Decoding United Parcel Service's Options Activity: What's the Big Picture?

Decoding United Parcel Service's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bearish stance on United Parcel Service.

擁有大量資金的鯨魚對聯合包裹採取了明顯的看淡立場。

Looking at options history for United Parcel Service (NYSE:UPS) we detected 22 trades.

查看聯合包裹(紐交所:UPS)的期權歷史,我們偵測到22筆交易。

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 50% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,31%的投資者以看好的預期進行了交易,50%則是以看淡的預期進行的。

From the overall spotted trades, 8 are puts, for a total amount of $327,470 and 14, calls, for a total amount of $635,914.

在總共觀察到的交易中,有8筆是看跌期權,總金額爲327,470美元,14筆是看漲期權,總金額爲635,914美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $160.0 for United Parcel Service over the recent three months.

根據交易活動,顯著的投資者似乎正在尋求聯合包裹在過去三個月內的價格區間爲100.0美元到160.0美元。

Insights into Volume & Open Interest

成交量和持倉量分析

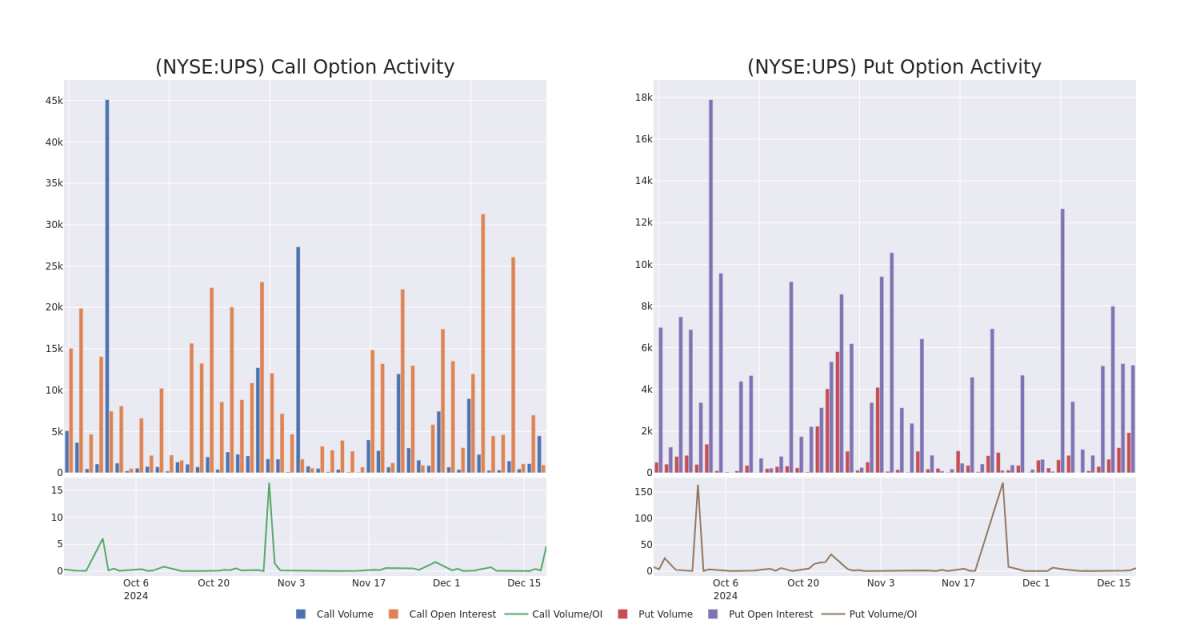

In today's trading context, the average open interest for options of United Parcel Service stands at 556.64, with a total volume reaching 6,399.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Parcel Service, situated within the strike price corridor from $100.0 to $160.0, throughout the last 30 days.

