在提交給 美國美國證券交易委員會於2023年2月22日發佈。

登記號333-269043

美國

證券交易委員會

華盛頓特區20549

第2號修正案

表格F-1

登記聲明

下

1933年證券法

銀河薪資 集團有限公司

(註冊人的確切名稱 憲章)

| 英屬維爾京群島 | 7361 | 不適用 | ||

| (述明或其他司法管轄權 成立或組織) |

(主要標準工業 分類代碼號) |

(稅務局僱主 識別號) |

Ovest 25樓

永樂街77號

香港上環

電話:+852 3105 2611

(地址,包括郵政編碼和電話號碼, 包括登記人主要行政辦公室的地區代碼)

Puglisi律師事務所

圖書館大道850號,204套房

紐瓦克,DE 19711

電話:302-738-6680

(Name、地址(包括郵政編碼)和電話 服務代理人的號碼,包括地區代碼)

將副本複製到:

伊麗莎白·菲陳, Esq. 普華永道現金管理有限公司 時代廣場7號 紐約州紐約州10036 電話:212-326-0199 |

方 劉先生 VCL Law LLP 1945老絞刑街,630號套房 弗吉尼亞州維也納,郵編:22182 電話:703-919-7285 |

擬議的大約開始日期 向公衆出售: 立即在本登記聲明生效之日後。

| 如本表格上登記的任何證券 根據1933年《證券法》第415條的規定,將以延遲或連續的方式提供債券,請勾選以下方框。 | ☐ | |

| 如本表格是爲了登記發售的額外證券而提交的 根據證券法下的規則462(B),請勾選以下框並列出證券法註冊聲明 同一發行的較早生效的註冊說明書編號。 | ☐ | |

| 如本表格是根據第462(C)條提交的生效後修訂 在《證券法》項下,勾選下列方框並列出較早生效的《證券法》登記聲明編號 同一股票發行的註冊聲明。 | ☐ | |

| 如本表格是根據第462(D)條提交的生效後修訂 在《證券法》項下,勾選下列方框並列出較早生效的《證券法》登記聲明編號 同一股票發行的註冊聲明。 | ☐ | |

| 用複選標記表示註冊者是否是新興增長者 1933年《證券法》第405條所界定的公司。 | ||

| 新興成長型公司。 | ☒ | |

| 如果一家新興的成長型公司準備其財務報表 根據美國公認會計原則,用複選標記表示註冊人是否已選擇不將延長的過渡期用於 遵守證券法第7(A)(2)(B)條規定的任何新的或修訂的財務會計準則。 | ☐ |

註冊人特此修改此註冊 關於推遲其生效日期所需的日期的聲明,直到註冊人提交進一步的修正案, 特別指出本登記聲明此後將根據證券第8(a)條生效 1933年法案或直至登記聲明於委員會根據上述部分行事的日期生效 8(a),可以確定。

解釋性說明

本註冊聲明表格F-1( 「註冊聲明」)包含兩份招股說明書,如下所述。

| ● | 公共 招股說明書。招股說明書將用於公開發行4,000,000股普通股,每股面值0.000625美元 (the註冊人的「普通股」)(「公開發行招股說明書」)通過指定的承銷商 在公開發行招股說明書的封面上。 |

| ● | 轉售招股說明書。招股說明書 用於出售股東轉售註冊人的960,000股普通股(「轉售招股說明書」)。 |

轉售招股說明書與公開發行實質相同 招股說明書,但以下要點除外:

| ● | 它們包含不同的 內外前蓋和封底; |

| ● | 它們包含不同的 招股說明書摘要部分中從第1頁開始的發售部分; |

| ● | 它們包含不同的 第44頁上的收益使用部分; |

| ● | 出售股東部分 已包含在轉售招股說明書中; |

| ● | 承保部分 從轉售招股說明書中刪除,幷包含出售股東分配計劃 在轉售招股說明書中;和 |

| ● | 法律事務部分 在轉售招股說明書Alt-4頁中刪除了對承銷商律師的提及等。 |

註冊人已包含在本註冊中 在公開發行招股說明書封底後的一組備用頁面(「備用頁面」)聲明, 反映了轉售招股說明書與公開發行招股說明書的上述差異。公開發行招股說明書 將排除替代頁面,並將用於註冊人的公開發行。轉售招股說明書將實質性地 除添加或替換頁面外,與公開發行招股說明書相同,並將用於轉售 由出售股東提供。

| 的 本初步招股說明書中的信息並不完整,可能會更改。在登記之前我們可能不會出售證券 向美國證券交易委員會提交的聲明有效。本初步招股說明書並非出售這些產品的要約 證券,並且不會在任何不允許此類要約或出售的司法管轄區徵求任何購買這些證券的要約。 |

有待完成

初步 檢察官日期:2023年2月22日

Galaxy發行4,000,000股普通股 薪資集團有限公司

銀河薪酬集團有限公司

這是Galaxy的首次公開募股 Payroll Group Limited的普通股。以下簡稱「公司」、「我們」、「銀河薪資」 BVI”均指銀河薪資集團有限公司。我們在堅定承諾的基礎上提供我們的普通股(面值) 每股0.000625美元(「普通股」)。在此次發行之前,我們的普通股尚未存在公開市場。 我們預計首次公開發行價格將在每股普通股[●]美元至[●]美元範圍內。我們已提交 向納斯達克申請將我們的普通股以代碼「GLXG」在納斯達克資本市場上市。閉幕 此次首次公開募股的上市日期取決於納斯達克對我們上市申請的批准。不能保證 此次發行將結束,我們的普通股將在納斯達克資本市場交易。

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 19 to read about factors you should consider before buying our Ordinary Shares.

We are a holding company incorporated in the British Virgin Islands, or BVI. As a holding company with no operations, we are not a Chinese operating company. Our operations are conducted by our Operating Entities, which are our indirect wholly-owned subsidiaries, Galaxy Payroll Services Limited (“Galaxy Payroll (HK)”), Galaxy GEO Services Limited (“Galaxy GEO Services”), Galaxy Corporate Management Consultancy (Shenzhen) Limited (“Galaxy HR (SZ)”), Galaxy Human Resources Limited (“Galaxy HR (TW)”), and Galaxy Recursos Humanos (Macau) Limitada (“Galaxy HR (Macau)”).

The selling shareholder as defined under Principal Shareholders section of this prospectus is offering 960,000 Ordinary Shares to be sold in the offering pursuant to the resale prospectus. Neither we nor the underwriter will receive any proceeds from the sales of any of the Ordinary Shares being offered by the selling shareholder.

This is an offering of the Ordinary Shares of Galaxy Payroll Group Limited, the holding company incorporated in BVI, instead of shares of our Operating Entities. You may never directly hold any equity interest in our Operating Entities.

Our Company faces various legal and operational risks and uncertainties relating to its operations in Hong Kong and in PRC. Our current corporate structure includes a wholly owned subsidiary doing business in PRC. We do not have any variable interest entity (the “VIE”) in PRC and we currently do not have any intention of establishing any VIEs in the future. If in the future there is any significant change to the current political arrangements between PRC and Hong Kong or PRC’s authority in Hong Kong, it could result in the PRC or Hong Kong regulatory authorities disallowing our current corporate structure, which in turn would likely result in a material adverse change in our operations, and cause our securities to decline significantly in value or become worthless. All of our operations are conducted by our Operating Entities in Hong Kong, PRC, Taiwan and Macau as subsidiaries of Galaxy Payroll BVI.

