On the evening of the 18th Beijing time, investors remain cautious ahead of the upcoming Federal Reserve monetary policy meeting. The market will closely monitor the Federal Reserve's comments on the potential impact of current tariffs and trade wars on the economy.

Today, the three major US stock indexes collectively fell, as of the time of writing, $S&P 500 Index (.SPX.US)$ down 1.03%, $Nasdaq Composite Index (.IXIC.US)$ Fell by 1.76%, $Dow Jones Industrial Average (.DJI.US)$ down 0.49%.

The Federal Reserve will begin a two-day interest rate setting meeting on Tuesday Eastern Time, with the meeting results announced on Wednesday Eastern Time.

The market currently widely expects the Federal Reserve to keep interest rates unchanged. According to the CME Group's FedWatch tool, the federal funds market currently predicts a 99% probability that the Federal Reserve will maintain interest rates on Wednesday.

The market currently widely expects the Federal Reserve to keep interest rates unchanged. According to the CME Group's FedWatch tool, the federal funds market currently predicts a 99% probability that the Federal Reserve will maintain interest rates on Wednesday.

The Federal Reserve's latest economic forecasts may reveal policymakers' assessments of the potential impacts of the tariff war to investors.

HSBC's US economist Ryan Wang stated, "We expect the central bank's tone to change in a more pessimistic direction. The uncertainty surrounding tariffs and trade policies has brought potential stagflation risks, complicating the outlook for monetary policy."

US President Trump's tariff policy has triggered trade frictions between the US and major trading partners, resulting in rapid retaliatory tariffs.

US Treasury Secretary Basant stated on Tuesday that the basic economic conditions in the US are "healthy", with no reason to fall into recession, while rejecting demands to guarantee that there will be no economic downturn. He said, "I cannot make any guarantees," and called demands for assurances against recession "foolish."

Economists warn that the risk of a recession in the US is rising, partly due to the uncertainty surrounding Trump's tariff measures, and concerns about the potential impacts once tariff decisions are made and implemented.

Basant said, "What I can assure you is that we have no reason to believe a recession is inevitable. Some data regarding basic economic conditions is performing very well," referring to the performance of credit cards and banks.

Bessenet stated that as the economy reduces its dependence on government spending, a "pause" may occur, but the Trump administration "will manage spending well, and we will bring manufacturing back home, making the USA more affordable for the working class."

Focus Stocks

Most Growth Tech stocks have fallen, $Tesla (TSLA.US)$ fell more than 6%, $Meta Platforms (META.US)$ 、 $Alphabet-A (GOOGL.US)$ Down over 4%, $NVIDIA (NVDA.US)$ a drop of nearly 4%.

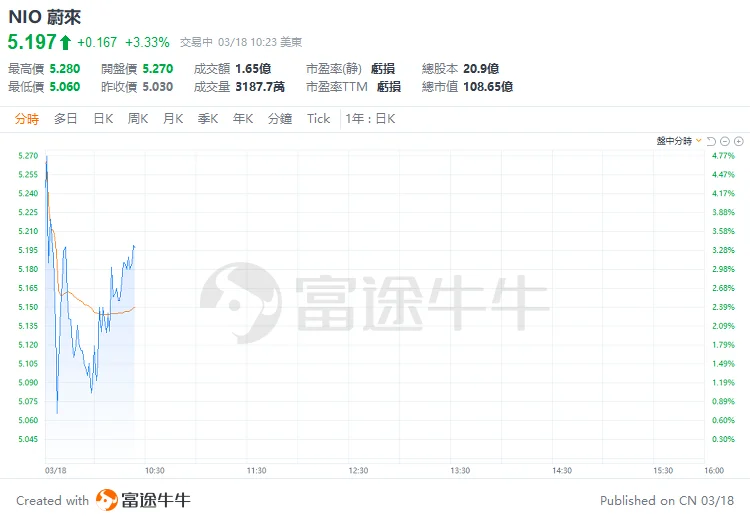

The trends of China Concept Stocks are mixed, $Tencent Music (TME.US)$ Increased by over 7%, $NIO Inc (NIO.US)$increased by over 3%, $Baidu (BIDU.US)$ Increased by nearly 2%, $Alibaba (BABA.US)$ Dropped over 2%, $KE Holdings (BEKE.US)$ Fell over 8%.

Most Quantum Computing concept stocks are down, $MicroCloud Hologram (HOLO.US)$ Dropped over 9%,$Arqit Quantum (ARQQ.US)$ Dropped over 8%, $Quantum (QMCO.US)$ Dropped by 6%, $Quantum Computing (QUBT.US)$ In contrast, increased nearly 4%.

$NVIDIA (NVDA.US)$ Down over 3%, at 1 AM Beijing time on Wednesday, Jensen Huang will deliver a keynote speech focusing on the latest developments in the AI frontier, while addressing market concerns about NVIDIA's stock price and growth potential.

$Tesla (TSLA.US)$ Down over 5%, Institutions are rushing to lower their Target Price, and hedge funds have earned over 16 billion dollars shorting Tesla in the past three months.

$XPeng (XPEV.US)$ Down over 7%, last year's fourth-quarter revenue was 16.11 billion yuan, with a NON-GAAP net loss of 1.39 billion yuan.

$NIO Inc (NIO.US)$ Up over 3%, Contemporary Amperex Technology is advancing a strategic investment in NIO Energy of no more than 2.5 billion yuan.

Editor/Somer

目前市场普遍预计美联储将维持利率不变。根据芝商所集团的FedWatch工具,联邦基金市场目前预测美联储在周三维持利率不变的可能性为99%。

目前市场普遍预计美联储将维持利率不变。根据芝商所集团的FedWatch工具,联邦基金市场目前预测美联储在周三维持利率不变的可能性为99%。

Comment(0)

Reason For Report