Check Out What Whales Are Doing With MELI

Check Out What Whales Are Doing With MELI

Financial giants have made a conspicuous bullish move on MercadoLibre. Our analysis of options history for MercadoLibre (NASDAQ:MELI) revealed 15 unusual trades.

金融巨頭在MercadoLibre上做出了明顯的看好動作。我們對MercadoLibre(納斯達克:MELI)期權歷史的分析揭示了15筆異常交易。

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $314,161, and 11 were calls, valued at $683,455.

深入細節,我們發現40%的交易者看好,而40%則表現出看淡的傾向。在我們發現的所有交易中,有4筆是看跌期權,價值314,161美元,11筆是看漲期權,價值683,455美元。

What's The Price Target?

價格目標是什麼?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1780.0 to $2220.0 for MercadoLibre over the last 3 months.

考慮到這些合約的成交量和未平倉合約,似乎鯨魚們在過去3個月內一直在瞄準MercadoLibre的價格區間,從1780.0美元到2220.0美元。

Insights into Volume & Open Interest

成交量和持倉量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

觀察成交量和未平倉合約是進行股票盡職調查的一個有見地的方法。

This data can help you track the liquidity and interest for MercadoLibre's options for a given strike price.

這些數據可以幫助您跟蹤MercadoLibre在特定行權價下的期權流動性和興趣。

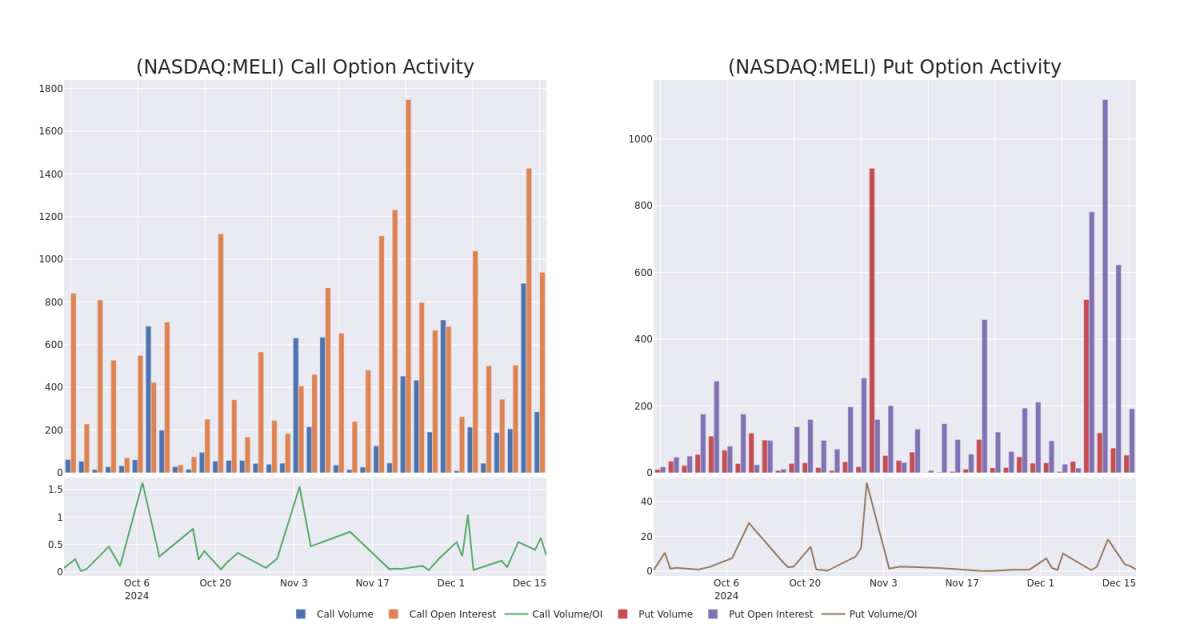

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre's whale activity within a strike price range from $1780.0 to $2220.0 in the last 30 days.