Although we believe that the laws and regulations of the PRC do not currently have any material negative impact on our business, financial condition or results of operations, and our corporate structure is stable without any interference from current applicable laws in Hong Kong, PRC, Taiwan and Macau, we face risks and uncertainties associated with the complex and evolving PRC laws and regulations and as to whether and how the recent PRC government statements and regulatory developments, such as those relating to corporate structure, data and cyberspace security, and anti-monopoly concerns, would be applicable to a company like us, given our foreign investment personality, substantial operations in Hong Kong, and the Chinese government’s significant oversight authority over the conduct of business in Hong Kong. See “Risk Factors - Risks Relating to the PRC” and “Risk Factors - Risks Relating to Hong Kong, Taiwan and Macau” for more details.

On February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Administrative Measures”), which will take effect on March 31, 2023. The Trial Administrative Measures further stipulate the rules and requirements for overseas offering and listing conducted by PRC domestic companies. After the Trial Administrative Measures take effect, we may be required to go through the filing procedure to satisfy the filing requirements. See “Risk Factor - Upon the effectiveness of the Trial Administrative measures, we may be subject to the Trial Administrative Measures if the Company has: (i) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by PRC domestic companies; and (ii) the main parts of the issuer’s business activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in mainland China; and if required, we cannot assure you that we will be able to complete such process on time” for more details.

Pursuant to the Holding Foreign Companies Accountable Act, or the HFCAA, the Public Company Accounting Oversight Board (the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (i) mainland China of the PRC, and (ii) Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our former auditor, Friedman LLP, is headquartered in New York, and has been inspected by the PCAOB on a regular basis. Our current auditor, Marcum Asia CPAs LLP (“Marcum Asia”), is also headquartered in New York, and has been inspected by the PCAOB on a regular basis, with the last inspection in 2020. Neither of them is headquartered in mainland China or Hong Kong nor was identified in this report as a firm subject to the PCAOB’s determination. Notwithstanding the foregoing, in the event that, in the future, either PRC regulators take steps to impair the auditing firm’s access to the workpapers in PRC or Hong Kong, or the PCAOB is not able to fully conduct inspections of our auditor’s work papers in mainland China, or the PCAOB expands the scope of the Determination Report so that we are subject to the HFCAA, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets, trading of our securities on a national securities exchange or in the over-the counter may be prohibited under the HFCAA and an exchange may determine to delist our securities. On June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two, thus, would reduce the time before an applicable issuer’s securities may be prohibited from trading or delisted. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was signed into law. It will pose more risks leading potential delisting as well as the price of an issuer’s securities especially on foreign companies. On August 26, 2022, the PCAOB announced and signed a Statement of Protocol (the “Protocol”) with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China. The Protocol provides the PCAOB with: (1) sole discretion to select the firms, audit engagements and potential violations it inspects and investigates, without any involvement of Chinese authorities; (2) procedures for PCAOB inspectors and investigators to view complete audit work papers with all information included and for the PCAOB to retain information as needed; (3) direct access to interview and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. On December 15, 2022, the PCAOB issued a new Determination Report which: (1) vacated the December 16, 2021 Determination Report; and (2) concluded that the PCAOB has been able to conduct inspections and investigations completely in the PRC in 2022. The December 15, 2022 Determination Report cautions, however, that authorities in the PRC might take positions at any time that would prevent the PCAOB from continuing to inspect or investigate completely. As required by the HFCAA, if in the future the PCAOB determines it no longer can inspect or investigate completely because of a position taken by an authority in the PRC, the PCAOB will act expeditiously to consider whether it should issue a new determination. See “Risk Factors — Our auditor is headquartered in New York, and is subject to inspection by the PCAOB on a regular basis. To the extent that our independent registered public accounting firm’s audit documentation related to their audit reports for our company become located in China, the PCAOB may not be able to inspect such audit documentation and, as such, you may be deprived of the benefits of such inspection and our common stock could be delisted from the stock exchange pursuant to the Holding Foreign Companies Accountable Act” for more information.

Funds may be transferred to Galaxy HR (SZ), Galaxy HR (TW) and Galaxy HR (Macau) through our subsidiaries in Hong Kong, Galaxy Payroll (China), Galaxy Payroll (TW) and Galaxy Payroll (HK) respectively, by additional capital contributions or shareholder’s loans. The funds were paid directly through Melkweg Cayman after reorganization since the bank account of Galaxy Payroll Group Limited had not been opened until November 15, 2022. The following is a table providing a description of how cash is transferred through our organization. See “Galaxy Payroll Group Limited - Consolidated Statements of Changes in Shareholders’ Equity - For the Two Fiscal Years Ended June 30, 2022 and 2021” and “Galaxy Payroll Group Limited - Consolidated Statements of Cash Flows - For the Two Fiscal Years Ended June 30, 2022 and 2021”.

| For the year ended June 30, 2022 | ||||||||||

| No. | Transfer from | Transfer to | Approximate value (HKD) |

Note | ||||||

| 1 | Galaxy Payroll Services Limited | Galaxy Human Resources Limited | 13,454,617 | Payroll funds and service fee income transferred and earned from the subsidiary in Hong Kong to the subsidiary in Taiwan | ||||||

| 2 | Galaxy Payroll Services Limited | Galaxy Corporate Management Consultancy (Shenzhen) Limited | 5,443,248 | Payroll funds and service fee income transferred and earned from the subsidiary in Hong Kong to the subsidiary in PRC | ||||||

| 3 | Galaxy Payroll Services Limited | Melkweg Holdings (BVI) Limited | 20,345,600 | Cash transferred as dividend from the subsidiary in Hong Kong to its direct parent entity in British Virgin Islands | ||||||

| 4 | Melkweg Holdings (BVI) Limited | Melkweg Holdings Limited | 20,274,166 | Cash transferred as dividend from the subsidiary in British Virgin Islands to its direct parent entity in Cayman | ||||||

| 5 | Melkweg Holdings Limited | The shareholders of the group | 18,924,782 | Cash transferred as dividend from the subsidiary in Cayman to its ultimate shareholders’ entities in British Virgin Islands | ||||||

| For the year ended June 30, 2021 | ||||||||||

| No. | Transfer from | Transfer to | Approximate value (HKD) |

Note | ||||||

| 1 | Galaxy Payroll Services Limited | Galaxy Recursos Humanos (Macau) Limitada | 6,899,027 | Payroll funds and service fee income transferred and earned from the subsidiary in Hong Kong to the subsidiary in Macau | ||||||

| 2 | Galaxy Payroll Services Limited | Galaxy Recursos Humanos (Macau) Limitada | 113,169 | Cash (as working capital) borrowed by the subsidiary in Macau from the subsidiary in Hong Kong | ||||||

| 3 | Galaxy Payroll Services Limited | Galaxy Human Resources Limited | 9,736,455 | Payroll funds and service fee income transferred and earned from the subsidiary in Hong Kong to the subsidiary in Taiwan | ||||||

| 4 | Galaxy Payroll Services Limited | Galaxy Corporate Management Consultancy (Shenzhen) Limited | 1,552,933 | Payroll funds and service fee income transferred and earned from the subsidiary in Hong Kong to the subsidiary in PRC | ||||||

| 5 | Galaxy Payroll Services Limited | Melkweg Holdings Limited | 2,990,266 | Cash transferred as dividend from the subsidiary in Hong Kong to its direct parent entity in Cayman | ||||||

| 6 | Galaxy Payroll Services Limited | Melkweg Holdings Limited | 60,000 | Cash (as working capital) borrowed by the subsidiary in Cayman from the subsidiary in Hong Kong | ||||||

| 7 | Melkweg Holdings Limited | Melkweg Holdings (BVI) Limited | 300,000 | Cash (as working capital) borrowed by the subsidiary in British Virgin Islands from the subsidiary in Cayman | ||||||

| 8 | Melkweg Holdings Limited | The shareholders of the group | 1,500,000 | Cash transferred as dividend from the subsidiary in Cayman to its ultimate shareholders’ entities in British Virgin Islands | ||||||

Galaxy Payroll BVI’s ability to pay dividends to its shareholders and to service any debt it may incur may largely depend upon dividends paid by Galaxy Payroll (HK). Galaxy HR (SZ), as an indirect wholly-owned subsidiary of Galaxy Payroll BVI, is statutorily limited because it is required to make appropriations to certain statutory reserve funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. See Transfers of Cash to and from Our Subsidiaries on page 3-4 under Prospectus Summary for more details.

As advised by our Hong Kong Legal Advisers, according to the Companies Ordinance of Hong Kong, a Hong Kong company may only make a distribution out of profits available for distribution or other distributable reserves. In addition, there can be no assurance that in the future the PRC government will not intervene or impose restrictions on Galaxy Payroll (HK)’s ability to transfer or distribute cash/assets to entities outside of Hong Kong, which could result in an inability or prohibition on making transfers or distributions to us and adversely affect our business. Therefore, to the extent funds and/or assets are in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds and/or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations by the PRC government. See Risk Factors Summary and “Risk Factor - Restrictions on currency exchange may limit our ability to receive and use our revenue effectively” for more details.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate that any cash dividends will be paid or any assets will be transferred in the foreseeable future. Currently the Company does not have any contractual cash management policies that dictate how funds are transferred between our subsidiaries, holding company and investors. If we decide to distribute dividends to our investors, we may distribute dividends by way of cash or by other means that we consider appropriate. A decision to declare and pay any dividends would require the approval of our Board and will be at its discretion. In addition, any final dividend for a financial year will be subject to Shareholders’ approval and even if approved, cannot be regarded as an indication of future dividend policy or our payment of dividends in the future. See “Galaxy Payroll Group Limited Consolidated Statements of Changes in Shareholders’ Equity” and “Galaxy Payroll Group Limited Consolidated Statements of Cash Flows”.

We are an “emerging growth company” as defined under the federal securities laws and will be subject to reduced public company reporting requirements. Please read the disclosures beginning on page 42 of this prospectus for more information.

| Per Share | Total

Without Over- Allotment Option | Total With Over- Allotment Option | ||||||||||

| Initial public offering price(1) | $ | $ | $ | |||||||||

| Underwriter’s discounts(2) | $ | $ | $ | |||||||||

| Proceeds to our company before expenses(3) | $ | $ | $ | |||||||||

| (1) | Initial public offering price per share is assumed as $[●] per share, which is the midpoint of the range set forth on the cover page of this prospectus. For more information, see “Underwriting” in this prospectus. |

| (2) | We have agreed to pay the underwriters a discount equal to 7%. |

| (3) | We expect our total cash expenses for this offering (including cash expenses payable to our underwriter for its out-of-pocket expenses) not to exceed $200,000, exclusive of the above discounts. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation, such as 1% of the total offering amount as the underwriter’s non-accountable expenses. These payments will further reduce proceeds available to us before expenses. For a detailed description of the compensation to be received by the underwriter, see “Underwriting.” |

This offering is being conducted on a firm commitment basis. The underwriter is obligated to take and pay for all of the Ordinary Shares if any such Ordinary Shares are taken. We have granted the underwriter an option for a period of 45 days after the effective date of this registration statement to purchase up to 15% of the total number of the Ordinary Shares to be offered by us pursuant to this offering (excluding Ordinary Shares subject to this option), solely for the purpose of covering over-allotments, at the public offering price less the underwriting discounts. If the underwriter exercises the option in full, and assuming an offering price of $[●] per Ordinary Share, which is the midpoint of the range set forth on the cover page of this prospectus, the total gross proceeds to us, before underwriting discounts and expenses, will be $[●].

The underwriter expects to deliver the Ordinary Shares against payment as set forth under “Underwriting” on or about [●], 2023.

Recently, the Chinese government announced that it would step up supervision of Chinese firms listed offshore and/or foreign investments in China based issuers. Under the new measures, China will improve regulation of cross-border data flows and security, crack down on illegal activity in the securities market and punish fraudulent securities issuance, market manipulation and insider trading, China will also check sources of funding for securities investment and control leverage ratios. The Cyberspace Administration of China (“CAC”) has also opened a cybersecurity probe into several U.S.-listed tech giants focusing on anti-monopoly, financial technology regulation and more recently, with the passage of the Data Security Law, how companies collect, store, process and transfer data.

The Company does not use variable interest entities in its corporate structure. We do not believe the Company’s current business to be within the targeted areas of concern by the Chinese government. However, because of the Company’s subsidiaries in Hong Kong and mainland China and their operations there, there is a risk that the Chinese government may in the future seek to affect operations of any company with any level of operations in Hong Kong or China through the exertion of increased control, oversight, intervention and influence of our Operating Entities’ operations, our ability to offer securities to investors, list our securities on a U.S. or other foreign exchange, conduct their business or accept foreign investment. Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition. If any or all of the foregoing were to occur, it could, in turn, result in a material change in the Company’s operations and/or the value of its Ordinary Shares and/or significantly limit or completely hinder its ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated February 22, 2023

TABLE OF CONTENTS

You should rely on the information contained in this prospectus or in any related free writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or in any related free writing prospectus. We are offering to sell, and seeking offers to buy the Ordinary Shares, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Ordinary Shares.

Neither we nor the underwriter have taken any action to permit a public offering of the Ordinary Shares outside the United States or to permit the possession or distribution of this prospectus or any filed free-writing prospectus outside the United States. Persons outside the United States who come into possession of this prospectus or any filed free writing prospectus must inform themselves about and observe any restrictions relating to the offering of the Ordinary Shares and the distribution of this prospectus or any filed free-writing prospectus outside the United States.

Until [●], 2023 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our Ordinary Shares, discussed under “Risk Factors,” before deciding whether to buy our Ordinary Shares.

Overview

We are a holding company incorporated in the British Virgin Islands, or BVI. As a holding company with no operations, we are not a Chinese operating company. Our operations are conducted by our Operating Entities, which include our indirect wholly-owned subsidiaries, such as Galaxy Payroll Services Limited (“Galaxy Payroll (HK)”), Galaxy GEO Services Limited (“Galaxy GEO Services”), Galaxy Corporate Management Consultancy (Shenzhen) Limited (“Galaxy HR (SZ)”), Galaxy Human Resources Limited (“Galaxy HR (TW)”), and Galaxy Recursos Humanos (Macau) Limitada (“Galaxy HR (Macau)”), which are incorporated in Hong Kong, PRC, Taiwan and Macau. As a reputable payroll outsourcing service, employment service and consultancy and market research service provider based in Hong Kong, the Company, through our Operating Entities, provides services to our customers which are mainly categorized as (i) channels which are global human resources service providers engaged by companies/organizations to handle payroll and/or employment-related matters for their branch offices in different regions; (ii) end-users which are mainly multinational companies/organizations that outsource their payroll and/or employment functions to us directly; (iii) end-users consulting us for their future expansion worldwide. Galaxy HR (SZ), Galaxy Payroll (HK), Galaxy HR (TW) and Galaxy HR (Macau) provide payroll outsourcing services in the mainland China, Hong Kong, Taiwan and Macau; Galaxy HR (SZ), Galaxy Payroll (HK), Galaxy GEO Services and Galaxy HR (TW) provide employment services in the mainland China, Hong Kong and Taiwan; and Galaxy Payroll (HK) provides consultancy and market research services in Hong Kong. End-users of our services may either be (i) our indirect customers engaging us through channels; or (ii) our direct customers. This is an offering of the Ordinary Shares of Galaxy Payroll Group Limited, the holding company incorporated in BVI, instead of shares of our Operating Entities. You may never directly hold any equity interest in our Operating Entities.

In providing payroll outsourcing services, we generally assist our end-users in (i) calculating employees’ salaries and the required employer’s contributions to Hong Kong’s Mandatory Provident Fund (MPF) and PRC’s social security and housing provident funds as well as individual income tax and any other deductions required to be made under the laws of the respective jurisdictions; (ii) arranging for payment to the employees’ bank accounts; (iii) monitoring and maintaining payroll records; and (iv) preparing and filing employment-related tax returns. For the two fiscal years ended June 30, 2022 and 2021, we handled approximately 62,200 and 83,300 payroll transactions for our payroll outsourcing service customers, respectively. Galaxy Payroll (HK) and Galaxy HR (Macau) provide payroll outsourcing services in Hong Kong and Macau directly and cooperate with in-country partners to provide payroll outsourcing services in the PRC and India where appropriate. The contractual arrangements with in-country partners to provide service are as effective as providing services directly. Although we may incur some challenges or additional costs to enforce the terms of the arrangements, we regard such risk to be minimal and remote, since we have maintained stable and long-term relationship with these in-country partners. In February 2020, we ceased to cooperate with in-country partners in Taiwan to streamline our cost structure. Since then, Galaxy HR (TW) provides payroll outsourcing services directly in Taiwan.

In providing employment services, our Operating Entities or our in-country partners (upon our request) (i) act as the employers of record to employ suitable candidates, who are sourced by our end-users, and second them back to our end-users; and (ii) handle the seconded employees’ payroll as their employers of record. Galaxy Payroll (HK), Galaxy GEO Services and Galaxy HR (Macau) provide employment services in Hong Kong and Macau directly and Galaxy Payroll (HK) cooperated with in-country partners to provide employment services in the PRC, Japan, Australia and other Asian countries where appropriate. In respect of our employment services in Taiwan, Galaxy Payroll (HK) cooperated with in-country partners during the year ended June 30, 2020. In February 2020, we ceased to cooperate with in-country partners in Taiwan to streamline our cost structure. Since then, Galaxy HR (TW) provides employment services directly in Taiwan.

In providing consultancy and market research services, our Operating Entities (i) provide consultation for local policy in advanced level and delivery of country profile reports; (ii) deliver general consultation on different topics as well as Q&A session with local experts on a monthly basis. Galaxy Payroll (HK) provides consultancy and market research services in Hong Kong directly.

With regard to the business the Company and its subsidiaries participated in, the Company has expressly confirmed to have received all requisite permissions or approvals in Taiwan and Macau, based on the knowledge of its own administrative staff who maintains the compliance status regarding Taiwan and Macau. As of the date of this prospectus, as advised by PRC Legal Advisers, the Company has received all requisite permissions or approvals necessary for its business operations in the PRC and as advised by Hong Kong Legal Advisers, the Company has received all requisite licenses, permits and approvals for its business operations in Hong Kong.

1

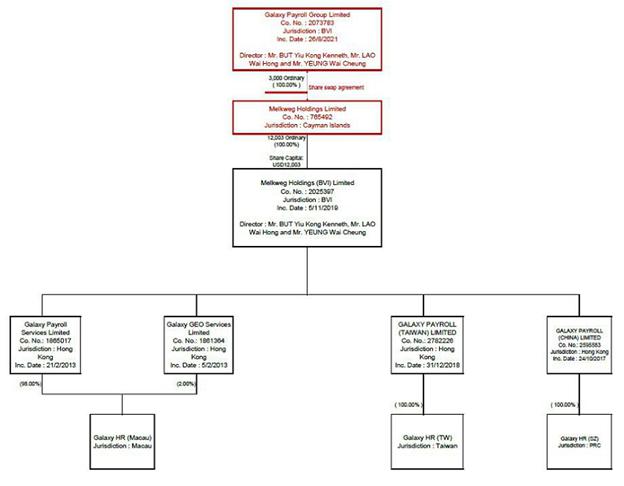

CORPORATE STRUCTURE

The following diagram illustrates our corporate structure:

| 1. | Pine Mountain Holdings Limited, 100% held by Mr. LAO Wai Hong, holds 2,400,000 shares which is 15.0% of the total share capital of Galaxy Payroll Group Limited. |

| 2. | PROFIT OASIS GLOBAL LIMITED, 100% held by Mr. SI Lin Tai, holds 880,000 shares which is 5.5% of the total share capital of Galaxy Payroll Group Limited. |

| 3. | GOLDEN EDGE DEVELOPMENTS LIMITED, 100% held by Ms. SUN Hsiu Na, holds 720,000 shares which is 4.5% of the total share capital of Galaxy Payroll Group Limited. |

| 4. | Agapao Investment Holding Limited, 100% held by Mr. BUT Yiu Kong Kenneth, holds 2,400,000 shares which is 15.0% of the total share capital of Galaxy Payroll Group Limited. |

| 5. | LUCKY PARTNER ENTERPRISES LIMITED, 100% held by Mr. WONG Tin Fat, holds 960,000 shares which is 6.0% of the total share capital of Galaxy Payroll Group Limited. |

| 6. | NEW BASIC GROUP LIMITED, 100% held by Mr. YEUNG Chun Kong Anson, holds 640,000 shares which is 4.0% of the total share capital of Galaxy Payroll Group Limited. |

| 7. | JEAN Oceania Limited, 100% held by Mr. YEUNG Wai Cheung, holds 2,400,000 shares which is 15.0% of the total share capital of Galaxy Payroll Group Limited. |

| 8. | FIRST START INTERNATIONAL LIMITED, 100% held by Mr. TSE Joseph, holds 960,000 shares which is 6.0% of the total share capital of Galaxy Payroll Group Limited. |

| 9. | DYNAMIC ALLY INVESTMENTS LIMITED, 100% held by Mr. WONG Ying Chuen, holds 640,000 shares which is 4.0% of the total share capital of Galaxy Payroll Group Limited. |

| 10. | EPT Development Holdings Limited, 100% held by Mr. CHAN Chi Keung Eric, holds 800,000 shares which is 5.0% of the total share capital of Galaxy Payroll Group Limited. |

| 11. | TOP VIRTUE INTERNATIONAL LIMITED, 100% held by Mr. YIU Pak To, holds 800,000 shares which is 5.0% of the total share capital of Galaxy Payroll Group Limited. |

| 12. | APTC Holdings Limited, 100% held by Mr. POON Tak Ching, holds 720,000 shares which is 4.5% of the total share capital of Galaxy Payroll Group Limited. |

| 13. | VALUE CLASSIC GLOBAL LIMITED, 100% held by Mr. WONG Tai Kuen, holds 960,000 shares which is 6.0% of the total share capital of Galaxy Payroll Group Limited. |

| 14. | GOLDEN BASE VENTURES LIMITED, 100% held by Mr. HUNG Kwok Wing, holds 720,000 shares which is 4.5% of the total share capital of Galaxy Payroll Group Limited. |

2

TRANSFERS OF CASH TO AND FROM OUR SUBSIDIARIES

Galaxy Payroll BVI is a holding company with no operations of its own. We conduct our operations in Hong Kong primarily through Galaxy Payroll (HK), and in China through our subsidiary, Galaxy HR (SZ); in Taiwan through our subsidiary, Galaxy HR (TW); and in Macau through our subsidiary, Galaxy HR (Macau). Galaxy Payroll BVI’s ability to pay dividends to its shareholders and to service any debt it may incur may largely depend upon dividends paid to us by Galaxy Payroll (HK), our largest subsidiary which accounts for over 90% of our revenue. If any of our subsidiaries incurs debt on its own in the future, the instruments governing such debt may restrict its ability to pay dividends to Galaxy Payroll BVI. In addition, Galaxy HR (SZ) is required to make appropriations to certain statutory reserve funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. During the year ended June 30, 2022, Melkweg Cayman declared the dividends of HK$14,407,426 (US$1,835,996) and made the dividend of HK$18,924,782 (US$2,411,660) to Pine Mountain, Agapao Investment and JEAN Oceania evenly with each entity received HK$6,308,261 (US$803,887) from Melkweg Cayman. During the year ended June 30, 2021, Melkweg Cayman declared the dividends of HK$8,018,400 (US$1,032,528) and made the dividend of HK$1,500,000 (US$193,155) evenly to Pine Mountain, Agapao Investment and JEAN Oceania respectively, with each entity received and HK$500,000 (US$64,385) from Melkweg Cayman. The dividends were still paid directly through Melkweg Cayman after reorganization since the bank account of Galaxy Payroll Group Limited had not been opened until November 15, 2022. Melkweg Cayman pays to the ultimate shareholders based on the cash flow position and its reserve at the beginning of each month, a point when dividend payment is assessed by its management. The total amount paid by Melkweg Cayman to the shareholders is less than the total amount paid from Melkweg BVI and that originally from Galaxy Payroll HK due to the differences resulted from the exchange rates at different conversion points. As of the date of this prospectus, we do not have any U.S. investors, and thus no dividends or distributions have been made to any U.S. investors.

Cash is transferred through our organization in the manner as follows: (i) we may transfer funds to Galaxy HR (SZ), Galaxy HR (TW) and Galaxy HR (Macau) through our subsidiaries in Hong Kong, Galaxy Payroll (China), Galaxy Payroll (TW) and Galaxy Payroll (HK) respectively, by additional capital contributions or shareholder’s loans, as the case may be; (ii) Payroll funds and service fees are from Galaxy Payroll (HK) to Galaxy HR (SZ), Galaxy HR (TW) and Galaxy HR (Macau); and (iii) dividends are paid from Galaxy Payroll (HK) to Melkweg BVI; then from Melkweg BVI to Melkweg Cayman; and finally from Melkweg Cayman to Galaxy Payroll BVI. As a holding company, we may rely on dividends and other distributions on equity paid by Galaxy Payroll (HK) and other subsidiaries for our cash and financing requirements. If Galaxy Payroll (HK) and other subsidiaries incur debt on their own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to the shareholders. To date, Galaxy Payroll BVI has not raised any capital, and thus, has not transferred funds to Galaxy Payroll (HK) and other subsidiaries. In the future, however, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to Galaxy Payroll (HK) and other subsidiaries via capital contribution or shareholder loans. As of the date of this prospectus, Melkweg Cayman and Galaxy Payroll BVI declared HK$4,003,330 (US$510,000) and Melkweg Cayman paid HK$4,003,330 (US$510,000) to Pine Mountain, Agapao Investment and JEAN Oceania evenly, with each entity received HK$1,334,443 (US$170,000) from Melkweg Cayman. Melkweg Cayman directly paid the dividends to the above-mentioned three shareholders. Meanwhile, there is no dividend payment to the new shareholders of the Group after the reorganization, and Galaxy Payroll BVI had not opened its bank account right after the reorganization until November 15, 2022. Therefore, Galaxy Payroll BVI had relied on Melkweg Cayman to distribute the dividend payment prior to its bank account was open. See “Galaxy Payroll Group Limited - Consolidated Statements of Changes in Shareholders’ Equity - For the Two Fiscal Years Ended June 30, 2022 and 2021” and “Galaxy Payroll Group Limited - Consolidated Statements of Cash Flows - For the Two Fiscal Years Ended June 30, 2022 and 2021”.

Our PRC subsidiary’s ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiary to pay dividends to Galaxy Payroll (China) only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, our subsidiary in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of our PRC subsidiary, the reserve funds are not distributable as cash dividends except in the event of liquidation.

The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments.

Cash dividends, if any, on our Ordinary Shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%.

3

In order to pay dividends to our shareholders, we rely on payments made from Galaxy Payroll (HK) to Melkweg BVI, and the distribution of such payments to Melkweg Cayman from Melkweg BVI and to Galaxy Payroll BVI from Melkweg Cayman as dividends. Certain payments from Galaxy Payroll (HK) to Galaxy HR (SZ) and Galaxy HR (TW) are subject to business taxes and VAT. During the year ended June 30, 2022, Galaxy Payroll (HK) paid payroll funds and service fees of HK$5,443,248 (US$693,655) to Galaxy HR (SZ); Galaxy Payroll (HK) paid the payroll funds and service fees of HK$13,454,617 (US$1,714,576) to Galaxy HR (TW). During the year ended June 30, 2021, Galaxy Payroll (HK) paid payroll funds and service fees of HK$1,552,933 (US$199,971) and to Galaxy HR (SZ); Galaxy Payroll (HK) paid the payroll funds and service fees of HK$9,736,455 (US$1,253,761) to Galaxy HR (TW); and Galaxy Payroll (HK) paid shareholder’s loan of HK$113,169 (US$14,573), payroll funds and service fees of HK$6,899,027 (US$888,386) and to Galaxy HR (Macau).

Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, and other applicable PRC laws, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC entity. However, based on the Circular on Certain Issues with Respect to the Enforcement of Dividend Provisions in Tax Treaties, or the SAT Circular 81, issued on February 20, 2009 by the State Administration of Taxation (“SAT”), if the relevant PRC tax authorities determine, in their discretions, that a company benefits from such reduced income tax rate due to a structure or arrangement that is primarily tax-driven, such PRC tax authorities may adjust the preferential tax treatment. In addition, the 5% withholding tax rate does not automatically apply and certain requirements must be satisfied, including, without limitation, that (a) the Hong Kong entity must be the beneficial owner of the relevant dividends; and (b) the Hong Kong entity must directly hold no less than 25% share ownership in the PRC entity during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong entity must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to dividends to be paid by our PRC subsidiary to its immediate holding company, Galaxy Payroll (China). As of the date of this prospectus, Galaxy HR (SZ) currently does not have plan to declare and pay dividends to Galaxy Payroll (China) and we have not applied for the tax resident certificate from the relevant Hong Kong tax authority. Galaxy Payroll (China) intends to apply for the tax resident certificate when Galaxy HR (SZ) plans to declare and pay dividends to Galaxy Payroll (China). When Galaxy HR (SZ) plans to declare and pay dividends to Galaxy Payroll (China) and when we intend to apply for the tax resident certificate from the relevant Hong Kong tax authority, we plan to inform the investors through SEC filings, such as a report on Form 6-K, prior to such actions.

