Core viewpoints

Mobile payment as the entrance to create a closed loop of digital financial ecology

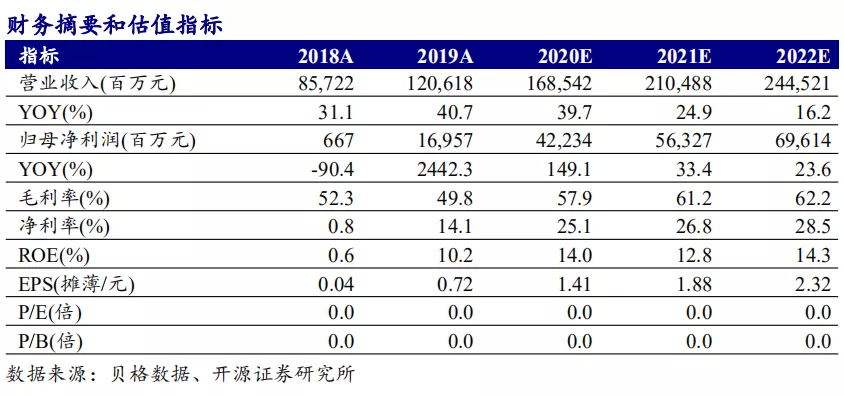

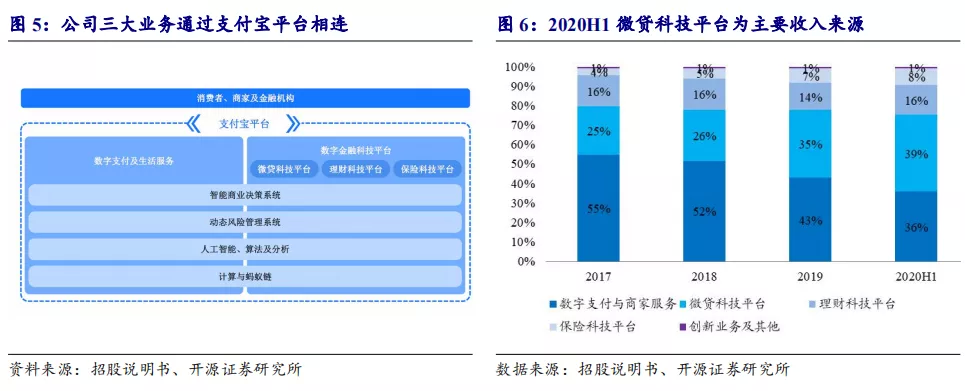

The company includes mobile payment and merchant services, digital financial technology platform and innovation and other three major businesses. With mobile payment as the traffic entrance, the company creates three major platforms: micro-loan technology, financial management technology and insurance technology. Expand the payment scene to the comprehensive scene of residents' life, and provide users with comprehensive financial services, including payment, financial management, credit, insurance and other financial services to realize the realization of traffic. Fully benefit from the flow of cash, consumption upgrading, residents' assets into the market and other dividends, the company's performance is expected to achieve further breakthroughs. Open source securities expects the net profit of the company from 2020 to 2022 to be 422.340.563.27 / 69.614 billion yuan respectively, and the EPS to be 1.41Universe 1.880.32 yuan respectively. According to FCFE and PE valuation methods, open source securities give Ant Group 40-60 times PE in 2020, corresponding market capitalization range of 1.69 trillion yuan to 2.53 trillion yuan, price range of 56.24 yuan to 84.36 yuan.

Payment creates traffic and creates core competitive advantage

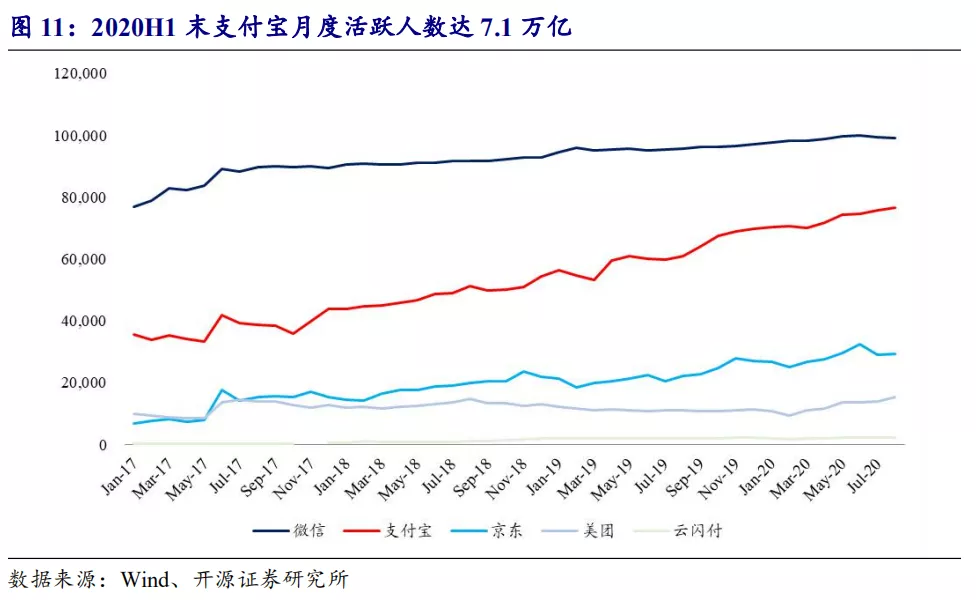

The company uses Alipay as the traffic entrance, and extends the payment scene to shopping, entertainment, tourism and other scenes by providing digital payment and various life services, so as to improve user stickiness. At present, Alipay has more than 700 million monthly active users, occupying a leading position in the industry. the market share of third-party Internet and mobile payment ranks first in the industry, and the scale of payment transactions is rising steadily. In the future, with the convenient and efficient user experience of digital payment, the industry size is expected to be 412 trillion by 2025; at the same time, the company continues to expand overseas markets and has established digital wallets in 9 regions around the world.

The three major financial technology platforms of micro-loan, financial management and insurance realize the realization of flow.

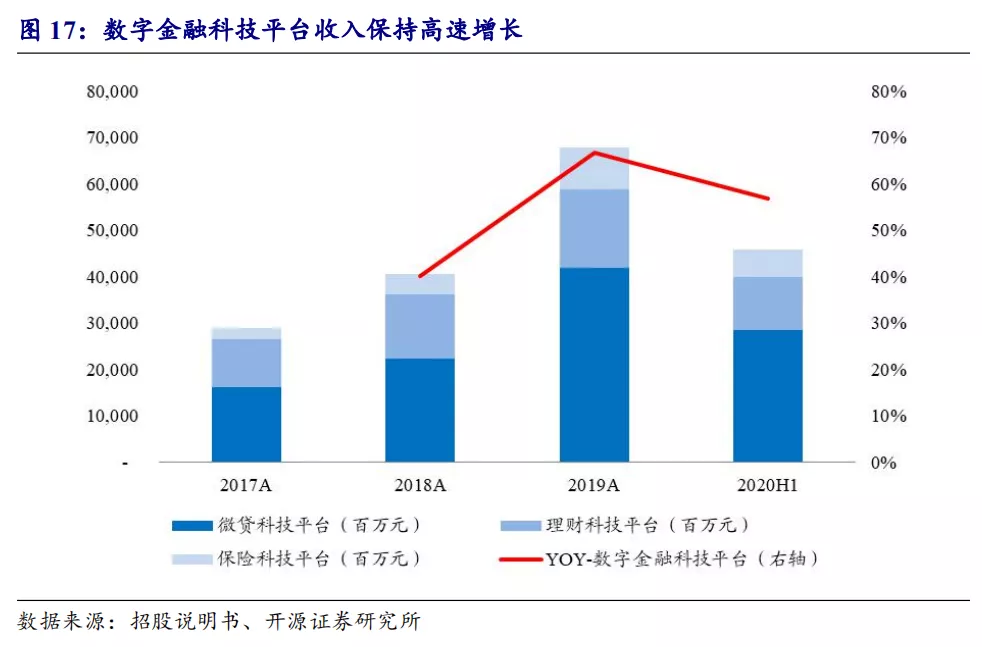

Financial digital technology platform has become the company's main source of income, 2020H1 revenue accounts for 63%, including micro-loan, financial management, insurance three major businesses. The company's micro-loan business is supported by scenarios and large flows, the number of income-end users and per capita balance are increasing, the business model is gradually changing from joint lending + ABS to light capital loan mode, and the income and cost side work together to drive the rapid growth of micro-loan business. In the financial management business, the company occupies the flow advantage, fully benefits from the residents' assets entering the market, and the rising volume and price of the consignment business drives the income to rise continuously. In terms of insurance business, the company provides many kinds of insurance products, and the business income continues to grow under high rates.

Risk Tips:With the intensification of Internet competition, the company's market share has declined; macroeconomic fluctuations have caused a credit crisis, which has a negative impact on the company's micro-loan business; affected by regulation, the growth of the company's business scale is limited.

1. Leading digital payment provider

1.1. A leading digital payment provider with simultaneous issuance of A shares and H shares.

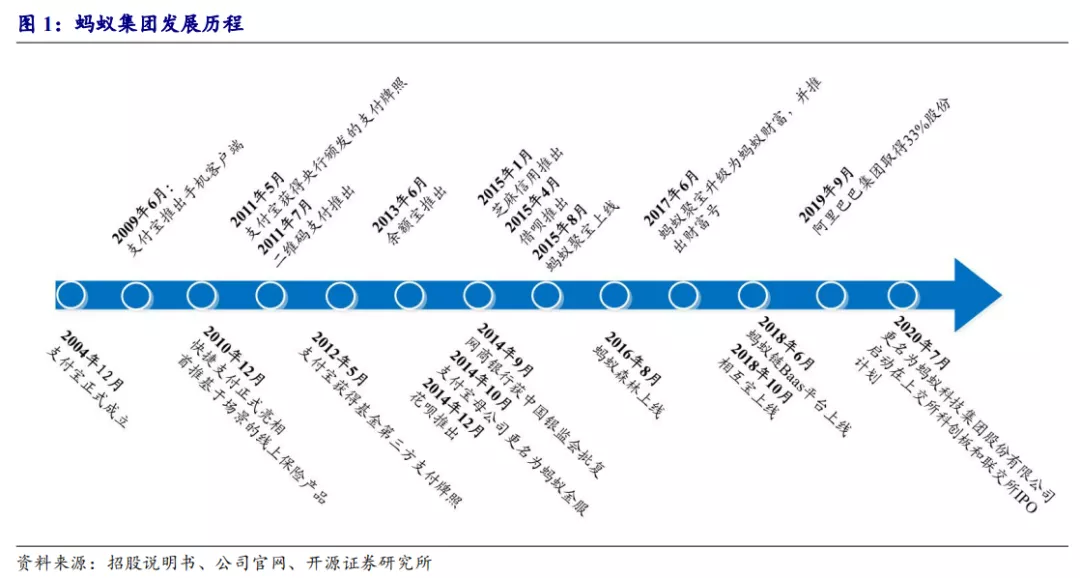

China's leading digital payment provider and digital financial technology platform.Ant Group started with Alipay launched by BABA in 2004 and has been operating independently since 2011. In June 2014, Zhejiang BABA, the legal subject of the company, changed its name to "Zhejiang Ant small and Micro Financial Services Group Co., Ltd.". Ant Co., Ltd. as a whole changed to a joint stock company and changed its name to "Zhejiang Ant small and Micro Financial Services Group Co., Ltd." in July 2020. The company changed its name to Ant Technology Group Co., Ltd., and launched listing plans on the Shanghai Stock Exchange Kechuang Board and the Stock Exchange.

