(根據特拉華州法律註冊為有限責任公司)

(根據英國法律成立為有限責任公司)

臨時全球票據,最高可達

系列本金合計

附註的標題

不可撤銷且無條件地由

聯合利華(英國)

聯合利華美國公司

(根據英國法律成立為有限責任公司)

(根據特拉華州法律註冊為有限責任公司)

本臨時全球票據針對以下對象發行

臨時全球票據本金金額

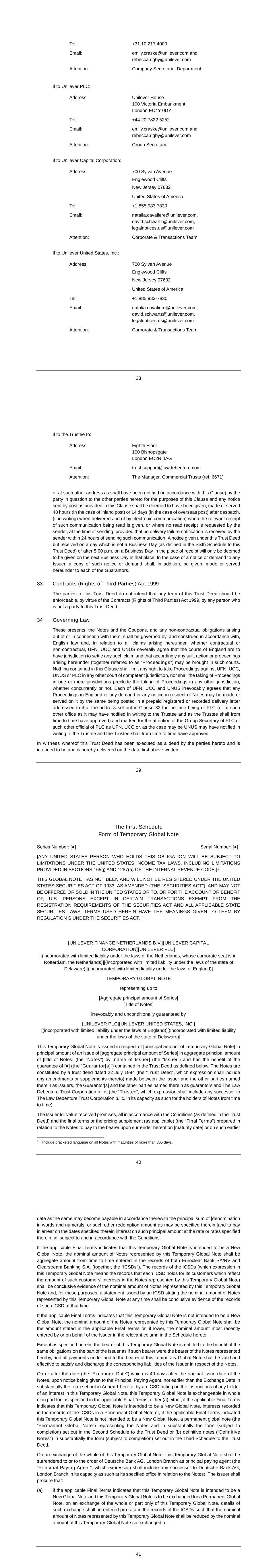

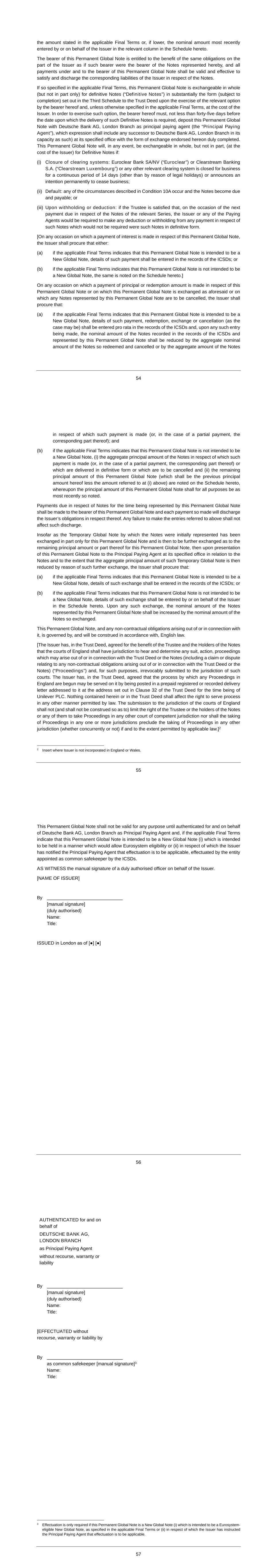

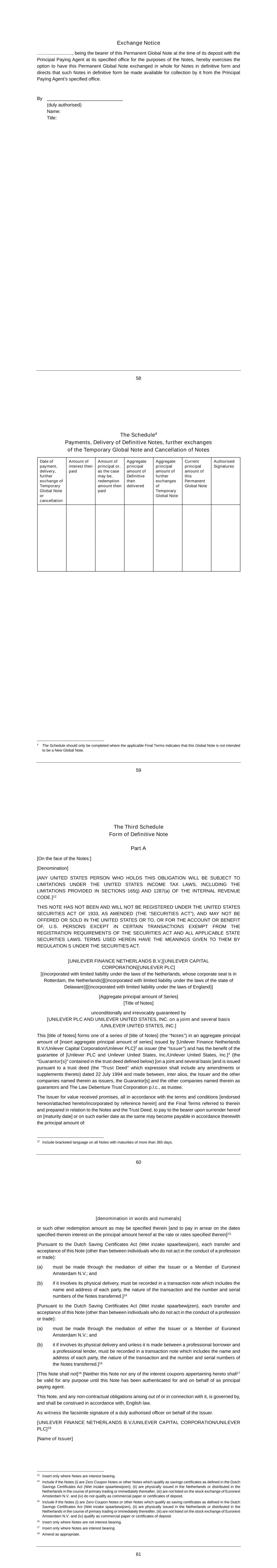

一次發行的本金[●]系列本金合計[●][合計本金金額]註釋標題[(《註釋》)作者:][簽發人姓名或名稱][(“發行人”),並享有以下擔保的利益][(“擔保人”][”)包含在以下定義的信託契約中。該等票據由發行人與該等發行人的其他各方(擔保人)訂立的日期為一九九四年七月二十二日的信託契據(「信託契據」,其中包括任何修訂或補充)構成][及該文件所列為擔保人的其他各方及The Law Debrider Trust Corporation p.l.c. (the“受託人”,該詞應包括法律債務信託公司的任何繼承人。以其身份不時為票據持有人)。 發行人已收到承諾,所有承諾均符合就票據而編制的條件(定義見信託契約)及最終條款或定價補充(如適用)(“最終條款”),於下列日期: ]到期日[1包括所有到期日超過365天的票據的方括號內的文字。 41日,根據該日起, ][文字和數字命名]或其中指明的其他贖回金額 [並在該通知書所指明的日期,按通知書所指明的利率,繳付該等本金的利息。][所有這些都受並符合條件。 如果適用的最終條款表明本臨時全球票據擬作為新的全球票據,則本臨時全球票據所代表的票據面值應為歐洲結算銀行SA/NV和Clearstream Banking S.A.記錄中不時錄入的總額。(統稱“ICSDs”)。ICSD的記錄(本臨時全面票據中的表述是指每個ICSD為其客户持有的記錄,反映客户在本臨時全面票據所代表的票據中的權益金額)應為本臨時全面票據所代表的票據面值的確證,併為此目的,ICSD在任何時候發出的聲明,説明本臨時環球票據所代表的票據面額,即為該ICSD當時記錄的確證。 如適用的最終條款表明本臨時全球票據並非擬為新的全球票據,則本臨時全球票據所代表的票據面值應為適用的最終條款所述的金額,或(如較低)由發行人或其代表在本協議附表相關欄最近輸入的面值。 除本協議另有規定外,本臨時整體票據的持有人有權享有發行人的相同責任,猶如該持有人是本協議所述票據的持有人一樣,而根據本臨時整體票據的持有人支付的所有款項及向本臨時整體票據的持有人支付的款項均有效及有效,以償付及解除發行人就票據的相應責任。 日期或之後(「交換日期」),即票據原發行日期後40天,國際證券交易委員會(ICSD)按本臨時整體票據權益持有人的指示,以實質上載於本臨時整體票據附件一的格式,向主要付款代理髮出通知後,根據適用的最終條款的規定,本臨時整體票據可全部或部分更換為(a)如果適用的最終條款表明本臨時整體票據擬成為新的整體票據,在永久性全球説明中記錄在ICSD記錄中的權益,或者如果適用的最終條款表明本臨時全球説明不打算成為新的全球説明,永久性的全球票據(“永久性全球性票據”)代表了這些票據,其形式基本上是(須填寫)載於信託契約附表2或(b)正式附註(“證明票據”),大致上按信託契據附表3所列的格式(須予填寫)。 在兑換全部本臨時環球票據時,本臨時環球票據須交回或交回德意志銀行倫敦分行作為主要付款代理人(“主要付款代理人”,該用語應包括德意志銀行倫敦分行在其指定辦事處的任何繼任者)。發行人應促使:(a)如果適用的最終條款表明本臨時全球票據擬成為新的全球票據,且本臨時全球票據將被交換為永久全球票據,則以本臨時全球票據的全部或部分交換,該等交易的詳細資料應按比例輸入國際證券交易委員會的記錄,以使本臨時全球票據所代表的票據面值減去本臨時全球票據的面值,全球票據如此交換;或 ][42(B)如果適用的最終條款表明該臨時全球票據不是一種新的全球票據,或者如果適用的最終條款表明該臨時全球票據的意圖是一種新的全球票據,並且該臨時全球票據將被交換為最終票據,則在僅交換該臨時全球票據的部分時,應由發行人或其代表將該交換的詳細情況記入本附表中,據此,該臨時全球票據及其所代表的票據的面值應減去該臨時全球票據所交換的面值。本臨時全球票據交換永久全球票據時,應由發行人或其代表在永久全球票據的附表中填寫交換細節。如上所述,如果臨時全球票據的利益被交換為永久全球票據,則該永久全球票據的利益此後可被交換為最終票據,如上所述。][在交換日期前到期的利息只能在以下情況下支付:(A)在向與票據有關的指定辦事處的主要支付代理出示臨時全球票據時,如果適用的最終條款表明該臨時全球票據打算成為一種新的全球票據,則無需提交該臨時全球票據;及(B)在歐洲結算銀行SA/NV或Clearstream Banking S.A.或任何其他相關結算系統的運營者發出的一份或多份證書交付給主要付款代理時或在一定程度上,該證書的日期不早於相關利息支付日期,其格式大致如本協議附件二所列。]在就本臨時全球票據支付利息的任何情況下,發行人應促使:(A)如果適用的最終條款表明本臨時全球票據旨在成為新的全球票據,則應在ICSD的記錄中記錄該付款的細節;或(B)如果適用的最終條款表明本臨時全球票據不打算成為新的全球票據,則在本協議的附表中予以註明。[在就本臨時全球票據支付本金或贖回金額或本臨時全球票據所代表的票據將被註銷的任何情況下,發行人應促使:(A)如果適用的最終條款表明本臨時全球票據擬為一種新的全球票據,則此類付款、贖回或註銷(視情況而定)的細節應按比例記入ICSD的記錄中,並在作出任何此類記項後,記錄在ICSD記錄中並由本臨時全球票據代表的票據的面值,應減去如此贖回和註銷的票據的面值總額,或減去支付此類款項的票據的總額(或在部分付款的情況下,減去相應的部分);及(B)如適用的最終條款顯示本臨時全球票據並非擬為新的全球票據,(I)已就其作出上述付款的票據(或如屬部分付款,則為其相應部分)或以最終形式交付或將予註銷的票據的本金總額,及(Ii)本臨時全球票據的剩餘本金金額(應為本臨時全球票據的先前本金43減去上文(I)所述的款額),在附表中註明,因此,就所有目的而言,本臨時全球票據的本金金額應與最近如此註明的金額相同。就本臨時全球票據所代表的票據而到期應付的款項,須向本臨時全球票據的持票人支付,而如此支付的每一筆款項,將會解除發行人對該票據的責任。任何未能填寫上述記項的情況,均不影響該項清繳。本臨時全球票據以及由此產生或與之相關的任何非合同義務均受英國法律管轄,並將根據英國法律進行解釋。]發行人已在信託契據內,為受託人及票據持有人的利益,同意英格蘭法院具有司法管轄權聆訊及裁定因信託契據或票據(包括與信託契約或票據產生或相關的任何非合約責任有關的申索或爭議)而可能引起或與信託契約或票據相關的任何訴訟、訴訟或法律程序(“法律程序”),併為此目的不可撤銷地接受該等法院的司法管轄權管轄。發行人已於信託契據中同意,在英格蘭開展任何法律程序的法律程序文件,可透過預付郵資的掛號或記錄派遞函件寄往聯合利華(英國)信託契據第32條所載地址寄往發行人。本協議或信託契約中包含的任何內容均不影響以法律允許的任何其他方式送達法律程序文件的權利。提交英格蘭法院的司法管轄權並不(亦不得解釋為)限制受託人或票據持有人或他們中的任何人在任何其他具司法管轄權的法院提起法律程序的權利,如適用法律容許在任何其他司法管轄區提起法律程序,則在任何一個或多個司法管轄區提起法律程序亦不妨礙在任何其他司法管轄區提起法律程序(不論是否同時進行)。[2本臨時綜合票據在作為主要付款代理人的德意志銀行倫敦分行認證之前,不得用於任何目的,如果適用的最終條款表明,該臨時全球票據擬成為新的全球票據(i)擬以允許歐元體系資格的方式持有,或(ii)發行人已通知主要付款代理,其生效將適用,並由ICSD指定為共同保管人的實體生效。 代表發行人的正式授權人員的手籤以證明。 ]簽發人姓名或名稱[通過]手動簽名[(duly授權) 產品名稱: 標題:倫敦發行 ]2填寫發行人並非在英格蘭和威爾士註冊成立的地方。 44代表德國銀行倫敦分行作為主要付款代理人,無追索權、擔保或責任。 [●]手動簽名[s](duly授權) 產品名稱: 標題: [s]無追索權、擔保或責任的擔保 作為共同的安全保障者 [手動簽名]3姓名: 標題:3僅在以下情況下才需要重新發行:(i)擬成為符合歐元體系條件的新全球票據,如適用的最終條款所述,或(ii)發行人已指示主要付款代理人將適用生效。 45附表4付款、交付永久性紙幣、兑換永久性紙幣及註銷紙幣付款、交付或註銷日期當時支付的利息金額本金額或(視情況而定)當時支付的贖回金額當時交付的贖回本金總額本臨時性整體本金總額該票據隨後兑換為永久性全球票據當時註銷的票據的本金總額本臨時性全球票據的剩餘本金額授權簽署人4只有當適用的最終條款表明本臨時性全球票據並非擬作為新的全球票據時,才應填寫本附表。 [46附件一 ]就將本臨時通用票據兑換為永久通用票據或臨時通用票據而發出的證書格式:[簽發人姓名或名稱]債券本金總額及標題

