On March 17, Futu News reported that the three major indices of the Hong Kong stock market had mixed performances, $Hang Seng Index (800000.HK)$ Up 0.77%, $Hang Seng TECH Index (800700.HK)$ Down 0.14%, $Hang Seng China Enterprises Index (800100.HK)$ Up 0.57%.

As of the market close, 1,244 Hong Kong stocks rose, 900 fell, and 963 were flat.

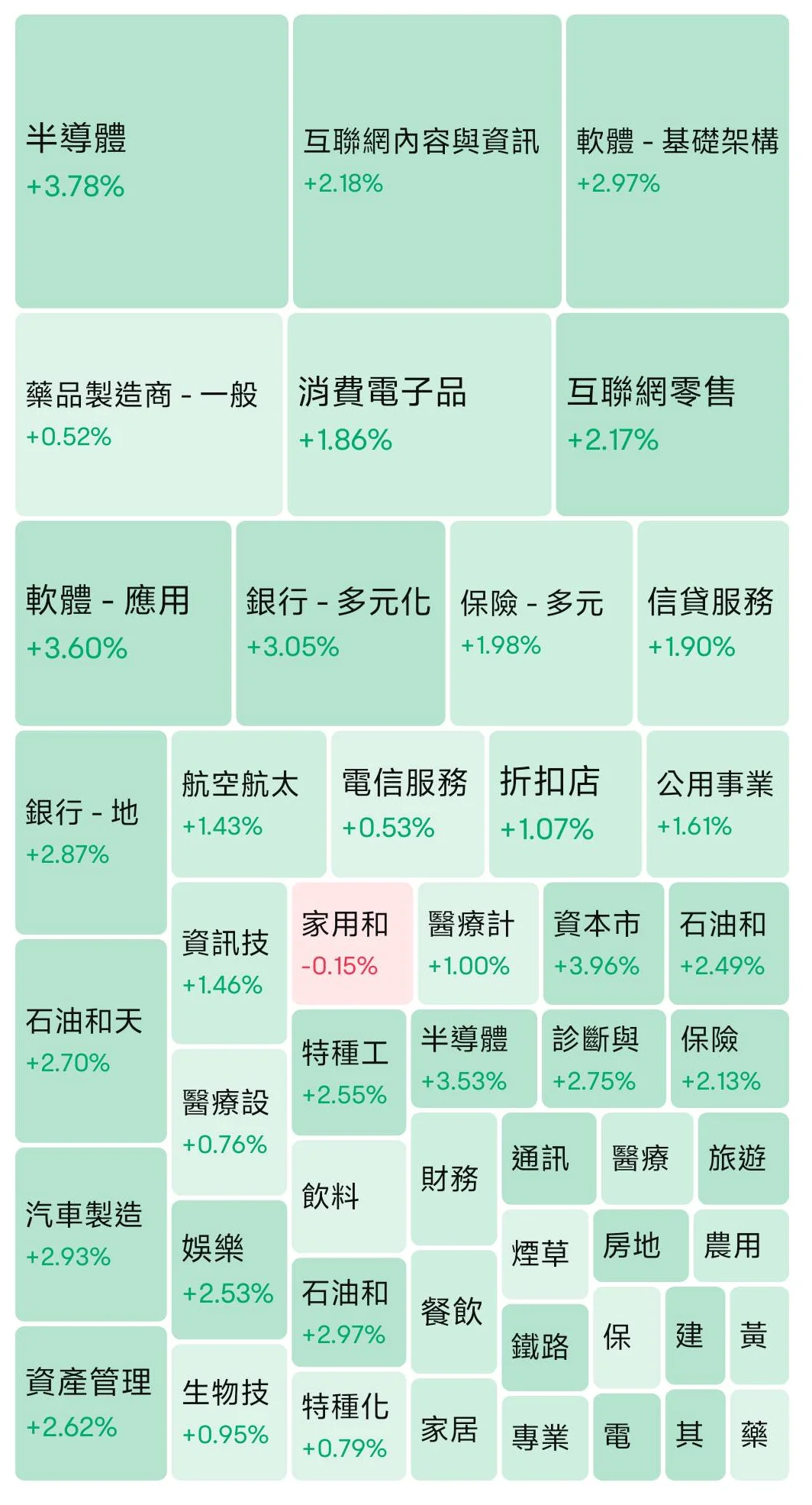

The specific industry performance is shown in the picture below:

In the Sector, the Network Technology stocks had mixed results, XIAOMI-W rose by 3.62%, NTES-S fell by 2.73%, KUAISHOU-W fell by 2.16%, JD-SW rose by 2.05%, Bilibili-W fell by 1.44%, MEITUAN-W rose by 0.98%, TENCENT rose by 0.58%, and Alibaba-W fell by 0.22%.

In the Sector, the Network Technology stocks had mixed results, XIAOMI-W rose by 3.62%, NTES-S fell by 2.73%, KUAISHOU-W fell by 2.16%, JD-SW rose by 2.05%, Bilibili-W fell by 1.44%, MEITUAN-W rose by 0.98%, TENCENT rose by 0.58%, and Alibaba-W fell by 0.22%.

Most Building Materials stocks rose, WESTCHINACEMENT fell by 12.28%, CHINA LESSO rose by 9.51%, CR BLDG MAT TEC rose by 8.05%, CNBM rose by 6.40%, ASIA CEMENT CH rose by 5.37%, CONCH CEMENT rose by 4.69%, BBMG Corporation rose by 3.95%, and Huaxin Cement rose by 2.13%.

