附件99.2美國金融集團投資者補充資料-2022年第二季度美國金融集團公司公司總部大美國保險集團大樓301E Fourth Street辛辛那提,郵編:45202 513 579 6739

American Financial Group, Inc. Table of Contents - Investor Supplement - Second Quarter 2022 Section Page Table of Contents - Investor Supplement - Second Quarter 2022...........................................................................................................................2 ........................................................................................................................................................................................................................................................................................................................................................................................................................................... Financial Highlights..................................................................................................................................................................................................3 .................................................................................................................................................................................................................................................................................................................................................................... Summary of Earnings..............................................................................................................................................................................................4 ........................................................................................................................................................................................................................................................................................................................................................................ Earnings Per Share Summary.................................................................................................................................................................................5 ..................................................................................................................................................................................................................................................................................................................................................................................... Property and Casualty Insurance Segment Property and Casualty Insurance - Summary Underwriting Results (GAAP)...........................................................................................................6 ........................................................................................................................................................................................................................................................................................................................................................................................................................................................... Specialty - Underwriting Results (GAAP).................................................................................................................................................................7 ..................................................................................................................................................................................................................................................................................................................................................................................................... Property and Transportation - Underwriting Results (GAAP)..................................................................................................................................8 .................................................................................................................................................................................................................................................................................................................................................................................................................................... Specialty Casualty - Underwriting Results (GAAP)..................................................................................................................................................9 .................................................................................................................................................................................................................................................................................................................................................................................................................... Specialty Financial - Underwriting Results (GAAP)................................................................................................................................................1 ..0 .................................................................................................................................................................................................................................................................................................................................................................................................................... Other Specialty - Underwriting Results (GAAP)......................................................................................................................................................1 ..1 .............................................................................................................................................................................................................................................................................................................................................................................................................. Annuity Segment Discontinued Annuity Operations............................................................................................................................................................................1 ..2 ........................................................................................................................................................................................................................................................................................................................................................................................ Consolidated Balance Sheet / Book Value / Debt Consolidated Balance Sheet...................................................................................................................................................................................1 ..3 ..................................................................... Book Value Per Share and Price / Book Summary.................................................................................................................................................1 ..4 ....................................................................................................... Capitalization..........................................................................................................................................................................................................1 ..5 .............................................. Additional Supplemental Information......................................................................................................................................................................1 ..6 .................................................................................. Consolidated Investment Supplement Total Cash and Investments...................................................................................................................................................................................1 ..7 ....................................................................................................................... Net Investment Income From Continuing Operations.............................................................................................................................................1 ..8 ............................................................................................................................................................. Alternative Investments - Continuing Operations....................................................................................................................................................1 ..9 ...................................................................................................................................................... Fixed Maturities - By Security Type - AFG Consolidated........................................................................................................................................2 ..0 .................................................................................................................................................................. Appendix A. Fixed Maturities by Credit Rating & NAIC Designation by Type 6/30/2022.......................................................................................................2 ..1 ................................................................................................................................................................................................... B. Fixed Maturities by Credit Rating & NAIC Designation by Type 12/31/2021.....................................................................................................2 ..2 ..................................................................................................................................................................................................... C. Corporate Securities by Credit Rating & NAIC Designation by Industry 6/30/2022..........................................................................................2 ..3 .............................................................................................................................................................................................................. D. Corporate Securities by Credit Rating & NAIC Designation by Industry 12/31/2021........................................................................................2 ..4 .................................................................................................................................................................................................................. E. Asset-Backed Securities by Credit Rating & NAIC Designation by Collateral Type 6/30/2022.........................................................................2 ..5 ................................................................................................................................................................................................................................. F. Asset-Backed Securities by Credit Rating & NAIC Designation by Collateral Type 12/31/2021.......................................................................2 ..6 ................................................................................................................................................................................................................................... G. Real Estate-Related Investments 6/30/2022.....................................................................................................................................................2 ..7 ..................................................................................................................................................... H. Real Estate-Related Investments 12/31/2021...................................................................................................................................................2 ..8 ....................................................................................................................................................... Page 2

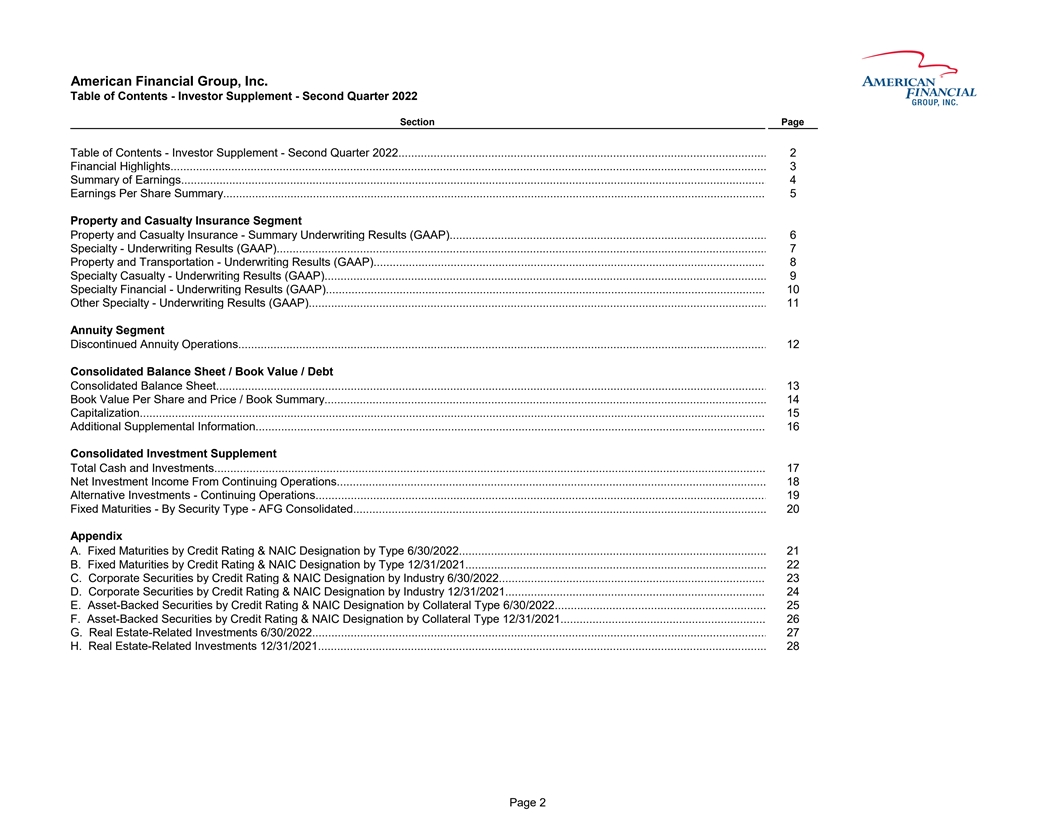

淨收益$167$290$355$219$457$1,421持續業務淨收益167 290 355 219 2 40 457 507核心淨營業淨收益243 303 351 231 2 05 546 411總資產28,084 28,762 28,929,942 28,780 28,084 28,780調整後股東權益(A)4,401,948 4,876 5,062396 4,401,396財產及意外傷害淨保費 1,516 1,368 1,270 1,729 1,369 2,884 2,574每股攤薄收益$1.96$3.40$4.18$2.56$1 1.70$5.36$16.51持續運營的攤薄每股收益1.96 3.40 4.18 2.56 2.81 5.36 5.90核心淨運營 每股收益2.85 3.56 4.12 2.71 2.39 6.41 4.78調整後每股賬面價值(A)51.68 58.14 57.42 59.70 6每股普通股股息8.5600 2.5600 6.5600 6.5000 14.5000 11.1200 15.0000財務比率年化股本回報率(B)14.3%23.5%28.5%16.6%72.0%19.2%51.2%年化核心營運股本回報率(B)20.7%24.6%28.1%17.6%14.7%23.0%14.8%財產和意外傷害綜合比率--專業:損失及保險比率55.4%53.1%56.5%62.4%57.2%54.3% 57.0%承保費用比率30.4%30.9%24.2%26.6%30.7%30.6%31.2%合併比率-專業85.8%84.0%80.7%87.9%84.9%88.2%(A)不包括與固定期限投資有關的未實現收益(虧損),對《公認會計原則》計量的對賬見第14頁。(B)不包括累積的其他全面收入。第3頁

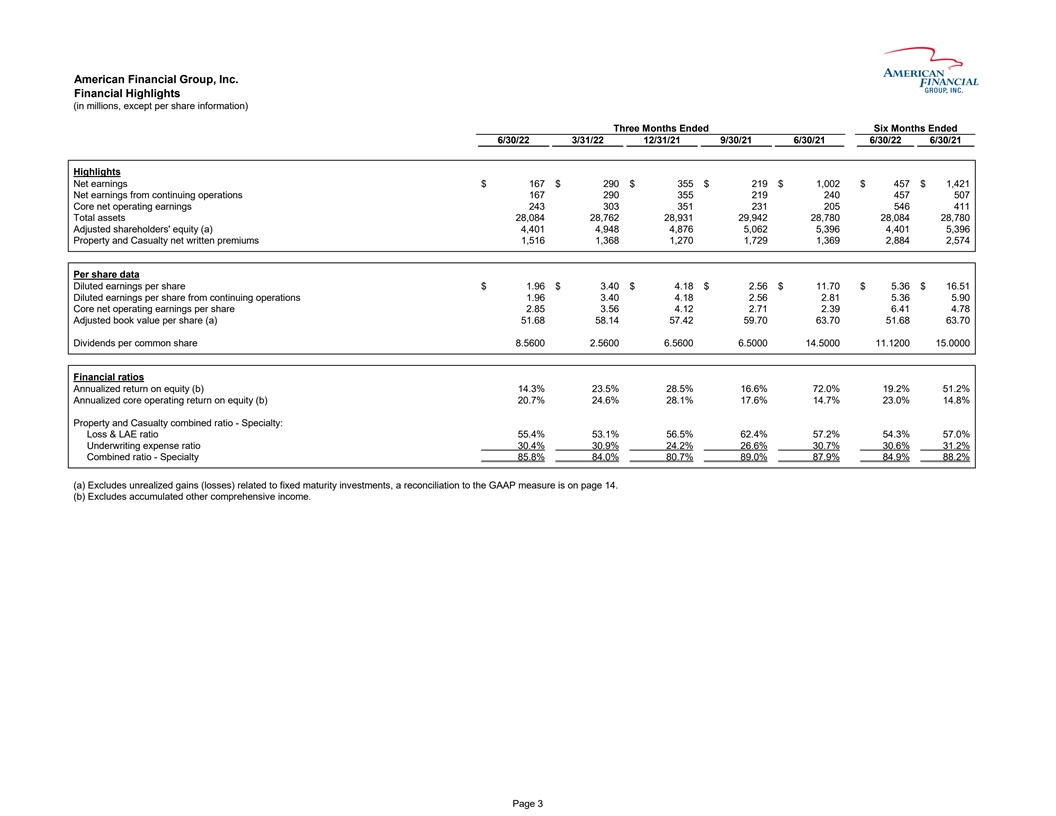

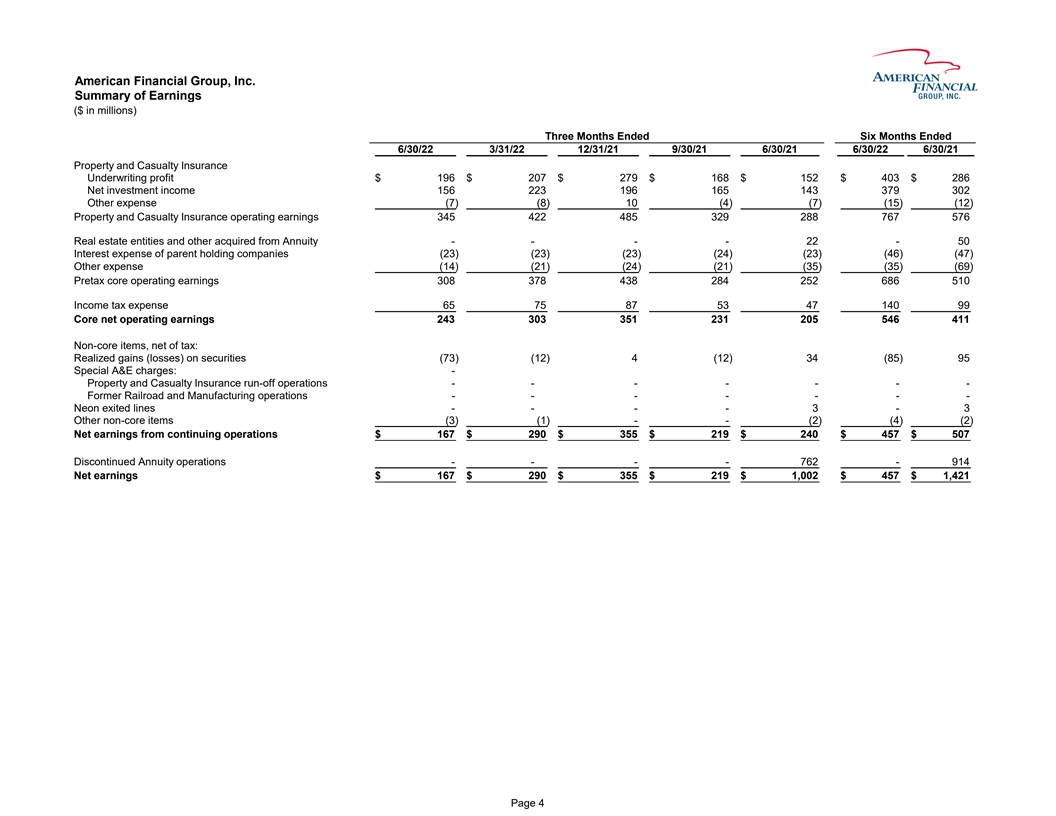

美國金融集團,截至6/30/22 3/31/22 12/31/21 6/30/22 6/30/22 6/30/21財產和意外傷害保險承保利潤$196$207$279$168$152$403$286淨投資收益156 223 196 1 43 379 302其他費用(7) (8)10(4)(7)(15)(12)財產和意外傷害保險運營收益345 422485 329 2 88 767 576房地產實體和其他從年金獲得的---2 2-50母控股公司利息支出(23)(23)(23)(24)(23)(46) (47)其他支出(14)(21)(24)(21)(35)(35)(69)税前核心運營收益308 378 438 284 2 52 686 510所得税支出65 75 87 53 4 140 99核心淨運營收益243 303 351 231 2 05 546 411非核心項目,税後淨額:已實現證券收益(虧損)(73)(12)4(12)3 4(85)95特別A&E費用:--財產和意外傷害保險分項業務---前鐵路和製造業務---霓虹燈退出線路---3-3其他 非核心項目(3)(1)--(2)(4)(2)持續業務淨收益$167$290$355$219$240$457$507終止年金業務---7 62-914淨收益$167$290$355$219$1,002$457$1,421第4頁