茲證明,僅根據我們收到的書面證明、經測試的電傳或電子傳輸的證明,來自我們記錄中作為有權獲得以下部分本金的人的成員組織,(本公司「成員機構」),其效力大致載於1994年7月22日經修訂的信託契約,自本協議之日起,不時重申或補充。 [上述證券的本金額(i)由下列人士擁有:(a)美國公民或居民,(b)國內合夥企業,(c)國內公司或其他應作為公司徵税的實體,(d)不動產,其收入須繳納美國聯邦所得税,不論其來源為何,或(e)信託(x)受美國境內法院和經修訂的《1986年國內税收法典》所指的一名或多名“美國人”的主要監管,有權控制每個此類信託的所有實質性決策,或(y)根據適用的財政條例作出有效選擇,以被視為國內信託("美國人"),(ii)由美國人擁有,(a)是美國金融機構的外國分支機構(如美國財政條例第1.165—12(c)(1)(iv)節所定義(“金融機構”)為自己的帳户或轉售而購買,或(b)通過購買證券並在本協議日期持有證券(如《美國財政條例》第1.163—5(c)(2)(i)(D)(6)節中描述的"通過獲得"和"通過持有"等術語)美國金融機構的外國分支機構(在(a)或(b)的任一情況下,每家美國金融機構均已代表其本身或通過其代理人同意,我們可通知發行人或發行人的代理人,其將遵守第165(j)(3)(A)條的要求,(B)或(C)1986年國內税收法典,經修訂,及其相關條例),(iii)為在受限制期間轉售目的由美國或外國金融機構擁有(如美國財政條例第1.163—5(c)(2)(i)(D)(7)節所定義),或(iv)由非─美國人或在不需要根據1933年美國證券法登記的交易中購買此類證券的美國人(《證券法》)(本條款(iv)中使用的術語應具有證券法下S條例賦予它們的含義)或州證券法,以及進一步含義,上文第(iii)條所述的美國或外國金融機構,(不論是否也在第(i)款中描述,(ii)或(iv))已證明他們沒有購買證券的目的是直接或間接轉售給美國人或美國境內的人,國家或其屬地。 我們進一步證明(i)我們不提供隨函交換(或如有相關,行使任何權利或收集任何權益)在此類證書中除外的臨時全球證券的任何部分,以及(ii)截至本協議日期,我們尚未收到任何會員組織的通知,大意是該等會員組織所作的聲明,在本協議的日期,隨此提交的部分中的任何部分(或行使任何權利或收集任何權益)不再真實,且不能依賴。 此處使用的"美國"是指美利堅合眾國(包括美國和哥倫比亞特區);其"屬地"包括波多黎各、美屬維爾京羣島、關島、美屬薩摩亞、威克島和北馬裏亞納羣島。 47我們理解,本認證是與某些税法和(如適用)美國某些證券法相關的要求。與此相關,如果行政或法律訴訟開始或威脅與本認證相關,我們不可否認地授權您向此類訴訟中的任何相關方出示本認證。 日期:5][Euroclear Bank SA/NV/Clearstream Banking S.A.]通過[授權簽名]產品名稱: 標題:5日期不得早於交易日。 48附件二 [就在交換日期前到期支付的利息而發出的證明書的格式:]簽發人姓名或名稱[債券本金總額及標題]茲證明,僅根據本公司已收到的書面證明、經測試的電傳或電子傳送,自本公司記錄中的成員組織(本公司的「成員組織」),作為有權獲得下文所列部分本金額的人士,其效力大致上載於1994年7月22日的信託契約(截至本協議日期) [●][●]上述證券的本金額(i)由下列人士擁有:(a)美國公民或居民,(b)國內合夥企業,(c)國內公司或其他應作為公司徵税的實體,(d)不動產,其收入須繳納美國聯邦所得税,不論其來源為何,或(e)信託(x)受美國境內法院和經修訂的《1986年國內税收法典》所指的一名或多名“美國人”的主要監管,有權控制每個此類信託的所有實質性決策,或(y)根據適用的財政條例作出有效選擇,以被視為國內信託("美國人"),(ii)由美國人擁有,(a)是美國金融機構的外國分支機構(如美國財政條例第1.165—12(c)(1)(iv)節所定義(“金融機構”)為自己的帳户或轉售而購買,或(b)通過購買證券並在本協議日期持有證券(如美國財政部條例第1.163—5(c)(2)(i)(D)(6)節所述的"通過"和"通過"持有"等術語)美國金融機構的外國分支機構(在(a)或(b)情況下,每家美國金融機構均已同意,代表其本身或通過其代理人,我們可告知發行人或發行人的代理人,其將遵守經修訂的1986年《國內税收法典》第165(j)(3)(A)、(B)或(C)條的要求,以及相關法規),或(iii)為在受限制期間內轉售目的而由美國或外國金融機構擁有(如美國財政條例第1.163—5(c)(2)(i)(D)(7)節所定義),並進一步説明上述第㈢款所述的美國或外國金融機構,(無論是否也在第(i)或(ii)款中描述)已證明其購買證券的目的並非直接或間接轉售給美國人或美國境內的人或其屬地。 此處使用的"美國"是指美利堅合眾國(包括美國和哥倫比亞特區);其"屬地"包括波多黎各、美屬維爾京羣島、關島、美屬薩摩亞、威克島和北馬裏亞納羣島。 我們進一步證明(i)我們不提供隨函交換(或如有相關,行使任何權利或收集任何權益)在此類證書中除外的臨時全球證券的任何部分,以及(ii)截至本協議日期,我們尚未收到任何會員組織的通知,大意是該等會員組織所作的聲明,在本協議的日期,隨此提交的部分中的任何部分(或行使任何權利或收集任何權益)不再真實,且不能依賴。 我們理解,本認證是與某些税法和(如適用)美國某些證券法相關的要求。與此相關,如果行政或法律訴訟開始或威脅與本認證相關,我們不可否認地授權您向此類訴訟中的任何相關方出示本認證。 49日期:6[Euroclear Bank SA/NV/Clearstream Banking S.A.]通過[授權簽名[名稱:標題:6不早於相關付息日期。]50附件III

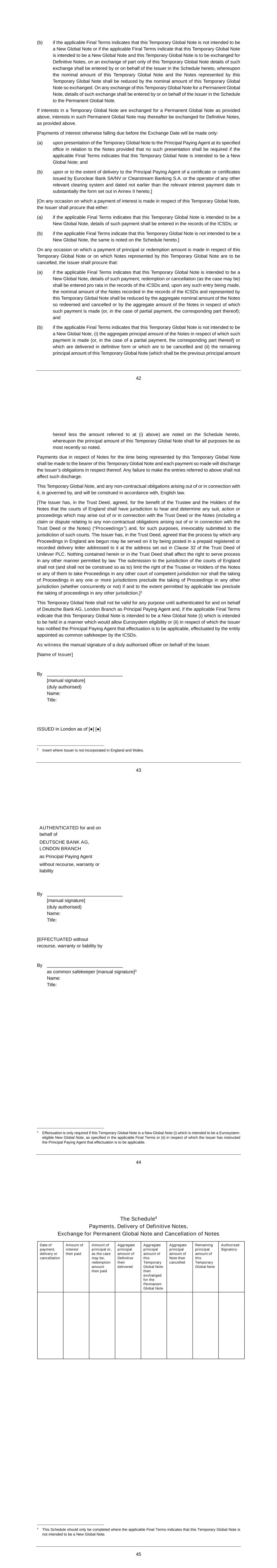

前幾份證書中所指的賬户持有人證明格式:[簽發人姓名或名稱][債券本金總額及標題][茲證明,自本協議之日起,除下文所述外,您為我們的賬户持有的上述證券(I)由以下人士所有:(A)美國公民或居民;(B)國內合夥企業;(C)國內公司或其他應作為公司納税的實體;(D)其收入應繳納美國聯邦所得税的財產,不論其來源為何;或(E)信託(X)受美國境內法院的主要監督,且一個或多個1986年《國税法》(經修訂)所指的“美國人”有權控制每個此類信託的所有重大決定,或(Y)已根據適用的財政部條例作出有效選擇,被視為國內信託(“美國人”);(2)由美國人(S)擁有:(A)是美國金融機構(根據美國財政部條例1.165-12(C)(1)(Iv)節(“金融機構”)的定義)的外國分支機構,為自己的賬户購買或轉售,或(B)通過並在本協議日期持有證券(如美國財政部條例1.163-5(C)(2)(I)(D)(6)節所述的“通過”和“持有”等術語)美國金融機構的外國分支機構(在(A)或(B)兩種情況下,每一家美國金融機構特此代表其自身或通過其代理人同意:您可以告知發行人或發行人的代理人,其將遵守1986年修訂的《國税法》第165(J)(3)(A)、(B)或(C)節的要求,或(Iii)為美國或外國金融機構(S)所有,用於在限制期內轉售(定義見美國財政部條例1.163-5(C)(2)(I)(D)(7)),此外,如果證券的所有者是上文第(Iii)款所述的美國或外國金融機構(無論是否也在第(I)或(Ii)款中描述),則進一步證明該金融機構沒有出於直接或間接轉售給美國人或美國境內的人或其財產的目的而購買證券。這裏所用的“美國”是指美利堅合眾國(包括美國和哥倫比亞特區);其“財產”包括波多黎各、美屬維爾京羣島、關島、美屬薩摩亞、維克島和北馬裏亞納羣島。我們承諾,如果任何適用的聲明不正確,我們將在您打算按照您的操作程序為我們的賬户提交與您持有的證券有關的證明的日期或之前,通過測試過的電傳及時通知您,在沒有任何此類通知的情況下,可以假定此證明自該日期起適用。本認證例外且與以下內容無關]在吾等作出上述證明前,吾等不能就上述證券中的該等權益作出證明,而吾等亦明白,交換及交付最終證券(或如有關,行使任何權利或收取任何權益)是不能作出的。我們理解,根據美國的某些税法和某些證券法(如果適用),該認證是必需的。與此相關,如果與本認證相關或將與本認證相關的行政訴訟或法律訴訟被啟動或受到威脅,我們不可撤銷地授權您向該訴訟中的任何利害關係方出示本認證。51日期:7[●]帳户持有人[●][作為或作為債券的實益擁有人的代理人。通過]授權簽名[名稱:標題:7,日期不得早於交換日期或有關付息日期(視屬何情況而定)前15天。52永久全球鈔票系列編號附表二:]序列號:[任何負有這一義務的美國人將受到美國所得税法的限制,包括國內税法第165(J)條和第1287(A)條規定的限制。][1本全球票據尚未、也不會根據1933年修訂後的《美國證券法》(以下簡稱《證券法》)註冊,不得在美國境內或為美國人的賬户或利益而發行或出售,除非在某些交易中不受證券法和所有適用的州證券法的註冊要求的約束。本辦法所用術語,與證券法S規定的含義相同。1在所有到期日超過365天的票據上包括括號內的語言。53][聯合利華為荷蘭公司提供資金。]聯合利華資本公司[●]聯合利華(英國)[●][(根據荷蘭法律註冊為有限責任公司,其公司總部設在荷蘭鹿特丹)](根據特拉華州法律註冊為有限責任公司)[(根據英國法律成立為有限責任公司)]關於以下方面的永久全球鈔票

