36Kr Seeks Continued Recovery From 2020 Shortfalls

36Kr Seeks Continued Recovery From 2020 Shortfalls

Summary

摘要

36Kr went public in November 2019, raising $20 million in a U.S. IPO.

The firm provides online digital content services and offline event promotion services to new economy businesses in China.

The COVID-19 pandemic was bad for business but management sees continued recovery, with autos and finance leading the way.

If the firm can continue to recover, with strong Q4 financial results, it may be time to look more closely at the stock. Until then, my outlook is Neutral.

Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Get started today »

36Kr於2019年11月上市,在美國首次公開募股(IPO)中籌集了2000萬美元。

該公司為中國的新經濟企業提供在線數字內容服務和線下活動推廣服務。

新冠肺炎疫情對企業不利,但管理層認為經濟將繼續復甦,其中汽車業和金融業是領頭羊。

如果該公司能夠繼續復甦,第四季度財務業績強勁,可能是時候更密切地關注該股了。在那之前,我的觀點是中性的。

想找更多像這樣的投資點子嗎?只在IPO Edge上購買。立即開始»

Quick Take

速戰速決

36Kr (KRKR) went publicin November 2019, raising $20 million from the sale of 1.38 million ADSs at $14.50 per ADS.

36Kr於2019年11月上市,以每ADS 14.5美元的價格出售138萬張美國存託憑證,籌資2,000萬美元。

The firm is a diversified digital content and offline event business services provider to new economy companies in China.

該公司是一家面向中國新經濟公司的多元化數字內容和線下活動商業服務提供商。

KRKR has been negatively impacted by the COVID-19 pandemic and is seeking to recover.

朝鮮半島受到新冠肺炎疫情的負面影響,正在尋求恢復。

As management proves its optimism with further material financial results improvement for Q4 2020’s results, it may be time to take a look at the stock, but until then I’m Neutral.

隨着管理層用2020年第四季度業績的進一步實質性財務業績改善來證明其樂觀情緒,可能是時候看看股票了,但在那之前,我持中性態度。

Company

公司

Beijing, China-based 36KR was founded in 2010 to provide business services to Chinese companies serving the Internet, hardware and software technologies, consumer and retail and finance industries, which the company refers to as the ‘New Economy’.

總部位於中國北京的36KR成立於2010年,旨在為服務於互聯網、硬件和軟件技術、消費、零售和金融行業的中國公司提供商業服務,該公司將這些行業稱為“新經濟”。

Management is headed by CEO Dagang Feng, who has been with the firm since 2019 and is also the CEO of Beijing Duoke.

管理層由首席執行官馮大剛領導,他自2019年以來一直在該公司工作,也是北京多科的首席執行官。

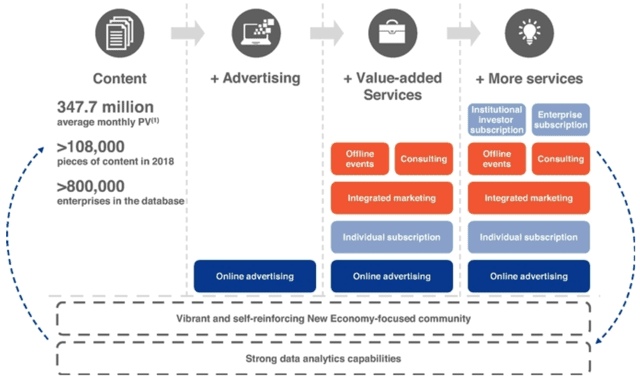

36KR has developed a suite of business services that includes tailored online advertising and subscription services, as well as other enterprise value-added services.

36KR開發了一套商業服務,包括量身定做的在線廣告和訂閲服務,以及其他企業增值服務。

The firm also provides services that help investors identify promising targets, source investment opportunities and connect with startups directly.

該公司還提供服務,幫助投資者識別有前途的目標,尋找投資機會,並直接與初創企業聯繫。

36KR has developed a database covering over 800,000 enterprises, through which it is able to gain valuable insights into the New Economy by using data analysis on user and customer preferences and provide tailored services.

