Microsoft Unusual Options Activity For December 12

Microsoft Unusual Options Activity For December 12

Financial giants have made a conspicuous bearish move on Microsoft. Our analysis of options history for Microsoft (NASDAQ:MSFT) revealed 30 unusual trades.

金融巨頭在微軟上做出了顯著的看淡動作。我們對微軟(納斯達克:MSFT)期權歷史的分析顯示有30筆異常交易。

Delving into the details, we found 33% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $64,618, and 28 were calls, valued at $1,143,396.

深入分析細節,我們發現33%的交易者持看好態度,而46%顯示出看淡傾向。在我們發現的所有交易中,有2筆爲看跌期權,價值爲64,618美元,28筆爲看漲期權,價值爲1,143,396美元。

Expected Price Movements

預期價格變動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $445.0 to $465.0 for Microsoft over the last 3 months.

考慮到這些合同的成交量和未平倉合約,似乎大型投資者在過去的3個月中瞄準了微軟價格區間爲445.0美元到465.0美元。

Insights into Volume & Open Interest

成交量和持倉量分析

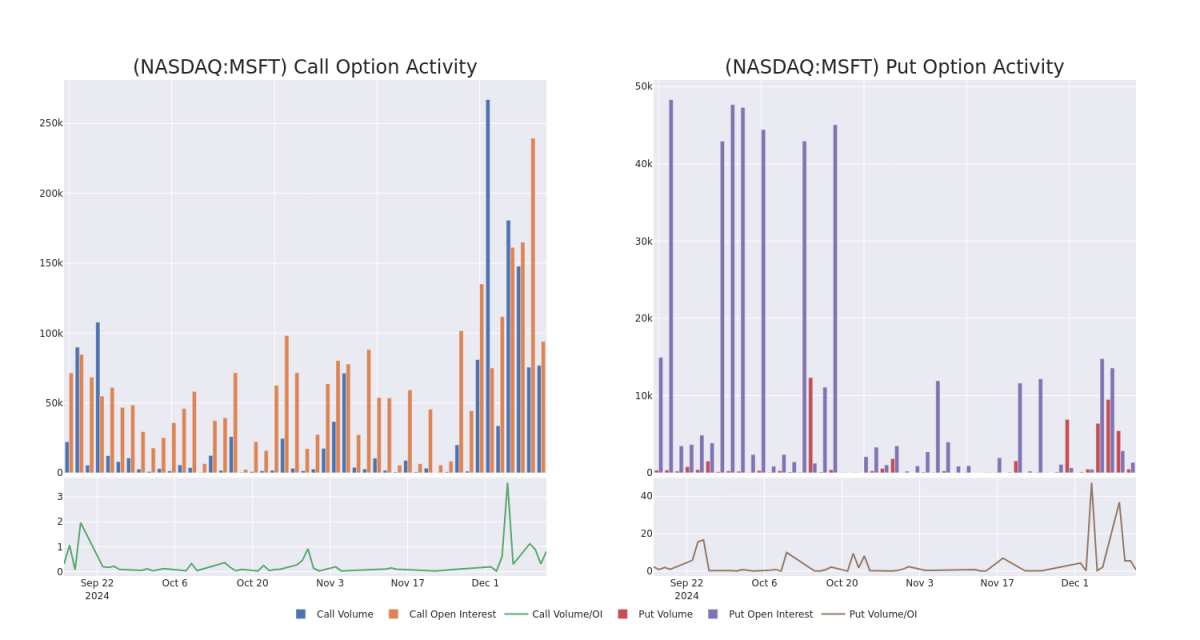

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

觀察成交量和未平倉合約是進行股票盡職調查的一個有見地的方法。

This data can help you track the liquidity and interest for Microsoft's options for a given strike price.

這些數據可以幫助您跟蹤微軟在特定行權價的期權流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Microsoft's whale activity within a strike price range from $445.0 to $465.0 in the last 30 days.

下面,我們可以觀察到微軟在過去30天內所有鯨魚活動的看漲期權和看跌期權的成交量和未平倉合約的演變,行權價範圍爲445.0美元到465.0美元。

Microsoft Call and Put Volume: 30-Day Overview

微軟看漲和看跌期權成交量:30天概覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | CALL | SWEEP | BULLISH | 12/13/24 | $4.95 | $4.6 | $4.79 | $447.50 | $96.5K | 2.3K | 264 |

| MSFT | CALL | SWEEP | BEARISH | 12/27/24 | $2.31 | $2.3 | $2.31 | $465.00 | $66.7K | 21.1K | 1.4K |

| MSFT | CALL | SWEEP | BEARISH | 12/13/24 | $2.67 | $2.58 | $2.67 | $452.50 | $60.4K | 2.7K | 2.8K |

| MSFT | CALL | SWEEP | BEARISH | 12/13/24 | $6.15 | $5.7 | $5.7 | $447.50 | $57.0K | 2.3K | 956 |

| MSFT | CALL | SWEEP | BULLISH | 07/18/25 | $32.5 | $32.2 | $32.5 | $465.00 | $55.2K | 28 | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | 看漲 | 掃單 | 看好 | 12/13/24 | $4.95 | $4.6 | $4.79 | $447.50 | 96.5K美元 | 2.3K | 264 |

| MSFT | 看漲 | 掃單 | 看淡 | 12/27/24 | $2.31 | $2.3 | $2.31 | $465.00 | $66.7K | 21.1K | 1.4K |

| MSFT | 看漲 | 掃單 | 看淡 | 12/13/24 | $2.67 | $2.58 | $2.67 | $452.50 | 60.4K美元 | 2.7K | 2.8K美元 |

| MSFT | 看漲 | 掃單 | 看淡 | 12/13/24 | $6.15 | $5.7 | $5.7 | $447.50 | 57.0K美元 | 2.3K | 956 |

| MSFT | 看漲 | 掃單 | 看好 | 07/18/25 | $32.5 | $32.2 | $32.5 | $465.00 | ¥55,200 | 28 | 20 |

About Microsoft

關於微軟

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

微軟開發和授權 消費 和企業 軟件。它以其 Windows 操作系統和 Office 辦公套件而聞名。該公司分爲三個規模相等的廣泛部門:生產力和 業務 流程(傳統的微軟 Office、基於雲的 Office 365、Exchange、SharePoint、Skype、LinkedIn、Dynamics)、智能雲(基礎設施和平台即服務的 Azure、Windows 服務器-雲計算 操作系統、SQL 服務器),以及更多個人計算(Windows 客戶端、Xbox、Bing 搜索、 蘋果-顯示屏 廣告和 Surface 筆記本、平板電腦和臺式機)。

Following our analysis of the options activities associated with Microsoft, we pivot to a closer look at the company's own performance.

通過對微軟的期權異動活動進行分析,我們將目光轉向該公司的實際表現。

Where Is Microsoft Standing Right Now?

微軟現在的狀況怎樣?

- With a volume of 1,309,255, the price of MSFT is up 0.68% at $452.05.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 47 days.

- MSFt的成交量爲1,309,255,價格上漲了0.68%,達到了$452.05。

- RSI因子提示相關股票可能接近超買。

- 下一個業績預計將在47天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因子以及密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.