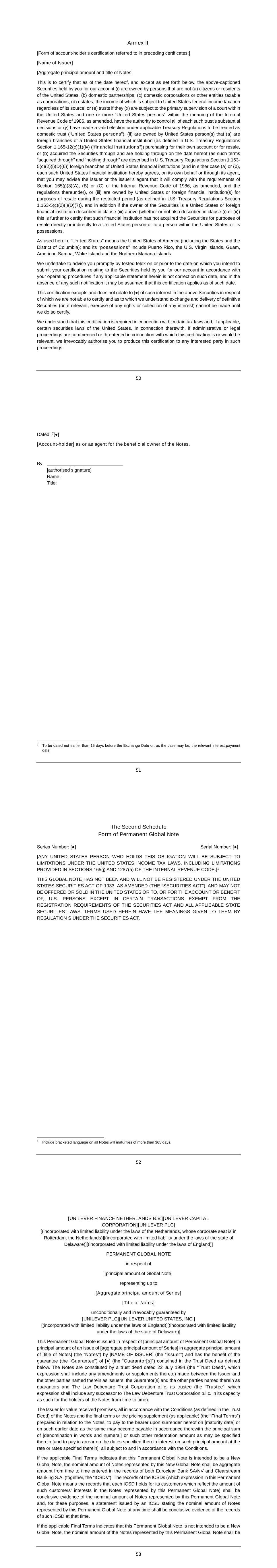

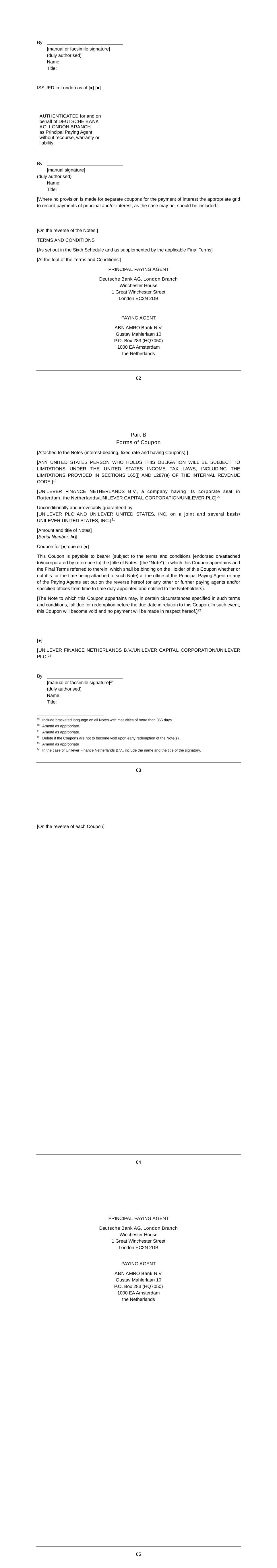

全球票據本金金額[表示高達][系列本金合計][附註的標題]無條件且不可撤銷地保證[●]聯合利華(英國)[●][聯合利華美國公司](根據英國法律成立為有限責任公司)[(根據特拉華州法律註冊為有限責任公司)]本永久全球票據是針對以下對象發行的[●]永久全球票據本金金額[●][一次發行的本金]系列本金合計[合計本金金額][註釋標題][(《註釋》)作者:][發行人名稱][(the“發行人”),並享有擔保(“擔保”)的利益, ][(“擔保人”]”)包含在以下定義的信託契約中。該等票據由發行人與該等發行人的其他各方(擔保人)訂立的日期為一九九四年七月二十二日的信託契據(「信託契據」,其中包括任何修訂或補充)構成[及該文件所列為擔保人的其他各方及The Law Debrider Trust Corporation p.l.c.作為受託人(“受託人”,該詞應包括The Law Debrider Trust Corporation p.l.c.)的任何繼承人。以其身份不時為票據持有人提供)。 發行人已收到承諾,所有承諾均符合票據之條件(定義見信託契約)及就票據擬備之最終條款或定價補充(如適用)(“最終條款”),於交回本票據時向持票人付款, ]到期日[或在較早的日期,按該日期支付本金。 ][字數和數字命名]或其中指明的其他贖回金額 [並在該通知書所指明的日期,按通知書所指明的利率,繳付該等本金的利息。][,所有這些都受條件和條件的約束。 如果適用的最終條款表明該永久性環球票據擬成為新環球票據,則該新環球票據所代表的票據面值應為歐洲結算銀行SA/NV和Clearstream Banking S.A.記錄中不時輸入的總額。(統稱“ICSDs”)。ICSD的記錄(本永久性環球票據中的表述是指每個ICSD為其客户持有的記錄,該等記錄反映該等客户在本永久性環球票據所代表的票據中的權益數額)應為本永久性環球票據所代表的票據面額的確證,併為此目的,ICSD在任何時候發佈的聲明,説明本永久性環球紙幣所代表的紙幣面額,即為該ICSD當時記錄的確證。 如果適用的最後條款表明本永久性整體票據並非擬作為新的整體票據,則本永久性整體票據所代表的票據的面值應為 ][54適用的最後條款所述的金額,或發行人或其代表最近在本協議附表有關欄所列的名義金額(如較低)。 本永久性整體票據的持有人有權享有發行人的相同責任,猶如該持有人是本永久性整體票據的持有人一樣,而根據本永久性整體票據的持有人支付的所有款項及向該持有人支付的款項均有效及有效,以償付及解除發行人就該等票據的相應責任。 倘適用的最終條款有此規定,則本永久性環球票據可於持有人行使有關選擇權後,全部(但非僅部分)兑換為基本上符合信託契約附表三所列形式(待填妥後)的正式票據(“永久性票據”),且除非適用的最終條款另有規定,否則費用由發行人承擔。為行使該選擇權,持票人必須在要求交付該等擔保票據的日期前至少四十五天,將該永久性環球票據存入作為主要付款代理的德意志銀行倫敦分行,(“主要付款代理人”),該詞包括德意志銀行股份公司的任何繼承人,倫敦分行以其身份)在其指定辦事處,並附有在此妥為填寫的兑換表格。 在任何情況下,該永久性全球票據將可全部(但不可部分)(費用由發行人承擔)兑換為永久性票據:(i)關閉清算系統:歐洲結算銀行(Euroclear)或Clearstream Banking S.A.(“Clearstream Luxembourg”)或任何其他相關結算系統連續14天(因法定假日原因除外)或宣佈永久停止營業的意向;(ii)違約:發生細則10A所述的任何情況,票據到期應付;或(iii)預扣或扣減:如受託人信納,在有關係列票據的下一次到期付款時,發行人或任何付款代理將須就該等票據的任何付款作出任何扣除或預扣,而該等票據為最終形式則無須作出。 ][在任何情況下,就本永久性環球票據支付利息,發行人應促使:(a)如適用的最終條款表明本永久性環球票據擬為新環球票據,則有關付款的詳情須記入國際證券交易委員會的記錄;或(b)如適用的最後條款表明本永久性環球票據並非擬作為新環球票據,則在本協議附表中註明相同。]凡就本永久全球票據支付本金或贖回金額,或在本永久全球票據按上述方式兑換時,或在本永久全球票據所代表的任何票據將予註銷的情況下,發行人應促使:(A)如適用的最終條款顯示本永久全球票據擬為一種新的全球票據,則該等付款、贖回、交換或註銷(視屬何情況而定)的詳情應按比例記入ICSD的記錄內,並在作出任何該等記項後,記錄在ICSD記錄中並由本永久全球票據代表的票據的名義金額,應減去如此贖回和註銷的票據的名義總額,或減去就其付款的票據55的總額(或在部分付款的情況下,減去其相應部分);以及(B)如果適用的最終條款表明本永久全球票據不打算是一種新的全球票據,(I)已就其付款的票據(或如為部分付款,則為其相應部分)、或以最終形式交付或將被註銷的票據的本金總額,以及(Ii)本永久全球票據的剩餘本金金額(應為本票據的上一本金額減去上文(I)所述的金額)在本協議的附表中註明,因此,就所有目的而言,本永久全球票據的本金金額應與最近如此註明的金額相同。就本永久全球票據當其時所代表的票據而到期的款項,須向本永久全球票據的持票人支付,而如此支付的每一筆款項,將會解除發行人對該票據的責任。任何未能填寫上述記項的情況,均不影響該項清繳。如果最初代表票據的臨時全球票據僅部分兑換了該永久全球票據,然後將就該永久全球票據的剩餘本金或部分進一步兑換,則在就該票據在其指定辦事處向主要付款代理人出示該永久全球票據時,如果該臨時全球票據的本金總額因該進一步交換而減少,則出票人應促使:(A)如果適用的最終條款表明該永久全球票據擬為一種新的全球票據,此種交流的細節應記入ICSD的記錄中;或(B)如果適用的最終條款表明本永久全球票據不打算成為新的全球票據,則此類交換的細節應由發行人或其代表在本協議的附表中填寫。在進行任何此類交換時,本永久全球票據所代表的票據的面值應增加所交換的票據的面值。本永久全球票據以及由此產生或與之相關的任何非合同義務均受英國法律管轄,並將根據英國法律進行解釋。[發行人已在信託契據內,為受託人及票據持有人的利益同意,英格蘭法院具有司法管轄權聆訊及裁定因信託契據或票據(包括與信託契約或票據產生或相關的任何非合約責任)(“法律程序”)可能引起或相關的任何訴訟、訴訟及法律程序(“法律程序”),併為此目的不可撤銷地接受該等法院的司法管轄權管轄。發行人在信託契約中同意,在英格蘭開展任何法律程序的法律程序文件,可透過預付郵資的掛號或記錄派遞函件郵寄至聯合利華(英國)當時的信託契約第32條所載地址而送達發行人。本協議或信託契約中包含的任何內容均不影響以法律允許的任何其他方式送達法律程序文件的權利。提交英格蘭法院的司法管轄權不應(也不得解釋為)限制受託人或票據持有人或他們中的任何人在任何其他具有司法管轄權的法院提起法律程序的權利,在適用法律允許的範圍內,在任何一個或多個司法管轄區提起法律程序,亦不得阻止在任何其他司法管轄區(不論是否同時進行)進行法律程序。]2 2如Issuer並非在英格蘭或威爾斯成立為法團,請填上。56在德意志銀行倫敦分行確認並代表德意志銀行倫敦分行為主要付款代理人之前,本永久全球鈔票在任何情況下均無效,且如適用的最終條款顯示,此永久全球鈔票擬為一種新的全球鈔票,其持有方式將容許歐元系統符合資格,或(Ii)發行人已通知主要付款代理人適用,並由ICSD指定為共同保管人的實體完成。由一位正式授權的高級職員代表髮卡人手工簽署,作為見證。[發行人名稱]通過[手動簽名](duly授權) 產品名稱: 標題:倫敦發行 [57經德意志銀行倫敦分行認證為主要付款代理,無追索權、擔保或責任,由]手動簽名[●](duly授權) 產品名稱: 標題: [s]無追索權、擔保或責任的擔保 作為共同的安全保障者 [s]手動簽名[3名稱:標題:3本永久全球票據只有在以下情況下才需要生效:(I)按照適用的最終條款的規定,該永久全球票據旨在成為符合歐元系統條件的新全球票據,或(Ii)發行者已通知委託人付款代理適用生效。]58交換通知……作為該永久全球票據的持有者,在該永久全球票據存放於其指定辦事處時,為該票據的目的,現行使選擇權,將該永久全球票據整體兑換為最終形式的票據,並指示該等最終形式的票據可供其從主要付款代理人的指定辦事處領取。按(正式授權)名稱:標題:59附表4付款、交付最終票據、進一步交換臨時全球票據及取消票據付款日期、交付日期、進一步交換臨時全球票據或註銷利息然後支付的本金金額或當時已支付的本金總額然後交付的最終全球票據的本金總額進一步交換臨時全球票據的本金總額本次永久全球票據授權簽署的本金4只有在適用的最終條款表明本全球票據不打算成為新的全球票據時,才應填寫附表4。60最終註明A部的附表3格式[在附註的封面上:]面額[任何負有這一義務的美國人將受到美國所得税法的限制,包括國內税法第165(J)條和第1287(A)條規定的限制。]12本票據不曾、也不會根據1933年修訂的《美國證券法》(以下簡稱《證券法》)進行登記,不得在美國境內或為美國人的賬户或利益進行發售或出售,除非在某些交易中不受證券法和所有適用的州證券法的登記要求的約束。本辦法所用術語,與證券法S規定的含義相同。

聯合利華為荷蘭公司提供資金。[聯合利華資本公司]聯合利華(英國)[(根據荷蘭法律註冊為有限責任公司,其公司總部設在荷蘭鹿特丹)](根據特拉華州法律註冊為有限責任公司)[(根據英國法律成立為有限責任公司)]系列本金合計[附註的標題]無條件且不可撤銷地保證[●][●]聯合利華(英國)和聯合利華美國公司在聯合和多個基礎上/聯合利華美國公司[這]註釋標題[形成了一系列[註釋標題](“債券”)本金總額為

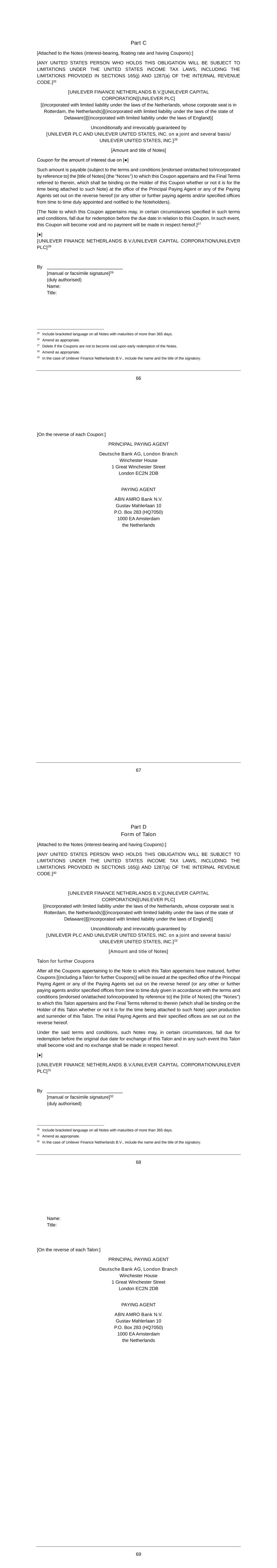

插入系列本金總額[頒發者][聯合利華金融荷蘭公司/聯合利華資本公司/聯合利華(英國)][2作為發行人(“發行人”),並享有以下擔保的利益]聯合利華(英國)和聯合利華美國公司/聯合利華美國公司[3(“擔保人”][“載於下文界定的信託契據內)][以共同和各別為基礎][並依據一份日期為1994年7月22日的信託契據(“信託契據”,其表述須包括對該契據的任何修訂或補充)發出,而該契據是發行人與其內指名為發行人、擔保人的其他公司之間訂立的][和其他被指名為擔保人的公司和作為受託人的法律債權信託公司。價值發行者收到的承諾,全部符合條款和條件][在此批註/附於此/以引用方式併入本文][及與票據及信託契據有關而擬備的最後條款,以在本證書交出時支付予持票人][到期日]或於相應的較早日期支付本金金額:12包括所有到期日超過365天的票據的括號內文字。61[文字和數字的面額]或其中指明的其他贖回金額 [並在該通知書所指明的日期,按通知書所指明的利率支付本合同本金的利息。]根據荷蘭儲蓄券法(Wet inzake spaarbewijzen),本票據的每次轉讓和承兑(不從事專業或貿易的個人之間除外):(a)必須通過發行人或Euronext Amsterdam N.V.成員的調解進行;及(b)如涉及實物交付,則須記錄在交易單據內,該單據須包括各方的名稱及地址、交易性質以及所轉讓票據的編號及序號。[根據荷蘭儲蓄券法(Wet inzake spaarbewijzen),本票據的每次轉讓和承兑(不從事專業或貿易的個人之間除外):(a)必須通過發行人或Euronext Amsterdam N.V.成員的調解進行;及(b)如涉及實物交付,則除非是專業借款人與專業貸款人之間作出,否則必須記錄在交易單據內,該單據須包括各方的姓名或名稱及地址、交易的性質,以及所轉讓票據的編號及序號。]本説明不應[在本票據已作為主付款代理人認證之前,本票據或與本票據有關的任何利息券均不得用於任何目的。 本説明書以及由此產生或與之相關的任何非合同義務均受英國法律管轄,並應根據英國法律解釋。 代表發行人的正式授權人員的傳真簽名作為證明。 ]UNIVER FINANCE NETHERLAND B.V./ UNILEVER CAPITAL CORPORATION/UNILEVER PLC[簽發人姓名或名稱]13僅在附註計息處插入。 14如果票據(i)是零息票據或其他票據,符合荷蘭儲蓄券法所定義的儲蓄券的資格(濕inzake spaarbewijzen),(ii)在荷蘭實際發行或在荷蘭主要貿易過程中或其後立即分銷,(iii)並非在Euronext Amsterdam N.V.的證券交易所上市及(iv)不符合商業票據或存款證的資格。 15如果票據(i)是零息票據或其他票據,符合荷蘭儲蓄證書法所定義的儲蓄證書資格(濕inzake spaarbewijzen),(ii)在荷蘭實際發行或在荷蘭主要貿易過程中或其後立即分銷,(iii)並非在Euronext Amsterdam N.V.證券交易所上市及(iv)符合商業票據或存款證的資格。 [16]僅在附註不計息的地方插入。 [17]只在附註有利息的地方插入。 18.酌情修改。 [62通過 ]手動或傳真簽名[s](duly授權) 產品名稱: 標題:倫敦發行 [代表德國銀行倫敦分行作為主要付款代理人,無追索權、擔保或責任。 ]手動簽名[s](duly授權) 產品名稱: 標題: [如果沒有規定支付利息的單獨息票,則應包括適當的網格,以記錄本金和/或利息的支付(視情況而定)。]在附註的背面:[條款和條件 ]如附件六所述,並由適用的最終條款補充[在條款和條件的末尾:]主要付款代理德意志銀行股份有限公司倫敦分行Winchester House 1 Great Winchester Street London EC2N 2DB付款代理ABN AMRO Bank N.V. Gustav Mahlerlaan 10 P.O. Box 283(HQ7050)1000 EA阿姆斯特丹荷蘭63部分B優惠券形式 [隨附附註(計息、固定利率、有優惠券):]13. [任何負有這一義務的美國人將受到美國所得税法的限制,包括國內税法第165(J)條和第1287(A)條規定的限制。]14 [UNIVER FINANCE NETHERLAND B.V.,一家位於荷蘭鹿特丹的公司/UNILEVER CAPITAL CORPORATION/UNILEVER PLC]15 [20無條件和不可剝奪的保證, ]16 [UNILEVER PLC和UNILEVER United States,INC.聯合和個別的基礎上/UNILEVER United States,INC.[債券的金額及名稱]18 [序列號:]優惠券

