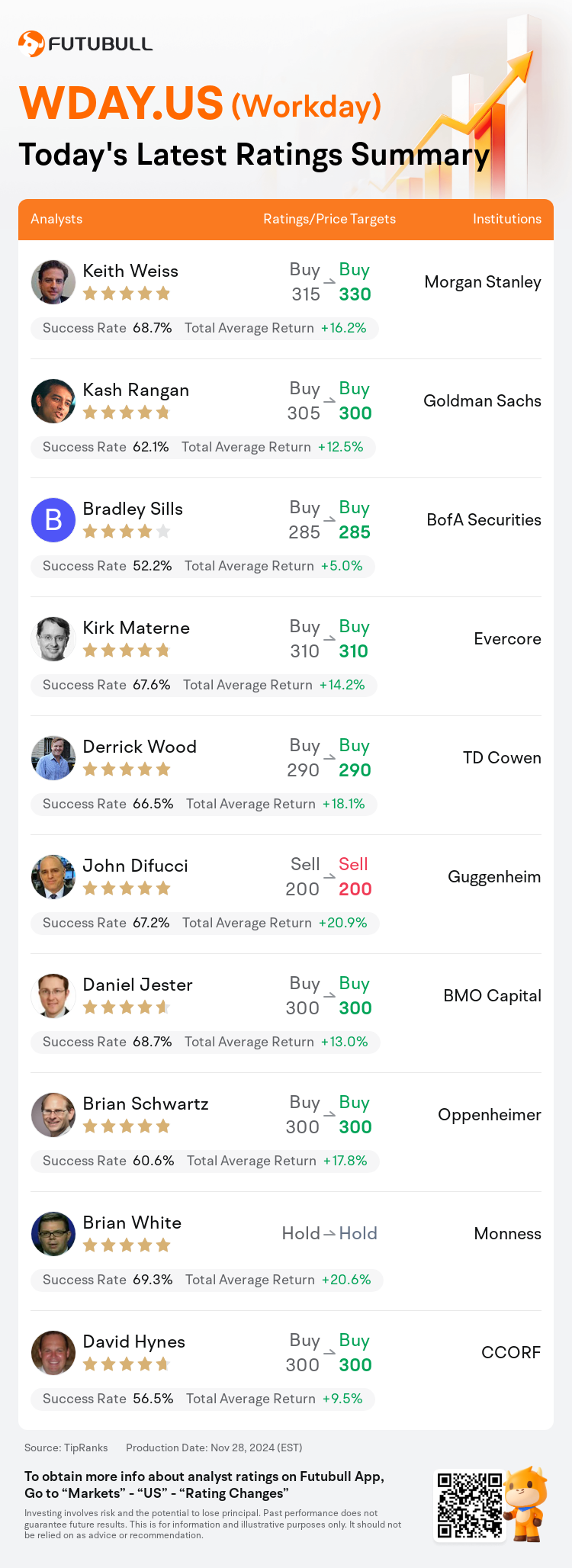

On Nov 28, major Wall Street analysts update their ratings for $Workday (WDAY.US)$, with price targets ranging from $200 to $330.

Morgan Stanley analyst Keith Weiss maintains with a buy rating, and adjusts the target price from $315 to $330.

Goldman Sachs analyst Kash Rangan maintains with a buy rating, and adjusts the target price from $305 to $300.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $285.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $285.

Evercore analyst Kirk Materne maintains with a buy rating, and maintains the target price at $310.

TD Cowen analyst Derrick Wood maintains with a buy rating, and maintains the target price at $290.

Furthermore, according to the comprehensive report, the opinions of $Workday (WDAY.US)$'s main analysts recently are as follows:

Workday management's recent adjustment of their medium-term outlook from the previously stated 15% for FY26/FY27 to a 14% subscription revenue growth for FY26 may lead to a considerable loss of investor confidence, supporting the bearish perspective. Nevertheless, the inherent strength of the core business and the potential for up-selling from an expanding range of solutions are believed to be undervalued at the present market prices.

Workday's Q4 and FY26 forecasts were found unsatisfactory, which can be largely clarified by some unique factors. Disregarding these factors, a continued growth trajectory in the mid-teens and a steady 200 basis point annual margin improvement remain intact. Despite a reduced outlook for FY26, it's assessed that with the market's reaction post-disclosure, the risk in the financial model has significantly diminished against the backdrop of an anticipated 14% growth in FY26.

The company's Q3 report was seen as neutral for the stock as the solid performance was balanced by somewhat weaker future guidance, according to an analyst. The negative reaction in after-hours trading was likely influenced by another reduction in the company's outlook. The belief is that this may represent a nearing low point in forecasts.

Workday is managing through a challenging yet improving economic climate, tempering its top-line growth expectations. It is now anticipating a 14% growth in subscription revenue for the next fiscal year, slightly lower than its prior forecast of 15%. The company's resilience, supported by its diverse product portfolio and customer base, positions it to sustain a medium-term target of 15% in subscription revenue growth annually.

