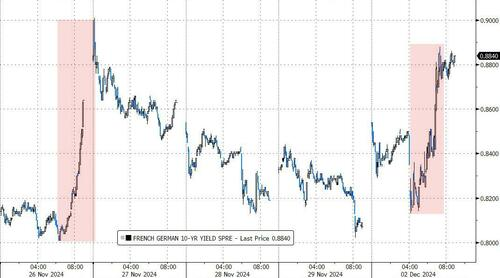

On the first trading day of December, Cyber Monday shopping amounts will break records, with the Nasdaq and Chinese concept stocks rising about 1%, and the chip index leading with a 2.6% increase, while the Dow fell from its peak. Tesla soared over 4% during the day, intel rose nearly 6% before turning negative, super micro computer surged nearly 29%, and Xpeng autos climbed over 5%, but Li Auto dropped nearly 4%. The French government faces a vote of no confidence, causing French stocks to briefly fall over 1%, and the spread between French and German government bond yields approached the widest in twelve years. US henry hub natural gas fell over 4%, the indian rupee hit a new low, and the offshore yuan dropped over 400 points, falling below 7.29 yuan.

The market expects the European Central Bank and the Federal Reserve to accelerate rate cuts. The U.S. November ISM manufacturing data remains in contraction but exceeded expectations, driven by new orders returning to expansion. The Eurozone's services and manufacturing November PMI both contracted, with new orders declining for six consecutive months, and corporate confidence at its lowest in a year.

In 2024, voting committee member and Atlanta Fed President Bostic stated an open attitude towards policy. Fed Governor Waller leans towards supporting a rate cut in December, but is concerned about inflation progress. The market expects the probability of a 25 basis point rate cut by the Fed in December to rise from 66% to 74.5%, while a 31 basis point rate cut by the ECB is anticipated, with a total reduction of 145 basis points by the end of 2025.

French Prime Minister Barnier has forced the approval of the budget proposal without going through parliament, with the far-right National Rally and left-wing parties both threatening a vote of no confidence, making the dissolution of the French government seem likely. French stocks and the euro both briefly fell over 1%, as investors flocked to German bonds for safety, widening the French-German 10-year bond yield spread by 8 basis points to 89 basis points, the largest increase since June, nearing twelve years' widest.

French Prime Minister Barnier has forced the approval of the budget proposal without going through parliament, with the far-right National Rally and left-wing parties both threatening a vote of no confidence, making the dissolution of the French government seem likely. French stocks and the euro both briefly fell over 1%, as investors flocked to German bonds for safety, widening the French-German 10-year bond yield spread by 8 basis points to 89 basis points, the largest increase since June, nearing twelve years' widest.

Bank of Japan Governor Ueda Kazu says that interest rate hikes are 'near,' with overnight index swaps showing a 60% probability of a rate increase in Japan in December, and a nearly 90% chance of a hike before the end of January next year.

On the first trading day of December, the Nasdaq and S&P reached all-time highs, while the Dow Jones turned negative after surpassing 45,000 points. Tech stocks and chip stocks generally rose, with Apple hitting new highs, and the China concept index up about 1%. Tesla rose over 4% at its peak, and Intel rose over 5.9% before closing down, while Super Micro Computer briefly rose over 35%.

Among the three major U.S. stock indices, only the Dow Jones fell. The S&P 500 index rose by 14.77 points, an increase of 0.24%, closing at 6047.15 points. The Dow Jones, closely related to the economic cycle, dropped by 128.65 points, a decrease of 0.29%, closing at 44782.00 points. The Nasdaq, which is heavily populated by tech stocks, rose by 185.78 points, an increase of 0.97%, closing at 19403.95 points. The Nasdaq 100 index rose by 1.12%. The Nasdaq Technology Market Capitalization Weighted Index (NDXTMC), which measures the performance of Nasdaq 100 technology component stocks, rose by 1.61%. The Russell 2000 small cap stock index, which is more sensitive to economic cycles, fell by 0.02%. The VIX volatility index fell by 1.26%, closing at 13.34.

U.S. stock industry ETFs had mixed performances. The semiconductor ETF rose by 2.37%, the global technology stock index ETF rose by 1.19%, the technology industry ETF, internet stock index ETF, and consumer discretionary ETF rose by about 0.9%, while the banking ETF and regional banking ETF fell by about 0.9%, and the financial sector ETF and energy sector ETF fell by about 1%, with the utilities ETF dropping by 2.15%.

