美國

證券交易委員會

華盛頓特區20549

形式

或

截至本財政年度止

或

或

需要該空殼公司報告的事件日期_

委員會檔案編號

CRESUD SOCIEDAD阿諾尼馬商業協會 印度金融和農業 |

(註冊人章程中規定的確切名稱) |

(註冊人姓名的英文翻譯) |

共和國

(註冊成立或組織的司法管轄權)

(主要行政辦公室地址)

首席財務和行政官

Tel +(

(公司聯繫人姓名、電話、電子郵件和/或傳真號碼及地址)

根據該法第12(B)條登記或將登記的證券:

每個班級的標題 |

| 交易符號 |

| 各交易所名稱 在哪裏註冊 |

美國存托股票(ADS),每股代表十股普通股 |

|

| 納斯達克證券市場的納斯達克全國市場 | |

|

|

|

* | 不用於交易,而僅限於根據美國證券交易委員會的要求註冊美國存托股票。 |

根據該法第12(G)條登記或將登記的證券:無

根據該法第15(D)條負有報告義務的證券:無

註明截至年報所述期間結束時發行人所屬各類資本或普通股的流通股數量:

如果註冊人是《證券法》第405條中定義的知名經驗豐富的發行人,則通過勾選標記進行驗證:是 ☒

如果本報告是年度報告或過渡報告,請勾選標記表明註冊人是否無需根據1934年證券交易法第13或15(d)條提交報告。☒

注:勾選上述方框不會免除任何根據《1934年證券交易法》第13或15(a)條要求提交報告的註冊人在這些條款下的義務,無論註冊人(1)是否已在過去12個月內提交了《1934年證券交易法》第13或15(d)條要求提交的所有報告,勾選上述方框(或登記人被要求提交此類報告的較短期限內),並且(2)在過去90天內一直遵守此類提交要求。☒

通過勾選來驗證註冊人是否已在過去12個月內(或在要求註冊人提交此類文件的較短期限內)以電子方式提交了根據S-t法規第405條(本章第232.405條)要求提交和發佈的所有互動數據文件。☒

通過勾選標記來確定註冊人是大型加速備案人、加速備案人、非加速備案人還是新興成長型公司。請參閱《交易法》第120億.2條規則中「大型加速備案人」、「加速備案人」和「新興成長公司」的定義。:

大型加速文件管理器: | ☐ | ☒ | 非加速文件服務器 | ☐ | 新興成長型公司 |

如果一家新興成長型公司根據美國公認會計原則編制財務報表,請通過勾選標記表明註冊人是否選擇不利用延長的過渡期來遵守根據《交易法》第13(a)條提供的任何新的或修訂的財務會計準則。☐

†「新的或修訂的財務會計準則」一詞是指財務會計準則委員會在2012年4月5日之後對其會計準則法典發佈的任何更新。

通過勾選標記檢查註冊人是否已提交報告並證明其管理層根據《薩班斯-奧克斯利法案》第404(b)條對其財務報告內部控制有效性的評估(15 U.S.C. 7262(b))由編制或發佈審計報告的註冊會計師事務所執行。

如果證券是根據該法第12(B)條登記的,應用複選標記表示登記人的財務報表是否反映了對以前發佈的財務報表的錯誤更正。☐

通過勾選標記來驗證這些錯誤更正是否是需要根據§240.10D-1(b)對註冊人的任何高管在相關期間收到的激勵性補償進行恢復分析的重述。☐

用複選標記表示註冊人在編制本文件所包括的財務報表時使用了哪種會計基礎:

美國公認會計原則 | ☐ | ☒ | 其他 | ☐ |

如果在回答前一個問題時勾選了「其他」,請用勾號表示登記人選擇遵循哪個財務報表項目。

項目17項目18

如果這是一份年度報告,請用複選標記表示註冊人是否爲空殼公司(如《交易法》第12b-2條所定義)。

(只適用於過去五年涉及破產程序的發行人)

在根據法院確認的計劃發行證券後,通過勾選標記檢查登記人是否已提交了1934年證券交易法第12、13或15(d)條要求提交的所有文件和報告。是的 沒有預設

請發送來自

美國證券交易委員會將:

卡羅琳娜·張 | Juan M.納韋拉 |

Zang Bergel & Viñes Iggados | Simpson Thacher & Bartlett LLP |

佛羅里達州537,18樓 C1005 AAk阿根廷布宜諾斯艾利斯市。 | 列剋星敦大道425號 紐約州紐約市,郵編:10017 美利堅合衆國 |

目錄

|

| 頁碼 |

|

| i |

| |

| iii |

| |

| v |

| |

| vi |

| |

| 1 |

| |

| 1 |

| |

| 1 |

| |

| 1 |

| |

| 1 |

| |

| 1 |

| |

| 1 |

| |

| 1 |

| |

| 2 |

| |

| 57 |

| |

| 57 |

| |

| 65 |

| |

| 125 |

| |

| 126 |

| |

| 130 |

| |

| 130 |

| |

| 130 |

| |

| 171 |

| |

| 182 |

| |

| 183 |

| |

| 187 |

| |

| 188 |

| |

| 188 |

| |

| 194 |

| |

| 197 |

| |

| 197 |

| |

| 198 |

| |

| 199 |

| |

| 199 |

| |

| 199 |

| |

| 200 |

| |

| 204 |

| |

| 204 |

| |

| 204 |

| |

| 213 |

| |

| 213 |

| |

| 213 |

| |

| 214 |

| |

| 214 |

| |

| 217 |

| |

| 217 |

| |

| 217 |

| |

| 217 |

| |

| 217 |

| |

| 217 |

| |

| 225 |

| |

| 225 |

| |

| 240 |

| |

| 249 |

| |

| 249 |

| |

| 250 |

| |

| 250 |

| |

| 250 |

| |

| 250 |

| |

| 250 |

| |

| 250 |

| |

| 251 |

| |

| 251 |

| |

| 252 |

| |

| 252 |

| |

| 252 |

| |

| 252 |

| |

| 252 |

| |

| 252 |

| |

| 253 |

| |

| 253 |

| |

| 253 |

| |

| 253 |

| |

| 253 |

| |

| 254 |

| |

| 255 |

| |

| 255 |

| |

| 256 |

| |

| 256 |

| |

| 259 |

| |

| 259 |

| |

| 260 |

| |

| 260 |

| |

| 262 |

| |

| 262 |

| |

| 262 |

| |

| 262 |

|

| 目錄 |

詞彙表

本年度報告中使用的某些術語術語表

除非上下文另有說明,否則以下術語的含義如下:

| · | 「ADR」:代表美國存託憑證的美國存託憑證; |

| · | 「美國存托股份」或「美國存託憑證」:指根據吾等與美國存托股份託管銀行根據日期爲1997年3月18日的存託協議(「存託協議」)發行的每股相當於本公司普通股10股的美國存托股份; |

| · | 「美國存托股份存託憑證」:紐約銀行; |

| · | 「AFIP」:聯邦公共收入管理局(聯邦行政當局); |

| · | 「Agrofy」:Agrofy S.A.U; |

| · | 「AMAUTA」:Amauta Ago S.A. |

| · | 「ANSES」:全國社會保障局(國家社會行政當局); |

| · | 「年度報告」:本年度報告; |

| · | 「ARS、披索或披索」:阿根廷披索; |

| · | 「反洗錢法」:第25,246號法律,除其他外,隨後經第26,087、26,119、26,268、26,683、26,733、26,734號法律和第27/2018號法令修訂; |

| · | 「阿根廷政府」:阿根廷聯邦政府; |

| · | 「已審計合併財務報表」:截至2024年6月30日、2024年6月30日和2022年6月30日及2022年6月30日、2024年、2023年和2022年終了年度的已審計合併財務報表及其附註; |

| · | 「BACS」:Banco de Crédito y Securitiación S.A. |

| · | 「Banco Hipotecario」:Banco Hipotecario S.A. |

| · | 「基地」:布宜諾斯艾利斯證券交易所; |

| · | 「董事會」:Cresud的董事會; |

| · | 「ByMA」:阿根廷證券交易所和市場(阿根廷博爾薩斯公司); |

| · | 「卡巴」:布宜諾斯艾利斯自治城市(布宜諾斯艾利斯市); |

| · | 「Caja de Valore」:受權依照資本市場法行事的託管機構((Caja de Valore S.A.); |

| · | 「CCI」:消費者信心指數; |

| · | 《中央銀行》:阿根廷央行(阿根廷中央銀行); |

| · | 「CML」:第26,831號資本市場法,除其他外,經27,440號法律修正; |

| · | 「國家競爭管理委員會」:國家競爭主管部門(Comisión National de Defensa de la Competencia); |

| · | 《CNV》:阿根廷國家證券委員會(Comisión National de Valore); |

| · | 「CNV規則」:由CNV發佈的規則; |

| · | 「CODM」:首席運營決策者; |

| · | 「消費者保護法」:阿根廷第24,240號法律; |

| · | 《企業刑事責任法》:《企業刑事責任法》第27,401號; |

| · | 「新冠肺炎」:冠狀病毒、起源於武漢的肺炎、中國; |

| · | 「COPREC」:消費者關係初步調解服務(Servicio de Conciliación Previa en las Relacones de Consumer o); |

| · | 《COSO報告》:特雷德韋委員會贊助組織委員會; |

| · | 「CPI」:居民消費價格指數; |

| · | 「CPF」:集體促進基金; |

| · | 「CRESUD」或「公司」:Cresud Sociedad Anónima Commercial、InMobiliaria、金融和農業; |

| · | 「CSJN」: 最高法院 (Corte Suprema de Justicia de la Nación); |

| · | 「CVCU」:Consultores Venture Capital Uruguary S.A.; |

| · | 「Dolphin b.V」:Dolphin Netherlands b. V; |

| · | 「EMAE」:經濟活動的月度估計; |

| · | 「EOH」:酒店空置率調查 (Encuesta de Ocupación Hotelera); |

| · | 「歐盟」:歐盟; |

| · | 《交易法》: 1934年美國證券交易法,經修訂; |

| · | 「高管計劃」:公司高管的激勵計劃; |

i |

| 目錄 |

| · | 《反海外腐敗法》:1977年美國《反海外腐敗法》; |

| · | 「FPC」:建築管理費和集體促進費(Fondo de Promoción Colectiva); |

| · | 「FyO」:Futuros y Opciones.Com S.A. |

| · | 「GCBA」:布宜諾斯艾利斯自治區政府(布宜諾斯艾利斯市政廳); |

| · | 「GCDI」:GCDI S.A. |

| · | 「國內生產總值」:國內生產總值; |

| · | 「GDS」:根據IRSA和GDS託管機構之間的存款協議發行的、日期爲1994年5月24日、經修訂和重述、於2000年11月15日修訂和重述的全球存托股份,每股相當於IRSA普通股的10股; |

| · | 「GDS存託憑證」:紐約銀行; |

| · | 「GLA」:可出租總面積; |

| · | 「國際會計準則第29號」:惡性通貨膨脹經濟體的財務報告; |

| · | 「IASB」:國際會計準則理事會; |

| · | 「ICSID」:國際投資結算中心; |

| · | 《IFRS會計準則》:國際財務報告準則 |

| · | 「IGJ」:布宜諾斯艾利斯市公共商業登記處(德賈斯蒂西亞監察長); |

| · | 「ILPA計劃」:長期股權激勵計劃; |

| · | 「貨幣基金組織」:國際貨幣基金組織; |

| · | 《所得稅法》:修正後的第20,628號法律; |

| · | 「INTRA」:巴西農業發展研究所(殖民地國家改革研究所); |

| · | 「INDEC」:國家統計和人口普查研究所(埃斯塔迪斯塔和森索斯國家學院); |

| · | 「投資公司法」:1940年投資公司法,經修訂; |

| · | 「IPC」:消費者價格指數 (Infndice de Precios al Consuidor); |

| · | 「IRS」:國稅局; |

| · | 「IRSA」:IRSA Inversiones y Representaciones SA; |

| · | 「IRSA CP」:IRSA Propiedades Comerciales SA; |

| · | 「公斤」或「公斤」:阿根廷標準體重單位,一公斤約等於2.2磅; |

| · | 「KPI」:關鍵績效指標; |

| · | 「LGS」:阿根廷總公司法第19,550號 (Ley社會將軍); |

| · | 「MAE」:Mercado Abierto Electrónico SA; |

| · | 「南方共同市場」:南方共同市場; |

| · | 「MULC」:外匯市場(坎比奧斯自由市場); |

| · | “m2,或「平方米」:阿根廷房地產市場面積的標準衡量標準是平方米; |

| · | 「納斯達克」:納斯達克證券市場的全國市場; |

| · | 「NIS」:以色列貨幣; |

| · | 「NYSE」:紐約證券交易所; |

| · | 《官方公報》:阿根廷官方公報(阿根廷共和國官方公報); |

| · | 「巴黎俱樂部2014年和解協議」:阿根廷與巴黎俱樂部成員國於2014年5月29日達成的和解協議; |

| · | 「PEN」:阿根廷行政部門(波德·埃斯庫蒂沃·國家隊); |

| · | 「PFIC」:被動外國投資公司; |

| · | 「真實」、「Reais」、「RS」。或「BRL」:巴西雷亞爾,法定貨幣巴西; |

| · | 「房地產登記處」:阿根廷房地產登記處(Propiedad Inmueble登記處); |

| · | 「RWS」:負責任的羊毛標準; |

| · | 「SAF協議」:國際貨幣基金組織與阿根廷於2022年1月28日簽署的協議。 |

| · | 「SEC」:美國證券交易委員會; |

| · | 「證券法」:1933年美國證券法,經修訂; |

| · | 「SEASA」:Servicio Nacional de Sanidad y Calidad Agroimentaria; |

| · | 「RTRS」:負責任大豆圓桌會議; |

ii |

| 目錄 |

| · | 「NAP」:個人資產稅; |

| · | 「噸」或「噸」:阿根廷標準重量單位,一公噸等於1,000公斤; |

| · | 「UIF」:金融信息股(金融信息聯盟); |

| · | 「美國」:美利堅合衆國; |

| · | 「美元和/或美元」:美元; |

| · | 「VAM」:Vista al Muelle SA |

| · | 「增值稅」:增值稅; |

| · | 「WEO」:世界經濟展望,國際貨幣基金組織編寫; |

| · | 「YPF」:Yacimientos Petrolíferos Fiscales SA; |

| · | 「2BSvs」:生物質生物燃料可持續發展自願計劃。 |

關於前瞻性陳述的免責聲明

本年度報告包含構成估計的陳述和前瞻性陳述,並以參考方式併入其中。「相信」、「將」、「可能」、「可能有」、「將會」、「估計」、「繼續」、「預期」、「打算」、「應該」、「計劃」、「預期」、「預測」、「潛在」、「尋求」和類似的詞語或短語,或這些術語的否定或其他類似表述,旨在識別估計和前瞻性表述。其中一些聲明包括關於我們目前的意圖、信念或期望的聲明。雖然我們認爲這些預期和假設是合理的,但前瞻性陳述會受到各種風險和不確定性的影響,其中大多數風險和不確定性很難預測,而且許多風險和不確定性超出了我們的控制範圍。前瞻性陳述並不能保證未來的業績。實際結果可能與前瞻性陳述中描述的預期大不相同。因此,投資者不應過度依賴前瞻性陳述作爲對實際結果的預測。

我們的這些前瞻性陳述基於我們對未來事件的當前信念、期望和假設。雖然我們認爲這些預期和假設是合理的,但它們本質上受到重大風險和不確定性的影響,其中大多數難以預測,其中許多超出了我們的控制範圍。可能影響我們前瞻性陳述的風險和不確定性包括以下內容:

| · | 阿根廷、巴西、拉丁美洲和其他發達和/或新興市場的總體經濟、金融、商業、政治、法律、社會或其他條件的變化; |

|

|

|

| · | 阿根廷新政府的政策,包括新政府促進經濟增長、執行有利於商業的政策和便利阿根廷公司獲得外國資本的能力; |

|

|

|

| · | 可能影響對阿根廷、巴西和拉丁美洲貸款或投資的政策或態度的資本市場變化,包括國內和國際金融市場的波動; |

|

|

|

| · | 通貨膨脹和利率; |

|

|

|

| · | 披索、巴西雷亞爾和美元對其他貨幣匯率的波動和下降,以及阿根廷現行利率的波動; |

|

|

|

| · | 融資成本增加或我們無法以有吸引力的條件獲得額外融資,這可能會限制我們爲現有業務和新活動提供資金的能力; |

|

|

|

| · | 現行和未來的規章以及法律或法院解釋方面的變化; |

|

|

|

| · | 農產品市場價格波動; |

|

|

|

| · | 政治、國內和武裝衝突; |

|

|

|

| · | 有關氣候變化的風險; |

|

|

|

| · | 包括新冠肺炎在內的傳染病的傳播和變異對我們業務的影響; |

|

|

|

| · | 不利的法律或法規糾紛或訴訟程序; |

|

|

|

| · | 阿根廷和巴西未償公共債務本金總額和阿根廷主權債務違約本金總額的波動; |

iii |

| 目錄 |

| · | 對與國際貨幣基金組織的談判以及與國際貨幣基金組織和巴黎俱樂部重組阿根廷主權債務的影響; |

|

|

|

| · | 政府對私營部門和經濟的干預; |

|

|

|

| · | 對外幣轉讓的限制和其他外匯管制; |

|

|

|

| · | 購物中心、寫字樓或其他商業地產及相關行業的競爭加劇; |

|

|

|

| · | 我們留住高級管理層關鍵成員的能力,以及我們與員工的關係; |

|

|

|

| · | 我們購物中心、寫字樓或其他商業物業的重要租戶的潛在損失; |

|

|

|

| · | 我們有能力及時把握房地產市場的機遇; |

|

|

|

| · | 限制阿根廷市場的能源供應或公用事業價格的波動; |

|

|

|

| · | 我們履行債務義務的能力; |

|

|

|

| · | 消費者購買習慣和趨勢的轉變; |

|

|

|

| · | 技術變革和我們實施新技術的潛在能力; |

|

|

|

| · | 網絡安全漏洞的威脅; |

|

|

|

| · | 區域、國家或全球企業和經濟狀況惡化; |

|

|

|

| · | 任何收購的整合,以及未能實現預期的協同效應; |

|

|

|

| · | 增加和/或創造稅收; |

|

|

|

| · | 改變與城市和商業租賃有關的現行法規; |

|

|

|

| · | 影響我國房地產項目發展的政府腐敗事件; |

|

|

|

| · | 農產品市場價格的波動可能會對我們的財務狀況和經營業績產生不利影響; |

|

|

|

| · | 蟲害和疾病可能會對我們的作物產量和牛隻產量產生不利影響; |

|

|

|

| · | 我們的業務是季節性的,我們的收入可能會隨着增長週期的不同而大幅波動; |

|

|

|

| · | 出口稅的徵收可能會對我們的銷售和運營業績產生不利影響;和 |

|

|

|

| · | 「風險因素」下討論的風險因素。 |

前瞻性陳述僅指本年度報告的日期,我們不承擔因新信息、未來事件或其他原因而更新或修改任何估計或前瞻性陳述的任何義務。影響我們業務的其他因素或事件可能會不時出現,我們無法預測所有這些因素或事件,也無法評估未來。

iv |

| 目錄 |

可用信息

我們向美國證券交易委員會(「SEC」)提交年度和當前報告以及其他信息。您可以通過SEC網站(Http://www.sec.gov)或在我們的網站(www.cresud.com.ar)。我們網站中包含的信息不構成本年度報告的一部分。

v |

| 目錄 |

財務和某些其他信息的呈現

在本年度報告(「年度報告」)中,提及的「Cresud」、「公司」、「我們」、「我們」和「我們的」是指Cresud Sociedad Anónima Comercial、InMobiliaria、Financiera y Agrogeneraria及其合併子公司, 除非上下文另有要求,或者我們明確該術語僅指Cresud而不是其子公司。

所提及的「美國存托股份」是指根據我們、紐約銀行(作爲存託機構)(「美國存托股份」)與根據該協議不時發行的美國存托股份的所有者和持有人之間的存託協議發行的美國存托股份,每股代表我們普通股的10股,其中所提及的「美國存託憑證」是指代表美國存託憑證。

財務報表

我們以披索(定義見下文「-貨幣」部分)並根據IASB和CNV規則發佈的IFRS會計準則準備和維護我們的財務賬簿和記錄。我們的財年從每年7月1日開始,此後每年6月30日結束。

我們截至2024年6月30日和2023年6月30日以及截至2024年、2023年和2022年6月30日止年度的經審計合併財務報表及其附註(我們的「經審計合併財務報表」)載於本年度報告F-1至F-109頁。

我們的經審計合併財務報表已於2024年10月22日舉行的董事會會議決議批准,並已由Price Waterhouse & Co S. RL審計阿根廷,普華永道國際有限公司的成員,普華永道國際有限公司是一家獨立註冊會計師事務所,其報告包含在本文中。

功能貨幣和紙幣;通貨膨脹調整

我們的功能貨幣和列報貨幣是阿根廷披索,本年度報告中包含的經審計合併財務報表以阿根廷披索列報。

IAS 29要求功能貨幣爲惡性通貨膨脹經濟體之一的實體的財務報表應按照財務報表截止日的當前計量單位計量,無論其是基於歷史成本法還是當前成本法。這項要求還包括財務報表的比較信息。

爲了得出經濟體「惡性通貨膨脹」的結論,IAS 29概述了一系列因素,包括三年內累積通貨膨脹率接近或超過100%。截至2018年7月1日,阿根廷報告三年累計通脹率超過100%,因此自該日起發佈的財務信息應根據IAS 29進行通脹調整。因此,我們的經審計合併財務報表和本年度報告中包含的財務信息是按照報告年度結束時當前的計量單位進行說明的。欲了解更多信息,請參閱上文「財務報表」部分和我們的經審計合併財務報表附註2.1。