Business territory continues to expand, access to a number of financial licenses.Alipay was officially established in 2004, and the Alipay mobile client was launched in 2009. The company opened the era of mobile payment and obtained a third-party payment license in 2011. In 2010, the company was granted a small loan license. Since then, products such as Yu'ebao, Huabai, borrowing, Ant Wealth and other products have been online, and the business territory has been expanded from payment business to digital financial services. At present, the company has obtained a number of financial licenses. In 2018, the ant chain Baas was launched, and the company realized the deep combination of finance and technology.

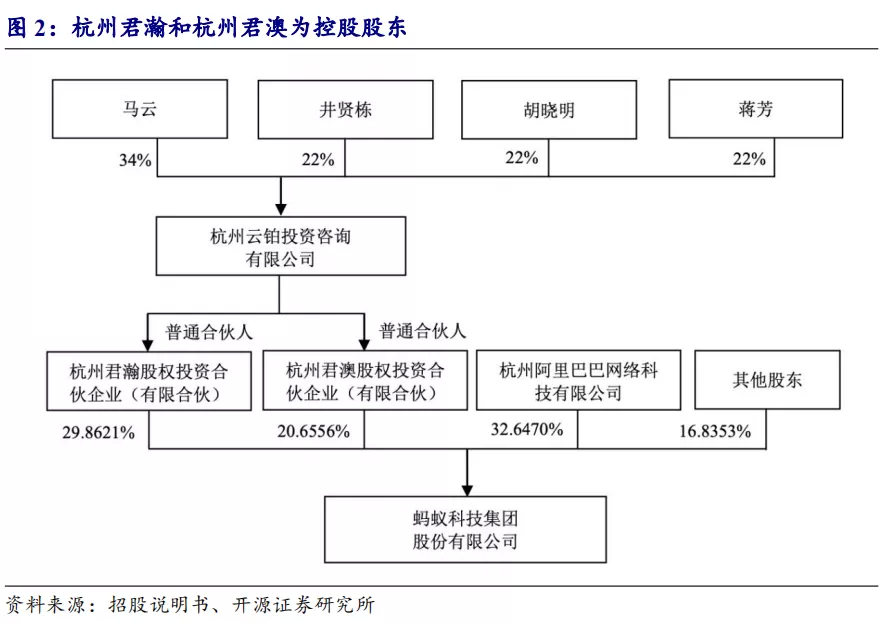

Hangzhou Junhan and Hangzhou Junao are the controlling shareholders, and the actual controller is Jack Ma.Hangzhou Junhan and Hangzhou Junao respectively directly hold 29.8621% 20.6556% of the shares of the company, both of which are controlling shareholders of the company and are both controlled by Hangzhou Yunplatinum. Jack Ma can actually control the voting results of matters related to the shareholders' meeting of Hangzhou Yunping and the exercise of the shareholders' rights of Ant Group, and indirectly control 50.5177% of the shares of the issuer through Hangzhou Junhan and Hangzhou Junao controlled by Hangzhou Yunplatin. is the actual controller of the issuer.

The Shanghai Stock Exchange and the Hong Kong Stock Exchange issued at the same time, raising funds mainly for technological research and development and innovation.The company plans to issue simultaneously on the Shanghai Stock Exchange Kechuang Board and the Hong Kong Stock Exchange, and the total share capital is expected to be not less than 30 billion shares. The funds raised are mainly used to further support the digital upgrading of the service industry, strengthen global cooperation and promote global sustainable development, and support companies to increase technological research and innovation.

1.2. The profitability is increasing, and the micro-loan business is the largest business.

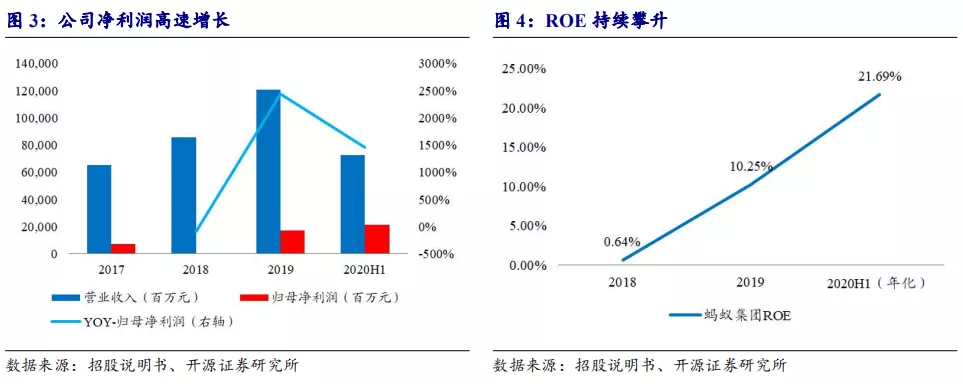

Net profit is growing at a high speed and profitability continues to rise.The company's operating income and net profit showed a trend of rapid growth, with a compound growth rate of 36% from 2017 to 2019. In 2018, the company made large-scale market investment, and the net profit decreased compared with the same period last year. From 2019, the net profit increased sharply, and the net profit of 2019 and 2020H1 respectively increased 1460% compared with the same period last year. ROE all the way up, 2020H1 annualized ROE as high as 21.69%, profitability continues to rise.

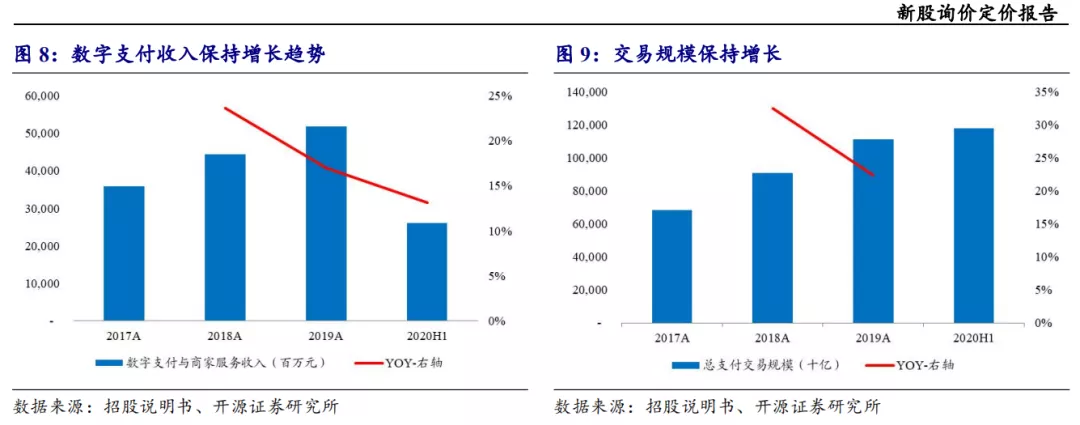

Of the three major businesses, the lending business is the main source of income.The company's main business includes digital payment and merchant services, digital financial technology platform and innovation business. Digital financial technology platform includes micro-loan technology platform, financial management technology platform and insurance technology platform, innovative business includes block chain and database services, the three major businesses are connected by Alipay platform. The company's micro-loan technology platform has grown rapidly, gradually replacing digital payment business to become the largest business, with 2020H1 accounting for 39%.

2. Three major businesses: payment business is the entrance to traffic, supporting the financial technology platform.

2.1. Mobile payment and merchant services: traffic entry

Traffic entrance, expanding in scale

Connect traffic and scenarios to build an integrated ecosystem.Alipay connects C-end traffic, B-side scenarios and financial institutions through business transactions paid by users to merchants, such as Credit Card Repayment, personal money transfers, credit and investment transactions. As a traffic portal, digital payment extends payment scenarios to shopping, entertainment, tourism and other scenarios by expanding digital life services, while providing users with comprehensive financial services including payment, financial management, credit, insurance and other financial services. improve user stickiness and build an integrated ecosystem.

Merchant transaction service fee is the main source of income.The company's mobile payment revenue mainly comes from the transaction service fees charged to merchants and transactions, the transaction service fees charged for cross-border commercial transactions, and the fees charged for financial transactions and personal transactions. For individuals, it is mainly aimed at Credit Card Repayment and cash withdrawal fees. After the free quota is exhausted, the service fee will be charged at 0.1%. For merchants, the service fee will be charged at the rate of 0.6% Mel 1.2% for the amount actually paid for valid transactions. During the 12-month period ended June 30, 2020, the total amount of payment transactions completed through the company's platform reached 118 trillion, Alipay APP

Serve more than 1 billion users and more than 80 million merchants.

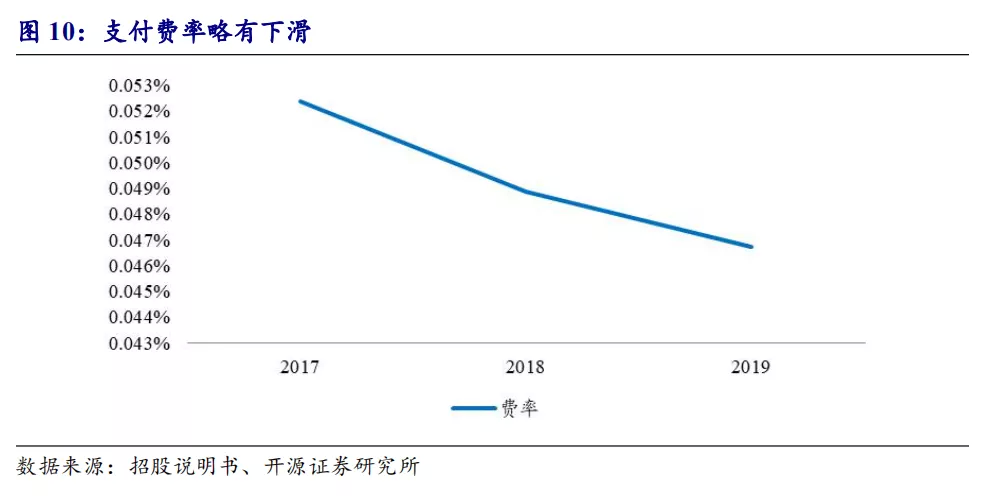

Revenue and transaction size continued to grow, while fees fell slightly.Benefiting from the continued growth in the number of users and merchants using digital payment services both online and offline, transaction size and transaction activity remained upward. The total transaction size of 2020H1 reached 118 trillion, and the growth rate slowed down at a high base. The payment rate has declined slightly, to $10,000 in 2019.

Competitive advantage: leading flow, stable market share in the industry leader

The company takes the lead in the scale of traffic..The number of monthly active users of the company is lower than that of Wechat. In addition to the payment function, Wechat also has a social attribute. Compared with the same industry, the flow scale of the company is in the leading position. 2020H1, Alipay has 7.1 trillion monthly active users, and its traffic advantage has laid a solid foundation for the company's payment business and digital financial technology platform.