Among the 11 sectors of the S&P 500 index, most fell while few rose. The telecommunications sector rose by 1.45%, the consumer discretionary sector rose by 1.06%, the information technology/technology sector rose by 1.03%, the consumer staples sector fell by 0.10%, the medical care sector fell by 0.13%, the materials sector fell by 0.20%, the industrial sector fell by 0.66%, the energy sector fell by 0.85%, the financial sector fell by 0.90%, the real estate sector fell by 1.44%, and the utilities sector fell by 2.08%.

In investment research strategy, morgan stanley predicts that the S&P 500 index is expected to further climb to 6200 to 6300 points by the end of the year, an increase of 3%-4% from last Friday's 6032 points. Analyst Andrew Tyler mentioned in the report that positive macro conditions, earnings growth, and support from the Federal Reserve are reasons to maintain a bullish outlook, and suggested leveraging market momentum to recommend value stocks and cyclical sectors, such as banks, auto manufacturers, transportation companies, and the Russell 2000 small cap index, while continuing to invest in seven major technology stocks in the technology and telecommunications fields, datacenters, and semiconductors.

The "Technology Seven Sisters" saw broad gains. Tesla rose by 3.46%, beginning the rollout of the latest version FSD V13.2. Meta Platforms rose by 3.22%, Microsoft rose by 1.78%, Google A rose by 1.5%, and Amazon rose by 1.36%. Apple rose by 0.95%, but ubs group indicated weak demand for Apple's AI-enabled phones, with little market interest. Nvidia rose by 0.27%.

Chip stocks are leading the way. The phlx semiconductor index closed up 2.61%. The industry etf SOXX rose 2.63%. Nvidia's 2x leveraged ETF rose 0.38%. Wolfspeed rose 15.87%, marvell technology rose 4.5%, asml holding rose 3.62%, kla corp rose 2.94%, applied materials rose 4.9%. Taiwan semiconductor ADR rose 5.27%. Broadcom rose 2.73%, qualcomm rose 2.84%, on semiconductor rose 3.98%, arm holdings rose 4.51%. AMD rose 3.56%. Micron technology rose 0.61%. Intel fell 0.5% after rising over 5.9%, the board of directors is dissatisfied with the work progress, and the intel CEO chose to retire after facing pressure.

AI concept stocks showed mixed results. SoundHound AI, an AI voice company held by Nvidia, fell 3.87%, BigBear.ai fell 3.93%, dell technologies fell 1.37%, c3.ai fell 2.66%, palantir fell 1.03%, oracle fell 1.86%, snowflake fell 1.36%, BullFrog AI fell 1.86%, while Serve Robotics rose 5.17%, crowdstrike rose 0.24%, super micro computer rose 28.68%, as the company will replace its CFO, and the special committee found no misconduct.

Most chinese concept stocks rose. The nasdaq golden dragon china index closed up 0.98%. The china technology index ETF (CQQQ) closed up 1.04%, the chinese concept internet index ETF (KWEB) closed up 1.14%, and the ftse china 3x leveraged ETF (YINN) closed up 0.83%. The ftse A50 futures index closed up 0.08%, settling at 13274.000 points.

Among popular chinese concept stocks, miniso rose 14.04%. daqo new energy rose 6.94%, xpeng motors rose 5.31%, bilibili rose 3.91%, meituan ADR rose 3.21%, zhihu rose 3.06%, new oriental rose 2.74%, pdd holdings rose 2.51%, zeekr rose 2.26%, tiger brokers rose 1.9%, baidu rose 1.73%, and baidu's 'robo taxi' was approved for the first automated driving license in hong kong and has begun global business expansion. fangdd network rose 0.05%, netease rose 1.59%, trip.com rose 0.93%, jd.com rose 0.24%, while nio fell 1.79%, vipshop fell 0.51%, ideal automobiles fell 3.72%, and alibaba fell 1.63%.

Bitcoin futures once fell below $95,000, with crypto concept stocks mostly falling. MARA dropped by 6.53%, Bitdeer Technologies fell by 3.01%, Canaan fell by 1.89%, and Riot Platforms fell by 4.35%. Microstrategy, a major holder of Bitcoin targeted for short selling by Citron, fell by 1.85%. The latest filings show that since November 11th, MSTR has purchased over $13.5 billion worth of Bitcoin, currently holding about $38 billion in Bitcoin. Mercurity Fintech fell by 11.3%, while the 'demon stock' Ideanomics dropped over 81.8% initially but closed up by 36.36%, and the crypto exchange giant Coinbase closed up by 2.09%.

