Check Out These 5 Nasdaq-Listed Multibaggers — One Made Investors 17.56x Richer This Year: Here's What To Expect In 2025

Check Out These 5 Nasdaq-Listed Multibaggers — One Made Investors 17.56x Richer This Year: Here's What To Expect In 2025

Several Nasdaq-listed companies have delivered remarkable returns in 2024, with one standout performer making investors significantly wealthier.

多个在纳斯达克上市的公司在2024年取得了显著的回报,其中一家公司表现突出,使投资者大幅致富。

What Happened: According to Benzinga Pro, several Nasdaq-listed companies have delivered impressive returns in 2024. Quantum Computing Inc. (NASDAQ:QUBT) tops the list with a staggering 1,756.12% increase. It recently signed a significant contract with NASA's Goddard Space Flight Center for advanced imaging and data processing. Despite this surge, analysts from Ascendiant Capital have set a price target of $8.5, suggesting a potential downside of 51.02%.

发生了什么:根据Benzinga Pro的报道,多个在纳斯达克上市的公司在2024年取得了令人印象深刻的回报。量子计算公司(NASDAQ:QUBT)名列前茅,增长率高达惊人的1,756.12%。它最近与美国国家航空航天局戈达德太空飞行中心签署了一项重要合同,涉及先进的成像和数据处理。尽管出现这种激增,Ascendiant Capital的分析师仍将目标价格设定为8.5美元,暗示可能有51.02%的下行空间。

MicroStrategy Inc. (NASDAQ:MSTR) saw a 450.14% rise, driven by its strategic Bitcoin (CRYPTO: BTC) acquisitions, which have significantly increased its asset-backed value. According to bitcointreasuries.net, the company now holds 444,262 BTCs, valued at over $41.74 billion. Analysts from Bernstein, TD Cowen, and Barclays have set an average price target of $546.67, indicating a 64.51% potential upside.

MicroStrategy Inc.(NASDAQ:MSTR)上涨了450.14%,这得益于其战略性比特币(CRYPTO: BTC)收购,显著提高了其资产支持的价值。根据bitcointreasuries.net的数据显示,该公司目前持有444,262个比特币,估计价值超过417.4亿人民币。来自Bernstein、TD Cowen和巴克莱银行的分析师将平均目标价格设定为546.67美元,表明有64.51%的潜在上行空间。

Palantir Technologies Inc. (NASDAQ:PLTR) achieved a 356.39% gain, bolstered by strong government revenue and a substantial contract extension with the U.S. Army, potentially worth $618.9 million over four years. However, the average analyst price target of $64.67 implies a 19.20% downside.

Palantir Technologies Inc.(NASDAQ:PLTR)实现了356.39%的增长,得益于强劲的政府营业收入和与美国陆军的重大合同延期,该合同可能在四年内价值61890万。然而,分析师的平均目标价格为64.67美元,暗示19.20%的下行风险。

NVIDIA Corp (NASDAQ:NVDA) experienced a 183.42% increase, fueled by robust growth in its AI and data center sectors. The company's commitment to expanding production capacity underscores confidence in continued revenue growth. Analysts from DA Davidson, Phillip Securities, and Truist Securities suggest a 10.53% upside with an average price target of $154.67.

英伟达(NVIDIA Corp)(NASDAQ:NVDA)上涨了183.42%,受益于其人工智能和IDC概念部门的强劲增长。该公司扩大生产能力的承诺彰显了对持续营业收入增长的信心。来自DA Davidson、Phillip Securities和Truist Securities的分析师建议以154.67美元的平均目标价格,潜在上行空间为10.53%。

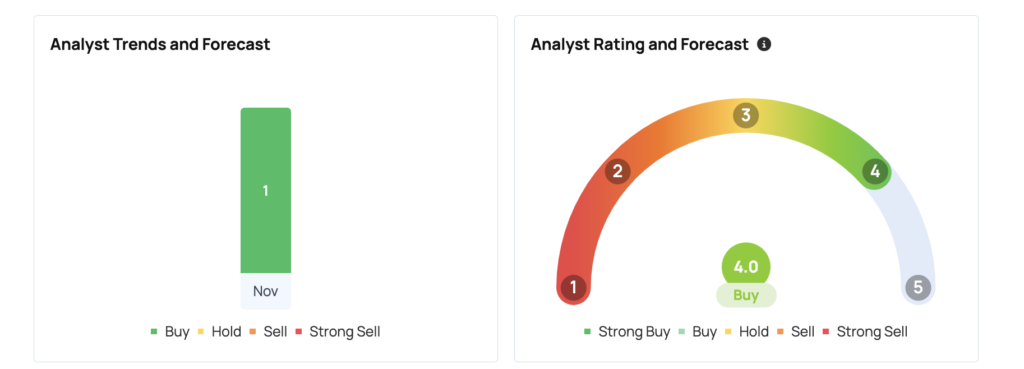

Powell Industries Inc. (NASDAQ:POWL) reported a 162.45% rise, supported by favorable analyst ratings and a consensus price target of $312, reflecting optimism in its market performance. The most recent analyst rating for Powell Industries came from Roth MKM on December 11, setting a price target of $312, which implies a 33.6% upside potential for the stock.

鲍威尔工业公司(纳斯达克:POWL)报告了162.45%的增长,得益于有利的分析师评级和312美元的共识价格目标,反映了对其市场表现的乐观。鲍威尔工业公司最近的分析师评级来自Roth MKm,日期为12月11日,设定了312美元的价格目标,这意味着该股票具有33.6%的上行潜力。

Multibagger stocks are equities that yield exceptional returns, often doubling or more in value within a year. These stocks are prized by investors for their potential to significantly grow wealth over a relatively short period. The term was first coined by Peter Lynch in his book "One Up on Wall Street."

多倍收益股是指在一年内实现异常回报的股票,通常价值翻倍或更多。这些股票因其在相对较短的时间内显著增长财富的潜力而受到投资者的青睐。这个词最初是由彼得·林奇在他的书《华尔街的一步》中提出的。

- Celebrities Like Ellen DeGeneres, David Beckham And Simon Cowell Have Turned England's Idyllic Cotswolds

- 像艾伦·德杰尼勒斯、大卫·贝克汉姆和西蒙·高伟这样的名人已将英格兰迷人的科茨沃尔德变为焦点。

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

免责声明:此内容部分由Benzinga Neuro生成,并由Benzinga编辑审核和发布。

Image via Shutterstock

图片来源:shutterstock

译文内容由第三方软件翻译。