SMCI Stock Drops In Pre-Market Despite Super Micro CEO's Assurance Against Delisting: What's Going On?

SMCI Stock Drops In Pre-Market Despite Super Micro CEO's Assurance Against Delisting: What's Going On?

Super Micro Computer Inc. (NASDAQ:SMCI) experienced a 7.18% drop in pre-market trading on Wednesday, as per Benzinga Pro. This decline occurred despite reassurances from CEO Charles Liang that the company's stock would not be delisted from Nasdaq.

超微計算機公司(納斯達克:SMCI)在週三的美股盤前交易中下跌了7.18%,根據Benzinga Pro的消息。這一下降發生在首席執行官查爾斯·梁對公司股票不會從納斯達克退市的保證之下。

What Happened: During the Reuters NEXT conference in New York, Liang expressed confidence that Super Micro would meet the Nasdaq deadline of February 25 to file its overdue financial reports. The company recently received a letter from Nasdaq granting an exception to its rules, allowing more time to submit these reports.

發生了什麼:在紐約的路透社NEXt會議上,梁表達了超微將按時滿足納斯達克截至2月25日提交逾期財務報告的信心。該公司最近收到了來自納斯達克的信件,批准了其規則的例外,允許更多時間提交這些報告。

The drop in stock also coincides with J.P. Morgan analysts noting an underweight rating on the stock, setting a one-year price target at $23 per share. However, they also noted that orders for Super Micro's servers remain strong, despite the controversies.

股票下跌也與摩根大通分析師指出該股票的低配評級相吻合,設定了一年的目標價爲每股23美元。然而,他們也指出,儘管存在爭議,超微的服務器訂單依然強勁。

J.P. Morgan analysts, after meeting with Super Micro's management, reported no significant loss of orders to competitors. The company plans to launch new products in 2025 and expects to scale up production at its Malaysia plant in the first half of next year.

摩根大通分析師在與超微管理層會面後報告稱沒有顯著的訂單流失給競爭對手。該公司計劃在2025年推出新產品,並預計在明年上半年擴大在馬來西亞工廠的生產。

The server manufacturer had previously benefited from the surge in demand for AI infrastructure, but its shares were affected by an auditing scandal.

這家服務器製造商之前受益於對人工智能基礎設施需求的激增,但其股票受到了審計醜聞的影響。

Why It Matters: The recent stock volatility of SMCI can be traced back to a series of events that have shaken investor confidence. In late October, the company's independent auditor Ernst & Young resigned, citing concerns over governance and transparency. This led to delays in the filing of its financial reports, causing uncertainty among investors.

爲什麼這很重要:SMCI近期的股票波動可以追溯到一系列動搖投資者信心的事件。去年十月底,該公司的獨立核數師安永辭職,稱其對公司的治理和透明度表示擔憂。這導致財務報告的提交延遲,造成投資者的不確定性。

On Tuesday, Super Micro shares initially surged by 10% in pre-market trading following the announcement of an extension from Nasdaq for filing its overdue reports. However, the excitement was short-lived as the stock continued to decline, reflecting ongoing investor concerns about potential demand weakness due to the financial reporting delays. The company's ability to navigate these challenges and reassure investors will be crucial in stabilizing its stock performance.

在週二,超微的股票在美股盤前交易中因納斯達克宣佈延長提交逾期報告的期限而最初上漲了10%。然而,這種興奮並沒有持續太久,因爲股票繼續下跌,反映出投資者對財務報告延遲可能導致需求疲軟的持續擔憂。公司能否應對這些挑戰並安撫投資者將對其股票表現的穩定至關重要。

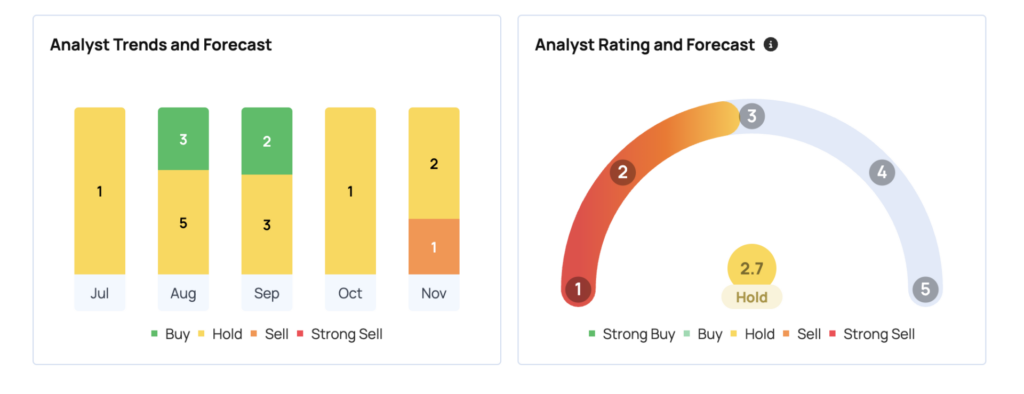

Meanwhile, as per the three recent analyst ratings collated by Benzinga Pro, namely Goldman Sachs, JP Morgan, and Wedbush, the average price target for SMCI is set at $27.67.

同時,根據Benzinga Pro整理的三份最新的分析師評級,即高盛、JP摩根和Wedbush,SMCI的平均目標價爲27.67美元。

- Bitcoin, Ethereum, Dogecoin Recover Losses After Flash Crash: Analyst Pinpoints Critical BTC Support Levels

- 比特幣、以太幣、狗狗幣在閃電崩盤後恢復損失:分析師指出比特幣關鍵壓力位

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

免責聲明:此內容部分由Benzinga Neuro生成,並由Benzinga編輯審核和發佈。

Image via Shutterstock

圖片來自Shutterstock

譯文內容由第三人軟體翻譯。

J.P. Morgan analysts, after meeting with Super Micro's management, reported no significant loss of orders to competitors. The company plans to launch new products in 2025 and expects to scale up production at its Malaysia plant in the first half of next year.

J.P. Morgan analysts, after meeting with Super Micro's management, reported no significant loss of orders to competitors. The company plans to launch new products in 2025 and expects to scale up production at its Malaysia plant in the first half of next year.