Mainland Real Estate and property management stocks rose, CG SERVICES rose by 7.53%, GREENTOWN SER rose by 5.83%, A-LIVING rose by 4.83%, Wanzhongyun rose by 3.57%, SUNAC SERVICES rose by 3.55%, CHINA OVS PPT rose by 2.25%, POLY PPT SER rose by 1.59%, CHINA RES MIXC rose by 1.50%, CG rose by 5.77%, SHIMAO GROUP rose by 1.89%, and GREENTOWN CHINA rose by 4.84%.

Dining stocks strengthened, Little Garden rose by 11.29%, XIABUXIABU rose by 8.89%, YUM CHINA rose by 2.85%, HAIDILAO rose by 1.95%, DPC DASH rose by 1.15%, Nayuki Tea rose by 0.81%, and SUPER HI rose by 0.63%.

Insurance stocks performed well, PICC P&C rose by 4.58%, CHINA TAIPING rose by 1.87%, Ping An Insurance rose by 1.83%, China Pacific Insurance rose by 1.72%, AIA rose by 1.55%, PICC GROUP rose by 1.36%, China Life Insurance rose by 0.36%, and New China Life Insurance rose by 0.32%.

Most Alcoholic Beverages stocks rose, WINE'S LINK rose by 5.56%, BUD APAC rose by 3.53%, MAJOR HLDGS fell by 3.23%, DYNASTY WINES fell by 3.13%, ZJLD fell by 1.62%, TIBET WATER rose by 1.54%, TSINGTAO BREW rose by 1.38%, and CHINA RES BEER rose by 0.92%.

In terms of individual stocks,$CHOW TAI FOOK (01929.HK)$Rising over 4%, the company announces a new Chief Financial Officer, and Daiwa previously indicated that the company's stock is severely undervalued.

$FOURTH PARADIGM (06682.HK)$Rising over 6%, jointly releasing AI, Agent, and collaborative operation solutions, a press conference for FOURTH PARADIGM will be held tomorrow morning.

$REMEGEN (09995.HK)$Rising over 17%, the Phase III study of Tisotumab vedotin in the treatment of myasthenia gravis has been selected for a significant oral presentation at the AAN Annual Meeting.

$MAO GEPING (01318.HK)$Rising over 9%, the performance during the 3.8 promotional campaign was impressive, and the company is expected to open up valuation space.

$MNSO (09896.HK)$Increased by nearly 3%, new consumer products such as IP are mentioned in the special plan to promote consumption, and the company is expected to achieve rapid growth in the fourth quarter of last year.

$MEITU (01357.HK)$Increased by over 4%, the company will announce its performance tomorrow, and it is expected that net profit will increase by up to 60% year-on-year.

$HKEX (00388.HK)$Increased by over 3%, it is reported that HKEX is exploring ways to lower the trading threshold for High Stock Price, and institutions say valuations are still at a low level.

$POP MART (09992.HK)$Increased by over 6%, hitting a new high during the trading session, the popularity of IP continues to rise, and Morgan Stanley expects its Q1 sales to potentially double.

Top 10 transaction amounts today.

Hong Kong Stock Connect funds.

In the context of Stock Connect, today's net Inflow for Hong Kong Stock Connect (southbound) is 10.483 billion HKD.

Institutional Views

Morgan Stanley: Maintains "Buy" rating on Swire Pacific A, expecting dividend growth and share buyback to support valuation.

Morgan Stanley indicated that Swire Pacific A. $SWIRE PACIFIC A (00019.HK)$The earnings per share forecast for 2025 and 2026 has been lowered by 21% and 9% respectively to reflect reduced rental income and beverage profit forecasts. The Target Price based on net asset value has been slightly raised from 73 HKD to 75 HKD, reflecting the increase in market value after the strong performance of Cathay Pacific's stock price. Morgan Stanley stated that Cathay Pacific and the company's Chinese beverage business have demonstrated resilience in a challenging macro environment. The firm expects continuous dividend growth and stock buybacks to support its valuation, maintaining a "Buy" rating on Swire Pacific A.

CITIC: Maintains HSBC Holdings 'Outperform' rating, raises profit forecast for 2026.

CITIC expects that the adjusted revenue in 2025 will decrease by 0.4% year-on-year, and will grow by 2.3% year-on-year in 2026. $HSBC HOLDINGS (00005.HK)$ Adjusted pre-tax profit is expected to decrease by 2.9% year-on-year in 2025, and grow by 2.3% year-on-year in 2026.

In addition, CITIC expects the company's adjusted return on tangible equity (RoTE) to reach 16.1% and 16% in 2025 and 2026, respectively, achieving the upper limit of the company's guidance of a double-digit return (14% to 16%). Therefore, its RoTE forecast may be revised upward compared to current market forecasts.

Goldman Sachs: Ideal Auto's fourth quarter performance meets expectations, rated 'Buy'.

Goldman Sachs published Research Reports stating, $LI AUTO-W (02015.HK)$ Last quarter's performance met expectations. The company will attend the performance analysis meeting tonight (17th), and the bank expects investors' questions to focus mainly on the future competitive environment of the market, further plans and progress on autonomous driving features, and the strategy for the company's upcoming pure electric vehicle (BEV) models. The bank has assigned a "Buy" rating, with a target price of HKD 137 for H shares.

Editor/danial

Comment(0)

Reason For Report