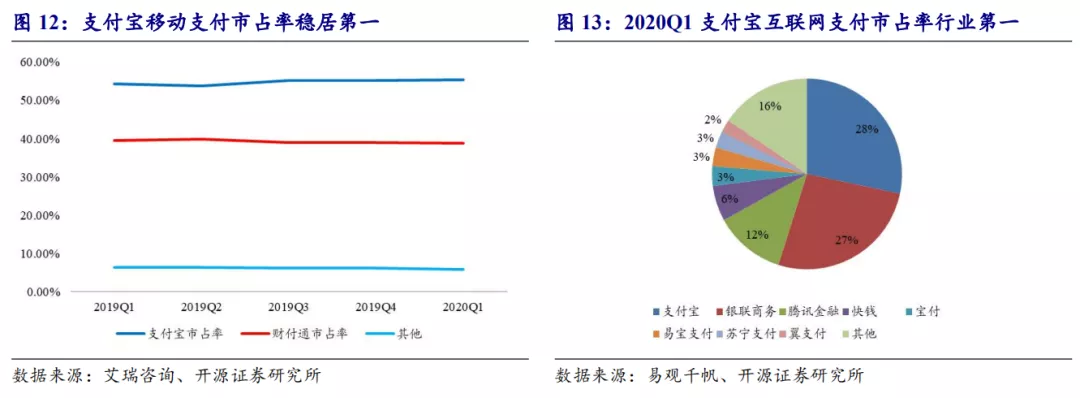

The market share of mobile payment and Internet ranks at the top of the industry.Alipay and Tenpay have jointly formed an oligopoly in the mobile payment industry. 2020Q1 Alipay and Tenpay have a market share of 55% and 39% respectively, with a combined market share of 94%. Alipay ranks first in the industry. In the Internet payment industry, Alipay maintains the first place in the Internet payment market with 28%, UnionPay maintains the second position in the industry, with a market share of 27%, and Tencent Finance ranks third.

Future space: under the two-wheel drive of industry growth and overseas expansion, the future space can be expected.

The scale growth of digital payment industry is expected..According to iResearch, China's personal disposable income will grow at an average annual compound growth rate of 7.6% from 2019 to 2025, and will reach 67 trillion in 2025. China Mobile Limited has 880 million Internet users in 2019, and it is estimated that by 2025, the number of China Mobile Limited users will increase to 1.1 billion, driving the increasing market demand. At the same time, with the convenient and efficient user experience of digital payment, the scale of the digital payment industry is expected to continue to increase, and it is estimated that the size of the digital payment industry will be 412 trillion by 2025.

Overseas expansion helps the company to open up the incremental market.As domestic traffic continues to peak, the company has opened up overseas market expansion. Drawing lessons from the mature domestic business model, the company has established digital wallets in 9 regions around the world, opened digital payments in more than 200 countries and regions around the world, supported merchants to serve global consumers in multiple mainstream international e-commerce platforms, and become an important support of the world e-commerce platform (eWTP). As of 2020

During the 12-month period ended June 30, 2006, 6219 of total international payment transactions were processed through the company's platform.

100 million yuan. With the continuous development of the market and the continuous development of cross-border e-commerce and other businesses, the overseas market is expected to become another growth point of the company.

2.2. Digital financial technology platform: micro-loan business is the main business.

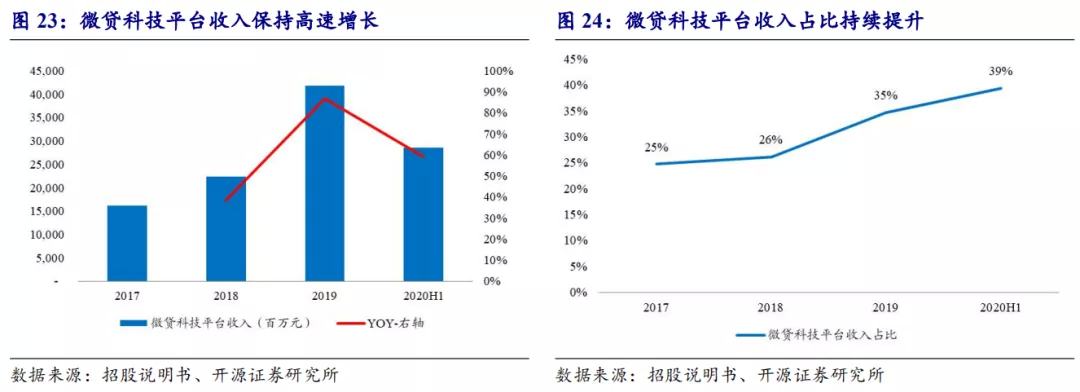

Three bigScience and technologyPlatformMicro-loan business is the main business.The company's digital financial technology platform includes three major technology platforms: micro-lending, financial management and insurance. The revenue of the 2020H1 digital financial technology platform is 29.3 billion, and both 2019 and 2020H1 maintain a growth rate of more than 50%, which is an important driver of the company's revenue growth. Among the three major technology platforms, the micro-loan technology platform is the main source of revenue for the company, and 2020H1 accounts for 61% of the revenue of the digital financial technology platform.

2.2.1. Micro-loan technology platform: light capital mode operation

Business model: light capital operation mode

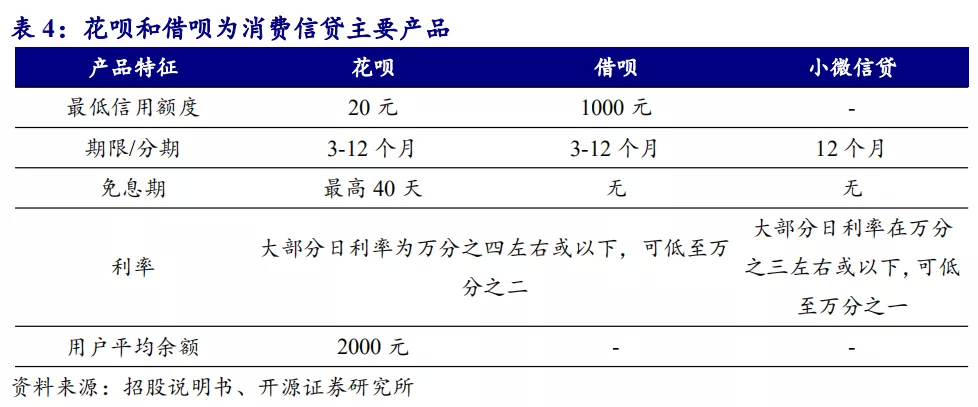

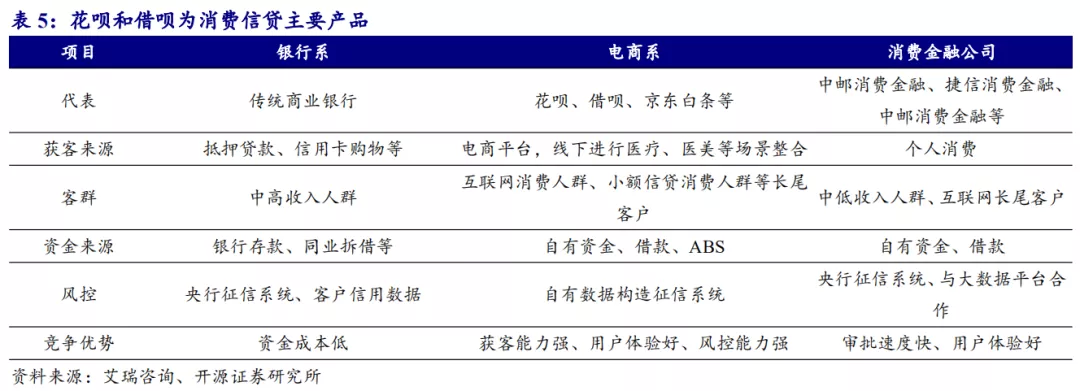

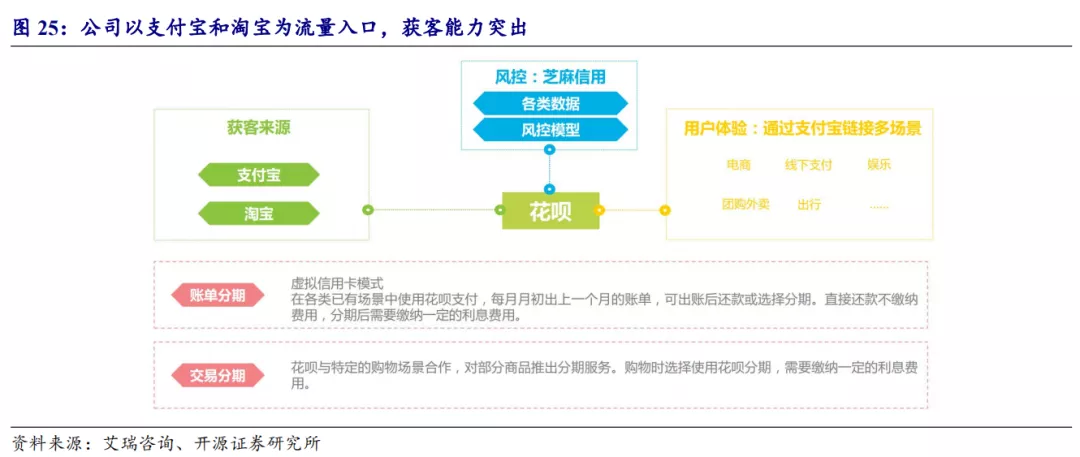

The two major businesses of consumer credit and micro-credit.Ant micro-loan technology platform is divided into consumer credit and small micro-credit, consumer credit is carried out through flower and borrowing, which is a digital unsecured circular consumer credit product with a maximum interest-free period of 40 days; borrowing is a digital unsecured short-term consumer credit product with a higher user threshold than Huabai, with a daily interest rate of about 4/10000 or less. The company provides small loan credit to sellers on Taobao and Tmall, offline merchants using Alipay and users of agriculture, rural areas and farmers. The interest rate of small micro loan is lower than consumer credit. During the 12-month period ended June 30, 2020, more than 20 million small micro users have access to credit.

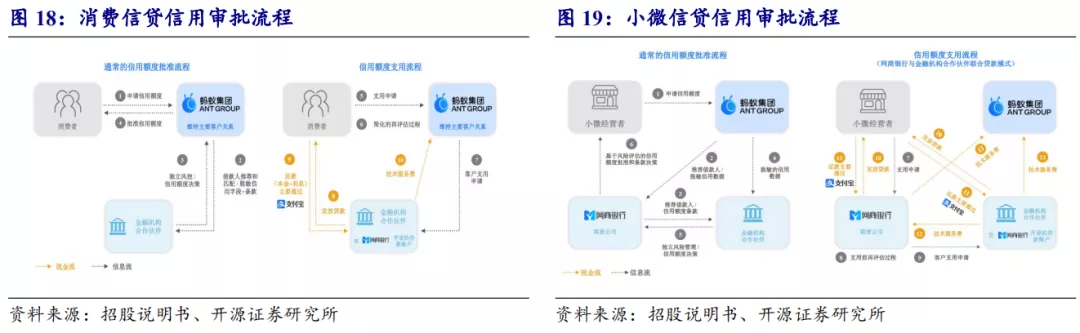

There are two modes of joint lending and assisted lending.Credit loans include joint lending and aid lending models. under joint lending, the company issues loans jointly with Ant Shang Cheng and Ant Xiaowei and financial institution partners. Most of the on-balance-sheet loans are subsequently transferred to investors in banks and other licensed financial institutions in the form of asset securitization..Under the loan aid mode, the company cooperates with commercial banks, trust companies and other financial institutions, and the company is responsible for obtaining customers, credit evaluation, dynamic risk management, monitoring collection, etc., and financial institutions make credit decisions and loans. In small and micro credit, the company and the Internet Merchant Bank cooperate with third-party financial institutions, and the Internet Merchant Bank is responsible for risk assessment and loan issuance.