Bank stocks mostly declined. The dow jones KBW regional bank index fell 0.58%. The phlx bank index fell 1.22%. Among the major Wall Street banks, jpmorgan and wells fargo both fell at least 1.17%, while bank of america, goldman sachs, and morgan stanley fell around 1% at most, while citigroup rose over 0.7%.

Among other key stocks: (1) Stellantis, the third largest traditional car manufacturer globally, saw its European and U.S. stocks drop more than 6% following news that the company's chief executive officer resigned. (2) Disney fell 0.26%, with Disney's movie "Moana 2" earning $0.221 billion in North American weekend box office during the Thanksgiving long weekend (five days), setting a historical record for the same period.

The turmoil in the French political landscape depressed European stocks, leading to a collective lower opening but ultimately closing higher; the French stock market opened down over 1.2% but surprisingly closed up, while the German stock index fell 0.12% before closing about 1.6% higher, creating a historical new high.

The pan-European STOXX 600 index closed up 0.66%, at 513.61 points. The eurozone STOXX 50 index closed up 0.88%. The FTSE pan-European top 300 index closed up 0.71%.

Among individual stocks, the wage conflict escalated as the German union announced that about 0.066 million Volkswagen workers participated in a strike, leading to Volkswagen’s stock falling 0.07%.

The Italian FTSE MIB index closed up 0.21%. The German DAX 30 index closed up 1.57%. The French CAC 40 index closed up 0.02%. The uk ftse100 index closed up 0.31%. The Spanish IBEX 35 index closed up 0.81%. The Netherlands AEX index closed up 0.67%.

Federal Reserve Governor Waller supports a rate cut in December, with two-year U.S. Treasury yield growth narrowing. The financing cost for the French government shows a V-shaped reversal, with German bond yields generally falling more than 5 basis points, as investors concerned about the stability of the French government seek refuge in German bonds.

U.S. Treasuries: Near the end of trading, the u.s. 10-year benchmark treasury yield rose by 1.54 basis points to 4.1839%. At 23:04 Beijing time, it refreshed the daily high to 4.2420%, then quickly fell, refreshing the daily low at 00:32 to 4.1724%. The two-year U.S. Treasury yield rose by 2.25 basis points to 4.1734%. Waller stated that "if the data is as expected, it leans towards supporting a rate cut in December. If the data is unexpected, then consider holding steady," after which it dropped from 4.2% and refreshed the daily low.

European bonds: At the close of the European market, the benchmark 10-year treasury notes yield in the eurozone fell by 5.4 basis points, marking a continuous decline for eight trading days, reported at 2.034%. The 2-year German bond yield fell by 5.3 basis points, at 1.899%. The UK 10-year treasury notes yield fell by 2.9 basis points. The 2-year UK bond yield fell by 2.6 basis points. The French 10-year treasury notes yield rose by 2.2 basis points, reported at 2.918%, initially rising, then falling, and closing with a rise again. The Italian 10-year treasury notes yield fell by 1.0 basis points.

The U.S. ISM manufacturing index exceeded expectations, helping push the USD index up more than 0.6%. Rate hike expectations pushed the yen towards 149, and market worries about stagnation in the eurozone and the collapse of the French government caused the euro to drop more than 1.1% at its lowest point. The offshore yuan fell more than 460 points, breaching 7.29 yuan. Bitcoin futures fell towards $0.095 million during trading, while XRP rose over 85% in the last five calendar days.

USD: The USD index DXY rose by 0.62%, reported at 106.388 points, opening higher throughout the day and continuing to rise steadily, approaching the 107-point mark at 23:47 Beijing time. Bloomberg's USD index rose by 0.49%.

Non-USD currencies: The euro against the dollar fell by 0.73% to 1.05, having dropped to 1.0461 at 00:04 Beijing time, testing the November 22 bottom of 1.0335. The British pound against the dollar fell by 0.61%, at 1.2656. The dollar against the Swiss franc rose by 0.62%, at 0.8864. Among commodity currencies, the Australian dollar against the U.S. dollar fell by 0.53%, the New Zealand dollar against the U.S. dollar fell by 0.47%, and the dollar against the Canadian dollar rose by 0.28%. The Swedish krona against the U.S. dollar fell by 0.86%, and the Norwegian krone against the U.S. dollar fell by 0.71%.

Yen: The yen closed at 0.13% against the US dollar, at 149.58 yen, with a daily trading range of 150.75-149.08 yen.