到期日期[此優惠券須支付給持票人(受條款和條件約束 ]背書/附於/以提述方式併入[●][●]這個[註釋標題](the“注”),本優惠券所涉及的最後條款,該票據對本息票持有人具有約束力,不論其當時是否附於該票據),在主要付款代理或任何付款代理的辦事處,(或任何其他或其他付款代理人及╱或不時妥為委任並通知票據持有人的指定辦事處)。 [本優惠券所涉及的票據,在該等條款及條件所指明的若干情況下,可能在本優惠券到期日前到期贖回。在此情況下,本優惠券將失效,且不會就此付款。][UNIVER FINANCE NETHERLAND B.V./ UNILEVER CAPITAL CORPORATION/UNILEVER PLC]23的 [手動或傳真簽名][24(正式授權) 產品名稱: 標題:19在所有到期日超過365天的票據上列入方括號內的文字。 20、酌情修改。 21.酌情修改。 22如優惠券不會因票據提早贖回而失效,則刪去。 23酌情修訂24聯合利華金融荷蘭公司,包括簽字人的姓名和頭銜。 64 ]在每張優惠券的反面[65主要付款代理德意志銀行倫敦分行温徹斯特大廈1 Great Winchester Street London EC2N 2DB付款代理荷蘭銀行Gustav Mahlerlaan 10 P.O.Box 283(HQ7050)1000 EA荷蘭阿姆斯特丹][66 C部]19 [附註(附息、浮息及附息):]任何負有這一義務的美國人將受到美國所得税法的限制,包括國內税法第165(J)條和第1287(A)條規定的限制。[聯合利華為荷蘭公司提供資金。]21 [聯合利華資本公司][聯合利華(英國)[●]](根據荷蘭法律註冊為有限責任公司,其公司總部設在荷蘭鹿特丹)[●](根據特拉華州法律註冊為有限責任公司)[●](根據英國法律成立為有限責任公司)[無條件且不可撤銷地保證]UNILEVER PLC和UNILEVER United States,INC.聯合和個別的基礎上/UNILEVER United States,INC.[債券的金額及名稱]年到期利息的票面利率[該款項須予支付(受條款及條件規限]22 [●][批註/附連/以參考方式併入]這個[註釋標題](“附註”)於主要付款代理人或本附註背面所列任何付款代理人的辦事處(或不時妥為委任並通知票據持有人的任何其他或其他付款代理人及/或指定辦事處),以及其中所指對本券持有人具約束力的最終條款(不論是否附於該票據)。[本優惠券所涉及的票據,在該等條款及條件所指明的若干情況下,可能在本優惠券到期日前到期贖回。在此情況下,本優惠券將失效,且不會就此付款。]UNIVER FINANCE NETHERLAND B.V./ UNILEVER CAPITAL CORPORATION/UNILEVER PLC

28乘以[手動或傳真簽名][29(正式授權)名稱:標題:25在所有到期日超過365天的票據上包括括號內的文字。26適當修訂。27如在提早贖回債券時,息票不會失效,請刪去。28適當修訂。29如果是聯合利華財務荷蘭公司,則包括簽字人的姓名和頭銜。67]25 [每張優惠券背面:][主要付款代理德意志銀行倫敦分行温徹斯特大廈1 Great Winchester Street London EC2N 2DB付款代理荷蘭銀行Gustav Mahlerlaan 10 P.O.Box 283(HQ7050)1000 EA荷蘭阿姆斯特丹68 D部分塔龍][附註(附息及附息):][任何負有這一義務的美國人將受到美國所得税法的限制,包括國內税法第165(J)條和第1287(A)條規定的限制。][聯合利華為荷蘭公司提供資金。][聯合利華資本公司]聯合利華(英國)[(根據荷蘭法律註冊為有限責任公司,其公司所在地為荷蘭鹿特丹)]26 [(根據特拉華州法律註冊為有限責任公司)](根據英國法律成立為有限責任公司)[●]無條件且不可撤銷地保證[UNILEVER PLC和UNILEVER United States,INC.聯合和個別的基礎上/UNILEVER United States,INC.]債券的金額及名稱[爪子用於進一步的優惠券在所有屬於本爪子附屬的票據的優惠券到期後,進一步的優惠券](包括購買更多優惠券的塔龍)[將在主要付款代理或本協議背面所列的任何付款代理的指定辦事處(或任何其他或進一步付款代理和/或根據條款和條件不時正式提供的指定辦事處)發出 ]27 [●][背書/附於/以提述方式併入]這個[註釋標題](the在出示和交出本Talon後,本Talon所屬的“票據”)以及其中提及的最終條款(無論是否附於該票據,對本Talon持有人具有約束力)。初始付款代理人及其指定辦事處見本協議背面。 根據上述條款和條件,在某些情況下,該等票據可能在本Talon的原定兑換到期日之前到期贖回,在任何情況下,本Talon將失效,不得就本Talon進行兑換。 [UNIVER FINANCE NETHERLAND B.V./ UNILEVER CAPITAL CORPORATION/UNILEVER PLC]31號 [手動或傳真簽名][32(正式授權)30在所有到期日超過365天的票據上加入方括號內的文字。 31.酌情修改。 32在聯合利華金融荷蘭公司一案中,包括簽字人的姓名和頭銜。 69姓名: 標題: ]30 [在每個爪的背面:][主要付款代理德意志銀行股份有限公司倫敦分行Winchester House 1 Great Winchester Street London EC2N 2DB付款代理ABN AMRO Bank N.V. Gustav Mahlerlaan 10 P.O. Box 283(HQ7050)1000 EA阿姆斯特丹荷蘭 ][70全球證書附表4表格 ][聯合利華為荷蘭公司提供資金。][聯合利華資本公司][聯合利華(英國)](根據荷蘭法律註冊為有限責任公司,其公司總部設在荷蘭鹿特丹)[(根據特拉華州法律註冊為有限責任公司)]23 [(根據英國法律成立為有限責任公司)]所保障 [聯合利華(英國)]和[聯合利華美國公司](根據英國法律成立為有限責任公司)[(根據特拉華州法律註冊為有限責任公司)]全球證書全球證書編號[●][本全球證書是就本證書附表A部分所指明的部分及系列的債券(“債券”)而發行的]聯合利華金融荷蘭公司[聯合利華資本公司]聯合利華(英國)[(“發行人”),並由]聯合利華(英國)

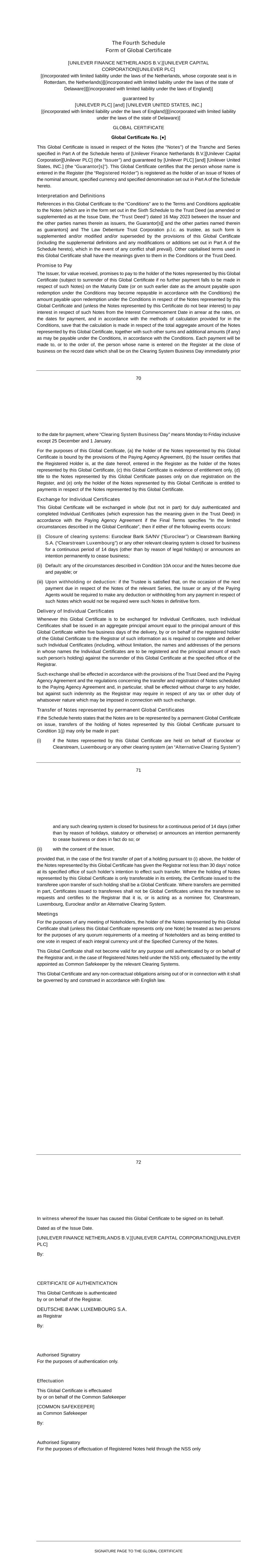

和[聯合利華美國公司][(“擔保人”][“)。本全球證書證明名列註冊紀錄冊的人士(“註冊持有人”)已註冊為本證書附表A部所列面額、指定貨幣及指定面額的票據的持有人。解釋和定義本全球證書中對“條件”的引用是指適用於發行人與發行人、擔保人等各方於2023年5月16日簽署的信託契約(經修訂或補充)附表6所列格式的票據的條款和條件][以及被指定為擔保人的其他當事人][和法律債務信託公司P.L.C.作為受託人,該格式如被本全球證書的條款(包括本全球證書的補充定義和本證書附表A部分所列的任何修改或增加)所補充和/或修改和/或取代,如有任何衝突,以補充和/或修改或補充為準)。本全球證書中使用的其他大寫術語應具有條件或信託契約中給予它們的含義。承諾就收到的價值向發行者支付本全球證書所代表的票據的持有人(如不會就該等票據進一步付款,則須退還本全球證書)在到期日(或在根據條件贖回時須根據條件贖回的款項可根據條件償還的較早日期),就本全球證書所代表的票據而在贖回時須支付的款額,以及(除非本證書所代表的票據不產生利息)就該等票據支付利息,利息由生效日期起計,按付款日的利率計算,並按照條件中規定的計算方法計算,但計算方法是按照本全球證書所代表的票據的總金額,連同根據條件可能應支付的其他款項和額外金額(如有),按照條件進行計算。 就本全球證書而言,(a)本全球證書所代表的票據持有人受付款代理協議條款約束,(b)發行人證明,登記持有人於本協議日期已登記為本全球證書所代表的票據持有人,(c)本全球證書僅為權利證明,(d)本環球證書所代表的票據的所有權只在登記冊上適當登記時才轉移,及(e)只有本環球證書所代表的票據持有人才有權就本環球證書所代表的票據收取付款。 交換個人證書此全球證書將全部交換(但非部分)經正式認證及填妥的個人證明書(該表述具有信託契約中給出的含義),如果最終條款規定“在全球證書中描述的有限情況下”,則如果發生以下任何一種事件:(i)關閉結算系統:歐洲結算銀行SA/NV("歐洲結算")或Clearstream Banking S.A. 個人證書的交付每當本環球證書被兑換為個人證書時,該個人證書的總本金額應等於本環球證書的本金額。 在由全球證書的註冊持有人或其代表向註冊官提交完成和交付該等個人證書所需的信息後五個工作日內提交全球證書(包括但不限於,個人證明書將以其名義登記的人的姓名或名稱及地址,以及每名該等人持有的本金額)在註冊官的指定辦事處交回本環球證書。 該等交換應根據信託契約及付款代理協議的條文以及有關付款代理協議所列票據的轉讓及登記的規例進行,特別是應不向任何持有人收取費用,但處長就任何税項或任何性質的其他税項而要求作出的彌償,交易所 如持有本總證書所代表的票據僅可全部轉讓,則在轉讓該等持有時向受讓人發出的證書應為總證書。在部分轉讓被允許的情況下,向受讓人發出的證書不得為全球證書,除非受讓人提出要求,並向登記官證明其是Clearstream、Luxembourg、Euroclear和/或替代結算系統的代名人。 會議就任何票據持有人會議而言,就票據持有人會議的法定人數要求而言,本環球證書所代表的票據持有人(除非本環球證書僅代表一張票據)應被視為兩名人士,並有權就票據指定貨幣的每一完整貨幣單位投一票。 本全球證書在經註冊處或其代表認證前,不得就任何目的而生效,而如屬只根據NSS持有的記名票據,則由有關結算系統委任為共同保障人的實體生效。 本全球證書以及由其產生或與之相關的任何非合同義務應受英國法律管轄並根據其解釋。 全球證書的簽名頁以資證明,發行人已代表其簽署本全球證書。 日期自發行日期起。 ][聯合利華為荷蘭公司提供資金。]環球資本公司[Unilever PLC][由:認證證書本全球證書由註冊官或代表註冊官認證。德意志銀行盧森堡分行註冊人:授權簽字人,僅供認證之用。本全球證書由共同安全管理員或其代表完成][常見安全措施][作為共同保管人:僅為完成通過新系統持有的已登記票據的目的而授權簽字人][74已收到的價值轉賬表格已簽署的轉賬至........................................................................................................................................(請用印刷體或打字填寫受讓人姓名和地址)]本全球證書所代表的票據的名義金額及其下的所有權利。註明日期的........................................................簽署.認證簽名説明:(I)完成轉讓的人的簽名應符合本全球證書所代表的票據持有人提供的正式授權的簽名樣本列表,或(如果該簽名與本全球證書表面的名稱相對應)由公證機構或認可銀行認證,或由轉讓代理或註冊官合理要求的其他證據支持。(2)票據持有人的代表應説明他簽署遺囑執行人的身份。75附表[●]將適用的最終條款中與《條件》或《全球證書》有關的條款作為附表插入。[76個人證書附表5格式][聯合利華為荷蘭公司提供資金。][聯合利華資本公司]聯合利華(英國)[(根據荷蘭法律註冊為有限責任公司,其公司總部設在荷蘭鹿特丹)][(根據特拉華州法律註冊為有限責任公司)][(根據英國法律成立為有限責任公司)]所保障 [s]聯合利華(英國)[s][和]聯合利華美國公司[(根據英國法律成立為有限責任公司)][(根據特拉華州法律註冊為有限責任公司)][系列編號]發行名稱[本證書證明]的

