What The Options Market Is Saying About The Big Tech Earnings Reports This Week

What The Options Market Is Saying About The Big Tech Earnings Reports This Week

Last week ended with stocks near all time highs and implied volatility near yearly lows.

上週收盤時,股市接近歷史高點,隱含波動率接近年度低點。

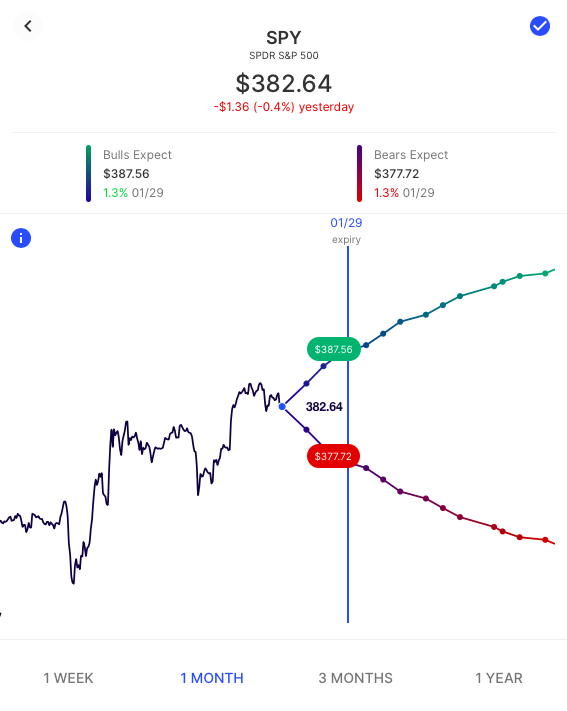

Looking ahead, SPY options are pricing in just a 1.3% expected move into Friday's expiration, implying a bullish consensus around $388 and a bearish consensus near $377:

展望未來,標普500ETF期權週五到期時的預期波動幅度僅為1.3%,這意味着看漲的共識在388美元附近,看跌的共識在377美元附近:

With some of the larger tech names set to report earnings this week (including Tesla Inc (NASDAQ: TSLA), Apple Inc (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), and Facebook Inc (NASDAQ:FB)), QQQ options are pricing in a 1.9% expected move into Friday's expiration, implying a bullish consensus around $332 and a bearish consensus near $319:

Expected Moves for Companies Reporting Earnings

公司報告收益的預期舉措

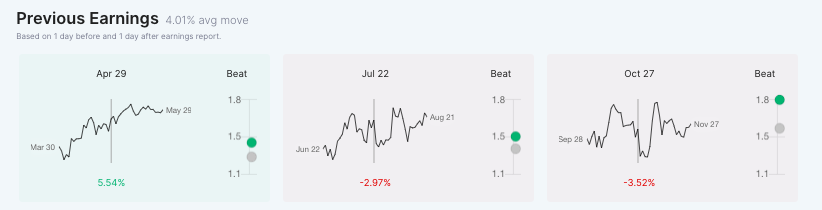

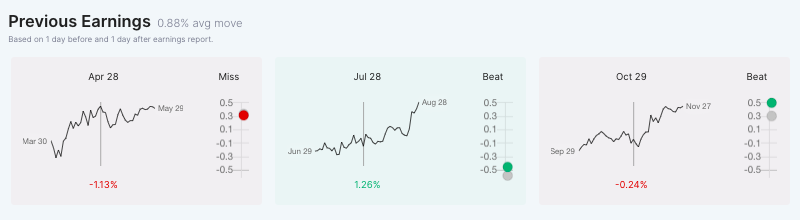

This week is highlighted by large tech names Microsoft, Apple, Facebook and Tesla. A more complete calendar with expected moves and prior earnings reactions to EPS beats/misses can be found on the Options AI Earnings Calendar.

本週的亮點是大型科技公司微軟、蘋果、Facebook和特斯拉。更完整的日曆,包括預期變動和先前對每股收益超出/未達到預期的收益反應,請訪問期權AI收益日曆.

