Top 3 Energy Stocks That Could Blast Off In December

Top 3 Energy Stocks That Could Blast Off In December

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

能源板塊中超賣的股票爲買入低估公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

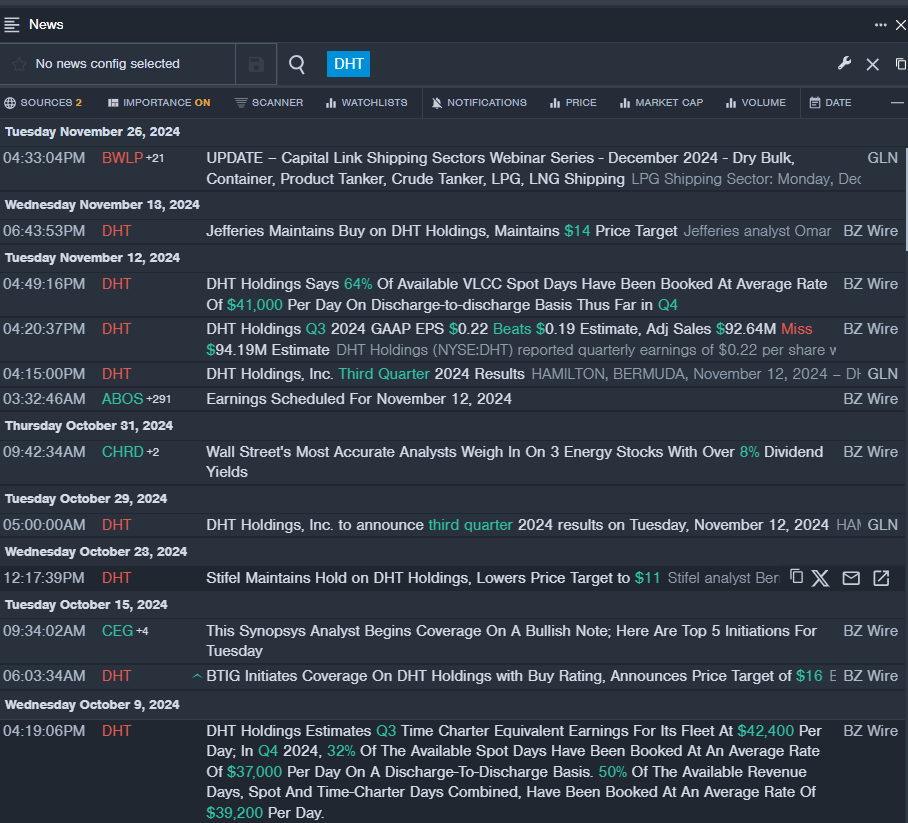

DHT Holdings Inc (NYSE:DHT)

dht控股有限公司(紐交所:DHT)

- On Nov. 12, DHT Holdings reported quarterly earnings of 22 cents per share which beat the analyst consensus estimate of 19 cents per share. The company's stock fell around 6% over the past five days and has a 52-week low of $9.28.

- RSI Value: 28.36

- DHT Price Action: Shares of DHT fell 2.2% to close at $9.42 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest DHT news.

- 11月12日,dht控股報告季度每股收益爲22美分,超過了分析師共識預期的19美分。該公司的股票在過去五天裏下跌了約6%,並且52周低點爲9.28美元。

- 相對強弱指標值:28.36

- dht價格走勢:dht的股票在週五下跌2.2%,收於9.42美元。

- Benzinga Pro的實時新聞提醒了最新的DHt消息。

Frontline Plc (NYSE:FRO)

frontline plc (紐交所:FRO)

- On Nov. 27, Frontline posted mixed third-quarter results. Revenue rose 29.9% year-over-year to $490.4 million, surpassing the $361.42 million consensus. "The third quarter of 2024 performed in line with seasonal expectations, as oil demand slowed over the summer months and domestic demand by oil exporting countries in the Middle East increased. We continue to sail in a troubled geopolitical landscape and with lower year-on-year demand in Asia, and especially China, the tanker markets have yet to experience the seasonal upswing into winter. The increase in sanctioned oil trade and movement of illicit barrels have negatively impacted our trade environment," commented Lars H. Barstad, Chief Executive Officer of Frontline Management AS. The company's stock fell around 16% over the past five days and has a 52-week low of $16.10.

- RSI Value: 21.81

- FRO Price Action: Shares of Frontline fell 3.6% to close at $16.18 on Friday.

- Benzinga Pro's charting tool helped identify the trend in FRO stock.

