ASML Holding's Options Frenzy: What You Need to Know

ASML Holding's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on ASML Holding.

擁有大量資金的鯨魚對阿斯麥採取了明顯的看淡姿態。

Looking at options history for ASML Holding (NASDAQ:ASML) we detected 63 trades.

查看阿斯麥(納斯達克:ASML)的期權歷史,我們發現了63筆交易。

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 50% with bearish.

如果考慮每筆交易的具體情況,可以準確地說,30%的投資者以看好的預期開了交易,而50%則是以看淡的預期開了交易。

From the overall spotted trades, 28 are puts, for a total amount of $2,186,971 and 35, calls, for a total amount of $1,970,434.

在所有發現的交易中,28筆爲看跌期權,總金額爲2,186,971美元,35筆爲看漲期權,總金額爲1,970,434美元。

Expected Price Movements

預期價格變動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $195.0 and $960.0 for ASML Holding, spanning the last three months.

經過評估交易量和未平倉合約,很明顯主要市場參與者關注阿斯麥在過去三個月之間的價格區間爲195.0美元到960.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

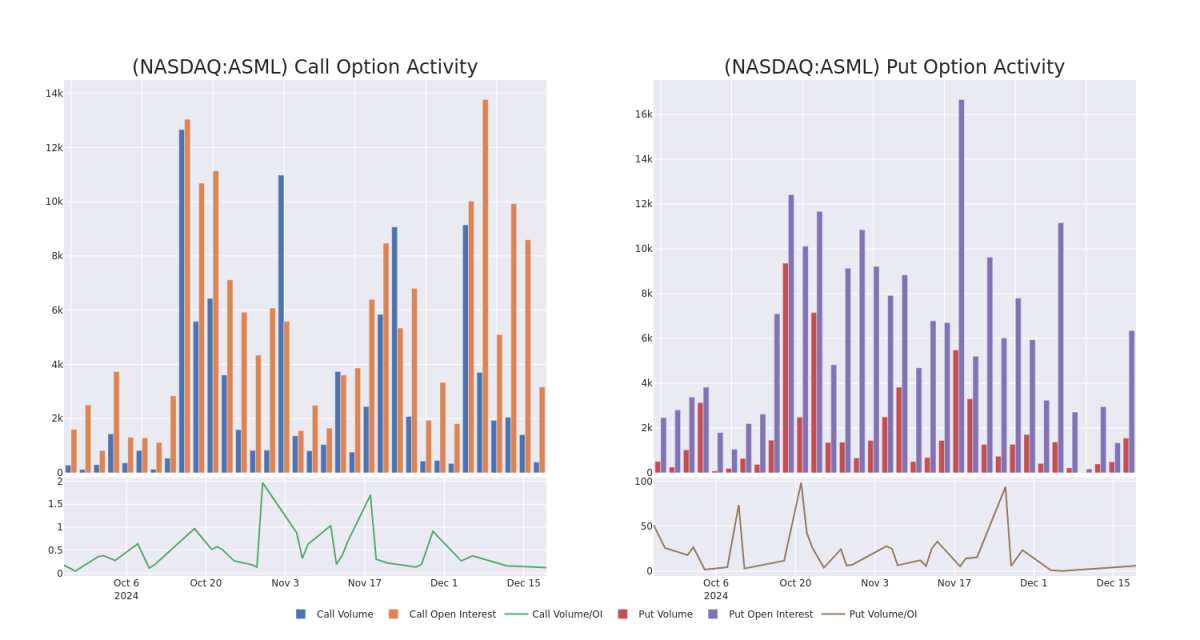

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

觀察成交量和未平倉合約是進行股票盡職調查的一個有見地的方法。

This data can help you track the liquidity and interest for ASML Holding's options for a given strike price.

這些數據可以幫助您跟蹤阿斯麥在特定行權價格下的期權流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ASML Holding's whale activity within a strike price range from $195.0 to $960.0 in the last 30 days.