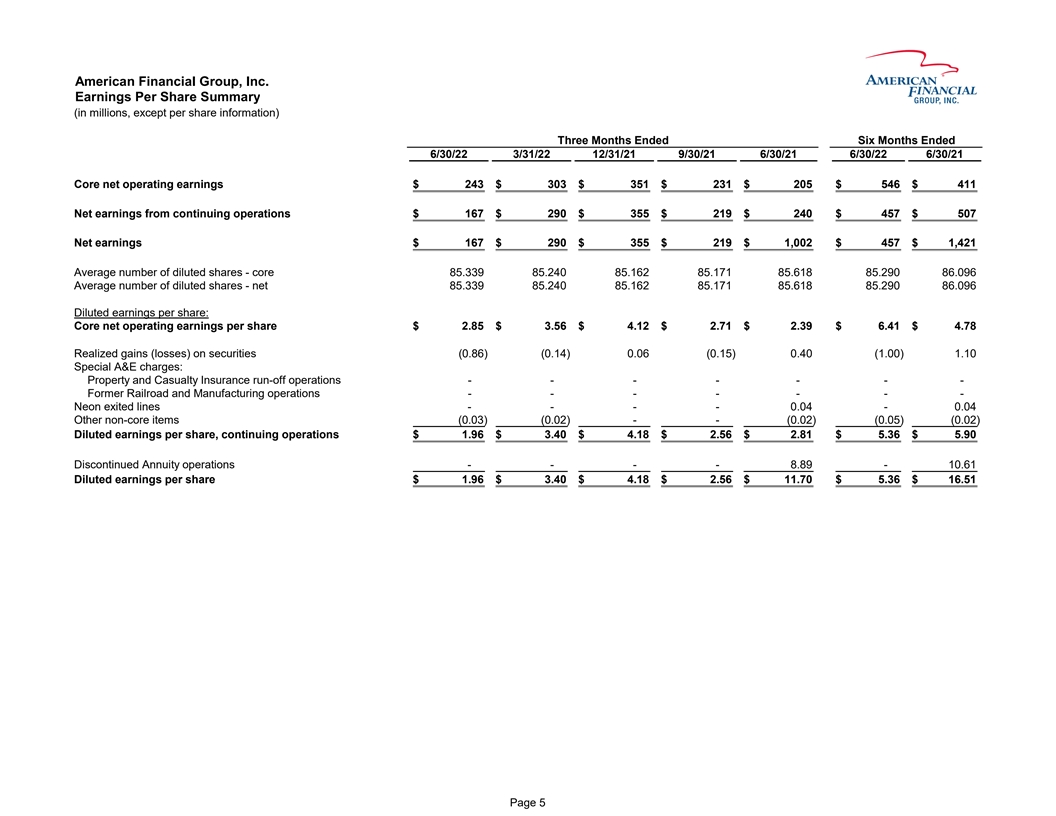

美國金融集團每股收益摘要(單位:百萬, 不包括每股信息)截至6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 6/30/22 6/30/21核心淨運營收益$243$303$351$231$205$5 46$4 11持續運營淨收益$167$290$ 355$219$240$4 57$5 07淨收益$167$290$355$219$1,002$457$1,攤薄平均股數-核心股數85.339 85.240 85.162 85.171 85.618 8 5.290 8 6.096攤薄股數-淨85.339 85.240 85.162 85.171 85.618 8 5.290 8 6.096攤薄每股收益:每股核心淨營業收益$2.85$3.56$4.12$2.71$2.39$6.41$4.78證券已實現收益(虧損)(0.14))0.06(0.15)0.40(1.00)1.10特別A&E費用: 財產和意外傷害保險分流業務---前鐵路和製造業務---Neon退出線路---0.04-0.04其他非核心項目(0.03)(0.02)--(0.02)(0.05)(0.02)稀釋後每股收益 ,持續業務$1.96$3.40$4.18$2.56$2.81$5.36$5.90非連續性年金業務---8.89-1 0.61稀釋後每股收益$1.96$3.40$4.18$2.56$11.70$5.36$1 6.51第5頁

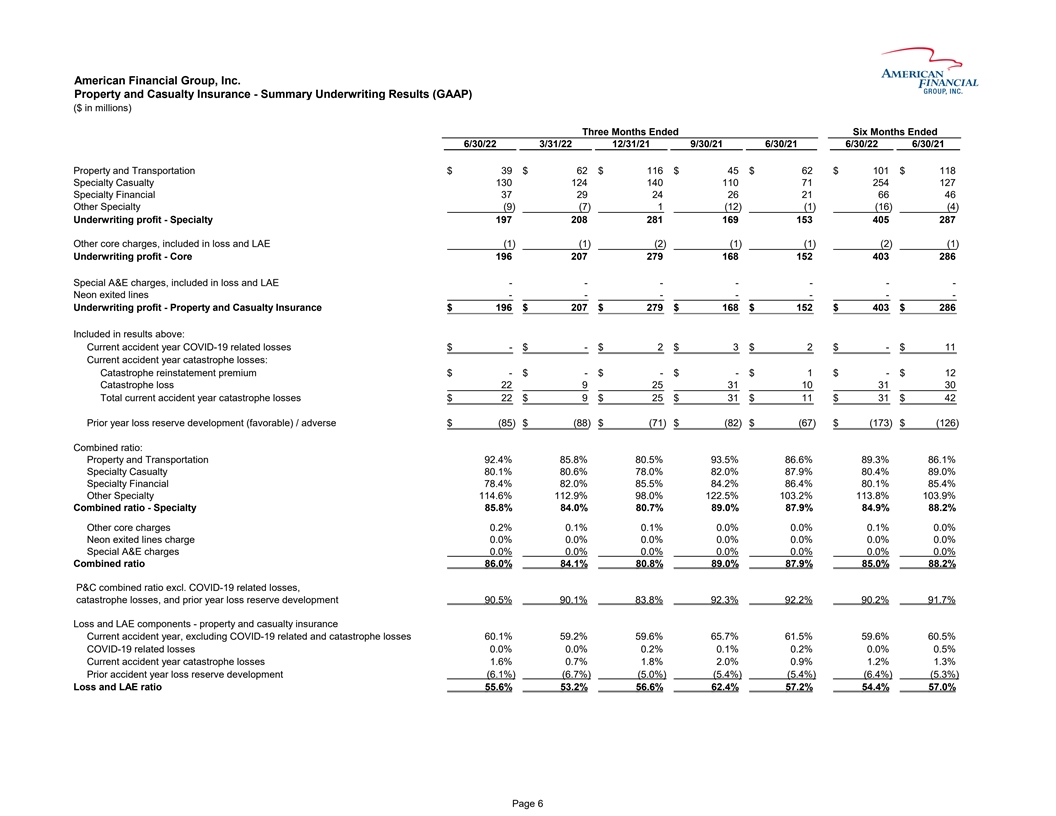

美國金融集團,財產和意外傷害保險公司-摘要 承保業績(GAAP)(以百萬美元為單位)截至6/30/22 3/31/22 12/31 9/30/21 6/30/21 6/30/22 6/30/21財產和運輸$3 9$6 2$1 16$4 5$62$101$118特殊意外傷害1 30 1 24 1 40 1 10 71 254 127特殊財務3 7 2 2 4 2 6 21 66 46其他特殊意外傷害(9)(7)1(12)(1)(16)(4)承保利潤-專業1 97 2 08 2 81 1 69 153 405 287其他核心費用,包括在虧損和LAE(1)(1)(2)(1)(1)(2)(1)承保 利潤-核心1 96 2 07 2 79 1 68 152 403 286特別A&E費用中,包括在損失和LAE中---霓虹燈退出線路-承保利潤-財產和意外傷害保險$1 96$2 07$2 79$1 68$152$403$286 包含在上述結果中:當前事故年份新冠肺炎相關損失$-$-$2$3$2$-$11當前事故年巨災損失:巨災恢復保費$-$-$-$1$-$12巨災損失2 2 9 2 53 1 10 31 30 當前事故年巨災損失總額$2 2$9$2 5$3 1$11$31$42前一年損失準備金髮展(有利)/不利$(85)$(88)$(71)$(82)$(67)$(173)$(126)綜合比率:財產和運輸92.4%85.8% 80.5%93.5%86.6%89.3%86.1%特殊傷亡80.1%80.6%78.0%82.0%87.9%80.4%89.0%專業財務78.4%82.0%85.5%84.2%86.4%80.1%85.4%其他專業114.6%112.9%98.0%122.5%103.2%113.8%103.9%組合比率-專業8 5.8%8 4.0%8 0.7%8 9.0%87.9%84.9%88.2%其他核心費用0.2%0.1%0.1%0.0%0.1%0.0%霓虹燈退出線路收費0.0%0.0%0.0%0.0%0.0%0.0%0.0%特別A&E費用0.0%0.0%0.0%0.0%0.0%合併比率8 6.0%8 4.1%8 0.8%8 9.0%87.9%85.0%88.2%P&C合併比率(不包括)新冠肺炎相關虧損, 巨災損失和上一年損失準備金髮展90.5%90.1%83.8%92.3%92.2%90.2%91.7%損失和LAE組成部分-財產和意外傷害保險 本事故年度,不包括新冠肺炎相關和巨災損失60.1%59.2%59.6%65.7%61.5%59.6%60.5%新冠肺炎相關損失0.0%0.0%0.2%0.1%0.2%0.0%0.5%當前事故年巨災損失1.6%0.7%1.8%2.0%0.9%1.2%1.3% 上一事故年損失準備金髮展(6.1%)(6.7%)(5.0%)(5.4%)(6.4%)(5.3%)損失和LAE比率5 5.6%53.2%56.6%6 2.4%57.2%54.4%57.0%第6頁

美國金融集團公司專業承保業績(GAAP) (百萬美元)截至6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 6/30/22 6/30/21毛保費$2,123$1,936$1,737$2,656$1,937$4,059$3,553放棄再保險費(607)(568)(467)(927)(568) (1,淨保費1,5161,368 1,270 1,729 1,3692,884 2,574未賺取保費變動(123)(66)182(200)(119)(189)(151)淨賺得保費1,393 1,3021,4521,529 1,250 2,695 2,423虧損及LAE 773 692 820 953 7131,465 1,380承保費用423 402 351 407 384 825 756承保利潤$197$208$281$169$153$405$287以上結果包括:本事故年新冠肺炎相關損失$-$-$2$3$2-$11本事故年 巨災損失:巨災恢復保費$-$-$-$1-$12巨災損失22 9 25 31 10 31 30本年度巨災損失$22$9$25$31$11$31$42前一年損失準備金髮展(有利) /逆差$(86)$(89)$(73)$(83)$(68)$(175)$(127)合併比率:虧損與資產負債比率5 5.4%53.1%5 6.5%62.4%57.2%54.3%57.0%承保費用比率30.4%30.9%24.2%26.6%30.7%30.6%31.2%合併比率8 5.8%8 4.0%8 0.7%8 9.0%87.9%84.9%88.2%專業合併比率(不包括)新冠肺炎相關損失、巨災損失和上年損失準備金髮展90.5%90.1%8 3.7%9 2.3%92.2%90.2%91.7%損失和LAE組成部分:當前事故年份, 不包括新冠肺炎相關損失和巨災損失60.1%59.2%59.5%65.7%61.5%59.6%60.5%新冠肺炎相關損失0.0%0.0%0.2%0.1%0.2%0.0%當前事故年巨災損失1.6%0.7%1.8%2.0%0.9%1.2%1.3%以前事故年損失準備金(6.3%)(6.8%)(5.0%)(5.4%)(5.4%)(6.5%)(5.3%)損失和LAE比率5 5.4%53.1%56.5%62.4%57.2%54.3%57.0%第7頁

