Amazon.com Inc. (NASDAQ:AMZN) faces renewed scrutiny over its warehouse safety practices following a Senate investigation that claims the e-commerce giant manipulated injury data and prioritized speed over worker safety, allegations the company strongly disputes.

What Happened: A 160-page report released on Sunday by Sen. Bernie Sanders (I-Vt.), chair of the Senate Committee on Health, Education, Labor and Pensions, found Amazon warehouses recorded 30% more injuries than the industry average in 2023, with workers nearly twice as likely to be injured compared to other warehouse employees.

"Amazon's self-assessment is disturbingly inaccurate and that the company operates uniquely dangerous warehouses—knowingly allowing unsafe conditions that injure workers and failing to fix those unsafe conditions if doing so could hurt the company's bottom line," the report said.

The investigation claims Amazon's productivity quotas force workers to "move in unsafe ways" and repeat movements thousands of times per shift, leading to musculoskeletal disorders. The report also alleges the company "actively discourages" injured workers from seeking outside medical care.

The investigation claims Amazon's productivity quotas force workers to "move in unsafe ways" and repeat movements thousands of times per shift, leading to musculoskeletal disorders. The report also alleges the company "actively discourages" injured workers from seeking outside medical care.

Amazon sharply rejected these findings in a detailed response, stating the investigation "wasn't a fact-finding mission, but rather an attempt to collect information and twist it to support a false narrative." The company reports it reduced its recordable incident rate by 28% and lost time incident rate by 75% between 2019 and 2023.

Why It Matters: The company defended its safety benchmarking practices, noting its transportation-focused facilities recorded a recordable incident rate of 6.3 in 2023, below the industry average of 9.7. Amazon emphasized that increasing delivery speeds has coincided with decreasing injury rates across its network.

"Our safety record continues to improve," Amazon stated, highlighting investments in ergonomic enhancements and climate-controlled facilities. The company maintains that its performance expectations are "reasonable and achievable," based on actual team accomplishments.

Price Action: Amazon stock closed at $232.93 on Monday, up 2.40% for the day, with a slight after-hours drop. Year-to-date, the stock has risen 55.36%.

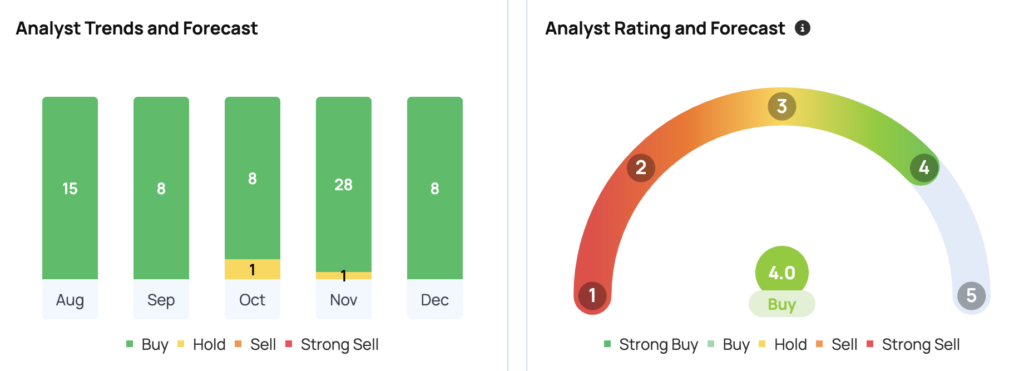

With a market cap of $2.45 trillion and a price-to-earnings ratio of 48.60, Amazon's RSI is 72. The consensus price target is $244.36, with a high of $285 from JMP Securities and a low of $197 from Wells Fargo. The average target of $273.33 suggests a 17.51% upside, according to data from Benzinga Pro.

- Tesla Will Be The 'Biggest Winner' In The Trump Era, Says Dan Ives; Predicts Nasdaq At 25,000 In 18 Months: 'Get the Popcorn Out'

Image via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.