INCREASE OF AUTHORIZED SHARES AND FORWARD SHARE SPLIT

On December 19, 2022, the Company filed Amended and Restated Charter with the Registrar to increase our authorized shares from 50,000 Ordinary Shares, par value of US$1 per share, to unlimited number of Ordinary Shares, par value of US$0.000625 per share and effectuated a forward split of all issued and outstanding shares at a ratio of 1,600:1.

OUR PRINCIPAL BUSINESS

We, through our subsidiaries (together, our “Group”) provide in-country payroll outsourcing services, employment services and consultancy and market research services to our customers from diversified industries. The table below sets out our customers, scope of services, geographical locations of the employees or seconded employees and service fees charged by our Group under each business during the two fiscal years ended June 30, 2022 and 2021:

| Business | Customers | Scope of services | Service fees | |||

| Payroll outsourcing services | (i) Channels; and (ii) end-users. |

In providing payroll outsourcing services, we assist our end-users in (i) conducting computation of salaries and the amounts of contributions to be paid for MPF in Hong Kong, social security, housing provident funds and individual income tax in the PRC and any other deductions required to be made under the laws of the respective jurisdictions; (ii) arranging for payment to the employees’ bank accounts; (iii) monitoring and maintaining payroll records; and (iv) preparing and filing employment- related tax returns. | The Operating Entities generally charge service fees for each employee of the end-users at a fixed amount per month, subject to a fixed amount of minimum charge per end-user per month.

Customers are generally required to settle the fees within 30 to 90 days from the dates of our invoices.

During the two fiscal years ended June 30, 2022 and 2021, our Group did not adjust our pricing schedule for our payroll outsourcing services with our customers. | |||

| Employment services | (i) Channels; and (ii) end-users. |

In providing employment services, the Operating Entities (i) employ candidates directly or through our in-country partners, who are sourced by the end-users themselves and second them back to the end-users; and (ii) handle the seconded employees’ payroll and other administrative matters as their employers of record directly or through our in-country partners. | The Operating Entities charge basic service fees for each seconded employee on a monthly basis during the service period based on an agreed percentage of the seconded employees’ monthly remuneration package or at a fixed fee agreed with our channel customers or our end-users.

Customers are generally required to settle the fees upon receipt of invoice or within 30 days from the dates of our invoices.

During the two fiscal years ended June 30, 2022 and 2021, our Group did not adjust our service fees for employment services with our customers. |

4

| Business | Customers | Scope of services | Service fees | |||

| Consultancy and market research services | (i) end-users. | In providing consultancy and market research services, the Operating Entities (i) provide consultation for local policy in advanced level and delivery of country profile reports; (ii) deliver general consultation on different topics as well as Q&A session with local experts on a monthly basis. |

The Operating Entities charge service fee for (i) consultancy and market research service on a project-by-project basis and (ii) human capital consulting service at a fixed fee agreed with our channel customers or our end-users on a monthly basis.

Customers are generally required to settle the fees within 30 days from the dates of our invoices.

During the year ended June 30, 2022, our Group did not adjust our pricing schedule for our consultancy and market research services with our customers. |

CUSTOMERS

Our Group’s customers are mainly categorized as (i) channels which are global human resources service providers engaged by companies/organizations to handle payroll and employment-related matters for their branch offices in different regions; and (ii) end-users which are mainly multinational companies/organizations that outsource their payroll or employment functions to us directly. During the two fiscal years ended June 30, 2022 and 2021, end-users of our services included mainly multinational companies/organizations engaging in a wide variety of industries. For payroll outsourcing services, a majority of our end-users during the two fiscal years ended June 30, 2022 and 2021 engaged in the retail and trading, industrial, IT, financial and professional services industries. For employment services, a majority of our end-users during the two fiscal years ended June 30, 2022 and 2021 engaged in the IT, retail and trading, industrial, professional institution and education and healthcare industries. For consultancy and market research services, a majority of our end-users during the year ended June 30, 2022 engaged in the IT, industrial, media, advertising and entertainment, professional services.

IN-COUNTRY PARTNERS

For the year ended June 30, 2022, our Operating Entities cooperated with one major in-country partner, China-Key HR Outsourcing Co., Limited, five other in-country partners in the PRC, CIIC Human Resources Consulting (Zhuhai) Hengqin Branch, FESCO Adecco Shanghai Co. Ltd., Shanghai Foreign Service (Group) co., Ltd., Dalian Pengyu Management Consulting Service Co., Ltd., Shanghai Firstray China Human Resources Service Co. Ltd., one in-country partner in Japan, SBC G.K, one in-country partner in Thailand and Malaysia, Eos Global Partners Limited, one in-country partner in Australia, People 2.0 Australia (ESS) Pty Ltd., one in-country partner in India, Procloz Services Private Limited, one in-country partner in Indonesia, PT. Tuas Solusi Karya and one in-country partner in Vietnam, Tuas Solutions Pte Ltd., on a non-exclusive basis to provide payroll outsourcing services and employment services in the PRC, Taiwan, Japan, Thailand, Malaysia, Australia, India, Indonesia and Vietnam, respectively.

For the year ended June 30, 2021, our Operating Entities cooperated with one major in-country partner, China-Key HR Outsourcing Co., Limited, five other in-country partners in the PRC, CIIC Human Resources Consulting (Zhuhai) Hengqin Branch, FESCO Adecco Shanghai Co. Ltd., Shanghai Foreign Service (Group) co., Ltd., Dalian Pengyu Management Consulting Service Co., Ltd., Shanghai Firstray China Human Resources Service Co. Ltd., one in-country partner in Taiwan, Raymond-L International Co., Ltd, and one in-country partner in Japan, SBC G.K., on a non-exclusive basis, to provide payroll outsourcing services and employment services in the PRC, Taiwan and Japan, respectively.

In February 2020, we ceased to cooperate with in-country partners in Taiwan. As of the date of this prospectus, we provided payroll outsourcing services in Hong Kong and Macau directly and cooperated with in-country partners to provide payroll outsourcing services in the PRC where appropriate. We provided employment services in Hong Kong and Taiwan directly and cooperated with in-country partners to provide employment services in the PRC and Japan where appropriate.

OUR COMPETITIVE STRENGTHS

We believe that we have the following competitive strengths which enable us to differentiate ourselves from our competitors:

| ● | we are a reputable in-country payroll outsourcing and employment service provider engaged by multinational channels and end-users from different industries; |

| ● | we have well-established business relationships with our customers; |

| ● | we are capable of providing high quality payroll outsourcing services and employment services to our customers to ensure compliance with local regulations for our end-users; and |

| ● | we have an experienced and strong management team with proven track record. |

For details, please refer to “Business — Competitive Strengths” in this prospectus.