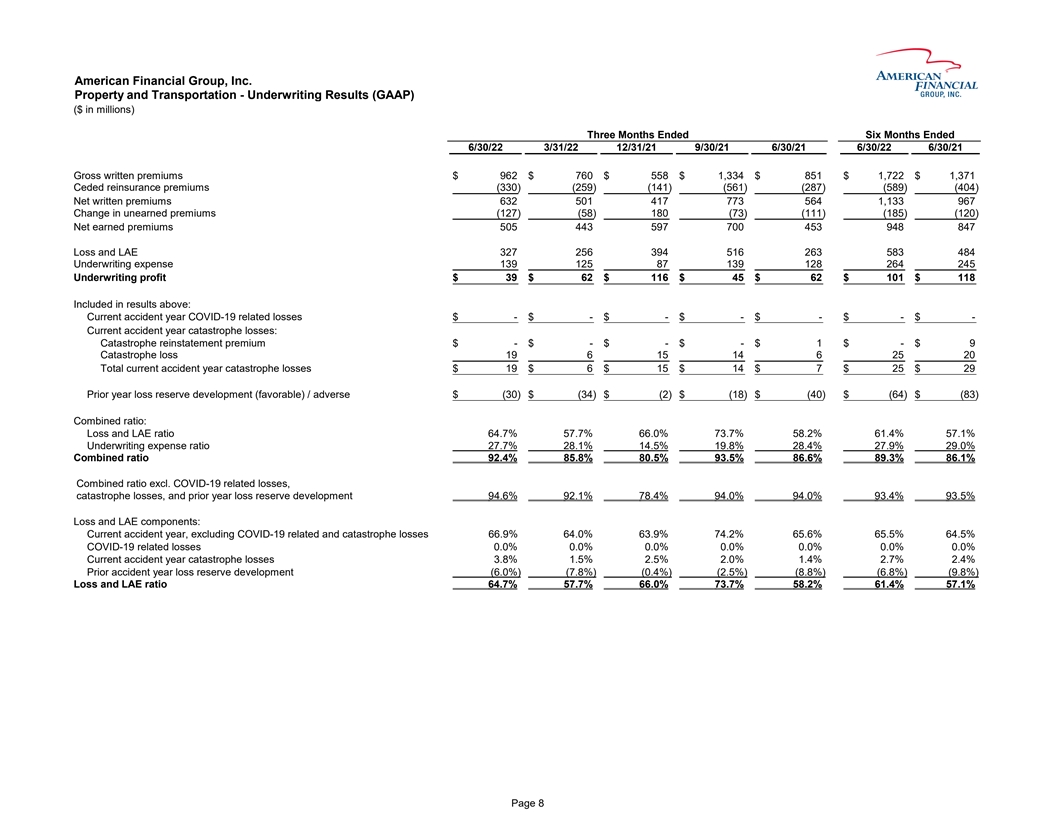

美國金融集團財產和運輸公司- 承保業績(以百萬美元為單位)截至6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 6/30/22 6/30/21毛保費$962$760$558$1,334$851$1,722$1,371放棄再保險保費(330)(259) (141)(561)(287)(589)(404)淨保費632 501 773 564133 9 67未賺取保費變動(127)(58)180(73)(111)(185)(120)淨賺取保費505 443 597 700 453 948 847虧損及LAE 327 256 394 516 263 583 484 承保費用139 125 87 139 128 2 64 2 45承保利潤$39$62$116$45$62$101$118以上結果包括:本意外年新冠肺炎相關虧損$-$-$-$-$--本意外年巨災 損失:巨災恢復保費$-$-$-$1$-$9巨災損失19 6 15 14 6 2 5 2 0當前事故年巨災損失總額$19$6$15$14$7$25$29前一年損失準備金髮展(有利)/不利$ (30)$(34)$(2)$(18)$(40)$(64)$(83)綜合比率:損失和LAE比率64.7%57.7%66.0%73.7%58.2%6 1.4%57.1%承保費用比率27.7%28.1%14.5%19.8%28.4%2 7.9%2 9.0%合併比率92.4%85.8%80.5%93.5%86.6%8 9.3% 8 6.1%合併比率除外。新冠肺炎相關損失、巨災損失和上年損失準備金髮展94.6%92.1%78.4%94.0%94.0%93.4%93.5%損失和LAE組成部分:當前事故年份, 不包括新冠肺炎相關損失和巨災損失 新冠肺炎相關損失66.9%64.0%63.9%74.2%65.6%65.5%64.5%新冠肺炎相關損失0.0%0.0%0.0%當前事故年巨災損失3.8%1.5%2.5%2.0%1.4%2.7%2.4%之前事故年損失準備金髮展(6.0%)(7.8%) (0.4%)(2.5%)(8.8%)(6.8%)(9.8%)損失和LAE比率64.7%57.7%66.0%73.7%58.2%6 1.4%57.1%第8頁

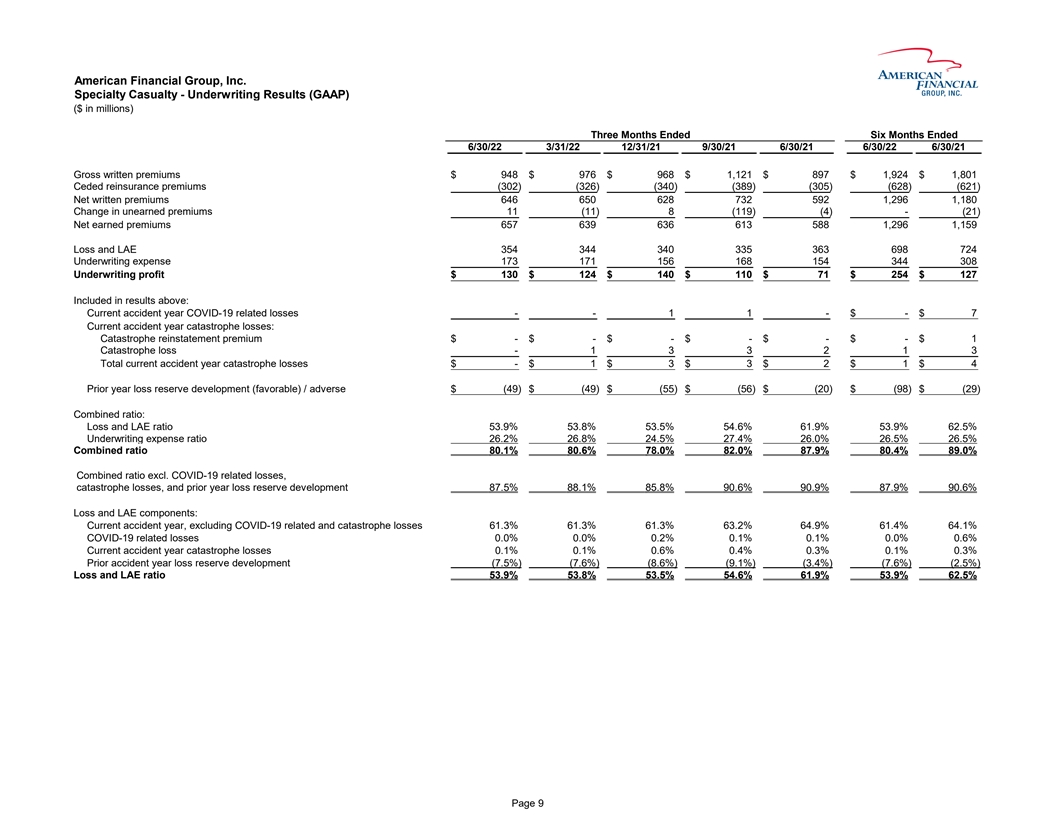

美國金融集團,截至6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 6/30/22 6/30/21毛保費$948$976$968$1,121$897$1,924$1,801再保險保費(302)(326)(340)(389)(305) (628)(621)淨保費646 650 628 732 1,296 1,180變化未賺取保費11(11)8(119)(4)-(21)賺取保費淨額657 639 636 613 588 1,296 1,159虧損及LAE 354 344 340 335 363 698 724承保費用173 171 156 168 154 344 308承保利潤$130$124$140$110$71$254$127以上結果包括:本意外年新冠肺炎相關虧損--1 1-$-$7本意外年巨災損失:巨災恢復保費$-$ -$-$--$1巨災損失-1 3 3 2 1 3當前事故年巨災損失總額$-$1$3$3$2$1$4前一年損失準備金髮展(有利)/不利$(49)$(55)$(56)$(20)$(98)$(29)綜合比率:損失和LAE比率53.9%53.8%53.5%54.6%6 1.9%53.9%62.5%承保費用比率26.26.8%24.5%27.4%2 6.0%26.5%26.5%合併比率80.1%80.6%78.0%82.0%87.9%80.4%89.0%合併比率除外。新冠肺炎相關損失, 巨災損失,上年損失準備金髮展87.5%881%85.8%90.6%90.9%87.9%90.6%損失及LAE成分:當前事故年,不包括新冠肺炎相關損失和巨災損失61.3%61.3%61.3%63.2%6 4.9%61.4%64.1% 新冠肺炎相關損失0.0%0.0%0.2%0.1%0.1%0.0%0.6%本事故年巨災損失0.1%0.1%0.6%0.4%0.3%0.1%0.1%0.4%0.3%之前事故年損失準備金髮展(7.5%)(7.6%)(8.6%)(9.1%)(3.4%)(7.6%)(2.5%)損失和LAE 比率53.9%53.8%53.5%54.6%61.9%53.9%62.5%第9頁

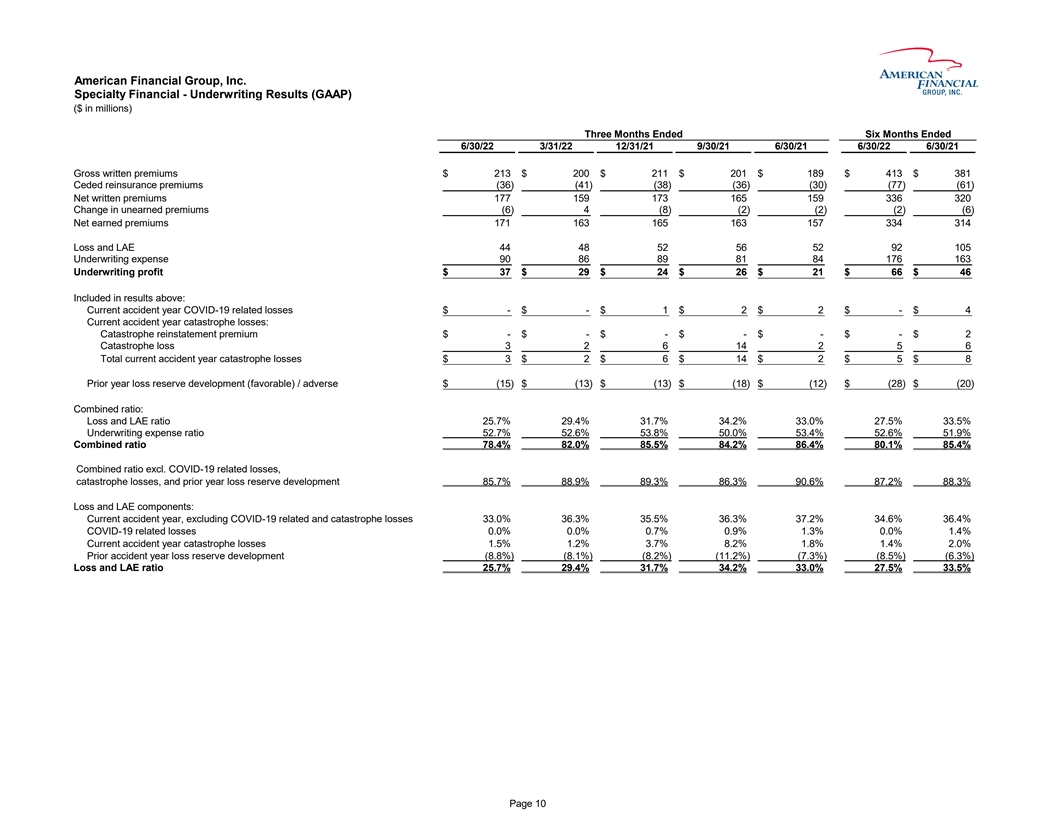

美國金融集團,截至6/30/22 3/31/21 9/30/21 6/30/21 6/30/22 6/30/21毛保費$2 13$2 00$2 11$2 01$189$413$381(36)(41)(38)(36)(30)(77)(61)淨保費1 77 1 591 73 1 65 159 336 320未賺取保費變動(6)4(8)(2)(2)(2)(6)(6)淨賺取保費1 71 1 63 1 65 1 63 157 334 314虧損及資產負債表4 4 8 5 5 5 6 52 92 105承保開支9 0 8 6 8 8 8 1 84 176 163承保利潤$3 7$2 9$2 4$2 6$21$66$46以上結果包括:當年意外年份新冠肺炎相關虧損$-$-$1$2$2$-$4當前事故年巨災損失:巨災恢復保費$-$-$ -$-$-$2巨災損失3 2 6 1 4 2 5 6當前事故年巨災損失總額$3$2$6$1 4$2$5$8上一年損失準備金髮展(有利)/不利$(15)$(13)$(13)$(18)$(12)$(28)$(20)綜合比率:損失與LAE比率25.7%29.4%31.7%34.2%33.0%27.5%33.5%承保費用比率52.7%52.6%53.8%50.0%53.4%52.6%51.9%合併比率78.4%82.0%85.5%84.2%86.4%80.1%85.4%合併比率除外。新冠肺炎相關損失, 巨災損失,上年損失準備金髮展85.7%88.9%89.3%86.3%90.6%87.2%88.3%損失及LAE成分:當前事故年,不包括新冠肺炎相關損失和巨災損失33.0%36.3%35.5%36.3%37.2%34.6%36.4% 新冠肺炎相關損失0.0%0.0%0.7%0.9%1.3%0.0%1.4%當前事故年巨災損失1.5%1.2%3.7%8.2%1.8%1.4%2.0%上一事故年損失準備金髮展(8.8%)(8.1%)(8.2%)(11.2%)(7.3%)(8.5%)(6.3%)損失和LAE 比率25.7%29.4%31.7%34.2%33.0%2 7.5%33.5%第10頁

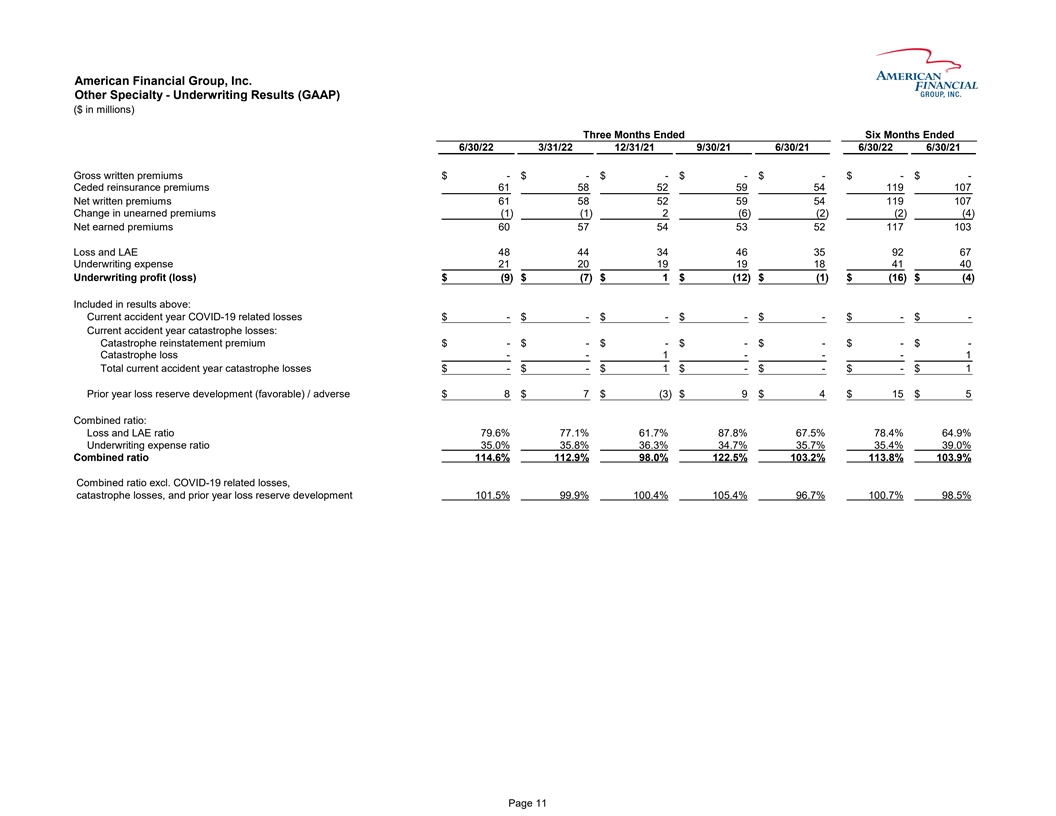

美國金融集團,截至6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 6/30/22 6/30/21毛保費$-$-$-$-$-$-再保險費61 58 52 59 54 119 107淨保費61 58 52 59 54 119 107未賺取保費變化(1)(1)2(6)(2)(2)(4)淨賺取保費60 57 54 53 52 117 103虧損及LAE 48 44 34 46 35 92 67承保費用21 20 19 18 41 40承保利潤(虧損)$(9)$(7)$1$(12)$(1)$(16)$ (4)以上結果包括:當年新冠肺炎相關虧損$-$-$-$-$-$-當前事故年巨災損失:巨災恢復保費$-$-$-$-$-$-巨災損失--1---1總計 本事故年巨災損失$-$-$1$-$-$1前一年損失準備金髮展(有利)/不利$8$7$(3)$9$4$15$5綜合比率:損失和資產負債比率79.6%77.1%61.7%87.8%67.5%78.4%64.9%承保費用比率35.0%35.8%36.3%34.7%35.7%35.4%39.0%合併比率114.6%112.9%98.0%122.5%103.2%113.8%103.9%合併比率除外。新冠肺炎相關損失、巨災損失和上年損失準備金髮展101.5%99.9%100.4% 105.4%96.7%100.7%98.5%第11頁

