Source: Wall Street Journal.

The S&P and Nasdaq closed up over 1%; Tesla rose nearly 5%, NVIDIA increased nearly 2%; Boeing soared nearly 7%, leading the Dow; GDS Holdings fell 14%, but Xpeng Autos rebounded over 5%. The two-year U.S. Treasury yield once plummeted over 10 basis points, dropping below 4% after Powell's speech. Following Powell's remarks, the USD gave back more than half of its gains. After Powell's speech, Gold's gains expanded, reaching a new intraday historical high.

The Federal Reserve has lowered its economic growth forecast and raised its inflation predictions, presenting typical "stagflation" characteristics. Powell hinted at increasing economic uncertainty and expressed a desire to maintain a wait-and-see approach while monitoring whether the slowdown in growth could become more severe.

However, the overall stance of the Federal Reserve is relatively dovish, significantly slowing down the pace of balance sheet reduction (QT), and Powell reassured the market by stating that the recession risk is not high and that the US economy remains strong with a stable job market. Despite the trade tensions raising recession concerns, the Federal Reserve still expects to cut interest rates twice this year, consistent with expectations prior to Trump taking office last December.

However, the overall stance of the Federal Reserve is relatively dovish, significantly slowing down the pace of balance sheet reduction (QT), and Powell reassured the market by stating that the recession risk is not high and that the US economy remains strong with a stable job market. Despite the trade tensions raising recession concerns, the Federal Reserve still expects to cut interest rates twice this year, consistent with expectations prior to Trump taking office last December.

In addition, Powell downplayed the impact of tariffs, believing that inflationary pressures are temporary, and that it is too early to determine that tariffs will have a severe impact. He pointed out that the inflation expectation data from the University of Michigan is "abnormal," indicating that the relationship between survey data and actual economic data is not very tight.

Market expectations for interest rate cuts are heating up, which helps boost risk assets. US stocks rebounded collectively, with Technology and Small Cap stocks leading the gains. Gold hit a new high, cryptocurrencies rallied, and the dollar narrowed its earlier gains.

Additionally, the political crisis escalated with the arrest of opposition leaders, triggering a triple whammy for Turkish stocks, bonds, and currency. The market is gearing up for a super Thursday, when the Swiss National Bank, the Swedish National Bank, and the Bank of England will announce their interest rate decisions.

On the day of the Federal Reserve's interest rate decision, the market warmed up, with Tesla rising nearly 5%, helping the consumer discretionary sector to lead the gains.

The three major US stock indices saw an overall increase.

The S&P 500 Index closed up 1.08%. The Dow Jones Industrial Average closed up 0.92%. The Nasdaq closed up 1.41%. The Nasdaq 100 closed up 1.30%.

The Nasdaq Technology Market Capitalization Weighted Index (NDXTMC), which measures the performance of the Nasdaq 100 Technology component stocks, closed up 1.52%.

The Russell 2000 Small Cap Index closed up 1.57%. The VIX, a measure of market volatility, closed down 8.25%, at 19.91.

The industry ETFs in the US stock market all rose.

The Global Aviation Industry ETF closed up 2.73%, while the Consumer Discretionary ETF and the Semiconductor ETF gained 0.88%, lagging behind.

"The Seven Sisters of Technology" all increased:

The Magnificent 7 Index increased by about 1.49%, and the 'Trump Tariff Losers' Index rose by about 1.13%.

Tesla closed up 4.68%, Google A rose 2%, NVIDIA rose 1.81%, Amazon rose 1.41%, Apple rose 1.21%, Microsoft rose 1.12%, and Meta rose 0.29%.

NVIDIA CEO Jensen Huang stated that US tariffs will not have a material impact in the short term.

Chip stocks all rose.

The PHLX Semiconductor Index closed up 0.99%. The NVIDIA double long ETF rose 3.21%.

Broadcom rose 3.66%, Wolfspeed rose 8.81%. Intel closed down 6.94%, ending a five-day upward trend.

AI Concept Stocks rise broadly.

BigBear.a rose 4.71%, Applovin rose 6.52%, and Palantir rose 2.63%.

Super Micro Computer rose 5.8%, and Super Micro Computer launched a new server using the NVIDIA Grace CPU super chip.

China Concept Stocks saw mixed results.

The Nasdaq Golden Dragon China Index closed down 0.44%. The FTSE A50 futures fell 0.06% in consecutive overnight trading.