有關採用新準則的更多信息,請參閱經審計合併財務報表的註釋2.2。

貨幣

除非另有說明或上下文另有要求,否則本年度報告中提及的「披索」、「披索」、「披索」或「ARS」指阿根廷披索,提及的「美元」、「美元」或「美元」指美元,提及的「雷亞爾」、「盧比」。或「BRL」是指巴西雷亞爾,巴西法定貨幣。

vi |

| 目錄 |

爲了方便起見,我們已將本年度報告中包含的部分披索金額轉換爲美元。除非另有說明或上下文另有要求,否則用於將披索金額轉換爲美元的匯率是阿根廷銀行所報的賣方匯率,截至2024年6月30日,1美元兌912.00澳元。阿根廷納西翁銀行引用的2024年財政年度平均賣方匯率爲614.03里亞爾。截至2024年10月18日,阿根廷納西翁銀行報價的賣方匯率爲1美元兌984.50澳元。本年度報告中提供的美元等值信息僅爲方便讀者而提供,不應被解釋爲暗示披索金額代表或已經或可以按該匯率或任何其他匯率兌換成美元。請參閱“項目3.關鍵信息--A1.本地外匯市場及匯率「和」風險因素-與阿根廷有關的風險-持續的高通貨膨脹率可能對經濟和我們的業務、財務狀況和經營結果產生不利影響。”

某些測量

在阿根廷,房地產市場面積的標準衡量標準是平方米(「m2」或「squm」),而在美國和某些其他司法管轄區,面積的標準衡量標準是平方英尺(sq.英尺)。本年度報告中顯示的所有面積單位(例如,GLA)和未開發土地的面積)以平方米表示。1平方米約等於10.8平方英尺。一公頃約等於10,000平方米,約等於2.47英畝。

在阿根廷,標準重量單位是噸(「噸」或「Tns」)和公斤(「公斤」或「公斤」),而在美國和某些其他司法管轄區,標準重量單位是磅或蒲舍耳。一公噸等於1,000公斤。一公斤約等於2.2磅。一公噸小麥約等於36.74蒲式耳。一公噸玉米約等於39.37蒲式耳。一公噸大豆約等於36.74蒲式耳。1公斤牛活重約等於0.5至0.6公斤屍體(肉和骨頭)。

正如本年度報告中所使用的那樣,購物中心的GLA是指物業的總出租面積,無論我們在此類物業中的所有權權益如何(不包括公共區域和停車區以及超市、大超市、加油站和共有人佔用的空間,另有明確規定的除外)。

舍入調整

爲了易於列報,本年度報告(包括百分比金額)和財務報表中出現的某些數字已進行四捨五入調整。因此,本年度報告的不同表格或不同部分以及我們的財務報表中列出的同一類別的數字可能略有不同,並且某些表格中顯示爲總數的數字可能不是之前數字的算術彙總。

經濟、行業和市場數據

本年度報告中包含或引用的經濟、行業和市場數據以及其他統計信息基於我們從內部來源彙編的數據,並基於彭博社、國際購物中心理事會、阿根廷購物中心商會(Cámara Argentina de Shopping Centers)和INDEC等出版物。儘管我們相信這些來源是可靠的,但我們尚未獨立驗證這些信息,也無法保證其準確性或完整性。

vii |

| 目錄 |

第一部分

項目1.董事、高級管理人員和顧問的身份

此項目不適用。

項目2.報價統計數據和預期時間表

此項目不適用。

項目3.關鍵信息

A.保留

A.1.當地外匯市場和匯率

阿根廷政府制定了一系列外匯管制措施,限制貨幣自由流動和資金向海外轉移。這些措施大大限制了個人和私營部門實體使用MULC的機會。這使得除其他外,必須獲得中央銀行的事先批准才能進行某些外匯交易,例如與阿根廷境外應付的特許權使用費、服務或費用有關的付款。有關兌換控制的更多信息,請參閱「第10項。其他信息-D。外匯管制」。

下表顯示了購買美元的每個適用時期的最高、最低、平均和收盤匯率。

|

| 最大 (1) (2) |

|

| 最低要求(1) (3) |

|

| 平均 (1) (4) |

|

| 在收盤時 (1) |

| ||||

財年結束: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

2022年6月30日 |

|

| 125.13 |

|

|

| 95.66 |

|

|

| 105.27 |

|

|

| 125.13 |

|

2023年6月30日 |

|

| 256.50 |

|

|

| 125.35 |

|

|

| 179.71 |

|

|

| 256.50 |

|

2024年6月30日 |

|

| 910.50 |

|

|

| 257.70 |

|

|

| 613.03 |

|

|

| 910.50 |

|

月結束: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024年7月31日 |

|

| 931.00 |

|

|

| 912.50 |

|

|

| 922.14 |

|

|

| 930.50 |

|

2024年8月31日 |

|

| 952.00 |

|

|

| 931.50 |

|

|

| 941.30 |

|

|

| 952.00 |

|

2024年9月30日 |

|

| 969.00 |

|

|

| 951.50 |

|

|

| 960.31 |

|

|

| 969.00 |

|

2024年10月(至2024年10月18日).. |

| 983.00 |

|

| 969.50 |

|

| 975.69 |

|

| 983.00 |

| ||||

________________

來源:阿根廷國家銀行

(1) | 報價匯率與投標匯率的平均值根據阿根廷國家銀行的外幣匯率計算。 |

(2) | 如圖所示,表中出現的最高匯率是當年或更短時期內的最高月末匯率。 |

(3) | 如圖所示,表中出現的最低匯率是當年或更短時期內的最低月底匯率。 |

(4) | 月底平均匯率。 |

B.資本化和負債

本節不適用。

C.提供和使用收益的原因

本節不適用。

| 1 |

| 目錄 |

D.風險因素

風險因素摘要

以下總結了下面提供的部分(但不是全部)風險。請仔細考慮本項3.D中討論的所有信息。本年度報告中的「風險因素」更全面地描述這些和其他風險:

與阿根廷、巴西和我們運營的其他國家相關的風險

| · | 我們取決於阿根廷的宏觀經濟和政治狀況。 |

|

|

|

| · | 阿根廷的經濟和政治發展以及阿根廷新政府未來的政策可能會對阿根廷經濟和我們從事活動的部門產生不利影響。 |

|

|

|

| · | 阿根廷新政府可能採取的某些措施,或政策、法律和法規的變化,可能會對阿根廷經濟產生不利影響,從而影響我們的業務、財務狀況和經營結果。 |

|

|

|

| · | 持續高企的通貨膨脹率可能會對經濟和我們的業務、財務狀況和經營業績產生不利影響。 |

|

|

|

| · | 阿根廷高水平的公共支出可能會對阿根廷經濟產生長期的不利影響。 |

|

|

|

| · | 阿根廷在國際資本市場獲得融資的能力有限,這可能會削弱我們進入國際信貸市場爲我們在阿根廷的業務融資的能力。 |

|

|

|

| · | 披索價值的波動可能會對阿根廷經濟以及我們的財務狀況和經營結果產生不利影響。 |

|

|

|

| · | 由於國際商品價格下降,阿根廷的經濟和財政可能會受到不利影響。 |

|

|

|

| · | 巴西政府已經並將繼續對巴西經濟施加重大影響,再加上巴西的政治和經濟狀況,可能會對我們產生不利影響。 |

與我們農業業務相關的風險

| · | 我們的農產品市場價格波動可能會對我們的財務狀況和經營業績產生不利影響。 |

|

|

|

| · | 我們產品的全球市場競爭可能會對我們的業務和運營業績產生不利影響。 |

|

|

|

| · | 不可預測的天氣條件、害蟲侵擾和疾病可能會對我們的農作物產量和養牛業產生不利影響。 |

|

|

|

| · | 由於農作物價格波動,我們可能會面臨重大損失,因爲我們的很大一部分產量未經對沖,並面臨農作物價格風險。 |

|

|

|

| · | 我們的業務是季節性的,我們的收入可能會根據增長週期而出現顯着波動。 |

|

|

|

| · | 我們的很大一部分資產是農田,這是一種流動性極低的資產。 |

|

|

|

| · | 我們的債務水平可能會對我們的運營和到期償還債務的能力產生不利影響,而我們以優惠條件成功進入當地和國際市場的能力也會影響我們的融資成本。 |

| 2 |

| 目錄 |

與IRSA阿根廷業務相關的風險

| · | IRSA面臨購物中心運營固有的風險,可能影響我們的盈利能力。 |

|

|

|

| · | IRSA的業績受到與其物業和房地產行業相關的風險的影響。 |

|

|

|

| · | IRSA可能會因其投資價值下降而受到不利影響。 |

|

|

|

| · | IRSA的債務水平可能會對其運營及其到期償還債務的能力產生不利影響,而其以優惠條件成功進入當地和國際市場的能力也會影響其融資成本。 |

|

|

|

| · | IRSA的資產高度集中在某些地理區域,這些地區的經濟衰退可能會對其運營業績和財務狀況產生重大不利影響。 |

|

|

|

| · | 租戶的流失可能會對IRSA的營業收入及其財產價值產生不利影響。 |

|

|

|

| · | IRSA可能面臨與收購房產相關的風險,IRSA未來的收購可能無法盈利,並且IRSA收購的房產可能承擔未知的負債。 |

與IRSA投資Banco Hipotecario相關的風險

| · | 金融體系的穩定取決於包括希波特卡里奧銀行在內的金融機構維持和增強儲戶信心的能力。 |

|

|

|

| · | 金融機構的資產質量受到非金融公共部門和央行債務的影響。 |

|

|

|

| · | 由於資本市場和匯率的波動,希波特卡里奧銀行的投資組合可能會遭受損失,這可能會嚴重影響希波特卡里奧銀行的財務狀況和運營業績。 |

|

|

|

| · | Banco Hipotecario在高度監管的環境中運營,其運營受到多個監管機構採用的資本管制法規的約束。 |

與我們的美國存託憑證和普通股相關的風險

| · | 符合出售條件的股份可能會對我們普通股和美國存託憑證的價格產生不利影響。 |

|

|

|

| · | 如果我們未來發行額外的股權證券,您可能會遭受稀釋,並且我們股權證券的交易價格可能會下降。 |

|

|

|

| · | 我們遵守與美國國內上市證券發行人不同的某些企業披露要求和會計準則。 |

|

|

|

| · | 投資者可能無法在美國境內送達訴訟程序,從而限制了他們對任何外國判決的收回。 |

|

|

|

| · | 根據阿根廷法律,股東權利的定義可能比其他司法管轄區更少或更不明確。 |

|

|

|

| · | 對資本移出阿根廷的限制可能會損害您接受股息和股息以及出售美國存託憑證相關普通股收益的能力。 |

|

|

|

| · | 我們的認購令可在有限情況下行使,並且將到期。 |

| 3 |

| 目錄 |

危險因素

在做出投資決定之前,除了本年度報告中包含的其他信息外,您還應仔細考慮以下風險。我們還可能面臨我們目前未知的額外風險和不確定性,或者截至本年度報告之日我們可能認爲不重大的風險和不確定性,這可能會對我們的業務產生不利影響。一般來說,當您投資新興市場(例如阿根廷)發行人的證券時,您比投資美國和某些其他市場發行人的證券時承擔的風險更大。您應該明白,投資我們的普通股和美國存託憑證涉及高度風險,包括您全部投資損失的可能性。

與阿根廷有關的風險

我們取決於阿根廷的宏觀經濟和政治狀況。

阿根廷經濟近幾十年來經歷了嚴重的波動,其特點是GDP增長緩慢或負、通脹水平高企和貨幣貶值。阿根廷的可持續經濟增長取決於多種因素,例如國際對阿根廷出口產品的需求、披索兌外幣的穩定性和競爭力、消費者和國內外投資者的信心、穩定的通脹率、國家就業水平以及阿根廷地區貿易伙伴的情況。

根據世界銀行的數據,由於持續的宏觀經濟失衡和嚴重乾旱導致農業產量下降26.0%,2023年阿根廷經濟下降了1.6%。世界銀行估計,由於阿根廷政府宣佈的措施,包括調整相對價格和消除財政和外部失衡,2024年阿根廷實際GDP將下降2.8%。2024年,阿根廷公共支出和通脹率有所下降,但通脹率仍然居高不下。世界銀行還估計,2025年阿根廷經濟將增長5.0%,主要是由於天氣條件改善、能源行業投資以及農業生產的恢復。然而,這些估計可能無法達到。

阿根廷經濟仍然脆弱且不穩定,因爲投資佔GDP的比例仍然很低,無法維持近幾十年的增長率,能源或天然氣的供應可能不足以滿足工業活動(從而限制工業發展)和消費的增長,失業率和非正規就業仍然居高不下。根據摩根士丹利資本國際公司(「MSCI」)2021年6月發佈的數據,阿根廷在2021年6月之前一直被視爲新興市場,當時阿根廷被歸類爲「獨立市場」。獨立市場被認爲存在額外的風險,例如可能限制投資的政府限制以及與政治發展相關的風險。此外,抗議或罷工可能會對政治、社會和經濟環境的穩定產生負面影響,並可能對全球金融市場對阿根廷經濟的信心產生負面影響。

2023年11月19日,阿根廷舉行總統決選,由「自由黨Avanza」候選人哈維爾·米萊和「愛國聯盟」候選人塞爾吉奧·馬薩組成,哈維爾·米萊以55.69%的得票率當選阿根廷總統。2023年選舉後,La Libertad Avanza在參議院72名代表中擁有7名,在衆議院257名代表中擁有41名。

| 4 |

| 目錄 |

阿根廷新政府面臨重大宏觀經濟挑戰,例如降低通脹率、實現商業和財政盈餘、積累儲備、支持披索、取消外匯管制、爲欠私人債權人的債務再融資以及提高阿根廷經濟的競爭力。阿根廷新政府上任以來,實施了大量旨在放鬆阿根廷經濟管制和限制政府對私營部門干預的措施,包括暫停公共工程招標、減少能源和交通補貼,預計未來將採取進一步措施。然而,其中一些措施正在國會受到質疑並提交司法程序。

如果政治和社會壓力阻礙阿根廷政府實施旨在控制通貨膨脹、促進增長和提高消費者和投資者信心的政策,或者阿根廷政府爲實現這些目標而實施的政策不成功,阿根廷經濟可能會受到影響。這些事態發展可能會對我們的財務狀況和運營結果產生重大影響。

我們無法向您保證,阿根廷經濟增長或政治狀況的下降不會對我們的業務、財務狀況或運營業績產生不利影響,並導致我們的美國存託憑證和普通股的市值下跌。

阿根廷的經濟和政治發展以及阿根廷新政府未來的政策可能會對阿根廷經濟和我們從事活動的部門產生不利影響。

阿根廷政府歷來對經濟施加重大影響,而我們公司一直在高度監管的環境中運營。近代歷史上,阿根廷政府直接干預經濟,包括實施徵收和國有化措施、價格管制和外匯管制。

在經濟、社會或政治危機時期,在阿根廷運營的公司可能面臨罷工、徵用、國有化、強制修改現有合同以及稅收政策變化(包括增稅和追溯性稅收索賠)的風險。由於我們的運營環境中,管轄法律和適用法規經常變化,部分原因是政府管理部門的變化,因此很難預測我們的活動是否以及如何受到此類變化的影響

這些措施或阿根廷政府和/或中央銀行未來可能實施的其他措施的成功受到不確定性的影響,阿根廷披索的任何進一步貶值、進一步通貨膨脹或我們無法獲取外幣可能會對我們的財務狀況和經營業績產生重大不利影響。我們無法預測這些措施的有效性。我們無法預測阿根廷披索兌美元或其他外幣是否會貶值或升值以及在多大程度上,以及這些不確定性將如何影響我們的業務。此外,

此外,無法保證未來不會實施額外的貨幣或外匯限制或控制。現有和未來的措施可能會對阿根廷的國際競爭力產生負面影響,阻礙外國投資者的外國投資和貸款,或增加外國資本外流,這可能對阿根廷的經濟活動產生不利影響,進而可能對我們的業務和經營業績產生不利影響。我們無法預測這些條件將如何影響我們償還以阿根廷披索以外貨幣計價的負債的能力。阿根廷政府對海外轉移資金實施的任何限制都可能會削弱我們向美國存託憑證支付股息或以美元支付未償債務(本金或利息)的能力,以及遵守任何其他以外幣計價的義務的能力。

詳情請參見 “第10項。其他信息- D.外匯管制”.

我們無法肯定阿根廷的經濟、監管、社會和政治框架或阿根廷政府採取或可能採取的政策或措施不會對我們的美國存託憑證的市場價值、我們的業務、財務狀況和/或運營結果產生不利影響。

| 5 |

| 目錄 |

阿根廷新政府可能採取的某些措施,或政策、法律和法規的變化,可能會對阿根廷經濟產生不利影響,從而影響我們的業務、財務狀況和經營結果。

阿根廷政府對經濟實施了實質性控制,包括通過監管市場條件和價格。

2023年12月27日,阿根廷新政府向國會提交了一項名爲“阿根廷自由黨的基地y Puntos de Partida para La Libertad de los Atlanos,”(《綜合法》)。《綜合法》是一項內容廣泛的法案,包括自由經濟措施和強有力的財政調整,旨在放鬆對阿根廷經濟的管制,通過減少阿根廷政府的部委和結構來實現政府組織結構現代化,放寬勞動法,並私有化國有公司。

2024年2月,阿根廷政府從阿根廷國會撤回了《總結法》的第一個法案。因此,開始了一項新的綜合性法律法案的工作,同時還進行了一項稅收改革。爲了確保《總結法》和稅制改革獲得批准,阿根廷政府對該法案進行了多次修改。與第一個法案不同,綜合法案的第二個法案從500多個章節減少到232個章節。2024年4月,阿根廷政府向阿根廷國會提交了新的總結法法案和稅制改革法案。2024年6月,阿根廷國會和參議院經過多次討論通過了這些法案。我們無法預測綜合法和稅制改革將如何影響我們的業務和我們的運營結果。有關總結法和稅制改革的更多信息,請參見「項目」。10--補充資料--D.外匯管制--第27,742號法律--「阿根廷自由法或總括法律」和「第27,743號法律--相關的財政和金融機構」。

2023年12月21日,阿根廷新政府發佈第70/2023號緊急法令,名爲“阿根廷經濟重建基礎.”第70/2023號法令宣佈經濟、金融、財政、行政、養老金、關稅、健康和社會事務等領域進入公共緊急狀態,直至2025年12月31日。截至本年度報告之日,該法令儘管於2023年12月29日生效,但仍在接受國會和司法審查。如果第70/2023號法令被廢除,則根據第26,122號法律,該法令將停止有效,但不損害其有效期內獲得的權利。

此外,阿根廷新政府宣佈打算實現阿根廷經濟美元化。從歷史上看,阿根廷政府在經濟方面的行動,包括利率、稅收、價格管制、工資上漲、提高工人福利、外匯管制以及外匯市場潛在變化的決定,對阿根廷經濟產生了重大不利影響。阿根廷新政府實施的措施可能會對阿根廷經濟產生負面影響,從而對我們的財務狀況或經營業績產生負面影響。

民間經濟學家普遍認爲,阿根廷政府通過徵收、價格管制、外匯管制和其他措施直接干預經濟,對阿根廷的投資水平、阿根廷公司進入國際資本市場以及阿根廷與其他國家的商業和外交關係產生了不利影響。如果阿根廷政府對經濟的干預水平繼續或增加,阿根廷經濟以及我們的業務、經營業績和財務狀況可能會受到不利影響。

持續高企的通貨膨脹率可能會對經濟和我們的業務、財務狀況和經營業績產生不利影響。

從歷史上看,通貨膨脹嚴重影響了阿根廷經濟和阿根廷政府創造穩定增長條件的能力。高通脹率還可能損害阿根廷在國際市場的競爭力,並對經濟活動和就業以及我們的業務、財務狀況和運營業績產生不利影響。

| 6 |

| 目錄 |

阿根廷面臨着通脹壓力,燃料、能源和食品價格大幅上漲等因素就證明了這一點。2023年CPI累計變化爲211.4%,2022年爲94.8%,2021年爲50.9%(截至每年12月31日)。此外,2024年1月、2月、3月、4月、5月、6月、7月和8月的CPI數據分別爲20.6%、13.2%、11.0%、8.8%、4.2%、4.6%、4.0%和4.2%。截至2024年9月30日,通脹率爲3.5%,2024年累計通脹率爲101.6%,同比通脹率爲209.0%。

2024年10月4日,央行發佈市場預期調查,報告稱2024年10月通脹率估計爲3.4%,2024年通脹率爲123.6%。哈維爾·米萊就任總統後,阿根廷披索貶值約50%,匯率從1美元兌換約400里亞爾升至1美元兌換約800里亞爾。這立即反映在價格上,2023年12月通脹率達到25.5%。阿根廷政府調整電力和天然氣關稅以及汽油價格上漲影響了價格,造成了額外的通脹壓力。如果阿根廷披索的價值無法通過財政和貨幣政策穩定,通脹率可能會上升。

高通脹率或惡性通脹過程會削弱披索貶值的影響,從而影響阿根廷的外國競爭力,對就業和經濟活動水平產生負面影響,並破壞人們對阿根廷銀行體系的信心,這可能會進一步限制公司獲得國內和國際信貸。此外,阿根廷的一部分債務仍然與與BER(一種與通脹密切相關的貨幣指數)相關。因此,通貨膨脹的任何顯着上升都將推動阿根廷外債增加,從而導致阿根廷金融義務增加,這可能會加劇阿根廷經濟的壓力。持續的通貨膨脹環境可能會損害我們的運營業績,對我們以優惠條款爲企業運營資金需求提供資金的能力和我們的運營業績產生不利影響,並導致我們美國存託憑證和普通股的市值下跌。

阿根廷政府爲維持通脹控制而實施的政策的有效性以及此類政策的潛在影響存在不確定性。我們無法保證通貨膨脹率未來不會上升,也無法保證阿根廷政府爲控制通貨膨脹而採取或即將採取的措施在長期內有效或成功。高通脹率繼續對阿根廷構成挑戰。

