36Kr Seeks Continued Recovery From 2020 Shortfalls

36Kr Seeks Continued Recovery From 2020 Shortfalls

Summary

摘要

36Kr went public in November 2019, raising $20 million in a U.S. IPO.

The firm provides online digital content services and offline event promotion services to new economy businesses in China.

The COVID-19 pandemic was bad for business but management sees continued recovery, with autos and finance leading the way.

If the firm can continue to recover, with strong Q4 financial results, it may be time to look more closely at the stock. Until then, my outlook is Neutral.

Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Get started today »

36Kr于2019年11月上市,在美国首次公开募股(IPO)中筹集了2000万美元。

该公司为中国的新经济企业提供在线数字内容服务和线下活动推广服务。

新冠肺炎疫情对企业不利,但管理层认为经济将继续复苏,其中汽车业和金融业是领头羊。

如果该公司能够继续复苏,第四季度财务业绩强劲,可能是时候更密切地关注该股了。在那之前,我的观点是中性的。

想找更多像这样的投资点子吗?只在IPO Edge上购买。立即开始»

Quick Take

速战速决

36Kr (KRKR) went publicin November 2019, raising $20 million from the sale of 1.38 million ADSs at $14.50 per ADS.

36Kr于2019年11月上市,以每ADS 14.5美元的价格出售138万张美国存托凭证,筹资2,000万美元。

The firm is a diversified digital content and offline event business services provider to new economy companies in China.

该公司是一家面向中国新经济公司的多元化数字内容和线下活动商业服务提供商。

KRKR has been negatively impacted by the COVID-19 pandemic and is seeking to recover.

朝鲜半岛受到新冠肺炎疫情的负面影响,正在寻求恢复。

As management proves its optimism with further material financial results improvement for Q4 2020’s results, it may be time to take a look at the stock, but until then I’m Neutral.

随着管理层用2020年第四季度业绩的进一步实质性财务业绩改善来证明其乐观情绪,可能是时候看看股票了,但在那之前,我持中性态度。

Company

公司

Beijing, China-based 36KR was founded in 2010 to provide business services to Chinese companies serving the Internet, hardware and software technologies, consumer and retail and finance industries, which the company refers to as the ‘New Economy’.

总部位于中国北京的36KR成立于2010年,旨在为服务于互联网、硬件和软件技术、消费、零售和金融行业的中国公司提供商业服务,该公司将这些行业称为“新经济”。

Management is headed by CEO Dagang Feng, who has been with the firm since 2019 and is also the CEO of Beijing Duoke.

管理层由首席执行官冯大刚领导,他自2019年以来一直在该公司工作,也是北京多科的首席执行官。

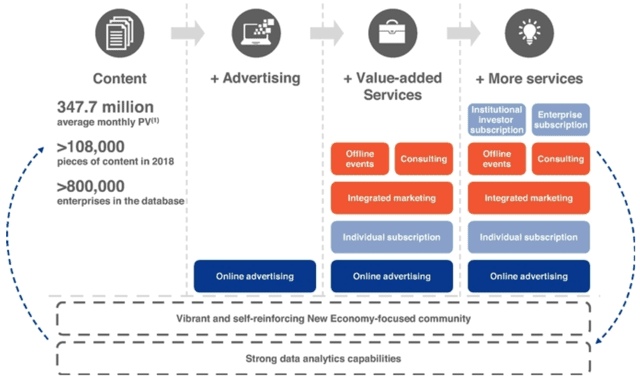

36KR has developed a suite of business services that includes tailored online advertising and subscription services, as well as other enterprise value-added services.

36KR开发了一套商业服务,包括量身定做的在线广告和订阅服务,以及其他企业增值服务。

The firm also provides services that help investors identify promising targets, source investment opportunities and connect with startups directly.

该公司还提供服务,帮助投资者识别有前途的目标,寻找投资机会,并直接与初创企业联系。

36KR has developed a database covering over 800,000 enterprises, through which it is able to gain valuable insights into the New Economy by using data analysis on user and customer preferences and provide tailored services.