Change from joint lending + ABS to light capital mode based on loan assistance.From 2017 to 2020H1, the proportion of the company's self-operated micro-loan interest net income has gradually declined, and the lending mode has changed from joint lending + ABS supplementary funds to light capital. As of the end of 2020H1, 98% of the credit balance has been issued by cooperative institutions or securitization has been completed.

Profit model: rapid expansion of loan scale

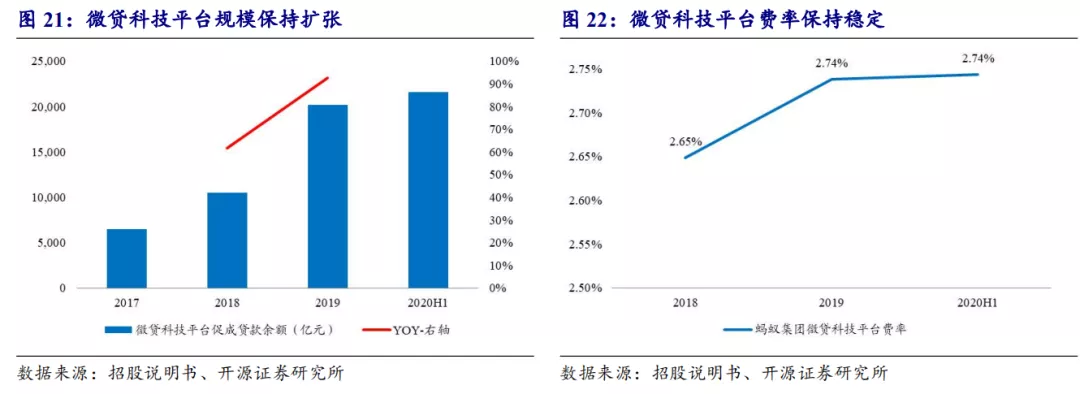

The loan balance has increased rapidly and the overall rate has remained stable..The company's micro-loan business is connected to the scene, using Alipay as the entry point of traffic. with the continuous increase of Alipay users and the continuous improvement of user consumption, the number of consumer credit users continues to grow, and the consumer credit balance of individual users continues to increase. the micro-loan scale continues to expand, with a compound growth rate of 76% from 2017 to 2019. At the end of 2020H1, the company contributed to a total credit balance of 21.5 billion yuan. In terms of rates, 2019 is slightly higher than 2018, and the overall situation is relatively stable.

The income is expanding rapidly and its share is increasing.In cooperation with financial institutions, the company mainly collects technical service fees according to a certain percentage of interest income earned by partners such as financial institutions. Benefiting from the rapid growth of the credit consumption scale promoted by the company, the income of the micro-loan technology platform has an average annual compound growth rate of 61% from 2017 to 2019. 2020H1 income reached 28.6 billion, accounting for 39% of the total operating income from 25% in 2017, becoming the company's main source of income.

Competitive advantage: three advantages: customer acquisition, capital cost and risk control

A hundred flowers blossom in the industry, and the company has outstanding ability to get customers..Participants in China's consumer financial market include e-commerce, banks, consumer financial institutions, etc., among which e-commerce is developing rapidly with high traffic and e-commerce scenarios, through payment to open up various consumption scenarios, iResearch data show that e-commerce lending ranked first in the industry in 2017, accounting for 35% of the total lending. The company uses Alipay as the traffic entrance, and the traffic scale has obvious advantages. Through Taobao, Tmall, Taobaipiao, Amazon.Com Inc, Vipshop Holdings Limited and other APP layout online consumption scenes, through Walmart Inc, Carrefour, Yonghui supermarket and other layout offline consumption scenes, the flow advantage is obvious, online and offline scenes are rich, high traffic + multi-scenarios are important competitive advantages of the company.

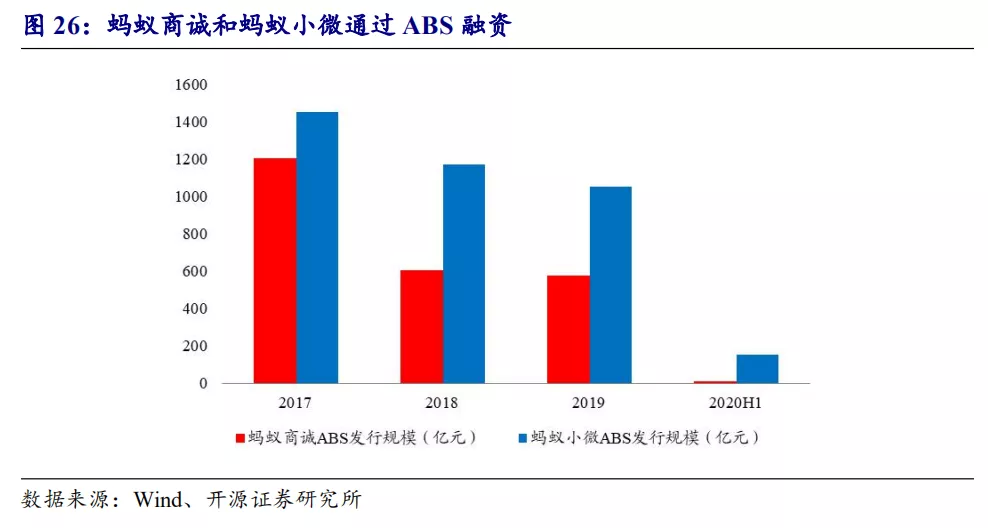

Strong bargaining powerLow cost of capital.Ant's main sources of funding are commercial banks, trusts and other third-party financial institutions, as well as financing through ABS, occupying only about 2 per cent of its own capital lending. As a large-scale Internet company with large traffic, ants have strong bargaining power when cooperating with third-party organizations. At the same time, Ant Shangcheng and Ant Xiaowei can raise funds through ABS. In 2019, Ant Shangcheng and Ant small Micro ABS issued 577 / 105.3 billion respectively, which broadened the funding sources of Ant Group.

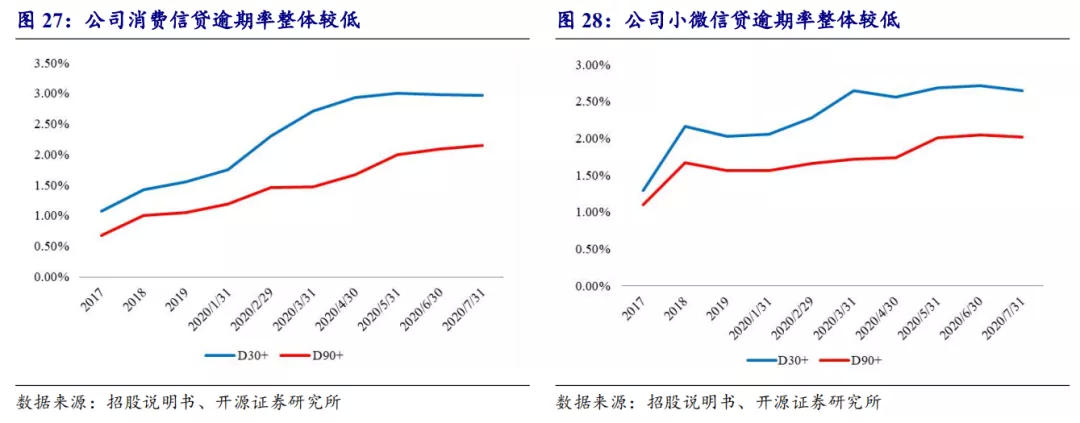

Strong risk control ability and high asset quality.The company has a powerful intelligent risk control system, builds systematic and omni-directional customer portraits based on real-time data in a variety of scenarios, and has more than 100 risk assessment models covering user profile, credit and fraud risk dimensions. Benefiting from the strong risk control ability, the overdue rate of the company as a whole is at a low level. From 2017 to 2019, the overdue rate of consumer credit is between 0.6% and 1.6%, and the overdue rate of small and micro loans is between 1.1% and 2.1%. In the first half of 2020, due to health events, the overdue rate increased, but now it has gradually declined, and the asset quality is higher.

Future space: ample room for loan balance

There is sufficient room for the balance of consumer loans in China..According to Oliver Wyman, the balance of consumer loans in China will continue to grow, with an average annual compound growth rate of 13% from 2020 to 2025. The balance of consumer loans in China will be 13 trillion in 2019, and it is expected that by 2025, the balance of consumer loans will grow to 24 trillion. There is plenty of market space in the future.

The loan balance of small and micro operators is expected to increase.At present, there is a huge unserved or underserved credit demand in China, 2019

In 2000, the contribution rate of Chinese small and micro enterprises to GDP reached 60%. However, the credit balance of small and micro operators accounted for only 32% of the total loan balance of enterprises, and the loan scale of small and micro operators is expected to increase. According to Oliver Wyman, the loan balance of small and micro operators with a single amount of less than 500000 yuan in 2019 is 6 trillion yuan, which is expected to rise to 26 trillion yuan by 2025, which will bring sufficient room for the development of the lending industry.

2.2.2, financial management technology platform: product consignment is the main source of income

Business model: the change from seller's consignment to buyer's investment

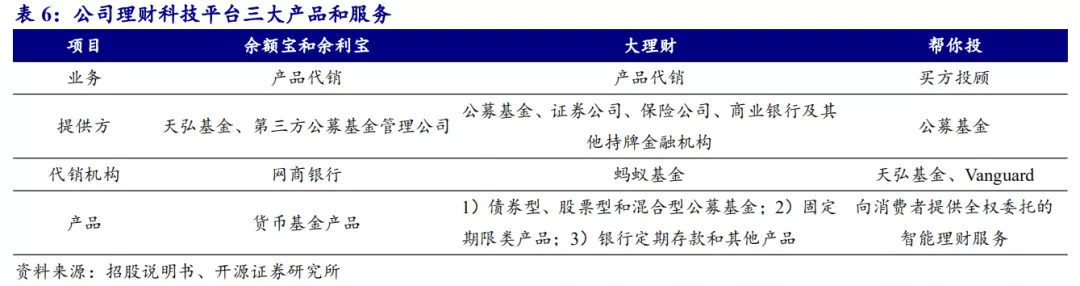

From goods-based consignment to buyer's patronage, including three major products and servicesBusiness.Corporate finance business has developed from Yu'e Bao to Ant Wealth, and then to the current buyer's patronage. Its products and services include Yu'e Bao and Yu Li Bao, large Finance and Fund Investment Business. In 2013, the company launched Yu'e Bao, docking money market fund products, and then launched an one-stop cash management service product "Yu Li Bao" for small and micro operators. The company cooperates with funds, securities, insurance and other institutions to launch the online "big financial management" platform, covering non-goods-based, fixed-term products and other financial products. In 2019, the company won the pilot qualification of public offering fund, and in cooperation with Vanguard, the company launched the "help you invest" intelligent investment service in April 2020, and the company's financial management business gradually changed from seller's consignment to buyer's investment.