Among ETFs, the China Technology Index ETF (CQQQ) fell 1.29%, the FTSE China 3x Long ETF (YINN) fell 1.28%, and the China Concept Internet Index ETF (KWEB) fell 0.50%.

Among popular China Concept Stocks, Xpeng Motors rose 5.12%, TENCENT ADR rose 0.14%, Baidu fell 4.17%, and Xiaomi Group ADR fell 3%.

GDS Holdings fell 13.97%, with Q4 revenue growth of 9.1%, and turned to profitability in net income year-on-year, with growth in the datacenter business.

Kingsoft Cloud rose 1.93%, with Q4 revenue growth of 30% year-on-year, outpacing industry averages, and AI revenue increased nearly 500%.

Other key stocks include.

Boeing rose 6.84%, with the company's CFO stating that the first quarter performance generally met expectations.

Berkshire Hathaway's Class B shares owned by Buffett rose by 0.41%, setting a closing historical high for four consecutive trading days.

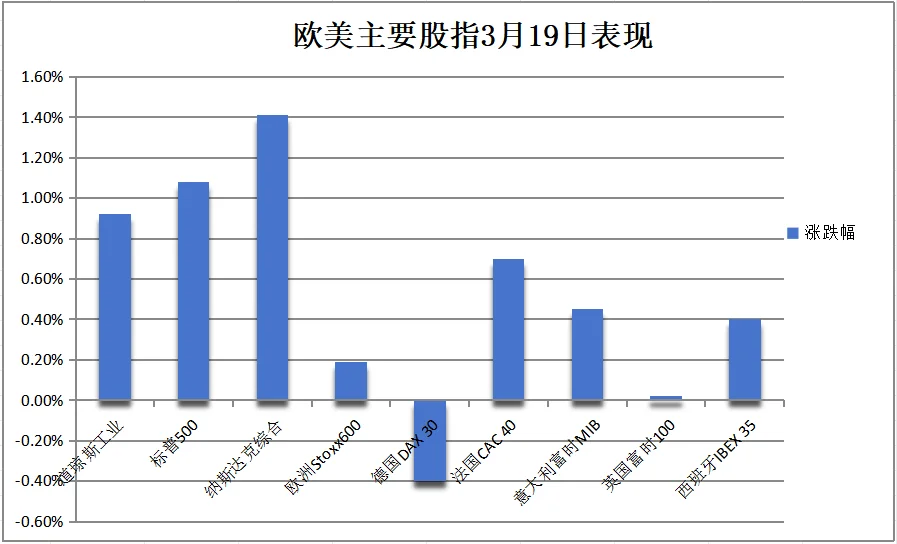

Ahead of the Federal Reserve's interest rate decision, European stocks showed mixed performance, Defense stocks pulled back, German stocks ended a three-day rally, and the Oil & Gas sector in Europe rose by more than 1.6%. The market is focusing on the Bank of England's interest rate meeting on Thursday, where it is expected to keep the interest rate unchanged:

European stocks:

The pan-European STOXX 600 index closed up by 0.19%. The Eurozone STOXX 50 index closed up by 0.41%.

The German stock index closed down by 0.40%. The French stock index closed up by 0.70%. The Italian stock index closed up by 0.45%. The UK stock index closed up by 0.02%. The Spanish stock index rose by 0.4%.

US Treasury prices soared on the day of the Federal Reserve's decision, with the two-year US Treasury yield dropping by about 7 basis points on Wednesday:

US Treasury:

The yield on the benchmark 10-Year US Treasury dropped by more than 4.00 basis points, refreshing the day's low to 4.2428%, and reaching a day's high of 4.3196% within 10 minutes before the Federal Reserve released its decision statement.

The two-year US Treasury yield fell by 6.75 basis points to 3.9723%, hitting a daily high of 4.0881% less than an hour before the FOMC announced to hold steady.

European bonds:

In the European market's closing, the German 10-Year Treasury Notes Yield fell by 0.6 basis points. The two-year German bond yield increased by 2.0 basis points.

The UK 10-Year Treasury Notes Yield fell by 1.8 basis points. The two-year British bond yield increased by 0.1 basis points.

The France 10-Year Treasury Notes Yield fell by 1.2 basis points. The Italy 10-Year Treasury Notes Yield fell by 1.5 basis points.

The USD rose sharply, but the increase quickly narrowed after the Federal Reserve announced to hold steady. On the day of the Bank of Japan + Federal Reserve resolution announcement, the yen rebounded after breaking through the 150 level. The offshore RMB fell more than 100 points during the session, dropping below 7.24, but narrowed most of its losses after Powell's speech.