阿根廷高水平的公共支出可能會對阿根廷經濟產生長期的不利影響。

本屆阿根廷政府之前的阿根廷政府大幅增加了公共支出。2021年、2022年和2023年,阿根廷的基本赤字分別佔GDP的3%、2.4%和2.9%。2023年12月基本財政赤字爲199131610萬澳元(相當於GDP的1.05%),導致2023年基本赤字總額爲548330530萬澳元。

本屆政府已表示有意通過削減公共支出來減少財政赤字。爲實現這一目標而採取的措施包括:(1)使阿根廷披索兌美元貶值50%;(2)暫停公共工程;(3)減少對能源和交通服務的補貼;(4)停止官方廣告;(5)減少部委和秘書處的數量。2024年1月,財政盈餘51840800萬,其次是2024年2月33811200萬、2024年3月27663800萬、2024年4月1740900萬、2024年5月118357100萬、2024年6月23818900萬阿盾;2024年7月逆差60095700萬、2024年8月盈餘353100萬、9月盈餘46663100萬。因此,阿根廷公共部門自2008年以來首次連續6個月錄得財政盈餘,截至2024年9月30日的9個月期間,扣除利息後的年度迄今盈餘約相當於GDP的0.4%,基本盈餘約佔GDP的1.7%。

阿根廷政府無法進入資本市場爲其赤字融資或依賴其他融資來源可能會對經濟產生負面影響,也可能限制阿根廷公司進入資本市場的機會,這可能會對我們的業務、財務狀況和運營結果產生不利影響。

| 7 |

| 目錄 |

阿根廷在國際資本市場獲得融資的能力有限,這可能會削弱我們進入國際信貸市場爲我們在阿根廷的業務融資的能力。

阿根廷外債違約的歷史和與堅持債權人的曠日持久的訴訟可能會在未來重演,阻止像我們這樣的阿根廷公司進入國際資本市場,或者可能導致此類融資的更高成本和更繁瑣的條款,因此可能對我們的業務、經營結果、財務狀況、我們證券的價值和我們履行財務義務的能力產生負面影響。在2001年發生外債違約後,阿根廷在2005年和2010年兩次提出交換條件,試圖重組其未償債務。阿根廷約93%違約債務的持有者參與了交換,但一些債券持有人拒絕交換提議,並對阿根廷採取了法律行動。阿根廷政府與違約債券持有人達成了幾項協議,結束了長達15年的訴訟。此外,在2020年8月,阿根廷政府成功地談判了阿根廷債券的債務重組,這些債券價值約650億美元億,是欠幾個債券持有人的。

2022年1月28日,阿根廷與國際貨幣基金組織簽署了一項協議(《SAF協議》),爲阿根廷最初於2018年與國際貨幣基金組織發生的超過400億美元的億債務進行再融資。阿根廷和國際貨幣基金組織就削減公共開支的某些措施達成一致。阿根廷國會和國際貨幣基金組織董事會批准了《蘇丹武裝部隊協定》。除其他事項外,阿根廷還制定了經濟和貨幣政策,國際貨幣基金組織將成爲董事的聯合執行者,對阿根廷的財政和經濟發展進行季度審計。2022年9月19日,貨幣基金組織工作人員和阿根廷當局就更新後的宏觀經濟框架和相關政策達成協議,以完成《SAF協定》下的第二次審查。2022年12月22日,國際貨幣基金組織董事會完成了對SAF協定的第三次審查,允許立即支付約60美元億。 *2023年3月13日,國際貨幣基金組織批准了SAF協定的第四次修訂,並授權支付約53美元億。2023年8月23日,國際貨幣基金組織批准了對《SAF協定》的第五次和第六次修訂,從而產生了750美元的新支出萬。2023年10月31日,阿根廷政府向國際貨幣基金組織支付了約26億美元,相當於《2023年10月SAF協定》規定的到期日。在支付這些款項後,中央銀行的儲備爲218億美元。2023年12月,阿根廷與拉丁美洲和加勒比開發銀行批准了96000美元的萬過橋貸款,使阿根廷能夠繼續執行SAF協議。2024年2月和2024年6月,國際貨幣基金組織完成了對《SAF協定》的第七次和第八次審查,結果分別向阿根廷支付了約47美元億和80000美元萬。截至本年度報告之日,阿根廷已實現《南部非洲穩定框架協定》規定的2024年第一季度目標。根據「南部非洲安全部隊協定」進行的第九次審查正在進行中,這可能爲阿根廷帶來新的付款。

2020年3月13日,阿根廷經濟部長致信巴黎俱樂部成員,表示阿根廷決定根據2014年5月29日與巴黎俱樂部成員達成的和解協議的條款,將原定於2020年5月5日支付的210000美元萬付款推遲到2021年5月5日。2020年4月7日,經濟部長向巴黎俱樂部成員發送了一份修改巴黎俱樂部2014年和解協議現有條款的提案,主要尋求延長到期日和大幅降低利率。2021年6月22日,阿根廷經濟部長宣佈,阿根廷政府在巴黎俱樂部談判框架內獲得了一段時間橋,從而避免了違約。根據這些協議,阿根廷應該在2022年3月31日之前與巴黎俱樂部成員國達成重組協議。然而,2022年3月31日,這樣的協議被延長到2022年7月31日,2022年5月31日,它又被進一步延長到2024年9月30日。2022年10月28日,經濟部長宣佈了與巴黎俱樂部的一項新協議。該協議是巴黎俱樂部2014年和解協議的附錄,確認本金爲197100美元萬,延長了13個半年度分期付款的還款期,從2022年12月開始,最終將於2028年9月取消。根據這項新協議,利率在前三期從9%提高到3.9%,並逐步提高到4.5%。付款情況表明,平均每半年支付17000美元萬(包括本金和利息)。2024年期間,阿根廷將償還到期本金的40%。

2009年,阿根廷與中國簽署了價值700億元CNY幣(約合99億美元)的掉期協議(「掉期」),根據該協議,央行向中國人民銀行(「央行」)提供披索,中國人民銀行向央行提供人民幣。2024年6月,阿根廷政府與中華人民共和國達成互換再融資協議,央行將部分到期日延長至2025年和2026年。掉期預計將於2026年中期達到最終到期。

| 8 |

| 目錄 |

我們無法預測這些協議和基於這些協議制定的政策將如何影響阿根廷進入國際資本市場的能力(以及間接影響我們進入此類市場的能力)、阿根廷經濟或我們的經濟和金融狀況或我們延長債務到期日的能力或可能影響我們的業績和運營或業務的其他條件。

披索價值的波動可能會對阿根廷經濟以及我們的財務狀況和經營結果產生不利影響。

阿根廷披索過去曾對美元大幅貶值,未來可能會出現波動。我們無法預測披索的價值是否會以及在多大程度上對美元貶值或升值,或者這種波動會如何影響我們的業務。除了上述其他因素外,披索與其他貨幣的價值還取決於央行維持的國際儲備水平,近年來國際儲備水平也出現了顯着波動。截至2024年8月30日,央行國際儲備總額爲2671900萬美元。此外,截至本年度報告之日,2024年阿根廷披索兌美元已貶值約21.7%。

我們無法保證官方匯率未來不會大幅波動。披索價值的波動也可能對阿根廷經濟以及我們的產品、財務狀況和運營業績產生不利影響。阿根廷披索貶值可能會對某些阿根廷企業償還外幣債務的能力產生負面影響,導致高通脹,大幅降低實際工資,危及包括公用事業和金融業在內的依賴國內市場需求的企業的穩定,並對阿根廷政府履行外債的能力產生不利影響。

另一方面,阿根廷披索兌美元大幅升值也給阿根廷經濟帶來風險,包括出口可能減少(由於外部競爭力喪失)。任何此類增長也可能對經濟增長和就業產生負面影響,減少阿根廷公共部門的實際稅收收入,並對我們的業務、我們的經營業績、我們在各自到期日內償還債務的能力產生重大不利影響,並影響我們美國存託憑證的市場價值,因爲阿根廷經濟疲軟的整體影響。

此外,由於深化了貨幣管制,阿根廷的官方匯率(目前用於商業和金融交易)與由於外匯市場上某些常見操作而出現的其他非正式匯率之間存在差異,導致截至2023年12月31日,官方匯率與官方匯率之間的差距約爲21%,截至2024年10月18日,阿根廷官方匯率與官方匯率之間的差距約爲18%。阿根廷政府發生變化後,官方匯率已超過800雷亞爾,其中包括如果適用必須加上現行稅額的數額,從而超過了「MEP」美元、「CCL」美元和「藍色」美元匯率,從而縮小了這些匯率之間的差距。在這方面,阿根廷政府可以維持單一官方匯率或爲不同類型的交易創造多種匯率,大幅改變我們購買外幣以償還以外幣計價的債務的匯率。

由於國際商品價格下降,阿根廷的經濟和財政可能會受到不利影響。

大宗商品市場的特點是波動性。大宗商品出口爲阿根廷政府的收入做出了重大貢獻。隨後,阿根廷經濟仍然相對依賴其出口產品(主要是大豆)的價格。由於阿根廷對農業大宗商品的依賴,也容易受到天氣事件的影響。

| 9 |

| Table of Contents |

In 2023, Argentina faced another severe drought, which resulted in losses of USD 20.0 billion. The negative impact of the 2018 and 2023 droughts has been exacerbated by the historically low levels of the Paraná river (Argentina’s main river) and numerous fire outbreaks across several Argentine provinces in 2022. These environmental factors have further affected the agricultural sector in Argentine.

2023年9月,厄爾尼諾現象影響了阿根廷經濟。厄爾尼諾現象通常會增加降水的頻率和強度,但也會帶來更高的洪水、河流溢流和嚴重風暴的風險。厄爾尼諾現象對阿根廷的影響仍然難以預測。

截至2024年8月,由於價格下跌,與2024年5月相比,阿根廷大豆和玉米綜合體出口損失約15.5億美元外匯。2024年5月10日,大豆和玉米離岸價出口價格分別爲每噸445美元和每噸206美元,截至2024年8月,大豆和玉米離岸價出口價格分別降至每噸43美元和每噸181.25美元。這些下降是由全球大豆產量增加推動的,大豆產量從2023年的39500萬噸增加到2024年的42800萬噸。外匯損失可能會影響阿根廷政府通過清算農產品出口和主要是阿根廷主要出口商品大豆來增加美元流入的目標。

此外,俄羅斯和烏克蘭之間的衝突、以色列和哈馬斯在加沙地帶的衝突以及以色列和真主黨之間的衝突導致石油、天然氣和大宗商品(包括阿根廷生產的商品)的國際價格上漲。國際石油價格長期下跌將對阿根廷的石油和天然氣前景產生負面影響,並導致這些行業的外國投資減少。

阿根廷出口主要商品的國際價格持續下跌,或未來的任何氣候事件或條件可能會對農業部門產生不利影響,從而對阿根廷政府的收入及其償還公共債務的能力產生不利影響,最終產生隱性或通脹壓力。此外,這種情況可能對阿根廷政府的稅收收入和外匯供應產生負面影響。任何此類事態發展都可能對阿根廷的經濟產生不利影響,從而對我們的業務、經營業績和財務狀況產生不利影響。

阿根廷經濟指數發佈的中斷或計算方法的改變可能會影響公司的預測。

2014年,INDEC建立了一個新的消費者價格指數CPI,該指數反映了消費者價格的廣泛衡量標準,考慮了全國24個省分成6個地區的價格信息。面對CPI以及INDEC發佈的其他指數的可信度受到質疑,阿根廷政府於2016年1月8日宣佈國家統計系統和INDEC進入行政緊急狀態,理由是INDEC未能提供可靠的統計信息,特別是關於CPI、GDP、通貨膨脹和外貿數據以及貧困和失業率。在重組其技術和行政結構以恢復其提供可靠統計信息的能力之前,國家統計和經濟委員會暫時停止公佈某些統計數據。2017年,INDEC開始發佈全國CPI,這是基於INDEC和幾個省統計局在包括阿根廷每個省在內的39個城市地區進行的調查。

由於INDEC對GDP計算方法進行了變更,根據英國和威爾士法律發行的2035年到期的阿根廷債券的某些持有人提起訴訟,要求賠償這些變更造成的損失。2023年4月,倫敦高等法院法官西蒙·普盧(Simon Pleston)做出裁決,認定GDP計算方法的變化及其演變給債券持有人造成了損失,命令阿根廷分別支付64300萬歐元和133000萬歐元的損害賠償和賠償。阿根廷政府對這一決定提出上訴。但2024年10月,英國最高法院駁回了阿根廷政府的上訴請求。因此,阿根廷將不得不支付133000萬歐元以及適用的利息。

| 10 |

| 目錄 |

未來需要對INDEC指數進行的任何修正或重述都可能導致人們對阿根廷經濟的信心下降,這反過來可能會對我們進入國際資本市場爲我們的運營和增長提供資金的能力產生不利影響,反過來又可能對我們的運營結果和財務狀況產生不利影響,並導致我們的ADS和普通股的市值下跌。

對外幣轉移和阿根廷資本匯回的限制可能會損害我們支付股息和分配的能力,投資者收取與阿根廷公司發行的公司債券相關的資本和利息的能力可能會面臨限制。

在阿根廷國際收支出現嚴重失衡或有理由預計出現這種失衡的情況下,阿根廷政府可以對阿根廷貨幣兌換外幣以及將在阿根廷投資產生的資金匯回外國投資者施加限制。

2019年9月1日,通過第609/2019號緊急法令,由於經濟不穩定和不確定性、阿根廷披索貶值、通貨膨脹率上升,總裁·馬克裏政府和央行實施了一系列貨幣和外匯管制措施。這些措施包括對存放在金融機構的資金的可及性進行限制。 以及未經中央銀行事先批准將資金轉移到國外。已經確定,貨物和服務出口的收益必須在中央銀行規定的條件和時限內以外幣帶入該國和/或在外匯市場上進行交易。此外,進入外匯市場購買外幣和貴金屬以及向國外轉移必須事先獲得中央銀行的批准,根據外匯市場現行條件的客觀指導方針,並區分個人和法人的情況。

通過頒佈《關於社會團結和生產性復興的第27,541號法》,延長了這些措施的期限,並引入了額外限制,其中包括對阿根廷個人和法人實體購買某些外幣徵收新稅。披索兌美元波動性加劇、升值或貶值,或者匯率干預導致央行儲備減少,可能會對阿根廷經濟、我們履行義務的能力以及我們股票的價值產生不利影響。

阿根廷的某些限制影響了公司進入MULC購買外幣以將資金轉移到海外、償還債務、在阿根廷境外付款和其他業務的能力,在某些情況下需要事先獲得中央銀行的批准。中央銀行通知「A」7953中規定的現行阿根廷外匯法規及其修正案對以下內容實施了某些外匯管制,例如中央銀行的事先批准:(i)股息支付;(ii)非居民進入外匯市場,但具體豁免除外;(iii)直接投資的匯回;和(iv)建立外國資產、匯款家庭援助以及爲居民個人提供與衍生品交易相關的擔保和運營付款。

2023年10月10日,CNV在《官方公報》上發佈了第981號一般決議,由於適用於進入MULC的限制性措施,暫時禁止向公司的GDS持有人支付股息。該法規通過限制每日操作量,(i)阻止了與BONY達成的存款協議中建立的機制的實施,以獲得向GDS持有人的外國帳戶支付股息所需的美元;(ii)阻礙了存款協議中建立的替代程序的實施;以及(iii)造成本地和外國持有人之間的不平等待遇(因爲本地股東在商定日期收到股息,而GDS持有人由於上述法規而尚未收到股息,並且尚不清楚他們何時能夠收到股息)。

| 11 |

| 目錄 |

公司向CNV提出豁免請求後,CNV於2023年11月30日發佈了第984號一般決議,放寬了規定,允許在國外付款。

我們無法保證未來不會實施央行和/或CNV發佈的新法規,從而阻止我們及時向GDS持有人支付股息。

2023年12月和4月,央行通過「A」7914號通知和「A」7746號通知實施了額外限制,該通知規定有義務披露對進入外匯市場的一方行使直接控制權並構成同一經濟集團一部分的個人或法律實體,該通知修改了進入MULC的時間範圍。這些措施可能會對阿根廷的全球競爭力產生不利影響,阻礙外國投資者的外國投資和貸款,或增加外國資本外流,這可能會對阿根廷的經濟活動產生不利影響,並可能對我們的業務和經營業績產生不利影響,或損害我們以美元支付股息的能力或阻止我們償還國際債務。

我們無法預測這些限制和/或其取消將如何演變,特別是關於向海外轉移資金的限制。儘管新政府逐步取消某些外匯限制,但阿根廷政府可能會對資本轉移實施新的外匯管制或限制,並採取其他可能限制或限制我們進入國際資本市場、支付本金和利息以及其他額外金額的能力的政策。境外(包括與我們的票據相關的付款),或進口我們用作投入的某些產品或商品。

由於阿根廷政府推動或採取某些措施以及工會部門的壓力,公司的運營成本可能會增加。

過去,阿根廷政府曾推動並通過法律和集體勞工協議,規定私營部門僱主有義務維持一定的工資水平併爲員工提供額外福利。此外,僱主還面臨來自員工和工會的強大壓力,要求他們加薪和其他福利。

我們無法確定阿根廷政府未來不會頒佈措施,導致僱主必須承擔的最低、重要和流動工資和/或福利、補償或其他勞動力成本增加。任何加薪和/或任何其他勞動力成本都可能導致成本上升和公司運營業績下降。

未能充分解決制度惡化和腐敗的實際和感知風險可能會對阿根廷的經濟和金融狀況產生不利影響。

缺乏與阿根廷政府及其機構簽訂合同的堅實和透明的制度框架,以及腐敗指控,已經並將繼續影響阿根廷。在透明國際2023年腐敗感知指數中,阿根廷在180個國家中排名98。

截至本年度報告之日,對洗錢和腐敗指控的多項調查正在進行中,這些指控對阿根廷經濟和政治環境產生了負面影響。根據這些調查的結果以及最終確定調查所需的時間,涉及的公司可能會面臨信用評級下降、投資者對其股票和債務證券提出索賠等後果,並且可能會進一步受到限制通過資本市場獲得融資,所有這些都可能會減少他們的收入。此外,如果針對公司的刑事案件繼續推進,他們可能會被限制提供服務,或者可能會因客戶的內部政策和程序而面臨新的限制。這些不利影響可能會限制這些公司開展運營活動和履行財務義務的能力。

| 12 |

| 目錄 |

阿根廷政府認識到不解決這些問題可能會增加政治不穩定的風險、扭曲決策過程並對阿根廷的國際聲譽和吸引外國投資的能力產生不利影響,因此宣佈了旨在加強阿根廷機構和減少腐敗的多項措施。

這些措施包括設立一個特別檢察官辦公室,負責調查涉及國家和省級官員與非法致富和資產增加有關的調查、以認罪協議換取與司法部門在腐敗調查中的合作、更大程度地獲取公共信息、沒收因腐敗而被起訴的官員的資產、擴大反腐敗辦公室的權力、以及頒佈新的公共道德法等。我們不能保證這些措施的實施會成功,也不能保證一旦實施就會達到預期的效果。

我們無法估計這些調查可能對阿根廷經濟產生的影響。同樣,無法預測腐敗調查的持續時間,也無法預測哪些公司可能會參與其中,或者這些調查的影響有多大,這可能會對阿根廷經濟產生負面影響。反過來,除其他問題外,上述任何問題導致的投資者信心下降可能會對阿根廷經濟的增長產生重大不利影響,這反過來又可能損害我們的業務、財務狀況和運營業績,並影響我們普通股和美國存託憑證的交易價格。

阿根廷的美元房地產價值可能會大幅下降。

以美元計算的房地產價值受到我們無法控制的多種因素的影響,例如由於宏觀經濟狀況惡化而導致房地產需求下降,或者房地產供應增加,這可能會對以美元計算的房地產價值產生不利影響。我們無法向您保證以美元計算的房產價值會增加或不會減少。我們擁有的大部分房產位於阿根廷。因此,由於我們的投資房地產是以美元計價的公平市場價值進行估值,阿根廷房產美元價值的減少可能會對我們的業務和財務報表產生重大影響。

Covid-19等大流行級別疾病或對公共衛生的威脅的出現和傳播可能會對阿根廷和全球經濟、我們的業務運營、財務狀況或運營業績產生重大不利影響。

全球公共衛生威脅,例如Covid-19、流感和其他高度傳染性疾病或病毒,世界各地不時爆發,可能會對我們的運營以及我們客戶的運營產生不利影響。

Covid-19的額外毒株,或另一種流行病、疾病或類似公共衛生威脅的爆發,可能會對全球經濟、金融和商業狀況產生重大不利影響,從而對我們的業務、財務狀況和經營業績產生不利影響。

如果上述任何事件或其他流行病再次發生,或者如果Covid-19或其他流行病的嚴重程度或持續時間增加,可能會對我們的業務、經營業績、現金流和財務狀況產生重大不利影響。

阿根廷經濟容易受到外部衝擊和政治事態發展的影響,而這些衝擊和政治事態發展可能由阿根廷貿易伙伴的重大經濟困難或更普遍的「傳染」效應引起。此類外部衝擊和「傳染」效應可能會對阿根廷的經濟增長產生重大不利影響,從而對我們的經營業績和財務狀況產生重大不利影響。