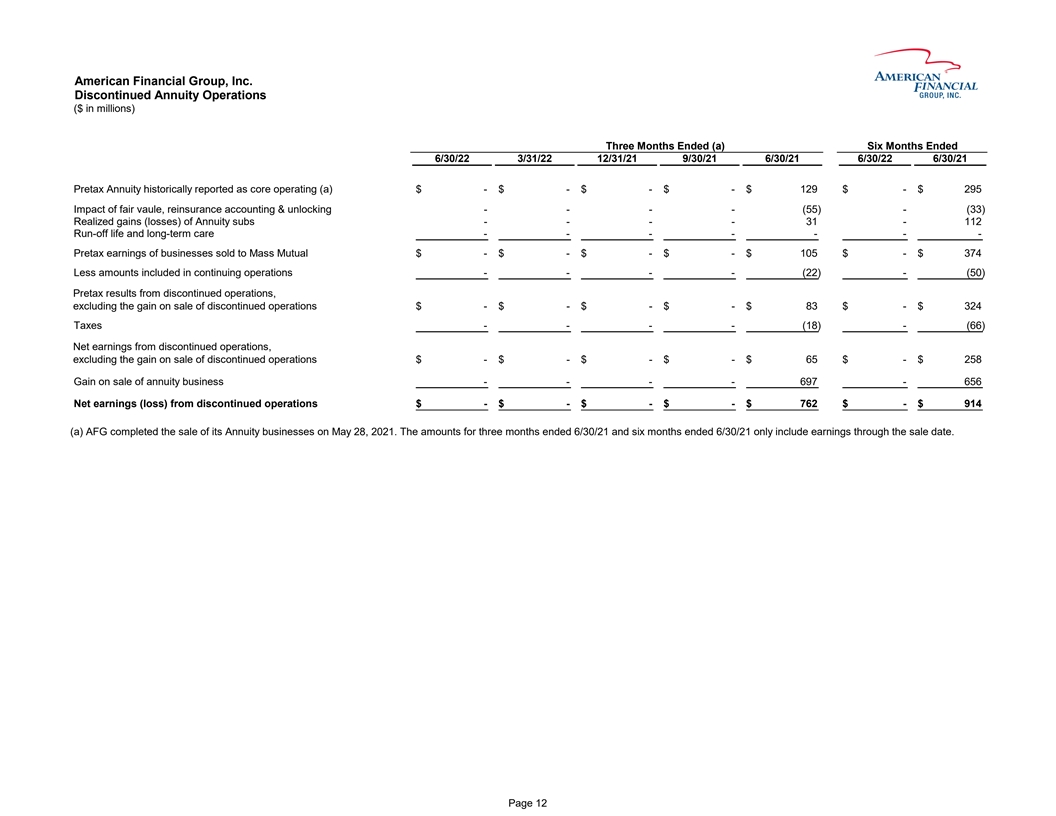

美國金融集團終止年金業務(以百萬美元為單位)截至3個月(A)截至6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 6/30/22 6/30/21歷史上報告為核心運營的税前年金(A)$-$-$-$129$-$295公平價值的影響,再保險會計& 解鎖---(55)-(33)年金分項的已實現收益(虧損)---112流出壽命和長期護理---出售給大眾互助的業務的税前收益$-$-$-$-$105-$-$374包括在持續運營中的金額---(22)-(50)非持續運營的税前結果,不包括非連續性業務的銷售收益$-$-$-$-$83-$324税---(18)-(66)非連續性業務的淨收益, 不包括出售非連續性業務的收益$-$-$-$65$-$258---697-656非連續性業務的淨收益(虧損)$-$-$-$-$762-$914(A)AFG於2021年5月28日完成了其年金業務的出售。截至21年6月30日的3個月和截至21年6月30日的6個月的金額僅包括截至銷售日期的收益。第12頁

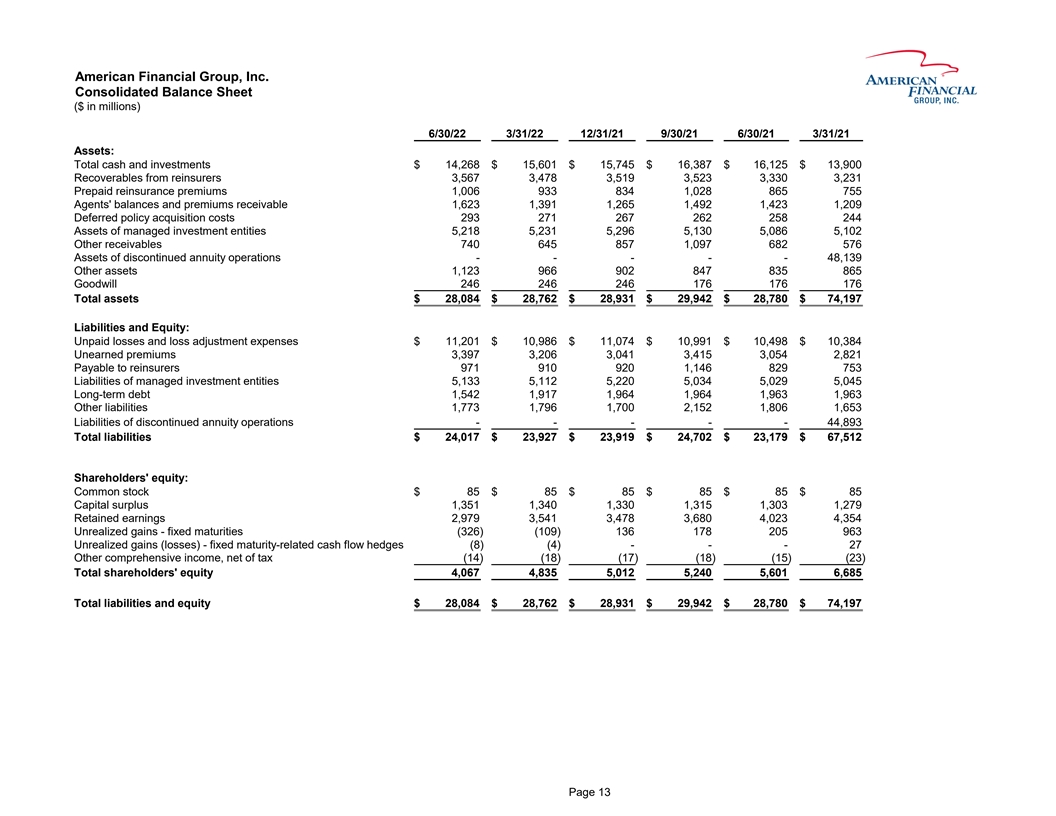

美國金融集團合併資產負債表(美元)6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 3/31/21資產:現金和投資總額$14,268$15,601$15,745$16,387$16,125$13,900應從再保險公司收回3,567 3,4783,5193,5233,330 3,231預付再保險保費1,006 933 834 1,028 8 65 755應收代理人餘額和保費1,623 1,391,3912651,492 1,423 1,209延期保單收購成本293 271 267 262 2 58 244管理投資實體的資產5,218 5,231 5,2965,130 5,086 5,102其他 應收賬款740 645 857 1,097 6 82 576非連續性年金業務的資產---48,139其他資產1,123 966 902 847 8 35 865商譽246 246 246 176 1 76 176總資產$28,084$28,762$28,931$29,942$28,780$74,197 負債和權益:未付虧損和虧損調整費用$11,201$10,986$11,074$10,991$10,498$10,384應付給再保險公司的未賺取保費3,397 3,206 3,041 3,415 3,054 2,821管理的 投資實體的負債5,133 5,112 5,220 5,034 5,029 5,045長期債務1,542 1,917 1,964 1,963 1,963 1,963 1,963---44,893總負債$ 24,017$23,927$23,919$24,702$23,179$67,512股東權益:普通股$85$85$85$85$85資本盈餘1,3511,340 1,330 1,3151,3031,279留存收益2,979 3,541 3,478 3,680 4,023 4,354未實現收益-固定到期日(326)(109)136 178 2 05 963與固定到期日相關的現金流對衝(8)(4)---27其他全面收益,除税後淨額(14)(18)(17)(18)(15)(23)股東權益總額4,067 4,835 5,012 5,240 5,601 6,685負債和權益總額$28,084美元28,762美元28,931美元29,942美元28,780美元74,197第13頁

美國金融集團每股賬面價值和賬面價格/賬面價格摘要(單位:百萬,不包括每股信息)6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 3/31/21股東權益$4,067$4,835$5,012$5,240$5,601$6,685與固定到期日有關的未實現(收益)虧損334 113(136)(178) (205)(990)調整後股東權益4,401 4,948 4,876 5,062 5,396 5695持續和非持續經營的商譽(246)(246)(176)(176)(207)無形資產(101)(104)(106)(29)(30)(31)$4,054$4,598$4,524$ 4,857$5,190$5,有形調整股東權益已發行普通股85.154 85.103 84.921 84.795 84.714 8 5.126每股賬面價值:每股賬面價值$47.76$56.81$59.02$61.80$66.12$7 8.53調整後(A)51.68 58.14 57.42 59.70 63.70 6 6.89(B)47.60 54.02 53.26 57.28 61.27 6 4.10 AFG的收盤普通股價格$138.81$145.62$137.32$125.83$124.72$1 14.10市值$11,820$12,393$11,661$ 10,670$10,566$9,713價格/調整後賬麪價值比率2.69 2.50 2.39 2.11 1.96 1.71(A)不包括與固定期限投資有關的未實現收益(虧損)。(B)不包括與固定期限投資、商譽和無形資產有關的未實現收益(虧損)。第14頁

美國金融集團資本(百萬美元)6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 3/31/21 AFG優先債務$893$1,270$1,318$1,318$1,318$1,318---在信貸安排債務項下提取的借款(不包括次級債務)$893$1,270$1,318$1,318$1,318 AFG 次級債券675 675 675 6 75長期債務本金總額$1,568$1,945$1,993$1,993$1,993$1,993股東權益4,067 4,835 5,012 5,240 5,6016,685以下:334 113(136)(178)(205)(990)(收益)與固定期限投資有關的未實現 虧損$5,969$6,893$7,0389美元688債務與調整後資本總額的比率:包括次級債務26.3%28.2%29.0%28.2%27.0%25.9%不包括次級債務15.0%18.4%19.2%18.7%17.8%7.1%第15頁

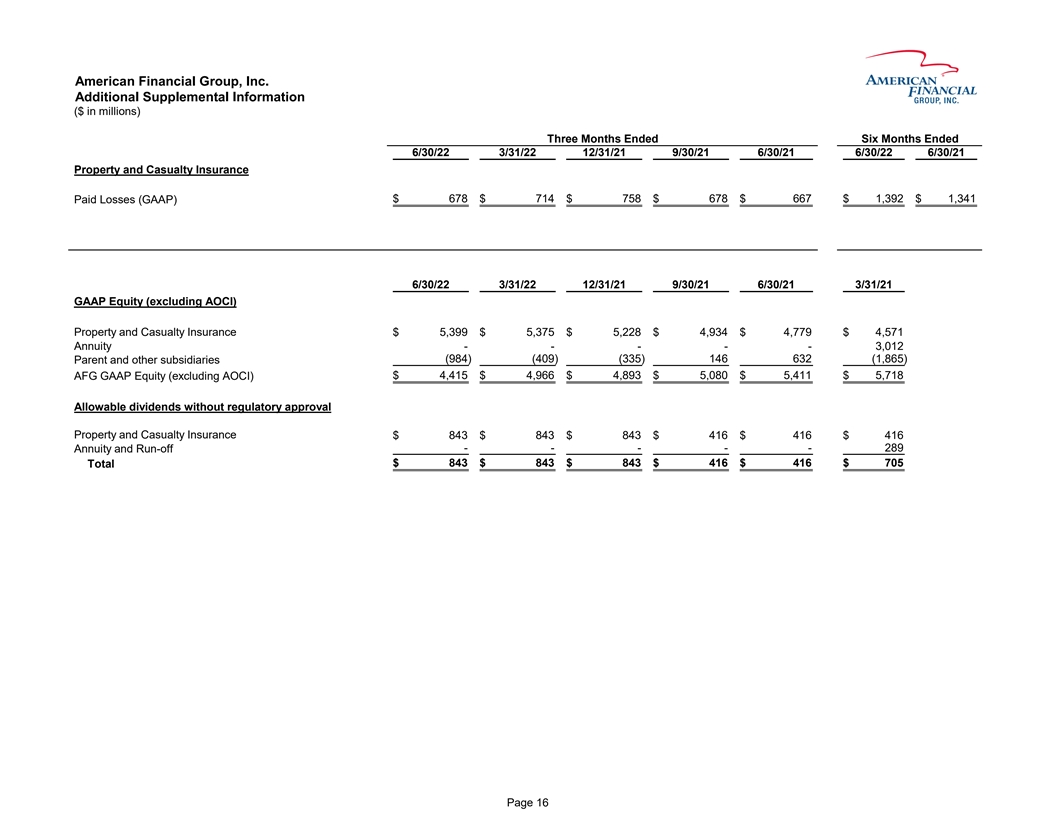

美國金融集團,截至6/30/22 3/31/21 6/30/21 6/30/22 6/30/22 6/30/21財產和意外保險$678$714$758$678$667$1,392$1,341已支付損失(GAAP)6/30/22 3/31/22 12/31/21 9/30/21 6/30/21(不包括AOCI)$5,399$5,375$5,228$4,934$4,779$4,571年金---3,012(984)(409)(335)146 6 32(1,865)母公司和其他子公司$4,415$4,966$4,893$5,080$5,411 $5,718 AFG GAAP股本(不包括AOCI)未經監管部門批准的允許股息財產和意外傷害保險$843$843$843$416$416$416--2 89年金和期末報告$843$843$416$705合計第16頁 16

