These Analysts Boost Their Forecasts On Credo Technology Group After Upbeat Results

These Analysts Boost Their Forecasts On Credo Technology Group After Upbeat Results

Credo Technology Group Holding Ltd (NASDAQ:CRDO) reported better-than-expected second-quarter financial results and issued strong guidance on Monday.

Credo科技集團控股有限公司(NASDAQ:CRDO)週一發佈了好於預期的第二季度財務業績,併發出了強勁的指引。

Credo Technology reported quarterly earnings of 7 cents per share which beat the analyst consensus estimate of 5 cents per share. The company reported quarterly sales of $72.000 million which beat the analyst consensus estimate of $66.789 million.

Credo科技報告的每股季度收益爲7美分,超過了分析師共識預估的5美分。該公司季度銷售額爲7200萬美元,超過了分析師共識預估的6678.9萬美元。

Bill Brennan, Credo's President and Chief Executive Officer, stated, "In the fiscal second quarter ended November 2, 2024 Credo generated record revenue of $72.0 million, up 21% sequentially and 64% year over year. The second quarter was our most successful to date across our three main product lines and Credo delivered total product revenue of $69.1 million. For the past few quarters, we have anticipated an inflection point in our revenues during the second half of fiscal 2025. I am pleased to share that this turning point has arrived, and we are experiencing even greater demand than initially projected, driven by AI deployments and deepening customer relationships."

Credo的總裁兼首席執行官比爾·布倫南表示:「截至2024年11月2日的財政第二季度,Credo實現了7200萬的創紀錄營業收入,環比增長21%,同比增長64%。第二季度是我們在三大主要產品線中最成功的一段時間,Credo實現了總產品營業收入爲6910萬。在過去幾個季度,我們預計在2025財政年度下半年,營業收入將出現拐點。我很高興地告訴大家,這一轉折點已經到來,我們正在經歷比最初預期更大的需求,這得益於人工智能的部署和與客戶關係的加深。」

Credo Technology Group said it sees third-quarter revenue of $115 million to $125 million, versus market estimates of $86.042 million.

Credo科技集團表示,預計第三季度營業收入爲11500萬至12500萬美元,高於市場預估的8604.2萬美元。

Credo Technology Group shares gained 46.1% to trade at $69.82 on Tuesday.

Credo科技集團股價週二上漲46.1%,報69.82美元。

These analysts made changes to their price targets on Credo Technology Group following earnings announcement.

這些分析師在Credo科技集團發佈業績後對其價格目標進行了調整。

- Needham analyst Quinn Bolton maintained Credo Technology with a Buy and raised the price target from $43 to $70.

- B of A Securities analyst Vivek Arya upgraded the stock from Underperform to Buy and boosted the price target from $27 to $80.

- Barclays analyst Thomas O'Malley maintained Credo Technology with an Overweight rating and raised the price target from $32 to $80.

- Stifel analyst Tore Svanberg reiterated Credo Technology with a Buy and increased the price target from $50 to $75.

- Craig-Hallum analyst Richard Shannon maintained the stock with a Buy and raised the price target from $38 to $75.

- Needham分析師Quinn Bolton維持對Credo科技的買入評級,並將價格目標從43美元上調至70美元。

- 美國銀行證券分析師Vivek Arya將該股票評級從表現不佳升級至買入,並將價格目標從27美元提高到80美元。

- 巴克萊銀行分析師托馬斯·奧馬利維持了對Credo Technology的超配評級,並將價格目標從32美元提高至80美元。

- 斯蒂費爾分析師託雷·斯萬伯格重申了對Credo Technology的買入評級,並將價格目標從50美元提高至75美元。

- 克雷格-哈盧姆分析師理查德·香農維持了對該股的買入評級,並將價格目標從38美元提高至75美元。

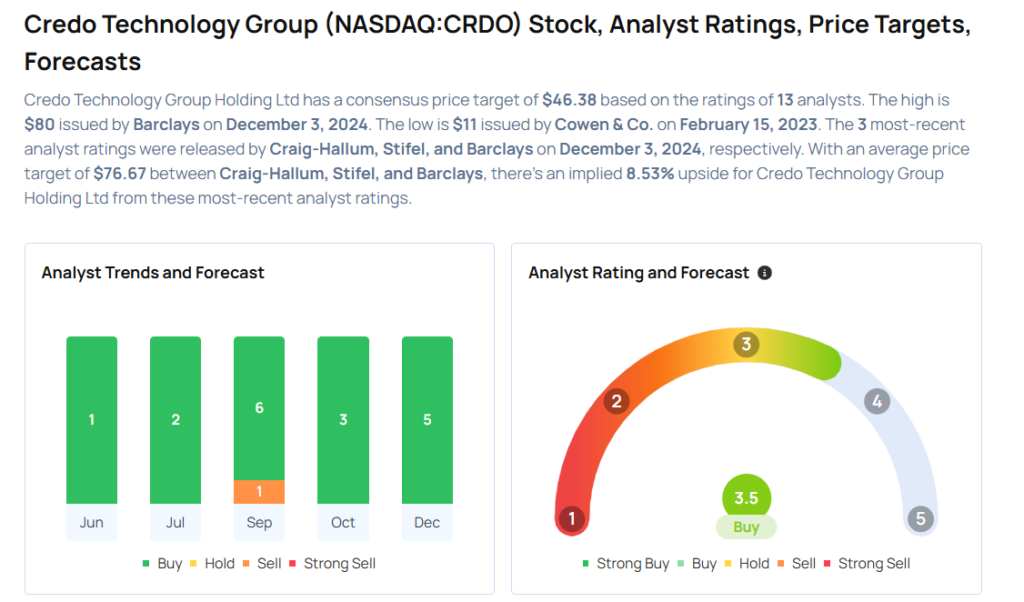

Considering buying CRDO stock? Here's what analysts think:

考慮購買CRDO股票嗎?這是分析師的看法:

Read This Next:

Read This Next:

- Jim Cramer Prefers FedEx Over This Delivery Giant That 'Screwed Up A Lot Of Holiday Seasons'

- 吉姆·克萊默更喜歡聯邦快遞,而不是這家曾經「搞砸了很多個假期季節」的快遞巨頭。

譯文內容由第三人軟體翻譯。

Credo Technology Group said it sees third-quarter revenue of $115 million to $125 million, versus market estimates of $86.042 million.

Credo Technology Group said it sees third-quarter revenue of $115 million to $125 million, versus market estimates of $86.042 million.