There is no reason for us to sit back and wait for the day of rotation between China and the United States to come automatically.

Today, China and the United States account for more than 40% of the world's economy (24% in the United States and nearly 17% in China). The movement between China and the United States is not only related to changes in the global pattern, but also affects the fate of countless people.

Today, I will mainly share with you an article about the future trend of the United States and China. Finally, I will briefly talk about my views.

01 The giant who foresaw the subprime crisis wrote ten thousand words.

Why is this article specially introduced today?

To put it simply, it is worth seeing, because it has a lot of foresight for the future development of China and the United States.

The title of this article is "The Big Cycles Over The Last 500 Years", and the direct translation is "the Great cycle of the past 500 years".

The author of the article is Ray Dalio, which I mentioned earlier.

Dario, who was born in New York in 1949, founded Bridgewater, the largest hedge fund in the world.

Qiaoshui currently manages assets of US $160 billion (more than 1.1 trillion yuan).

The place where the bridge crosses the river is that its clients are mainly pensions, university endowments, charitable funds, multinational organizations, sovereign funds and central banks, of which foreign customers account for about 1 / 2.

It is not easy for Dario to be favored by such big clients.

One of them is that he is very focused on macro issues and often explores some fundamental issues related to the operation of the country and the economy.

Of course, the test of strength has always been the actual results.

Dario foresaw the subprime crisis in the United States in 2008.

He laid out ahead of time, long treasury bonds and long yen, and in the end, he not only survived, but also earned a 9.4% gain (80% of the world's hedge funds were losing money that year).

At that time, the Obama administration also listened to Dario's advice and conducted stress tests on banks, resulting in a possible loss of more than 400 trillion before the United States adopted a strong rescue policy.

The research results of Qiaoshui have become a reference for decision-makers in many countries around the world.

Dario also has a deep relationship with China.

As early as 1984, at the beginning of China's reform and opening up, Dario came to China to explain the operation of the international capital market for the Chinese people, and he also participated in the reform of China's financial market.

When he first came to China, he was acutely aware of the great potential of China's development.

Even in 1995, he sent his then 11-year-old son Matt to Beijing to attend Shijia Hutong Primary School.

He not only deals with China early, but also at a very high level.

To take a simple example, here is the evaluation of Dario (that is, Mr. Dario) in the Comparative study of the two Great Global crises.

As for this book, interested friends, feel free to search the author, and you will know the weight.

Finally, to sum up, Dario not only has a deep study of macro trends, but also has an in-depth understanding of China.

Therefore, his article on Sino-US relations is naturally worth reading.

02 500Over the past few years, why has the World Congress changed?

In this article, Dario actually provides an analytical framework: the password for the rise and fall of global hegemony.

That's what he called the great cycle of imperial life.

He pointed out that global hegemony, like human beings, has its own life cycle.

For example, in the first stage, people basically go to school under the care of their parents; until the age of 18 is 24, they begin to enter the second stage, working, getting married, having children, and raising a family; finally, at the age of 55, when they reach the final stage, they no longer bear the burden of family and work, and their lives come to an end.

According to our age, we can generally judge what will happen to him (her) and how to deal with him (her).

Global hegemony has a similar pattern.

