reviews

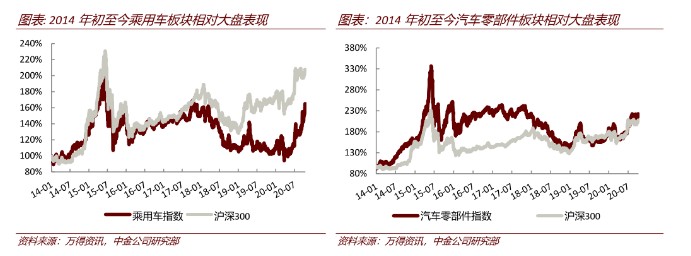

The production and sales trend was strong in September, and the industry entered the peak season. The year-on-year growth rate of passenger car retail and wholesale sales in the narrow sense of July-September remained above 7%. There was an effect of the low base after inventory clearance in June last year, but in absolute terms, the 3rd quarter gradually recovered to the same period in 2018, reflecting the continuous recovery of the car market after being affected by public health events. Furthermore, looking at the month-on-month trend, the third quarter continued to strengthen month by month. The month-on-month increase in retail sales in September was in the historical month-on-month central range, and the month-on-month increase in wholesale was higher than the historical center, reflecting the characteristics of entering the Golden Nine peak season. It also shows that, driven by the intensive introduction of new cars at the auto show, car companies and terminals are more optimistic about the continued recovery of demand in the car market.

By brand, luxury brand sales remained strong, but growth slowed month-on-month. In September, luxury car retail sales were +33% yoy and +5% month-on-month, and the penetration rate was 11.6%. Retail sales of major joint venture brands were +7% yoy and +12% month-on-month. Among them, Japanese brands remained strong. Dongfeng Honda, FAW Toyota, and GAC Honda all increased more than 20% year on year, while American brands were driven by the good performance of SAIC GM and Changan Ford, and their market share rebounded. Retail sales of independent brands were +1% yoy and +16% month-on-month. The month-on-month improvement trend continued to outperform the industry, and the penetration rate increased to 36.6% month-on-month. Strong first-tier independent brands have maintained a higher growth trend.

Channel plus inventory has started, and prices are relatively stable. In September, manufacturer inventories fell by 52,000 vehicles, and channel inventories increased by 82,000 vehicles, slightly higher than the average for previous years. The dealer inventory index reached 54.0% in September, +1.2ppt month-on-month, but -4.6ppt year-on-year. The overall inventory level in the industry was low. Thanks to the active inventory removal trend in the first half of the year and the relatively conservative pace of inventory addition in July-August, the cumulative channel inventory in January-September was reduced by 220,000 vehicles. The start of inventory addition in September also shows that OEMs are relatively more optimistic about the demand expectations for the car market in the fourth quarter. According to Thinkercar data, discounts for luxury and joint venture brands were basically the same month-on-month in September, with slight independent recycling. Related to the intensive introduction of new cars at auto shows and the reduction in average discounts, discounts on some old models remained flat or expanded slightly.

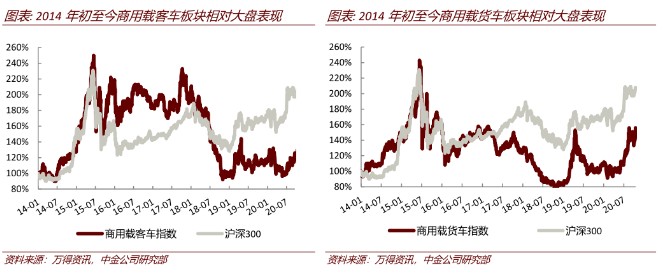

New energy and heavy trucks are expected to maintain a high level of prosperity. In September, production and sales of new energy vehicles reached 136,000 and 138,000 units respectively, up 48.0% and 67.7% respectively over the previous year. Production and sales data set a new record in September history. Among them, BEVs were sold 112,000 units, up 71.5% year on year; PHEV sales were 26,000 units, up 53.9% year on year. By model, the Wuling Mini EV drove A00 class sales to 33,000 units, and the penetration rate increased to 24%; the total market share of high-end models such as Tesla, BYD Han, Ideal, and NIO also exceeded 20%, and the momentum of both ends of the NEV market is obvious. In September, bus sales turned positive year on year, and trucks remained strong. Among them, the number of heavy trucks sold was 151,000 units, +80.2% over the same period last year. Our forecast for September's month-on-month correction was verified. We believe that actual demand in the industry is expected to remain month-on-month in October, and demand for heavy engineering trucks is expected to continue to grow month-on-month. The high boom in the 4Q industry is expected to continue. Excluding the influence of adjustment factors such as a “good start”, the actual demand in the heavy truck industry may exceed 1.65 million vehicles throughout the year.