5

OUR BUSINESS STRATEGIES

Our objective is to leverage on our experience in the payroll outsourcing service industry and employment service industry to expand our business operation in the PRC and Hong Kong, with a focus on the PRC market, by pursuing the following strategies:

| ● | expand our business operation in the payroll outsourcing service industry and employment service industry in the Asia market by (i) seeking strategic mergers and acquisitions to expand our business presence in the Asia market; or (ii) expanding our operation by providing services directly; |

| ● | expand our service capacity in Hong Kong; |

| ● | enhance our IT system to support our business operation; and |

| ● | develop marketing capability and conduct marketing campaigns to promote our payroll outsourcing services and employment services to direct end-users. |

RISK FACTORS SUMMARY

Our business is subject to a number of risks and uncertainties, including the following highlighted risks:

| ● | a significant portion of our revenue was generated from our five largest customers during the two fiscal years ended June 30, 2022 and 2021 and any significant decrease in the demand from such customers for our services may materially and adversely affect our financial conditions and operating results; |

| ● | our IT system may not perform as anticipated and is vulnerable to damage and interruption, which may lead to leakage of personal data of the employees of our end-users and our seconded employees; |

| ● | the Major In-country Partner accounted for over 50% of our in-country partner costs throughout the year ended June 30, 2022. The Major In-country Partner accounted for over 80% of our in-country partner costs throughout the year ended June 30, 2021. Any deterioration, termination of relationship or change of service offerings may adversely affect our business and results of operations; |

| ● | our success depends on our key management personnel; |

| ● | our end-users may consider setting up their own human resources departments to manage their own payroll and employment matters when they expand to a larger scale at the respective regions; and |

In particular, we are subject to risks and uncertainties from doing business in China, including:

| ● | We are a holding company incorporated in British Virgin Islands with most of our business operations in PRC and Hong Kong. Chinese legal system is still very unstable and is undergoing frequent changes following various policy reformation. Therefore, substantial uncertainties are posed on companies to conduct business with very little guidelines. There have been constant changes and amendments of laws and regulations over the past 30 years in order to keep up with the rapidly changing society and economy in China. Because government agencies and courts provide interpretations of laws and regulations and decide contractual disputes and issues, their inexperience in adjudicating new business and new polices or regulations in certain less developed areas causes uncertainty and may affect our business. |

| ● | There remain some uncertainties as to whether we will be required to obtain approvals from Chinese authorities to list on the U.S. exchanges and offer securities in the future, and if required, we cannot assure you that we will be able to obtain such approval. The Chinese government is exerting more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. |

| ● | Upon the effectiveness of the Trial Administrative Measures, we may be subject to the Trial Administrative Measures if the Company has: (i) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by PRC domestic companies; and (ii) the main parts of the issuer’s business activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in mainland China; and if required, we cannot assure you that we will be able to complete such process on time. |

| ● | Uncertainties regarding the enforcement of laws and the fact that rules and regulations in China can change quickly with little advance notice, along with the risk that the Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers could result in a material change in our operations, financial performance and/or the value of our common stock or impair our ability to raise money. See Risk Factor - Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition for more details. |

| ● | The Company also operates business in Hong Kong, Taiwan and Macau, any trivial change may have significant impact on the Company’s business. See Risk Factor - Risks relating to the economic, political, legal and social conditions in Hong Kong, Taiwan and Macau for more details. |

6

| ● | The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. Our ability to operate in China may be adversely affected by changes in Chinese laws and regulations. Such oversight exerted and controlled by the Chinese government over offerings that are conducted overseas and/or foreign investment in China-based issuers may significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. See Risk Factor - Adverse regulatory developments in China may subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted by the SEC in response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies like us with China-based operations, all of which could increase our compliance costs, subject us to additional disclosure requirements for more details. |

| ● | Recently, the Cyberspace Administration of China has taken action against several Chinese internet companies in connection with their initial public offerings on U.S. securities exchanges, for alleged national security risks and improper collection and use of the personal information of Chinese data subjects. The enactment of such new law inevitably force the Company to bear heavier burden both in cost and in effort to be compliant. Such oversight exerted and controlled by the Chinese government over offerings that are conducted overseas and/or foreign investment in China-based issuers may significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. See Risk Factor - Compliance with China’s new Data Security Law, Cybersecurity Review Measures, Personal Information Protection Law, regulations and guidelines relating to the multi-level protection scheme and any other future laws and regulations may entail significant expenses and could materially affect our business for more details. |

| ● | Some of our revenue is denominated in China’s currency Renminbi. It is convertible for trade purposes under the current account, but it is not freely convertible under the capital account, which covers portfolio investment and borrowing. As a result, restrictions on currency exchange and on dividend distribution may limit our ability to use revenue generated in Renminbi to fund any business activities we may have outside China in the future or to make dividend payments to our shareholders in U.S. dollars. Therefore, to the extent PRC government is enacting regulations to exert more control over convertibility of foreign currency, and that cash and/or assets in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds and/or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash and/or assets. See Risk Factor - Restrictions on currency exchange may limit our ability to receive and use our revenue effectively for more details. |

| ● | In addition, due to Company’s doing business outside the United States, we are not using U.S. dollars as our currency, therefore, various factors, such as changes in China’s political and economic conditions and China’s foreign exchange controls procedure, may lead to the change in value of the Renminbi against the U.S. dollar and other currencies. See Risk Factor - The fluctuation of the Renminbi may have a material adverse effect on your investment for more details. |

| ● | Due to the fact that substantially all of our operations are in China and Hong Kong, substantially all of our assets being in PRC and Hong Kong, and a majority of our directors and officers being nationals and/or residents of countries other than the United States, direct recognition and enforcement in PRC or Hong Kong of judgments of a court in any of these non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be extremely hard and burdensome, if not impossible. See Risk Factor - You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the annual report based on foreign laws for more details. |

Pursuant to the Holding Foreign Companies Accountable Act, or the HFCAA, the Public Company Accounting Oversight Board (the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (i) mainland China of the PRC, and (ii) Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our former auditor, Friedman LLP, is headquartered in New York, and has been inspected by the PCAOB on a regular basis. Our current auditor, Marcum Asia CPAs LLP (“Marcum Asia”), is also headquartered in New York, and has been inspected by the PCAOB on a regular basis, with the last inspection in 2020. Neither of them headquartered in mainland China or Hong Kong and were not identified in this report as firms subject to the PCAOB’s determination. Notwithstanding the foregoing, in the event that, in the future, either PRC regulators take steps to impair the auditing firm’s access to the workpapers in PRC or Hong Kong, or the PCAOB is not able to fully conduct inspections of our auditor’s work papers in mainland China, or the PCAOB expands the scope of the Determination Report so that we are subject to the HFCAA, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets, trading of our securities on a national securities exchange or in the over-the counter may be prohibited under the HFCAA and an exchange may determine to delist our securities. On June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two, under this proposal, if the auditor is not subject to PCAOB inspections for two consecutive years, an issuer’s securities may be prohibited from trading or delisted. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was signed into law. This will pose more risks leading delisting as well as the price of an issuer’s securities especially on foreign companies. On August 26, 2022, the PCAOB announced and signed a Statement of Protocol (the “Protocol”) with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China. The Protocol provides the PCAOB with: (1) sole discretion to select the firms, audit engagements and potential violations it inspects and investigates, without any involvement of Chinese authorities; (2) procedures for PCAOB inspectors and investigators to view complete audit work papers with all information included and for the PCAOB to retain information as needed; (3) direct access to interview and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. On December 15, 2022, the PCAOB issued a new Determination Report which: (1) vacated the December 16, 2021 Determination Report; and (2) concluded that the PCAOB has been able to conduct inspections and investigations completely in the PRC in 2022. The December 15, 2022 Determination Report cautions, however, that authorities in the PRC might take positions at any time that would prevent the PCAOB from continuing to inspect or investigate completely. As required by the HFCAA, if in the future the PCAOB determines it no longer can inspect or investigate completely because of a position taken by an authority in the PRC, the PCAOB will act expeditiously to consider whether it should issue a new determination. See “Risk Factors — Our auditor is headquartered in New York, and is subject to inspection by the PCAOB on a regular basis. To the extent that our independent registered public accounting firm’s audit documentation related to their audit reports for our company become located in China, the PCAOB may not be able to inspect such audit documentation and, as such, you may be deprived of the benefits of such inspection and our common stock could be delisted from the stock exchange pursuant to the Holding Foreign Companies Accountable Act” for more information.