儘管各國的經濟狀況各不相同,但投資者對某些國家發生的事件的看法過去已經並可能繼續對其他國家(包括阿根廷)發行人證券的資本流入和投資產生了重大影響。無法保證阿根廷金融體系和證券市場不會受到外國政府或阿根廷政府未來可能採取的政策的不利影響。阿根廷還可能受到其他國家發生的負面經濟或金融事件的不利影響,隨後影響我們的運營和財務狀況,包括我們在到期日償還債務的能力。

| 13 |

| 目錄 |

阿根廷經濟容易受到外部衝擊的影響。例如,經濟放緩,特別是巴西等阿根廷主要貿易伙伴的經濟放緩,導致阿根廷過去幾年出口下降。具體來說,阿根廷出售的大宗商品價格波動以及披索兌美元大幅貶值可能會損害阿根廷的競爭力並影響其出口。此外,國際投資者對一個市場發生的事件的反應可能會導致「傳染」效應,從而導致整個地區或整個投資類別不受國際投資者青睞。

此外,即將舉行的美國總統選舉可能會帶來重大不確定性。政治過渡,包括領導層的更迭,可能會導致監管和財政政策、貿易協定和其他經濟因素的轉變。此外,選舉前後可能會導致金融市場波動、貨幣波動和整體經濟不穩定。美國外交或國內政策的任何重大變化,包括貿易協定、關稅或國際關係的變化,都可能影響全球經濟,包括阿根廷經濟。雖然選舉結果仍然不確定,但可能影響監管格局和經濟狀況的政策轉變的可能性帶來了可能對我們的財務業績和未來增長前景產生負面影響的風險。

此外,阿根廷的金融和證券市場還受到全球其他市場經濟和市場狀況的影響。

與此同時,近年來全球經濟狀況出現了嚴重不穩定,例如大宗商品價格高度波動,烏克蘭與俄羅斯之間的戰爭以及哈馬斯從加沙地帶對以色列的襲擊造成的全球經濟不確定性和金融市場狀況。

無法保證阿根廷金融體系和證券市場不會受到外國政府或阿根廷政府未來可能採取的政策,或發達國家經濟或其他新興市場發生的事件的不利影響。

最後,國際投資者對一個市場發生的事件的看法可能會產生「傳染」效應,導致整個地區或類別的投資不受國際投資者的青睞。阿根廷可能會受到其他新興國家和發達國家負面經濟或金融發展的不利影響,這反過來可能會對阿根廷經濟產生重大不利影響,並間接對我們的業務、財務狀況和運營業績以及我們的美國存託憑證和普通股的市值產生重大不利影響。

俄羅斯入侵烏克蘭 哈馬斯從加沙地帶對以色列的襲擊以及以色列對真主黨的襲擊可能會對全球經濟以及國際和當地證券市場產生不可預測的影響,並對我們的業務和經營業績產生不利影響。

隨着地緣政治緊張局勢升級、俄羅斯和烏克蘭之間軍事衝突的開始、哈馬斯從加沙地帶對以色列的襲擊以及以色列對黎巴嫩南部真主黨的襲擊,全球市場經歷了波動和混亂。

俄羅斯對烏克蘭的軍事幹預已經並可能導致美國、歐盟和其他國家對俄羅斯實施更多制裁,可能還包括直接或間接支持俄羅斯入侵的國家。這些制裁旨在增加俄羅斯政權的戰爭成本。俄羅斯的軍事入侵和隨之而來的制裁可能會對全球能源和金融市場產生不利影響,包括阿根廷的能源和金融市場,因此可能會影響我們的業務和我們客戶的業務,儘管我們與俄羅斯或鄰近地理地區沒有任何直接敞口。我們無法預測烏克蘭局勢的進展或結果,因爲衝突和政府反應正在迅速發展,超出了他們的控制。影響該地區的長期動亂、加強的軍事活動或更廣泛的制裁可能會對全球經濟產生實質性的不利影響,而這種影響又可能對我們的業務、財務狀況和業務結果產生實質性的不利影響。

2023年10月7日,哈馬斯武裝分子和其他恐怖組織成員從加沙地帶滲透到以色列南部邊境,對平民和軍事目標發動了一系列恐怖襲擊。此後,這些恐怖分子對以色列與加沙地帶邊境的以色列民衆和工業中心發動了大規模火箭襲擊。襲擊發生後不久,以色列安全內閣向哈馬斯宣戰。新政府公開表示相信以色列有權自衛。這場衝突的未來及其對國際貿易和阿根廷等新興市場經濟體的影響仍然不確定。 以色列當前針對哈馬斯的戰爭的強度和持續時間很難預測,此類戰爭對公司業務和運營以及全球地緣政治不穩定的經濟影響也很難預測。

| 14 |

| 目錄 |

同樣,目前以色列和真主黨之間的武裝衝突,以及以色列和黎巴嫩邊境地區的直接衝突,加劇了中東的緊張局勢。暴力升級造成了全球不確定性,特別是影響金融市場和石油和天然氣等能源大宗商品價格。衝突可能蔓延到該地區其他地區以及國際行爲體的干預可能會加劇全球經濟不穩定,導致能源成本上升和全球供應鏈中斷。

俄羅斯對烏克蘭的持續入侵、哈馬斯從加沙地帶對以色列的襲擊、以色列和真主黨之間當前的武裝衝突直接或間接導致信貸市場的任何惡化都可能限制我們獲得外部融資來資助我們的運營和資本支出的能力,這可能會對我們的業務、運營結果和/或財務狀況產生重大不利影響。

我們的內部政策和程序可能不足以保證遵守反腐敗和反賄賂法律法規。

我們的業務受到各種反腐敗和反賄賂法律法規的約束,包括《企業刑事責任法》和《FCPA》。《企業刑事責任法》和《反海外腐敗法》都對直接或通過中間人賄賂阿根廷政府官員的公司規定了責任。反腐敗法一般禁止爲獲取或保留業務或獲取任何不當商業優勢而向阿根廷政府官員提供任何有價值的東西。作爲我們業務的一部分,我們可能會與員工被視爲政府官員的實體打交道。我們有一個合規計劃,旨在根據這些新的和現有的法律和監管要求管理開展業務的風險。

儘管我們制定了旨在確保遵守適用的反腐敗和反賄賂法律法規的內部政策和程序,但無法保證此類政策和程序足夠。違反反腐敗法律和制裁法規可能會導致我們受到經濟處罰、我們的活動受到限制、我們的授權和許可證被吊銷、我們的聲譽受損以及可能對我們的業務、經營業績和財務狀況產生重大不利影響的其他後果。此外,與涉嫌違反反腐敗法律和制裁法規有關的訴訟或調查可能成本高昂。

阿根廷面臨阿根廷公司外國股東和阿根廷違約債券持有人的訴訟,這已經並可能導致針對阿根廷資產的不利判決或禁令,並限制其財務資源。

向解決投資爭端國際中心提交了針對阿根廷政府的未決索賠,這可能會導致對阿根廷政府實施新的制裁,這反過來又可能對阿根廷政府實施改革和促進經濟增長的能力產生重大不利影響。我們無法向您保證阿根廷政府未來不會違反其義務。

針對阿根廷政府的訴訟以及ICIDS索賠已導致重大判決,並可能導致進一步的重大判決,並可能導致扣押或禁止阿根廷政府打算用於其他用途的阿根廷資產。因此,阿根廷政府可能沒有所有必要的財政資源來履行其義務、實施改革和促進增長,這可能會對阿根廷經濟產生重大不利影響,從而對我們的業務、財務狀況和運營業績產生重大不利影響。ICIDS針對阿根廷政府的索賠懸而未決,這可能會導致阿根廷受到進一步賠償,這反過來又可能對阿根廷政府實施改革和促進經濟增長的能力產生重大不利影響。

彼得森和伊頓公園資本管理公司最近提起的訴訟中的裁決,Eton Park Master Fund,LTD.和Eton Park Fund,LP提交了開場陳述,支持就YPF和阿根廷的責任和損害賠償索賠進行簡易判決的交叉動議。原告請求地方法院做出對他們有利的簡易判決,而每個被告都辯稱,他們沒有責任,不應該賠償原告,並請求地方法院做出對他們有利的簡易判決,並駁回針對他們的所有剩餘索賠。

| 15 |

| 目錄 |

2023年3月31日,地方法院批准了YPF的簡易判決動議,並駁回了原告對YPF的全部簡易判決動議。地方法院裁定YPF不承擔合同責任,也不因違反合同而向原告承擔損害賠償,因此駁回了原告對YPF的索賠。地方法院駁回了阿根廷的簡易判決動議,原告與阿根廷之間的訴訟將繼續進行,阿根廷被勒令支付160億美元。2023年10月,阿根廷對該裁決提出上訴,2023年11月,地方法院裁定阿根廷的請求,允許阿根廷不存入1600億美元,但命令其提供YPF股票等其他資產作爲抵押品,以防止扣押。

隨後,伯福德資本正式請求地方法院命令阿根廷將阿根廷國家持有的YPF D類股票交付給伯福德資本,部分遵守地方法院的判決。阿根廷反對這一動議。截至本年度報告之日,地方法院尚未發佈新裁決。 我們無法保證不會對阿根廷提起新的訴訟,也無法保證這些案件不會影響阿根廷的經濟和我們的業務。

與巴西有關的風險

巴西政府已經並將繼續對巴西經濟施加重大影響,再加上巴西的政治和經濟狀況,可能會對我們產生不利影響。

我們可能會受到以下因素以及巴西聯邦政府對這些因素的反應的不利影響:

| · | 經濟和社會不穩定; |

|

|

|

| · | 加息; |

|

|

|

| · | 外匯管制和對海外匯款的限制; |

|

|

|

| · | 對農產品出口的限制和徵稅; |

|

|

|

| · | 匯率波動; |

|

|

|

| · | 通貨膨脹; |

|

|

|

| · | 國內資本和信貸市場的波動性和流動性; |

|

|

|

| · | 巴西經濟的擴張或收縮,以國內生產總值增長率衡量; |

|

|

|

| · | 針對政黨、民選官員或其他公職人員的腐敗指控,包括與Lava Jato調查有關的指控; |

|

|

|

| · | 政府與我們界別有關的政策;以及 |

|

|

|

| · | 財政或貨幣政策和稅收立法修正案;以及巴西國內或影響到的其他政治、外交、社會或經濟發展。 |

歷史上,巴西政府經常干預巴西經濟,偶爾也會對經濟政策和法規做出重大改變,包括制定新稅法、改變貨幣、財政和稅收政策、貨幣貶值、資本管制和進口限制等。

近年來,巴西經濟經歷了波動性增長和放緩。2021年,巴西經濟開始大幅增長。巴西GDP 2021年增長4.6%,2022年增長2.9%,2023年增長2.5%,2024年前六個月增長2.5%。

| 16 |

| 目錄 |

通貨膨脹和利率最近有所上升,巴西人 真實 相對於美元大幅疲軟。巴西不利的經濟狀況可能會對我們的業務、財務狀況和運營業績產生重大不利影響。

根據與 Lava Jato (Car華盛頓)在巴西的腐敗行動中,包括國會議員在內的一些高級政客和巴西某些主要國有公司的高管已辭職或被捕,而其他人則因不道德和非法行爲指控而接受調查。由於或與之相關的問題已經曝光並可能繼續曝光 Lava Jato 業務和其他類似業務對巴西經濟、市場和巴西發行人在不久的將來發行的證券的交易價格產生了不利影響,我們預計它們將繼續產生不利影響。

這些調查的最終結果尚不確定,但它們已經對涉案公司的形象和聲譽以及市場對巴西經濟、政治環境和巴西資本市場的普遍看法產生了不利影響。這些調查的進展已經並可能繼續對我們產生不利影響。我們無法預測這些調查是否會給巴西帶來進一步的政治或經濟不穩定,或者是否會對巴西聯邦政府高層成員提出新的指控。此外,我們無法預測這些調查的結果,也無法預測它們對巴西經濟的影響。

巴西持續的經濟不確定性和政治不穩定可能會對巴西經濟、我們的業務以及我們股票和美國存託憑證的市場價格產生不利影響。

巴西的政治環境歷史上影響並繼續影響該國經濟的表現。政治危機已經並將繼續影響投資者和公衆的信心,歷史上導致經濟減速和巴西公司發行的證券波動性加劇。

此外,巴西的聯邦預算自2014年以來一直處於赤字狀態。同樣,巴西各組成州的政府也面臨着財政擔憂,因爲它們的債務負擔沉重,收入下降,支出不靈活。雖然巴西國會批准了政府支出上限,將在至少10年內將基本公共支出增長限制在前一年的通貨膨脹率,但當地和外國投資者認爲,財政改革,特別是巴西國會於2019年批准的巴西養老金制度改革,將對巴西遵守支出上限至關重要。截至本年度報告之日,巴西國會關於財政改革的討論仍在進行中。對巴西政府預算狀況和財政立場的信心下降可能導致信用評級機構下調巴西主權債務評級,對巴西經濟產生負面影響,導致雷亞爾進一步貶值,通脹和利率上升,從而對我們的業務、經營業績和財務狀況產生不利影響。

巴西政府實施影響此類實施的政策或法規變化的不確定性可能會導致巴西經濟不穩定,並增加巴西公司在海外發行的證券(包括我們的證券)的波動性。上述任何因素都可能造成額外的政治不確定性,對巴西經濟、我們的業務、財務狀況、運營業績以及我們股票和美國存託憑證的市場價格產生不利影響。

| 17 |

| 目錄 |

通貨膨脹,加上巴西政府抗擊通貨膨脹的措施,可能會阻礙巴西經濟增長並提高利率,這可能會對我們產生重大不利影響。

巴西過去經歷過顯著的高通貨膨脹率。因此,巴西政府採取了貨幣政策,導致巴西的利率位居世界最高之列。中央銀行貨幣政策委員會根據巴西的經濟增長水平、通貨膨脹率和其他經濟指標,爲巴西金融系統制定了官方利率目標。SELIC比率隨着時間的推移有升有降,截至2024年6月30日,每年爲10.50%。2021年通貨膨脹率爲17.8%,2022年爲5.5%,2023年爲3.18%。通貨膨脹率由一般市場價格指數(IGP-m)衡量,並由瓦加斯基金會計算。按照同樣的指數計算,2024年前六個月的累計通脹率爲2.0%。2021年、2022年和2023年的通貨膨脹率分別爲10.1%、5.8%和4.62%,這是由巴西地質統計研究所(IBGE)計算的擴展國家消費者價格指數(IPCA)衡量的通貨膨脹率。按照同樣的指數計算,2024年前六個月的累計通脹率爲2.85%。

通貨膨脹和政府對抗通貨膨脹的措施已經並可能繼續對巴西經濟和我們的業務產生重大影響。此外,巴西政府控制通脹的措施往往包括維持高利率的緊縮貨幣政策,從而限制信貸的可用性並減緩經濟增長。另一方面,巴西政府貨幣政策的放鬆可能會引發通脹上升。如果通貨膨脹上升,我們可能無法調整每日費率以抵消通貨膨脹對我們成本結構的影響,這可能會對我們產生重大不利影響。

利率上升可能會對我們產生重大不利影響。此外,截至2024年6月30日,我們的部分貸款受到利率波動的影響,例如巴西長期利率(隆戈·普拉佐柔道分類,或TJLP),以及同業存款利率(國際銀行文憑),或CDI。如果利率突然上升,我們履行財務義務的能力可能會受到重大不利影響。

稅法的變化或其解釋的變化可能會增加我們的稅收負擔,從而對我們的經營業績和財務狀況產生負面影響。

巴西政府定期對稅收制度實施變革,這可能會增加我們、我們的供應商和客戶的稅收負擔,這反過來可能會提高我們對銷售產品的收取價格,限制我們在現有市場開展業務的能力,因此對我們的經營業績和財務狀況產生重大不利影響。

這些變化包括修改稅率,以及有時頒佈臨時稅,臨時稅的收益指定用於指定的政府用途。過去,巴西政府曾提出過一些稅收改革提案,主要是爲了簡化巴西稅收體系,避免巴西各州和市內部和之間的內部糾紛,並重新分配稅收收入。稅收改革提案規定修改聯邦社會融合計劃規則(社會融合課程)或PIS,以及社會保障資金繳款(爲社會安全籌資捐款),或COFins、稅收、ICMS和某些其他稅收,例如工資稅和股息分配預扣稅的增加。

由於是否會實施任何改變的不確定性,這些擬議的稅收改革措施以及實施額外稅收改革可能導致的任何其他變化的影響尚未也無法量化。

巴西貨幣價值的波動真實與美元的關係可能會對我們產生不利影響。

外匯波動,尤其是巴西人的波動 真實兌美元匯率可能會顯着影響我們的經營業績,因爲:(1)我們的產品和生產中使用的基本供應品在國際上進行交易;(2)大豆價格是根據芝加哥期貨交易所(CBOT)的普遍價格定義的;和(3)大多數市場由來自不同國家的多個供應商提供服務,鑑於巴西貨幣相對於美元升值,國外農產品的競爭力可能會相對於我們的競爭力有所增強。價值的波動 真實與美元相關的風險可能會影響我們的出口收入、我們在巴西市場的美元銷售以及我們的財務費用和運營成本,這可能會對我們的業務、財務狀況和運營業績產生不利影響。

| 18 |

| 目錄 |

這個真實 在過去十年中,美元和其他外幣經常貶值和升值。巴西政府過去曾採用不同的匯率制度,包括突然貶值、週期性小幅貶值(調整頻率從每天到每月不等)、外匯管制、雙重匯率市場和浮動匯率制度。自1999年以來,巴西實行浮動匯率制度,央行干預外匯買賣。巴西與巴西之間的匯率不時出現大幅波動 真實 以及美元和其他貨幣。最近一段時期的貶值導致匯率大幅波動 真實兌美元和其他貨幣。

2021年,雷亞爾兌美元貶值7.4%,2021年12月31日,巴西雷亞爾兌美元匯率爲5.5799巴西雷亞爾。2022年,雷亞爾兌美元升值6.5%,2022年12月31日巴西雷亞爾兌美元匯率爲1.00美元兌換5.2177巴西雷亞爾。2023年,雷亞爾兌美元升值7.2%,2023年12月31日,雷亞爾兌美元匯率爲4.8413雷亞爾。2024年(至2024年9月30日),雷亞爾兌美元貶值12.5%,2024年9月30日巴西雷亞爾/美元匯率爲1.00美元兌換5.4481巴西雷亞爾。無法保證雷亞爾未來不會對美元貶值或升值。

我們還持有衍生金融工具以對沖與以外幣計價的出口收入和運營成本相關的風險。如果我們未能妥善管理這些工具,我們可能會受到這些風險的不利影響,這可能會對我們的財務狀況和經營業績產生重大不利影響。

對外國人在巴西收購農業財產實施限制可能會嚴重限制我們在巴西拉格羅投資的發展。

2010年8月,當時的巴西總統總裁批准了聯邦總檢察長辦公室的意見,確認了巴西第5709/71號法律的合憲性,該法律對外國人和外國人控制的巴西公司在巴西收購和租賃土地施加了重要限制。根據這項立法,由外國人持有多數股權的公司不得收購超過100個無限期勘探模塊或MEI(巴西農業發展研究所採用的衡量單位)。殖民地國家改革研究所這些公司在巴西不同地區收購面積從5公頃到100公頃不等的土地,未經巴西國會事先批准,而這類公司收購面積小於100兆瓦的土地則需要事先獲得國家土地管理協會的批准。此外,外國人或外國人控制的公司擁有的農業面積不得超過本市表面積的25%,其中40%以下的面積不得屬於外國人或同一國籍的外國人控制的公司,即屬於外國人或同一國籍的外國人控制的公司的農業面積總和不得超過有關市表面積的10%。此外,INCRA還被要求核實在這些地區開發的農業、養牛、工業或殖民項目是否事先得到了有關當局的批准。在進行分析後,INCRA將簽發證書,允許收購或農村租賃該房產。不符合上述要求的農業財產的購買和農村租賃需要得到巴西國會的授權。在這兩種情況下,都不可能確定覈准程序的估計時間範圍,因爲截至本年度報告之日,尚無已知的頒發這種證書的案例。

最近,巴西2020年4月7日第13,986號法律修訂了第5,709/91號法律,規定上述限制不適用於:(i)以房地產作爲抵押品的質押(包括房地產財產的受託轉讓);和(ii)因執行房地產抵押品而產生的債務結算。這兩種例外都有利於外國人或外國實體控制的巴西公司。這兩種例外都有利於外國人或外國實體控制的巴西公司。

| 19 |

| 目錄 |

根據巴西的適用法規,並考慮到一些投資者通過持有巴西部分股份的投資基金或其他方式間接在巴西使用資源,巴西無法確定最終外國人受益人擁有的股本百分比。如果當局了解到,就第5,709/71號法律而言,Brasilagro應被視爲外國公司,則Brasilagro可能會面臨涉及公司在AGU-LA-2010意見批准後進行的收購和租賃的最終問題,以及第5號法律的可能適用,709/71可能會導致未來農村房產收購的嚴重延誤,並且我們無法獲得必要的批准。此外,違反現有限制進行的收購可能會被宣佈無效。

第5,709/71號法律的適用性正在最高聯邦法院(Supremo Tribunal Federation,或「STF」)第2,463號原始民事訴訟(ACO)和違反基本戒律訴訟(ADPF)第342號中討論。第一項行動(ACO No. 2,463)涉及聖保羅司法總審計長的第461/2012-E號意見(科雷格多里亞 聖保羅州傑拉爾德賈斯蒂薩),其中規定聖保羅州的公證員和房地產登記官員將免於遵守Lei第5,709/71號和第74,965/74號法令實施的限制。巴西農村協會於2015年4月16日提出了第二項行動(ADPF No. 342),該協會對第5,709/71號法律第1條第1款的適用性以及總檢察長辦公室(AGU)2010年發表的意見的適用性提出質疑。

巴西最高法院(STF)於2021年2月開始審理,特別報告員Justice投票表示,必須維持對被認爲由外國實體控制的公司的限制。第二位法官要求暫停訴訟程序以審查檔案,從而中斷了審判,審判直到2021年6月才恢復,當時法官提出了與特別報告員不同的投票,證實了限制的不適用性。

截至本年度報告之日,最終判決仍在等待中,我們無法提供最高法院發佈最終判決的時間表的估計。根據這些未決訴訟的最終決定,巴西拉格羅可能需要修改其業務戰略和預期實踐,以便能夠收購農業財產。

