Is Northwest Natural Holding Company's (NYSE:NWN) ROE Of 5.8% Concerning?

Is Northwest Natural Holding Company's (NYSE:NWN) ROE Of 5.8% Concerning?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. To keep the lesson grounded in practicality, we'll use ROE to better understand Northwest Natural Holding Company (NYSE:NWN).

雖然一些投資者已經非常熟悉財務指標(特別鳴謝),但本文是爲那些想要學習淨資產收益率(roe)及其重要性的人準備的。爲了使課程更具實用性,我們將使用roe來更好地了解西北天然氣控股公司(紐交所:NWN)。

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

股東應考慮的重要因素是淨資產收益率或roe,因爲它告訴他們投資的資本如何被有效地再投資。簡單來說,它用於評估公司與其股權資本相關的盈利能力。

How Do You Calculate Return On Equity?

如何計算淨資產收益率?

The formula for ROE is:

roe的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

淨資產收益率 = 淨利潤(來自持續經營) ÷ 股東權益

So, based on the above formula, the ROE for Northwest Natural Holding is:

因此,根據上述公式,西北天然氣控股公司的roe爲:

5.8% = US$79m ÷ US$1.4b (Based on the trailing twelve months to September 2024).

5.8% = 7900萬美元 ÷ 14億美金(基於截至2024年9月的過去十二個月)。

The 'return' is the yearly profit. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.06 in profit.

'收益'是年度利潤。可以這樣理解,每1美元的股本,公司能夠賺取0.06美元的利潤。

Does Northwest Natural Holding Have A Good Return On Equity?

西北天然氣控股的淨利潤表現如何?

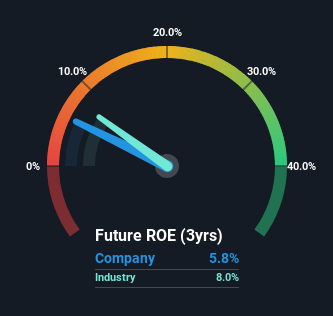

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. As is clear from the image below, Northwest Natural Holding has a lower ROE than the average (8.0%) in the Gas Utilities industry.

評估公司roe的最簡單方法是與其行業的平均水平進行比較。重要的是,這遠不是一個完美的衡量標準,因爲同一行業分類內的公司差異顯著。如下圖所示,西北天然氣控股的roe低於燃料幣行業的平均水平(8.0%)。

That's not what we like to see. That being said, a low ROE is not always a bad thing, especially if the company has low leverage as this still leaves room for improvement if the company were to take on more debt. A high debt company having a low ROE is a different story altogether and a risky investment in our books. Our risks dashboard should have the 3 risks we have identified for Northwest Natural Holding.

這並不是我們想要看到的。然而,低roe並不總是壞事,特別是如果公司槓桿較低,因爲如果公司能夠承擔更多債務,仍然留有改善的空間。對於高負債公司的低roe則是另一個故事,在我們看來這是一個風險投資。我們的風險特斯拉-儀表應包含我們爲西北天然氣控股識別的3個風險。

How Does Debt Impact ROE?

債務對ROE的影響是怎樣的?

Companies usually need to invest money to grow their profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. That will make the ROE look better than if no debt was used.

公司通常需要投資資金來增加利潤。 這筆資金可以來自留存收益、發行新股(股本)或債務。 在前兩種情況下,roe將捕捉到這種使用資本來增長的情況。 在後一種情況中,用於增長的債務將提高回報率,但不會影響股東權益。 這將使roe看起來比不使用債務時更好。

Northwest Natural Holding's Debt And Its 5.8% ROE

西北天然氣的債務及其5.8%的roe

Northwest Natural Holding does use a high amount of debt to increase returns. It has a debt to equity ratio of 1.28. Its ROE is quite low, even with the use of significant debt; that's not a good result, in our opinion. Debt increases risk and reduces options for the company in the future, so you generally want to see some good returns from using it.

西北天然氣確實使用了高額債務來提高回報。它的債務股本比率爲1.28。即使使用了大量債務,它的roe仍然很低;在我們看來,這不是一個好的結果。債務增加了風險,並減少了公司未來的選擇,因此通常希望看到一些良好的回報。

Summary

總結

Return on equity is one way we can compare its business quality of different companies. A company that can achieve a high return on equity without debt could be considered a high quality business. All else being equal, a higher ROE is better.

ROE是我們可以比較不同公司業務質量的一種方式,能夠在不使用債務的情況下實現高ROE的公司可以被認爲是高質量的企業,其他情況相等的情況下,較高的ROE更佳。

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So you might want to check this FREE visualization of analyst forecasts for the company.

儘管ROE是衡量公司質量的一項有用指標,但您需要查看一系列因素才能確定購買股票的正確價格。重要的是,要考慮到其他因素,如未來的利潤增長以及未來需要投入多少資本。因此,您可能需要查看該公司分析師預測的免費可視化工具。

But note: Northwest Natural Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

但請注意:西北天然氣可能不是最好的股票買入選擇。因此,請查看這份有趣的免費公司名單,裏面有高roe和低債務的公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

譯文內容由第三人軟體翻譯。

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity