AGNC Investment's (NYSE:AGNC) short percent of float has fallen 16.26% since its last report. The company recently reported that it has 42.25 million shares sold short, which is 4.79% of all regular shares that are available for trading. Based on its trading volume, it would take traders 2.07 days to cover their short positions on average.

Why Short Interest Matters

Short interest is the number of shares that have been sold short but have not yet been covered or closed out. Short selling is when a trader sells shares of a company they do not own, with the hope that the price will fall. Traders make money from short selling if the price of the stock falls and they lose if it rises.

Short interest is important to track because it can act as an indicator of market sentiment towards a particular stock. An increase in short interest can signal that investors have become more bearish, while a decrease in short interest can signal they have become more bullish.

List of the most shorted stocks

List of the most shorted stocks

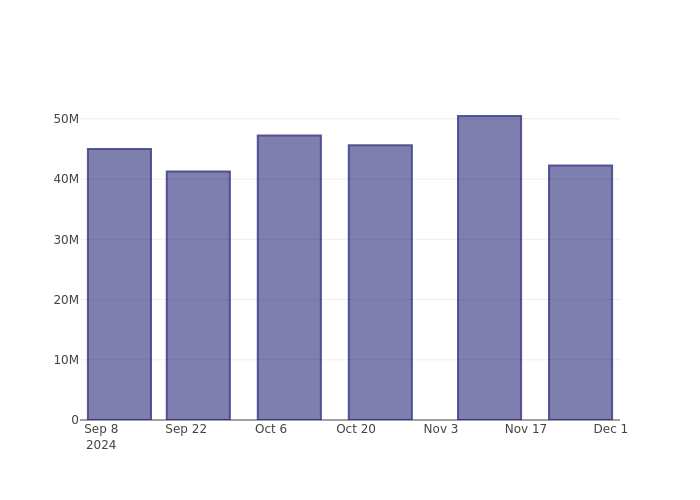

AGNC Investment Short Interest Graph (3 Months)

As you can see from the chart above the percentage of shares that are sold short for AGNC Investment has declined since its last report. This does not mean that the stock is going to rise in the near-term but traders should be aware that less shares are being shorted.

Comparing AGNC Investment's Short Interest Against Its Peers

Peer comparison is a popular technique amongst analysts and investors for gauging how well a company is performing. A company's peer is another company that has similar characteristics to it, such as industry, size, age, and financial structure. You can find a company's peer group by reading its 10-K, proxy filing, or by doing your own similarity analysis.

According to Benzinga Pro, AGNC Investment's peer group average for short interest as a percentage of float is 7.13%, which means the company has less short interest than most of its peers.

Did you know that increasing short interest can actually be bullish for a stock? This post by Benzinga Money explains how you can profit from it.

This article was generated by Benzinga's automated content engine and was reviewed by an editor.

自上次报告以来,AGNC Investment(纽约证券交易所代码:AGNC)的空头浮动量已下降16.26%。该公司最近报告称,已卖空4225万股股票,占所有可供交易普通股的4.79%。根据其交易量,交易者平均需要2.07天才能填补空头头寸。

为什么空头利息很重要

空头利息是指已卖空但尚未被偿还或平仓的股票数量。卖空是指交易者出售不拥有的公司的股票,希望价格下跌。如果股票价格下跌,交易者通过卖空获利,如果股票价格上涨,他们将蒙受损失。

空头利率很重要,因为它可以作为指标 市场情绪 转向特定股票。空头利率的增加可能表明投资者变得更加看跌,而空头利率的减少可能表明他们变得更加看涨。

做空次数最多的股票清单

做空次数最多的股票清单

AGNC 投资短期利率图表(3 个月)

从上面的图表中可以看出,自上次报告以来,AGNC Investment卖空的股票百分比有所下降。这并不意味着该股将在短期内上涨,但交易者应意识到,做空的股票减少了。

将AGNC Investment的空头利率与同行进行比较

同行比较是分析师和投资者常用的衡量公司表现的技术。公司的同行是另一家具有相似特征的公司,例如行业、规模、年龄和财务结构。你可以通过阅读公司的10-k、代理文件或自己进行相似度分析来找到公司的同行群体。

根据Benzinga Pro的数据,AGNC Investment的同行平均空头利率占浮动量的百分比为7.13%,这意味着该公司的空头利率低于大多数同行。

你知道增加空头利息实际上可以看涨股票吗?Benzinga Money的这篇文章解释了如何从中获利。

本文由Benzinga的自动化内容引擎生成,并由编辑审阅。

做空次数最多的股票清单

做空次数最多的股票清单