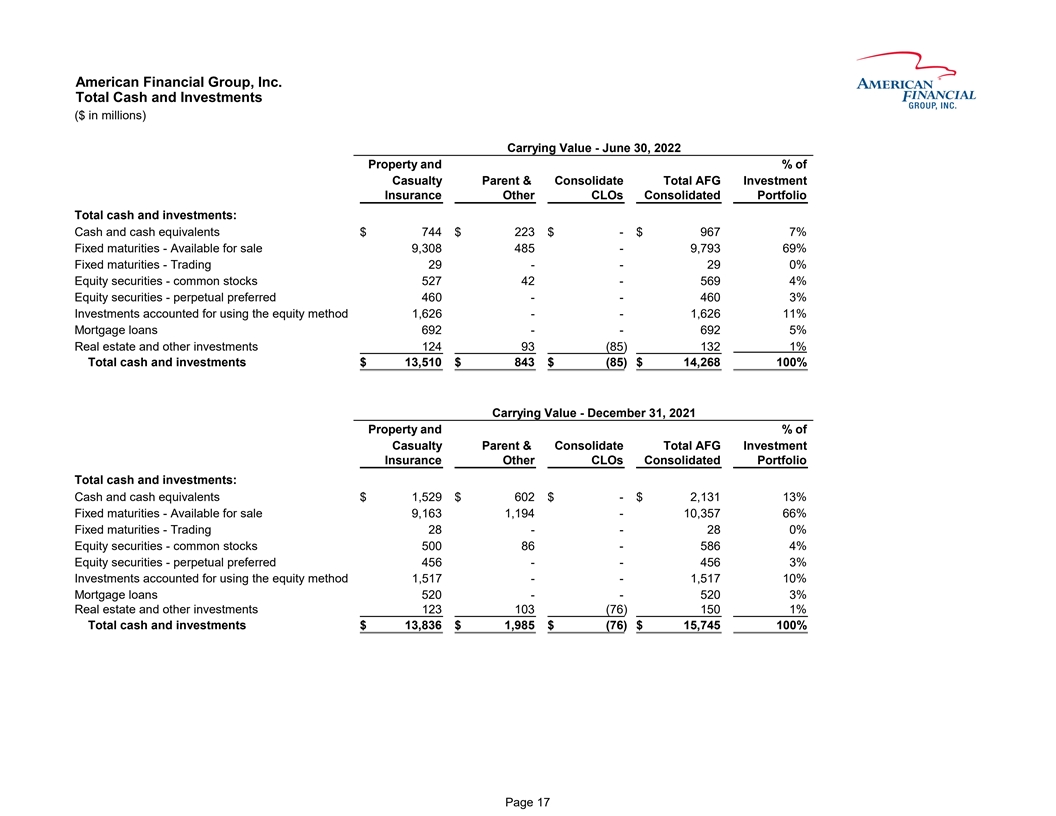

美國金融集團,Inc.總現金和投資($in 百萬)賬面價值-6月30日,2022財產和意外傷害母公司和合並總額AFG投資保險其他CLO合併投資組合現金和投資總額:現金和現金等價物$744$2 23$-$967 7%固定 到期日-可供出售9,308 4 85-9,793 69%固定到期日-交易29--29 0%股權證券-普通股527 42-5694%股權證券-永久優先股460-460 3%使用股權方法的投資佔1,626-1,626 11%抵押貸款692-692 5%房地產和其他投資9 3(85)132 1%現金及投資總額$13,510$8 43$(85)$14,268 100%賬面價值-12月31日2021年財產和意外傷害母公司和 合併AFG投資保險其他CLO合併投資組合總現金和投資:現金和現金等價物$1,529$6 02$-$2,131 13%固定到期日-可供出售9,163 1固定到期日--194-10,357 66%交易28--28 0%股權證券-普通股500 8 6-586 4%股權證券-永久優先股456--4563%使用權益法計算的投資1,517--1,517 10%抵押貸款520--5203%房地產和其他投資123 1 03(76)150 1%現金和投資總額$13,836$1,985$(76)$15,745 100%第17頁

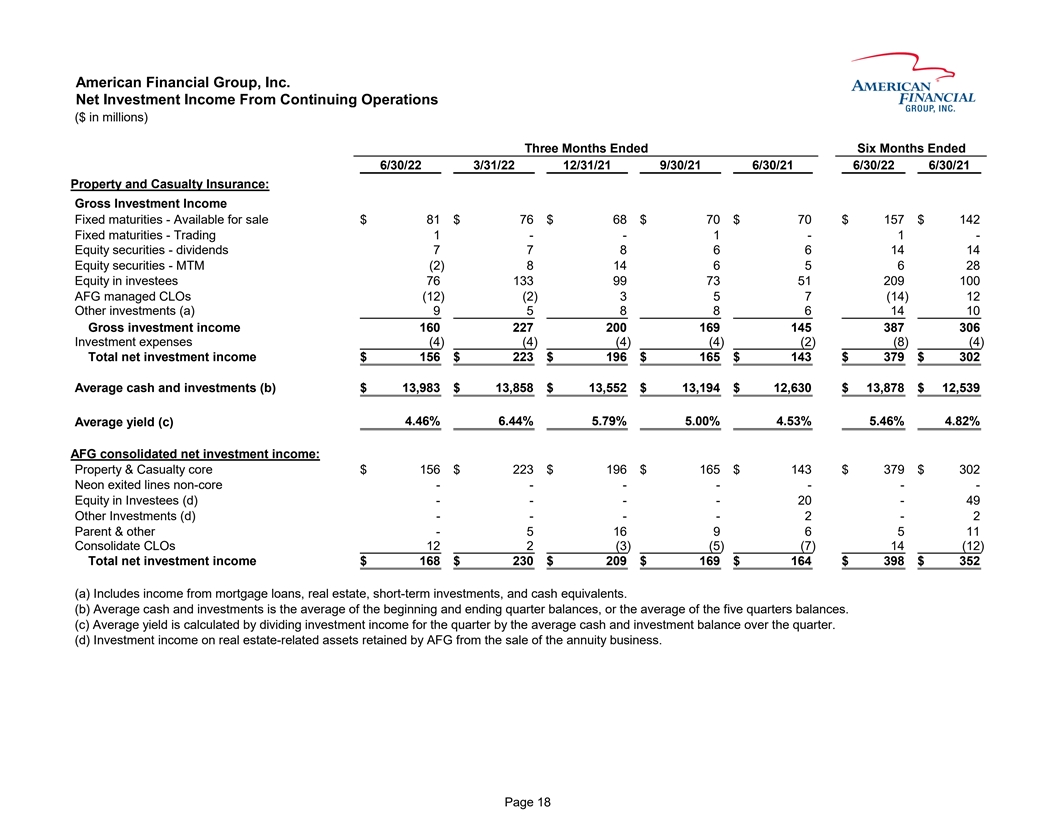

美國金融集團,公司持續經營的淨投資收入(以百萬美元為單位)截至6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 6/30/22 6/30/21財險公司:總投資收益固定到期日-可供出售$8 1$7 6$6 8$7 0$70$1 57$1 42固定到期日-交易1-1-1-1-股票證券-股息7 7 8 6 6 1 4證券-MTM(2)8 1 4 6 5 6 2 8被投資人的股權7 6 1 33 9 9 7 3 51 2 09 1 00 AFG管理的CLO(12)(2)3 57 7(14)1 2其他 投資(A)9 5 8 8 6 1 1 0總投資收益1 60 2 27 2 00 1 69 145 3 87 3 06投資支出(4)(4)(4)(4)(2)(8)(4)(4)總投資收益$1 56$2 23$1 96$1 65$143$3 79$3 02平均現金和投資(B) $13,983$13,858$13,552$13,194$12,630$13,878$12,539 4.46%6.44%5.79%5.00%4.53%5.46%4.82%平均收益率(C)AFG綜合淨投資收益:財產與意外傷害核心$1 56$2 23$1 96$1 65$143$3 79$3 02 Neon 退出非核心領域--被投資方股權(D)---20-4 9其他投資(D)---2-2母公司和其他-5 1 6 9 6 5 1 1合併CLO 1 2 2(3)(5)(7)1 4(12)總投資淨收入$1 68$2 30$2 09$1 69 $164$3 98$3 52(A)包括抵押貸款收入,房地產、短期投資和現金等價物。(B)平均現金和投資是指季度初和期末餘額的平均值,或五個季度餘額的平均值 。(C)平均收益率的計算方法是將該季度的投資收入除以該季度的平均現金和投資餘額。(D)AFG通過出售年金業務保留的與房地產相關的資產的投資收入 。第18頁

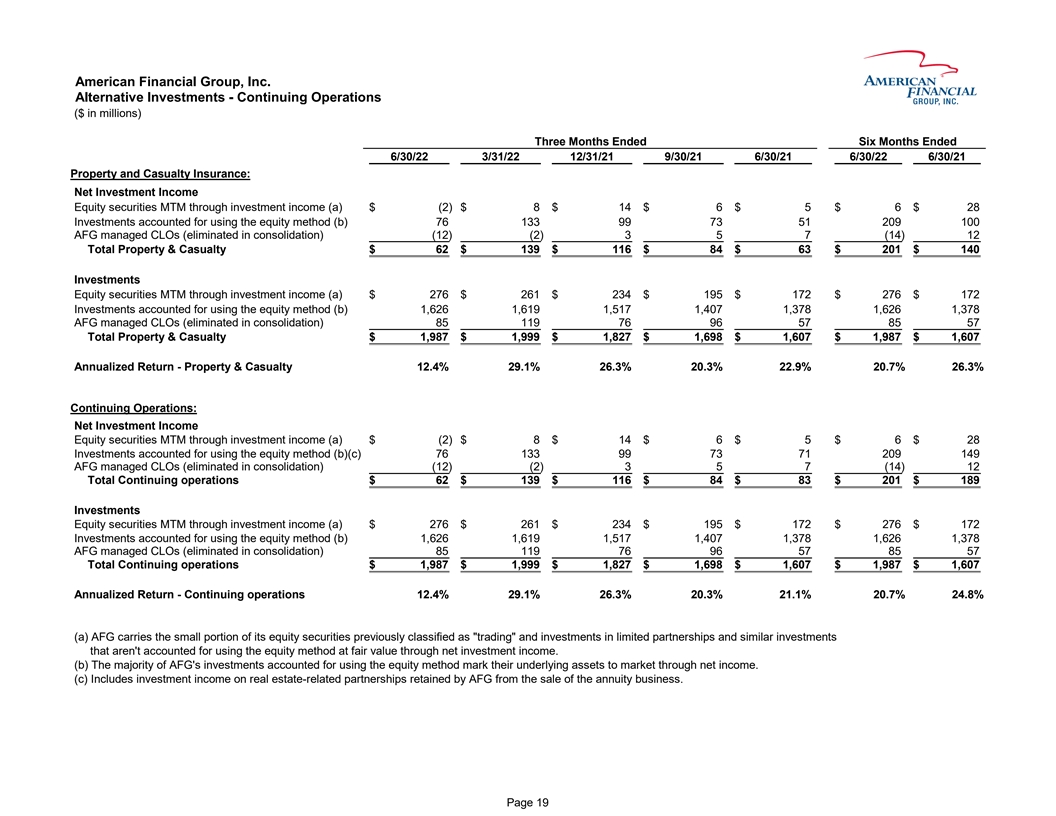

美國金融集團,另類投資-持續經營(以百萬美元為單位)截至6/30/22 3/31/22 12/31/21 9/30/21 6/30/21 6/30/22 6/30/21財險公司:通過投資收益計算的淨投資收益股權證券MTM(A)$(2)$8$1 4$6$ 5$6$28 8投資使用權益法核算(B)7 6 1 33 9 9 7 5 1 09 1 00 AFG託管CLO(在合併中被剔除)(12)(2)3 57(14)1 2財產及意外傷害保險總額$6 2$1 39$1 16$8 4$6 3$2 01$1 40 通過投資收益進行的股權證券MTM投資(A)$2 76$2 61$2 34$1 95$172$2 76$1 72投資採用權益法(B)1,626 1,6191,5171,4071,3781,626 1,378 AFG管理的CLO(在 合併中取消)8 5 1 19 7 6 6 6 5 7 8 5 5 7財產和意外傷害合計$1,987$1,999$1,827$1,698$1,607$1,987$1,607年化回報-財產和意外傷害1 2.4%2 9.1%2 6.3%2 0.3%22.9%20.7%26.3%持續經營:淨投資收入(Br)投資收益(A)$(2)$8$1 4$6$5$6$2 8投資使用權益法核算(B)(C)7 6 1 33 9 9 7 3 7 1 2 09 1 49 AFG管理的CLO(合併中剔除)(12)(2)3{Br}5 7(14)1 2持續經營業務總額$6 2$1 39$1 16$8 4$83$2 01$1 89通過投資收益計算的股權證券MTM(A)$2 76$2 61$2 34$1 95$172$2 76$1 72投資採用權益法核算 (B)1,626 1,6191,5171,4071,3781,626 1,378 AFG管理的CLO(在合併中被取消)8 5 1 19 7 6 9 6 5 7 8 5 5 7持續運營總額$1,987$1,999$1,827$1,698$1,607$1,987$1, 607年化回報-持續經營1 2.4%2 9.1%2 6.3%2 0.3%21.1%20.7%24.8%(A)AFG持有之前歸類為有限合夥企業的交易和投資以及類似投資的一小部分股權證券,這些證券未按公允價值通過淨投資收入計入 權益法。(B)AFG的大部分投資採用權益法,其標的資產通過淨收入按市價計價。(C)包括AFG從出售年金業務中保留的與房地產有關的合夥企業的投資收入。第19頁