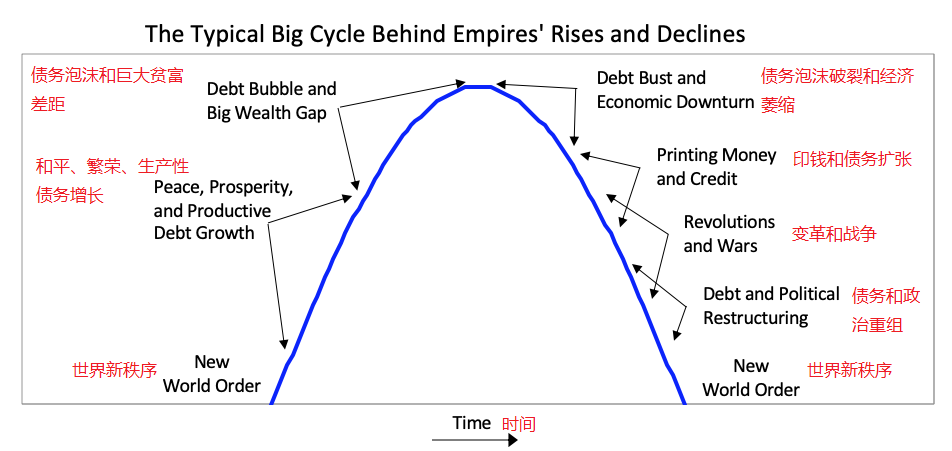

He summed it up in the following picture.

To put it simply, there will be a period of peace and prosperity after the establishment of a world order.

People take it for granted that prosperity will last forever, so borrowing money for pleasure and increasing leverage leads to economic bubbles and the gap between the rich and the poor.

Then, in order to maintain the so-called prosperity, we can only do whatever we want, keep printing money, and continue to expand debt.

In this process, there will be huge contradictions and conflicts, and the only way to end it is war or some other great change.

The old order collapses and the new order is rebuilt.

Thus creating a new overlord and moving on to the next cycle.

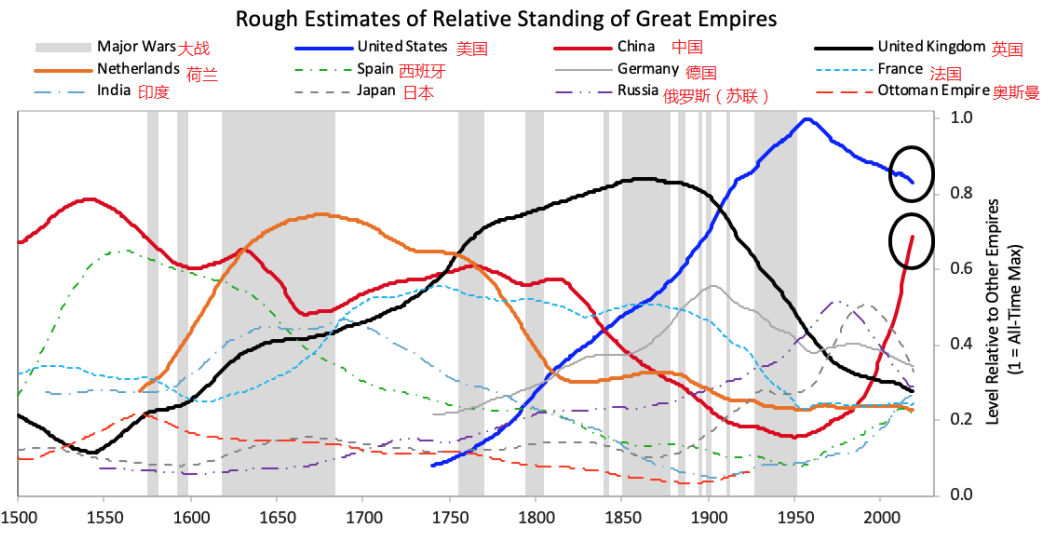

He looks back on the rise and fall cycle of global hegemony since the 16th century (it is generally believed that mankind entered the era of globalization after the great geographical discovery) and uses the following picture.

Dario devoted a lot of space to proving his judgment with examples (Holland, England).

However, we are more concerned about China and the United States.