- 11月27日,frontline公佈了第三季度的混合業績。營業收入同比增長29.9%,達到49040萬,超過了36142萬的共識。"2024年第三季度的表現符合季節性預期,因爲夏季油需求放緩,來自中東的石油出口國的國內需求增加。我們繼續在動盪的地緣政治環境中航行,亞洲特別是中國的年度需求有所下降,油輪市場尚未經歷進入冬季的季節性上漲。受制裁的石油貿易和非法原油交易的增加對我們的交易環境產生了負面影響," front line管理公司的首席執行官Lars H. Barstad評論道。該公司的股票在過去五天內下跌了大約16%,並在52周內達到16.10美元的低點。

- 相對強弱指數值:21.81

- FRO價格走勢:週五frontline的股票下跌3.6%,收於16.18美元。

- Benzinga Pro的圖表工具有助於識別FRO股票的趨勢。

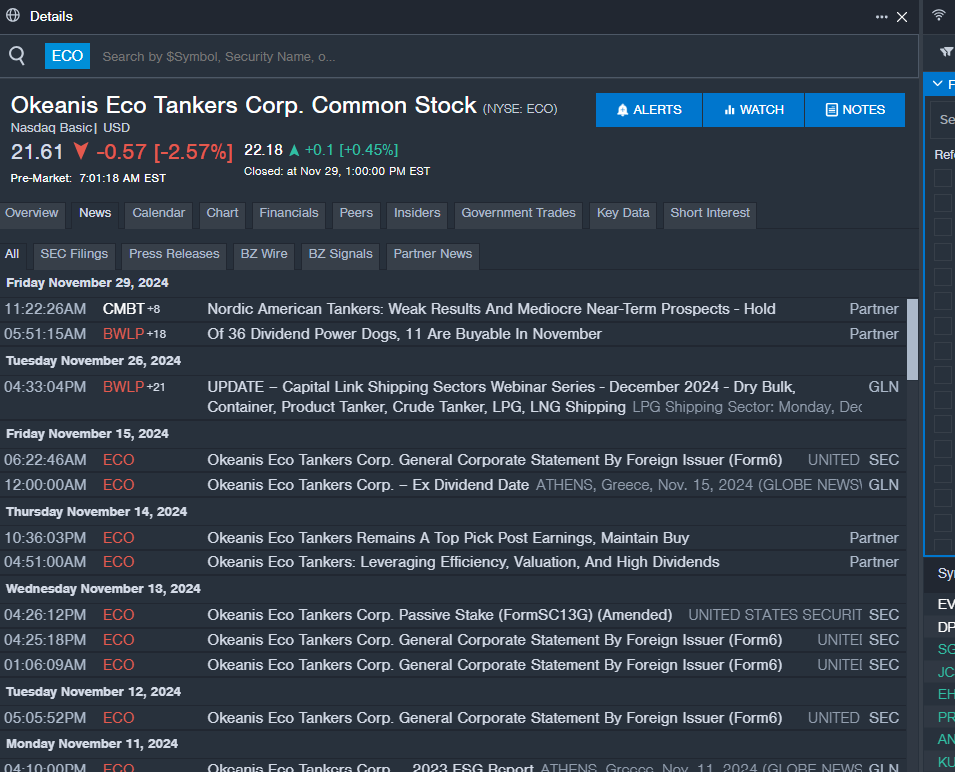

Okeanis Eco Tankers Corp. (NYSE:ECO)

Okeanis Eco Tankers Corp. (紐交所:ECO)

- On Nov. 8, Okeanis Eco Tankers reported quarterly earnings of 45 cents per share which beat the analyst consensus estimate of 9 cents per share. The company's stock fell around 13% over the past month and has a 52-week ow of $20.95.

- RSI Value: 27.27

- ECO Price Action: Shares of Okeanis Eco Tankers gained 0.5% to close at $22.18 on Friday.

- Benzinga Pro's news feature alerted to latest ECO news.

- 在11月8日,Okeanis Eco Tankers報告季度每股盈利45美分,超過分析師預期的每股9美分。該公司的股票在過去一個月下跌了約13%,並且52周最低爲20.95美元。

- RSI數值:27.27

- ECO價格動態:Okeanis Eco Tankers的股票在週五上漲了0.5%,收於22.18美元。

- Benzinga Pro的資訊功能提醒了最新的ECO資訊。

Read More:

閱讀更多:

- Top 3 Defensive Stocks You'll Regret Missing In November

- 11月你會後悔錯過的前三隻防禦性股票

譯文內容由第三人軟體翻譯。