(“登記持有人”)在本合約日期已登記為[●]名義金額[上述系列債券(以下簡稱“債券”)的]聯合利華金融荷蘭公司[聯合利華資本公司][聯合利華(英國)][(“發行者”)由][聯合利華(英國)][和][聯合利華美國公司](“擔保人”[“),如本合同標題所指定。該等票據須受本附註所批註的條款及條件(“該等條件”)規限,並受該等條件所述信託契約的規限及受惠而發行。條件中定義的詞語在本證書中具有相同的含義。對於收到的價值,發票人承諾在到期日(或在根據條件贖回時根據條件可成為按照條件償還的金額的較早日期),向本證書所代表的票據的持有人(S)支付根據條件贖回時根據本證書所代表的票據而須支付的款額,並(除非本證書所代表的票據(S)不生息)就該等票據支付利息(除非本證書所代表的票據(S)不生息),在該等條件所規定的款額及付款日期,連同根據該等條件可予支付的其他款項及額外款額(如有的話),按照該等條件。就本證書而言,(A)本證書所代表的票據(S)的持有人受付款代理協議的條文約束,(B)出票人證明登記持有人在本證書日期當日已作為本證書所代表的票據(S)的持有人記入登記冊,(C)本證書僅作為權利的證據,(D)本證書所代表的票據(S)的所有權僅在正式登記於登記冊時轉移,及(E)只有本證書所代表的紙幣(S)的持有人有權就本證書所代表的紙幣(S)收取款項。在註冊官或其代表認證之前,本證書不得為任何目的而生效。77本證書由簽發人代表其簽署,特此為證。日期截至發行日期。][聯合利華為荷蘭公司提供資金。][環球資本公司][Unilever PLC][由:認證證書本證書由註冊官或其代表認證。德意志銀行盧森堡分行註冊人:授權簽字人,僅供認證之用。]78背面:I附註的條款和條件[●][根據信託契約第17(E)條並以其規定的方式成為發行人。 129(E) ]已同意保證支付新發行人根據信託契約應付的所有款項,以及就新發行人按本協議及信託契約所列方式發行的任何票據。 (F) [●]受託人已收到新發行人註冊成立國家的法律顧問的法律意見, [●]及英國法律顧問,令其合理滿意,其大意為,除其他外,新發行人, [每個人都有能力和權力簽署本補充契據,當該新發行人簽署和交付時, ],本補充契據將構成該新發行人的有效及具法律約束力的責任。[1因此,本補充契約現予保留,並特此聲明如下:1定義及詮釋(A)在本補充契約中,任何提述“代理人”之處均指主要付款代理人、其他付款代理人、計算代理人、過户登記處、其他過户代理人或其中任何一名。 (B)在適用範圍內,除非本協議另有規定,信託契約第1條所載的定義及條文應適用於本補充契約(包括本補充契約的敍述),並納入本補充契約。 2新發行人之確認新發行人特此委任受託人(而受託人特此接納該委任)按信託契約所載之相同條款擔任受託人。 3確保 ][茲確認信託契約第8條所載之擔保適用於新發行人根據信託契約或根據信託契約所欠之所有款項及任何與之相關之票據或息票。 4委任代理人新發行人現按付款代理協議所載相同條款委任各代理人為其代理人,各代理人接受其委任為新發行人就新發行人發行的任何票據的代理人,並須遵守適用於該等條款及條件、付款代理協議的條文,以及就此而言,須採取一切附帶的行動。 5納入條款現聲明,信託契據、其附表、條件及付款代理協議之所有契諾、承諾、權力、義務及╱或其他條文,均視為已納入本補充契據,其方式及範圍猶如已在作出必要修訂後,全文載於本補充契據並適用於新1的敍述(F)及本補充契據第6條為替代方案,其中一項(由受託人決定)應予刪除。 ][130發行人,和(在不損害上述一般性的原則下)新發行人據此承諾:(iii)以受託人為受益人,妥為履行及遵守上述承諾、承諾、權力、義務及╱或由或根據信託契約或附表或條件施加於或影響其的其他條款,並受其約束;及(iv)以受託人及各代理人為受益人,妥為履行及遵守上述契諾、承諾、權力、義務及╱或由或根據付款代理協議施加或影響該契諾、承諾、權力、義務及╱或其他條文,並受其約束。 6 ]條件本補充契約將不會生效,除非及直至受託人已收到新發行人註冊成立的國家的法律顧問的意見及 [及在英格蘭,令其合理滿意,其中包括新發行人, ][各自有能力及權力訂立本補充契據,且本補充契據構成新發行人的有效及具法律約束力的責任, ][7副本本補充契據可簽署任何數目的副本,每份副本均須相同,所有副本合併後應構成同一份文書,而任何一方均可簽署任何副本,以籤立本補充契據。 本協議各方面應受中華人民共和國大陸地區法律的管轄。 9 ]司法管轄權關於本補充契據所產生的所有申索(包括與本補充契據所產生或與本補充契據有關的任何非合約義務有關的申索) [s]雙方分別同意英格蘭法院有管轄權解決任何該等索賠,因此任何訴訟、訴訟或法律程序(統稱為“法律程序”)均可在該等法院提起。本條所載的任何內容均不限制對下列行為提起訴訟的任何權利。 [在任何其他有管轄權的法院提起訴訟,在一個或多個司法管轄區提起訴訟也不妨礙在任何其他司法管轄區提起訴訟,無論是否同時提起訴訟。中的每 ][明確同意,任何法律訴訟程序或任何要求或任何通知可以通過預付郵資的掛號或記錄的交付信向其提出或送達,地址是聯合利華公司當時的信託契約第32條所列的地址,(或在其書面通知受託人並獲受託人不時批准的其他職位)並註明聯合利華有限公司集團祕書或聯合利華有限公司其他官員, ][可以書面通知受託人,受託人應不時批准。]131本補充契據已由雙方籤立為證,並擬於上述第一個日期交付,特此作為見證。132發放發行人補充地契附表9本補充地契制定如下

年月日[The Terms and Conditions that are set out in the Sixth Schedule to the Trust Deed as amended by and incorporating any additional provisions forming part of such Terms and Conditions and set out in Part A of the applicable Final Terms shall be set out here.] 79 Form of Transfer For value received the undersigned transfers to .................................................................... .................................................................... (PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS OF TRANSFEREE) [●] nominal amount of the Notes represented by this Certificate, and all rights under them. Dated ........................................................ Signed ............................................. Certifying Signature Notes: (i) The signature of the person effecting a transfer shall conform to a list of duly authorised specimen signatures supplied by the holder of the Notes represented by this Certificate or (if such signature corresponds with the name as it appears on the face of this Certificate) be certified by a notary public or a recognised bank or be supported by such other evidence as a Transfer Agent or the Registrar may reasonably require. (ii) A representative of the Noteholder should state the capacity in which he signs. Unless the context otherwise requires capitalised terms used in this Form of Transfer have the same meaning as in the Trust Deed dated 16 May 2023 between the Issuer and the other parties named therein as issuers, the Guarantor[s][ and the other parties named therein as guarantors] and The Law Debenture Trust Corporation p.l.c. as trustee. [TO BE COMPLETED BY TRANSFEREE: [INSERT ANY REQUIRED TRANSFEREE REPRESENTATIONS, CERTIFICATIONS, ETC.]] PRINCIPAL PAYING AGENT & TRANSFER AGENT Deutsche Bank AG, London Branch Winchester House 1 Great Winchester Street London EC2N 2DB United Kingdom PAYING AGENT ABN AMRO Bank N.V. Gustav Mahlerlaan 10 P.O. Box 283 (HQ7212) 1000 EA Amsterdam the Netherlands REGISTRAR Deutsche Bank Luxembourg S.A. 2, Boulevard Konrad Adenauer L-1115 Luxembourg Luxembourg 80 The Sixth Schedule Terms and Conditions of the Notes The Notes are constituted by a trust deed dated [16 May] 2023 (the “Trust Deed”, which expression shall include any amendments or supplements thereto or any restatement thereof) made between Unilever Finance Netherlands B.V. (“UFN”), Unilever PLC (“PLC”) and Unilever Capital Corporation (“UCC”) as issuers (the “Issuers” and each an “Issuer”, which expression shall include any Group Company (as defined below) which becomes an Issuer as contemplated by Condition 15 or 17), PLC and Unilever United States, Inc. (“UNUS”) as guarantors of the Notes as hereinafter described (the “Guarantors” and each a “Guarantor”) and The Law Debenture Trust Corporation p.l.c. (the “Trustee”, which expression shall include any successor to The Law Debenture Trust Corporation p.l.c. in its capacity as such) as trustee for the holders of each Series of the Notes (the “Noteholders”). Pursuant to the Trust Deed, the Notes issued by (i) UFN (the “UFN Notes”) are guaranteed unconditionally and irrevocably on a joint and several basis by PLC and UNUS, (ii) PLC (the “PLC Notes”) are guaranteed unconditionally and irrevocably by UNUS and (iii) UCC (the “UCC Notes” and, together with the UFN Notes and the PLC Notes, the “Notes”) are guaranteed unconditionally and irrevocably on a joint and several basis by PLC and UNUS. These terms and conditions (the “Conditions”) are summaries of, and are subject to, the detailed provisions of the Trust Deed, which includes the form of the Bearer Notes, Certificates, Coupons and Talons referred to below. A paying agency agreement dated 22 July 1994 (the “Paying Agency Agreement”, which expression shall include any amendments or supplements thereto or any restatement thereof) has been entered into between UFN, PLC, UNUS and UCC in their capacities as Issuers and Guarantors (as applicable), Deutsche Bank AG, London Branch as principal paying agent (the “Principal Paying Agent”, which expression shall include any successor to Deutsche Bank AG, London Branch in its capacity as such and any substitute or additional principal paying agent appointed in accordance with the Paying Agency Agreement), the paying agents named therein (the “Paying Agents”, which expression shall, unless the context otherwise requires, include the Principal Paying Agent and any substitute or additional paying agents appointed in accordance with the Paying Agency Agreement), the registrar for the time being (the “Registrar”), the transfer agents for the time being (the “Transfer Agents”) (which expression shall include the Registrar) and the Trustee. Noteholders and the holders of the interest coupons relating to interest bearing Notes in bearer form (the “Coupons”) and, where applicable in the case of such Notes, talons for further Coupons (the “Talons”) (the “Couponholders”) are entitled to the benefit of, are bound by, and are deemed to have notice of, all the provisions of the Trust Deed and the Paying Agency Agreement which are applicable to them. Copies of the Trust Deed and the Paying Agency Agreement are available for inspection during normal business hours at the registered office for the time being of the Trustee (being at the date of this Information Memorandum at Eighth Floor, 100 Bishopsgate, London EC2N 4AG) and at the specified office of each of the Paying Agents. The Notes are issued in series (each a “Series”), and each Series may comprise one or more tranches (“Tranches” and each a “Tranche”) of Notes. Each Tranche will be the subject of final terms or a pricing supplement (“Final Terms”) prepared by, or on behalf of, the Issuer, a copy of which will, in the case of a Tranche of Notes which is to be listed on the Euronext in Amsterdam (“Euronext Amsterdam”) and/or the Stock Exchange of Hong Kong and/or the Singapore Exchange, be lodged with Euronext Amsterdam and/or the Stock Exchange of Hong Kong and/or the Singapore Exchange and be available for inspection at the specified office of each of the Paying Agents appointed in respect of such Notes. In these Conditions, unless otherwise expressly stated, references to Notes are to Notes of the relevant Series, references to Coupons are to Coupons appertaining to interest bearing Notes in bearer form of the relevant Series, references to the Issuer are to the Issuer of such Notes, references to the Guarantor(s) are references to the Guarantor(s) of such Issuer’s obligations under such Notes and references to the Paying Agents are references to the Paying Agents appointed in respect of such Notes. Subject thereto, capitalised terms shall, unless defined herein, have the meanings ascribed thereto in the Trust Deed. 81 1 Form and Denomination (a) The Notes are issued in bearer form (“Bearer Notes”) or in registered form (“Registered Notes”). UCC may only issue Registered Notes. Each Note is a Fixed Rate Note, a Floating Rate Note or a Zero Coupon Note or a combination of any of the foregoing. All payments in respect of each Note shall be made in the currency shown on its face. Bearer Notes (b) Each Tranche of Bearer Notes will be represented upon issue by a temporary global note (a “Temporary Global Note”) in substantially the form (subject to amendment and completion) scheduled to the Trust Deed and, if so specified in the relevant Final Terms, such Temporary Global Note shall be a New Global Note. On or after the date (the “Exchange Date”) which is 40 days after the completion of distribution of the Bearer Notes of the relevant Tranche and provided certification as to the beneficial ownership thereof as required by U.S. Treasury regulations (in the form set out in the Temporary Global Note or such other form as may replace it) has been received, interests in the Temporary Global Note may be exchanged for: (i) interests in a permanent global note (a “Permanent Global Note”) representing the Bearer Notes of that Tranche and in substantially the form (subject to amendment and completion) scheduled to the Trust Deed; or (ii) definitive Bearer Notes in bearer form (“Definitive Notes”) which will be serially numbered and in substantially the form (subject to amendment and completion) scheduled to the Trust Deed. If interests in the Temporary Global Note are exchanged for interests in a Permanent Global Note pursuant to sub-paragraph (i) above, interests in such Permanent Global Note may thereafter be exchanged for Definitive Notes described in sub-paragraph (ii) above. Each exchange of an interest in a Temporary Global Note for an interest in a Permanent Global Note or for a Definitive Note, and each exchange of an interest in a Permanent Global Note for a Definitive Note, shall be made outside the United States. (c) If any date on which a payment of interest is due on the Bearer Notes of a Tranche occurs while any of the Bearer Notes of that Tranche are represented by the Temporary Global Note, the related interest payment will be made on the Temporary Global Note only to the extent that certification as to the beneficial ownership thereof as required by U.S. Treasury regulations (in the form set out in the Temporary Global Note or such other form as may replace it) has been received by Euroclear Bank SA/NV (“Euroclear”), Clearstream Banking S.A. (“Clearstream, Luxembourg”) or any other relevant clearing system. Payments of principal or interest (if any) on a Permanent Global Note will be made through Euroclear or Clearstream, Luxembourg without any requirement for certification. If so specified in the relevant Final Terms, interests in a Permanent Global Note will be exchangeable in whole (but not in part only), at the option of the holder of such Permanent Global Note and in accordance with the rules and procedures for the time being of Euroclear, Clearstream, Luxembourg and/or any other relevant clearing system and, unless otherwise specified in the relevant Final Terms, at the Issuer’s cost, for Definitive Notes. In order to exercise such option, the holder must, not less than 45 days before the date on which delivery of Definitive Notes in global or definitive form is required, deposit the relevant Permanent Global Note with the Principal Paying Agent with the form of exchange notice endorsed thereon duly completed. Interests in a Permanent Global Note will, in any event, be exchangeable in whole (but not in part only) at the cost of the Issuer, for Definitive Notes:

82 (i) if any Bearer Note of the relevant Series becomes due and repayable following a Default (as defined in Condition 10A), or (ii) if either Euroclear or Clearstream, Luxembourg or any other relevant clearing system should cease to operate as a clearing system (other than by reason of public holiday) or should announce an intention permanently to cease business and it shall not be practicable to transfer the relevant Notes to another clearing system within 90 days. In relation to any issue of Bearer Notes which are represented by a Temporary Global Note which is expressed to be exchangeable for Definitive Notes or an issue of Bearer Notes which are represented by a Permanent Global Note exchangeable for Definitive Notes at the option of the holder, such Bearer Notes shall be tradeable only in principal amounts of at least the Specified Denomination (or if more than one Specified Denomination, the lowest Specified Denomination) and multiples thereof. The exchange upon notice option should not be expressed to apply in the relevant Final Terms if the Specified Denomination of the Bearer Notes includes language substantially to the following effect: “€100,000 and integral multiples of €1,000 in excess thereof up to and including €199,000.” Furthermore, such Specified Denomination construction is not permitted in relation to any issue of Bearer Notes which is to be represented on issue by a Temporary Global Note exchangeable for Definitive Notes. (d) Interest-bearing Definitive Notes will have attached thereto at the time of their initial delivery Coupons, the presentation of which will be a prerequisite to the payment of interest in certain circumstances specified below. Interest-bearing Definitive Notes will also, if applicable, have attached thereto, at the time of their initial delivery, a Talon for further coupons and the expression “Coupons” shall, where the context so permits, include Talons. (e) The following legend will appear on all Bearer Notes with maturities of more than 365 days and (in the case of Definitive Notes) on Coupons and Talons appertaining thereto: “Any United States person who holds this obligation will be subject to the limitations under the United States income tax laws, including the limitations provided in Sections 165(j) and 1287(a) of the Internal Revenue Code”. The Internal Revenue Code sections referred to above provide that United States holders, with certain exceptions, will not be entitled to deduct any loss on Bearer Notes, Coupons or Talons and will not be entitled to capital gains treatment in respect of any gain recognised on any sale, disposition, redemption or payment of principal in respect of Bearer Notes or Coupons. (f) Bearer Notes of one Specified Denomination may not be exchanged for Bearer Notes of another Specified Denomination. Bearer Notes may not be exchanged for Registered Notes. Registered Notes (g) Each Tranche of Registered Notes will be represented by either: (i) individual note certificates in registered form ("Individual Certificates"); or (ii) one or more global note certificates ("Global Certificate(s)"), in each case, as specified in the relevant Final Terms. A certificate ("Certificate") will be issued to each holder of Registered Notes in respect of its registered holding. Each Note represented by a Global Certificate will either be: (A) in the case of a Global Certificate which is not to be held under the new safekeeping structure (“NSS”), registered in the name of a common depositary (or its nominee) for Euroclear and/or Clearstream, Luxembourg and/or any other relevant clearing system and the relevant Global Certificate will be deposited on or about the issue date 83 with the common depositary and/or the sub-custodian; or (B) in the case of a Global Certificate to be held under the NSS, registered in the name of a common safekeeper (or its nominee) for Euroclear and/or Clearstream, Luxembourg and the relevant Global Certificate will be deposited on or about the issue date with the common safekeeper for Euroclear and/or Clearstream, Luxembourg. If the relevant Final Terms specifies the form of Notes as being “Individual Certificates”, then the Notes will at all times be represented by Individual Certificates issued to each Noteholder in respect of their respective holdings. (h) Registered Notes may not be exchanged for Bearer Notes. (i) If the relevant Final Terms specifies the form of Notes as being "Global Certificate exchangeable for Individual Certificates", then the Notes will initially be represented by one or more Global Certificates each of which will be exchangeable in whole, but not in part, for Individual Certificates: (i) on the expiry of such period of notice as may be specified in the relevant Final Terms; or (ii) at any time, if so specified in the relevant Final Terms; or (iii) if the relevant Final Terms specifies "in the limited circumstances described in the Global Certificate", then: a. if any Registered Note of the relevant Series becomes due and repayable following a Default (as defined in Condition 10A), or b. if either Euroclear or Clearstream, Luxembourg or any other relevant clearing system should cease to operate as a clearing system (other than by reason of public holiday) or should announce an intention permanently to cease business and it shall not be practicable to transfer the relevant Notes to another clearing system within 90 days. Whenever a Global Certificate is to be exchanged for Individual Certificates, each person having an interest in a Global Certificate must provide the Registrar (through the relevant clearing system) with such information as the Issuer and the Registrar may require to complete and deliver Individual Certificates (including the name and address of each person in which the Notes represented by the Individual Certificates are to be registered and the principal amount of each such person's holding). Whenever a Global Certificate is to be exchanged for Individual Certificates, the Issuer shall procure that Individual Certificates will be issued in an aggregate principal amount equal to the principal amount of the Global Certificate within five business days of the delivery, by or on behalf of the registered holder of the Global Certificate to the Registrar of such information as is required to complete and deliver such Individual Certificates against the surrender of the Global Certificate at the specified office of the Registrar. Such exchange will be effected in accordance with the provisions of the Trust Deed and the Paying Agency Agreement and the regulations concerning the transfer and registration of Notes scheduled to the Paying Agency Agreement and, in particular, shall be effected without charge to any holder, but against such indemnity as the Registrar may require in respect of any tax or other duty of whatsoever nature which may be levied or imposed in connection with such exchange. (j) One or more Registered Notes may be transferred upon the surrender (at the specified office of the Registrar or any Transfer Agent) of the Certificate representing such Registered Notes to be transferred, together with the form of transfer endorsed on such Certificate (or another form of transfer substantially in the same form and containing the same representations and certifications (if any), unless otherwise agreed by the Issuer), duly completed and executed and any other evidence as the Registrar or Transfer Agent may reasonably require. In the case of a transfer of part only of a holding of Registered Notes represented by one Certificate, a new Certificate shall be issued to the transferee 84 in respect of the part transferred and a further new Certificate in respect of the balance of the holding not transferred shall be issued to the transferor. All transfers of Notes and entries on the Register (as defined below) will be made subject to the detailed regulations concerning transfers of Notes scheduled to the Paying Agency Agreement. The regulations may be changed by the Issuer, with the prior written approval of the Registrar and the Trustee. A copy of the current regulations will be made available by the Registrar to any Noteholder upon request. (k) In the case of an exercise of an Issuer’s or Noteholders’ option in respect of, or a partial redemption of, a holding of Registered Notes represented by a single Certificate, a new Certificate shall be issued to the holder to reflect the exercise of such option or in respect of the balance of the holding not redeemed. In the case of a partial exercise of an option resulting in Registered Notes of the same holding having different terms, separate Certificates shall be issued in respect of those Notes of that holding that have the same terms. New Certificates shall only be issued against surrender of the existing Certificates to the Registrar or any Transfer Agent. In the case of a transfer of Registered Notes to a person who is already a holder of Registered Notes, a new Certificate representing the enlarged holding shall only be issued against surrender of the Certificate representing the existing holding. (l) Each new Certificate to be issued pursuant to Conditions 1(j) or 1(k) shall be available for delivery within three business days of receipt of the form of transfer or Exercise Notice (as defined in Condition 7(f)) and surrender of the Certificate for exchange. Delivery of the new Certificate(s) shall be made at the specified office of the Transfer Agent or of the Registrar (as the case may be) to whom delivery or surrender of such form of transfer, Exercise Notice or Certificate shall have been made or, at the option of the holder making such delivery or surrender as aforesaid and as specified in the relevant form of transfer, Exercise Notice or otherwise in writing, be mailed by uninsured post at the risk of the holder entitled to the new Certificate to such address as may be so specified, unless such holder requests otherwise and pays in advance to the relevant Transfer Agent the costs of such other method of delivery and/or such insurance as it may specify. In this Condition 1(m), “business day” means a day, other than a Saturday or Sunday, on which banks are open for business in the place of the specified office of the relevant Transfer Agent or the Registrar (as the case may be). (m) Transfers of Notes and Certificates on registration, transfer, exercise of an option or partial redemption shall be effected without charge by or on behalf of the Issuer, the Registrar or the Transfer Agents, but upon payment of any tax or other governmental charges that may be imposed in relation to it (or the giving of such indemnity as the Registrar or the relevant Transfer Agent may require). (n) No Noteholder may require the transfer of a Registered Note to be registered (i) during the period of 15 days prior to any date on which Notes may be called for redemption by the Issuer at its option pursuant to Condition 7(c)(1), 7(c)(2) or 7(c)(4), (ii) after any such Note has been called for redemption or (iii) during the period of seven days ending on (and including) any Record Date. Denomination of Notes (o) Subject to any then applicable legal and regulatory requirements, (i) Notes will be in the denomination or denominations (each of which denominations must be integrally divisible by either the smallest denomination or by the smallest increment between denominations, whichever is smaller) specified in the relevant Final Terms and (ii) Notes may not be issued under the Programme which have a minimum denomination of less than €100,000 (or its equivalent in another currency). Notes of one denomination will not be exchangeable, after their initial delivery, for Notes of any other denomination. 85 Currency of Notes (p) Notes may be denominated in any currency (including, without limitation, euro (as defined in Condition 8C(3)) subject to compliance with all applicable legal or regulatory requirements. References to “Notes” (q) For the purposes of these Conditions, references to “Notes” shall, as the context may require, be deemed to be to Temporary Global Notes, Permanent Global Notes, Definitive Notes, Global Certificates or Individual Certificates. 2 Status of the Notes Subject to Condition 4, the Notes constitute direct, unconditional and unsecured obligations of the Issuer and (subject as aforesaid) rank and will rank pari passu without any preference among themselves with all other present and future unsecured and unsubordinated obligations of the Issuer (other than obligations preferred by law). 3 Status of the Guarantee Subject to Condition 4, the obligations of each Guarantor under the guarantee constitute unsecured obligations of such Guarantor and (subject as aforesaid) rank and will rank (subject to any obligations preferred by law) pari passu with all other present and future unsecured and unsubordinated obligations of such Guarantor. 4 Negative Pledge (A) Negative Pledge for UFN Notes So long as any UFN Notes remain outstanding (as defined in the Trust Deed): (a) UFN will not create or have outstanding any mortgage, charge, lien, pledge or other security interest upon the whole or any part of its undertaking or assets (including any uncalled capital), present or future; and (b) PLC will not create or have outstanding any mortgage, charge, lien, pledge or other security interest upon the whole or any substantial part of its undertaking or assets (including any uncalled capital), present or future, to secure any Indebtedness of any person (or any guarantee or indemnity given in respect thereof) unless the UFN Notes and the Coupons thereon shall be secured by such mortgage, charge, lien, pledge or other security interest equally and rateably therewith in the same manner or in a manner satisfactory to the Trustee or such other security for the UFN Notes and the Coupons thereon shall be provided as the Trustee shall, in its absolute discretion, deem not less beneficial to the Noteholders or as shall be approved by an Extraordinary Resolution (as defined in the Trust Deed) of Noteholders, provided that the restriction contained in this Condition 4(A) shall not apply to: (i) any mortgage, charge, lien, pledge or other security interest arising solely by mandatory operation of law; and (ii) any security over assets of PLC or UFN arising pursuant to the Algemene Voorwaarden (general terms and conditions) of the Nederlandse Vereniging van Banken (Dutch Bankers’ Association) and/or similar terms applied by financial institutions, if and insofar as applicable.

