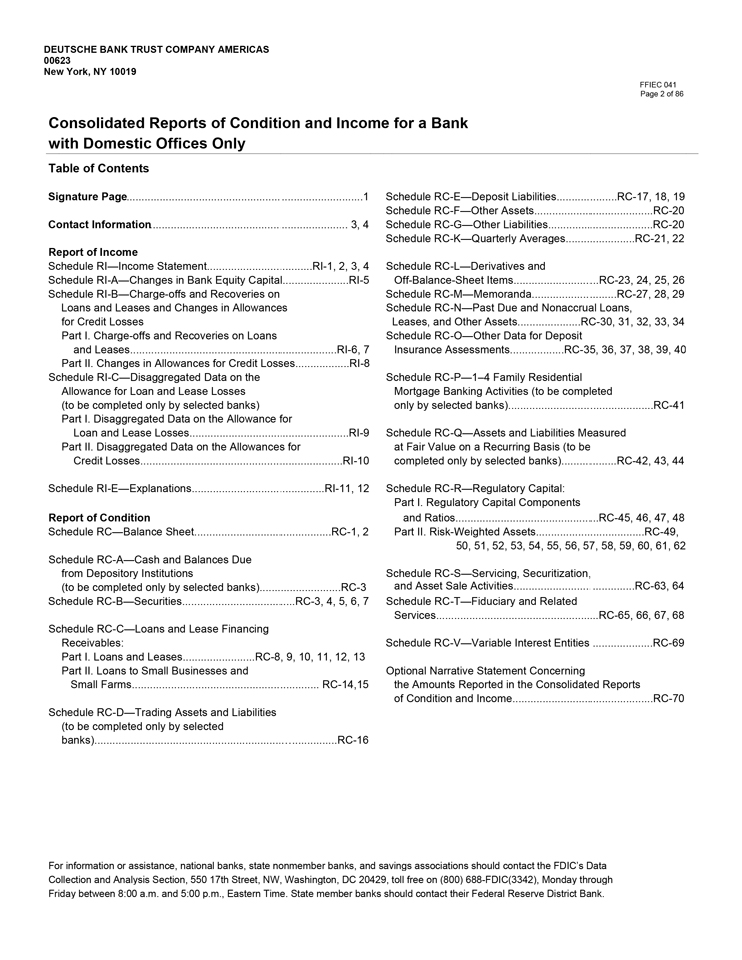

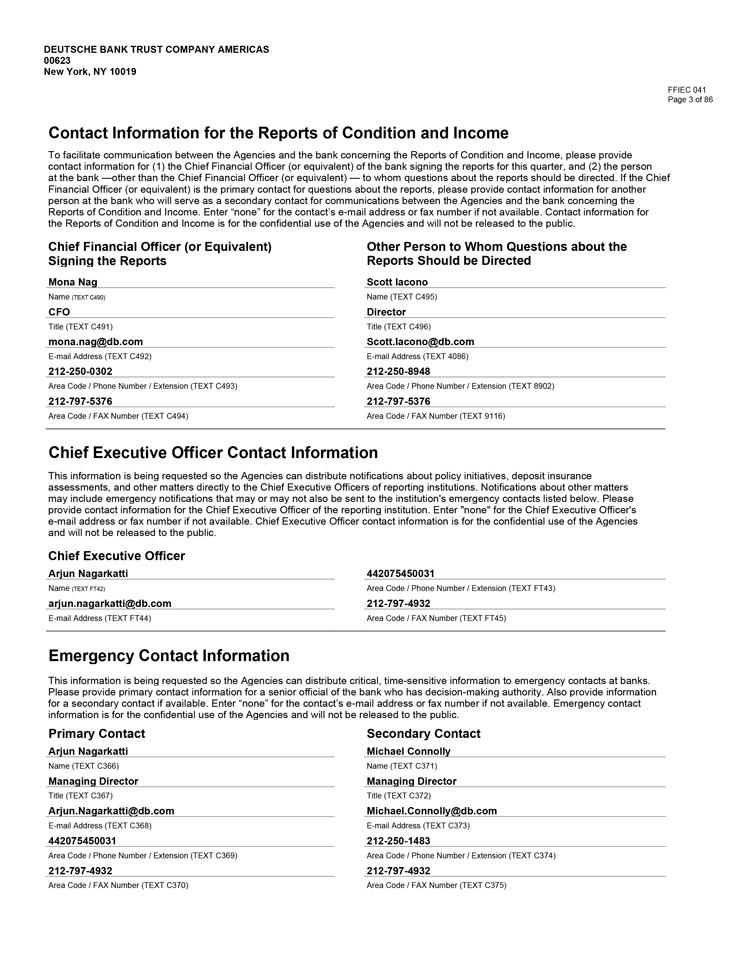

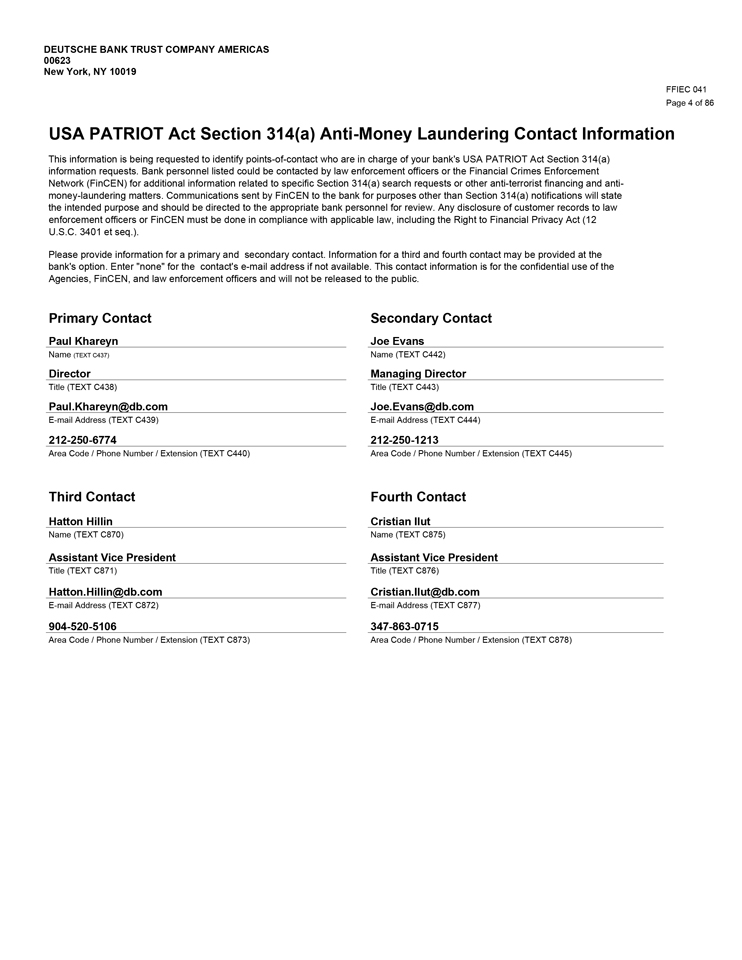

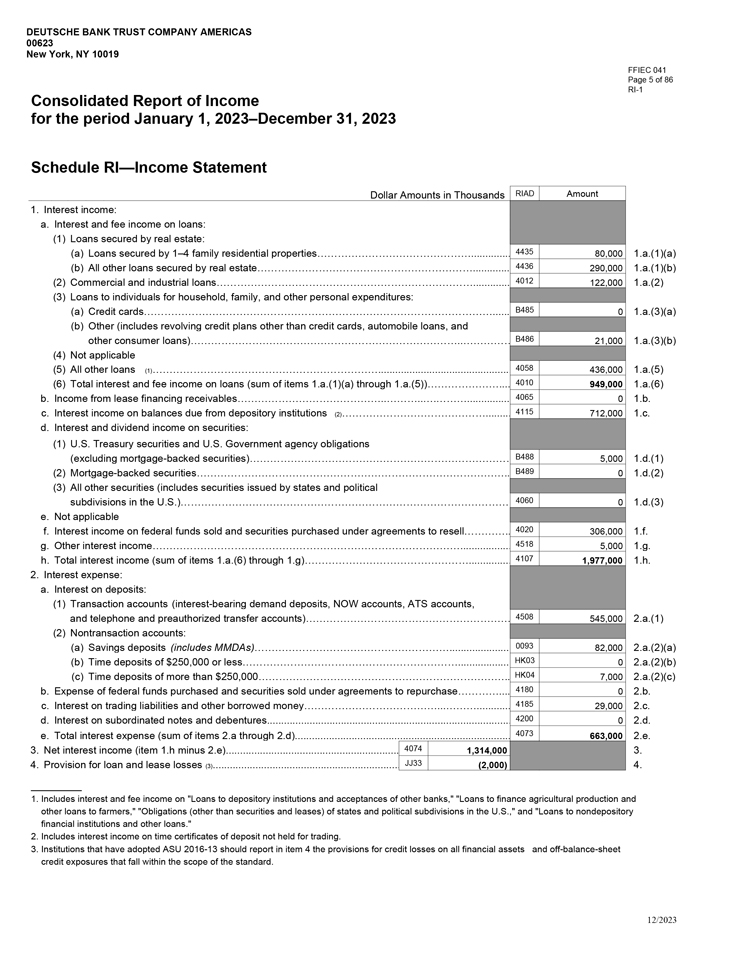

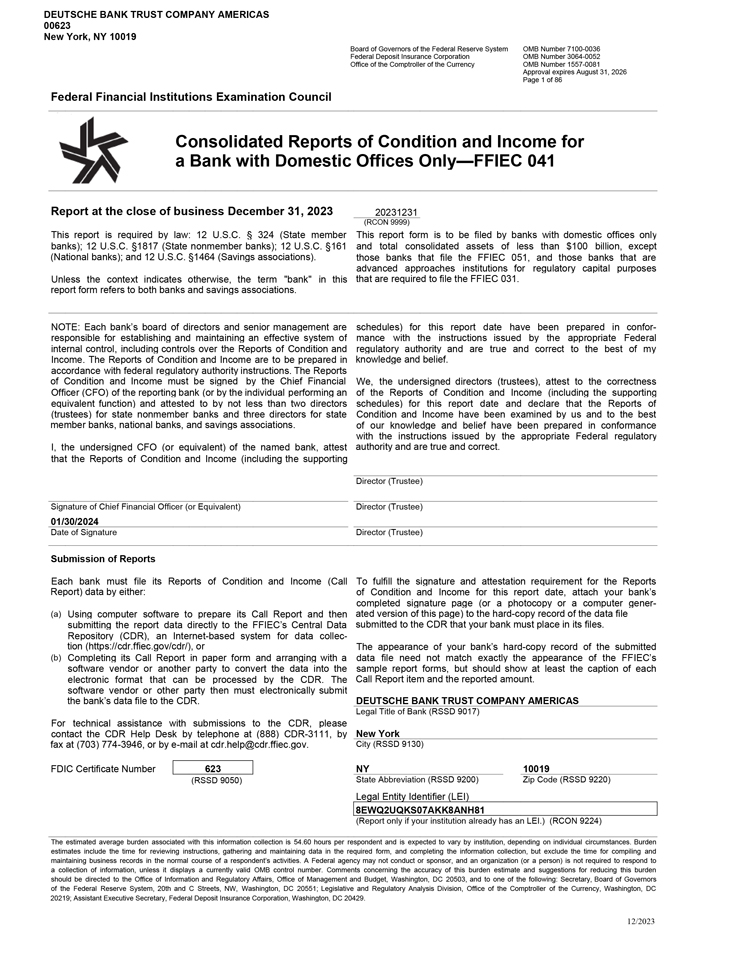

DEUTSCHE BANK TRUST COMPANY AMERICAS 00623 New York, NY 10019 Board of Governors of the Federal Reserve System OMB Number 7100-0036 Federal Deposit Insurance Corporation OMB Number 3064-0052 Office of the Comptroller of the Currency OMB Number 1557-0081 Approval expires August 31, 2026 Page 1 of 86 Federal Financial Institutions Examination Council Consolidated Reports of Condition and Income for a Bank with Domestic Offices OnlyFFIEC 041 Report at the close of business December 31, 2023 20231231 (RCON 9999) This report is required by law: 12 U.S.C. § 324 (State member This report form is to be filed by banks with domestic offices only banks); 12 U.S.C. §1817 (State nonmember banks); 12 U.S.C. §161 and total consolidated assets of less than $100 billion, except (National banks); and 12 U.S.C. §1464 (Savings associations). those banks that file the FFIEC 051, and those banks that are advanced approaches institutions for regulatory capital purposes Unless the context indicates