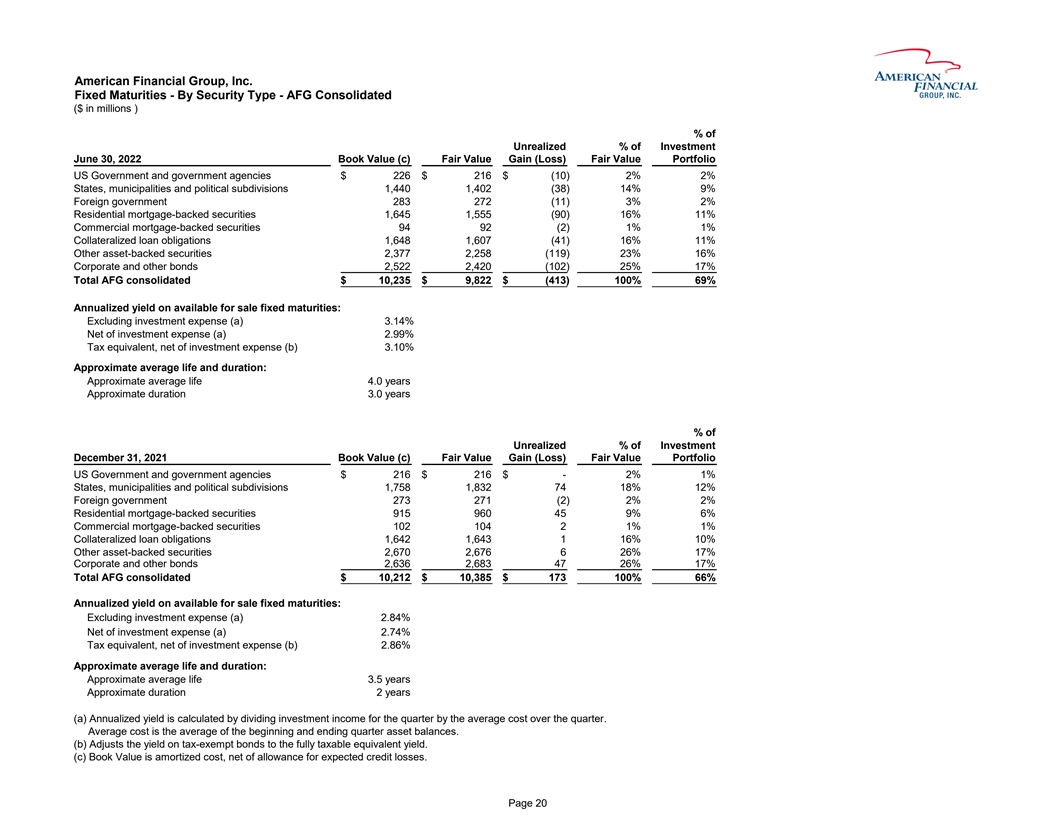

固定到期日-按證券類型劃分-AFG合併(以百萬美元為單位)%投資未實現%2022年6月30日賬面價值(C)公允價值收益(虧損)公允價值投資組合美國政府和政府機構$226$216$(10)2%2%各州、市政當局和政治部門1,440 1,402(38)14%9%外國政府283 272(11)3%2%住宅抵押貸款支持證券1,6451,555(90)1 6%1 1%商業抵押貸款支持證券94 92(2)1%1%抵押貸款債券1,648 1,607 (41)1 6%1 1%其他資產支持證券2,377 2,258(119)2 3%1 6%公司和其他債券2,522 2,420(102)25%17%AFG合併總額10,235美元9,822美元(413)100%69%可供出售固定到期日的年化收益率: 不包括投資費用(A)3.14%扣除投資費用(A)2.99%税額,扣除投資費用(B)3.10%近似平均壽命和持續期:大約平均壽命4.0年大約持續時間3.0年投資未實現% 賬面價值(C)公允價值收益(損失)公允價值投資組合美國政府和政府機構$216$216$-2%1%州、市和政治分區1,7581,832 74 1 8%1 2%外國政府 273 271(2)2%2%住宅抵押貸款支持證券915 960 459%6%商業抵押貸款支持證券102 104 21%1%抵押貸款支持證券1,642 1,643 1 16%1 0%其他資產支持證券2,670 2,676 6 26%1.7% 公司債券和其他債券2,636 2,683 47 26%17%AFG合併總額10,212美元10,385$173 100%66%可供出售的年化收益率固定到期日:不包括投資費用(A)2.84%扣除投資費用(A)2.74%税 等值, 扣除投資費用後的淨額(B)2.86%近似平均壽命和持續期:近似平均壽命3.5年近似持續期2年(A)年化收益率的計算方法是該季度的投資收入除以該季度的平均成本。平均成本是指本季度的期初和期末資產餘額的平均值。(B)將免税債券的收益率調整為完全應税的等值收益率。(C)賬面價值是攤銷成本扣除預期信貸損失準備後的淨額。第20頁

Appendix A American Financial Group, Inc. Fixed Maturities by Credit Rating & NAIC Designation by Type 6/30/2022 ($ in millions) Fair Value by Type By Credit Rating (a) US Gov Munis Frgn Gov RMBS CMBS CLOs ABS Corp/Oth Total % Total Investment grade AAA $ 216 $ 543 $ 238 $ 1,258 $ 63 $ 1,413 $ 919 $ 39 $ 4,689 48% AA - 795 10 6 17 134 373 156 1,491 15% A - 52 5 64 6 49 443 550 1,169 12% BBB - 8 9 2 3 8 396 1,150 1,576 16% Subtotal - Investment grade 216 1,398 262 1,330 89 1,604 2,131 1,895 8,925 91% BB - - - 9 3 - 7 169 188 2% B - - - 8 - - 4 31 43 1% CCC, CC, C - - - 117 - - 2 3 122 1% D - - - 15 - - - - 15 0% Subtotal - Non-Investment grade - - - 149 3 - 13 203 368 4% Not Rated (b) - 4 10 76 - 3 114 322 529 5% Total $ 216 $ 1,402 $ 272 $ 1,555 $ 92 $ 1,607 $ 2,258 $ 2,420 $ 9,822 100% Fair Value by type NAIC designation US Gov Munis Frgn gov RMBS CMBS CLOs ABS Corp/Oth Total % Total 1 $ 216 $ 1,394 $ 230 $ 1,473 $ 89 $ 1,353 $ 1,730 $ 931 $ 7,416 81% 2 - 8 - 1 - - 396 1,180 1,585 17% Subtotal 216 1,402 230 1,474 89 1,353 2,126 2,111 9,001 98% 3 - - - 1 3 - 7 183 194 2% 4 - - - 2 - - 5 17 24 0% 5 - - - 4 - - 7 23 34 0% 6 - - - 1 - - - - 1 0% Subtotal - - - 8 3 - 19 223 253 2% Total insurance companies $ 216 $ 1,402 $ 230 $ 1,482 $ 92 $ 1,353 $ 2,145 $ 2,334 $ 9,254 100% Total non-insurance (c) - - 42 73 - 254 113 86 568 Total $ 216 $ 1,402 $ 272 $ 1,555 $ 92 $ 1,607 $ 2,258 $ 2,420 $ 9,822 (a) If two agencies rate a security, the rating displayed above is the lower of the two; if three or more agencies rate a security, the rating displayed is the second lowest. (b) For ABS, 95% are NAIC 1 and 0% are held by non-insurance companies. For Corp/Oth, 58% are NAIC 1, 9% NAIC 2 and 26% are held by non-insurance companies. For Total, 70% are NAIC 1, 5% NAIC 2 and 17% are held by non-insurance companies. (c) 76% are investment grade rated. Page 21

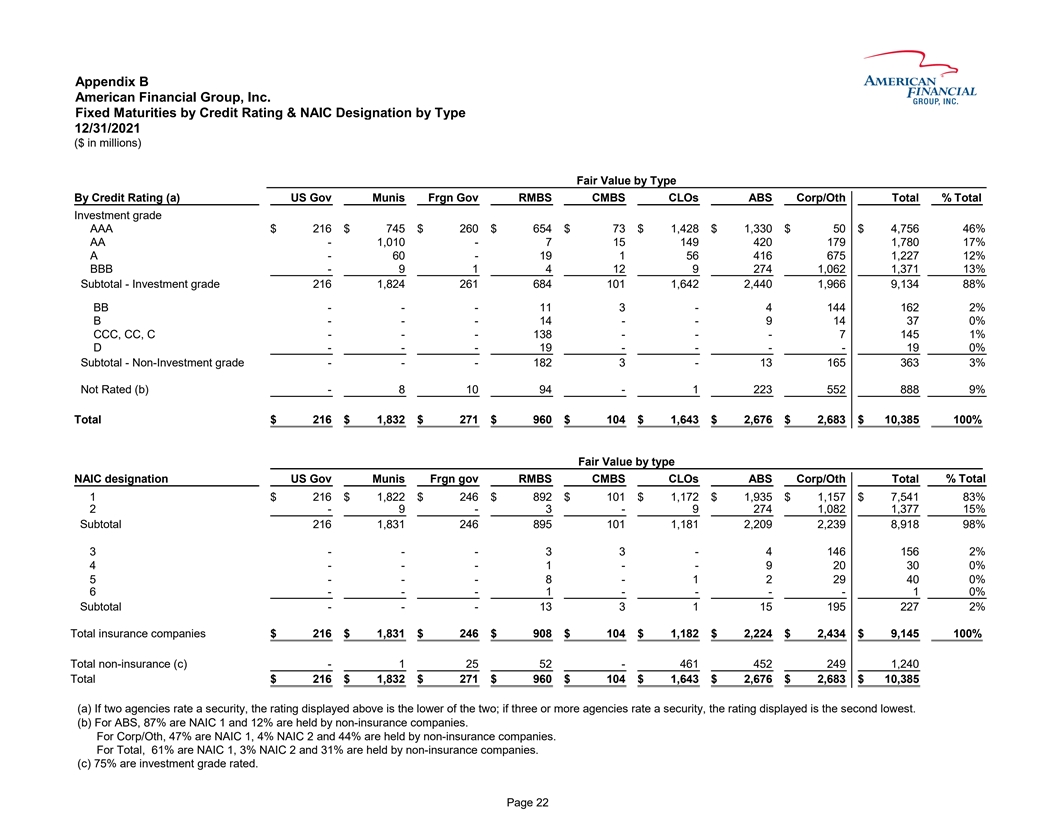

Appendix B American Financial Group, Inc. Fixed Maturities by Credit Rating & NAIC Designation by Type 12/31/2021 ($ in millions) Fair Value by Type By Credit Rating (a) US Gov Munis Frgn Gov RMBS CMBS CLOs ABS Corp/Oth Total % Total Investment grade AAA $ 216 $ 745 $ 260 $ 654 $ 73 $ 1,428 $ 1,330 $ 50 $ 4,756 46% AA - 1,010 - 7 15 149 420 179 1,780 17% A - 60 - 19 1 56 416 675 1,227 12% BBB - 9 1 4 12 9 274 1,062 1,371 13% Subtotal - Investment grade 216 1,824 261 684 101 1,642 2,440 1,966 9,134 88% BB - - - 11 3 - 4 144 162 2% B - - - 14 - - 9 14 37 0% CCC, CC, C - - - 138 - - - 7 145 1% D - - - 19 - - - - 19 0% Subtotal - Non-Investment grade - - - 182 3 - 13 165 363 3% Not Rated (b) - 8 10 94 - 1 223 5 52 888 9% Total $ 216 $ 1,832 $ 271 $ 960 $ 104 $ 1,643 $ 2,676 $ 2,683 $ 10,385 100% Fair Value by type NAIC designation US Gov Munis Frgn gov RMBS CMBS CLOs ABS Corp/Oth Total % Total 1 $ 216 $ 1,822 $ 246 $ 892 $ 101 $ 1,172 $ 1,935 $ 1,157 $ 7,541 83% 2 - 9 - 3 - 9 274 1,082 1,377 15% Subtotal 216 1,831 246 895 101 1,181 2,209 2,239 8,918 98% 3 - - - 3 3 - 4 146 156 2% 4 - - - 1 - - 9 20 30 0% 5 - - - 8 - 1 2 29 40 0% 6 - - - 1 - - - - 1 0% Subtotal - - - 13 3 1 15 195 227 2% Total insurance companies $ 216 $ 1,831 $ 246 $ 908 $ 104 $ 1,182 $ 2,224 $ 2,434 $ 9,145 100% Total non-insurance (c) - 1 25 52 - 461 452 249 1,240 Total $ 216 $ 1,832 $ 271 $ 960 $ 104 $ 1,643 $ 2,676 $ 2,683 $ 10,385 (a) If two agencies rate a security, the rating displayed above is the lower of the two; if three or more agencies rate a security, the rating displayed is the second lowest. (b) For ABS, 87% are NAIC 1 and 12% are held by non-insurance companies. For Corp/Oth, 47% are NAIC 1, 4% NAIC 2 and 44% are held by non-insurance companies. For Total, 61% are NAIC 1, 3% NAIC 2 and 31% are held by non-insurance companies. (c) 75% are investment grade rated. Page 22