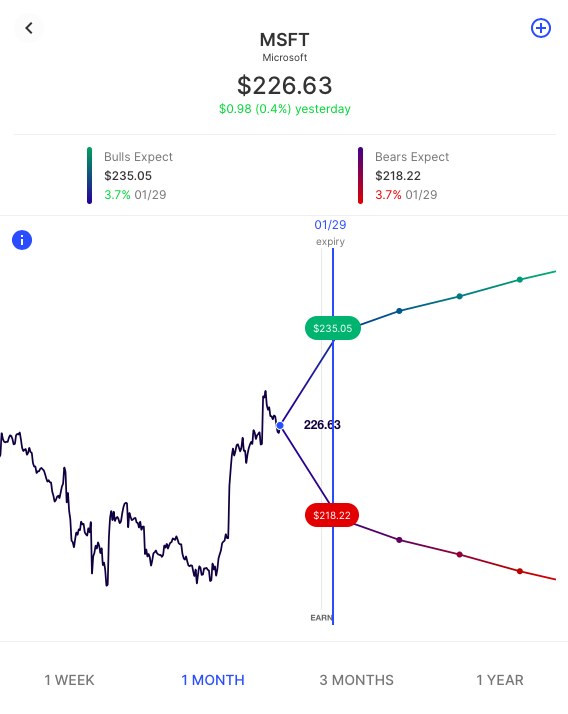

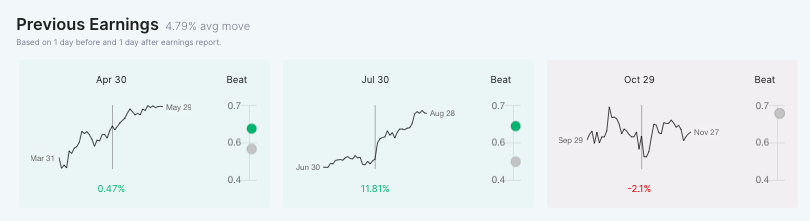

Microsoft / Reporting Tuesday after hours / 3.7% Expected Move / link

微軟/週二報道盤後/3.7%預期變動/鏈接

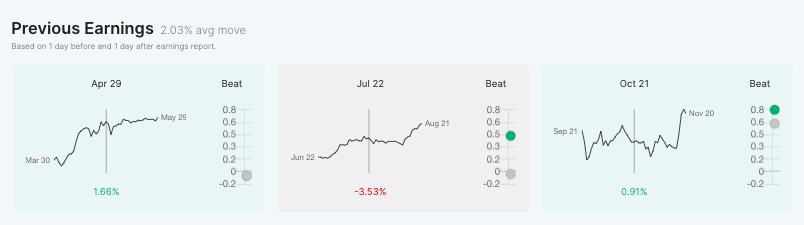

Apple / Reporting Wednesday after hours / 5.3% Expected Move / link

蘋果/週三報道盤後/5.3%預期變動/鏈接

Facebook / Reporting Wednesday after hours / 6.0% Expected Move / link

臉譜/週三報道盤後/6.0%預期變動/鏈接

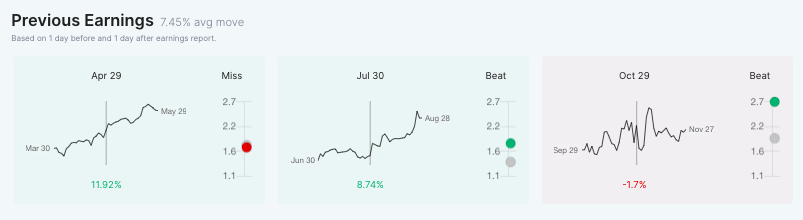

Tesla / Reporting Wednesday after hours / 7.2% Expected Move / link

特斯拉/週三報道盤後/7.2%預期變動/鏈接

Using the Expected Move to Help Inform Spread Trading

利用預期中的舉措幫助價差交易提供信息

The expected move is the amount that options traders believe a stock price will move up or down. It can serve as a quick way to cut through the noise and see where real-money option traders are pricing potential stock moves. On Options AI, it is calculated using real-time option prices and displayed on a chart.

預期變動是期權交易員認為股票價格將上升或下降的幅度。它可以作為一種快速的方式,避開噪音,看看真正的貨幣期權交易員正在為潛在的股票走勢定價。在期權AI上,它是使用實時期權價格計算的,並顯示在圖表上。

Knowing this consensus before making a trade can be incredibly powerful, regardless of whether you're using stock or options to make your trade. A helping hand with setting more informed price targets as well as a useful basis for starting strike selection.