36KR已經開發了一個覆蓋80多萬家企業的數據庫,通過這個數據庫,它能夠通過對用户和客户偏好的數據分析來獲得對新經濟的寶貴見解,並提供量身定做的服務。

Below is an overview graphic of the company’s business model:

以下是該公司業務模式的概貌圖:

Page Views - during the twelve-month period ended June 30, 2019.

頁面瀏覽量-截至2019年6月30日的12個月期間。

Source: Company

消息來源:公司

Management says that as of the end of 2018, the company provided business services to 23 of the Global Fortune 100 companies and to 59 of the Top 100 ‘New Economy’ companies in China as measured by market capitalization and valuation, according to a 2019 China Insights Consultancy [CIC] report.

管理層表示,根據2019年中國洞察諮詢公司(China Insights)的數據,截至2018年底,該公司為全球財富100強公司中的23家公司以及中國市值和估值排名前100名的59家公司提供了商業服務。[中投]報告情況。

Additionally, since the launch of its institutional investors subscription services in Q1 2017, 36KR has already covered 46 of the Top 200 institutional investors in China as of the end of 2018, as measured by assets under management, according to the CIC report.

此外,根據中投公司的報告,自2017年第一季度推出機構投資者認購服務以來,截至2018年底,36KR已經覆蓋了中國前200家機構投資者中的46家,以管理的資產衡量。

The firm markets its solutions through an in-house sales teams that consist of 217 employees as of the end of June 2019, with knowledge and expertise of the New Economy sector.

截至2019年6月底,該公司通過擁有新經濟領域知識和專業知識的217名員工組成的內部銷售團隊營銷其解決方案。

They are tasked with understanding 36KR’s customers' needs as well as to maintain a close relationship with them by providing support and customer services during the course of services.

他們的任務是瞭解36KR的客户需求,並通過在服務過程中提供支持和客户服務來與他們保持密切的關係。

According to a 2018 market research reportby IBIS World, the IT services market in China had reached a total revenue of $159 billion in 2018, an increase of 6.2% year-over-year.

根據IBIS World發佈的2018年市場研究報告,2018年中國IT服務市場總收入達到1590億美元,同比增長6.2%。

This represents a CAGR of 7.7% between 2013 and 2018.

這意味着2013至2018年間的複合年增長率為7.7%。

36KR operates in the business services subset of the IT services market.

36KR在IT服務市場的業務服務子集中運營。

The main factors driving forecast market growth is the increase in IT investments and the growth of China’s information sector.

推動預測市場增長的主要因素是IT投資的增加和中國信息行業的增長。

The China IT services market accounts for about 20% of China's total IT investment, as compared to an average 40% share in other developed countries.