這可能會增加我們必須完成的交易數量,從而增加我們的交易成本。它還可能要求我們採取替代措施,以減少我們對擁有或租賃農村房產的公司的興趣,包括成立合資企業,這增加了與這些交易相關的複雜性和風險。

任何監管限制和限制都可能嚴重限制巴西拉格羅收購農業財產的能力,增加此類交易的投資、交易成本或複雜性,或使所需的監管程序複雜化,其中任何一種都可能對巴西拉格羅和我們以及我們成功實施業務戰略的能力產生重大不利影響。

| 20 |

| 目錄 |

我們受到巴西廣泛的環境法規的約束,這可能會顯着增加公司的費用。

我們在巴西的商業活動受到廣泛的聯邦、州和市政環保法律法規的約束,這些法規對我們施加了各種環境義務,例如環境許可要求、污水排放的最低標準、農用化學品的使用、固體廢物的管理、保護某些地區(法定保護區和永久保護區),以及需要特別授權才能使用水等。不遵守此類法律和法規可能會對違規者處以行政罰款、強制中斷活動和刑事制裁,以及糾正損害和支付環境損害賠償和第三方損害賠償的義務,沒有任何上限。此外,巴西環境法對環境損害採取了連帶和嚴格的責任制度,即使在沒有疏忽的情況下,污染者也要承擔責任,並使我們對承包商或承購者的義務承擔連帶責任。如果我們承擔了環境責任,我們爲糾正可能的環境破壞而可能產生的任何成本都將導致我們的財務資源減少,否則,這些資金將留在我們目前或未來的戰略投資中,從而對我們的業務、財務狀況和運營結果造成不利影響。

隨着環境法及其執行變得越來越嚴格,我們未來遵守環境要求的費用可能會增加。此外,新法規的實施、現有法規的變化或其他措施的採取可能會導致我們用於環境保護的支出的金額和頻率與當前估計或歷史成本相比出現顯着差異。任何計劃外的未來費用都可能迫使我們減少或放棄戰略投資,因此可能對我們的業務、財務狀況和運營業績產生重大不利影響。

與我們運營的其他國家/地區相關的風險

我們的業務取決於我們經營或打算經營的國家/地區的經濟狀況。

我們已經在阿根廷、巴西、巴拉圭和玻利維亞的農田進行了投資,我們可能會在拉丁美洲和美國等國內外的其他國家進行投資。由於對牲畜和農產品的需求通常與當地市場的經濟狀況相關,而當地市場的經濟狀況又取決於市場所在國家的宏觀經濟狀況,因此我們的財務狀況和經營結果在相當程度上取決於我們開展業務的國家不時出現的政治和經濟狀況。拉丁美洲國家歷來經歷了經濟增長不均衡時期、經濟衰退時期、高通脹時期和經濟不穩定時期。某些國家已經經歷了嚴重的經濟危機,這可能仍會產生未來的影響。因此,各國政府可能沒有必要的財政資源來實施改革和促進增長。任何這些不利的經濟狀況都可能對我們的業務產生實質性的不利影響。

我們面臨着政治和經濟危機、不穩定、恐怖主義、內亂、徵用以及在新興市場開展業務的其他風險。

除了阿根廷和巴西外,我們還在巴拉圭和玻利維亞等其他拉丁美洲國家開展或打算開展業務。我們經營所在國家的經濟和政治發展,包括未來的經濟變化或危機(例如通貨膨脹或衰退)、政府僵局、政治不穩定、恐怖主義、內亂、法律法規變化、財產徵收或國有化以及外匯管制可能會對我們的業務、財務狀況和經營結果產生不利影響。

特別是,阿根廷和巴西的經濟波動以及這些國家政府採取的行動已經並可能繼續對在這些國家運營的公司(包括我們)產生重大影響。具體來說,我們已經並可能繼續受到通貨膨脹、利率上升、披索和巴西雷亞爾兌外幣價值波動、價格和外匯管制、監管政策、商業和稅收法規以及阿根廷和巴西以及其他可能影響阿根廷和巴西的政治、社會和經濟情況的影響。

| 21 |

| 目錄 |

儘管一個國家的經濟狀況可能與另一個國家的經濟狀況存在很大差異,但我們無法保證僅在一個國家發生的事件不會對我們的業務、普通股和/或ADS的市值或市場產生不利影響。

我們開展業務或打算開展業務的國家/地區的政府對其經濟產生重大影響。

新興市場政府,包括我們經營所在國家的政府,經常干預各自國家的經濟,偶爾會在貨幣、信貸、行業和其他政策法規方面做出重大變化。政府控制通脹的行動和其他政策和法規通常涉及價格管制、貨幣貶值、資本管制和進口限制等措施。我們的業務、財務狀況、經營業績和前景可能會受到政府政策或法規變化的不利影響,包括以下因素:

| · | 匯率和外匯管制政策; |

|

|

|

| · | 通貨膨脹率; |

|

|

|

| · | 勞動法; |

|

|

|

| · | 經濟增長; |

|

|

|

| · | 貨幣波動; |

|

|

|

| · | 貨幣政策; |

|

|

|

| · | 金融體系的流動性和償付能力; |

|

|

|

| · | 外國人對農村土地所有權的限制; |

|

|

|

| · | 通過世界貿易組織或其他國際組織進行貿易談判的進展; |

|

|

|

| · | 環境法規; |

|

|

|

| · | 對投資匯回和資金轉移到國外的限制; |

|

|

|

| · | 沒收或國有化; |

|

|

|

| · | 進出口限制或影響對外貿易和投資的其他法律和政策; |

|

|

|

| · | 價格管制或價格固定規定; |

|

|

|

| · | 對土地收購或使用或農業商品生產的限制 |

|

|

|

| · | 利率; |

|

|

|

| · | 關稅和通貨膨脹控制政策; |

|

|

|

| · | 信息技術設備的進口稅; |

| 22 |

| 目錄 |

| · | 國內資本和借貸市場的流動性; |

|

|

|

| · | 電力配給; |

|

|

|

| · | 稅收政策; |

|

|

|

| · | 武裝衝突或戰爭宣言;以及 |

|

|

|

| · | 每個企業所在國或影響每個企業所在國的其他政治、社會和經濟發展,包括政治、社會或經濟不穩定。 |

政府未來是否會實施影響這些或其他因素的政策或監管變化的不確定性可能會導致經濟不確定性和證券市場波動加劇,這可能會對我們的業務、經營業績和財務狀況產生重大不利影響。此外,最終減少對我們開展業務的任何國家的外國投資可能會對該國的經濟產生負面影響,影響利率和公司進入金融市場的能力。

其他市場的發展可能會影響我們經營或打算經營的拉丁美洲國家,因此我們的財務狀況和經營業績可能會受到不利影響。

像我們這樣的公司的證券市值可能會在不同程度上受到其他全球市場經濟和市場狀況的影響。儘管各國的經濟狀況有所不同,但投資者對一個國家發生的事件的看法可能會極大地影響其他國家(包括拉丁美洲國家)的資本流入和發行人的證券。近年來,多個新興經濟體發生的政治和經濟事件對拉丁美洲各經濟體造成了不利影響。此外,拉丁美洲經濟體可能會受到作爲貿易伙伴或影響全球經濟並對我們的活動和運營結果產生不利影響的發達經濟體事件的影響。

拉丁美洲國家的土地可能會被沒收或佔領。

倡導土地改革和財產重新分配的社會運動在拉丁美洲非常活躍,特別是在巴西,有無地農村工人運動(Movimento dos Trabalhadores Rurais Sem Terra)和田園土地委員會(Comissão Pastoral da Terra)等運動,在玻利維亞,有玻利維亞文化間聯合會(Confederación de Interculturales de Bolivia)等運動。

大量人入侵和佔領農業用地是此類運動成員的常見做法,在某些地區,包括我們目前投資的地區,警察保護或驅逐程序等補救措施不足或不存在。因此,我們無法向您保證我們的農業財產不會受到任何社會運動的入侵或佔領。任何入侵或佔領都可能嚴重損害我們土地的使用,並對我們的業務、財務狀況和運營業績產生不利影響。

此外,環保社會運動經常促進和組織聚會和其他活動,以防止、推遲或減少合法森林砍伐,這可能會對我們的運營產生不利影響。因此,我們無法向您保證我們的運營不會受到環境社會運動的不利影響,這可能導致運營許可證被吊銷、延誤或修改,或者我們的財產不會受到入侵或佔領。土地入侵或佔領可能會嚴重影響我們財產的正常使用,或者對我們或我們普通股和美國存託憑證的價值產生重大不利影響。

| 23 |

| 目錄 |

交通和物流服務中斷或公共基礎設施投資不足可能會對我們的經營業績產生不利影響。

我們經營所在國家農業部門的主要缺點之一是關鍵增長地區遠離主要港口。因此,交通運輸和港口基礎設施的有效利用對於我們運營所在國家、特別是我們業務的整體農業增長至關重要。可能需要改善交通基礎設施,以使農業生產以有競爭力的價格進入出口碼頭。目前,我們經營所在國家的很大一部分農業生產是通過卡車運輸的,這種運輸方式比美國和其他國際生產商提供的鐵路運輸貴得多。我們對卡車運輸的依賴可能會影響我們作爲低成本生產商的地位,從而使我們在世界市場上的競爭能力可能會受到損害。

儘管巴西部分地區已考慮實施道路和鐵路改善項目,並在某些情況下實施了道路和鐵路改善項目,但道路和鐵路改善項目仍需要大量投資,而這些項目可能無法及時完成,甚至可能無法完成。開發基礎設施系統的任何延誤或失敗都可能會減少對我們產品的需求、阻礙我們產品的交付或給我們帶來額外成本。我們目前外包運營業務所需的運輸和物流服務。這些服務的任何中斷都可能導致我們的農場和加工設施出現供應問題,並損害我們及時向客戶交付產品的能力。

BrasilAgro的運營結果取決於BrasilAgro運營所在地巴拉圭的經濟狀況,經濟狀況的任何下降都可能會損害我們的運營結果或財務狀況。

截至2024年6月30日,BrasilAgro 29%的資產位於巴拉圭。巴拉圭有經濟和政治不穩定、外匯管制、監管政策頻繁變化、腐敗和司法安全薄弱的歷史。然而,2013年,巴拉圭的GDP增長率爲14%,位居拉丁美洲最高,位居世界第三。此後,2014年GDP增長4%,2015年增長3%,2016年增長3.8%,2017年增長4.3%,2018年增長3.6%,2019年增長0.2%,2020年下降6.0%,2021年增長4.1%,2022年增長0.08%,2023年下降0.5%。巴拉圭的國內生產總值與巴拉圭農業部門的表現密切相關,農業部門的表現可能不穩定,可能會對我們的業務、財務狀況和經營業績產生不利影響。

巴拉圭的匯率是自由浮動的,巴拉圭中央銀行積極參與外匯市場,以減少波動。2018年,巴拉圭貨幣兌美元升值6.7%,2019年升值8.26%,2020年升值6.7%,2021年貶值0.55%,2022年升值6.92%。2023年,巴拉圭貨幣兌美元升值1.08%。當地貨幣大幅貶值可能會對我們的業務、財務狀況和經營業績產生不利影響。然而,由於我們的大部分原材料和供應成本以美元計價,當地貨幣的大幅貶值可能會對我們的業務、財務狀況和運營業績產生不利影響,並影響其他費用,例如專業費用和維護成本。

此外,巴拉圭或其任何主要貿易伙伴(例如巴西或阿根廷)的經濟增長顯着惡化,可能會對巴拉圭的貿易平衡產生重大影響,並可能對其經濟增長產生不利影響,從而對我們的業務、財務狀況和經營業績產生不利影響。

| 24 |

| 目錄 |

BrasilAgro的運營結果取決於BrasilAgro運營所在地玻利維亞的經濟狀況,經濟狀況的任何下降都可能會損害我們的運營結果或財務狀況。

截至2024年6月30日,BrasilAgro 5%的資產位於玻利維亞。玻利維亞經常面臨經濟、社會和政治不穩定、外匯管制、監管框架政策頻繁變化、公民和罷工、高稅率以及國家官員、司法部門和私營部門腐敗的歷史。

玻利維亞面臨社會動盪的高風險,導致抗議者設置遊行和路障向政府施壓,增加了破壞風險。此外,針對環境問題的抗議活動通常與勞資糾紛嚴重重疊,這可能會升級爲破壞性的抗議形式,包括佔領工地。

反過來,玻利維亞經濟在拉丁美洲排名第14,嚴重依賴天然氣和礦產等出口商品。玻利維亞過去十年GDP增長率位居拉丁美洲前列,2015年增長4.9%,2016年增長4.3%,2017年增長4.2%,2018年增長4.2%,2019年增長2.2%,而2020年下降7.3%,2021年增長6.1%,2022年增長3.2%,2023年增長3.5%。在此背景下,過去30年來通貨膨脹一直相對較低並得到控制。2023年通脹率約爲3.6%。此外,玻利維亞正在成爲南方共同市場的積極合作伙伴,南方共同市場是一個旨在逐步整合巴西、阿根廷、烏拉圭、巴拉圭和玻利維亞之間的經濟活動的共同市場。

全球和國內宏觀經濟的嚴重惡化、玻利維亞的政治穩定或社會動盪,可能會對其經濟增長產生重大影響,從而對我們的業務、財務狀況和經營業績產生不利影響。

與我們農業業務相關的風險

我們的農產品市場價格波動可能會對我們的財務狀況和經營業績產生不利影響。

與其他大宗商品的價格一樣,農作物、油籽和副產品的價格歷來具有周期性,對國內外供需變化敏感,預計會大幅波動。此外,我們生產的農產品和副產品在大宗商品和期貨交易所交易,因此受到投機交易的影響,這可能會對我們造成不利影響。我們能夠獲得的農產品價格取決於許多我們無法控制的因素,包括:

| · | 現行世界價格,歷史上,根據全球需求和供應,這些價格在相對短的時間內會發生重大波動; |

|

|

|

| · | 一些主要國家(主要是美國和歐盟國家)某些消費市場農業補貼水平和貿易壁壘的變化,以及政府採取的其他影響市場條件和行業價格的政策; |

|

|

|

| · | 原材料成本、燃料成本和保險費增加,特別是考慮到俄羅斯和烏克蘭之間以及以色列和哈馬斯之間持續的衝突; |

|

|

|

| · | 政府生物燃料政策的變化; |

|

|

|

| · | 在農業和農業企業部門經營的其他大公司採取的經營戰略; |

|

|

|

| · | 世界庫存水平,即逐年結轉的商品供應量; |

|

|

|

| · | 農產品種植地區的氣候條件和自然災害; |

|

|

|

| · | 我們競爭對手的生產能力;以及 |

|

|

|

| · | 競爭商品和替代品的需求和供應。 |

| 25 |

| 目錄 |

我們產品的全球市場競爭可能會對我們的業務和運營業績產生不利影響。

在我們經營的每個市場以及我們的許多產品線上,我們都面臨着激烈的全球競爭。穀物、油籽和副產品市場競爭激烈,對行業產能、庫存和世界經濟的週期性變化也很敏感,其中任何一項都可能嚴重影響我們產品的銷售價格,從而影響我們的盈利能力。阿根廷在油籽市場上比在穀物市場上更具競爭力。由於我們的許多產品都是農產品,它們在國際市場上的競爭幾乎完全是以價格爲基礎的。大宗商品市場高度分散。小生產者也可能是重要的競爭對手,其中一些在非正規經濟中運營,能夠通過滿足較低的質量標準來提供較低的價格。來自其他生產商的競爭是擴大我們在國內外市場銷售的障礙。這些產品的許多其他生產商比我們更大,擁有更多的財政和其他資源。此外,許多其他生產商從各自的國家獲得補貼,而我們沒有從阿根廷政府獲得任何此類補貼。這些補貼可能允許其他國家的生產商以比我們更低的成本進行生產,和/或比我們更長時間地忍受低價和運營虧損。與我們的產品有關的任何競爭壓力的增加都可能對我們的財務狀況和經營結果產生實質性的不利影響。

不可預測的天氣條件、害蟲侵擾和疾病可能會對我們的農作物產量和養牛業產生不利影響。

嚴重不利天氣條件的發生,尤其是乾旱、冰雹或洪水,是不可預測的,可能會對我們的農作物生產以及較小程度上對我們的牛和羊毛生產產生潛在的破壞性影響,並且可能會對我們在業務中銷售和使用的農產品的供應和價格產生不利影響。嚴重不利天氣條件的發生可能會降低我們農田的產量,或要求我們增加投資水平以維持產量。此外,高於平均水平的氣溫和降雨量可能會導致害蟲和昆蟲的存在增加,從而可能對我們的農業生產產生不利影響。

據美國農業部USDA估計,阿根廷2024/2025年農作物產量(小麥、玉米和大豆)將達到12000萬噸。預計大豆產量將達到5100萬噸,小麥產量將達到1800萬噸,玉米產量將達到51億噸。

疾病和瘟疫的發生和影響可能是不可預測的,對農產品來說是毀滅性的,可能導致所有或很大一部分受影響的收成不適合銷售。我們的農產品也容易受到與過度潮溼條件相關的真菌和細菌的影響。即使只有一部分生產受到損害,我們的運營結果也可能受到不利影響,因爲所有或大部分生產成本已經產生。儘管有些疾病是可以治療的,但治療成本很高,我們無法向您保證未來的此類事件不會對我們的經營業績和財務狀況產生不利影響。此外,如果我們未能控制特定的瘟疫或疾病並且我們的生產受到威脅,我們可能無法向主要客戶供貨,這可能會影響我們的運營結果和財務狀況。

因此,我們無法向您保證當前和未來的惡劣天氣條件或害蟲侵擾不會對我們的經營業績和財務狀況產生不利影響。

我們的牛患有疾病,這可能會對牛生產的需求和銷售產生負面影響。

我們牛群中的疾病,例如乳腺炎、結核病、布魯桿菌病和口蹄疫,可能對肥育生產產生不利影響,使奶牛無法生產供人類消費的肉類。牛疾病的爆發還可能導致某些重要市場(例如美國)對我們的牛產品關閉。此外,任何這些或其他動物疾病的爆發或對爆發的擔憂可能會導致我們客戶的訂單被取消,特別是如果該疾病可能影響人類,或造成不利宣傳,從而對消費者對我們產品的需求產生不利的實質影響。

| 26 |

| 目錄 |

儘管我們遵守國家獸醫健康指南,其中包括實驗室分析和疫苗接種,以控制牛群中的疾病,特別是口蹄疫,但我們無法保證未來不會爆發牛疾病。未來我們的牛群爆發疾病可能會對我們的牛銷售產生不利影響,從而對我們的經營業績和財務狀況產生不利影響。

疾病的起源和傳播可能因許多我們無法控制的原因而發生,包括其他生產商未能遵守適用的健康和環境法規。新疾病的出現或現有疾病的突變或擴散可能會損害或完全摧毀我們的牛群,這將對我們的業務、財務狀況和運營業績產生重大不利影響。

由於農作物價格波動,我們可能會面臨重大損失,因爲我們的很大一部分產量未經對沖,並面臨農作物價格風險。

由於我們沒有對所有農作物進行對沖,我們無法保證所有生產的最低價格,因此面臨與農作物價格水平和波動相關的重大風險。我們受到農作物價格波動的影響,這可能導致我們的農作物價格低於我們的生產成本。鑑於我們的期貨和期權頭寸以美元計價,因此我們還面臨與對沖作物相關的匯率風險。

此外,如果惡劣天氣或任何其他災難導致農作物產量低於市場上已售出的頭寸,我們可能會在回購已售出合同時遭受重大損失。

徵收出口稅和/或市場干預可能會對我們的銷售和運營業績產生不利影響。

阿根廷政府維持現有的出口稅收制度,作爲控制通貨膨脹和匯率波動、增加財政收入、減少阿根廷財政赤字的機制。

我們生產出口產品,因此出口稅的增加可能會導致我們的產品價格下降,從而導致我們的銷售額下降。出口稅可能會對我們的銷售和經營業績產生重大不利影響。

此外,阿根廷政府此前已制定市場條件和行業價格,以防止基礎產品價格因通貨膨脹而大幅上漲。自2005年以來,阿根廷政府爲了增加國內牛肉供應並降低國內價格,採取了多項措施,包括提高營業稅和制定最低平均屠宰牲畜數量。我們無法確保阿根廷政府不會通過制定價格或監管其他市場條件來干預其他領域。因此,我們無法保證我們將來能夠自由談判所有產品的價格,或者阿根廷政府施加的任何價格或其他市場條件將允許我們自由談判產品的價格。

我們無法保證阿根廷政府未來將採取哪些措施,也無法保證這些措施不會對我們的財務狀況和經營業績產生負面影響。有關更多信息,請參閱「項目10。其他信息- D.外匯管制。」

| 27 |

| 目錄 |

我們依賴於我們主要出口市場的國際貿易、經濟和其他條件。

我們的產品在出口市場有效競爭的能力可能會受到許多我們無法控制的因素的不利影響,包括宏觀經濟狀況惡化、匯率波動、徵收關稅或其他貿易壁壘或這些市場中的其他因素,例如與農產品化學含量有關的法規以及安全和健康法規。

美國和中國之間貿易緊張局勢的升級,以及徵收關稅、報復性關稅或其他貿易限制,可能會導致我們主要出口市場的全球出口流量重新平衡,並加劇全球競爭,這反過來可能會對我們的業務、財務狀況和經營業績產生不利影響。

如果我們產品在一個或多個重要市場的競爭力受到其中任何一個事件的影響,我們可能無法以可比條款將我們的產品重新分配到其他市場,因此可能會對我們的業務、財務狀況和經營業績產生不利影響。

