According to the Zhizhong Finance APP, as we approach 2025, the analyst team at Wall Street financial giant Bank of America has released its list of preferred chip stocks for the US stock market next year, which includes the "three giants of AI chips" that have seen explosive investment interest since 2023.

In the view of the Bank of America analyst team, chip stocks are still likely to be one of the best-performing sectors in the US stock market next year, and the contribution to growth is expected to expand from chip companies like the "three giants of AI chips" that benefit from the AI boom to include analog chips and electric vehicle chip stocks that have long underperformed the large cap market and.$PHLX Semiconductor Index (.SOX.US)$the "non-AI" chip stock symbols.

The latest report from the Bank of America analyst team shows that one of the core driving forces behind the current "long-term bull market in US stocks" since 2023— chip stocks, has regained global investor favor after being sold off at the beginning of the earnings season, and is expected to continue attracting funds in 2025, therefore it is very likely to ignite another "crazy bull" rally and become the core focus of the US stock market.

The "three giants of AI chips" in the US stock chip sector—namely.$NVIDIA (NVDA.US)$、$Broadcom (AVGO.US)$and $Marvell Technology (MRVL.US)$are all included in Bank of America's "preferred chip stocks list" for 2025, which also includes semiconductor equipment giants.$Lam Research (LRCX.US)$and leading Automotive AI Chips manufacturers.$ON Semiconductor (ON.US)$and one of the leaders in EDA Software.$Cadence Design Systems (CDNS.US)$。

The "three giants of AI chips" in the US stock chip sector—namely.$NVIDIA (NVDA.US)$、$Broadcom (AVGO.US)$and $Marvell Technology (MRVL.US)$are all included in Bank of America's "preferred chip stocks list" for 2025, which also includes semiconductor equipment giants.$Lam Research (LRCX.US)$and leading Automotive AI Chips manufacturers.$ON Semiconductor (ON.US)$and one of the leaders in EDA Software.$Cadence Design Systems (CDNS.US)$。

On this list, Broadcom is undoubtedly the most dazzling chip company in the recent US stock market, and even globally. After it announced strong growth results and extremely optimistic outlook expectations for the AI ASIC chip market last Friday morning Beijing time, its stock price surged over 20% in a single day in US stock trading, and its market cap exceeded the significant milestone of one trillion dollars. On Monday, during US stock trading hours, it continued to soar over 10%, with an overall market cap nearing the 1.2 trillion dollar mark.

Among the "three AI chip giants," NVIDIA focuses on AI GPUs, while the latter two focus on the AI ASIC chip market. Customized AI ASICs can provide hardware acceleration for specific tasks, especially excelling in large-scale AI training and inference tasks, offering higher efficiency and cost-effectiveness compared to general-purpose NVIDIA GPUs. These two types of AI chips will coexist in the long term, providing the best solutions for different AI computing power demand scenarios.

With the strong demand for Broadcom Ethernet Switch Chip from major Global datacenters, and its absolute technological leadership in inter-chip communication and high-speed data transfer among chips, Broadcom has become one of the most important participants in the customized AI Chip field in recent years. For example, in Google's self-developed Server AI Chip - the TPU AI Acceleration Chip, Broadcom plays a core role, collaborating with the Google team in the R&D of the TPU AI Acceleration Chip and the AI training/inference acceleration library.

In addition to chip design, broadcom also provides critical inter-chip communication intellectual property for google, and is responsible for manufacturing, testing, and packaging new chips, thereby safeguarding google's expansion into new ai datacenters.

With its leading position in the AI ASIC market, Broadcom is expected to soon break NVIDIA's monopoly position in the AI chip market. Analyst Jordan Klein from Mizuho pointed out that Wall Street is paying attention to the demand for ASICs from large cloud computing companies like Google, which may be one of the reasons for NVIDIA's stock unexpectedly dropping on Friday. 'In my view, customized AI chips will continue to capture a share from NVIDIA AI GPUs every year, although NVIDIA GPUs still dominate for AI training purposes.'