otherwise, the term bank in this that are required to file the FFIEC 031. report form refers to both banks and savings associations. NOTE: Each banks board of directors and senior management are responsible for establishing and maintaining an effective system of internal control, including controls over the Reports of Condition and Income. The Reports of Condition and Income are to be prepared in accordance with federal regulatory authority instructions. The Reports of Condition and Income must be signed by the Chief Financial Officer (CFO) of the reporting bank (or by the individual performing an equivalent function) and attested to by not less than two directors (trustees) for state nonmember banks and three directors for state member banks, national banks, and savings associations. I, the undersigned CFO (or equivalent) of the named bank, attest that the Reports of Condition and Income (including the supporting Signature of Chief Financial Officer (or Equivalent) 01/30/2024 Date of Signature schedules) for this report date have been prepared in conformance with the instructions issued by the appropriate Federal regulatory authority and are true and correct to the best of my knowledge and belief. We, the undersigned directors (trustees), attest to the correctness of the Reports of Condition and Income (including the supporting schedules) for this report date and declare that the Reports of Condition and Income have been examined by us and to the best of our knowledge and belief have been prepared in conformance with the instructions issued by the appropriate Federal regulatory authority and are true and correct. Director (Trustee) Director (Trustee) Director (Trustee) Submission of Reports Each bank must file its Reports of Condition and Income (Call To fulfill the signature and attestation requirement for the Reports Report) data by either: of Condition and Income for this report date, attach your banks completed signature page (or a photocopy or a computer gener-(a) Using computer software to prepare its Call Report and then ated version of this page) to the hard-copy record of the data file submitting the report data directly to the FFIECs Central Data submitted to the CDR that your bank must place in its files. Repository (CDR), an Internet-based system for data collection (https://cdr.ffiec.gov/cdr/), or The appearance of your banks hard-copy