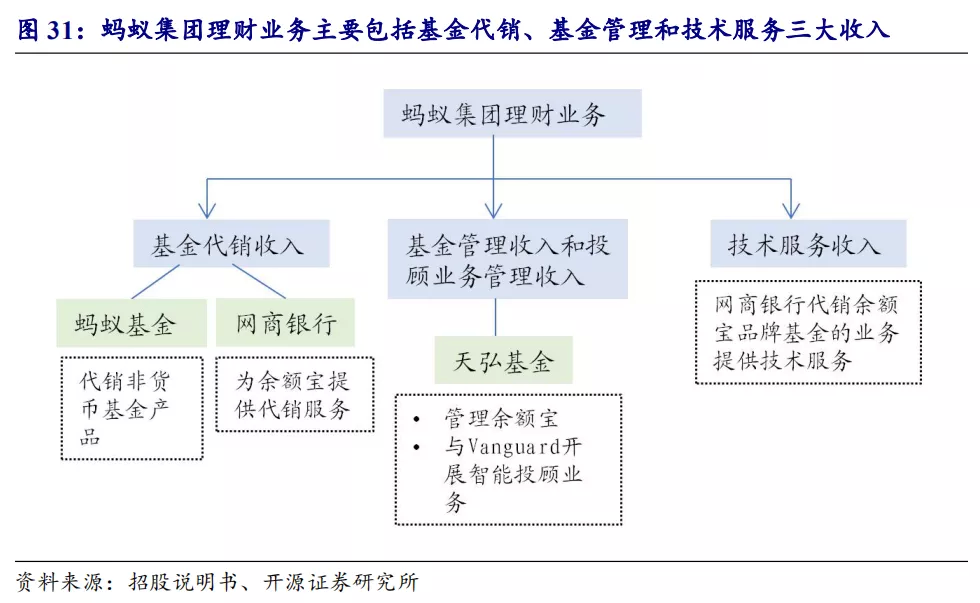

Three major sources of income.Corporate financial management business income includes fund consignment income, fund management income and investment business management income as well as technical service income. Fund consignment business is carried out through Ant Fund and Internet Merchant Bank, in which Ant Fund provides major financial products on consignment. Tianhong Fund, a subsidiary of the company, manages the money fund and carries out fund investment business with Vanguard, collecting fund management fees and investment business management fees.

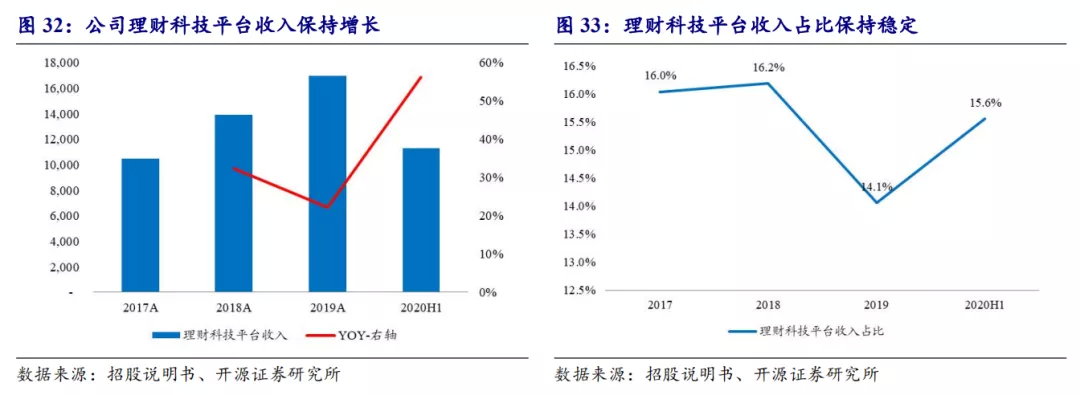

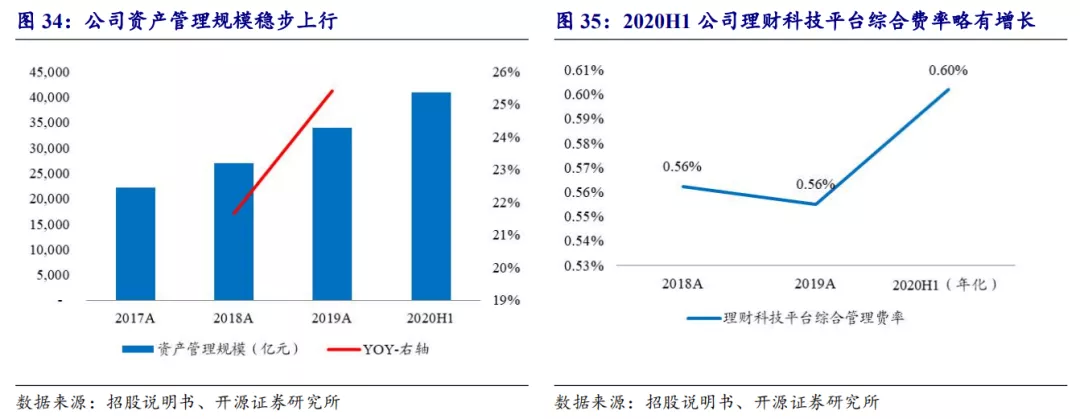

The rise in volume and price drives the continuous growth of income, and the share of income remains stable.From 2017 to 2019, the income of the company's financial management technology platform maintained a growth trend, with an average annual compound growth rate of 27%, accounting for a relatively stable proportion of total business income, which was about 16% in the past three years. The size of the company's asset management showed a steady growth trend, 2020H1 reached 4.1 trillion; 2020H1 comprehensive rate increased slightly, open source securities estimated 2020H1 annualized rate of 0.6%. Since 2020, the consignment scale of public offering funds has increased significantly, and the technical service fees charged by the companies have been higher, and the driving rates have increased.

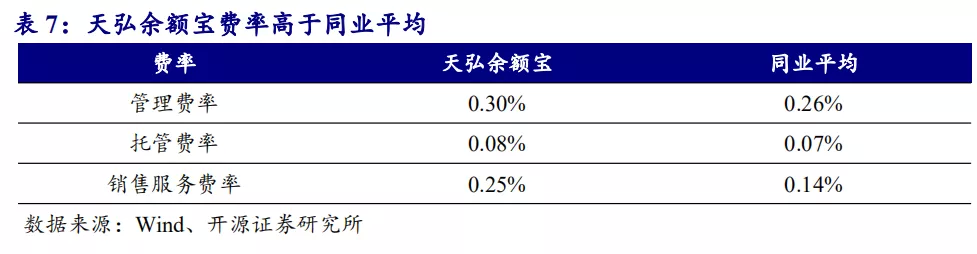

Yu'ebao: the rate is higher than the average of the industry.

The scale of Tianhong fund management is relatively high..The company launched Yu'e Bao in 2013 and was initially managed by subsidiary Tianhong Fund. Since its launch, Yu'e Bao has expanded rapidly, reaching 1.6 trillion yuan in 2017. The company introduced a third-party public offering fund management company in May 2018. As of June 30, 2020, the company has worked with 24.

A third-party public fund management company carries out money market fund cooperation under the Yu'e Bao brand. Tianhong Yu'e Bao still accounts for a large proportion. As of 2020H1, Tianhong Yu'e Bao is expected to account for 49% of Yu'e Bao.

The overall rate of Tianhong Yu'ebao is higher than the average of the industry.According to the company announcement, Tianhong Yuebao charges investors a management fee, an escrow fee and a sales service fee of 0.3%, 0.08% and 0.25%, respectively, which are higher than the industry average, and the sales service fee is nearly twice that of the industry average.

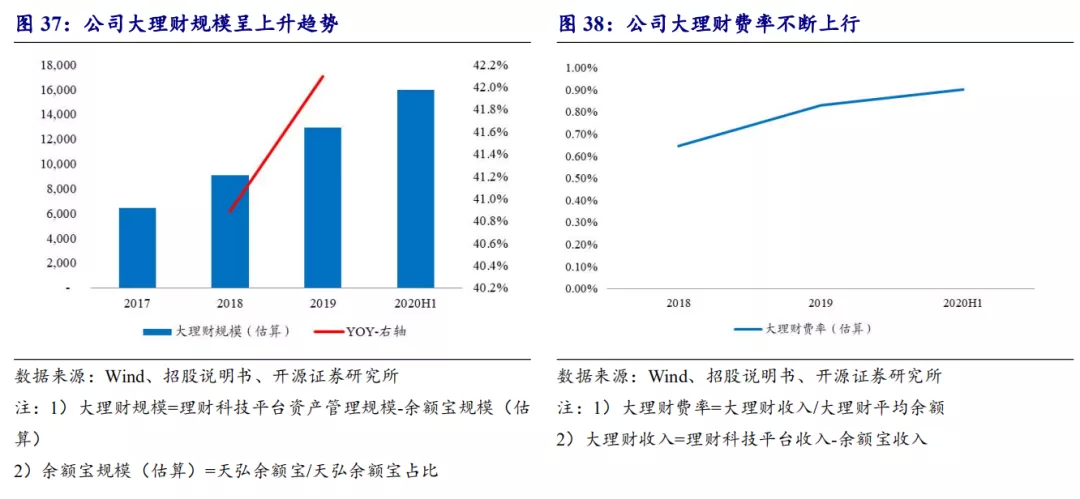

Big financial management: both quantity and price rise

The rise in volume and price drives income to rise continuously..Driven by the growth of the number of users and the size of individual users, the scale of the company's large financial platform is on the rise; at the same time, the company charges higher technical service rates for public fund products, as residents' assets continue to enter the market, the scale of public offering products continues to rise, driving the overall rate to continue to rise, and the company's large financial platform income is growing at a high speed.

Help you invest: the scale of the business is growing rapidly.

Buyer patronage mode, scale developmentQuickly.In April 2020, Tianhong Fund and Vanguard jointly launched "help you Investment", which adopts an intelligent investment model, which is mainly aimed at low net worth customers with small assets. The initial investment amount is 800yuan, and the investment fee is calculated on the basis of 0.0014% of the total daily assets and 0.5% of the total annualized asset management. "help you" has attracted about 200000 new customers within 100 days after its launch, with a total investment of 2.2 billion yuan. in the future, as the seller's consignment mode continues to shift to the buyer's mode, "helping you" is expected to become a new profit growth point of the company.

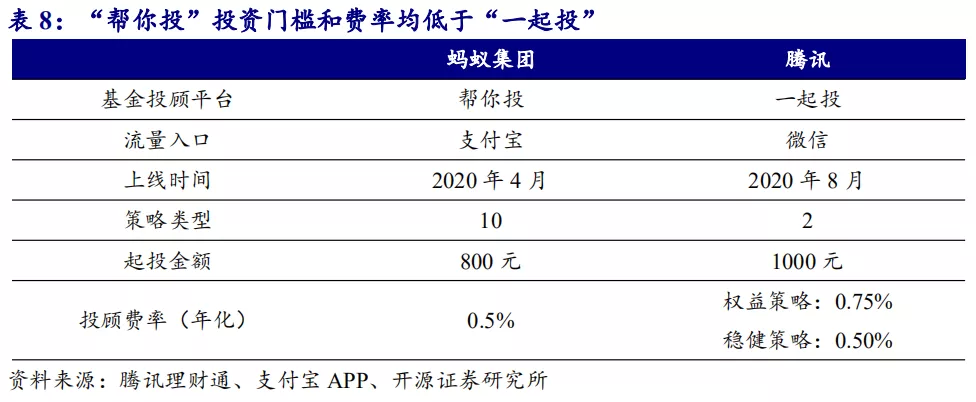

The investment threshold and rate of "help you invest" are low, and the types of strategies are rich.In August 2020, Tencent launched the online "invest together", which uses Tencent and LiCaiTong as the traffic entrance and carries out drainage through Wechat. The starting investment amount is 1000 yuan, including equity and prudent strategies, and the investment rates are 0.75% and 0.50% respectively. Compared with "invest together", "help you invest" includes ten investment strategies, the starting investment amount and the investment fee are lower, and the advantage is relatively obvious.