The semiconductor boom cycle is far from over, and the rising chip stocks still have ample room for growth.

The team led by Bank of America analyst Vivek Arya wrote in this chip stock research report that after a significant rise, there is still a broad upward space for chip stocks, and we believe two different upward trend lines will emerge in 2025.

In the first half of the year, the AI investments driven by super customers in USA Cloud Computing and the scale of NVIDIA's Blackwell architecture AI GPU deployment will sustain the upward momentum of stocks in these chip companies closely related to AI. In the second half of the year, if the global economy continues to recover, market focus may shift to inventory replenishment and a rebound in Autos production, which means that long-term undervalued and significantly underperformed Autos/Industrial chip manufacturers are expected to regain investor favor.

The team led by Arya at Bank of America also stated that, overall, it is expected that the overall sales of the semiconductor market in 2025 will grow by about 15% on the strong growth in 2024, reaching 725 billion dollars. "This is still a very strong pace of growth, although it is a decrease compared to this year's predicted growth rate of 20%."

The analysis team added that NVIDIA, Broadcom, and Marvell Technology are expected to continue benefiting from the market demand closely associated with data center AI chips, the super-scale cloud customers, and the explosive demand for AI computing resources from global datacenter operators, while semiconductor equipment giant Lam Research is expected to benefit from demand for flash memory and the continuous recovery of semiconductor equipment spending in the Chinese market.

Moreover, the Bank of America analyst team stated that ON Semiconductor, a giant in automotive chips that has long underperformed against the USA stock market and the PHLX Semiconductor Index, is expected to benefit significantly from the recovery of "final" demand in electric vehicles and the entire automotive sector (possibly occurring in the second half of this year), while Cadence Design Systems has long been a leader in chip design automation and is expected to benefit in the long run from technology giants and leaders in chip design, such as NVIDIA, AMD, and Apple.$Amazon (AMZN.US)$、$Microsoft (MSFT.US)$As Cloud Computing giants accelerate the pace of developing high-performance AI Chips, their demand for EDA Software that can design more complex architectures for AI Chips while also accelerating chip design with new AI technologies is expected to continue to expand.

EDA Software tools are indispensable for chip giants like Apple, NVIDIA, and AMD in designing all types of chips, while Lithography is one of the core tools that transforms chip design blueprints into actual products.

The Bank of America analysis team, led by Arya, noted in the report: "The demand boom cycle in the semiconductor market typically lasts about 2.5 years (followed by a downturn cycle lasting up to 1 year), and we are currently merely at the mid-point of this semiconductor upcycle that began in [Q4 2023]." "We expect that the sales of the memory chip market will grow again on the strong base of 2024, with an expected growth of 20% (vs a 79% year-on-year increase in 2024), and the core semiconductor market (excluding the memory sector) is expected to grow by 13%, mainly due to strong performance from datacenters. However, other sub-segments, such as Consumer Electronics, electric vehicles, the overall auto sector, and industrial sector chip products, while showing signs of recovery, may slightly decline, though the decline is significantly narrowed compared to 2024.