在今天的交易背景下,聯合包裹期權的平均未平倉合約爲556.64,總成交量達到6,399.00。附帶的圖表顯示了聯合包裹在過去30天內高價值交易的看漲和看跌期權的成交量和未平倉合約的發展。

United Parcel Service Option Volume And Open Interest Over Last 30 Days

聯合包裹期權成交量和未平倉合約在過去30天的情況

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | SWEEP | NEUTRAL | 02/21/25 | $6.2 | $6.1 | $6.1 | $125.00 | $123.9K | 9 | 302 |

| UPS | CALL | SWEEP | NEUTRAL | 04/17/25 | $21.25 | $21.0 | $21.0 | $105.00 | $86.2K | 9 | 27 |

| UPS | CALL | SWEEP | BULLISH | 12/20/24 | $1.54 | $1.29 | $1.29 | $124.00 | $58.5K | 136 | 491 |

| UPS | CALL | TRADE | NEUTRAL | 01/16/26 | $28.3 | $27.6 | $27.99 | $100.00 | $55.9K | 234 | 20 |

| UPS | PUT | TRADE | BEARISH | 12/27/24 | $3.65 | $3.5 | $3.65 | $126.00 | $54.7K | 228 | 160 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 聯合包裹 | 看漲 | 掃單 | 中立 | 02/21/25 | $6.2 | $6.1 | $6.1 | $125.00 | ¥123.9K | 9 | 302 |

| 聯合包裹 | 看漲 | 掃單 | 中立 | 04/17/25 | $21.25 | $21.0 | $21.0 | $105.00 | $86.2K | 9 | 27 |

| 聯合包裹 | 看漲 | 掃單 | 看好 | 12/20/24 | $1.54 | $1.29 | $1.29 | $124.00 | $58.5K | 136 | 491 |

| 聯合包裹 | 看漲 | 交易 | 中立 | 01/16/26 | $28.3 | $27.6 | $27.99 | $100.00 | 55.9K美元 | 234 | 20 |

| 聯合包裹 | 看跌 | 交易 | 看淡 | 12/27/24 | $3.65 | $3.5 | $3.65 | $126.00 | 54.7K美元 | 228 | 160 |

About United Parcel Service

關於聯合包裹

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing "strategic alternatives" for its truck brokerage unit, Coyote, which it acquired in 2015.

作爲全球最大的包裹遞送公司,UPS管理着超過500架飛機和100,000輛車輛,以及數百個分揀設施,每天平均交付約2200萬包裹到全球的住宅和企業。UPS在美國國內的包裹業務產生了約64%的總營業收入,而國際包裹佔20%。空運和海運貨運代理、整車經紀和合同物流佔其餘部分。UPS目前正在爲其卡車經紀單位Coyote尋求「戰略替代方案」,該單位是其在2015年收購的。

Present Market Standing of United Parcel Service

聯合包裹目前的市場狀況

- Trading volume stands at 1,267,211, with UPS's price down by -0.62%, positioned at $123.05.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 40 days.

- 交易量爲1,267,211,聯合包裹的價格下跌了-0.62%,現報$123.05。

- 相對強弱指數因子顯示股票可能接近超賣。

- 預計在40天內發佈收益公告。

Professional Analyst Ratings for United Parcel Service

聯合包裹的專業分析師評級

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $150.0.

在過去30天裏,總共有1位專業分析師對這隻股票進行了評估,設定了150.0美元的平均價格目標。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from BMO Capital has elevated its stance to Outperform, setting a new price target at $150.

Benzinga Edge的期權異動板塊在潛在市場動向發生之前就進行識別。看看大筆資金在您最喜歡的股票上採取了什麼頭寸。點擊這裏以獲取訪問權限。* BMO資本的一位分析師已將其評級上調至優於大盤,同時設定新的價格目標爲150.0美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因子以及密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 8 are puts, for a total amount of $327,470 and 14, calls, for a total amount of $635,914.

From the overall spotted trades, 8 are puts, for a total amount of $327,470 and 14, calls, for a total amount of $635,914.