36KR已经开发了一个覆盖80多万家企业的数据库,通过这个数据库,它能够通过对用户和客户偏好的数据分析来获得对新经济的宝贵见解,并提供量身定做的服务。

Below is an overview graphic of the company’s business model:

以下是该公司业务模式的概貌图:

Page Views - during the twelve-month period ended June 30, 2019.

页面浏览量-截至2019年6月30日的12个月期间。

Source: Company

消息来源:公司

Management says that as of the end of 2018, the company provided business services to 23 of the Global Fortune 100 companies and to 59 of the Top 100 ‘New Economy’ companies in China as measured by market capitalization and valuation, according to a 2019 China Insights Consultancy [CIC] report.

管理层表示,根据2019年中国洞察咨询公司(China Insights)的数据,截至2018年底,该公司为全球财富100强公司中的23家公司以及中国市值和估值排名前100名的59家公司提供了商业服务。[中投]报告情况。

Additionally, since the launch of its institutional investors subscription services in Q1 2017, 36KR has already covered 46 of the Top 200 institutional investors in China as of the end of 2018, as measured by assets under management, according to the CIC report.

此外,根据中投公司的报告,自2017年第一季度推出机构投资者认购服务以来,截至2018年底,36KR已经覆盖了中国前200家机构投资者中的46家,以管理的资产衡量。

The firm markets its solutions through an in-house sales teams that consist of 217 employees as of the end of June 2019, with knowledge and expertise of the New Economy sector.

截至2019年6月底,该公司通过拥有新经济领域知识和专业知识的217名员工组成的内部销售团队营销其解决方案。

They are tasked with understanding 36KR’s customers' needs as well as to maintain a close relationship with them by providing support and customer services during the course of services.

他们的任务是了解36KR的客户需求,并通过在服务过程中提供支持和客户服务来与他们保持密切的关系。

According to a 2018 market research reportby IBIS World, the IT services market in China had reached a total revenue of $159 billion in 2018, an increase of 6.2% year-over-year.

根据IBIS World发布的2018年市场研究报告,2018年中国IT服务市场总收入达到1590亿美元,同比增长6.2%。

This represents a CAGR of 7.7% between 2013 and 2018.

这意味着2013至2018年间的复合年增长率为7.7%。

36KR operates in the business services subset of the IT services market.

36KR在IT服务市场的业务服务子集中运营。

The main factors driving forecast market growth is the increase in IT investments and the growth of China’s information sector.

推动预测市场增长的主要因素是IT投资的增加和中国信息行业的增长。

The China IT services market accounts for about 20% of China's total IT investment, as compared to an average 40% share in other developed countries.

