Intel Unusual Options Activity

Intel Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Intel (NASDAQ:INTC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in INTC usually suggests something big is about to happen.

深謀遠慮的投資者對英特爾(納斯達克: INTC)採取了看淡態度,這是市場參與者不應忽視的。本質千金跟蹤了Benzinga公共期權記錄的信息,今天披露了這一重大動態。這些投資者的身份尚不明確,但在英特爾(INTC)中出現如此大規模的動態通常意味着有大事將要發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 17 extraordinary options activities for Intel. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這一信息,當Benzinga的期權掃描儀突出顯示了英特爾的17項非凡期權活動時,這一活動水平並非尋常。

The general mood among these heavyweight investors is divided, with 23% leaning bullish and 70% bearish. Among these notable options, 5 are puts, totaling $307,733, and 12 are calls, amounting to $497,995.

這些重量級投資者中普遍情緒分歧,23%持看漲態度,70%持看淡態度。在這些引人注目的期權中,5項爲看跌期權,總額爲$307,733,而12項爲看漲期權,總額爲$497,995。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $21.0 and $55.0 for Intel, spanning the last three months.

在評估交易量和持倉量後,顯而易見,主要的市場推動者正專注於英特爾的價格區間,在過去三個月內涵蓋了$21.0至$55.0。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

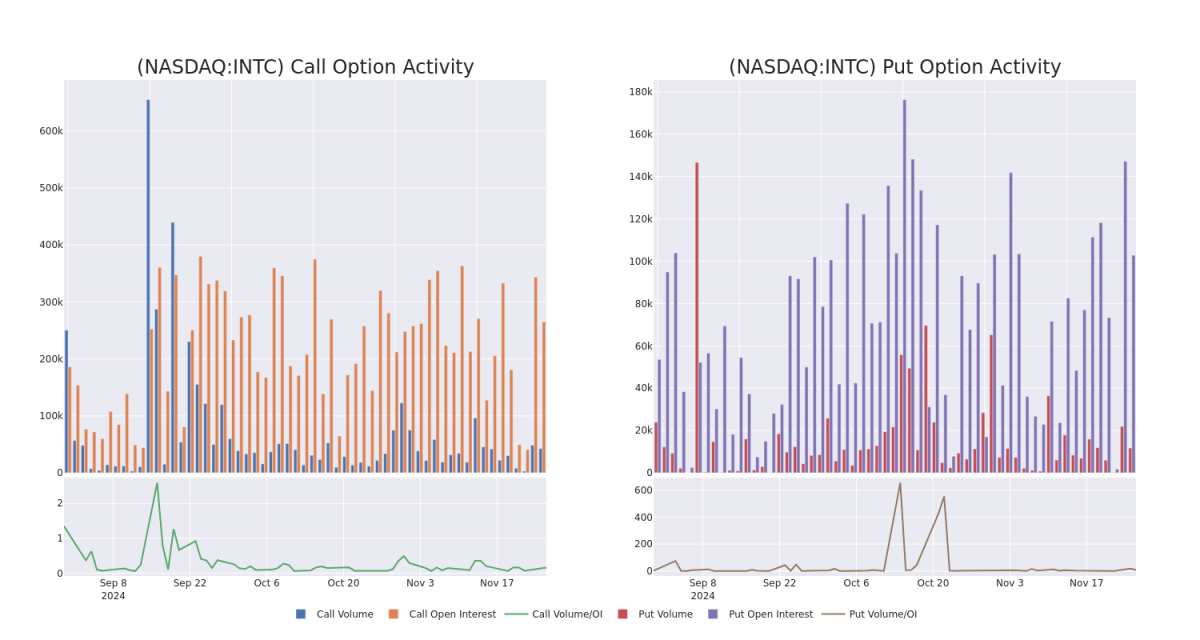

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Intel's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Intel's significant trades, within a strike price range of $21.0 to $55.0, over the past month.

檢查成交量和持倉量能夠爲股票研究提供關鍵見解。這些信息對於評估某些執行價格下英特爾期權的流動性和興趣水平至關重要。在下文中,我們介紹了過去一個月內英特爾重要交易的成交量和持倉量趨勢快照,範圍在$21.0至$55.0的執行價格區間內的看漲和看跌期權。

Intel Call and Put Volume: 30-Day Overview

英特爾看漲和看跌期權成交量:30天總覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | PUT | SWEEP | BEARISH | 02/21/25 | $1.94 | $1.92 | $1.94 | $23.00 | $97.0K | 4.3K | 521 |

| INTC | PUT | SWEEP | BEARISH | 03/21/25 | $31.4 | $30.85 | $31.24 | $55.00 | $74.9K | 0 | 24 |

| INTC | CALL | SWEEP | NEUTRAL | 01/15/27 | $6.75 | $6.45 | $6.3 | $25.00 | $65.1K | 4.4K | 105 |

| INTC | CALL | TRADE | BEARISH | 06/20/25 | $1.66 | $1.44 | $1.45 | $30.00 | $63.8K | 32.3K | 569 |

| INTC | PUT | SWEEP | BEARISH | 04/17/25 | $2.75 | $2.74 | $2.75 | $24.00 | $52.5K | 4.7K | 191 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 英特爾-t | 看跌 | SWEEP | 看淡 | 02/21/25 | $1.94每股 | $1.92 | $1.94每股 | $23.00 | $97.0K | 4.3千 | 521 |

| 英特爾-t | 看跌 | SWEEP | 看淡 | 03/21/25 | $31.4 | $30.85 | $31.24 | $55.00 | $74.9K | 0 | 24 |

| 英特爾-t | 看漲 | SWEEP | 中立 | 01/15/27 | $6.75 | $6.45 | $6.3 | $25.00 | $65.1K | 4.4K | 105 |

| 英特爾-t | 看漲 | 交易 | 看淡 | 06/20/25 | $1.66 | $1.44 | $1.45 | $30.00 | $63.8K應該是指成交量爲63,800股。 | 32.3K | 569 |

| 英特爾-t | 看跌 | SWEEP | 看淡 | 04/17/25 | $2.75 | $2.74 | $2.75 | $24.00 | $52.5K | 4.7K | 191 |

About Intel

關於英特爾

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

英特爾是一家領先的數字芯片製造商,專注於爲全球個人電腦和數據中心市場設計和製造微處理器。英特爾率先提出了微處理器的x86架構,並是Moore's law在半導體制造方面的主要支持者。英特爾在PC和服務器終端市場的中央處理單元方面保持市場份額領先地位。英特爾還擴展到了新的附加領域,如通信基礎設施、汽車和物聯網。此外,英特爾希望利用其芯片製造能力進入外包晶圓廠模式,在此模式下爲他人構建芯片。

Following our analysis of the options activities associated with Intel, we pivot to a closer look at the company's own performance.

在分析與英特爾相關的期權活動之後,我們將轉向更仔細地觀察公司的表現。

Current Position of Intel

英特爾的現狀

- With a volume of 16,234,689, the price of INTC is down -2.81% at $23.38.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 57 days.

- 成交量爲16,234,689,英特爾股價下跌了-2.81%,報23.38美元。

- RSI指標暗示該股票可能要超買了。

- 下一次業績公佈還有57天。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $21.0 and $55.0 for Intel, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $21.0 and $55.0 for Intel, spanning the last three months.