以下是我們可以觀察到的在過去30天內,MercadoLibre鯨魚活動的看漲和看跌期權的成交量和未平倉合約的演變,行權價範圍爲1780.0美元到2220.0美元。

MercadoLibre Call and Put Volume: 30-Day Overview

MercadoLibre 看漲和看跌成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | PUT | TRADE | BEARISH | 03/21/25 | $420.0 | $417.7 | $420.0 | $2220.00 | $210.0K | 10 | 6 |

| MELI | CALL | TRADE | BULLISH | 01/24/25 | $99.5 | $92.0 | $97.19 | $1810.00 | $145.7K | 0 | 30 |

| MELI | CALL | TRADE | BEARISH | 12/20/24 | $6.9 | $5.5 | $5.5 | $1900.00 | $110.0K | 700 | 217 |

| MELI | CALL | TRADE | NEUTRAL | 06/20/25 | $196.8 | $184.9 | $189.9 | $1840.00 | $75.9K | 12 | 5 |

| MELI | CALL | TRADE | BULLISH | 02/21/25 | $132.9 | $122.8 | $129.4 | $1820.00 | $64.7K | 9 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MercadoLibre | 看跌 | 交易 | 看淡 | 03/21/25 | $420.0 | $417.7 | $420.0 | $2220.00 | $210.0K | 10 | 6 |

| MercadoLibre | 看漲 | 交易 | 看好 | 01/24/25 | $99.5 | $92.0 | $97.19 | $1810.00 | 145.7K美元 | 0 | 30 |

| MercadoLibre | 看漲 | 交易 | 看淡 | 12/20/24 | $6.9 | $5.5 | $5.5 | $1900.00 | 110,000美元 | 700 | 217 |

| MercadoLibre | 看漲 | 交易 | 中立 | 06/20/25 | $196.8 | $184.9 | $189.9 | $1840.00 | 75.9K美元 | 12 | 5 |

| MercadoLibre | 看漲 | 交易 | 看好 | 02/21/25 | $132.9 | $122.8 | $129.4 | $1820.00 | $64.7K | 9 | 0 |

About MercadoLibre

關於mercadolibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

MercadoLibre 在拉丁美洲運營着最大的電子商務市場,截至2023年底,活躍用戶超過21800萬,活躍賣家超過100萬,覆蓋18個國家,融入其商業網絡或金融科技解決方案。該公司經營着一系列與其核心在線商店互補的業務,包括運輸解決方案(Mercado Envios)、支付和融資事件(Mercado Pago 和 Mercado Credito)、廣告(Mercado Clics)、分類信息以及一個即用型電子商務解決方案(Mercado Shops),構成其業務陣容。MercadoLibre 從最終價值費用、廣告版稅、支付處理、插入費、訂閱費以及消費者和小企業貸款的利息收入中獲得營業收入。

Where Is MercadoLibre Standing Right Now?

MercadoLibre目前的狀況如何?

- Currently trading with a volume of 114,860, the MELI's price is down by -0.06%, now at $1808.0.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 64 days.

- 目前成交量爲114,860的情況下,MELI的價格下降了-0.06%,現在爲$1808.0。

- RSI讀數表明該股票目前在超買和超賣之間保持中立。

- 預期的收益發布時間爲64天后。

What Analysts Are Saying About MercadoLibre

分析師對MercadoLibre的看法

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $2450.0.

在過去的30天裏,共有1位專業分析師對這隻股票發表了看法,設置了2450.0美元的平均目標價。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on MercadoLibre with a target price of $2450.

Benzinga Edge的期權異動板塊能夠在市場變動發生前發現潛在的市場移動因素。查看大資金在你最喜歡的股票上的持倉情況。點擊這裏獲取訪問權限。* 根據其評估,一位來自花旗集團的分析師對MercadoLibre保持買入評級,目標價爲2450美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續教育、戰略交易調整、利用各種因子以及保持對市場動態的關注來降低這些風險。請通過Benzinga Pro實時跟蹤MercadoLibre最新的期權交易。

譯文內容由第三人軟體翻譯。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.