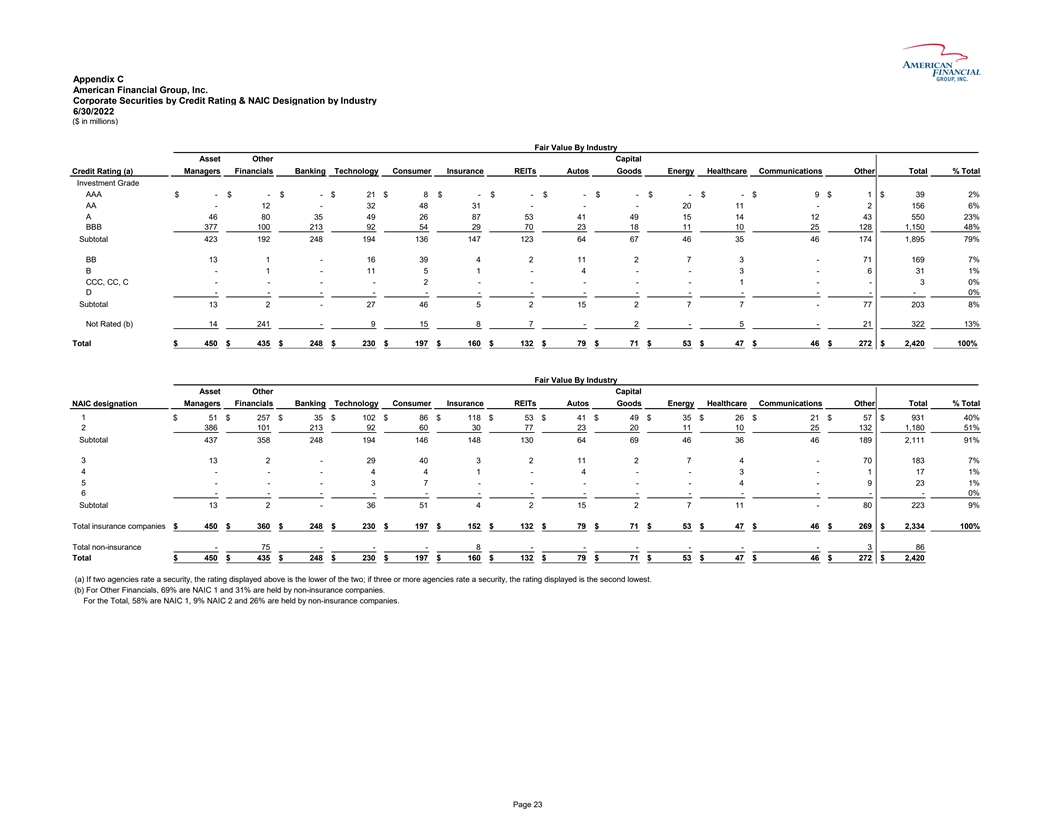

Appendix C American Financial Group, Inc. Corporate Securities by Credit Rating & NAIC Designation by Industry 6/30/2022 ($ in millions) Fair Value By Industry Asset Other Capital Managers Financials Banking Technology Consumer Insurance REITs Autos Goods Energy Healthcare Communications Other Total % Total Credit Rating (a) Investment Grade AAA $ - $ - $ - $ 2 1 $ 8 $ - $ - $ - $ - $ - $ - $ 9 $ 1 $ 3 9 2% AA - 1 2 - 3 2 4 8 3 1 - - - 2 0 1 1 - 2 1 56 6% A 4 6 8 0 3 5 4 9 2 6 8 7 5 3 4 1 4 9 1 5 1 4 1 2 4 3 5 50 23% BBB 3 77 1 00 2 13 9 2 5 4 2 9 7 0 2 3 1 8 1 1 1 0 2 5 1 28 1,150 48% Subtotal 4 23 1 92 2 48 1 94 1 36 1 47 1 23 6 4 6 7 4 6 3 5 4 6 1 74 1 ,895 79% BB 1 3 1 - 1 6 3 9 4 2 1 1 2 7 3 - 7 1 1 69 7% B - 1 - 1 1 5 1 - 4 - - 3 - 6 3 1 1% CCC, CC, C - - - - 2 - - - - - 1 - - 3 0% D - - - - - - - - - - - - - - 0% Subtotal 1 3 2 - 2 7 4 6 5 2 1 5 2 7 7 - 7 7 2 03 8% Not Rated (b) 1 4 2 41 - 9 1 5 8 7 - 2 - 5 - 2 1 3 22 13% Total $ 4 50 $ 4 35 $ 2 48 $ 2 30 $ 1 97 $ 1 60 $ 1 32 $ 7 9 $ 7 1 $ 5 3 $ 4 7 $ 4 6 $ 2 72 $ 2,420 100% Fair Value By Industry Asset Other Capital NAIC designation Managers Financials Banking Technology Consumer Insurance REITs Autos Goods Energy Healthcare Communications Other Total % Total 1 $ 5 1 $ 257 $ 3 5 $ 102 $ 8 6 $ 118 $ 5 3 $ 4 1 $ 4 9 $ 3 5 $ 2 6 $ 2 1 $ 5 7 $ 931 40% 2 386 1 01 2 13 9 2 6 0 3 0 7 7 2 3 2 0 1 1 1 0 2 5 1 32 1,180 51% Subtotal 4 37 3 58 2 48 1 94 1 46 1 48 1 30 64 6 9 4 6 3 6 4 6 1 89 2 ,111 91% 3 1 3 2 - 2 9 4 0 3 2 1 1 2 7 4 - 7 0 1 83 7% 4 - - - 4 4 1 - 4 - - 3 - 1 1 7 1% 5 - - - 3 7 - - - - - 4 - 9 2 3 1% 6 - - - - - - - - - - - - - - 0% Subtotal 1 3 2 - 3 6 5 1 4 2 1 5 2 7 1 1 - 8 0 2 23 9% Total insurance companies $ 4 50 $ 3 60 $ 2 48 $ 2 30 $ 1 97 $ 1 52 $ 1 32 $ 7 9 $ 7 1 $ 5 3 $ 4 7 $ 4 6 $ 2 69 $ 2,334 100% Total non-insurance - 7 5 - - - 8 - - - - - - 3 8 6 Total $ 4 50 $ 4 35 $ 2 48 $ 2 30 $ 1 97 $ 1 60 $ 1 32 $ 7 9 $ 7 1 $ 5 3 $ 4 7 $ 4 6 $ 2 72 $ 2,420 (a) If two agencies rate a security, the rating displayed above is the lower of the two; if three or more agencies rate a security, the rating displayed is the second lowest. (b) For Other Financials, 69% are NAIC 1 and 31% are held by non-insurance companies. For the Total, 58% are NAIC 1, 9% NAIC 2 and 26% are held by non-insurance companies. Page 23

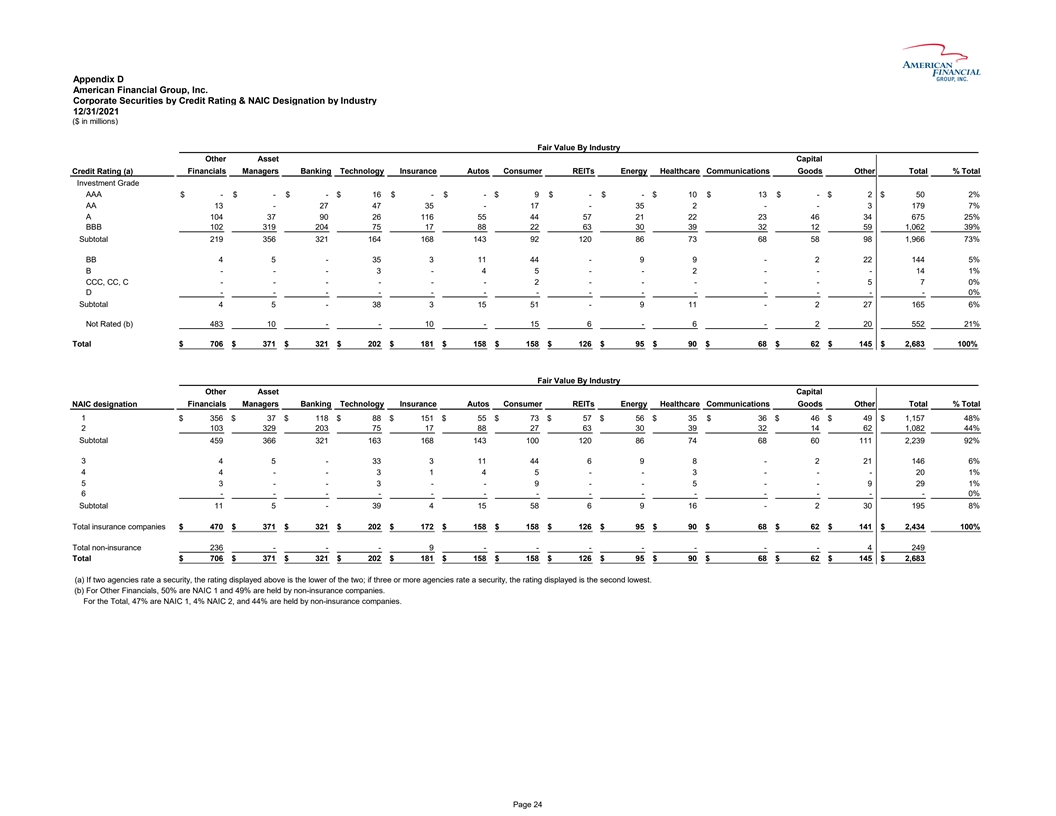

Appendix D American Financial Group, Inc. Corporate Securities by Credit Rating & NAIC Designation by Industry 12/31/2021 ($ in millions) Fair Value By Industry Other Asset Capital Financials Managers Banking Technology Insurance Autos Consumer REITs Energy Healthcare Communications Goods Other Total % Total Credit Rating (a) Investment Grade AAA $ - $ - $ - $ 1 6 $ - $ - $ 9 $ - $ - $ 1 0 $ 13 $ - $ 2 $ 5 0 2% AA 1 3 - 2 7 4 7 3 5 - 1 7 - 3 5 2 - - 3 1 79 7% A 1 04 3 7 9 0 2 6 1 16 5 5 4 4 5 7 2 1 2 2 23 4 6 3 4 6 75 25% BBB 1 02 3 19 2 04 7 5 1 7 8 8 2 2 6 3 3 0 3 9 32 1 2 5 9 1 ,062 39% Subtotal 2 19 3 56 3 21 1 64 1 68 1 43 9 2 1 20 8 6 7 3 68 5 8 9 8 1 ,966 73% BB 4 5 - 3 5 3 1 1 4 4 - 9 9 - 2 2 2 1 44 5% B - - - 3 - 4 5 - - 2 - - - 1 4 1% CCC, CC, C - - - - - - 2 - - - - - 5 7 0% D - - - - - - - - - - - - - - 0% Subtotal 4 5 - 3 8 3 1 5 5 1 - 9 1 1 - 2 2 7 1 65 6% Not Rated (b) 4 83 1 0 - - 1 0 - 1 5 6 - 6 - 2 2 0 5 52 21% Total $ 7 06 $ 3 71 $ 3 21 $ 2 02 $ 1 81 $ 1 58 $ 1 58 $ 1 26 $ 9 5 $ 9 0 $ 68 $ 6 2 $ 1 45 $ 2,683 100% Fair Value By Industry Other Asset Capital NAIC designation Financials Managers Banking Technology Insurance Autos Consumer REITs Energy Healthcare Communications Goods Other Total % Total 1 $ 356 $ 3 7 $ 118 $ 8 8 $ 151 $ 5 5 $ 7 3 $ 5 7 $ 5 6 $ 3 5 $ 36 $ 4 6 $ 4 9 $ 1,157 48% 2 1 03 3 29 2 03 7 5 1 7 8 8 2 7 6 3 3 0 3 9 3 2 1 4 6 2 1,082 44% Subtotal 4 59 3 66 3 21 1 63 1 68 1 43 1 00 1 20 86 7 4 68 6 0 1 11 2 ,239 92% 3 4 5 - 3 3 3 1 1 4 4 6 9 8 - 2 2 1 1 46 6% 4 4 - - 3 1 4 5 - - 3 - - - 2 0 1% 5 3 - - 3 - - 9 - - 5 - - 9 2 9 1% 6 - - - - - - - - - - - - - - 0% Subtotal 1 1 5 - 3 9 4 1 5 5 8 6 9 1 6 - 2 3 0 1 95 8% Total insurance companies $ 4 70 $ 3 71 $ 3 21 $ 2 02 $ 1 72 $ 1 58 $ 1 58 $ 1 26 $ 9 5 $ 9 0 $ 68 $ 6 2 $ 1 41 $ 2,434 100% Total non-insurance 2 36 - - - 9 - - - - - - - 4 2 49 Total $ 7 06 $ 3 71 $ 3 21 $ 2 02 $ 1 81 $ 1 58 $ 1 58 $ 1 26 $ 9 5 $ 9 0 $ 68 $ 6 2 $ 1 45 $ 2,683 (a) If two agencies rate a security, the rating displayed above is the lower of the two; if three or more agencies rate a security, the rating displayed is the second lowest. (b) For Other Financials, 50% are NAIC 1 and 49% are held by non-insurance companies. For the Total, 47% are NAIC 1, 4% NAIC 2, and 44% are held by non-insurance companies. Page 24

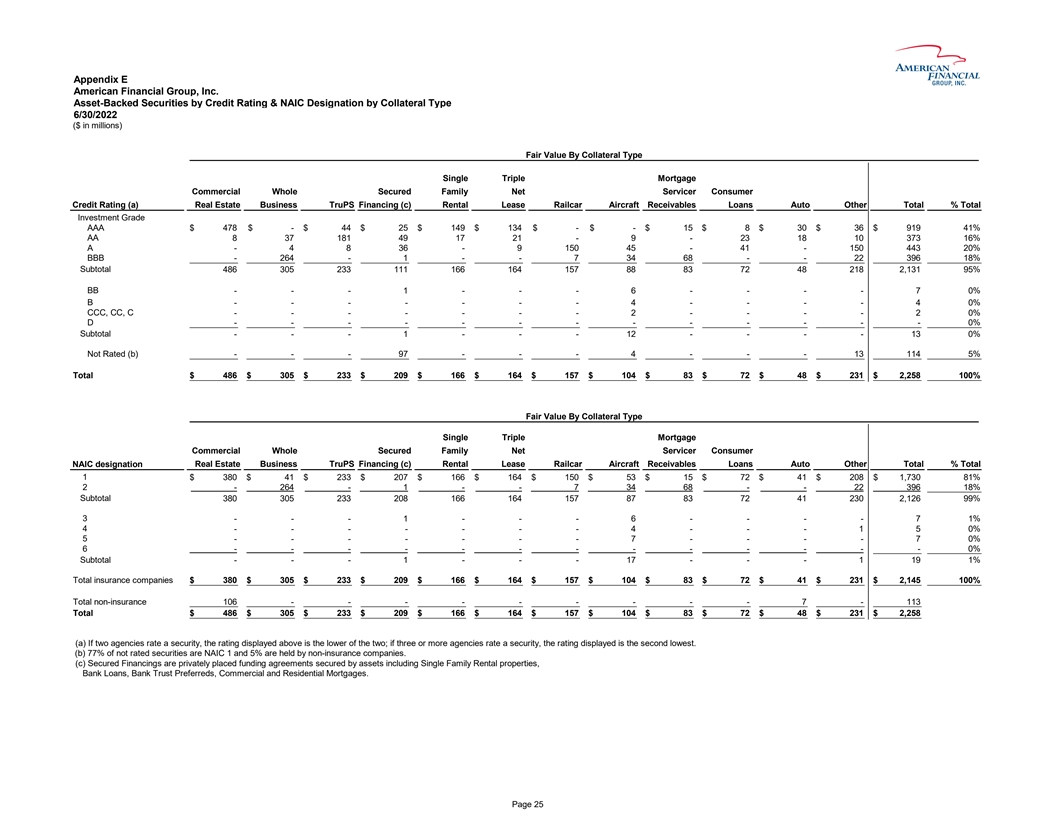

附錄E美國金融集團,按抵押品劃分的資產支持證券6/30/2022(以百萬美元為單位)按抵押品劃分的公允價值按抵押品類型劃分的公允價值單一三重抵押商業整體擔保家庭淨值服務商消費者信用評級(A)房地產業務TruPS融資(C) 租賃鐵路飛機應收賬款汽車貸款總額%投資級AAA$478$-$44$25$149$134$-$-$15 8$30$36$919 41%AA 8 37 1 81 49 21-9-23 18 10 3 73 16%A-4 8 3 6-9 1 50 4 5-4 1-1 50 4 43 20%BBB-2 64-1--7 3 4 68--2 2 396 18%小計4 86 3 05 2 33 1 11 1 66 1 64 1 57 8 8 3 7 2 4 8 2 182,131 95%BB---1---6---7%B---4---4%CCC,CC,C---2---2 0%D---0%小計---1---1 2---1 30%未評級(B)---9 7---4---1 3 114.5%總計$4 86$3 05$233$2 09$166$1 64$1 57$1 04$8 3$7 2$4 8$2 31$2258 100%按抵押品類型劃分的公允價值單一三重 按揭商業全擔保家庭淨值服務商消費者房地產業務TruPS融資(C)租賃鐵路飛機應收賬款汽車其他合計%NAIC指定1$380$41$233$207$166$164$150$53$15$ 72$41$208$1,730 81%2-2 64-1--7 34 6 8-2 2 3 96 18%小計3 80 3 05 2 33 2 08 1 66 1 64 1 57 87 83 72 41 2 30 2,126 99%3---1---7 1%4---7%6---0%小計---1---1 7---保險公司總數$380$3 05$2 33$209$1 66$1 64$157$1 04$8 3$7 2$4 1$231$2145 100%非保險合計1 06---7-1 13合計$4 86$3 05$ 233$209$1 66$1 64$1 57$104$8 3$7 2$4 8$2 31$2, 258(A)如果兩個機構對證券進行評級,則上面顯示的評級是兩個機構中較低的一個;如果三個或更多機構對證券進行評級,則顯示的評級是第二低的。(B)未評級證券中77%為NAIC 1,5%由非保險公司持有。(C)擔保融資是指以獨户租賃物業、銀行貸款、銀行信託優先股、商業及住宅按揭等資產作擔保的私人配售融資協議。第25頁