86 (B) Negative Pledge for PLC Notes So long as any PLC Notes remain outstanding (as defined in the Trust Deed), PLC will not create or have outstanding any mortgage, charge, lien, pledge or other security interest upon the whole or any substantial part of its undertaking or assets (including any uncalled capital), present or future, to secure any Indebtedness of any person (or any guarantee or indemnity given in respect thereof) unless the PLC Notes and the Coupons thereon shall be secured by such mortgage, charge, lien, pledge or other security interest equally and rateably therewith in the same manner or in a manner satisfactory to the Trustee or such other security for the PLC Notes and the Coupons thereon shall be provided as the Trustee shall, in its absolute discretion, deem not less beneficial to the Noteholders or as shall be approved by an Extraordinary Resolution (as defined in the Trust Deed) of Noteholders, provided that the restriction contained in this Condition 4(B) shall not apply to: (i) any mortgage, charge, lien, pledge or other security interest arising solely by mandatory operation of law; and (ii) any security over assets of PLC arising pursuant to the Algemene Voorwaarden (general terms and conditions) of the Nederlandse Vereniging van Banken (Dutch Bankers’ Association) and/or similar terms applied by financial institutions, if and insofar as applicable. (C) Negative Pledge for UCC Notes So long as any UCC Notes remain outstanding (as defined in the Trust Deed): (a) UCC will not create or have outstanding any mortgage, charge, lien, pledge or other security interest upon the whole or any part of its undertaking or assets (including any uncalled capital), present or future; and (b) PLC will not create or have outstanding any mortgage, charge, lien, pledge or other security interest upon the whole or any substantial part of its undertaking or assets (including any uncalled capital), present or future, to secure any Indebtedness of any person (or any guarantee or indemnity given in respect thereof) unless the UCC Notes and the Coupons thereon shall be secured by such mortgage, charge, lien, pledge or other security interest equally and rateably therewith in the same manner or in a manner satisfactory to the Trustee or such other security for the UCC Notes and the Coupons thereon shall be provided as the Trustee shall, in its absolute discretion, deem not less beneficial to the Noteholders or as shall be approved by an Extraordinary Resolution (as defined in the Trust Deed) of Noteholders, provided that the restriction contained in this Condition 4(C) shall not apply to: (i) any mortgage, charge, lien, pledge or other security interest arising solely by mandatory operation of law; and (ii) any security over assets of PLC or UCC arising pursuant to the Algemene Voorwaarden (general terms and conditions) of the Nederlandse Vereniging van Banken (Dutch Bankers’ Association) and/or similar terms applied by financial institutions, if and insofar as applicable. For the purposes of this Condition 4: “Indebtedness” means any loan or other indebtedness in the form of, or represented by, bonds, notes, debentures or other securities which at the time of issue thereof either is, or is intended to be, quoted, listed or ordinarily dealt in on any stock exchange, over-the-counter or other recognised securities market and which by its terms has an initial stated maturity of more than one year; and “substantial” means an aggregate amount equal to or greater than 25 per cent. of the aggregate value of the fixed assets and current assets of PLC and its group companies (being those companies required to be consolidated in accordance with United Kingdom legislative requirements relating to consolidated accounts) 87 (the “Unilever Group”, and any company within the Unilever Group being referred to herein as a “Group Company”), such value and such assets being determined by reference to the then most recently published audited consolidated balance sheet of the Unilever Group. A report by the Auditors of PLC that, in their opinion, (1) the amounts shown in a certificate provided by PLC (showing the fixed assets and current assets of the relevant part and those fixed assets and current assets expressed as a percentage of the fixed assets and current assets of the Unilever Group) have been accurately extracted from the accounting records of the Unilever Group, and (2) the percentage of the fixed assets and current assets of that part to the fixed assets and the current assets of the Unilever Group has been correctly calculated, shall, in the absence of manifest error, be conclusive evidence of the matters to which it relates. 5 Title (a) Title to the Bearer Notes, the Coupons and the Talons will pass by delivery. Title to the Registered Notes shall pass by registration in the register that the Issuer shall procure to be kept by the Registrar in accordance with the provisions of the Paying Agency Agreement (the “Register”). In these Conditions, “Noteholder” means the bearer of any Bearer Note relating to it or the person in whose name a Registered Note is registered (as the case may be), “holder” (in relation to a Note, Coupon or Talon) means the bearer of any Bearer Note, Coupon or Talon or the person in whose name a Registered Note is registered (as the case may be). (b) The Issuer, the Guarantor(s), the Trustee, the Paying Agents, the Registrar and the Transfer Agents may deem and treat the holder of any Note or Coupon as the absolute owner thereof (whether or not such Note or Coupon shall be overdue and notwithstanding any notice of any previous loss or theft thereof (or that of the related Certificate) or any express or constructive notice of any claim by any other person of any interest therein) for the purpose of making payments and for all other purposes. 6 Interest Notes may be interest-bearing or non-interest-bearing, as specified in the relevant Final Terms. The Final Terms in relation to each Tranche of interest-bearing Notes shall specify which one (and one only) of Condition 6A, 6B or 6C shall be applicable and Condition 6D will be applicable to each Tranche of interest- bearing Notes as specified therein. Condition 6G shall be applicable to Zero Coupon Notes. (A) Interest – Fixed Rate Notes, in relation to which this Condition 6A is specified in the relevant Final Terms as being applicable, shall bear interest from their date of issue (the “Issue Date”) (as specified in the relevant Final Terms) or from such other date as may be specified in the relevant Final Terms at the rate or rates per annum (or otherwise) (the “Fixed Rate of Interest”) specified in the relevant Final Terms. Such interest will be payable in arrear on such dates (the “Fixed Interest Payment Dates”) as are specified in the relevant Final Terms and on the date of final maturity thereof (the “Maturity Date”). The amount of interest payable in respect of any Note in relation to which this Condition 6A is specified in the relevant Final Terms as being applicable shall be calculated by multiplying the product of the Fixed Rate of Interest and: (i) in the case of any such Note in global form, the principal amount of such Note; or (ii) in the case of any such Note in definitive form, the Calculation Amount, in each case, by the applicable Day Count Fraction (as defined in Condition 6E(6)) as specified in the relevant Final Terms and rounding the resultant figure to the nearest sub-unit of the relevant Specified Currency, half of any such sub-unit being rounded upwards or otherwise in accordance with applicable market convention. Where the Denomination of a Note in relation to which this Condition 6A is specified in the relevant Final Terms as being applicable and which is in definitive form comprises 88 more than one Calculation Amount, the amount of interest payable in respect of such Note shall be the aggregate of the amounts (determined in the manner provided above) for each Calculation Amount comprising the Denomination without any further rounding. If no Day Count Fraction is specified in the relevant Final Terms then, in the case of Notes denominated in any currency other than U.S. dollars, the applicable Day Count Fraction shall be Actual/Actual (ICMA) (as defined in Condition 6E(5)(ii)) and, in the case of Notes denominated in U.S. dollars, the applicable Day Count Fraction shall be 30/360 (as defined in Condition 6E(5)(v)). (B) Interest – Floating Rate (Screen Rate Determination) (1) Notes, in relation to which this Condition 6B is specified in the relevant Final Terms as being applicable, shall bear interest at the rates per annum (or otherwise) determined in accordance with this Condition 6B. (2) Such Notes shall bear interest from their Issue Date (as specified in the relevant Final Terms) or from such other date as may be specified in the relevant Final Terms. Such interest will be payable on each Interest Payment Date (as defined in Condition 6E(1)) and on the date of the final maturity thereof (the “Maturity Date”) (if any). (3) The relevant Final Terms, in relation to Notes in relation to which this Condition 6B is specified as being applicable, shall specify which page (the “Relevant Screen Page”), on the Reuters Screen or any other information vending service, shall be applicable. For these purposes, “Reuters Screen” means the Reuters Money Market Rates Service (or such other service as may be nominated as the information vendor for the purpose of displaying comparable rates in succession thereto). The reference rate for such Notes shall be the Euro interbank offered rate (“EURIBOR”), in each case for the relevant period, as specified in the relevant Final Terms (the “Reference Rate”). Screen Rate Determination for Floating Rate Notes not referencing Compounded Daily SONIA, Compounded Daily SOFR or Weighted Average SOFR (4) The rate of interest (the “Rate of Interest”) for each Interest Period (as defined in Condition 6E(1)) in relation to Notes in relation to which this Condition 6B is specified as being applicable and the Reference Rate in respect of the Notes is not specified in the relevant Final Terms as being “Compounded Daily SONIA”, “Compounded Daily SOFR” or “Weighted Average SOFR” shall, subject to Condition 6H or 6I (as applicable), be determined by the Determination Agent (being the Principal Paying Agent or any other party named in the relevant Final Terms) on the following basis: (i) the Determination Agent will determine the rate for deposits (or, as the case may require, the arithmetic mean of the rates for deposits rounded (if necessary) to the fourth decimal place, with 0.00005 being rounded upwards) in the relevant currency for a period of the duration of the relevant Interest Period according to the rate (or rates) appearing for the Reference Rate on the Relevant Screen Page as at the Relevant Time on the Interest Determination Date (as defined in Condition 6B(6)). If five or more rates for deposits appear for the Reference Rate on the Relevant Screen Page as at the Relevant Time on the Interest Determination Date, the highest (or, if there is more than one such highest quotation, one only of such quotations) and the lowest (or, if there is more than one such lowest quotation, one only of such quotations) shall be disregarded by the Determination Agent for the purpose of determining the arithmetic mean (rounded as provided above) of such rates for deposits; (ii) if, on any Interest Determination Date, no such rate for deposits so appears (or, as the case may require, if fewer than three such rates for deposits so appear) or if the Relevant 89 Screen Page (or any replacement therefor) is unavailable or if the Reference Rate is unavailable on the Relevant Screen Page, the Issuer will request appropriate quotations and the Determination Agent will determine the arithmetic mean of the rates at which deposits in the relevant currency are offered by four major banks in, in the case of Notes denominated in any currency other than euro, the London interbank market or, in the case of Notes denominated in euro, the Euro-zone interbank market, selected by the Determination Agent, at the Relevant Time on the Interest Determination Date to prime banks in, in the case of Notes denominated in any currency other than euro, the London interbank market or, in the case of Notes denominated in euro, the Euro-zone interbank market for a period of the duration of the relevant Interest Period and in an amount that is representative for a single transaction in the relevant market at the relevant time. If two or more of such banks provide the Issuer with such quotations, the Rate of Interest for such Interest Period shall be the arithmetic mean (rounded (if necessary) to the fourth decimal place, with 0.00005 being rounded upwards) of such quotations. “Euro-zone” means the zone comprising the member states of the European Union that from time to time have the euro as their currency; (iii) if, on any Interest Determination Date, only three such rates for deposits are so quoted by such banks, the Determination Agent will determine the arithmetic mean (rounded as aforesaid) of the rates so quoted; or (iv) if fewer than three or no rates are so quoted by such banks, the Determination Agent will determine the arithmetic mean of the rates quoted by four major banks in the Relevant Financial Centre (as defined in Condition 8B(1)) (or, in the case of Notes denominated in euro, in such financial centre or centres as the Issuer may select), selected by the Issuer, at approximately 11.00 a.m. (Relevant Financial Centre time (or local time at such other financial centre or centres as aforesaid)) on the Interest Determination Date for loans in the relevant currency to leading European banks for a period of the duration of the relevant Interest Period and in an amount that is representative for a single transaction in the relevant market at the relevant time, and the Rate of Interest applicable to such Notes during each Interest Period will be the sum of the relevant margin (the “Margin”) specified in the relevant Final Terms and the rate (or, as the case may be, the arithmetic mean) so determined; provided that, if the Determination Agent is unable to determine a rate (or, as the case may be, an arithmetic mean) in accordance with the above provisions in relation to any Interest Period, the Rate of Interest applicable to such Notes during such Interest Period will be the sum of the Margin and the rate (or, as the case may be, the arithmetic mean) last determined in relation to such Notes in respect of the preceding Interest Period; and provided always that, if there is specified in the relevant Final Terms a minimum interest rate (the “Minimum Rate of Interest”) or a maximum interest rate (the “Maximum Rate of Interest”), then the Rate of Interest shall in no event be less than or, as the case may be, exceed such Minimum Rate of Interest or Maximum Rate of Interest. Unless otherwise specified in the relevant Final Terms, the Minimum Rate of Interest shall be deemed to be zero. (5) The Determination Agent will, as soon as practicable after determining the Rate of Interest in relation to each Interest Period, calculate the amount of interest (the “Interest Amount”) payable in respect of the principal amount of each denomination of such Notes specified in the relevant Final Terms for the relevant Interest Period. The Interest Amount will be calculated by multiplying the product of the Rate of Interest for such Interest Period and: (i) in the case of such Notes in global form, the principal amount of such Notes; or

