Spotlight on AbbVie: Analyzing the Surge in Options Activity

Spotlight on AbbVie: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bearish stance on AbbVie (NYSE:ABBV).

拥有大量资金的投资者对艾伯维公司(纽交所:ABBV)持看淡态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ABBV, it often means somebody knows something is about to happen.

无论这些人是机构还是富裕个人,我们并不清楚。但是,当ABBV发生如此重大的事件时,往往意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 8 uncommon options trades for AbbVie.

今天,Benzinga的期权扫描器发现了8笔艾伯维公司的非常规期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 25% bullish and 75%, bearish.

这些大资金交易者的总体情绪在25%的看好和75%的看淡之间分隔。

Out of all of the special options we uncovered, 2 are puts, for a total amount of $212,565, and 6 are calls, for a total amount of $256,922.

在我们发现的所有特殊期权中,有2个看跌期权,总金额为$212,565,有6个看涨期权,总金额为$256,922。

What's The Price Target?

目标价是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $175.0 and $190.0 for AbbVie, spanning the last three months.

经过评估交易量和未平仓合约后,显而易见,主要市场推动者将焦点放在艾伯维公司的价格区间$175.0和$190.0之间,这跨越了过去三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

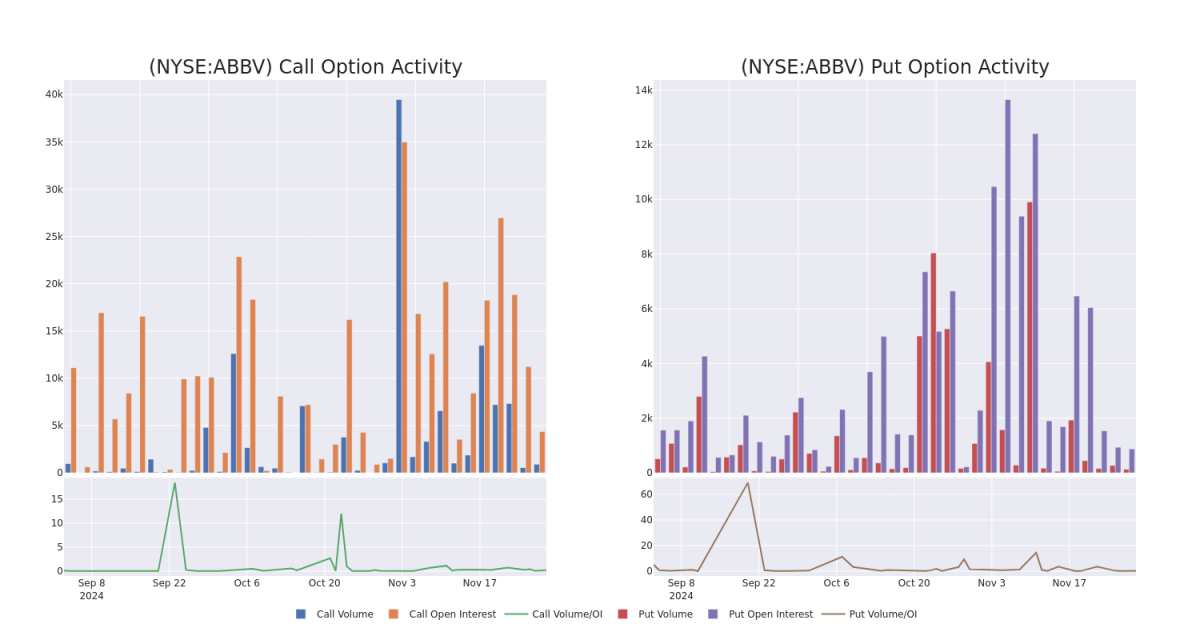

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for AbbVie's options for a given strike price.

这些数据可以帮助您跟踪AbbVie期权的流动性和兴趣,以获得给定的行权价格。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AbbVie's whale activity within a strike price range from $175.0 to $190.0 in the last 30 days.

在下面,我们可以观察到在过去30天内,所有艾伯维公司的大宗交易活动的成交量和未平仓合约的演变,分别涵盖了从$175.0到$190.0的行权价格范围内的看涨期权和看跌期权。

AbbVie Option Activity Analysis: Last 30 Days

AbbVie期权活动分析:最近30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | PUT | SWEEP | BEARISH | 01/16/26 | $20.1 | $20.0 | $20.05 | $190.00 | $174.4K | 664 | 87 |

| ABBV | CALL | SWEEP | BULLISH | 12/20/24 | $1.93 | $1.66 | $1.66 | $187.50 | $70.0K | 447 | 431 |

| ABBV | CALL | SWEEP | BEARISH | 02/21/25 | $9.6 | $9.35 | $9.35 | $180.00 | $44.8K | 1.8K | 58 |

| ABBV | CALL | SWEEP | BEARISH | 02/21/25 | $9.85 | $9.7 | $9.7 | $180.00 | $42.6K | 1.8K | 78 |

| ABBV | CALL | TRADE | BEARISH | 11/29/24 | $9.4 | $7.55 | $8.26 | $175.00 | $41.3K | 481 | 77 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | 看跌 | SWEEP | 看淡 | 01/16/26 | $20.1 | $20.0 | $20.05 | $190.00 | 174.4K美元 | 664 | 87 |

| ABBV | 看涨 | SWEEP | BULLISH | 12/20/24 | $1.93 | $1.66 | $1.66 | 187.50美元 | $70.0K | 447 | 431 |

| ABBV | 看涨 | SWEEP | 看淡 | 02/21/25 | 9.6 | $9.35 | $9.35 | $180.00 | $44.8千 | 1.8K | 58 |

| ABBV | 看涨 | SWEEP | 看淡 | 02/21/25 | $9.85 | 9.7 | 9.7 | $180.00 | $42.6K | 1.8K | 78 |

| ABBV | 看涨 | 交易 | 看淡 | 11/29/24 | $9.4 | $7.55 | $8.26 | $175.00 | $41.3K | 481 | 77 |

About AbbVie

关于艾伯维公司

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

AbbVie是一家药品公司,其在免疫学(包括Humira、Skyrizi和Rinvoq)和肿瘤学(包括Imbruvica和Venclexta)方面拥有强大的业务。该公司于2013年初从Abbott分拆而来。2020年收购雅培使其在美容业务(包括Botox)中新增了一些产品和药品。

Present Market Standing of AbbVie

艾伯维公司目前市场地位

- With a volume of 2,710,151, the price of ABBV is down -0.11% at $182.88.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 63 days.

- ABBV的成交量为2,710,151,价格下跌-0.11%,报$182.88。

- RSI指标暗示基础股票可能接近超卖。

- 下一次财报预计在63天发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

译文内容由第三方软件翻译。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ABBV, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ABBV, it often means somebody knows something is about to happen.