中國的IT服務市場約佔中國IT總投資的20%,而其他發達國家的平均份額為40%。

Recent Performance

近期表現

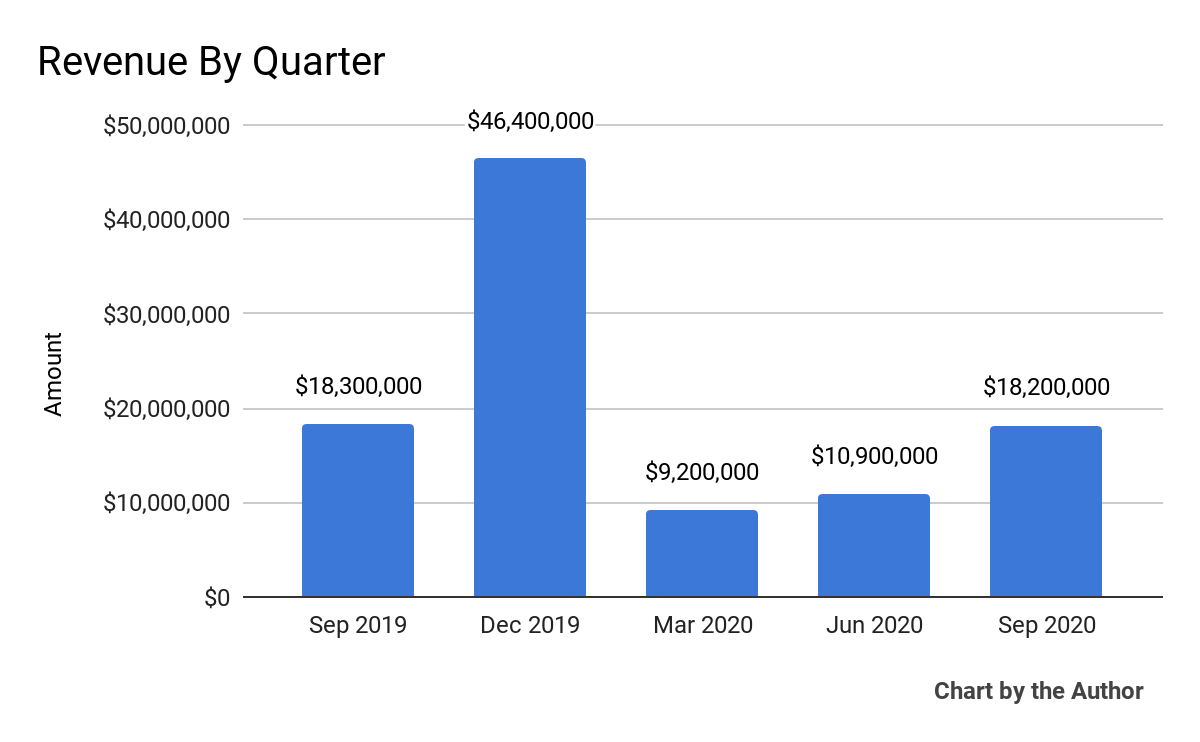

Topline revenue by quarter has been highly variable, with Q3 2020’s results 5.5% below that of Q3 2019, as the chart shows here:

各季度的背線收入變化很大,2020年第三季度的業績比2019年第三季度低5.5%,如下圖所示:

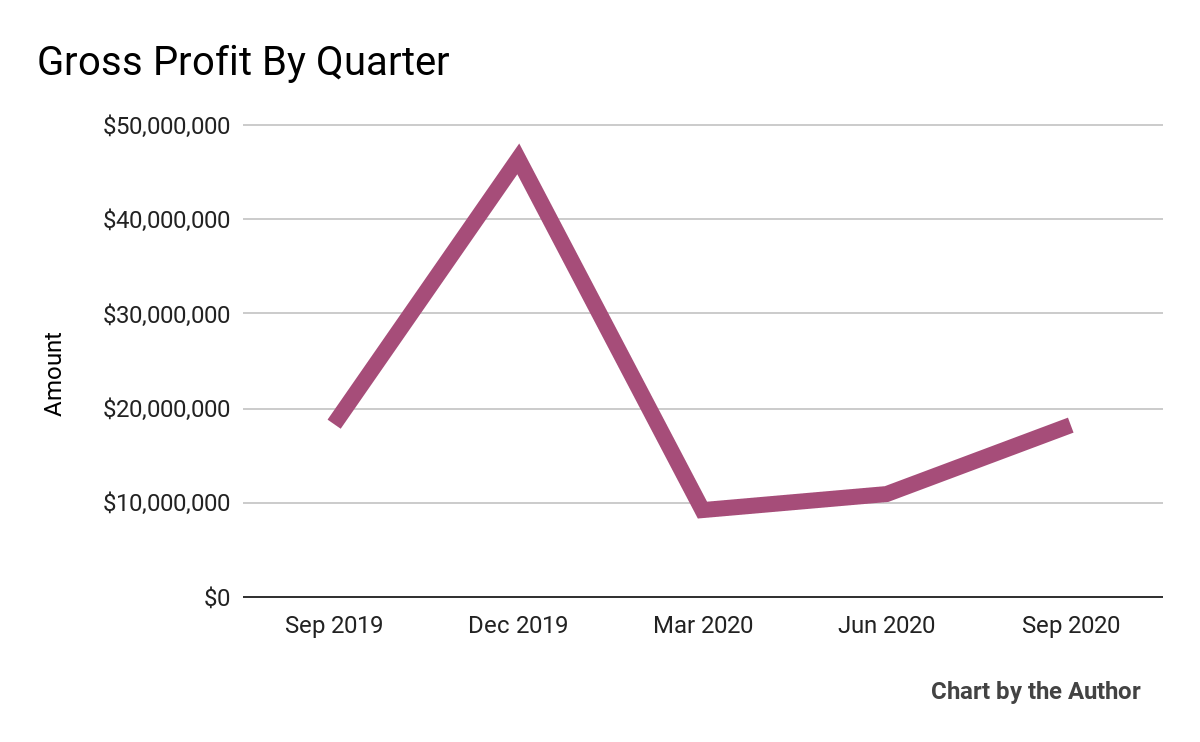

Gross profit by quarter has followed a similarly fluctuating trajectory:

按季度計算的毛利潤也遵循了類似的波動軌跡:

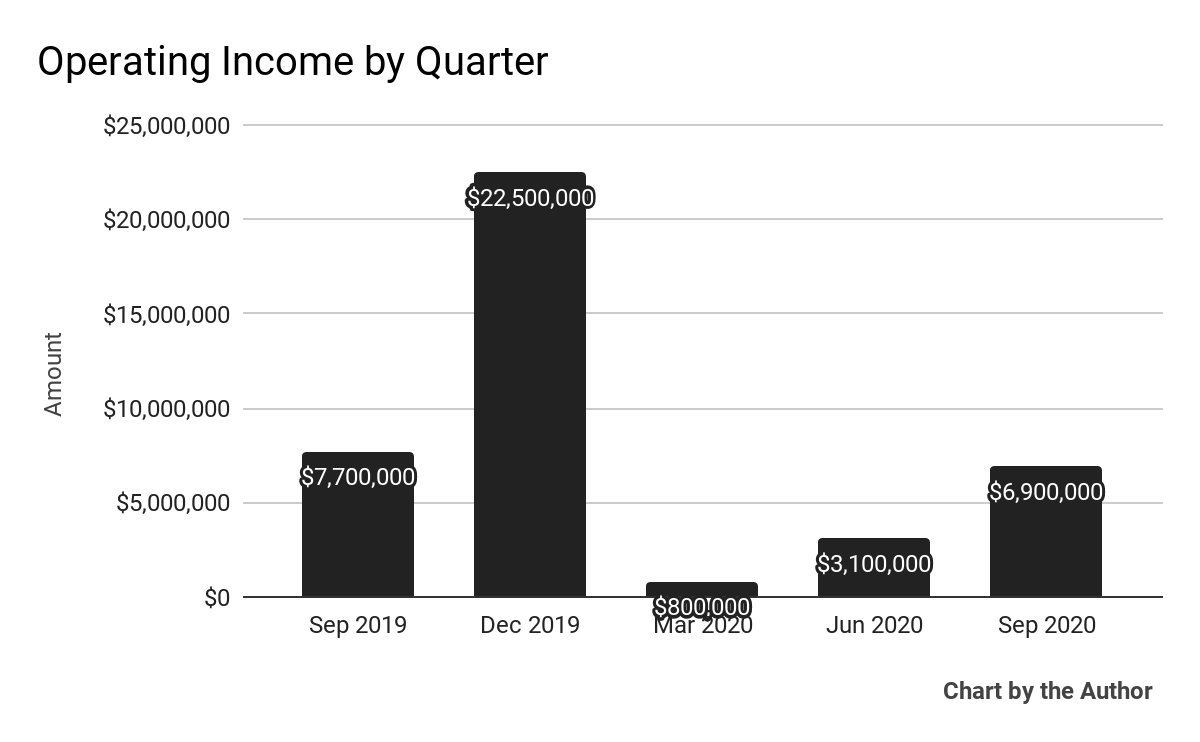

Operating income by quarter has remained positive, although highly variable, also:

按季度劃分的營業收入保持正增長,儘管變數很大,但也:

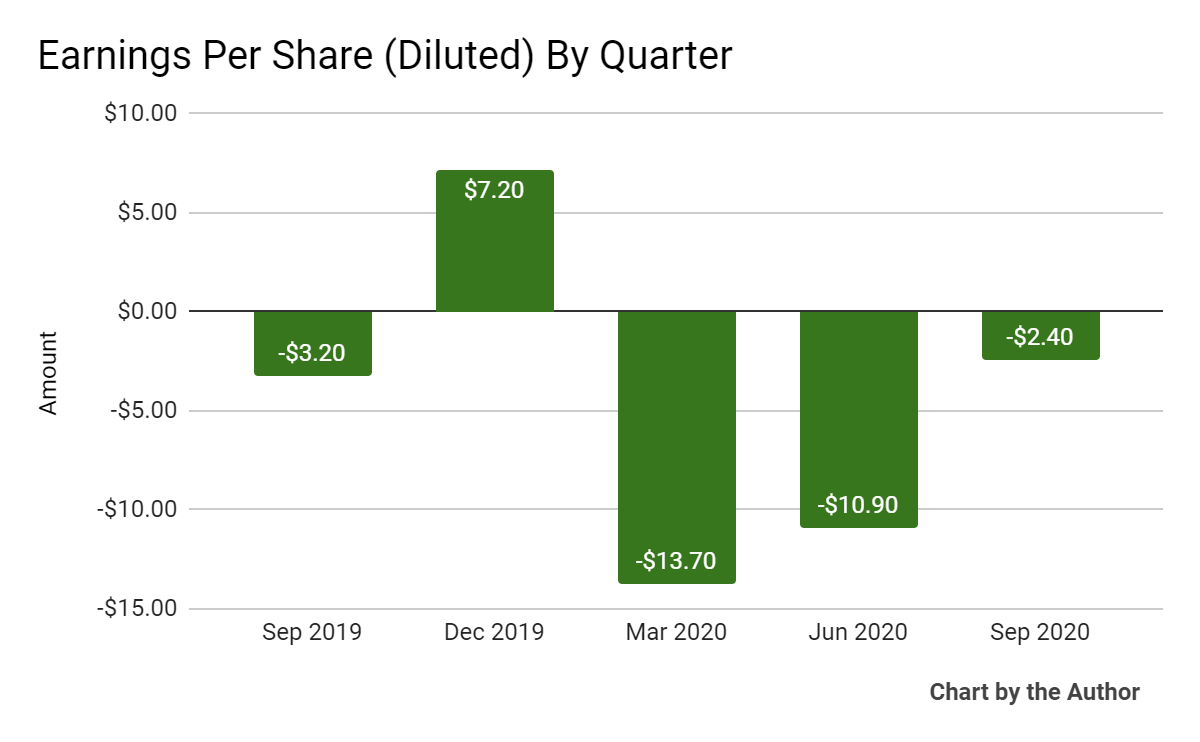

Earnings per share (Diluted) have been negative in four of the last five quarters:

過去五個季度中,有四個季度每股收益(攤薄)為負值:

Source for chart data: Seeking Alpha

圖表數據來源:尋找Alpha

In the past 12 months, KRKR’s stock price has dropped 12.3 percent vs. the U.S. Interactive Media and Services index’ rise of 45.8 percent and the overall U.S. market’s growth of 29.0 percent, as the chart below indicates:

在過去的12個月裏,KRKR的股價下跌了12.3%,而美國互動媒體和服務指數(U.S.Interactive Media and Services index)上漲了45.8%,美國整體市場增長了29.0%,如下圖所示:

Source: Simply Wall Street

來源:簡單的華爾街

Valuation Metrics

估值指標

Below is a table of relevant capitalization and valuation figures for the company:

下表為該公司的相關資本和估值數字:

Measure |

Amount |

Market Capitalization |

$184,470,000 |

Enterprise Value |

$160,810,000 |

Price / Sales |

2.10 |

Enterprise Value / Sales |

1.86 |

Enterprise Value / EBITDA |

1.12 |

Revenue Growth Rate [TTM] |

-60.78% |

Earnings Per Share |

-$19.80 |

量測 |

金額 |

市場資本化 |

$184,470,000 |

企業價值 |

$160,810,000 |

價格/銷售額 |

2.10 |

企業價值/銷售額 |

1.86 |

企業價值/EBITDA |

1.12 |

收入增長率[TTM] |

-60.78% |

每股收益 |

-$19.80 |

Source: Company Financials

資料來源:公司財務

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

以下是對該公司預期增長和收益的估計DCF(貼現現金流)分析:

Commentary

評註

In its last earnings call, covering Q3 2020’s results, management highlighted its strategic efforts to ‘expand and diversify’ its content production and distribution for both PGC (Professional Generated Content) and UGC (User Generated Content).

在涵蓋2020年第三季度業績的上一次財報電話會議上,管理層強調了其戰略努力,即“擴大和多樣化”PGC(專業生成內容)和UGC(用户生成內容)的內容生產和分發。

The firm also inked a partnership deal with Youku Tudou to create co-produced programs covering ‘financial and industry specific topics.’

該公司還與優酷土豆(Youku Tudou)簽署了一項合作協議,共同製作涵蓋金融和行業特定話題的節目。

The company also ‘hosted more than 200 live streaming events every month’ during Q3 2020 around specific themes such as finance, career and new economy industries.

該公司還在2020年第三季度圍繞金融、職業和新經濟行業等特定主題,每月舉辦200多場直播活動。

As to its financial results, the firm was impacted negatively by the COVID-19 pandemic relative to its offline activities of investor summits.

至於財務業績,與投資者峯會的線下活動相比,該公司受到了新冠肺炎疫情的負面影響。

Management said the customer demand has been showing ‘signs of further recovery’ from industries including autos, 3C (Computers, Communications and Consumer electronics) and real estate.

管理層説,汽車、3C(計算機、通信和消費電子)和房地產等行業的客户需求一直顯示出進一步復甦的跡象。

Additionally, the firm is seeking to expand its service to government clients at the local level for cities that are prioritizing industrial development activities.

此外,該公司正尋求將其服務擴大到優先發展工業活動的城市的地方政府客户。

Management essentially stated that the firm is in a recovery phase as the effects of the pandemic become less pronounced and businesses once again seek their service offerings.

管理層基本上表示,公司正處於恢復階段,因為大流行的影響變得不那麼明顯,企業再次尋求提供服務。

Risks to the company’s outlook include a resurgence of the pandemic or its variant viruses as well as permanent damage to its client base, resulting in a slow process of recovery that continues throughout 2021.

該公司前景面臨的風險包括大流行或其變異病毒的捲土重來,以及對其客户基礎的永久性損害,導致整個2021年持續的緩慢復甦過程。

Management believes that recovery will continue, with special improvement from the automobile and finance sectors.

管理層認為,隨着汽車和金融行業的特別改善,復甦將繼續下去。

I’m in more of a wait and see mode for 36Kr. The stock is down 66% from its IPO price more than one year after the IPO, so management will have quite a big lift to show strong growth and catalyze the stock higher.

對於36Kr,我更多的是處於觀望狀態。在首次公開募股(IPO)一年多後,該股較IPO價格下跌了66%,因此管理層將有相當大的提振作用,以顯示出強勁的增長並催化股價走高。

At $5.00, my outlook is Neutraluntil the firm shows continued improvement across all major financial metrics.

在5美元,我的展望是中性的,直到公司在所有主要財務指標上都顯示出持續的改善。

譯文內容由第三人軟體翻譯。