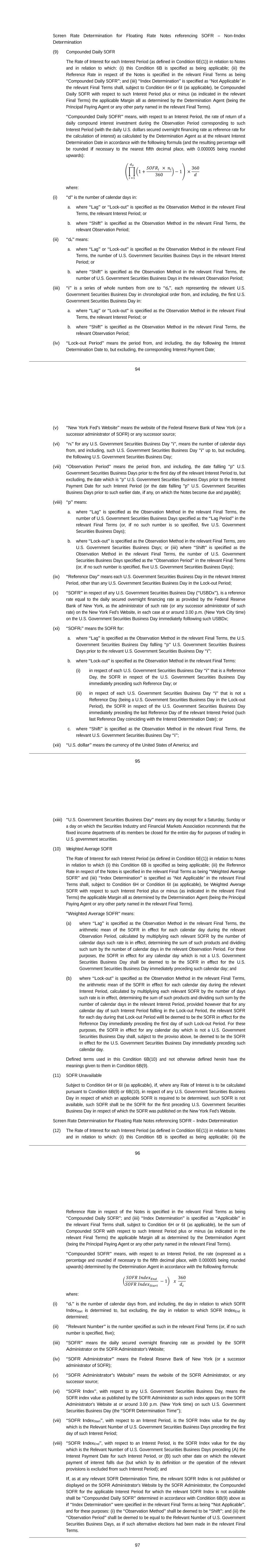

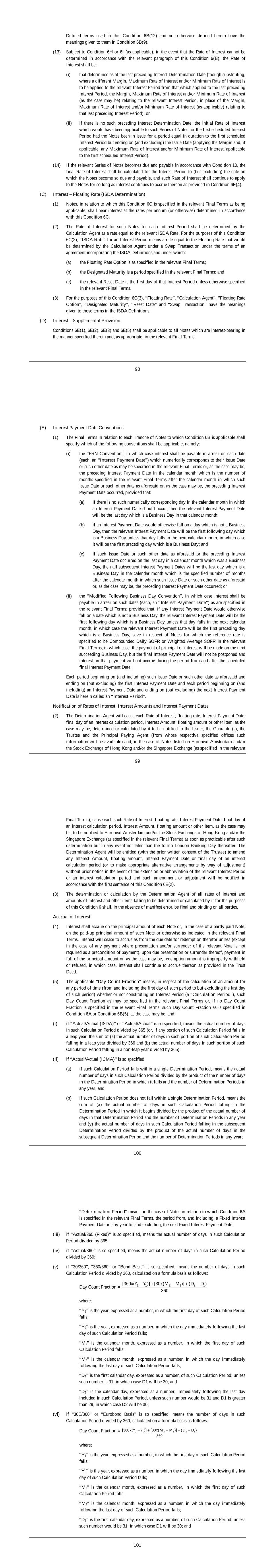

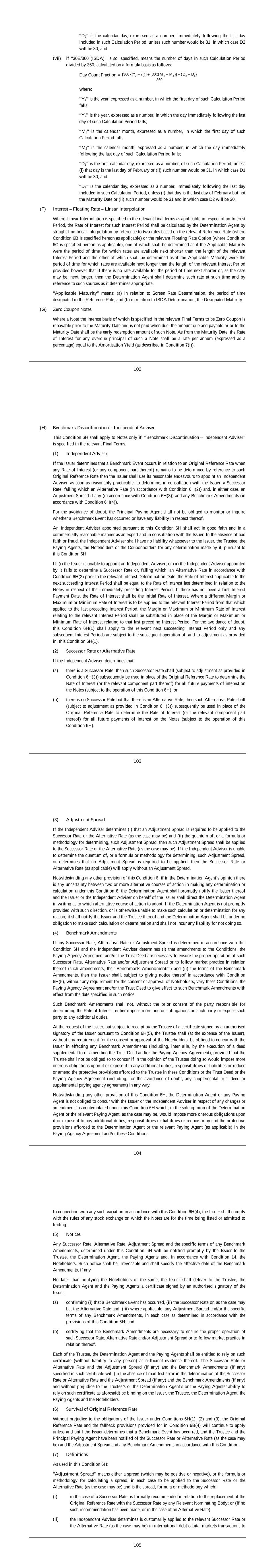

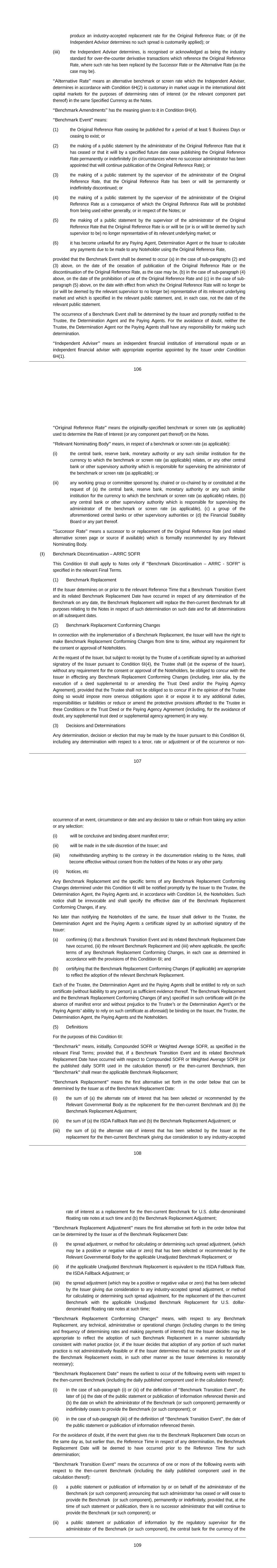

90 (ii) in the case of such Notes in definitive form, the Calculation Amount, in each case, by the applicable Day Count Fraction specified in the relevant Final Terms and rounding the resultant figure to the nearest sub-unit of the relevant Specified Currency, half of any such sub-unit being rounded upwards or otherwise in accordance with applicable market convention. Where the Denomination of a Note to which this Condition 6B is specified in the relevant Final Terms as being applicable and which is in definitive form comprises more than one Calculation Amount, the Interest Amount payable in respect of such Note shall be the aggregate of the amounts (determined in the manner provided above) for each Calculation Amount comprising the Denomination without any further rounding. If no Day Count Fraction is specified in the relevant Final Terms then, in the case of Notes denominated in any currency other than sterling, the applicable Day Count Fraction shall be Actual/360 (as defined in Condition 6E(5)) and, in the case of Notes denominated in sterling, the applicable Day Count Fraction shall be Actual/Actual (ISDA) (as defined in Condition 6E(5)). (6) For the purposes of these Conditions: (i) “Interest Determination Date” means, in respect of any Interest Period, the date falling such number (if any) of London Banking Days or, as the case may be, TARGET Days as may be specified in the relevant Final Terms prior to the first day of such Interest Period or, if none is specified: (a) in the case of Notes denominated in sterling, the first day of such Interest Period; or (b) in the case of Notes denominated in euro, the date falling two TARGET Days prior to the first day of such Interest Period; or (c) in any other case, the date falling two London Banking Days prior to the first day of such Interest Period; (ii) “London Banking Day” means a day on which commercial banks are open for business (including dealings in foreign exchange and foreign currency deposits) in London; (iii) “Relevant Time” means the time as of which any rate is to be determined as may be specified in the relevant Final Terms or, if none is specified: (a) in the case of Notes denominated in euro, approximately 11.00 a.m. (Brussels time); or (b) in any other case, approximately 11.00 a.m. (London time); (iv) “TARGET Day” means any day on which T2 (as defined in Condition 8B(1)(c)) is open for the settlement of payments in euro; and (v) “sub-unit” means, with respect to any currency other than euro, the lowest amount of such currency that is available as legal tender in the country of such currency and, with respect to euro, means one cent. Screen Rate Determination for Floating Rate Notes referencing Compounded Daily SONIA – Non-Index Determination (7) The Rate of Interest for each Interest Period (as defined in Condition 6E(1)) in relation to Notes in relation to which: (i) this Condition 6B is specified as being applicable; (ii) the Reference Rate in respect of the Notes is specified in the relevant Final Terms as being “Compounded Daily SONIA”; and (iii) “Index Determination” is specified as “Not Applicable” in the relevant Final Terms shall, subject to Condition 6H or as provided below, be Compounded Daily SONIA 91 with respect to such Interest Period plus or minus (as indicated in the relevant Final Terms) the applicable Margin all as determined by the Determination Agent (being the Principal Paying Agent or any other party named in the relevant Final Terms). “Compounded Daily SONIA” means, with respect to an Interest Period, the rate of return of a daily compound interest investment during the Observation Period corresponding to such Interest Period (with the daily Sterling overnight reference rate as reference rate for the calculation of interest) as calculated by the Determination Agent (or such other party responsible for the calculation of the Rate of Interest, as specified in the relevant Final Terms) as at the relevant Interest Determination Date in accordance with the following formula (and the resulting percentage will be rounded if necessary to the nearest fifth decimal place, with 0.000005 being rounded upwards): [∏(1+ SONIAi-pLBD × ni 365 ) -1 do i=1 ]× 365 d where: (i) “d” is the number of calendar days in: a. where “Lag” is specified as the Observation Method in the relevant Final Terms, the relevant Interest Period; or b. where “Shift” is specified as the Observation Method in the relevant Final Terms, the relevant Observation Period; (ii) “do” means: a. where “Lag” is specified in as the Observation Method in the relevant Final Terms, the number of London Banking Days in the relevant Interest Period; or b. where “Shift” is specified as the Observation Method in the relevant Final Terms, the number of London Banking Days in the relevant Observation Period; (iii) “i” is a series of whole numbers from one to do, each representing the relevant London Banking Day in chronological order from, and including, the first London Banking Day in: a. where “Lag” is specified in as the Observation Method in the relevant Final Terms, the relevant Interest Period; or b. where “Shift” is specified in as the Observation Method in the relevant Final Terms, the relevant Observation Period; (iv) “London Banking Day” or “LBD” means any day on which commercial banks are open for general business (including dealing in foreign exchange and foreign currency deposits) in London; (v) “ni” for any London Banking Day “i”, means the number of calendar days from (and including) such London Banking Day “i” up to (but excluding) the following London Banking Day; (vi) “Observation Period” means the period from (and including) the date falling “p” London Banking Days prior to the first day of the relevant Interest Period to (but excluding) the date falling “p” London Banking Days prior to (A) (in the case of an Interest Period) the Interest Payment Date for such Interest Period or (B) (in the case of any other Interest Period) the date on which the relevant payment of interest falls due; 92 (vii) “p” means: a. where “Lag” is specified as the Observation Method in the relevant Final Terms, the number of London Banking Days by which an Observation Period precedes the corresponding Interest Period, being the number of London Banking Days specified as the “Lag Period (p)” in the relevant Final Terms (which shall not, without the prior agreement of the Determination Agent be less than five, or, if no such number is so specified, five London Banking Days); or b. where “Shift” is specified as the Observation Method in the relevant Final Terms, the number of London Banking Days by which an Observation Period precedes the corresponding Interest Period, being the number of London Banking Days specified as the “Shift Period (p)” in the relevant Final Terms (which shall not, without the prior agreement of the Determination Agent be less than five, or, if no such number is so specified, five London Banking Days); (viii) the “SONIA reference rate”, in respect of any London Banking Day (“LBDx”), is a reference rate equal to the daily Sterling Overnight Index Average (“SONIA”) rate for such LBDx as provided by the administrator of SONIA to authorised distributors and as then published on the Relevant Screen Page (or, if the Relevant Screen Page is unavailable, as otherwise published by such authorised distributors) on the London Banking Day immediately following LBDx; and (ix) “SONIAi-pLBD” means: a. where “Lag” is specified as the Observation Method in the relevant Final Terms, in respect of any London Banking Day falling in the relevant Observation Period, the SONIA reference rate for the London Banking Day falling “p” London Banking Days prior to the relevant London Banking Day “i”; or b. where “Shift” is specified as the Observation Method in the relevant Final Terms, the SONIA reference rate for the relevant London Banking Day “i”. If, in respect of any London Banking Day in the relevant Observation Period, the applicable SONIA reference rate is not made available on the Relevant Screen Page or has not otherwise been published by the relevant authorised distributors, then (unless the Determination Agent (or other party responsible for the calculation of the Rate of Interest, as specified in the relevant Final Terms) has been notified of any Successor Rate or Alternative Rate (and any related Adjustment Spread and/or Benchmark Amendments) pursuant to Condition 6H, if applicable) the SONIA reference rate in respect of such London Banking Day shall be: (i) the Bank of England’s Bank Rate (the “Bank Rate”) prevailing at 5.00 p.m. (or, if earlier, close of business) on such London Banking Day; plus (ii) the mean of the spread of the SONIA reference rate to the Bank Rate over the previous five London Banking Days on which a SONIA reference rate has been published, excluding the highest spread (or, if there is more than one highest spread, one only of those highest spreads) and lowest spread (or, if there is more than one lowest spread, one only of those lowest spreads). Screen Rate Determination for Floating Rate Notes referencing Compounded Daily SONIA – Index Determination (8) The Rate of Interest for each Interest Period (as defined in Condition 6E(1)) in relation to Notes in relation to which: (i) this Condition 6B is specified as being applicable; (ii) the Reference Rate in respect of the Notes is specified in the relevant Final Terms as being “Compounded Daily SONIA”; and (iii) “Index Determination” is specified as “Applicable” in the relevant Final Terms shall, subject to Condition 6H and as provided below, be the SONIA Compounded 93 Index Rate with respect to such Interest Period plus or minus (as indicated in the relevant Final Terms) the Margin. “SONIA Compounded Index Rate” means, with respect to an Interest Period, the rate of return of a daily compound interest investment during the Observation Period corresponding to such Interest Period (with the daily Sterling overnight reference rate as reference rate for the calculation of interest) (expressed as a percentage and rounded, if necessary, to the fifth decimal place, with 0.000005 being rounded upwards) and will be calculated by the Determination Agent (being the Principal Paying Agent or any other party named in the relevant Final Terms) on the Interest Determination Date in accordance with the following formula: ( 𝑆𝑂𝑁𝐼𝐴 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑒𝑑 𝐼𝑛𝑑𝑒𝑥𝐸𝑁𝐷 𝑆𝑂𝑁𝐼𝐴 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑒𝑑 𝐼𝑛𝑑𝑒𝑥𝑆𝑇𝐴𝑅𝑇 − 1) × ( 365 𝑑 ) where: (i) “London Banking Day” and “Observation Period” have the meanings set out in Condition 6B(7) above; (ii) “d” means the number of calendar days in the relevant Observation Period; (iii) “p” means the number of London Banking Days included in the SONIA Compounded Index Observation Period specified in the relevant Final Terms (or, if no such number is specified, five London Banking Days); (iv) “SONIA Compounded Index” means the index known as the SONIA Compounded Index administered by the Bank of England (or any successor administrator thereof); (v) “SONIA Compounded IndexStart” means, with respect to an Interest Period, the SONIA Compounded Index Value on the first day of the relevant Observation Period; (vi) “SONIA Compounded IndexEnd” means the SONIA Compounded Index Value on the last day of the relevant Observation Period; and (vii) “SONIA Compounded Index Value” means, in relation to any London Banking Day, the value of the SONIA Compounded Index as published on the Relevant Screen Page on such London Banking Day or, if the value of the SONIA Compounded Index cannot be obtained from the Relevant Screen Page, as published on the Bank of England’s website at www.bankofengland.co.uk/boeapps/database/(or such other page or website as may replace such page for the purposes of publishing the SONIA Compounded Index) in respect of the relevant London Banking Day. Subject to Condition 6H, if the SONIA Compounded Index Value is not available in relation to any Interest Period on the Relevant Screen Page or the Bank of England’s website (or such other page or website referred to in the definition of “SONIA Compounded Index Value” above) for the determination of either or both of SONIA Compounded IndexStart and SONIA Compounded IndexEnd, the Rate of Interest for such Interest Period shall be “Compounded Daily SONIA” determined in accordance with Condition 6B(7) above plus or minus (as indicated in the relevant Final Terms) the applicable Margin and as if Index Determination were specified in the relevant Final Terms as being “Not Applicable”, and for these purposes: (A) (i) the “Observation Method” shall be deemed to be “Shift” and (ii) the “Observation Period” shall be deemed to be equal to the “SONIA Compounded Index Observation Period”, as if those alternative elections had been made in the relevant Final Terms; and (B) the “Relevant Screen Page” shall be deemed to be the “Relevant Fallback Screen Page” specified in the relevant Final Terms.