Broadcom's Options Frenzy: What You Need to Know

Broadcom's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on Broadcom.

有大量資金可供支配的鯨魚對博通採取了明顯看好的立場。

Looking at options history for Broadcom (NASDAQ:AVGO) we detected 20 trades.

查看博通(納斯達克:AVGO)的期權歷史,我們發現了20筆交易。

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 40% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,45%的投資者持有看好期權,40%持有看淡期權。

From the overall spotted trades, 12 are puts, for a total amount of $547,745 and 8, calls, for a total amount of $426,081.

從所有交易中發現,有12筆是看跌期權,總金額爲547,745美元,還有8筆看漲期權,總金額爲426,081美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $115.0 to $195.0 for Broadcom over the recent three months.

根據交易活動,看起來一些重要的投資者正在瞄準博通股票在過去三個月內的價格區間,範圍從115.0美元到195.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

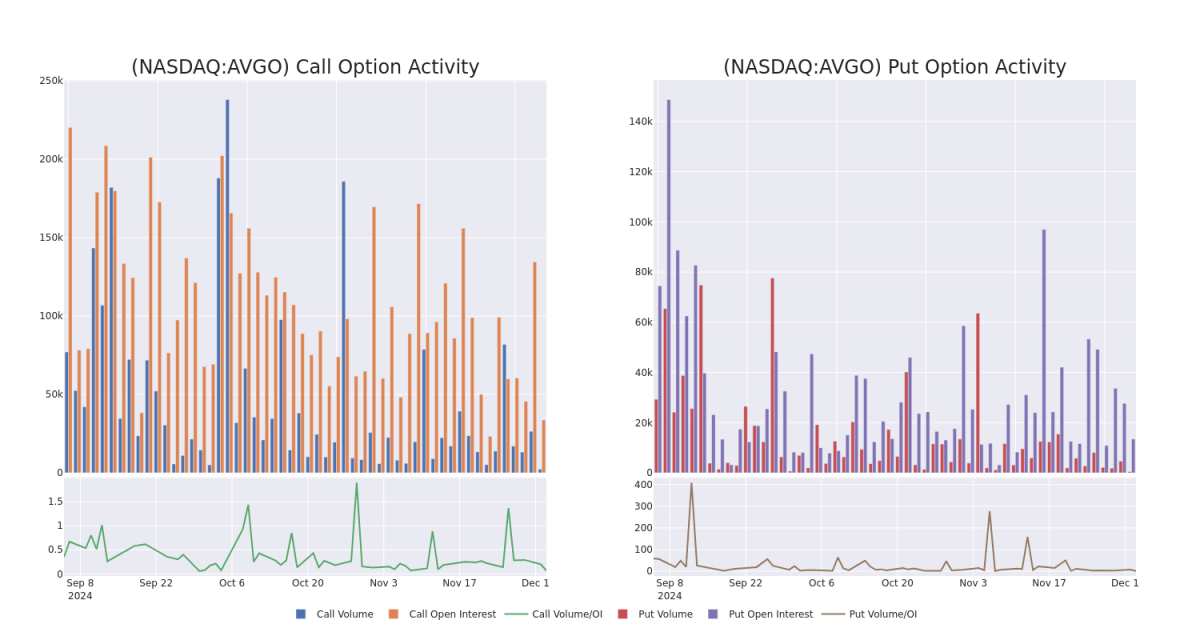

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Broadcom's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Broadcom's whale trades within a strike price range from $115.0 to $195.0 in the last 30 days.