Future space: huge space for market growth

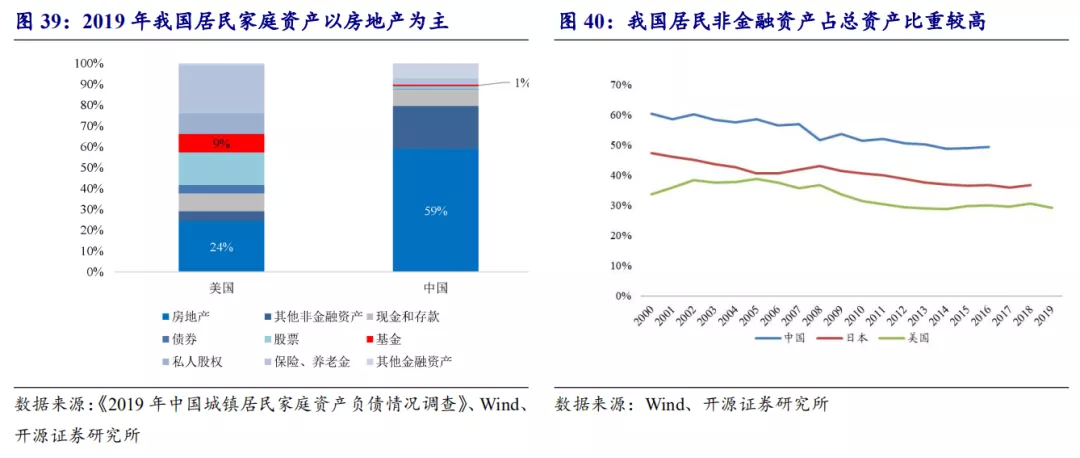

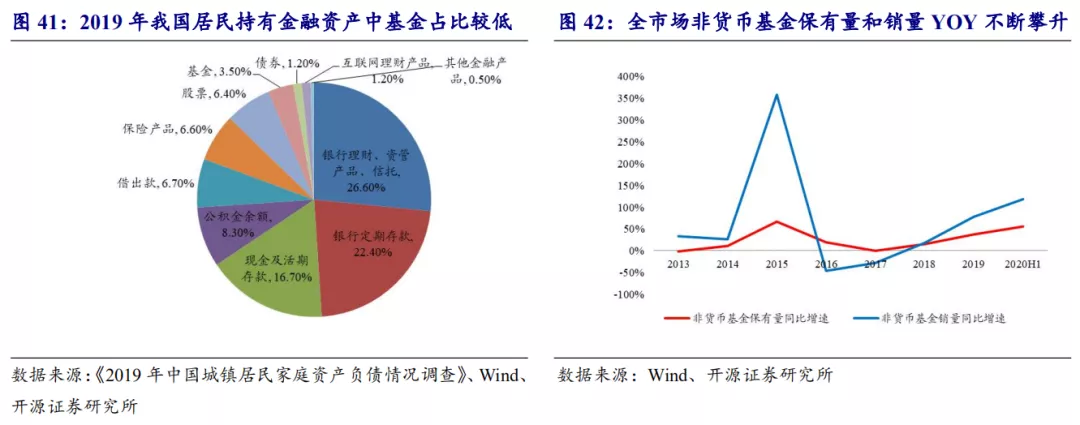

The allocation of real estate may have peaked, and the wealth of residents may have reached its peak.It is expected to speed up the transfer to the equity market.In China, household assets are mainly non-financial assets such as real estate, and real estate accounts for more than 60% in 2019. The Central Economic work Conference has repeatedly proposed "housing speculation". In the future, as housing prices slow down and leverage becomes more difficult, the relative attractiveness of real estate decreases, and residents' asset allocation or transfer to financial assets. With the new regulations on asset management, bank wealth management products break just exchange to bring lower yields and higher risks of wealth management products. Under the deep reform of the capital market, high-quality assets continue to enter the market, and residents' wealth will continue to transfer to the equity market.

The fund market has great potential for growth, driving the continuous growth of the company's fund consignment business.According to the 2019 Survey of the assets and liabilities of Chinese Urban households released by the Central Bank, funds account for only 3.5% of the financial assets held by Chinese residents. With the continuous transfer of residents' assets to the equity market, the stock market risk and volatility are relatively high. Compared with the mature capital market, the proportion of funds in China's residents' assets is relatively low. At present, the fund scale shows a significant upward trend. The holding and sales of 2020H1 non-monetary funds have increased by 56% and 118% respectively compared with the same period last year. The inflection point of residents' asset allocation has emerged, and the fund market has great growth potential in the future, which will become the main driving factor of fund underwriting business.

2.2.3. Insurance science and technology platform: the scale growth drives the high increase of insurance consignment income.

Business model: insurance agency is the main source of income

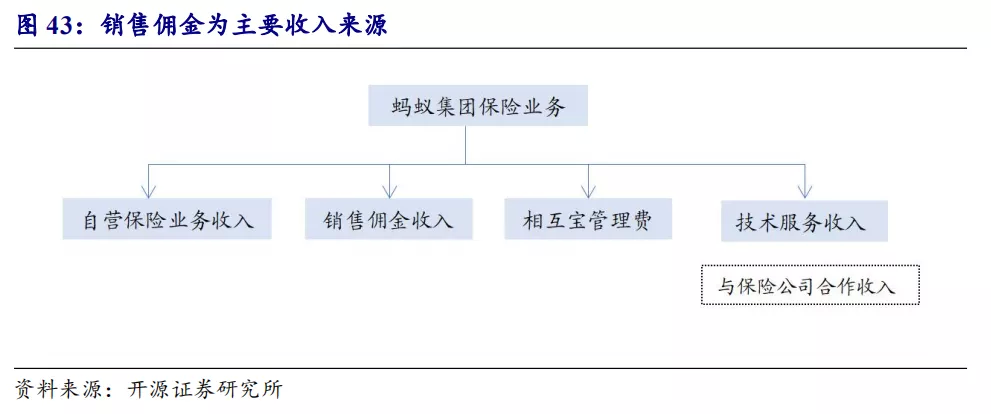

Sales commission is the main source of income.The company's insurance technology platform mainly includes self-insurance business income, sales commission income, mutual insurance management fees and technical service income, of which sales commission income is the main source of income. Xinmei Life Insurance Mutual Insurance is currently in a state of loss, and Cathay Pacific Insurance has turned a profit in 2019.

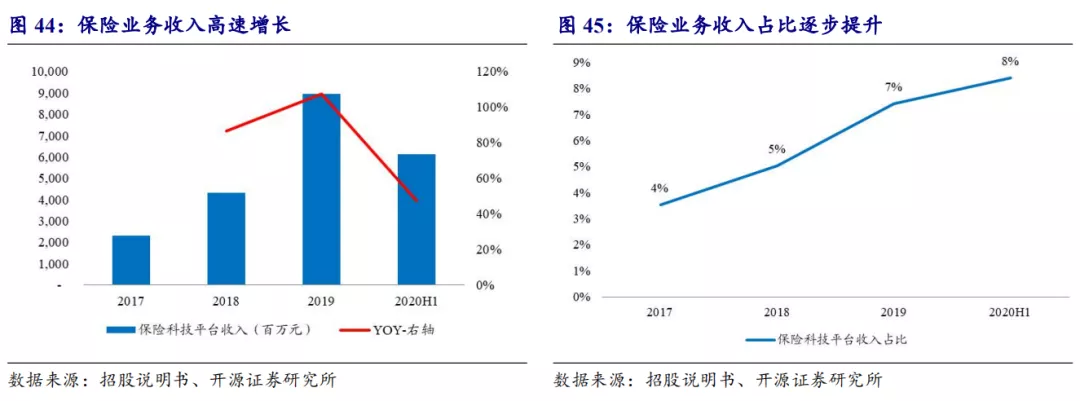

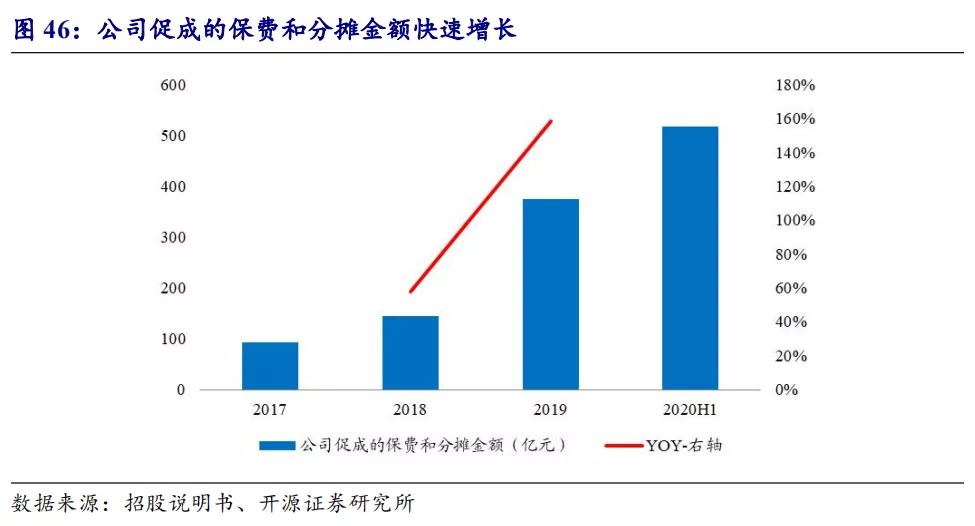

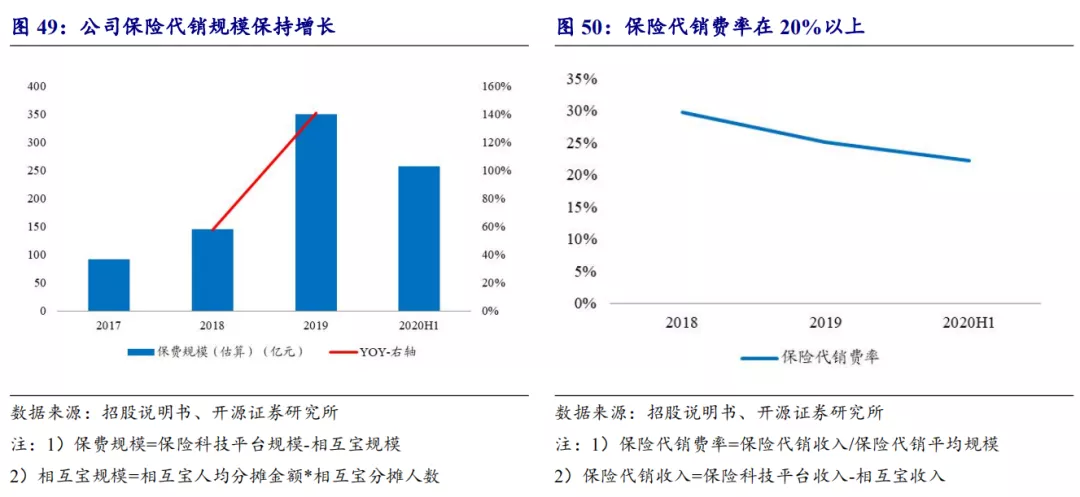

The company promotes the rapid growth of premium and sharing scale to drive the rapid expansion of premium income.The average annual compound growth rate of premiums and apportionment scale contributed by the company from 2017 to 2019 was 102%, mainly due to the rapid growth of the premium scale of third-party cooperation agencies, driving the company's premium income to increase significantly, and the company's insurance technology platform revenue growth rate exceeded 80% in 2018 and 2019 compared with the same period last year. The proportion of insurance technology platform revenue in total revenue has gradually increased from 4 per cent in 2017 to 8 per cent of 2020H1. The overall share of the company's insurance business is relatively low, but it is growing rapidly.