7

For details, please refer to “Risk Factors” starting page 19 in this prospectus.

OUR CORPORATE INFORMATION

Our principal executive offices are located at 25th Floor, Ovest, 77 Wing Lok Street, Sheung Wan, Hong Kong. Our phone number is +852 3105 2611. Our registered office in the British Virgin Islands is located at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands.

Investors should submit any inquiries to the address and telephone number of our principal executive offices. We maintain a corporate website at www.galaxy-hk.com. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus. Our agent for service of process in the United States is Puglisi & Associates, located at 850 Library Avenue, Suite 204, Newark, DE, 19711.

RECENT REGULATORY DEVELOPMENT IN PRC

We are a holding company incorporated in the British Virgin Islands with all of our operations conducted by the Operating Entities in Hong Kong, Taiwan, Macau and the PRC. We currently do not have or intend to set up any subsidiary or enter into any contractual arrangements to establish a VIE structure with any entity in mainland China. Hong Kong is a special administrative region of the PRC and the basic policies of the PRC regarding Hong Kong are reflected in Hong Kong’s constitutional document, namely, the Basic Law, which provides Hong Kong with a high degree of autonomy and executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one country, two systems”. Accordingly, we believe the laws and regulations of the PRC do not currently have any material impact on our business (except for the business conducted by us in the PRC or through our PRC subsidiary), financial condition or results of operations and that we are currently not required to obtain approvals from Chinese authorities to list on the U.S. exchanges and offer securities. However, there is no assurance that there will not be any changes in the economic, political and legal environment in Hong Kong in the future. If there is significant change to current political arrangements between mainland China and Hong Kong, companies operating in Hong Kong may face similar regulatory risks as those operating in PRC, including their ability to offer securities to investors, list their securities on a U.S. or other foreign exchange, conduct their businesses, or accept foreign investment. In light of China’s recent expansion of authority in Hong Kong, there are risks and uncertainties which we cannot foresee for the time being, and rules and regulations in China can change quickly with little or no advance notice. The Chinese government may intervene or influence our current and future operations in Hong Kong at any time, or may exert more control over offerings conducted overseas and/or foreign investment in issuers likes us.

We are aware that, recently, the PRC government initiated a series of regulatory actions and released statements to regulate business operations in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued the Opinions on Strictly and Lawfully Cracking Down Illegal Securities Activities to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On December 24, 2021, the China Securities Regulatory Commission, or the “CSRC”, published the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comment) (the “Administration Provisions”), and the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comment) (the “Measures”) for public comments. The Administration Provisions and Measures for overseas listings lay out specific requirements for filing documents and include unified regulation management, strengthening regulatory coordination, and cross-border regulatory cooperation. Domestic companies seeking to list abroad must carry out relevant security screening procedures if their businesses involve such supervision. Companies endangering national security are among those off-limits for overseas listings. On February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Administrative Measures”), which will take effect on March 31, 2023. The Trial Administrative Measures further stipulate the rules and requirements for overseas offering and listing conducted by PRC domestic companies. Upon the effectiveness of the Trial Administrative Measures, the Company may be required to go through the filing procedure. See “Risk Factor - Upon the effectiveness of the Trial Administrative measures, we may be subject to the Trial Administrative Measures if the Company has: (i) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by PRC domestic companies; and (ii) the main parts of the issuer’s business activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in mainland China; and if required, we cannot assure you that we will be able to complete such process on time” for more details. Furthermore, on December 28, 2021, the Cyberspace Administration of China, or the “CAC”, and other PRC authorities promulgated the Cybersecurity Review Measures, which took effect on February 15, 2022. The Cybersecurity Review Measures further restates and expands the applicable scope of the cybersecurity review in effect. Pursuant to the Cybersecurity Review Measures, critical information infrastructure operators that procure internet products and services and network platform operators engaging in data processing activities must be subject to the cybersecurity review if their activities affect or may affect national security. The Cybersecurity Review Measures further stipulates that network platform operators holding personal information of over one million users must apply to the Cybersecurity Review Office for a cybersecurity review before a foreign listing. We believe that we are currently compliant with the regulations or policies that have been issued by the CAC to date, in the event that we were deemed to be subject to such regulations or policies. As of the date of this prospectus, we have not been involved in any investigations on cybersecurity or data security initiated by related governmental regulatory authorities, and we have not received any inquiry, notice, warning, or sanction in such respect.

8

Nevertheless, since these statements and regulatory actions are new, it is highly uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. It is also highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation, our ability to accept foreign investments and the listing of our Ordinary Shares on a U.S. or other foreign exchanges. The PRC government has the power to exercise significant oversight and discretion over the conduct of our business, and the regulations to which we are subject may change rapidly and with little advance notice to us or our shareholders. New regulations and policies, which may be adopted with little advance notice, could result in a material change in our operations and/or the value of our Ordinary Shares. As of the date of this prospectus, (i) the Company does not hold personal information of over one million users; (ii) we process data for the sole purpose of human resource services which does not involve data processing activities that affect or may affect national security, and (iii) the Company has not been informed by any PRC governmental authority of any requirement that it file for a cybersecurity review; therefore, based on the foregoing and as advised by our PRC Legal Advisers, the Company believes it is not required to pass cybersecurity review of CAC. Further, as of the date of this prospectus, the Company has expressly confirmed that it has received all requisite permissions or approvals in Taiwan and Macau, based on the knowledge of its own administrative staff who maintains the compliance status regarding Taiwan and Macau. As advised by our Hong Kong Legal Advisers, as of the date of this prospectus, our Hong Kong subsidiaries have obtained all requisite licenses, permits and approvals for our business operations in Hong Kong including the business registration certificates and the employment agency license. As advised by our PRC Legal Advisers, as of the date of this prospectus, our PRC subsidiary has obtained all requisite PRC licenses, permits and approvals necessary for its operation of business, including the business license, Labor Dispatch Operation Permit and the record-filing receipt from the competent human resource authority for its human resource services business; except for such PRC regulatory approvals as required for the operation of business of our PRC subsidiary, on the basis that the Administration Provisions, Measures and Trial Administrative Measures have not yet come into effect, we and our PRC subsidiary (1) are not required to obtain permissions or approvals from the PRC authorities to issue our Ordinary Shares to foreign investors, (2) are not subject to permission requirements of the CSRC, the CAC or other PRC authorities that are required to approve of our PRC subsidiary’s operations, and (3) have not received or were denied such permissions or approvals by the PRC authorities. However, if there is any significant change to current political arrangements between mainland China and Hong Kong, or the applicable laws, regulations, or interpretations change, and that the Company or our PRC subsidiary is required to obtain such approval in the future, and that the Company does not receive or maintain the approvals or is denied permissions from the PRC authorities, or inadvertently concludes that such approvals are not required, it could incur material costs to ensure compliance, and we could be subject to fines and no longer be permitted to continue our current business operations. We may not be able to list our Ordinary Shares on a U.S. national securities exchange, or continue to offer securities to investors, which would materially affect the interest of the investors and cause significantly depreciation of our price of Ordinary Shares.

9

IMPLICATIONS OF OUR BEING AN “EMERGING GROWTH COMPANY”

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or “MD&A;” | |

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes); | |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; | |

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and | |

| ● | will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 20-F following the effectiveness of our initial public offering. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.