Behind the Scenes of Cigna's Latest Options Trends

Behind the Scenes of Cigna's Latest Options Trends

High-rolling investors have positioned themselves bullish on Cigna (NYSE:CI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CI often signals that someone has privileged information.

高風險投資者對信諾(紐交所:CI)的看好立場值得關注,零售交易者也應該注意這一點。\這種活動今天通過Benzinga對公開可用的期權數據的追蹤引起了我們的注意。這些投資者的身份尚不確定,但CI的如此大規模變動通常表明有些人掌握了內部信息。

Today, Benzinga's options scanner spotted 15 options trades for Cigna. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了15筆信諾的期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 100% bullish and 0% bearish. Among all the options we identified, there was one put, amounting to $29,400, and 14 calls, totaling $6,210,967.

這些主要交易者的情緒分裂,100%看好,0%看淡。在我們識別的所有期權中,有一筆看跌期權,金額爲29,400美元,和14筆看漲期權,合計爲6,210,967美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $180.0 to $312.5 for Cigna over the last 3 months.

考慮到這些合約的成交量和未平倉合約,看來鯨魚投資者在過去3個月裏對信諾的目標價格區間爲180.0美元到312.5美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

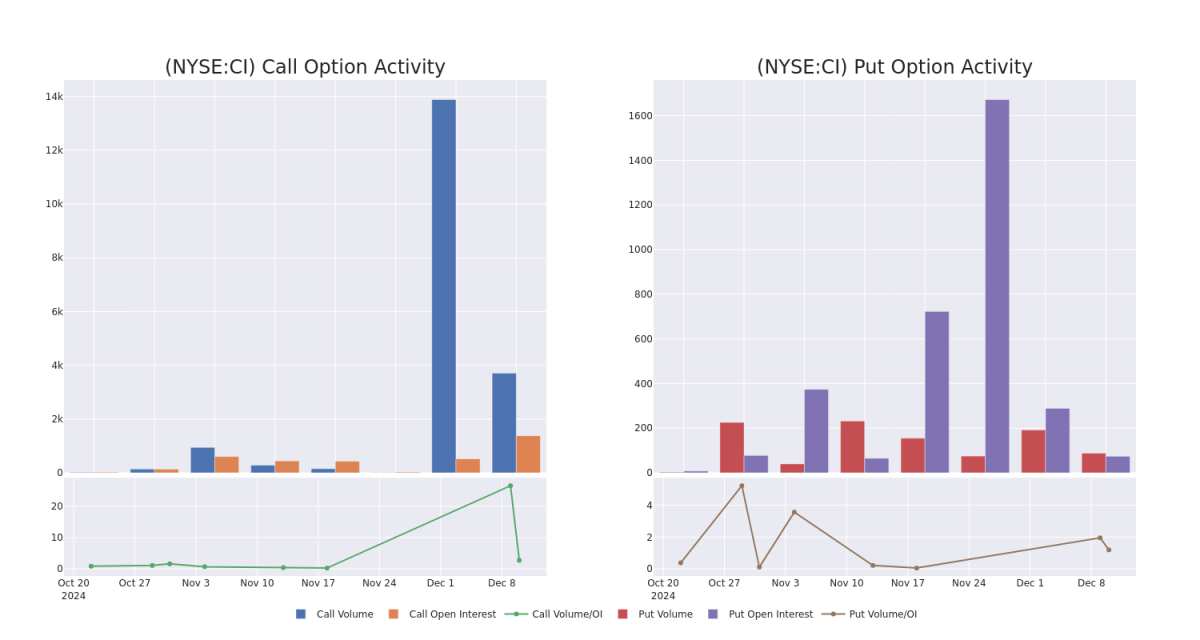

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cigna's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cigna's substantial trades, within a strike price spectrum from $180.0 to $312.5 over the preceding 30 days.

評估成交量和未平倉合約是期權交易中的一個戰略步驟。這些指標揭示了在指定行權價格下,投資者對信諾期權的流動性和興趣。以下數據可視化了過去30天內信諾重大交易的看漲和看跌期權的成交量和未平倉合約的波動,行權價格範圍從180.0美元到312.5美元。

Cigna Option Volume And Open Interest Over Last 30 Days

信諾過去30天的期權成交量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CI | CALL | SWEEP | BULLISH | 01/15/27 | $147.0 | $142.5 | $147.0 | $180.00 | $1.1M | 1.3K | 113 |

| CI | CALL | SWEEP | BULLISH | 01/15/27 | $146.7 | $142.0 | $146.5 | $180.00 | $805.6K | 1.3K | 207 |

| CI | CALL | SWEEP | BULLISH | 01/15/27 | $146.5 | $142.3 | $146.5 | $180.00 | $571.3K | 1.3K | 152 |

| CI | CALL | SWEEP | BULLISH | 01/15/27 | $146.0 | $142.5 | $146.0 | $180.00 | $511.0K | 1.3K | 35 |

| CI | CALL | SWEEP | BULLISH | 01/15/27 | $146.0 | $142.0 | $146.0 | $180.00 | $496.4K | 1.3K | 392 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CI | 看漲 | 掃單 | 看好 | 01/15/27 | $147.0 | $142.5 | $147.0 | $180.00 | $1.1M | 1.3K | 113 |

| CI | 看漲 | 掃單 | 看好 | 01/15/27 | $146.7 | $142.0 | $146.5 | $180.00 | $805.6K | 1.3K | 207 |

| CI | 看漲 | 掃單 | 看好 | 01/15/27 | $146.5 | $142.3 | $146.5 | $180.00 | $571.3K | 1.3K | 152 |

| CI | 看漲 | 掃單 | 看好 | 01/15/27 | $146.0 | $142.5 | $146.0 | $180.00 | $511.0K | 1.3K | 35 |

| CI | 看漲 | 掃單 | 看好 | 01/15/27 | $146.0 | $142.0 | $146.0 | $180.00 | $496.4K | 1.3千 | 392 |

About Cigna

關於信諾

Cigna primarily provides pharmacy benefit management and health insurance services. Its PBM and specialty pharmacy services, which were greatly expanded by its 2018 merger with Express Scripts, are mostly sold to health insurance plans and employers. Its largest PBM contract is the Department of Defense, and it recently won a deal with top-tier insurer Centene. In health insurance and other benefits, Cigna mostly serves employers through self-funding arrangements, and the company operates mostly in the US with 17 million US and 2 million international medical members covered as of September 2024.

信諾主要提供藥品福利管理和健康保險服務。其藥品福利管理和特殊藥房服務在2018年與埃克斯普雷斯藥房合併後得到了極大的擴展,主要銷售給健康保險計劃和僱主。其最大的藥品福利管理合同是國防部,最近還與頂級保險公司康西哥贏得了一份合同。在健康保險和其他福利方面,信諾主要通過自籌資金安排爲僱主提供服務,截至2024年9月,公司在美國運營,覆蓋1700萬美國和200萬國際醫療成員。

Current Position of Cigna

信諾的當前狀況

- With a volume of 954,391, the price of CI is down -2.48% at $311.25.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 52 days.

- 成交量爲954,391,CI的價格下跌了-2.48%,爲311.25美元。

- RSI因子暗示標的股票可能被超賣。

- 下一個業績預計將在52天內發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cigna with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高收益的潛力。聰明的交易者通過持續的教育、戰略交易調整、利用各種因子以及關注市場動態來降低這些風險。通過Benzinga Pro實時獲取Cigna的最新期權交易提醒。

譯文內容由第三人軟體翻譯。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $180.0 to $312.5 for Cigna over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $180.0 to $312.5 for Cigna over the last 3 months.