record of the submitted (b) Completing its Call Report in paper form and arranging with a data file need not match exactly the appearance of the FFIECs software vendor or another party to convert the data into the sample report forms, but should show at least the caption of each electronic format that can be processed by the CDR. The Call Report item and the reported amount. software vendor or other party then must electronically submit the banks data file to the CDR. DEUTSCHE BANK TRUST COMPANY AMERICAS Legal Title of Bank (RSSD 9017) For technical assistance with submissions to the CDR, please contact the CDR Help Desk by telephone at (888) CDR—3111,通過紐約傳真(703)774—3946,或通過電子郵件(www.example.com @ cdr. ffiec. gov. City(RSSD 9130)FDIC證書編號623 NY 10019(RSSD 9050)州縮寫(RSSD 9200)郵政編碼(RSSD 9220)法律實體標識符(LEI)8EWQ2UQKS 07AK8ANH81(僅在貴機構已經有LEI的情況下報告)。(RCON 9224)與此信息收集相關的估計平均 負擔為每位受訪者54.60小時,預計會因機構而異,具體情況視個人情況而異。負擔估計包括審閲指示、以所需形式收集和維護 數據以及完成信息收集的時間,但不包括在答辯人活動的正常過程中彙編和維護業務記錄的時間。聯邦機構不得進行或贊助, 組織(或個人)無需對信息收集作出迴應,除非該組織顯示當前有效的OMB控制編號。有關此負擔估算準確性的意見和減少此負擔的建議應 發送給信息和監管事務辦公室,管理和預算辦公室,華盛頓特區20503,以及以下人員之一:祕書,美聯儲系統理事會,20街和C街,NW,華盛頓特區 20551;貨幣監理署立法和監管分析司,華盛頓特區20219;聯邦存款保險公司助理執行祕書,華盛頓特區20429。12/2023 06/2012