在交易期權時,查看成交量和未平倉合約量是一個強有力的策略。這些數據可以幫助您追蹤特定執行價對應的博通期權的流動性和興趣。下面,我們可以觀察在過去30天內,針對博通所有跨越115.0美元至195.0美元執行價區間的大手交易中,看漲和看跌期權的成交量和開倉興趣的演變。

Broadcom 30-Day Option Volume & Interest Snapshot

博通30天期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | CALL | SWEEP | BULLISH | 01/17/25 | $9.95 | $9.9 | $9.95 | $168.00 | $99.5K | 2.9K | 120 |

| AVGO | PUT | TRADE | BULLISH | 01/16/26 | $5.7 | $5.5 | $5.55 | $115.00 | $83.2K | 1.8K | 150 |

| AVGO | CALL | SWEEP | BEARISH | 12/06/24 | $8.15 | $7.95 | $7.96 | $160.00 | $79.5K | 1.3K | 238 |

| AVGO | PUT | TRADE | BEARISH | 04/17/25 | $26.05 | $25.8 | $26.05 | $185.00 | $67.7K | 378 | 26 |

| AVGO | CALL | SWEEP | NEUTRAL | 12/27/24 | $9.35 | $9.3 | $9.3 | $165.00 | $60.4K | 1.0K | 85 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 博通 | 看漲 | SWEEP | BULLISH | 01/17/25 | $9.95 | $9.9 | $9.95 | $168.00 | 99.5K美元 | 2.9K | 120 |

| 博通 | 看跌 | 交易 | BULLISH | 01/16/26 | $5.7 | $5.5 | $5.55 | $115.00 | $83.2K | 1.8K | 150 |

| 博通 | 看漲 | SWEEP | 看淡 | 12/06/24 | $8.15 | $7.95 | $7.96 | $160.00 | $79.5K | 1.3千 | 238 |

| 博通 | 看跌 | 交易 | 看淡 | 04/17/25 | $26.05 | $25.8 | $26.05 | $185.00 | $67.7千美元 | 378 | 26 |

| 博通 | 看漲 | SWEEP | 中立 | 12/27/24 | $9.35 | $9.3 | $9.3 | $165.00 | $60.4千 | 1.0千 | 85 |

About Broadcom

關於博通

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

博通是全球第六大半導體公司,已擴展到各種軟件業務,年收入超過300億美元。它在無線、網絡、寬帶、存儲和工業市場銷售17個核心半導體產品系列。它主要是一家半導體設計公司,但擁有一些內部製造能力,例如爲蘋果iPhone銷售的最佳FBAR濾波器。在軟件方面,它向大型企業、金融機構和政府銷售虛擬化、基礎設施和安全軟件。博通是合併的產物。其業務是由之前的公司如傳統的博通和芯訊科技以及Brocade、CA技術和賽門鐵克在軟件方面的業務組成的。

Having examined the options trading patterns of Broadcom, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了博通的期權交易模式之後,我們現在將直接關注該公司。這種轉變使我們能夠深入了解其當前的市場地位和表現。

Current Position of Broadcom

博通的當前持倉

- Trading volume stands at 1,911,348, with AVGO's price up by 0.42%, positioned at $167.22.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 9 days.

- 交易成交量達到1,911,348,AVGO的價格上漲了0.42%,定位在$167.22。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計在9天內公佈業績。

What Analysts Are Saying About Broadcom

分析師對博通的看法

1 market experts have recently issued ratings for this stock, with a consensus target price of $200.0.

1位市場專家最近爲這支股票發出了評級,目標價爲200.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from UBS persists with their Buy rating on Broadcom, maintaining a target price of $200.

一位從事期權交易20年的專業交易員揭示了他的一行圖表技術,該技術可顯示何時買入和賣出。跟隨他的交易,這些交易平均每20天盈利27%。點擊這裏獲取訪問權限。瑞銀分析師堅持對博通給予買入評級,並維持目標價爲200美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Broadcom options trades with real-time alerts from Benzinga Pro.

期權交易可能存在更高的風險和潛在的回報。精明的交易者通過不斷地學習、調整策略、監測多個因子並密切關注市場動向來管理這些風險。通過Benzinga Pro實時提醒了解最新的博通期權交易信息。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 12 are puts, for a total amount of $547,745 and 8, calls, for a total amount of $426,081.

From the overall spotted trades, 12 are puts, for a total amount of $547,745 and 8, calls, for a total amount of $426,081.