03 There is not much left of the US lead.

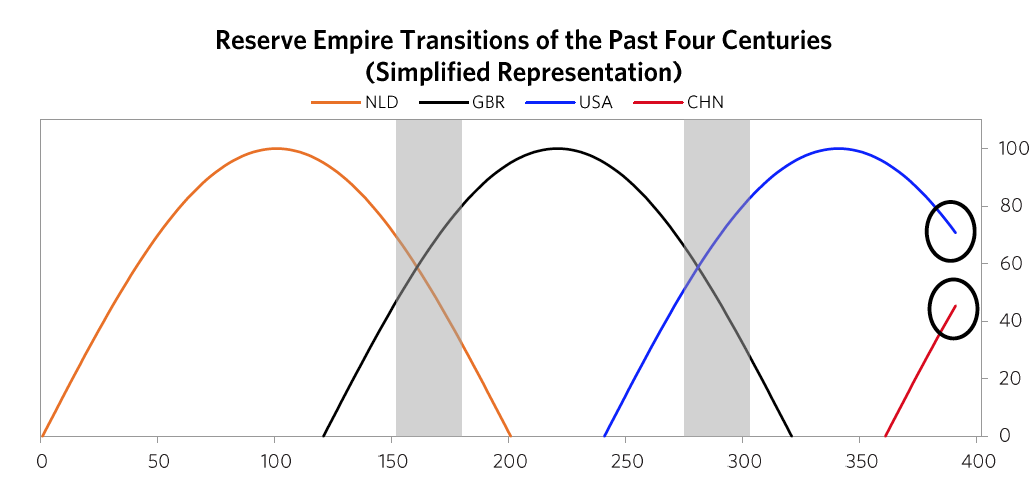

Dario drew a simpler but clearer picture, which is the one below.

Among them, red represents China and blue represents the United States.

On the basis of the law of global hegemony in the past 500 years, Dario pointed out:

The lead of the world's most powerful empire in the United States is running out and is in relative decline; China's power is rising rapidly, and no country can match it.

He said that this kind of strength mainly includes eight aspects: education, competitiveness, scientific and technological level, economic output, trade share, military strength, financial center strength, reserve currency.

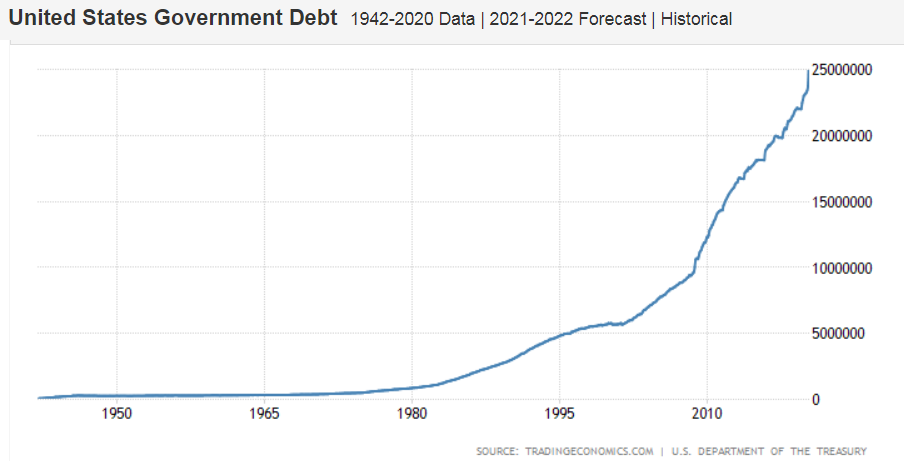

The United States has been repeatedly experiencing printing money, leverage, bubbles and recessions in the past three or four decades, which is a reflection of this cycle of decline.

From 1982 to 2000, the expansion of the currency Xiaobai Maimai Inc brought about the Internet bubble, which led to the recession after 2000.

In 2002-2007, the real estate bubble led to the Great Recession of 2008.

Since 2020, the COVID-19 epidemic in the United States will burst the bubble again.

In these three stages, the final solution for the United States is to print money and borrow money.

Internal wealth is divided and society is torn apart.