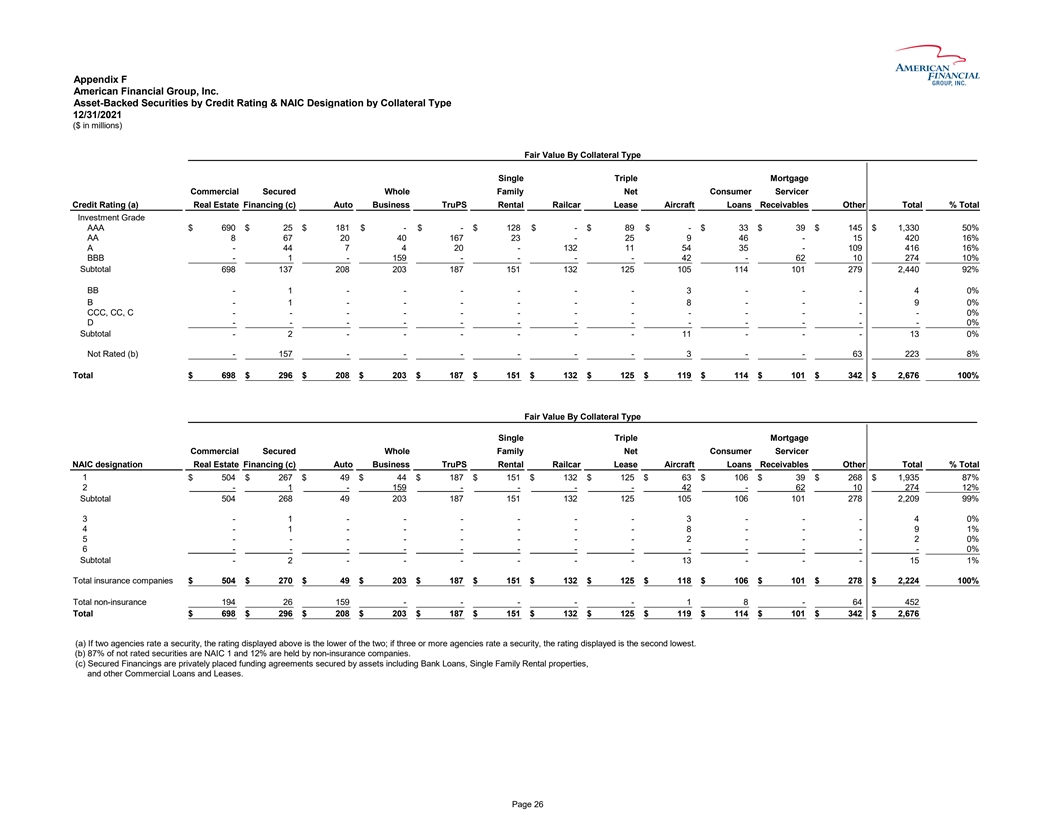

附錄F美國金融集團資產支持證券按抵押品劃分的信用評級和NAIC指定類型12/31/2021(以百萬美元為單位)按抵押品劃分的公允價值按抵押品類型單一三重抵押商業擔保全家庭淨消費服務商信用評級(A)房地產融資(C)汽車業務 TruPS租賃鐵路汽車租賃飛機貸款應收賬款其他總額%總投資級AAA$690$25$181$-$128$-$89$-$33$39$145$1,330 50%AA 8 67 20 40 1 67 23-25 9 46-15 4 20 16%A-4 4 7 4 2 0-1 32 1 1 5 4 35---4 2-6 2 1 0 2 74 10%小計6 98 1 37 2 08 2 03 1 87 1 51 1 32 1 25 1 05 1 14 1 01 2 79 2,440 92%BB-1---3---4 0%B-1---8---9 0%CCC,CC,2 08$2 03$187$1 51$1 32$125$119$114$1 01$3 42$2676 100%按抵押品類型劃分的公允價值單一 三按揭商業擔保全家庭淨值消費服務商NAIC指定房地產融資(C)汽車業務信託基金租賃鐵路租賃飛機貸款應收賬款總額1$504$267$49$44$187$151$132$125 $63$106$39$268$1,935 87%2-1-1-1 59---42-6 2 1 0 274 12%小計5 04 2 68 49 2 03 1 87 1 51 1 32 1 06 1 01 2 78 2209 99%3-1---3---4 0%4-1---8---9 1%5---2---2 0%6- ---1 51%保險公司總數$504$270$49$203$1 87$1 51$132$125$1 18$1 06$01$278$2, 224 100%非保險合計1 94 2 6 1 59---1 8-6 4 4 52合計 $698$296$2 08$2 03$187$1 51$132$125$119$114$1 01$342$2,676(A)如果兩家機構對一種證券進行評級,則上面顯示的評級是兩種機構中較低的一種;如果三家或更多機構對一種證券進行評級,則顯示的評級是次低的 。(B)87%的未評級證券為NAIC 1,12%由非保險公司持有。(C)擔保融資是指以資產擔保的私募融資協議,包括銀行貸款、獨户租賃物業和其他商業貸款和租賃。第26頁

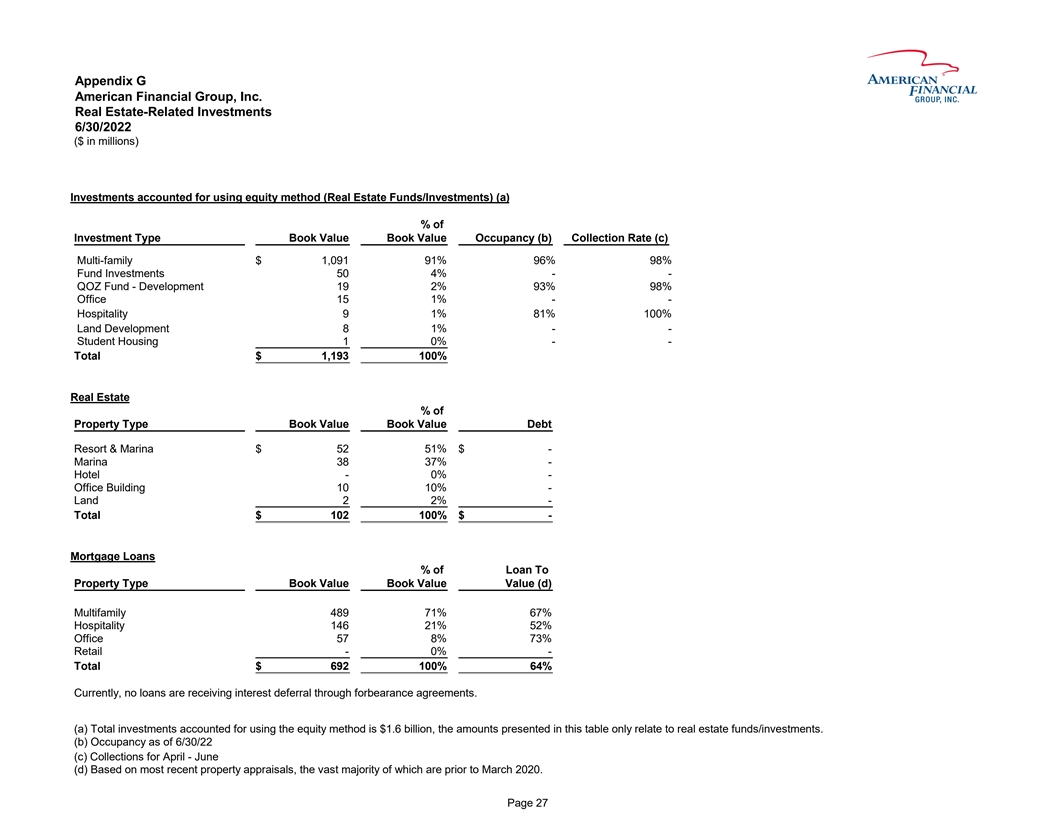

附錄G美國金融集團,公司房地產相關投資6/30/2022(以百萬美元為單位)使用權益法進行投資(房地產基金/投資)(A)投資類型賬面價值佔用的百分比(B)收款率(C)多户$1,091%96%98%基金投資50 4%--QOZ基金開發19 2%93%98%寫字樓15 1%--酒店業9 1%81%100%土地開發8 1%--學生住房--總計$1,193 100%房地產類型賬面價值債務度假村和碼頭$52 51%$- Marina 38 37%-酒店-0%-寫字樓10 10%-土地2 2%-總計$102 100%$-抵押貸款佔貸款與物業類型賬面價值的百分比(D)多户489 71%67%酒店業146 21%52%辦公室57 8%73%零售-0%-總計$ 692 100%64%目前,沒有一筆貸款通過忍耐協議獲得利息延期。(A)使用權益法核算的投資總額為16億美元,本表所列金額僅涉及房地產 基金/投資。(B)截至22年6月30日的入住率(C)4月至6月的收藏量(D)根據最新的財產評估,其中絕大多數是在2020年3月之前進行的。第27頁

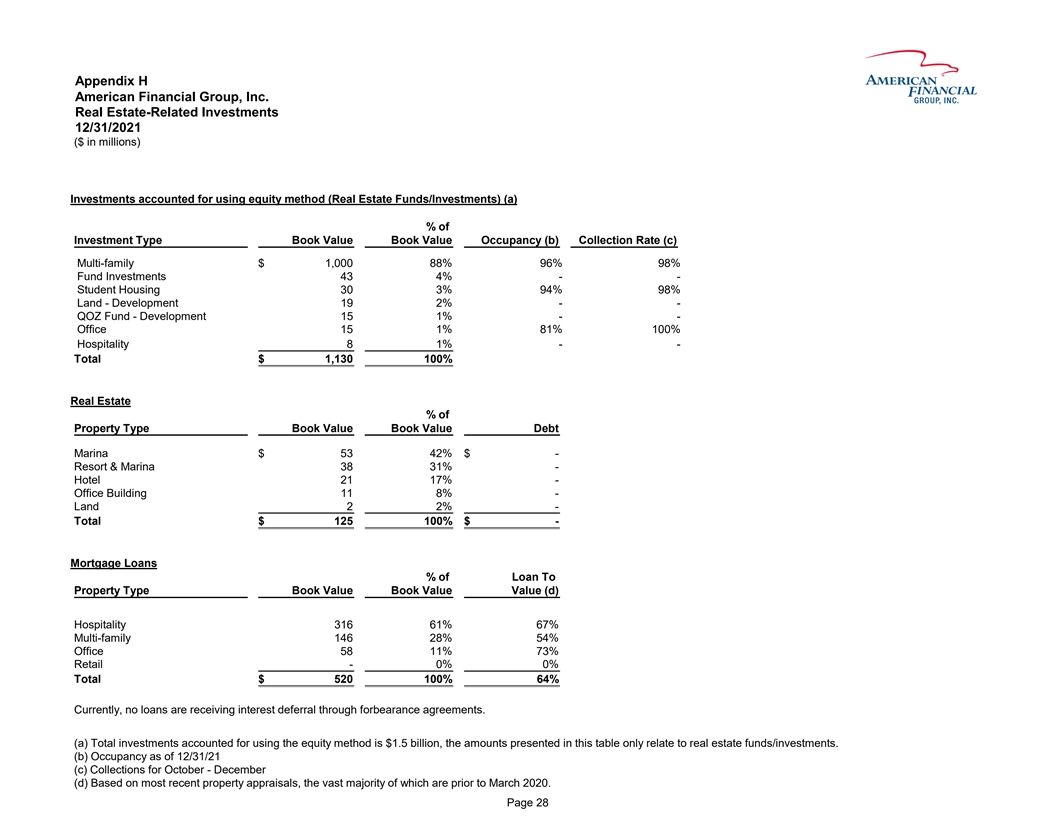

Appendix H American Financial Group, Inc. Real Estate-Related Investments 12/31/2021 ($ in millions) Investments accounted for using equity method (Real Estate Funds/Investments) (a) % of Investment Type Book Value Book Value Occupancy (b) Collection Rate (c) Multi-family $ 1 ,000 88% 96% 98% Fund Investments 43 4% - - Student Housing 30 3% 94% 98% Land - Development 19 2% - - QOZ Fund - Development 15 1% - - Office 15 1% 81% 100% Hospitality 8 1% - - Total $ 1 ,130 100% Real Estate % of Property Type Book Value Book Value Debt Marina $ 5 3 42% $ - Resort & Marina 38 31% - Hotel 21 17% - Office Building 11 8% - Land 2 2% - Total $ 1 25 100% $ - Mortgage Loans % of Loan To Property Type Book Value Book Value Value (d) Hospitality 316 61% 67% Multi-family 146 28% 54% Office 58 11% 73% Retail - 0% 0% Total $ 5 20 100% 64% Currently, no loans are receiving interest deferral through forbearance agreements. (a) Total investments accounted for using the equity method is $1.5 billion, the amounts presented in this table only relate to real estate funds/investments. (b) Occupancy as of 12/31/21 (c) Collections for October - December (d) Based on most recent property appraisals, the vast majority of which are prior to March 2020. Page 28