Valuation and advice

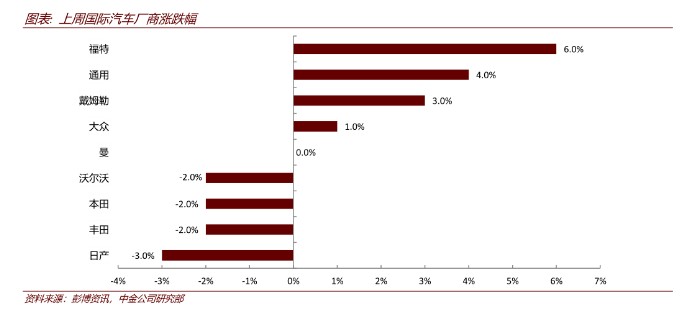

Demand in the car market showed a steady recovery after the health incident, and there is still room for improvement in sector valuations. We have sorted out the investment logic for the fourth quarter, which is mainly divided into four main lines - moving towards a new one: new energy vehicles maintain their popularity, and two electric wheels stand out; brand confidence: independent rise, brand differentiation; production and sales recovery: the possibility of high industry growth in 2021 continues to increase, overseas recovery: overseas health incidents have been repeated, but the car market is picking up fast.

Compatible with recommended Ideal Auto (LI.US), Maverick Electric (NIU.US), Great Wall Motor (02333), Changan Automobile, BYD (01211), Weichai Power (02338), and Huayu Automobile.

risks

Subsequent car sales fell short of expectations, and health incidents were repeated/affected automobile production and sales.

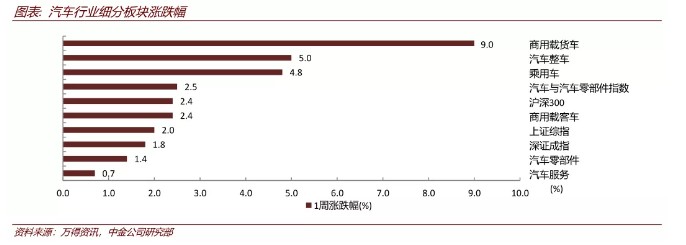

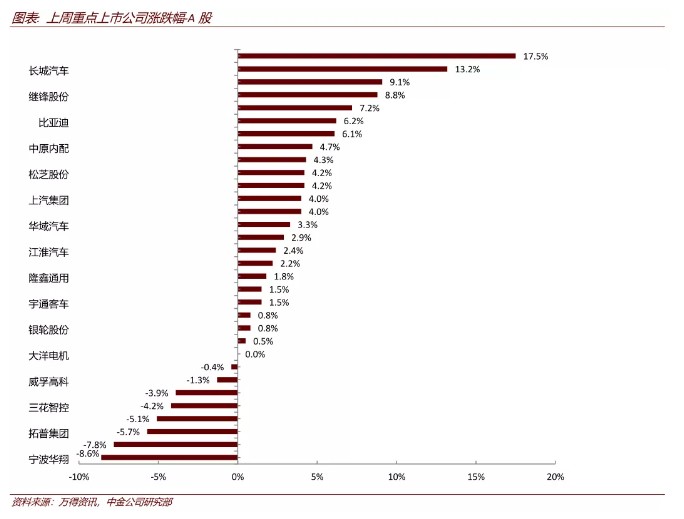

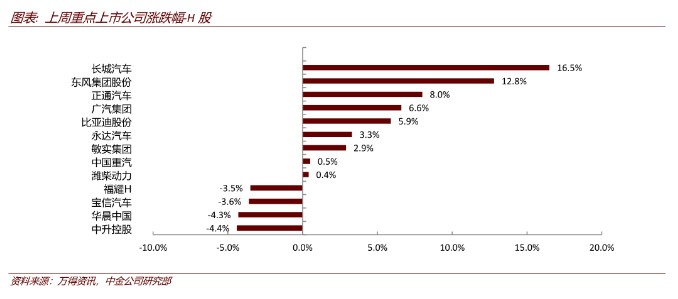

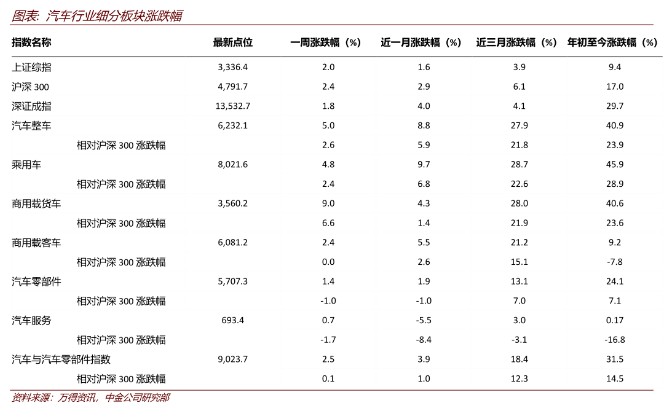

Industry key chart