以下,我們可以觀察到在過去30天裏阿斯麥的所有期權異動中,看漲和看跌的成交量和未平倉合約的演變,行權價格區間從195.0美元到960.0美元。

ASML Holding 30-Day Option Volume & Interest Snapshot

ASML Holding 30天期權成交量和持有量快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | PUT | TRADE | BULLISH | 03/21/25 | $203.3 | $201.1 | $201.1 | $900.00 | $361.9K | 114 | 36 |

| ASML | CALL | TRADE | BEARISH | 01/15/27 | $244.1 | $239.0 | $239.0 | $580.00 | $239.0K | 13 | 10 |

| ASML | CALL | SWEEP | BEARISH | 02/21/25 | $47.2 | $45.3 | $47.2 | $710.00 | $202.9K | 516 | 43 |

| ASML | PUT | SWEEP | BEARISH | 01/17/25 | $31.8 | $30.7 | $31.8 | $720.00 | $171.7K | 793 | 84 |

| ASML | CALL | SWEEP | BULLISH | 09/19/25 | $130.1 | $126.0 | $130.1 | $660.00 | $104.0K | 141 | 8 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 阿斯麥 | 看跌 | 交易 | 看好 | 03/21/25 | $203.3 | $201.1 | $201.1 | $900.00 | 361.9K美元 | 114 | 36 |

| 阿斯麥 | 看漲 | 交易 | 看淡 | 01/15/27 | $244.1 | $239.0 | $239.0 | $580.00 | $239.0K | 13 | 10 |

| 阿斯麥 | 看漲 | 掃單 | 看淡 | 02/21/25 | $47.2 | $45.3 | $47.2 | $710.00 | 20.29萬美金 | 516 | 43 |

| 阿斯麥 | 看跌 | 掃單 | 看淡 | 01/17/25 | $31.8 | $30.7 | $31.8 | $720.00 | 171.7K美元 | 793 | 84 |

| 阿斯麥 | 看漲 | 掃單 | 看好 | 09/19/25 | $130.1 | $126.0 | $130.1 | $660.00 | $104.0K | 141 | 8 |

About ASML Holding

關於阿斯麥控股

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

阿斯麥是用於半導體製造的光刻機系統的領導者。光刻是一個過程,其中使用光源將電路圖案從掩膜版曝光到半導體晶圓上。該領域最新的技術進步使得芯片製造商能夠不斷增加相同面積硅上的晶體管數量,而光刻歷史上佔據了製造尖端芯片成本的很大一部分。阿斯麥將大部分零部件的製造外包,扮演組裝者的角色。阿斯麥的主要客戶是台積電、三星和英特爾。

Following our analysis of the options activities associated with ASML Holding, we pivot to a closer look at the company's own performance.

在我們分析與阿斯麥相關的期權活動後,我們轉向更仔細地研究公司的自身表現。

Current Position of ASML Holding

阿斯麥控股的當前位置

- With a volume of 1,014,978, the price of ASML is up 0.5% at $713.84.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 40 days.

- ASML的成交量爲1,014,978,價格上漲0.5%,現爲$713.84。

- RSI因數提示相關股票可能接近超買。

- 下次業績預計將在40天后發佈。

What The Experts Say On ASML Holding

關於阿斯麥的持股分析師觀點

1 market experts have recently issued ratings for this stock, with a consensus target price of $767.0.

1位市場專家最近已對該股票發佈了評級,普遍目標價爲$767.0。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Bernstein persists with their Outperform rating on ASML Holding, maintaining a target price of $767.

Benzinga Edge的期權異動板塊在潛在市場動向發生之前發現可能的市場動向。查看大資金在您最喜歡的股票上採取了哪些頭寸。點擊這裏訪問。* 一位來自伯恩斯坦的分析師堅持對阿斯麥的優於大盤評級,維持目標價爲767美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ASML Holding options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的收益。成熟的交易者通過不斷學習、調整策略、監控多個因數以及密切關注市場動態來管理這些風險。通過Benzinga Pro的實時提醒,保持對最新阿斯麥期權交易的了解。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 28 are puts, for a total amount of $2,186,971 and 35, calls, for a total amount of $1,970,434.

From the overall spotted trades, 28 are puts, for a total amount of $2,186,971 and 35, calls, for a total amount of $1,970,434.