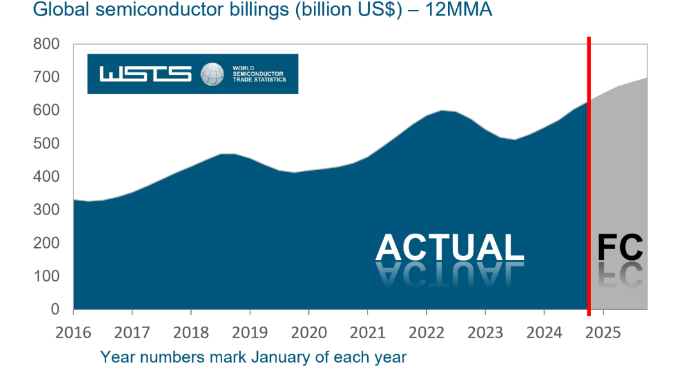

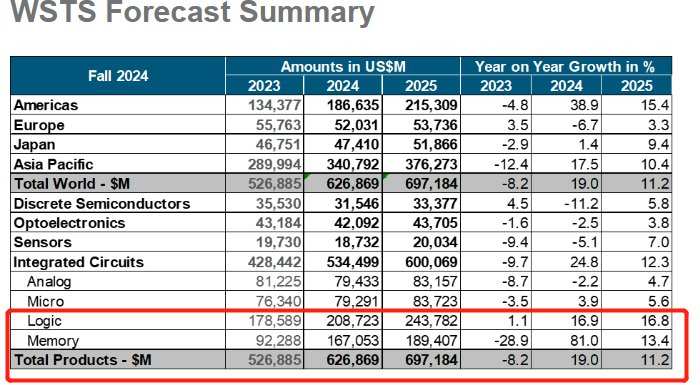

The extremely optimistic outlook for the semiconductor market in this Bank of America research report aligns with the latest semiconductor market size forecast report from the World Semiconductor Trade Statistics (WSTS), which is optimistic about strong growth in chip demand continuing in 2025. WSTS significantly upgraded its forecasts for the semiconductor market size for 2024 and 2025 in its latest autumn forecast compared to its spring forecast, expecting the global semiconductor market to grow by 19.0% year-on-year to 627 billion dollars in 2024. WSTS expects the semiconductor market size in 2025 to grow from the 2024 level, indicating that the global semiconductor market is expected to grow by about 11.2% on top of the already strong recovery trend in 2024, with the global market size likely reaching approximately 697 billion dollars.

WSTS expects that the growth of the semiconductor market scale in 2025 will be mainly driven by the memory chip category and AI logic chip category. It is anticipated that under the unprecedented global surge in AI deployment, the total sales growth rate of memory chips dominated by DRAM and NAND will exceed 13% in 2025, while the total sales growth rate of logic chips, including CPUs and GPUs, is expected to exceed 16%. At the same time, it is also expected that all other segmented chip markets, such as discrete devices, optoelectronics, Sensors, MCUs, and analog chips, will achieve single-digit growth rates.

For chip stocks, some potential risks cannot be ignored.

Despite the overall optimistic outlook for the semiconductor market, the Bank of America analysis team stated in its Research Reports that there are still many unknown factors in 2025. The most significant risk factors for negative impact are concentrated on AI-related market demand growth, demand in China, the broader macroeconomic recovery situation, and how the story of the USA's long-established chip giant Intel continues.

The Bank of America analysis team led by Alia added that, given the accelerated penetration of AI applications into business operations and the daily lives of individual Consumers, this "rotation trend" from Semiconductors to AI-benefiting Software stocks will continue in 2025. This trend may create intermittent pressure on the surge of popular chip stocks, driving funds to realize profits in chip stocks and shift towards software stocks. "From a positive perspective, we can see that the support policies for economic growth under Trump's new administration will drive merger and acquisition activities (especially mergers in the semiconductor and software markets) to restart," the Bank of America analysis team wrote.

Nevertheless, the analysis team at Bank of America, led by Alia, emphasized in the report that chip stocks benefiting from the global trend of AI, especially the "three giants of AI chips," are expected to continue to experience strong upward momentum, at least until the second half of this year.

In addition to these three popular chip stocks and the aforementioned "preferred chip stock list," the analysis team at Bank of America stated that.$Arm Holdings (ARM.US)$、$Micron Technology (MU.US)$、$Coherent (COHR.US)$、$Credo Technology (CRDO.US)$And$MACOM Technology Solutions (MTSI.US)$Other chip giants are also expected to gain significantly from this unprecedented AI boom.

Editor/ping

美股芯片板块的“AI芯片三巨头”——即

美股芯片板块的“AI芯片三巨头”——即