Offshore RMB (CNH): The offshore RMB (CNH) closed down 373 points against the US dollar, at 7.2864 yuan, trading overall in the range of 7.2495-7.2956 yuan.

Cryptos: The market's largest leading bitcoin futures closed down 2.00%, at $96,400.00, refreshing the daily low to $95,270.00 at 01:59 Bejing time. The second largest ethereum closed up 1.07%, at $3,670.50, after refreshing the daily high to $3,816.50 at 11:03 and then fluctuating downwards. XRP (spot) rose 26.9% in the last 24 hours, up over 92.85% since trading ended on November 28.

Boosted by Chinese manufacturing data and escalating tensions in the Middle East, oil prices hit a daily high on Monday, rising about 1.5%. However, the strengthening dollar and uncertainty over OPEC+'s oil production policy dragged oil prices down during the day, ultimately closing almost flat. Gas storage ahead of the winter heating season in the USA reached its highest level since 2016, and US natural gas futures fell over 4%.

US oil: WTI January crude oil futures closed up $0.10, an increase of nearly 0.15%, at $68.10 per barrel. US oil was up over 1.6% pre-market, exceeding $69.10, and during US midday trading, it fell over 0.4% to around $67.70.

Brent oil: February Brent crude oil futures closed down $0.01, a decrease of 0.01%, at $71.83 per barrel. Brent oil was up nearly 1.5% pre-market, approaching $72.90, and during US midday trading, it fell over 0.4% to around $71.50.

In terms of news, OPEC crude oil production has increased for the second consecutive month, with an average output of 27.02 million barrels per day in November, a month-on-month increase of 0.12 million barrels per day. The recovery in Libyan production, following the resolution of its political crisis, accounted for the major increase, while Iraq has reduced production for the third consecutive month under OPEC pressure, still slightly exceeding its quota. The UAE's daily production increased to 3.26 million barrels, far exceeding the limits.

Natural Gas: NYMEX January U.S. natural gas futures closed down 4.46%, reported at 3.2130 dollars per million British thermal units. Europe's benchmark Dutch TTF natural gas futures increased by 2.45%, reported at 48.460 euros per megawatt hour. ICE UK natural gas futures rose by 1.20%, reported at 121.000 pence per kilocalorie.

The U.S. dollar and U.S. bond yields have risen together, leading to widespread declines in precious metals and London industrial metals. Spot gold dropped nearly 1.2%, weakening the upward momentum of the previous four trading days, but geopolitical uncertainty partially narrowed the decline.

Gold: COMEX gold futures for February fell by 0.73% at the close, reported at 2661.60 dollars per ounce. Spot gold dropped nearly 1.2% during the day, approaching 2620 dollars, and closed down 0.15%, reported at 2639.08 dollars per ounce.

Silver: COMEX silver futures for March fell by 0.49% at the close, reported at 30.955 dollars per ounce. Spot silver dropped nearly 1.8% during the day, approaching 30 dollars, and closed down 0.38%, reported at 30.5098 dollars per ounce.

London industrial metals fell across the board, with nickel and tin dropping over 1%: Copper in London fell by 18 dollars, reported at 8992 dollars per ton. COMEX copper futures rose 0.04%, reported at 4.1415 dollars per pound. Zinc in London fell by 26 dollars, reported at 3076 dollars per ton. Aluminum in London fell by 4 dollars, reported at 2590 dollars per ton. Lead in London rose by 4 dollars, reported at 2076 dollars per ton. Nickel in London fell by 210 dollars, a decline of 1.32%, reported at 15693 dollars per ton. Tin in London fell by 340 dollars, declining over 1.17%, reported at 28573 dollars per ton. Cobalt in London remained steady, reported at 24300 dollars per ton.

Robusta coffee fell by about 11%, while New York cocoa once surged above $9,500, setting a new historical high.

Editor/Lambor

法国总理巴尼耶绕过议会强行批准预算案,极右翼国民联盟和左翼政党均威胁启动不信任投票,法国政府解散几成定局。法股和欧元均一度跌超1%,投资者涌入德债避险,法国-德国10年期国债利差一度扩大8个基点至89个基点,创6月以来最大升幅,接近十二年最阔。

法国总理巴尼耶绕过议会强行批准预算案,极右翼国民联盟和左翼政党均威胁启动不信任投票,法国政府解散几成定局。法股和欧元均一度跌超1%,投资者涌入德债避险,法国-德国10年期国债利差一度扩大8个基点至89个基点,创6月以来最大升幅,接近十二年最阔。