Mutual Bao: rapid expansion

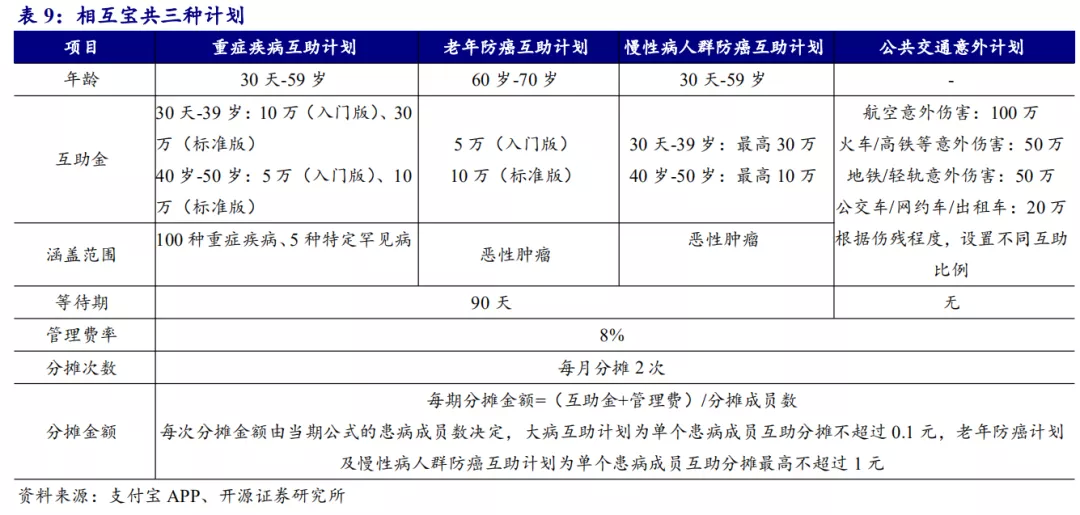

Three mutual aid programs cover a variety of serious diseases.In 2018, ants online Mutual Bao, Mutual Bao in the form of mutual assistance and post-payment, members do not have to pay when joining Mutual Bao. Upon approval of the mutual grant application, the member will receive an one-time mutual grant, which will be shared by all other members, covering serious diseases such as lung cancer, breast cancer, thyroid cancer and severe brain damage. The company charges 8% of the management fee, which is used for sharing the amount of income and expenditure, case investigation and review, fair litigation and arbitration, planned daily operation and maintenance, etc.

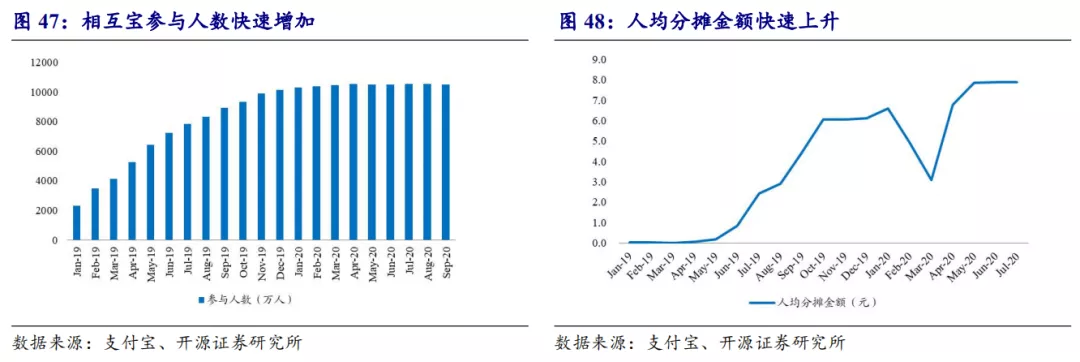

The number of participants is growing and the contribution is rising rapidly.Since 2019, the number of Mubao participants has increased rapidly, from 23.31 million in January 2019 to 100m in September 2020, doubling the number of participants. With the continuous increase in the number of participants, the number of people who fell ill and applied for assistance increased, and the per capita balance increased rapidly.

Insurance consignment: the scale is growing rapidly and the overall premium rate is relatively high.

Compared with Tencent micro-insurance, there are a variety of product choices.Ant insurance covers health, accident, travel, property, life, car insurance and other types of insurance, providing more than 2000 kinds of products, while introducing national insurance, health benefits, compared with traditional insurance, with low threshold, transparency, simple universal benefits and other advantages. Tencent Microinsurance is also an insurance consignment company. In terms of business strategy, Tencent Microinsurance selects insurance products for customers in advance and controls the number of products on the line. Compared with Ant Insurance, there are fewer types of products.

Rapid growth in scaleThe overall rate is relatively high..The company's insurance consignment scale continues to grow as a whole, driving the rapid expansion of insurance consignment income. The overall consignment rate is relatively high, and open source securities are expected to maintain more than 20 per cent in the past three years. Life insurance premiums with lower premium rates have increased rapidly, and 2019 and 2020H1 consignment rates have declined.

Future space: there is huge room for premium scale growth.

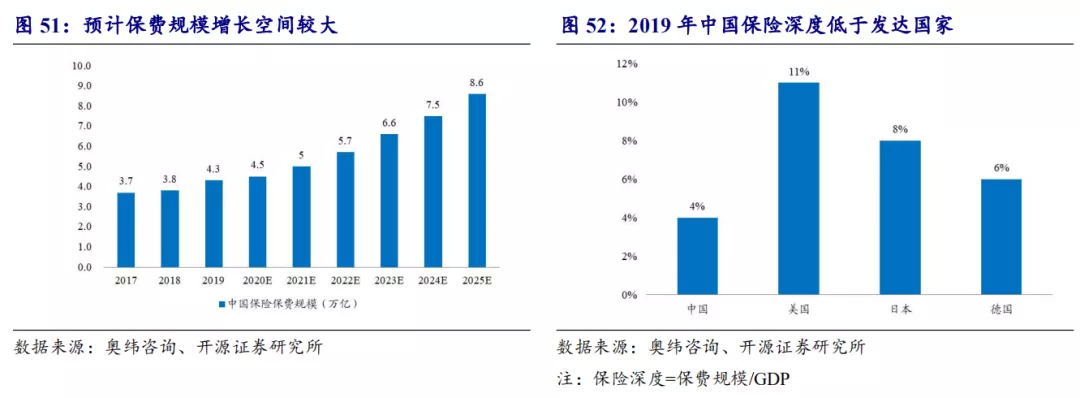

There is a lot of room for the growth of premium scale.According to Oliver Wyman, the scale of insurance premium in China is only 4.3 trillion in 2019, and the insurance depth of 4% is much lower than that of 11% in the United States, and there is a certain gap compared with developed countries. Oliver Wyman forecasts that from 2019 to 2025, China's insurance premium scale will have an average annual compound growth rate of 12%, and by 2025, the premium scale will reach 8.6 trillion. At present, China's insurance industry has great potential for growth.

2.3, innovative business and others: great potential for business growth

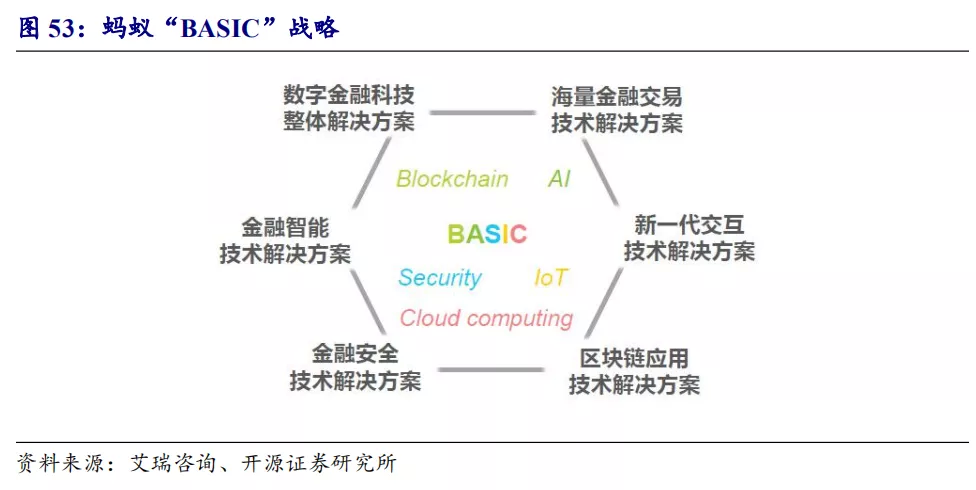

The "BASIC" strategy promotes the upgrading of financial technology.Ant Group focuses on the layout of the "BASIC" strategy, which mainly includes Blockchain, AI, Security, LoT and Cloud, and extends the three capabilities of risk control, credit and connection. The "BASIC" strategy promotes the upgrading of financial technology, provides solutions for digital financial technology, digital financial transaction technology, and financial security technology, and connects consumers and businesses.

Ant chain solves the trust problem.The company's Ant chain BaaS open platform supports all kinds of applications and value-added services on the block chain, can be quickly deployed at low cost, and can be customized according to customer needs, with the characteristics of high performance, high reliability and high fault tolerance. Ant chain has solved trust problems in more than 50 scenarios with technology, as of 2020

During the 12-month period ended June 30, 2006, the Ant chain platform generated more than 100 million daily active uplink data, including patents, vouchers and warehouse receipts. At present, the patent application and authorization of ant chain block chain are the first in the world.

Revenue from innovation business is relatively low.Rapid growth.The company earns innovative business and other revenue from providing a variety of innovative technical services, as well as administrative and support services, from 2019

At the beginning of 2008, the company earned revenue from the ant chain. At present, the proportion of the company's innovation business in operating income is relatively low, only about 1%. Since the company obtained revenue from the ant chain, the revenue growth rate has achieved rapid growth, 2020H1 revenue is + 113% compared with the same period last year, and the business development potential is great.

