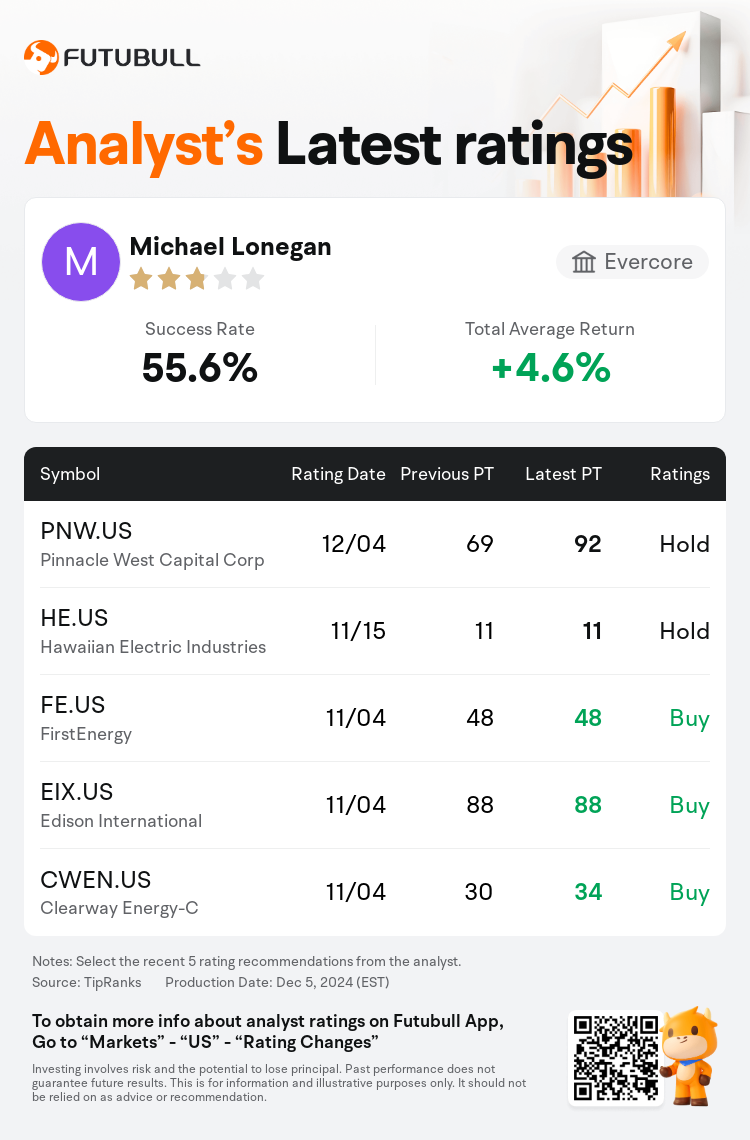

Evercore analyst Michael Lonegan maintains $Pinnacle West Capital Corp (PNW.US)$ with a hold rating, and adjusts the target price from $69 to $92.

According to TipRanks data, the analyst has a success rate of 55.6% and a total average return of 4.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Pinnacle West Capital Corp (PNW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Pinnacle West Capital Corp (PNW.US)$'s main analysts recently are as follows:

Following a decision by the Arizona Corporation Commission, which was approved 3-2 to adopt a significant policy statement, there are now higher-level guidelines set for utilities to pursue formula rates in upcoming rate cases. Though the impact of this development remains uncertain in the long term, it potentially enhances the outlook for Pinnacle West by decreasing the risk associated with the scheduling of its forthcoming rate case expected by mid-2025.

The approval of formula ratemaking by the Arizona Corporation Commission with minor modifications to the regulatory lag docket policy statement should allow Pinnacle West to smooth out the variability in its earnings profile. This is expected to support the company's capability to consistently achieve an annual EPS growth rate of 5%-7%.

The structural improvements in the Arizona regulatory environment are viewed positively. Additionally, the state is well-placed to benefit from the data economy and industrial load growth, along with favorable population trends.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

Evercore分析師Michael Lonegan維持$西帕納卡資本 (PNW.US)$持有評級,並將目標價從69美元上調至92美元。

根據TipRanks數據顯示,該分析師近一年總勝率為55.6%,總平均回報率為4.6%。

此外,綜合報道,$西帕納卡資本 (PNW.US)$近期主要分析師觀點如下:

此外,綜合報道,$西帕納卡資本 (PNW.US)$近期主要分析師觀點如下:

在亞利桑那州公司委員會通過一項以3-2票通過的重要政策聲明後,現已爲公用事業制定了更高級別的指導方針,以在即將到來的費率案件中尋求公式費率。儘管這一發展的長期影響仍不確定,但它可能通過降低與預計在2025年中期舉行的即將進行的費率案件的調度相關的風險,從而增強Pinnacle West的前景。

亞利桑那州公司委員會對公式費率制定的批准,經過對監管滯後政策聲明的小幅修改,應該能夠幫助Pinnacle West平滑其收益表現的波動性。這預計將支持該公司持續實現每年每股收益增長率達到5%-7%的能力。

亞利桑那州監管環境的結構性改善被視爲積極因素。此外,該州在數據經濟和工業負荷增長方面處於良好位置,並且人口趨勢也有利。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$西帕納卡資本 (PNW.US)$近期主要分析師觀點如下:

此外,綜合報道,$西帕納卡資本 (PNW.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of