中国的IT服务市场约占中国IT总投资的20%,而其他发达国家的平均份额为40%。

Recent Performance

近期表现

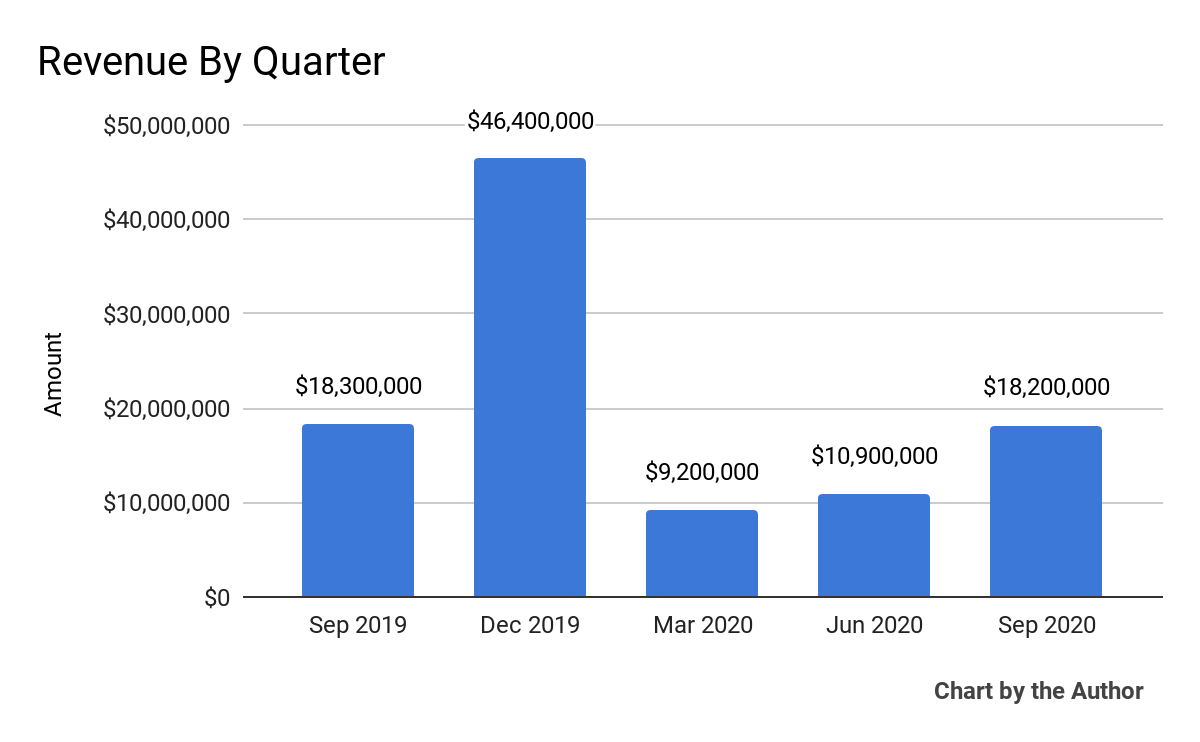

Topline revenue by quarter has been highly variable, with Q3 2020’s results 5.5% below that of Q3 2019, as the chart shows here:

各季度的背线收入变化很大,2020年第三季度的业绩比2019年第三季度低5.5%,如下图所示:

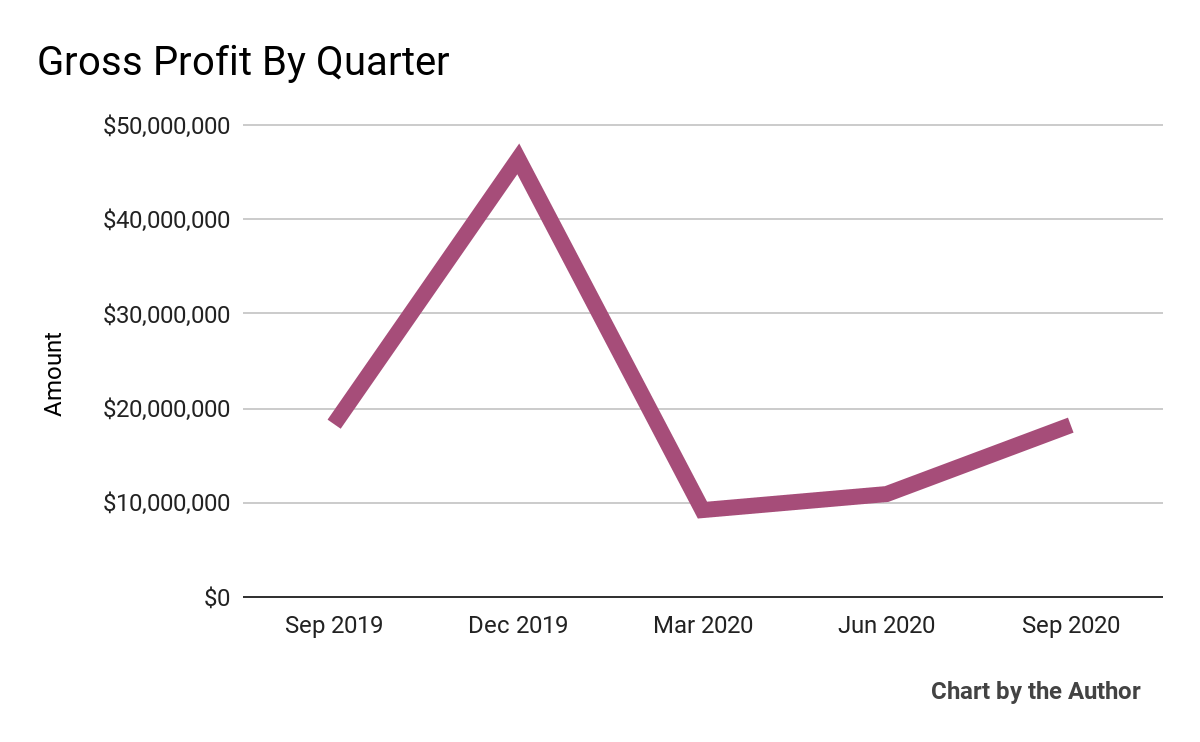

Gross profit by quarter has followed a similarly fluctuating trajectory:

按季度计算的毛利润也遵循了类似的波动轨迹:

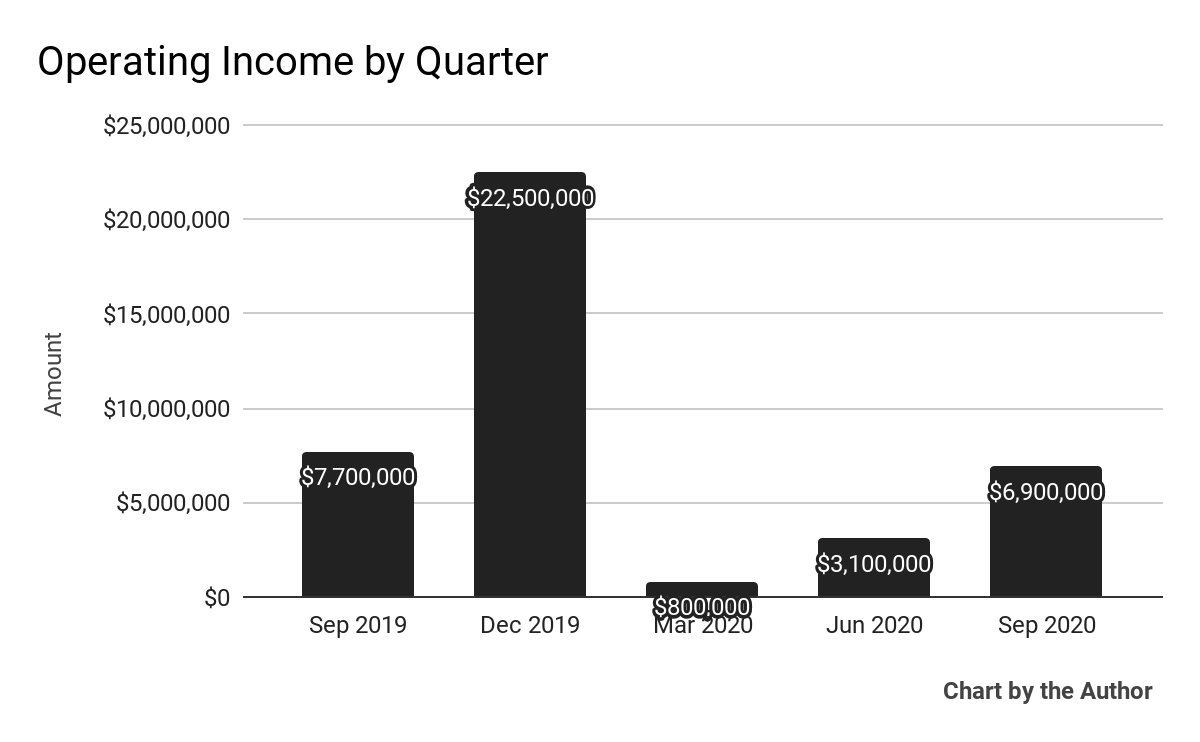

Operating income by quarter has remained positive, although highly variable, also:

按季度划分的营业收入保持正增长,尽管变数很大,但也:

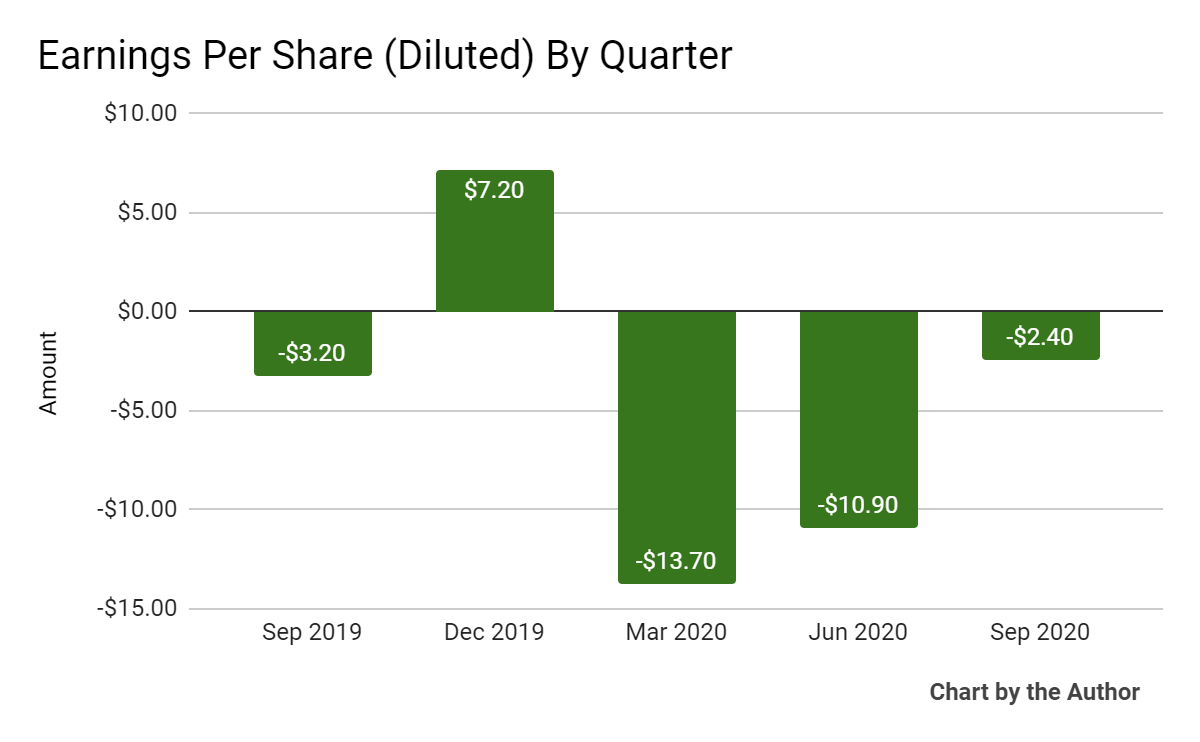

Earnings per share (Diluted) have been negative in four of the last five quarters:

过去五个季度中,有四个季度每股收益(摊薄)为负值:

Source for chart data: Seeking Alpha

图表数据来源:寻找Alpha

In the past 12 months, KRKR’s stock price has dropped 12.3 percent vs. the U.S. Interactive Media and Services index’ rise of 45.8 percent and the overall U.S. market’s growth of 29.0 percent, as the chart below indicates:

在过去的12个月里,KRKR的股价下跌了12.3%,而美国互动媒体和服务指数(U.S.Interactive Media and Services index)上涨了45.8%,美国整体市场增长了29.0%,如下图所示:

Source: Simply Wall Street

来源:简单的华尔街

Valuation Metrics

估值指标

Below is a table of relevant capitalization and valuation figures for the company:

下表为该公司的相关资本和估值数字:

Measure |

Amount |

Market Capitalization |

$184,470,000 |

Enterprise Value |

$160,810,000 |

Price / Sales |

2.10 |

Enterprise Value / Sales |

1.86 |

Enterprise Value / EBITDA |

1.12 |

Revenue Growth Rate [TTM] |

-60.78% |

Earnings Per Share |

-$19.80 |

量测 |

金额 |

市场资本化 |

$184,470,000 |

企业价值 |

$160,810,000 |

价格/销售额 |

2.10 |

企业价值/销售额 |

1.86 |

企业价值/EBITDA |

1.12 |

收入增长率[TTM] |

-60.78% |

每股收益 |

-$19.80 |

Source: Company Financials

资料来源:公司财务

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

以下是对该公司预期增长和收益的估计DCF(贴现现金流)分析:

Commentary

评注

In its last earnings call, covering Q3 2020’s results, management highlighted its strategic efforts to ‘expand and diversify’ its content production and distribution for both PGC (Professional Generated Content) and UGC (User Generated Content).

在涵盖2020年第三季度业绩的上一次财报电话会议上,管理层强调了其战略努力,即“扩大和多样化”PGC(专业生成内容)和UGC(用户生成内容)的内容生产和分发。

The firm also inked a partnership deal with Youku Tudou to create co-produced programs covering ‘financial and industry specific topics.’

该公司还与优酷土豆(Youku Tudou)签署了一项合作协议,共同制作涵盖金融和行业特定话题的节目。

The company also ‘hosted more than 200 live streaming events every month’ during Q3 2020 around specific themes such as finance, career and new economy industries.

该公司还在2020年第三季度围绕金融、职业和新经济行业等特定主题,每月举办200多场直播活动。

As to its financial results, the firm was impacted negatively by the COVID-19 pandemic relative to its offline activities of investor summits.

至于财务业绩,与投资者峰会的线下活动相比,该公司受到了新冠肺炎疫情的负面影响。

Management said the customer demand has been showing ‘signs of further recovery’ from industries including autos, 3C (Computers, Communications and Consumer electronics) and real estate.

管理层说,汽车、3C(计算机、通信和消费电子)和房地产等行业的客户需求一直显示出进一步复苏的迹象。

Additionally, the firm is seeking to expand its service to government clients at the local level for cities that are prioritizing industrial development activities.

此外,该公司正寻求将其服务扩大到优先发展工业活动的城市的地方政府客户。

Management essentially stated that the firm is in a recovery phase as the effects of the pandemic become less pronounced and businesses once again seek their service offerings.

管理层基本上表示,公司正处于恢复阶段,因为大流行的影响变得不那么明显,企业再次寻求提供服务。

Risks to the company’s outlook include a resurgence of the pandemic or its variant viruses as well as permanent damage to its client base, resulting in a slow process of recovery that continues throughout 2021.

该公司前景面临的风险包括大流行或其变异病毒的卷土重来,以及对其客户基础的永久性损害,导致整个2021年持续的缓慢复苏过程。

Management believes that recovery will continue, with special improvement from the automobile and finance sectors.

管理层认为,随着汽车和金融行业的特别改善,复苏将继续下去。

I’m in more of a wait and see mode for 36Kr. The stock is down 66% from its IPO price more than one year after the IPO, so management will have quite a big lift to show strong growth and catalyze the stock higher.

对于36Kr,我更多的是处于观望状态。在首次公开募股(IPO)一年多后,该股较IPO价格下跌了66%,因此管理层将有相当大的提振作用,以显示出强劲的增长并催化股价走高。

At $5.00, my outlook is Neutraluntil the firm shows continued improvement across all major financial metrics.

在5美元,我的展望是中性的,直到公司在所有主要财务指标上都显示出持续的改善。

译文内容由第三方软件翻译。