我們可能面臨與阿根廷土地徵用相關的風險。

土地掠奪是阿根廷一個長期存在的問題,多年來隨着每次經濟危機而升級。

兩個群體之間存在着衝突,一方面聲稱擁有體面住房的權利,另一方面聲稱擁有私有財產的權利應該受到尊重。阿根廷過去50年持續的週期性經濟危機也導致貧困率急劇上升,導致住房赤字。

因此,我們無法保證政府對此類干擾的反應將恢復投資者對阿根廷土地的信心,這可能會對土地價值、我們的財務狀況和運營業績產生不利影響。

對外國國民在我們經營所在國家收購農業財產實施限制可能會嚴重限制我們在這些國家的業務發展。

根據公司在阿根廷開展的資產和/或活動,可能會根據第26,737號法律對外國人的持股比例施加限制”Régimen de Protección al Dominio Nacional sobre la Propiedad,Posesión o Tencil de las Tierras Rurales“該法案規定了對外國人或外國人控制的公司的所有權和佔有的限制,無論其預期用途或生產目的地如何。

第70/2023號法令第154條廢除了第26,737號法律。在這一廢除之後,對阿根廷政府提起了集體訴訟,要求違憲並取消第70/2023號法令第154條,該條廢除了第26,737號法律。最初,這一訴訟被法院駁回。然而,2024年3月21日,拉普拉塔聯邦上訴法院推翻了這一裁決,宣佈第70/2023號法令第154條違憲。儘管拉普拉塔聯邦上訴法院的裁決不是最終裁決,但第70/2023號法令第154條違憲的宣佈暫時恢復了第26,737號法律規定的限制。因此,這些限制目前正在生效,等待最高法院的最終裁決。關於巴西,有關這一主題的更多信息,請見「與巴西有關的風險--對外國國民在巴西收購農業資產施加限制,可能會對我們在巴西農業公司的投資發展造成實質性限制。」

全球經濟衰退可能會減少對我們產品的需求或降低價格。

對我們銷售的產品的需求可能會受到我們無法控制的國際、國家和地方經濟狀況的影響。真實或感知的經濟氣候的不利變化,例如燃料價格上漲、利率上升、房地產和房地產市場的下跌和/或波動、限制性更強的信貸市場、更高的稅收和政府政策的變化,可能會降低需求水平或我們生產的產品的價格。我們無法預測這種放緩或經濟復甦的時間、持續時間、幅度或強度。如果經濟衰退持續很長一段時間或惡化,我們可能會經歷需求和價格長期下降的情況。此外,經濟衰退已經並可能對我們的供應商產生負面影響,這可能導致商品和服務中斷以及財務損失。

| 28 |

| 目錄 |

國際信貸危機可能會對我們的主要客戶產生負面影響,進而可能會對我們的經營業績和流動性產生重大不利影響。

2008年發生的國際信用危機可能會對世界各地的企業產生重大負面影響。儘管我們相信當前條件下可用的借貸能力和潛在農田出售產生的收益將爲我們提供充足的流動性,但危機對我們主要客戶的影響無法預測,並且可能相當嚴重。我們的重要客戶獲取流動性的能力中斷可能會導致他們的業務嚴重中斷或整體惡化,這可能導致他們未來對我們產品的訂單減少,以及他們無法或未能履行對我們的付款義務,其中任何一種情況都可能對我們的經營業績和流動性產生重大不利影響。

我們和我們的供應商使用的原材料交付延遲或失敗可能會對我們產生不利影響。

我們依賴供應商爲我們提供肥料、種子、其他原材料和機械服務。此類物品的交付可能會延遲我們的種植工作,直到我們能夠與其他供應商達成協議,或者可能會因機械交付延遲而推遲我們的收穫。因此,我們的供應商在交付原材料或投入物或向我們提供服務方面的任何延誤、故障或缺陷都可能對我們的業務和經營業績產生不利影響。

我們不爲所有農作物儲存設施提供保險;因此,如果火災或其他災難損壞了我們的部分或全部收成,我們將無法完全獲得保險。

一般來說,我們的生產面臨不同的風險和危害,包括惡劣的天氣條件、火災、疾病、害蟲侵擾和其他自然現象,以及穀物或化肥和用品的盜竊或其他意外損失。由於通常會出現價格季節性下跌,我們在收穫期間儲存了很大一部分糧食產量。目前,我們將很大一部分糧食生產儲存在塑料筒倉中。我們不爲塑料筒倉提供保險。儘管我們的塑料筒倉放置在幾個不同的位置,並且自然災害不太可能同時影響所有這些筒倉,但損壞儲存穀物的火災或其他自然災害,特別是如果此類事件發生在收穫後不久,可能會對我們的經營業績和財務狀況產生不利影響。

| 29 |

| 目錄 |

我們對BrasilAgro的投資可能會對我們產生重大不利影響。

我們與Brasilagro合併了我們的財務報表。巴西農業公司成立於2005年9月23日,目的是利用巴西農業部門的機會。Brasilago尋求收購和開發未來的資產,以生產各種農產品(可能包括甘蔗、穀物、棉花、林業產品和牲畜)。Brasilagro是一家自2006年以來一直在運營的公司。因此,它擁有不斷髮展的業務戰略和既定的記錄。Brasilago的商業戰略可能不會成功,如果不成功,Brasilago可能無法成功修改其戰略。Brasilago實施其擬議業務戰略的能力可能會受到許多已知和未知因素的實質性和不利影響。如果我們註銷我們在Brasilago的投資,這可能會對我們的業務產生實質性的不利影響。截至2024年6月30日,我們擁有Brasilago已發行普通股的35.22%(扣除庫藏股)。

| 30 |

| 目錄 |

事實和情況的變化可能會影響我們對BrasilAgro的會計合併。

截至2024年6月30日,我們擁有BrasilAgro已發行普通股中35.22%(扣除庫存股)。我們的結論是,在會計基礎上,我們根據以下內容對BrasilAgro行使「事實控制」:(i)我們投票權的百分比和集中度,以及擁有重大投票權的股東的缺席(ii)出席股東大會的記錄和其他股東投票的記錄;和(iii)我們通過董事會對指導BrasilAgro的相關活動行使有效控制,我們任命了九名董事會成員中的五名。然而,我們評估的事實模式變化可能會導致從會計角度來看的去綜合。

勞資關係可能會對我們產生負面影響。

截至2024年6月30日,阿根廷農業業務約36%的員工由工會根據集體協議代表。雖然我們目前與員工和工會保持着良好的關係,但我們無法保證這種良好的勞資關係將在未來繼續積極發展,也無法保證其最終惡化不會對我們產生重大或負面影響。

我們的內部流程和控制可能不足以遵守廣泛的環境法規,當前或未來的環境法規可能會阻止我們充分開發我們的土地儲備。

我們的活動受到一系列與環境保護有關的聯邦、州和地方法律法規的約束,這些法規規定了各種環境義務。義務包括強制維護我們物業中的某些保留區,管理殺蟲劑和相關的危險廢物,以及獲得用水許可證。我們擬議的業務可能涉及處理和使用可能導致某些受管制物質排放的危險材料。此外,我們產品的儲存和加工可能會造成危險條件。我們可能面臨刑事和行政處罰,除了有義務糾正我們的業務對環境的不利影響,並賠償第三方的損害,包括支付不遵守這些法律和法規的罰款。由於阿根廷的環境法及其執行越來越嚴格,我們的資本支出和環境合規費用未來可能會大幅增加。此外,由於未來監管或其他發展的可能性,與環境有關的資本支出和支出的數額和時間可能與目前預期的有很大不同。遵守環境法規的成本可能會導致其他戰略投資的減少,這可能會減少我們的利潤。任何不可預見的重大環境成本可能會對我們的業務、運營結果、財務狀況或前景產生重大不利影響。我們不能確保我們的內部流程和控制足以遵守廣泛的環境法規。

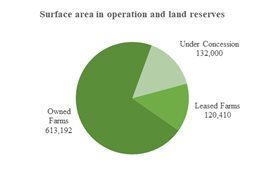

截至2024年6月30日,我們擁有超過331,214公頃的土地儲備,這些土地是以非常有吸引力的價格購買的。此外,我們還保留了超過132,000公頃的特許權供未來開發。我們相信,有技術工具可以提高這些農田的生產力,從而實現長期回報。然而,當前或未來的環境法規可能會阻止我們充分開發我們的土地儲備,因爲我們要求我們將部分土地保留爲天然林地,不得用於生產目的。

可能會對我們生產的含有轉基因生物的農產品和食品制定新的限制,從而對我們的業務產生潛在的不利影響。

我們的農產品含有轉基因生物,其比例根據年份和生產國家而不同。在食品中使用轉基因生物在我們運營的市場上得到了不同程度的接受。例如,阿根廷和巴西已批准在食品中使用轉基因生物,這些國家的轉基因生物和非轉基因生物穀物在穀物起源過程中經常生產和混合。在其他地方,有關轉基因食品的負面宣傳導致政府監管限制轉基因生物產品的銷售。我們的部分產品可能會對主要市場的轉基因生物產品實施新的限制,這可能會對我們的業務、股權和運營結果產生不利影響。

| 31 |

| 目錄 |

如果我們的產品受到污染,我們可能會面臨產品責任索賠、產品撤回和出口限制,這可能會對我們的業務產生不利影響。

雖然我們遵守嚴格的生產協議,但產品的銷售意味着對消費者造成傷害的風險。這些傷害可能是由於第三方操縱、生物恐怖主義、產品污染或變質造成的,包括生長階段、儲存、處理或運輸過程中引入的細菌、病原體、異物、物質、化學品、其他製劑或廢物的存在。

我們無法確定消費我們的產品不會在未來導致與健康相關的疾病,或者我們不會受到與此類問題相關的索賠或判斷的影響。即使產品責任索賠不成功或未完全實現,圍繞我們的產品導致疾病或傷害的任何索賠的負面宣傳也可能會對我們在當前和潛在客戶中的聲譽以及我們作爲公司的形象產生負面影響,我們還可能引發重大事件。此外,此類性質的索賠或責任可能不包括我們對他人可能擁有的任何補償或繳款權,這可能會對我們的業務、股權狀況和我們的運營結果產生重大不利影響。

我們持有阿根廷證券,其波動性可能比美國證券更大,違約風險更大。

我們目前和過去都對阿根廷政府債務證券、公司債務證券和股權證券進行了某些投資。特別是,我們持有IRSA的大量權益,IRSA是一家阿根廷公司,該公司遭受了重大損失,特別是在2001和2002財年。儘管我們持有的這些投資(IRSA除外)往往是短期的,但對此類證券的投資涉及某些風險,包括市場波動(高於通常與美國政府和公司證券相關的風險)以及本金損失。

我們已經投資和可能投資於未來的一些發行人,包括阿根廷政府,過去在償還債務方面經歷了巨大困難,導致某些債務的重組。我們無法保證我們已投資或可能投資的發行人未來不會遇到類似或其他困難,從而可能對我們對該發行人的投資價值產生不利影響。此外,此類發行人以及此類投資通常會面臨本節中針對我們描述的風險,因此價值可能很小或沒有價值。

與我們的業務相關的風險

我們的債務水平可能會對我們的運營和到期償還債務的能力產生不利影響,而我們以優惠條件成功進入當地和國際市場的能力也會影響我們的融資成本。

截至2024年6月30日,Cresud的合併財務總債務爲82253500萬澳元。我們無法向您保證我們將擁有足夠的現金流和足夠的財務能力來爲我們未來的業務提供資金。Cresud正在從其運營現金流中產生足夠的資金來履行我們的債務償還義務,並且其獲得新融資的能力也足夠,然而,考慮到阿根廷目前的貸款融資可用性,我們無法向您保證我們將擁有足夠的現金流和足夠的財務結構未來。

我們的槓桿率可能會影響我們爲現有債務再融資或借入額外資金以資助營運資金需求、收購和資本支出的能力。此外,阿根廷市場的宏觀經濟狀況可能會對我們爲現有債務再融資的能力以及未來信貸的可用性和成本產生不利影響。在這種情況下,獲得股權和債務融資選擇的機會可能會受到限制,並且可能不確定這些經濟狀況會持續多久。這需要我們分配很大一部分現金流來償還資本和利息,從而減少可用於投資運營的資金數量,包括收購和資本支出。此外,由於市場條件的變化、房地產行業的變化和/或未來經濟衰退,我們的槓桿率也可能影響我們的競爭力並限制我們償還債務的能力。

| 32 |

| 目錄 |

我們業務的成功和交易的可行性取決於房地產市場投資的連續性以及我們獲得資本和債務融資的能力。從長遠來看,對房地產投資缺乏信心和缺乏收購信貸可能會限制增長。

我們的信用評級是維持流動性的重要組成部分。信用評級的任何下調都可能會增加我們的借貸成本,或者根據降級的嚴重程度,大幅限制我們進入資本市場的機會,要求我們支付現金或提供抵押品,並允許交易對手終止某些重要合同。可能影響我們信用評級的因素包括債務水平、計劃的資產購買或出售以及近期和長期增長機會等。評級下調可能會對我們未來進入債務市場的能力產生不利影響,增加未來債務的成本,並可能要求我們就某些義務寄出信用證。

如果我們無法滿足債務償還要求,或者如果我們違約債務安排中的任何財務或其他契約,我們證券的貸方和/或持有人將能夠加速此類債務的到期或在其他債務安排下違約。我們償還債務或爲其再融資的能力將取決於我們未來的財務和運營業績,而這在一定程度上將受到我們無法控制的因素的影響,例如阿根廷的宏觀經濟狀況和監管變化。如果我們無法獲得未來融資,我們可能不得不推遲或放棄部分或全部計劃資本支出,這可能會對我們產生現金流和償還到期債務的能力產生不利影響。

有關詳細信息,請參閱“項目5.運營和財務審查和招股說明書-b。流動性和資本資源-負債”.

我們依賴我們的董事長和高級管理層。

我們的成功在很大程度上取決於Eduardo S先生的繼續僱用。我們的主席Elsztain和Alejandro G. Elsztain,我們的首席執行官兼第二副董事長。出於任何原因失去他們的服務都可能對我們的業務產生重大不利影響。如果我們目前的主要股東失去對我們業務管理的影響力,我們的主要執行官可能會辭職或被免職。

我們未來的成功在一定程度上取決於我們吸引和留住其他高素質人才的能力。我們無法向您保證我們將成功僱用或留住合格的人員,或者我們的任何人員將繼續受僱於我們。

網絡安全事件可能會對我們的聲譽、財務狀況和運營結果產生負面影響。

我們依賴於平台、數據處理網絡、通信和基於互聯網的信息交換的高效且不間斷的運行。我們可以通過在線平台訪問大量信息並控制大量資產。因此,網絡安全漏洞對我們來說是一個重大風險。

儘管我們的運營並不完全依賴互聯網,但網絡安全仍然是公司的一個關鍵風險。我們依賴數字系統來管理財務、運營和行政信息。這些系統可能會受到網絡入侵、病毒、勒索軟件、拒絕服務攻擊、網絡釣魚、身份盜竊和其他可能影響我們的運營並對我們的聲譽造成財務損失或損害的中斷。

我們已實施強有力的安全措施,包括在環境中進行多因素身份驗證和持續的網絡安全監控,以保護信息和系統。我們還提高員工對網絡安全實踐的認識,以降低風險。儘管做出了這些努力,但我們無法保證我們的系統完全沒有漏洞。

| 33 |

| 目錄 |

如果發生重大網絡攻擊,我們可能會面臨運營中斷、欺詐或敏感信息被盜的情況,從而對我們的財務狀況和股東信心產生負面影響。此外,保險範圍可能不足以覆蓋所有潛在損失,這可能會對我們的業務產生負面影響。

儘管我們打算繼續實施和更新我們的安全技術設備和操作程序以防止網絡安全損害,但我們的系統可能並非沒有漏洞,並且這些安全對策可能會被擊敗。如果發生其中任何事件,我們的聲譽可能會受到損害,影響我們的業務以及我們的運營業績和財務狀況。

《投資公司法》可能會限制我們未來的活動。

根據《投資公司法》第3(a)(3)條,投資公司在相關部分的定義包括擁有或提議收購價值超過該公司未合併總資產40%的投資證券的任何公司(不包括美國政府證券和現金項目)。對關聯實體少數股權的投資以及本身爲投資公司的合併子公司的多數股權均包括在《投資公司法》規定的40%限額中的「投資證券」的定義中。

屬於《投資公司法》含義內的投資公司且不符合這些規定豁免的公司,必須向SEC註冊,並遵守有關資本結構、運營、與關聯公司的交易和其他事項的實質性法規。如果此類公司未根據《投資公司法》註冊,則除其他外,它們不得在美國公開發行其證券或在美國從事州際商業。此外,即使我們希望在美國證券交易委員會註冊爲投資公司,如果沒有美國證券交易委員會的命令,我們也無法這樣做,因爲我們是一家非美國公司,美國證券交易委員會不太可能發佈這樣的命令。

截至2024年6月30日,我們擁有IRSA約55.40%的股權(扣除庫存股)。雖然我們相信我們不是《投資公司法》所指的「投資公司」,但我們的信念存在很大的不確定性,我們不能向您保證我們不會被確定爲「投資公司法」所規定的「投資公司」。因此,根據《投資公司法》,有關我們地位的不確定性可能會對我們在美國或向美國人提供和銷售證券的能力產生不利影響。美國資本市場歷來是我們的重要資金來源,我們未來獲得融資的能力可能會因爲無法進入美國市場而受到不利影響。如果我們未來無法根據《投資公司法》獲得豁免,而我們希望進入美國資本市場,我們唯一的途徑將是向美國證券交易委員會提交申請,要求豁免《投資公司法》的規定,這是一個漫長且高度不確定的過程。

此外,如果我們在美國或向美國人提供和銷售證券,並且我們被視爲投資公司法下的投資公司,並且未豁免適用投資公司法,則我們違反投資公司法或其履行導致違反投資公司法而簽訂的合同,包括任何此類證券,可能無法對我們執行。

與IRSA阿根廷業務相關的風險

IRSA面臨購物中心運營固有的風險,可能影響我們的盈利能力。

IRSA的購物中心受到影響其發展、管理和盈利能力的各種因素的影響,包括:

| · | 由於經濟狀況,租賃價格下降或租戶違約水平上升; |

|

|

|

| · | 利率上升和我們無法控制的其他因素; |

|

|

|

| · | 我們購物中心所在區域的可及性和吸引力; |

| 34 |

| 目錄 |

| · | 購物中心的內在吸引力; |

|

|

|

| · | 購物中心的人流和租賃單位的銷售水平; |

|

|

|

| · | 互聯網銷售的競爭日益激烈; |

|

|

|

| · | 向購物中心租戶收取的租金金額; |

|

|

|

| · | 消費者需求和消費信貸供應的變化,兩者對總體宏觀經濟狀況高度敏感;以及 |

|

|

|

| · | 我們購物中心的入住率波動。 |

如果我們的租戶因費用增加而無法支付我們可能需要徵收的更高租金,我們運營成本的增加也可能對我們產生重大不利影響。此外,購物中心業務與消費者支出密切相關,並受到當前經濟狀況的影響。我們所有購物中心和商業物業均位於阿根廷,因此,這些業務可能會受到阿根廷經濟衰退或經濟不確定性的不利影響。經濟狀況持續不佳可能導致消費者支出下降,從而對購物中心收入產生重大不利影響。

IRSA的業績受到與其物業和房地產行業相關的風險的影響。

IRSA的經營業績及其房地產資產價值,以及因此其證券價值,面臨着其財產可能無法產生足夠的收入來支付其運營費用(包括債務償還和資本支出)的風險,其現金流需求及其償還債務的能力。超出其控制範圍、可能對其運營或財產價值產生不利影響的事件或情況包括:

| · | 國家、區域和地方經濟低迷; |

|

|

|

| · | 消費支出和消費減少; |

|

|

|

| · | 來自其他購物中心和銷售點的競爭; |

|

|

|

| · | 當地房地產市場狀況,例如供應過剩或零售空間需求下降; |

|

|

|

| · | 利率和融資可用性的變化; |

|

|

|

| · | 我們的租戶行使提前終止租約的權利; |

|

|

|

| · | 空置、市場租金變化以及定期維修、翻新和重新租賃空間的需要; |

|

|

|

| · | 運營成本增加,包括保險費用、加薪、水電費、房地產稅、聯邦和地方稅以及更高的安全成本; |

|

|

|

| · | 內亂、罷工、自然災害、恐怖行爲或戰爭行爲造成損失的影響; |

|

|

|

| · | 與每個投資房產相關的重大固定支出,例如債務償還付款、房地產稅、保險和維護成本; |

| 35 |

| 目錄 |

| · | 我們租戶的財務狀況和我們收取到期租金的能力下降; |

|

|

|

| · | 我們或我們的租戶提供足夠維護和保險的能力發生變化,導致財產的使用壽命縮短;以及 |

|

|

|

| · | 法律或政府法規的變化(例如管理使用、分區和不動產稅的法規)或交易所控制或政府行爲的變化(例如徵用)。 |

如果上述任何一個或多個條件影響IRSA的活動,可能會對我們的財務狀況和運營業績產生重大不利影響,從而對公司的業績產生重大不利影響。

IRSA可能會因其投資價值下降而受到不利影響。

IRSA的投資面臨着房地產行業普遍固有的風險,其中許多風險不在我們的控制之下。這些風險中的任何一項都可能對IRSA的業務、財務狀況和經營結果產生不利和實質性的影響。與房地產相關的資本支出的任何回報取決於銷售量和/或租賃收入以及發生的費用。此外,還有其他因素可能對財產的表現和價值產生不利影響,包括財產所在地區的當地經濟狀況、阿根廷和全球的宏觀經濟狀況、競爭、IRSA尋找承租人的能力及其履行租約的能力、立法和政府條例的變化(例如財產的使用、城市規劃和房地產稅)以及外匯管制(鑑於阿根廷的房地產市場依賴美元來確定估值)。利率的變化(包括利率上升的風險,減少了住宅開發地塊的銷售)以及第三方融資的可用性。此外,鑑於阿根廷房地產市場的流動性相對不足,我們可能無法有效地應對不利的市場狀況和/或被迫低價出售一處或多處房產。當出現減少投資收入、增加相對支出的情況時,一些重大支出,如償債、房地產稅和運營維護成本,不會下降。這些因素和事件可能會削弱IRSA應對投資回報不利變化的能力,進而可能對我們的財務狀況和IRSA的運營結果產生不利影響。

IRSA的債務水平可能會對其運營及其到期償還債務的能力產生不利影響,而其以優惠條件成功進入當地和國際市場的能力也會影響其融資成本。

截至2024年6月30日,IRSA的合併財務總債務爲36675400萬澳元。IRSA正在從其運營現金流中產生足夠的資金來履行其債務償還義務,並且獲得新融資的能力也足夠。考慮到阿根廷目前的貸款融資可用性,我們無法向您保證IRSA未來將擁有足夠的現金流和足夠的財務結構。有關更多信息,請參閱「項目10。其他信息-D。外匯管制。」

IRSA的槓桿率可能會影響IRSA爲現有債務再融資或借入額外資金爲營運資金需求、收購和資本支出提供資金的能力。獲得股權和債務融資選擇可能會受到限制,並且可能不確定這些經濟狀況會持續多久。這將需要IRSA分配很大一部分現金流來償還本金和利息,從而減少可用於投資運營的資金數量,包括收購和資本支出。

IRSA可能無法從運營中產生足夠的現金流來滿足IRSA的債務償還要求或獲得未來融資。如果IRSA無法滿足IRSA的債務償還要求,或者IRSA違約其債務安排中的任何財務或其他契約,IRSA證券的貸方和/或持有人將能夠加速此類債務的到期或在其他債務安排下違約。IRSA償還債務或爲其再融資的能力將取決於我們未來的財務和運營業績,這在一定程度上將受到其無法控制的因素的影響,例如阿根廷的宏觀經濟狀況和監管變化。如果IRSA無法獲得未來融資,IRSA可能不得不推遲或放棄部分或全部計劃資本支出,這可能會對IRSA產生現金流和償還到期債務的能力產生不利影響。

| 36 |

| 目錄 |

有關詳細信息,請參閱“項目5.運營和財務審查和招股說明書-b。流動性和資本資源-負債”.

IRSA的資產高度集中在某些地理區域,這些地區的經濟衰退可能會對我們的運營業績和財務狀況產生重大不利影響。

截至2024年6月30日,IRSA來自Shopping Malls部門提供的租賃和服務的大部分收入來自位於布宜諾斯艾利斯市和大布宜諾斯艾利斯都市區的物業。此外,IRSA的所有辦公樓均位於布宜諾斯艾利斯,IRSA的很大一部分收入來自此類物業。儘管IRSA擁有布宜諾斯艾利斯和大布宜諾斯艾利斯都會區以外的房產,並可能收購或開發其他房產,但IRSA可能會在很大程度上受到經濟狀況或其他可能影響這些人口稠密地區的影響。因此,這些地區的經濟衰退可能會導致我們的租金收入減少,並對其遵守IRSA債務償還和基金運營的能力產生不利影響。

租戶的流失可能會對IRSA的營業收入和我們物業的價值產生不利影響。

雖然在任何財政年度,沒有一個租戶佔IRSA收入的6.0%以上,但如果其零售或寫字樓物業的大量租戶遇到財務困難,包括破產、資不抵債或業務普遍下滑,或者如果IRSA未能留住他們,IRSA的業務可能會受到不利影響。此外,IRSA的購物中心通常有一個重要的「錨」租戶,如著名的百貨商店,在每個購物中心產生消費者流量。這些租戶決定停止在IRSA的任何購物中心物業運營,可能會對我們的財務狀況和運營結果產生實質性的不利影響。此外,關閉一個或多個吸引消費者流量的商店可能會促使其他租戶終止或不續約,尋求租金優惠和/或關閉他們的商店。此外,一個或多個物業的租戶可能會因合併、收購、合併、處置或破產而終止租約。如果IRSA不能成功釋放受影響的空間,破產和/或關閉多家門店可能會對涉及的物業的營業收入和潛在價值產生重大不利影響。

IRSA可能面臨與收購房產相關的風險。

作爲IRSA增長戰略的一部分,IRSA已經收購併打算在未來這樣做,包括大型房地產,這些房地產往往會擴大我們的業務規模並可能改變我們的資本結構。儘管IRSA認爲IRSA過去已完成收購,並且IRSA預計將增強IRSA的財務業績,但此類交易的成功受到許多不確定性的影響,包括以下風險:

| · | IRSA可能無法以優惠條件獲得收購融資; |

|

|

|

| · | 收購的房產可能無法達到預期的效果; |

|

|

|

| · | 重新定位或重新開發所收購房產的實際成本可能高於IRSA的估計; |

|

|

|

| · | 收購的房產可能位於新市場,IRSA對當地經濟的了解和理解可能有限,在該地區缺乏業務關係或不熟悉當地政府和許可程序;和 |

|

|

|

| · | IRSA可能無法有效地將收購的財產(特別是財產組合)整合到IRSA的組織中,並以能夠實現成本節約和協同效應的方式管理新財產。 |

| 37 |

| 目錄 |

IRSA未來的收購可能不會盈利。

IRSA尋求收購更多購物中心,前提是IRSA能夠以有利的條款和條件收購它們並且它們符合我們的投資標準。商業地產的收購會帶來與任何房地產投資相關的一般投資風險,包括:

| · | IRSA對使房產達到市場既定標準所需的改進成本的估計可能被證明是不準確的; |

|

|

|

| · | IRSA收購的物業可能無法在我們預計的時間範圍內實現我們在做出收購決定時預期實現的入住率或租金率,這可能導致物業未能實現我們預計的回報; |

|

|

|

| · | IRSA的收購前評估和每項新投資的物理狀況可能無法檢測到某些缺陷或識別必要的維修,這可能會顯着增加我們的總收購成本;和 |

|

|

|

| · | IRSA在收購前對房產或建築物進行的調查,以及IRSA可能從此類建築或物業的賣家那裏收到的任何陳述,可能無法揭示各種負債,這可能會減少房產的現金流或增加我們的收購成本。 |

如果IRSA收購一家企業,IRSA將被要求合併和整合所收購企業的運營、人員、會計和信息系統。此外,收購或投資公司可能會導致我們的運營中斷,並轉移管理層的注意力對日常運營的注意力,這可能會損害我們與當前租戶和員工的關係。

房地產公司不利的經濟環境和信貸危機可能會對IRSA的運營業績產生不利影響。

IRSA業務的成功及其業務的盈利能力取決於對房地產的持續投資和獲得長期融資。對房地產投資的長期信心危機和收購缺乏信用可能會限制IRSA的增長和維持我們目前的業務和運營。作爲我們戰略的一部分,IRSA打算通過以優惠的價格進行戰略性收購來增加我們的物業組合,IRSA相信它可以帶來必要的專業知識來提升物業價值。爲了進行收購,IRSA可能需要資本或債務融資。金融市場的混亂可能會對IRSA對現有債務進行再融資的能力以及未來的信貸供應和成本產生不利影響。出售現有物業或投資組合權益的任何代價,可能會被較低的物業價值所抵消。IRSA按計劃付款或爲其現有債務再融資的能力取決於IRSA的經營和財務業績,而這又取決於當前的經濟狀況。如果未來金融市場出現中斷或出現中斷,IRSA不能保證阿根廷政府對此類中斷的反應將恢復投資者信心。

2021年9月,中國最大的房地產公司之一恒大宣佈將無法履行債務義務。從那時起,市場就受到了該公告的負面影響。2023年8月,恒大集團申請破產,向香港高等法院和英屬維爾京群島東加勒比最高法院尋求承認外國重組程序。

2024年1月,香港高等法院下令恒大集團清算其在中國大陸的子公司,此前該公司試圖重組欠債權人的3000億美元,但失敗。清算人已開始採取法律行動,從包括前高管在內的多名被告處追回約60億美元。

中國房地產行業約佔中國經濟活動的30%,超過三分之二的家庭財富與房地產行業有關。

| 38 |

| 目錄 |

我們無法預測中國房地產危機的不確定性是否以及在多大程度上會影響我們的業務、穩定市場或增加流動性和信貸可用性。

IRSA的收入和利潤可能會受到阿根廷持續通脹和經濟活動的重大不利影響。

IRSA的業務主要由消費者支出驅動,因爲其購物中心部門的一部分收入直接來自租戶的銷售,而租戶的收入依賴於對消費者的銷售。因此,IRSA的收入和淨利潤在很大程度上受到阿根廷經濟狀況的影響,包括紡織行業和國內消費的發展。消費者支出受到IRSA無法控制的許多因素的影響,包括消費者對當前和未來經濟狀況的看法、通貨膨脹、政治不確定性、就業率、利率、稅收和貨幣匯率。任何持續的經濟放緩,無論是實際的還是感覺到的,都可能大幅減少阿根廷的國內消費者支出,從而對我們的業務、財務狀況和運營業績產生不利影響。

IRSA購買的一些土地並未分區用於開發,IRSA可能無法獲得必要的分區許可證和其他授權,或者可能在獲得方面面臨延誤。

IRSA擁有幾塊土地,這些土地並未被劃分爲我們預期的開發計劃。此外,IRSA尚未爲這些房產申請所需的土地使用、建築、佔用以及其他所需的政府許可和授權。我們無法向您保證IRSA將繼續成功重新分區土地並獲得所有必要的許可和授權,或者重新分區工作和許可請求不會被推遲或拒絕。此外,IRSA可能會受到建築暫停和反增長立法的影響。如果IRSA無法獲得我們按計劃開發當前和未來項目所需的政府許可和授權,IRSA可能會被迫對此類項目進行不必要的修改或完全放棄它們。

IRSA可能面臨與阿根廷土地徵用相關的風險。

土地掠奪是阿根廷一個長期存在的問題,多年來隨着每次經濟危機而升級。

土地徵用的蔓延在阿根廷重新引發了一場古老的爭論。兩個群體之間存在着衝突,一方面聲稱擁有體面住房的權利,另一方面聲稱擁有私人財產的權利應該得到尊重阿根廷過去50年持續的週期性經濟危機也導致貧困率急劇上升,因此更少的人可以上屋頂,導致住房短缺。

因此,我們無法保證阿根廷政府對此類干擾的反應將恢復投資者對阿根廷土地的信心,這可能會對我們的財務狀況和運營業績產生不利影響。

IRSA對租金收入的依賴可能會對IRSA履行IRSA債務義務的能力產生不利影響。

IRSA的很大一部分收入來自租金收入。因此,IRSA的業績取決於其向IRSA租戶收取租金的能力。如果IRSA的大量租戶或任何重要租戶發生以下行爲,IRSA的收入和利潤將受到負面影響:

| · | 推遲租賃開始; |

|

|

|

| · | 租約到期後拒絕延長或續訂; |

|

|

|

| · | 未能在到期時支付租金;或 |

|

|

|

| · | 關閉商店或宣佈破產。 |

| 39 |

| 目錄 |

任何這些行爲都可能導致租賃終止和相關租金收入的損失。此外,IRSA無法向您保證租約到期的任何租戶都會續簽租約,或者我們能夠以經濟上合理的條款重新出租該空間。我們的許多租戶的租金收入損失以及IRSA無法取代此類租戶可能會對我們的盈利能力及其履行債務償還義務的能力產生不利影響。這些因素在流行病或流行病等緊急情況下尤其具有破壞性,可能會對我們的業務造成重大不利影響。

快速買賣房地產可能很困難,並且轉讓限制可能適用於IRSA的部分房產組合。

房地產投資的流動性相對較差,這往往會限制我們根據經濟環境或其他條件改變IRSA投資組合的能力。此外,當一項投資產生的收入較低時,與每項投資相關的重大支出,如抵押貸款付款(如果有的話)、房地產稅和維護費用通常不會減少。如果物業收入下降,而支出保持不變,我們的經營業績將受到不利影響。某些財產是抵押的,如果我們無法履行基本的付款義務,我們可能會因爲這些抵押財產喪失抵押品贖回權而遭受損失。此外,如果我們被要求處置我們的一個或多個抵押財產,我們將無法在不支付相關債務的情況下獲得解除抵押貸款利息。喪失抵押品贖回權或無法出售房產可能會對我們的業務產生不利影響。在這種交易中,我們可能會同意在相當長的一段時間內不出售收購的物業,這可能會影響我們的運營結果。

如果IRSA無法獲得額外融資,IRSA的增長能力將受到限制。

儘管截至本年度報告之日,IRSA具有流動性,但IRSA必須保持流動性爲其流動資本提供資金、償還未償債務併爲投資機會融資。如果沒有足夠的流動性,IRSA可能會被迫縮減其業務,或者可能無法尋求新的商業機會。

IRSA的增長戰略重點是IRSA已擁有的物業的開發和重建以及收購額外物業進行開發。因此,IRSA可能不得不在很大程度上依賴於資本融資的可用性,即使有的話,資本融資也可能不會以優惠的條款提供。IRSA無法向您保證將以IRSA要求的金額或優惠條款提供額外融資、再融資或其他資本。IRSA進入債務或股權資本市場取決於多種因素,包括市場對IRSA增長潛力的看法、IRSA支付股息的能力、IRSA的財務狀況、IRSA的信用評級及其當前和潛在的未來收益。根據這些因素,我們在以令人滿意的條件或根本實施IRSA的增長戰略時可能會遇到延誤或困難。

自過去幾年以來,阿根廷的資本和信貸市場一直經歷着極端的波動和混亂。如果IRSA當前的資源無法滿足我們的流動性要求,IRSA可能不得不尋求額外的融資。融資的可用性將取決於多種因素,例如經濟和市場狀況、信貸的可用性和我們的信用評級,以及貸方可能對阿根廷、IRSA公司或整個行業的風險前景產生負面看法的可能性。IRSA可能無法以優惠條件成功獲得任何必要的額外融資,甚至根本無法獲得任何必要的額外融資。

IRSA信用評級下調可能會對我們獲得資本的成本和能力產生負面影響。

IRSA的信用評級是維持其流動性的重要組成部分。信用評級的任何下調都可能增加IRSA的借貸成本,或者根據降級的嚴重程度,大幅限制IRSA進入資本市場的機會,要求IRSA支付現金或提供抵押品,並允許交易對手終止某些重要合同。可能影響IRSA信用評級的因素包括債務水平、計劃的資產購買或出售以及近期和長期增長機會等。評級機構還考慮流動性、資產質量、成本結構、產品結構等因素。評級下調可能會對IRSA未來進入債務市場的能力產生不利影響,增加未來債務的成本,並可能要求IRSA就某些債務寄出信用證。

| 40 |

| 目錄 |

IRSA購物中心發生的不良事件可能會導致IRSA聲譽受損並導致顧客數量減少。

鑑於IRSA的購物中心向公衆開放,人員流動較多,因此無論我們採取何種預防措施,我們的設施都可能發生事故、盜竊、搶劫、公衆抗議、流行病影響和其他事件。如果發生此類事件或一系列事件,購物中心顧客和遊客可能會選擇前往他們認爲更安全的其他購物場所,這可能會導致我們購物中心的銷量和營業收入下降。

阿根廷租賃法施加了限制IRSA靈活性的限制。

阿根廷管理租約的法律施加了某些限制。2023年12月,阿根廷現任政府批准了第70/2023號法令,該法令修改了阿根廷租賃協議的某些方面,廢除了27551號法律,並修改了《阿根廷民商法》的某些條款。以下是通過第70/2023號法令修改的房地產租賃部門的主要方面:(1)取消了適用於租賃的法定最低條款,如果租賃協議中沒有規定條款,《阿根廷民商法》規定的默認期限爲兩年,對於有或沒有傢俱的永久住宅租賃,或對於其他用途和臨時租賃的三年;(2)租金可以披索或外幣設定,如果是外幣,承租人不能要求房東接受不同貨幣的付款;和(3)當事人可以自由商定付款頻率,不能少於一個月。

根據阿根廷管轄租賃的法律,IRSA面臨租戶行使撤銷權的風險,這可能會對我們的業務和經營業績產生重大不利影響。IRSA無法向您保證其租戶不會行使此類權利,特別是如果租金未來穩定或下降,或者經濟狀況繼續惡化。此外,IRSA目前無法預測第70/2023號法令可能會如何影響其業務、運營結果或財務狀況。

IRSA可能對IRSA建築物的某些缺陷負責。

《阿根廷民商事法典》規定,房地產開發商、建築商、技術項目經理和建築師對房產存在隱性缺陷負有責任,期限爲三年,自房產所有權提交給買家之日起,即使這些缺陷沒有造成重大財產損失。如果有任何缺陷影響結構可靠性或使房產不適合使用,責任期限爲十年。

在IRSA的房地產開發中,IRSA通常充當開發商和賣家,而施工通常由第三方承包商進行。由於沒有具體索賠,IRSA無法量化未來索賠可能產生的任何義務的潛在成本,並且IRSA也沒有在IRSA的財務報表中記錄與這些義務相關的撥備。如果IRSA被要求糾正已完成工程的任何缺陷,我們的財務狀況和運營業績可能會受到不利影響。

如果我們必須在阿根廷訴諸驅逐程序來收取未付租金,IRSA可能會遭受損失,因爲此類程序複雜且耗時。

儘管阿根廷法律允許提起行政訴訟以收取未付租金,並提起特別訴訟以驅逐租戶,但阿根廷的驅逐程序複雜且耗時。從歷史上看,法院的繁重工作量和所需的衆多程序步驟通常會推遲房東驅逐租戶的努力。驅逐程序從提起訴訟之日到實際驅逐時通常需要六個月到兩年的時間。

從歷史上看,IRSA曾試圖在最初幾個月不付款後與違約租戶談判終止租約,以避免法律訴訟。未來違約行爲可能會大幅增加,與租戶的此類談判可能不會像過去那樣成功。此外,阿根廷新的法律和法規可能會禁止或限制驅逐,在每種情況下,它們都可能對我們的財務狀況和經營業績產生重大不利影響。

| 41 |

| 目錄 |

氣候變化可能會對IRSA的業務產生不利影響。

我們、我們的客戶和我們運營所在的社區可能會受到氣候變化的物理風險的不利影響,包括氣溫上升、海平面上升以及火災、風暴、洪水和乾旱等不利氣候事件的頻率和嚴重程度。這些影響,無論是急性還是慢性,都可能通過擾亂業務和經濟活動或影響收入和資產價值來直接影響我們和我們的客戶。

氣候變化意味着可能對我們產生不利影響的金融風險的多重驅動因素:

| · | 過渡風險:向低碳經濟的轉變,無論是在特殊層面還是系統層面--例如通過政策、監管和技術變化,以及商業和消費者偏好--可能會增加我們的支出,並影響我們的戰略。 |

|

|

|

| · | 物理風險:此外,我們還面臨着一些突發事件,如洪水和野火,極端天氣影響以及氣候模式的長期變化,如極端高溫、海平面上升和更頻繁、更長時間的乾旱,這可能會導致財務損失,從而損害我們客戶的資產價值和信譽。此類事件可能會擾亂我們的運營,也可能擾亂我們所依賴和與之做生意的客戶或第三方的運營。 |

|

|

|

| · | 責任風險:可能因氣候變化而蒙受損失的各方可以向國有實體、監管機構、投資者和貸款人等尋求賠償。 |

|

|

|

| · | 信用風險:實際氣候變化可能導致信貸敞口增加,商業模式與向低碳經濟轉型不一致的公司可能面臨更高的風險,即由於新法規或市場變化而導致企業盈利減少和業務中斷。 |

|

|

|

| · | 市場和流動性風險:碳最密集行業的市場和流動性變化可能會影響能源和大宗商品價格、公司債券、股票和某些衍生品合約。惡劣天氣事件越來越頻繁,可能會影響宏觀經濟狀況,削弱經濟增長、就業和通脹等基本因素。企業可能面臨來自現金外流的流動性風險,這些現金外流旨在提高它們在市場上的聲譽,或者解決與氣候相關的問題。 |

|

|

|

| · | 運營風險:惡劣天氣事件可能會直接影響客戶和我們業務的業務連續性和運營。 |

|

|

|

| · | 合規風險:監管合規風險增加的原因可能是要求在短時間內在多個司法管轄區實施的監管預期的速度、廣度和深度不斷增加,以及與氣候變化和相關環境可持續性問題有關的公共政策、法律和法規的變化。 |

|

|

|

| · | 行爲風險:在有不同的和正在制定的標準或分類的地方,對「綠色」產品的需求增加。 |

|

|

|

| · | 聲譽風險:我們的聲譽和客戶關係可能會因爲我們在氣候變化、社會和環境問題上的做法和決定,或者我們的客戶、供應商或供應商在與導致或加劇氣候變化相關的某些行業或項目中的做法或參與而受到損害。 |

| 42 |

| 目錄 |

緩解或應對氣候變化的舉措可能會影響市場和資產價格、經濟活動和客戶行爲,特別是在受這些變化影響的排放密集型行業部門和地區。上述任何情況或未能有效管理和披露這些風險可能會對我們的業務、前景、聲譽、財務業績或財務狀況產生不利影響。

信貸危機的重演可能會對IRSA的主要客戶產生負面影響,進而可能對IRSA的運營業績和流動性產生重大不利影響。

阿根廷正在經歷信貸危機,這可能會對IRSA租戶履行租賃義務的能力產生負面影響。未來信貸危機對IRSA主要租戶的影響無法預測,並且可能相當嚴重。IRSA重要租戶獲取流動性的能力中斷可能會造成嚴重中斷或其業務的整體惡化,這可能導致其產品未來訂單大幅減少,以及他們無法或未能遵守其義務,其中任何一種情況都可能對我們的運營業績和流動性產生重大不利影響。

