Analysts Expect QuinStreet, Inc. (NASDAQ:QNST) To Breakeven Soon

Analysts Expect QuinStreet, Inc. (NASDAQ:QNST) To Breakeven Soon

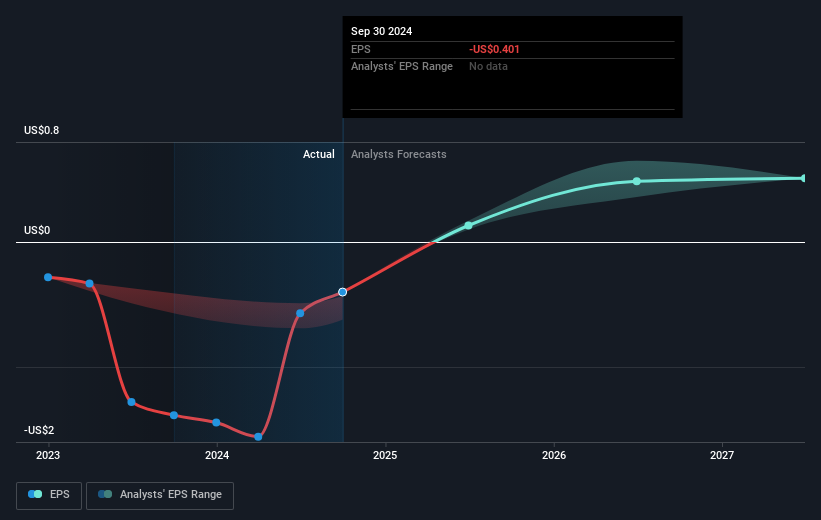

QuinStreet, Inc. (NASDAQ:QNST) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. QuinStreet, Inc., an online performance marketing company, provides customer acquisition services for its clients in the United States and internationally. The US$1.3b market-cap company posted a loss in its most recent financial year of US$31m and a latest trailing-twelve-month loss of US$22m shrinking the gap between loss and breakeven. As path to profitability is the topic on QuinStreet's investors mind, we've decided to gauge market sentiment. Below we will provide a high-level summary of the industry analysts' expectations for the company.

QuinStreet, Inc.(纳斯达克:QNST)可能正在接近其业务的重大成就,因此我们希望对该公司进行一些介绍。QuinStreet, Inc.是一家在线绩效营销公司,为其在美国及国际上的客户提供客户获取服务。 这家市值达13亿美元的公司在其最近的财年中遭遇了3100万美元的亏损,并且最近12个月的亏损为2200万美元,缩小了亏损与盈亏平衡之间的差距。 由于盈利之路是QuinStreet投资者关注的话题,我们决定评估市场情绪。以下将提供行业分析师对该公司的预期的高层次总结。

QuinStreet is bordering on breakeven, according to the 6 American Interactive Media and Services analysts. They anticipate the company to incur a final loss in 2024, before generating positive profits of US$7.5m in 2025. The company is therefore projected to breakeven around 12 months from now or less. At what rate will the company have to grow in order to realise the consensus estimates forecasting breakeven in under 12 months? Using a line of best fit, we calculated an average annual growth rate of 105%, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

根据6位美国互动媒体和服务分析师的观点,QuinStreet正接近盈亏平衡。他们预计该公司将在2024年遭遇最后一次亏损,然后在2025年产生750万美元的正利润。因此,该公司预计将在12个月内或更短时间内实现盈利。 为了实现共识预期,即在12个月内实现盈亏平衡,该公司必须以多快的速度增长?通过最佳拟合线,我们计算出的年平均增长率为105%,这非常乐观。如果该业务以较慢的速度增长,盈利时间将会晚于预期。

Underlying developments driving QuinStreet's growth isn't the focus of this broad overview, but, keep in mind that typically a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

驱动QuinStreet增长的基础发展并不是此概述的重点,但请记住,通常对于一家目前正在经历投资期的公司来说,高预测增长率并不少见。

One thing we'd like to point out is that QuinStreet has no debt on its balance sheet, which is rare for a loss-making growth company, which typically has high debt relative to its equity. The company currently operates purely off its shareholder funding and has no debt obligation, reducing concerns around repayments and making it a less risky investment.

我们想指出的一件事情是,QuinStreet在其资产负债表上没有债务,这在一家公司处于亏损增长状态时是非常罕见的,这类公司通常相对于其股本负债较高。该公司目前完全依靠股东资金运营,并且没有债务义务,从而减轻了对还款的担忧,使其成为一种风险较低的投资。

Next Steps:

下一步:

This article is not intended to be a comprehensive analysis on QuinStreet, so if you are interested in understanding the company at a deeper level, take a look at QuinStreet's company page on Simply Wall St. We've also put together a list of pertinent aspects you should further research:

本文并不打算对QuinStreet进行全面分析,因此如果您希望更深入了解该公司,请查看QuinStreet在Simply Wall St的公司页面。我们还整理了一份您应该进一步研究的相关方面的清单:

- Valuation: What is QuinStreet worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether QuinStreet is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on QuinStreet's board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

- 估值:QuinStreet今天值多少钱?未来的增长潜力是否已经反映在价格中?我们免费研究报告中的内在价值信息图帮助可视化QuinStreet当前是否被市场低估。

- 管理团队:一个经验丰富的管理团队能够增强我们对业务的信心 – 了解一下谁在QuinStreet的董事会和CEO的背景。

- 其他高表现股票:是否还有其他股票提供更好的前景和经过验证的业绩?在这里查看我们这些优秀股票的免费列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

译文内容由第三方软件翻译。

One thing we'd like to point out is that QuinStreet has no debt on its balance sheet, which is rare for a loss-making growth company, which typically has high debt relative to its equity. The company currently operates purely off its shareholder funding and has no debt obligation, reducing concerns around repayments and making it a less risky investment.

One thing we'd like to point out is that QuinStreet has no debt on its balance sheet, which is rare for a loss-making growth company, which typically has high debt relative to its equity. The company currently operates purely off its shareholder funding and has no debt obligation, reducing concerns around repayments and making it a less risky investment.