The euro fell about 0.4% on the day of the Federal Reserve's decision, significantly narrowing the decline compared to before the FOMC announced to hold steady. Political turmoil caused the Turkish lira to plummet to record lows. Bitcoin rebounded about $4,000, approaching the $86,000 mark.

USD:

At the close in New York, the ICE USD rose by 0.21%, reporting 103.461 points, quickly retracing gains after the Federal Reserve announced to hold steady.

The Bloomberg Dollar Index rose by 0.22%, reporting 1264.38 points, quickly dropping during Powell's press conference.

Non-USD currencies:

The Euro fell by 0.38% against the USD, reporting 1.0903. The British Pound was roughly flat against the USD. The USD rose by 0.13% against the Swiss Franc.

The Australian Dollar fell by 0.08% against the USD, the New Zealand Dollar fell by 0.13% against the USD, and the USD rose by 0.18% against the Canadian Dollar.

Yen:

At the close in New York, the USD fell by 0.37% against the Japanese Yen, reporting 148.72 JPY. At 15:39 Beijing time (after the press conference of the Bank of Japan Governor Ueda Kazuo), it had briefly dropped below 149.20 JPY, and after the Federal Reserve's decision statement at 02:00 announced to hold steady, it rapidly plummeted from the 150 JPY range.

Offshore Renminbi:

The offshore Chinese Yuan (CNH) against the USD fell by 32 points compared to Tuesday's New York close, quoted at 7.2309 yuan, trading within a range of 7.2271-7.2413 yuan during the day.

Cryptos:

At the New York close, the largest Market Cap leader Bitcoin rose by 4.51% to $85,940.00, reaching a daily high of $86,145.00 at 03:10 Beijing time (during the Federal Reserve Chair Powell's press conference).

The second-largest Ethereum rose by 7.40% to $2,046.00, reaching a daily high of $1,911.00 at 02:00 when the Federal Reserve announced to maintain the status quo and slow the reduction of bond purchases.

The Federal Reserve's decision indicates increasing economic uncertainty, with investors focusing on oil demand prospects. Although crude oil futures closed higher, the gains were narrowed:

WTI April crude oil futures closed up 0.39% at $67.16 per barrel.

Brent May crude oil futures closed up 0.31% at $70.78 per barrel.

Natural Gas:

In April, natural gas futures in the USA rose to $4.2470 per million British thermal units.

TTF benchmark Dutch natural gas futures increased by 6.98%, reaching €43.380 per megawatt hour.

ICE UK natural gas futures rose by 6.13%, reaching 106.140 pence per kilocalorie.

Spot gold prices hit a historical high for two consecutive days, approaching $3052 during Powell's press conference, while New York copper futures increased by 2.1%:

Gold:

COMEX gold futures rose by 0.44%, reaching $3054.30 per ounce, with an increase to $3061.60 at 03:10, marking consecutive days of historical highs.

Spot gold closed up 0.35%, reported at $3045.25 per ounce after the US stock market closed, and rose to $3051.96 at 03:10 Beijing time (as the Federal Reserve Chairman Powell's press conference was near its end), marking two consecutive days of historical highs.

Silver:

COMEX Silver Futures fell by 1.17%, trading at $34.410 per ounce.

Spot Silver ended the day down by 0.64%, trading at $33.7968 per ounce.

London Industrial Metals experienced mixed trading:

LME Copper futures rose by $83. COMEX Copper Futures increased by 2.10%, trading at $5.1220 per pound.

LME Aluminum futures rose by $16. LME Zinc futures fell by $38. LME Lead futures dropped by $8. LME Nickel futures increased by $150. LME Tin futures fell by $244. LME Cobalt futures remained flat.

但美联储整体立场相对偏鸽,大幅放缓缩表(QT)步伐,且鲍威尔安抚市场称,衰退风险不高,美国经济仍然强劲,就业市场依旧稳固。尽管贸易紧张局势引发衰退忧虑,美联储仍预计今年将降息两次,与去年12月特朗普上台前预期一致。

但美联储整体立场相对偏鸽,大幅放缓缩表(QT)步伐,且鲍威尔安抚市场称,衰退风险不高,美国经济仍然强劲,就业市场依旧稳固。尽管贸易紧张局势引发衰退忧虑,美联储仍预计今年将降息两次,与去年12月特朗普上台前预期一致。

Comment(1)

Reason For Report