IRSA面臨辦公樓運營固有的風險,可能影響IRSA的盈利能力。

辦公樓面臨各種可能影響其開發、管理和盈利能力的因素,包括以下因素:

| · | 由於實行混合辦公和家庭辦公,對辦公空間的需求降低; |

|

|

|

| · | 我們租戶的財務狀況惡化,由於缺乏流動資金、獲得資本或其他原因而導致租約違約; |

|

|

|

| · | 續租或轉租空間出現困難或延遲; |

|

|

|

| · | 由於供應過剩,租金下降,特別是新的或重新開發的物業的租金; |

|

|

|

| · | 來自寫字樓物業和其他商業地產的開發商、業主和運營商的競爭,包括我們的租戶提供的轉租空間; |

|

|

|

| · | 爲保持我們辦公大樓的競爭力而產生的維護、維修和翻新費用; |

|

|

|

| · | 外匯管制可能會干擾他們支付通常與美元掛鉤的租金的能力; |

|

|

|

| · | 大流行、流行病或疾病暴發會導致辦公空間需求下降的後果;以及 |

|

|

|

| · | 如果租戶因開支增加而無法支付更高的租金,由通脹或其他因素導致的經營成本上升,可能會對我們造成重大的不利影響。 |

| 43 |

| 目錄 |

IRSA對房地產開發和管理活動的投資利潤可能低於IRSA的預期。

IRSA通常通過第三方承包商從事用於辦公、住宅或商業目的、購物中心和住宅綜合體的開發和建設。與我們的開發、再轉換和建設活動相關的風險包括以下內容:

| · | 放棄發展機遇和改造建議; |

|

|

|

| · | 建築成本可能會超過我們的估計,原因包括更高的利率或材料和勞動力成本的增加,使項目無利可圖; |

|

|

|

| · | 新落成物業的入住率和租金可能會因多項因素而波動,包括市場和經濟情況,導致租金收入低於預期,投資回報亦相應下降; |

|

|

|

| · | 施工前購房者可能會違約,或者新樓房的單位在建成後可能仍未售出; |

|

|

|

| · | 私人和公共債務市場缺乏負擔得起的融資選擇; |

|

|

|

| · | 住宅單位的銷售價格可能不足以支付開發成本; |

|

|

|

| · | 施工和租賃開工可能無法如期完成,導致償債費用和施工成本增加; |

|

|

|

| · | 未能或拖延獲得必要的分區、土地使用、建築、佔用和其他所需的政府許可和授權,或建築暫停和反增長立法; |

|

|

|

| · | 由於總體經濟的波動,項目從開工到完工有很長的時間間隔,使我們面臨更大的風險; |

|

|

|

| · | 施工可能因一些因素而延誤,包括天氣、罷工或延遲收到分區或其他監管批准,或人爲或自然災害,導致償債費用和建築費用增加; |

|

|

|

| · | 租戶對布宜諾斯艾利斯以外地區出租物業需求的變化;以及 |

IRSA可能會產生需要大量時間和精力的資本支出,並且由於政府限制或整體市場狀況而可能永遠無法完成。

此外,IRSA可能會因阿根廷執行勞動法而面臨索賠。許多公司從提供外包服務的第三方僱用人員,並在此類第三方員工出現勞工索賠時簽署賠償協議。然而,近年來,一些法院否認這些勞資關係中存在獨立性,並裁定兩家公司承擔共同和個別責任。

雖然IRSA有關擴建、翻新和開發活動的政策旨在限制與此類活動相關的一些風險,但IRSA仍面臨與房地產開發相關的風險,例如成本超支、設計變更和由於缺乏材料和勞動力可用性而產生的時間延遲、天氣條件和我們控制之外的其他因素,以及融資成本可能超出最初的估計,可能使相關投資無利可圖。任何延誤或意外費用都可能對這些開發項目的投資回報產生不利影響,並損害我們的經營業績。

| 44 |

| 目錄 |

建築成本的增幅超出預期可能會對IRSA新開發項目的盈利能力產生不利影響。

IRSA的業務活動包括房地產開發。與這項活動相關的主要風險之一與建築成本的潛在增加相對應,這可能是由購物中心和建築行業的需求增加和新開發項目推動的。高於原始預算的增幅可能會導致盈利能力低於預期。

房地產開發的盈利能力也可能受到未能以優惠條件獲得融資、施工延誤以及未能獲得必要的分區、土地使用、建築、佔用和其他所需的政府許可和授權的影響。

阿根廷競爭日益激烈的房地產行業可能會對IRSA租賃或出售辦公空間和其他房地產的能力產生不利影響,並可能影響IRSA場所的銷售和租賃價格。

IRSA的房地產活動高度集中在布宜諾斯艾利斯大都市區,由於熱門地點的物業稀缺以及當地和國際競爭對手數量的增加,該地區的市場競爭非常激烈。阿根廷房地產行業競爭激烈,分散,對新競爭對手的進入門檻不高。房地產開發業務的主要競爭因素包括土地的可獲得性和位置、價格、資金、設計、質量、聲譽和與開發商的合作伙伴關係。許多住宅和商業開發商以及房地產服務公司在尋找土地收購機會、吸引財政資源以及吸引潛在買家和租戶方面展開競爭。其他公司,包括外國和當地公司的合資企業,在市場上變得越來越活躍,進一步加劇了競爭。如果我們的一個或多個競爭對手能夠收購和開發理想的物業,因爲它可以獲得更多的財政資源,如果我們不能像我們的競爭對手一樣迅速地應對這些壓力,或者競爭加劇,我們的業務和財務狀況可能會受到不利影響。

IRSA的所有購物中心和商業辦公物業均位於阿根廷。我們每個物業的地理範圍內還有其他購物中心、獨立零售商店和住宅物業。特定地區競爭物業的數量可能會對我們租賃購物中心零售空間或銷售住宅區單元的能力以及我們能夠收取的租金或售價產生重大不利影響。IRSA無法向您保證其他購物中心運營商在不久的將來不會在阿根廷投資。如果購物中心領域出現更多競爭對手,此類競爭可能會對我們的運營業績產生重大不利影響。

IRSA的幾乎所有辦公室和其他非購物中心租賃物業都位於發達的城市地區。IRSA物業所在地區有許多辦公樓、購物中心、零售和住宅場所。這是一個高度分散的市場,我們附近豐富的可比物業可能會對我們租賃或銷售辦公空間和其他房地產的能力產生不利影響,並可能影響我們場所的銷售和租賃價格。未來,國內外公司都可能參與阿根廷的房地產開發市場,與我們爭奪商業機會。

未保險的損失或超過IRSA財產保單的損失可能會導致IRSA在這些財產上損失資本或收入。

目前有效的IRSA標準格式物業租約的條款規定,租戶須賠償因在物業上進行的活動而對處所內外的人或財產造成傷害的法律責任,並使IRSA不受損害,但因IRSA的代理人的疏忽或故意不當行爲而引起的索償除外。承租人通常被要求在租賃期內自費獲得並保持完全有效的責任保險單。IRSA不能保證其租戶能夠適當地維持他們的保險單或有能力支付免賠額。如果發生未投保的損失或超過保單綜合總限額的損失,或者如果發生了根據保單可獲得大量免賠額的損失,IRSA可能會損失我們在一個或多個物業上投資的全部或部分資本和預期收入,這可能會對IRSA的業務、財務狀況和運營結果產生重大不利影響。

| 45 |

| 目錄 |

一些潛在的損失不在保險範圍內,某些類型的保險範圍可能會變得貴得令人望而卻步。

IRSA目前已有保險單,涵蓋IRSA所有財產的潛在風險,如民事責任、所有運營風險(除其他外,包括火災、利潤損失、洪水、自然事件和我們資產的其他物質損失)和恐怖主義。雖然我們認爲這些保單的保單規格和保險限額是慣例,但某些類型的損失,如租賃和其他合同索賠和戰爭行爲,通常不在阿根廷提供的保險單範圍內。如果發生未投保的損失或超過保險限額的損失,IRSA可能會損失IRSA投資於物業的全部或部分資本,以及預期的未來收入。在這種情況下,IRSA可能仍然有義務償還與財產有關的任何抵押債務或其他財務義務。IRSA不能向您保證未來不會發生超過保險金額的重大損失。如果IRSA的任何財產遭受災難性損失,可能會嚴重擾亂我們的運營,推遲收入,並導致巨額維修或重建財產的費用。

IRSA不爲我們的員工購買人壽或喪失工作能力保險。如果我們的任何員工死亡或殘疾,IRSA可能會因我們的運營中斷而遭受損失,而保險不承保,這可能會對IRSA的財務狀況和運營業績產生重大不利影響。

此外,我們無法保證IRSA能夠以足夠的金額或合理的價格續保其保險範圍。保險公司可能不再爲某些類型的損失提供保險,或者,如果他們這樣做,這些類型的保險可能會貴得令人望而卻步。

對IRSA針對高收入消費者的優質房產的需求可能不夠。

IRSA專注於迎合富裕消費者的開發項目,IRSA已達成房地產易貨安排,根據該安排,IRSA將未開發的土地捐贈給與開發商的合資實體,開發商同意在優質開發地點交付單位,以換取IRSA的土地貢獻。當開發商將這些房產歸還給我們時,對優質住宅單位的需求可能會顯着下降。在這種情況下,IRSA將無法按估計價格或時間範圍出售這些住宅單位,這可能會對IRSA的財務狀況和運營業績產生不利影響。

消費者轉向通過進入門檻較低的互聯網購買商品,這可能會對IRSA購物中心的銷售產生負面影響。

近年來,阿根廷的互聯網零售額大幅增長,儘管此類銷售額的市場份額仍然不大。互聯網使製造商和零售商能夠直接向消費者銷售產品,削弱了零售店和購物中心等傳統分銷渠道的重要性。IRSA認爲,我們的目標消費者越來越多地使用互聯網,無論是在家裏、辦公室還是其他地方,以電子方式購買零售商品,這一趨勢可能會繼續下去。IRSA物業的零售商面臨來自在線銷售的日益激烈的競爭,這可能導致他們的租約終止或不續簽,或者他們的總銷售額減少,影響我們基於租金的收入百分比。如果電子商貿和網上零售額繼續增長,零售商和消費者對我們購物中心的依賴可能會大幅減少,對我們的財務狀況、經營業績和業務前景產生重大不利影響。

| 46 |

| 目錄 |

IRSA面臨影響酒店業的風險。

我們酒店運營的住宿行業的全方位服務部門競爭激烈。IRSA酒店的運營成功高度取決於我們在通道、位置、住宿質量、房價、優質餐飲設施以及其他服務和設施等領域的競爭能力。如果其他公司決定建造新酒店或改善現有酒店以增加吸引力,IRSA的酒店可能會面臨額外的競爭。

| · | 此外,我們酒店的盈利能力取決於: |

|

|

|

| · | 我們有能力與國際和當地運營商建立成功的關係來運營我們的酒店; |

|

|

|

| · | 旅遊業和旅行趨勢的變化,包括季節性變化和大流行爆發導致的變化,例如甲型H1N1亞型流感和寨卡病毒、潛在的埃博拉疫情、Covid-19、猴痘等,或天氣現象或其他自然事件,例如分別於2011年6月和2015年4月普耶韋火山和卡爾布科火山的噴發; |

|

|

|

| · | 遊客的富裕程度,這可能會受到全球和當地經濟放緩的影響;以及 |

|

|

|

| · | 影響工資、價格、利率、施工程序和成本的稅收和政府法規。 |

IRSA的業務受到廣泛的監管,未來可能會實施額外的監管。

IRSA的活動受阿根廷聯邦、州和市法律的約束,以及有關建築、分區、土壤使用、環境保護和歷史地標保護、消費者保護、反壟斷和其他要求所需的法規、授權和許可證,所有這些都影響IRSA獲得土地、建築物和購物中心、開發和建設項目以及與客戶談判的能力。此外,該行業的公司還面臨稅率提高、新稅種的引入和稅收制度的變化。IRSA需要獲得不同政府機構的許可才能實施我們的項目。維護IRSA的許可證和授權的成本可能很高。如果我們未能遵守此類法律、法規、許可和授權,IRSA可能會面臨罰款、項目關閉以及吊銷許可和撤銷授權。

阿根廷的反壟斷法可能會限制IRSA通過收購或合資企業擴大業務的能力。阿根廷反壟斷法包含的條款要求獲得這些國家反壟斷當局的授權才能收購具有相關市場份額的公司或與其簽訂合資協議。

此外,公共機構可能會發布新的、更嚴格的標準,或以更具限制性的方式執行或廢除現有法律和法規,這可能會迫使我們爲遵守而支出。開發活動還面臨可能延誤或無法獲得所有必要的分區、環境、土地使用、開發、建築、佔用和其他許可證和授權的風險。任何此類延誤或未能獲得此類政府批准都可能對IRSA的業務產生不利影響。

過去,阿根廷政府爲應對住房短缺、高通貨膨脹率和難以獲得信貸而頒佈了有關租賃的規定。這些規定限制或禁止提高租金價格,並禁止驅逐租戶,即使是拖欠房租的租戶也是如此。IRSA的大多數租約規定,租戶支付與其各自租賃區域相關的所有成本和稅收。如果此類成本和稅收大幅增加,阿根廷政府可能會通過管制這種做法來應對要求其干預的政治壓力,從而對IRSA的租金收入產生負面影響。IRSA不能向您保證阿根廷政府今後不會實施類似或其他法規。改變現行法律或頒佈管理阿根廷購物中心和寫字樓物業所有權、經營或租賃的新法律,可能會對房地產和租賃市場產生負面影響,並對IRSA的運營和財務狀況產生重大不利影響。

勞資關係可能會對IRSA產生負面影響。

截至2024年6月30日,IRSA 69.8%的員工由工會根據集體談判協議代表。儘管IRSA目前與IRSA的員工及其工會關係良好,但IRSA無法向您保證勞資關係將繼續保持積極,或者勞資關係的惡化不會對我們產生重大不利影響。

| 47 |

| 目錄 |

IRSA的經營業績包括投資物業的未實現重新估值調整,該調整可能會在財務期間大幅波動,並可能對IRSA的業務、經營業績和財務狀況產生重大不利影響。

截至2024年6月30日止年度,IRSA投資物業的公允價值損失爲35059100萬澳元。儘管向上或向下的重新估值調整反映了相關期間我們投資性房地產的未實現資本收益或損失,但這些調整並不反映我們投資性房地產銷售或租賃產生的實際現金流或損益。除非此類投資物業以類似的重新估值金額處置,否則IRSA將無法實現實際現金流。重新估值調整的金額已經並將繼續受到阿根廷當前房地產市場和宏觀經濟狀況的顯着影響,並將受到這些市場的市場波動的影響。

我們無法保證市場狀況的變化是否會增加、維持或減少我們投資物業的歷史平均公允價值收益,甚至根本不會。此外,我們投資房地產的公允價值可能與我們從投資房地產的任何實際銷售中收到的金額存在重大差異。如果未來我們的投資物業重新估值出現任何重大下調,或者如果我們的投資物業以遠低於其估值或評估價值的價格處置,我們的業務、經營業績和財務狀況可能會受到重大不利影響。

由於IRSA資產和負債之間的貨幣錯配,IRSA的貨幣風險敞口很高。

截至2024年6月30日,其大部分負債,如第XIV、XV、XVI、XVII、XVIII和XX系列票據,以美元計價,而公司收入主要以披索計價。考慮到我們的資產是以美元交易的,這種貨幣缺口主要影響我們支付美元計價債務利息的運營流程。此外,限制進入MULC以獲得支付我們以美元計價的債務所需的美元,或者未來可能制定不同的匯率(高於當前官方匯率)以將披索轉換爲美元的規定,使我們面臨波動風險。如果美元對披索升值,這可能會對我們的財務業績產生不利影響,並可能影響我們支付美元計價債務利息的能力。披索對美元的任何貶值都會增加IRSA以披索計價的債務的名義金額,這進一步對IRSA的運營和財務狀況產生不利影響,並可能增加IRSA從租戶和抵押貸款中收取租賃和其他應收款項的風險,這些收入大多產生披索計價的收入。

IRSA在當地和國際資本市場發行債務,作爲其主要資金來源之一,其以優惠條件成功進入當地和國際市場的能力會影響其資金成本。

IRSA以可接受的條款成功進入當地和國際資本市場的能力在很大程度上取決於阿根廷和國際資本市場的普遍狀況。IRSA無法控制資本市場狀況,資本市場狀況可能波動且不可預測。如果IRSA無法在當地和/或國際資本市場上以IRSA可接受的條款發行債務,無論是由於法規和外匯限制、資本市場狀況惡化還是其他原因,IRSA可能會被迫尋找融資替代方案,其中可能包括短期或更昂貴的融資來源。如果發生這種情況,IRSA可能無法以有競爭力的成本滿足我們的流動性需求,其業務運營結果和財務狀況可能會受到重大不利影響。

通過合資企業或被投資者擁有財產可能會限制我們僅爲我們的利益行事的能力。

當我們認爲情況需要使用此類結構時,我們與其他個人或實體在合資企業中開發和收購物業,或對實體進行少數股權投資。

截至2024年6月30日,IRSA擁有Puerto Retiro 50%的股權和Cyrsa SA 50%的股權在酒店部門,IRSA擁有Hotel Llao Llao 50%的股權,另外50%由Sutton Group擁有。在購物中心部門,IRSA擁有Nuevo Puerto Santa Fe SA 50%的股權,該公司是其建造並目前經營「La Ribera」購物中心的一棟建築的租戶。

| 48 |

| 目錄 |

此外,截至2024年6月30日,IRSA持有Banco Hipotecario約29.9%的股權,阿根廷政府是該銀行的控股股東。

IRSA可能會在一項投資中與其一個或多個合資夥伴或控股股東發生糾紛,這可能會影響其運營共同所有物業的能力。此外,其合資夥伴或投資的控股股東可能在任何時候具有與其目標不一致的商業、經濟或其他目標,包括與物業任何出售或再融資的時間和條款有關的目標。例如,在運營預算和再融資、扣押、擴建或出售任何此類物業方面,都需要得到其某些投資者的批准。在某些情況下,其合資夥伴或投資的控股股東可能在其市場上存在利益衝突,這可能會造成利益衝突。如果其合資夥伴或控股股東在一項投資中的目標與我們自己的目標不一致,IRSA將不能完全根據我們的利益行事。

如果其任何共同擁有的物業的一名或多名投資者遭遇財務困難,包括破產、資不抵債或業務普遍低迷,可能會對相關物業產生不利影響,進而對IRSA的財務表現產生不利影響。如果投資的合資企業合作伙伴或控股股東宣佈破產,IRSA可能對其合作伙伴在合資企業負債或投資工具負債中的普通股負責。

IRSA依賴其董事會、高級管理層和其他關鍵人員。

IRSA的成功在很大程度上取決於愛德華多·S的繼續僱用。Elsztain以及我們董事會的某些其他成員和高級管理人員,他們對我們的業務和行業擁有豐富的專業知識和知識。無論出於何種原因,他們的服務損失或中斷都可能對我們的業務和經營業績產生重大不利影響。我們未來的成功在一定程度上取決於我們吸引和留住其他高素質人才的能力。我們無法向您保證我們將成功僱用或留住合格的人員,或者我們的任何人員將繼續受僱於我們,這可能會對我們的財務狀況和運營業績產生重大不利影響。

IRSA可能面臨與我們的主要股東相關的潛在利益衝突。

IRSA的最大受益所有人是Eduardo S先生。根據Elsztain通過該公司間接持股的情況。截至2024年6月30日,該受益所有權包括公司持有的422,460,367股普通股。我們與關聯公司的管理層之間可能會因各自業務活動的表現而產生利益衝突。截至2024年6月30日,愛德華多·S·先生Elsztain還實際擁有IRSA約57.0%的普通股。IRSA無法向您保證,我們的主要股東和我們的附屬公司不會限制或導致我們放棄我們的附屬公司可能追求的商業機會,或者追求其他機會符合我們的利益。

與IRSA投資Banco Hipotecario相關的風險

金融體系的穩定取決於包括希波特卡里奧銀行在內的金融機構維持和增強儲戶信心的能力。

截至2024年6月30日,IRSA擁有Banco Hipotecario約29.9%的已發行股本。Banco Hipotecario截至該日的資產爲228194200萬里亞爾。Banco Hipotecario的所有業務、財產和客戶均位於阿根廷。因此,Banco Hipotecario貸款組合的質量、財務狀況和運營結果取決於阿根廷普遍的經濟、監管和政治狀況。這些條件包括增長率、通貨膨脹率、匯率、利率變化、政府政策變化、社會不穩定以及發生在阿根廷或以其他方式影響阿根廷的其他政治、經濟或國際事態發展。

| 49 |

| 目錄 |

如果儲戶未來無法自由地從銀行提款,可能會對包括Banco Hipotecario在內的金融機構開展業務的方式及其作爲金融中介的運營能力產生重大負面影響。對國際金融市場失去信心也可能對阿根廷儲戶對當地銀行的信心產生不利影響。

在經濟形勢不利的情況下,即使與金融體系無關,也可能引發儲戶從當地銀行大規模撤資,作爲保護其資產免受潛在危機影響的替代方案。任何大規模提取存款都可能導致金融部門的流動性問題,從而導致信貸供應收縮。

上述任何情況的發生可能會對Banco Hipotecario的費用和業務、運營業績和財務狀況產生重大不利影響。

金融機構的資產質量受到非金融公共部門和央行債務的影響。

金融機構持有阿根廷政府和省政府發行的大量債券組合以及向這些政府發放的貸款。根據央行發佈的銀行報告,截至2024年6月,公共部門貸款佔金融部門資產的36.9%。

此外,金融機構目前在其投資組合中持有央行發行的證券,這些證券通常是短期的。截至2024年6月30日,Banco Hipotecario對公共部門的總風險敞口爲123758900萬澳元,佔其截至該日資產的57.8%,央行發行的證券風險敞口總額爲18273400萬澳元,佔其截至2024年6月30日總資產的8.5%。