Here are the latest investment ratings and price targets for $Workday (WDAY.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

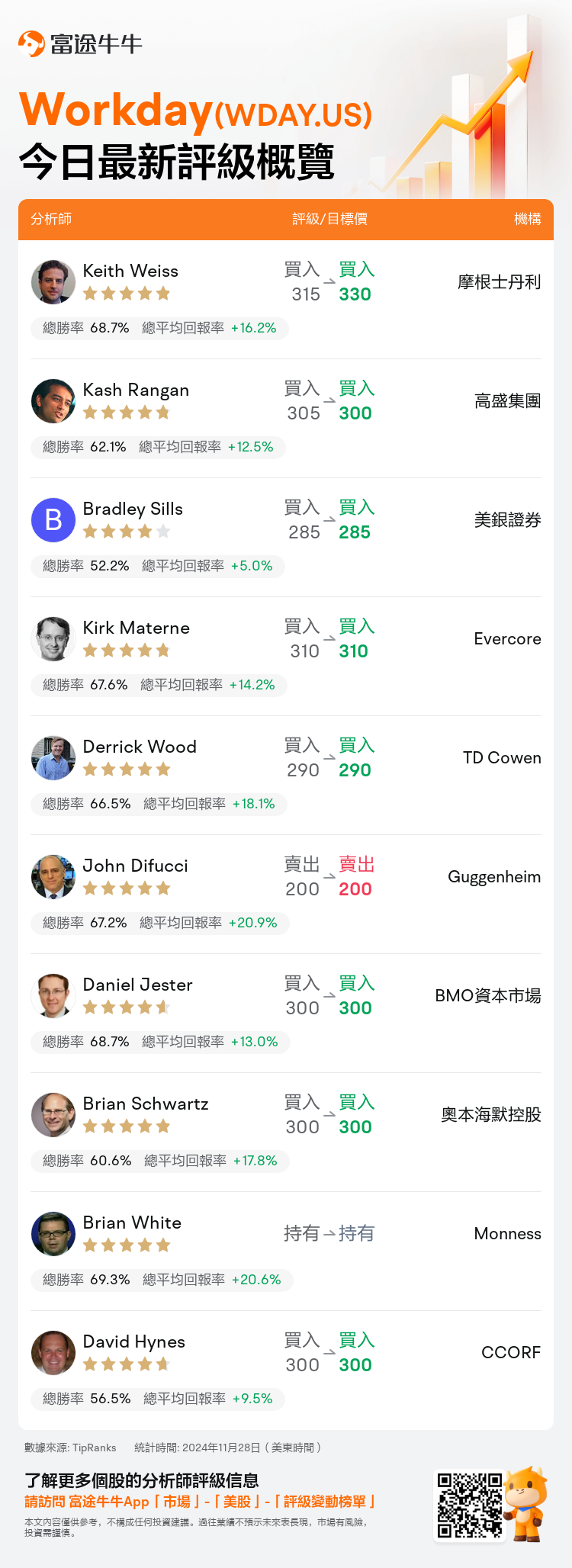

美東時間11月28日,多家華爾街大行更新了$Workday (WDAY.US)$的評級,目標價介於200美元至330美元。

摩根士丹利分析師Keith Weiss維持買入評級,並將目標價從315美元上調至330美元。

高盛集團分析師Kash Rangan維持買入評級,並將目標價從305美元下調至300美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價285美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價285美元。

Evercore分析師Kirk Materne維持買入評級,維持目標價310美元。

TD Cowen分析師Derrick Wood維持買入評級,維持目標價290美元。

此外,綜合報道,$Workday (WDAY.US)$近期主要分析師觀點如下:

Workday管理層最近將其中期展望從之前預計的FY26/FY27 15%下調至FY26 14%的訂閱營業收入增長,這可能會導致投資者信心大幅下降,支持看淡的觀點。然而,核心業務的內在實力以及從擴大解決方案區間進行追加銷售的潛力在當前市場價格下被認爲被低估。

Workday的第四季度和FY26預測被認爲不令人滿意,這主要可以通過一些獨特因素來解釋。如果不考慮這些因素,中期增長軌跡保持在中位數十幾,並且年度利潤率穩步提高200個點子也依然有效。儘管FY26的展望下調,但評估認爲,在信息披露後的市場反應背景下,財務模型中的風險已經顯著降低,預計FY26將增長14%。

分析師表示,公司的第三季度報告對股票而言是中立的,因爲穩健的表現被未來指引稍弱所平衡。盤後交易中的負面反應很可能受到公司展望再次下調的影響。相信這可能代表了預測的低點逐漸逼近。

Workday正在應對一個具有挑戰性但改善中的經濟環境,降低了其銷售收入的增長預期。它現在預計下一財年的訂閱營業收入增長爲14%,略低於之前的15%預測。在其多樣化的產品組合和客戶基礎的支持下,公司展現出的韌性使其能夠保持每年15%的中期訂閱營業收入增長目標。

以下爲今日10位分析師對$Workday (WDAY.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Bradley Sills維持買入評級,維持目標價285美元。

美銀證券分析師Bradley Sills維持買入評級,維持目標價285美元。

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $285.

BofA Securities analyst Bradley Sills maintains with a buy rating, and maintains the target price at $285.