3. Cost side: transaction size drives costs up.

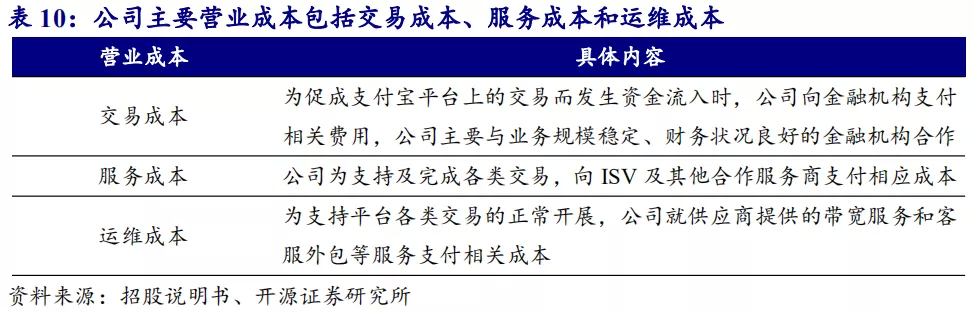

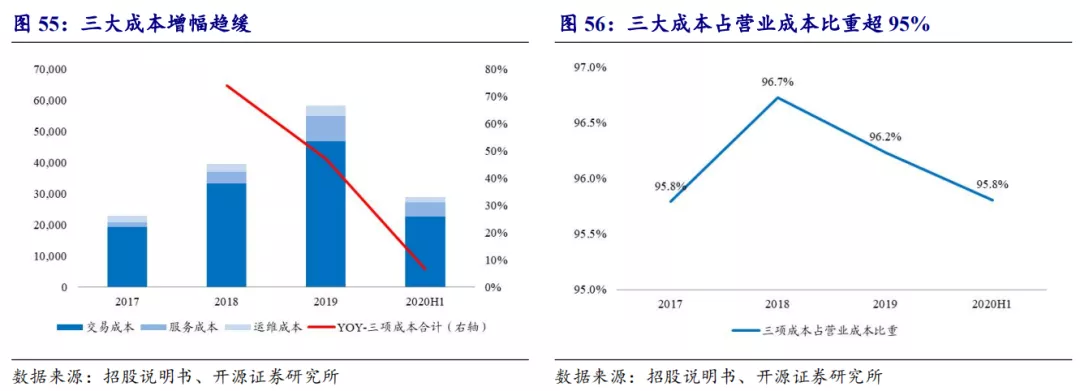

threeLarge operating costs, driven by transaction size.The company's main operating costs include transaction costs, service costs and operation and maintenance costs. The three major costs account for more than 95% of the total operating costs, mainly to support the corresponding costs incurred in the normal development of transactions on the company's platform. The increase in transaction fees paid by the company to financial institutions in 2018 led to a substantial increase in transaction costs, and the increase in the company's main operating costs has slowed down.

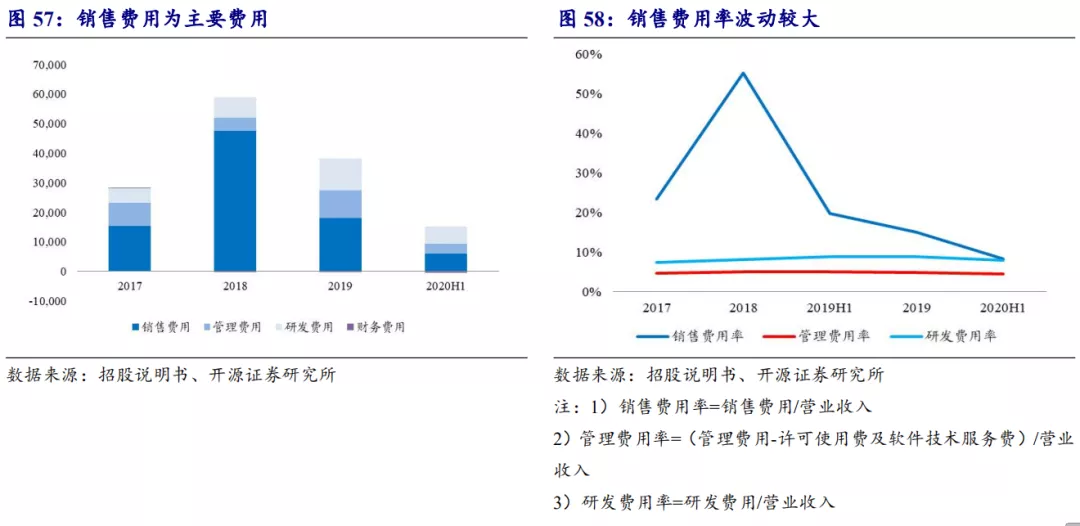

Sales expenses account for the highest proportion.Sales expenses are the main expenses of the company. in order to further expand market leadership in 2018, the company has made a large-scale active investment in promotion and advertising expenses, resulting in a substantial increase in sales costs and expense rates. The company's management expenses and R & D expenses are relatively stable as a whole, the management expense rate is about 5%, and the R & D expense rate is about 9%.

4. Profit forecast and investment suggestions

4.1. Profit forecast

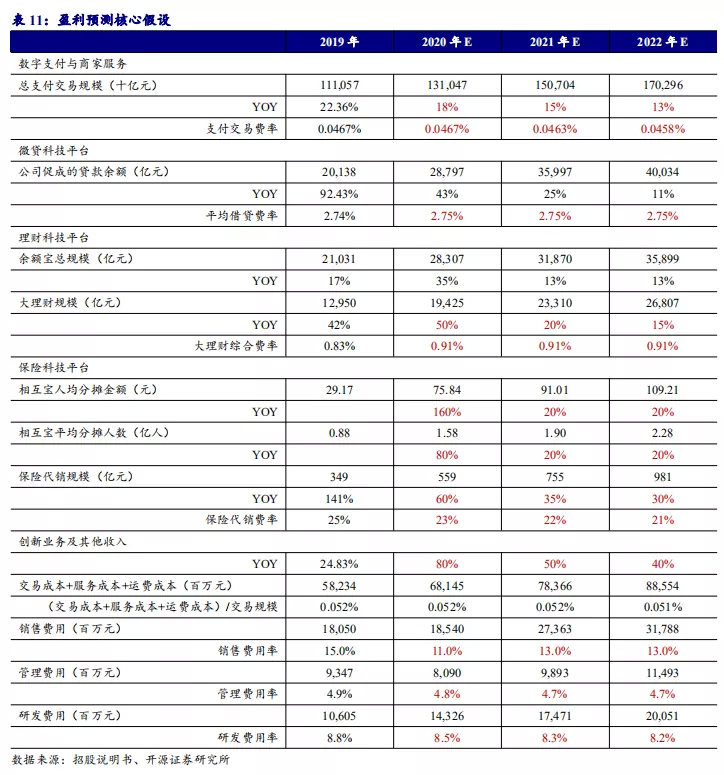

Based on the above assumptions, Open Source Securities expects the company's homing net profit from 2020 to 2022 to be 42.234 billion yuan, 56.327 billion yuan and 69.615 billion yuan, respectively, compared with the same period last year. The weighted average ROE is 13.99%, 12.77%, 14.30%, 1.41, 1.88, 2.32 yuan, respectively.

4.2. Valuation analysis

Absolute valuation

Open source securities use a three-stage FCFE model to calculate the reasonable valuation of the company:

The first phase assumes a four-year period:The open source securities assumes that the net profit of the company from 2020 to 2023 is 4220.563max 696 / 86.3 billion and FCFE is 248max 459max 698 / 93.2 billion respectively. Open source securities take the yield of 10-year treasury bonds as the risk-free rate of return, assuming that the market necessary rate of return is 10%, with Tencent's weighted adjusted Beta in the past five years as the β coefficient, and the estimated market risk discount rate is 11.07%.

The second phase of the five-year assumption:Open source securities assume that the company's FCFE grew at an annual rate of 25 per cent from 2024 to 2028.

The third stage is the assumption of permanence:Open source securities assume that the company will continue to grow by 3%.

Based on the above assumptions, through the three-stage FCFE model, the reasonable market capitalization of open source securities computing companies is 2.03 trillion, corresponding to 48 times of PE in 2020, and corresponding to the target price of 67.45 yuan.

Relative valuation

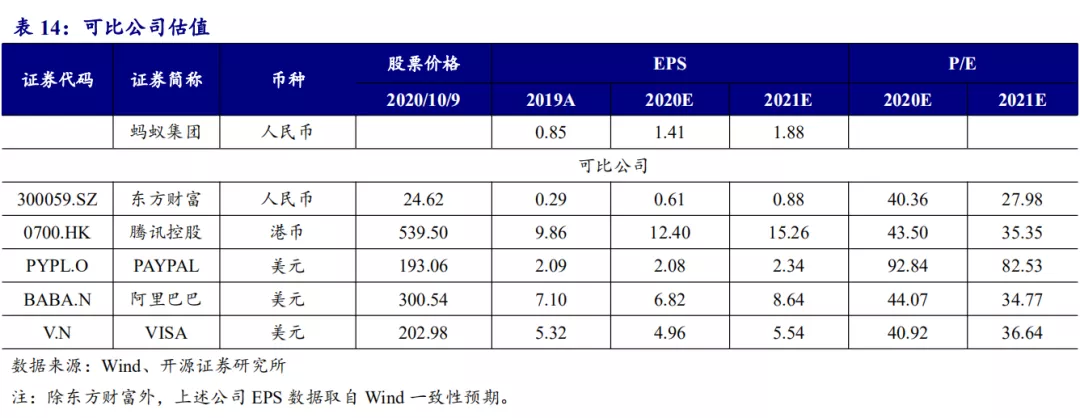

According to the company mainly engaged in business, open source securities select Oriental Wealth, Tencent, PayPal Holdings Inc, BABA, Visa Inc as comparable companies, using the PE method of valuation. With reference to the average valuation of comparable companies, open source securities give Ant Group 40-60 times PE in 2020, corresponding to the market.

The value range is 1.69 trillion yuan to 2.53 trillion yuan, and the price range is 56.24 yuan to 84.36 yuan.

To sum up, through the above two valuation methods, the open source securities determine that the company's PE in 2020 is 40-60 times, the market capitalization range is 1.69 trillion-2.53 trillion yuan, and the target price is 56.24-84.36 yuan.

4.3. Investment viewpoint

Taking payment as the traffic entrance and building a digital financial ecosystem has obvious competitive advantages.The company takes mobile payment as the traffic entrance, creates three major platforms of micro-loan technology, financial management technology and insurance technology, extends the payment scene to the comprehensive scene of residents' life, and provides users with comprehensive financial services, including payment, financial management, credit, insurance and other financial services. realize the realization of traffic. Fully benefit from the flow of cash, consumption upgrading, residents' assets into the market and other dividends, the company's performance is expected to achieve further breakthroughs. Open source securities expects the net profit of the company from 2020 to 2022 to be 422.340.563.27 / 69.615 billion yuan respectively, and the EPS to be 1.41Universe 1.880.32 yuan respectively. According to FCFE and PE valuation methods, open source securities give Ant Group 40-60 times PE in 2020, corresponding market capitalization range of 1.69 trillion yuan to 2.53 trillion yuan, price range of 56.24 yuan to 84.36 yuan.

5. Risk hint

Competition on the Internet intensifies and companies' market share has declined.

Macroeconomic fluctuations cause a credit crisis, which adversely affects the company's micro-loan business.

Under the influence of regulation, the growth of the company's business scale is limited.