TOYO (NASDAQ:TOYO) Has A Somewhat Strained Balance Sheet

TOYO (NASDAQ:TOYO) Has A Somewhat Strained Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that TOYO Co., Ltd. (NASDAQ:TOYO) does use debt in its business. But the real question is whether this debt is making the company risky.

有人说波动性而非债务是投资者思考风险的最佳方式,但华伦·巴菲特曾 famously 说过“波动性远不是风险的同义词”。所以似乎聪明的钱知道,债务——通常与破产有关——是评估一家公司风险时非常重要的因素。我们可以看到,TOYO Co., Ltd.(纳斯达克:TOYO)确实在其业务中使用了债务。但是,真正的问题是这笔债务是否使公司变得具有风险。

When Is Debt Dangerous?

债务何时有危险?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

当一个企业无法轻易履行债务和其他负债时,这些负债就变得有风险,无论是通过自由现金流还是以有吸引力的价格筹集资本。如果事情真的很糟糕,贷方可以控制这个企业。然而,更常见(但仍然代价高昂)的情况是,一家公司必须以廉价价格发行股票,永久稀释股东的权益,仅仅是为了稳定其资产负债表。当然,许多公司使用债务来推动增长,而没有任何负面影响。当我们考察债务水平时,首先考虑现金和债务水平的结合。

How Much Debt Does TOYO Carry?

TOYO负债有多少?

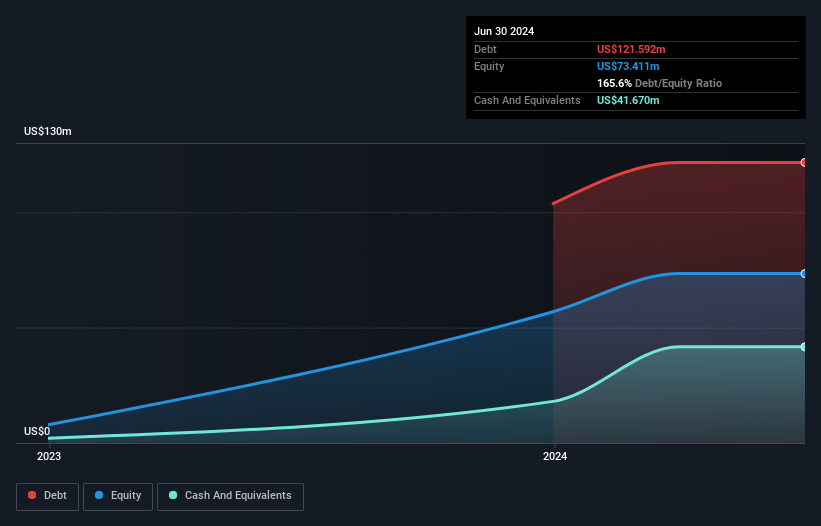

The image below, which you can click on for greater detail, shows that at June 2024 TOYO had debt of US$121.6m, up from none in one year. However, it does have US$41.7m in cash offsetting this, leading to net debt of about US$79.9m.

下图,您可以点击以查看更详细信息,显示截至2024年6月,TOYO的债务为12160万美元,比一年前增加了没有。然而,它有4170万美元的现金抵消这部分,从而导致净债务约为7990万美元。

How Healthy Is TOYO's Balance Sheet?

TOYO的资产负债表健康状况如何?

According to the last reported balance sheet, TOYO had liabilities of US$145.4m due within 12 months, and liabilities of US$22.6m due beyond 12 months. Offsetting these obligations, it had cash of US$41.7m as well as receivables valued at US$121.1k due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$126.2m.

根据最后报告的资产负债表,TOYO的负债为14540万美元,需在12个月内偿还,且有2260万美元的负债需在12个月之后偿还。 抵消这些义务的,是4170万美元的现金和12.11万美元的应收款,均需在12个月内收回。 因此,其负债比现金和(短期)应收款的总和多出12620万美元。

This deficit is considerable relative to its market capitalization of US$139.7m, so it does suggest shareholders should keep an eye on TOYO's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

这一赤字相对于其市场资本总值13970万美元而言相当可观,因此确实表明股东应关注TOYO的债务使用情况。 这表明如果公司急需提高资产负债表,就会严重稀释股东权益。

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

为了对公司的债务相对于其收益进行规模适应,我们计算其净债务与利息、税、折旧和摊销前收益(EBITDA)之比及其税前收益(EBIT)与利息支出之比(利息保障倍数)。因此,我们既考虑到不包括折旧和摊销费用在内的收益,又包括折旧和摊销费用的收益相对于债务。

With a debt to EBITDA ratio of 1.6, TOYO uses debt artfully but responsibly. And the alluring interest cover (EBIT of 7.4 times interest expense) certainly does not do anything to dispel this impression. Better yet, TOYO grew its EBIT by 573% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is TOYO's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

TOYO的债务与EBITDA比率为1.6,合理而巧妙地使用债务。而迷人的利息覆盖率(EBIT是利息支出的7.4倍)无疑加深了这种印象。 更好的是,TOYO去年EBIT增长了573%,这是一个令人印象深刻的改善。 这种增长将使其未来偿还债务更加容易。 在分析债务时,资产负债表显然是关注的重点。 但影响未来资产负债表表现的将是TOYO的盈利能力。 因此,如果您想了解更多关于其盈利的信息,查看这张长期盈利趋势图可能值得一试。

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last two years, TOYO saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

最后,业务需要自由现金流来偿还债务;会计利润不足以应对。因此,我们始终检查EBIT中有多少转化为自由现金流。 在过去两年中,TOYO的自由现金流总额显著为负。 虽然投资者无疑期待这种情况会在适当的时候逆转,但这显然意味着其债务使用风险更大。

Our View

我们的观点

TOYO's conversion of EBIT to free cash flow and level of total liabilities definitely weigh on it, in our esteem. But its EBIT growth rate tells a very different story, and suggests some resilience. Taking the abovementioned factors together we do think TOYO's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 5 warning signs we've spotted with TOYO (including 4 which are concerning) .

TOYO将EBIt转化为自由现金流的能力和总负债水平确实令我们深感忧虑。但是,它的EBIt增长率则显现出截然不同的情况,表明了一定的韧性。综合上述因素,我们确实认为TOYO的债务对其业务构成了一定风险。因此,虽然这种杠杆确实提升了股本回报率,但我们并不希望它在此基础上继续增加。在分析债务水平时,资产负债表显然是一个显而易见的起点。但归根结底,每个公司都可能存在资产负债表之外的风险。为此,你应该了解我们发现的TOYO的5个预警信号(其中4个令人担忧)。

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

当一切尘埃落定时,有时更容易专注于那些甚至不需要债务的公司。读者可以立即免费查看零净债务的成长股列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

译文内容由第三方软件翻译。

According to the last reported balance sheet, TOYO had liabilities of US$145.4m due within 12 months, and liabilities of US$22.6m due beyond 12 months. Offsetting these obligations, it had cash of US$41.7m as well as receivables valued at US$121.1k due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$126.2m.

According to the last reported balance sheet, TOYO had liabilities of US$145.4m due within 12 months, and liabilities of US$22.6m due beyond 12 months. Offsetting these obligations, it had cash of US$41.7m as well as receivables valued at US$121.1k due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$126.2m.