無論你是使用股票還是期權進行交易,在進行交易之前瞭解這一共識可能會非常有效。幫助設定更有見地的價格目標,併為開始執行選擇提供有用的基礎。

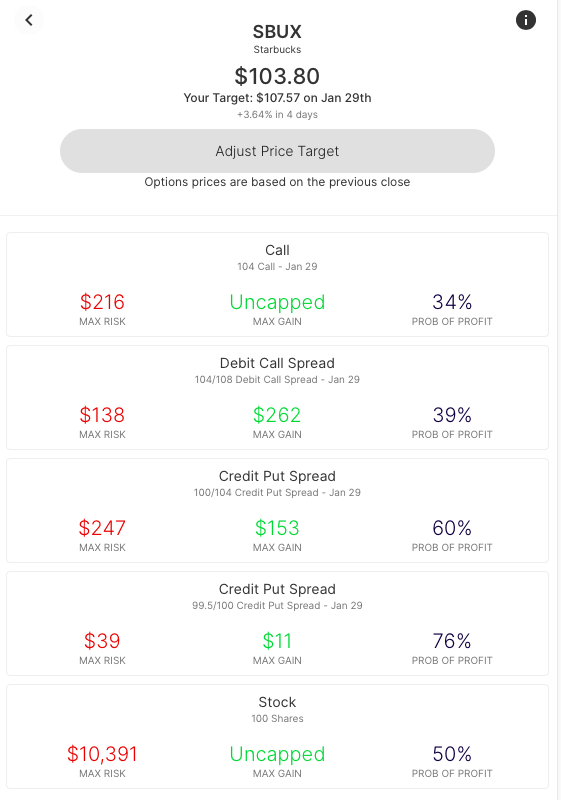

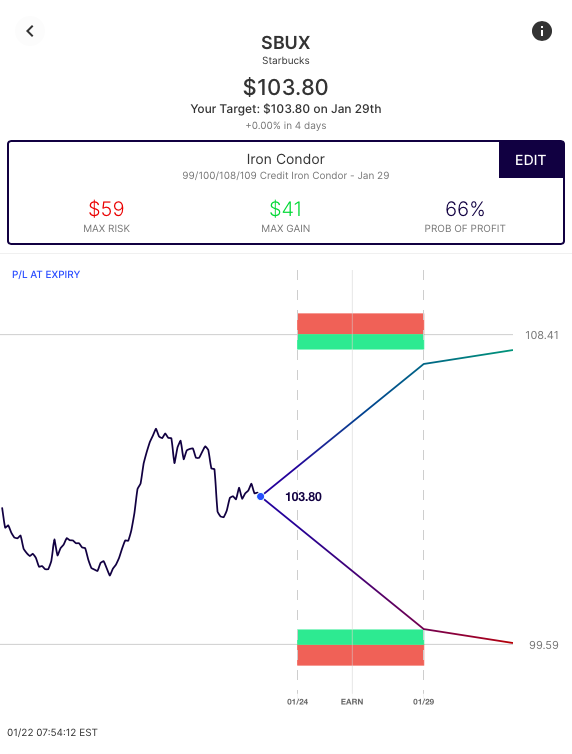

Here's an example, using Starbucks and its expected move. On the Options AI platform, a trader can select the bullish consensus for spread trades to generate debit call spreads and credit put spreads around the move. Or, if a trader believes that the options market is overestimating the move, a trader can select a neutral view to sell to both the bulls and the bears and generate credit/income generating strategies such as an Iron Condor at the expected move – shown here:

這裏有一個例子,使用星巴克及其預期的舉措。在期權AI平臺上,交易員可以選擇利差交易的看漲共識,以在走勢附近產生借方看漲利差和信用賣權利差。或者,如果交易員認為期權市場高估了走勢,交易員可以選擇中性觀點,同時賣給多頭和空頭,並在預期的走勢中產生信貸/創收策略,如鐵雕-如下所示:

A closer look at some spread trades to the bullish consensus, compared to stock and a single call:

仔細看看與看漲共識相比的一些利差交易,與股票和一次看漲期權相比:

And a closer look at the Iron Condor, with strikes set at the expected move:

更仔細地觀察鐵雕,罷工設定在預期的行動:

Summary

摘要

Remember, the above are just examples of the many ways a trader might express a view using option spreads. They are intended solely to demonstrate how the expected move can provide actionable insight to consider before making any trade, particularly into an uncertain event. Whether gut-checking your own expectations versus the options crowd, generating trade ideas from option market signals, or for more informed strike selection. That's why Options AI puts the expected move at the heart of its chart-based platform. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts shown in Starbucks can apply to any stock and it is simply used here for illustrative purposes. Expected moves will change slightly into each company's earnings events so be sure to stay up to date via the earnings calendar. We'll be back later this week with previews of Tesla, Facebook and more.

請記住,以上只是交易員可能使用期權價差表達觀點的許多方式的例子。它們的目的只是為了證明,預期中的舉措如何能夠提供可操作的洞察力,供在進行任何交易之前考慮,特別是在發生不確定事件時。無論是仔細檢查自己對期權人羣的預期,從期權市場信號中產生交易想法,還是進行更有見地的罷工選擇。這就是為什麼Options AI將預期的走勢放在其基於圖表的平臺的核心。學習/選項人工智能有幾個免費工具,以及關於預期走勢和價差交易的培訓。星巴克展示的概念可以適用於任何股票,這裏僅用於説明目的。預期變動將根據每家公司的收益事件略有變化,因此請務必通過收益日程表。本週晚些時候,我們將帶着特斯拉、Facebook和更多的預覽回來。

The post What You Need to Know in Options – Week of January 25th appeared first on Options AI: Learn.

崗位在期權中你需要知道什麼-1月25日的一週第一次出現在選項AI:學習.

譯文內容由第三人軟體翻譯。