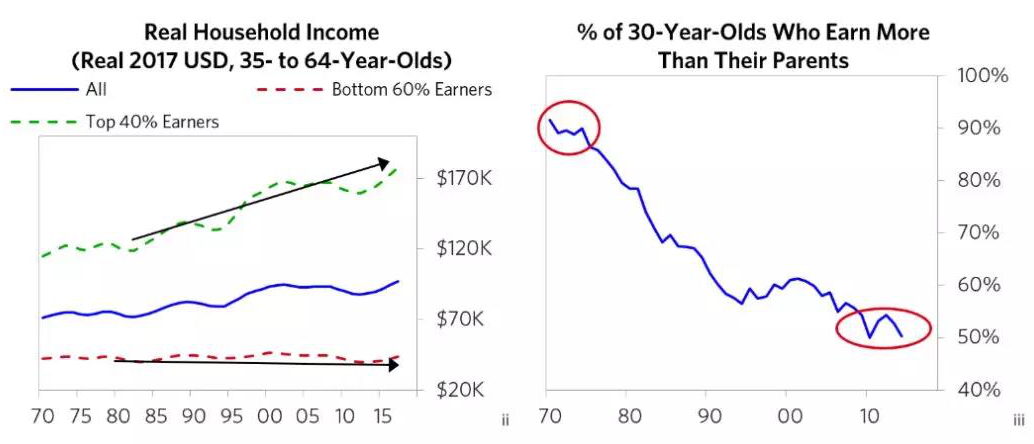

With regard to the wealth differentiation in the United States, Dario has found that the wealth of the richest 1% of the population in the United States is the sum of the wealth of the bottom 90%.

More crucially, the gap between the rich and the poor is widening.

For more than 40 years, the income of 60 per cent of workers of the golden age in the US has barely increased, while the income of the richest 10 per cent has at least doubled, while that of the top 1 per cent has tripled.

Only half of Americans now earn more than their parents (90% in the 1970s).

Although the United States still has dollar hegemony, once the default problem and the action of printing the dollar destroy the bond market in a few years' time, the ability of the dollar as a reserve currency will shrink.

The historical tragedies of Britain and the Netherlands have shown that the loss of hegemony will follow.

Us debt has broken through the skyline

Dario believes that China will become more important in the next decade or so.

Reflected in the actual action, Qiaoshui's overall securities holdings fell by 48.5% in the first quarter, but increased its holdings in several Chinese companies, with a high proportion of even more than 100%.

04 We need to keep a clear head.

What do you think of Dario's article?

At present, the United States does have problems of one kind or another, and there are many voices who are not optimistic about the United States.

However, the United States is still the world's largest economy.

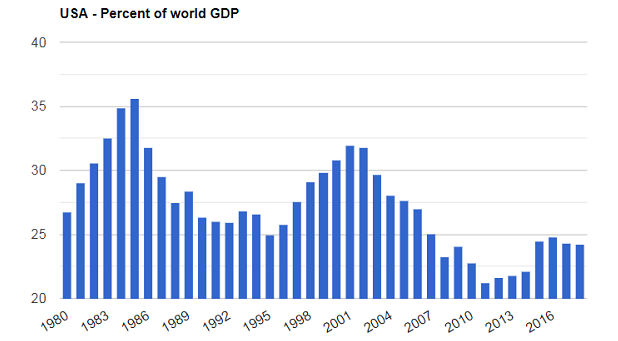

And, in fact, the US share of the global economy has rebounded in the past decade because the US economy has grown faster than the global average, especially in western developed countries.

What does that mean?

The United States has a strong ability to correct mistakes and its economy is resilient.

The proportion of the United States in the global economy

In fact, Americans themselves say that the decline of the United States is no longer a matter of one or two days.

From 1981 to 1984, Robert Keohan, a famous American scholar on international issues, wrote a book called "after hegemony". The "hegemony" mentioned here refers to the United States. "after hegemony" is to warn the United States that its economic and political advantages will decline.

In 2002, Charles Kupchan, an international relations expert at Georgetown University, also wrote a book with a more straightforward name: "the end of the American era."

Such studies are common in the United States.

Is American hegemony in decline? Everyone's view may be different.

However, one point is precisely worthy of our attention: the United States has a sense of hardship and a sense of crisis, which in turn will promote the commissioning and innovation of science and technology, institutions and policies in the United States.

The cover of the first issue of the Atlantic, a famous American magazine

And for China.

Even if Dario's prediction is 100% accurate, there is no reason for us to sit back and wait for the day of rotation between China and the United States to come automatically.

The first thing China should do is always to do its own thing well.

Edit / emily