Top 3 Consumer Stocks That Are Set To Fly In Q4

Top 3 Consumer Stocks That Are Set To Fly In Q4

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消費不可或缺板塊中最被低估的公司股票出現了買入機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

Kohls Corp (NYSE:KSS)

科爾士公司 (紐交所: KSS)

- On Nov. 26, Kohl's shares are trading lower after the company reported worse-than-expected third-quarter results, cut its FY24 EPS guidance, and projected a net sales decrease of 7%-8%. Tom Kingsbury, Kohl's chief executive officer, said, "Our third quarter results did not meet our expectations as sales remained soft in our apparel and footwear businesses. Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies "R" Us shops in 200 of our stores, these were unable to offset the declines in our core business." The company's stock fell around 20% over the past month and has a 52-week low of $14.22.

- RSI Value: 26.35

- KSS Price Action: Shares of Kohls fell 17% to close at $15.22 on Tuesday.

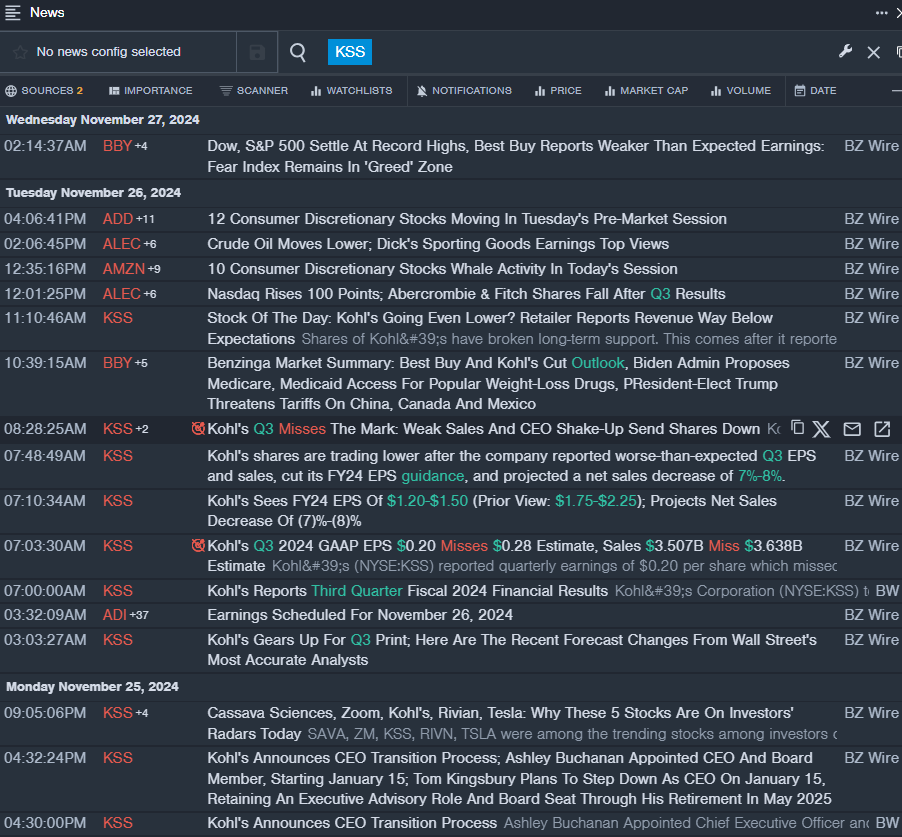

- Benzinga Pro's real-time newsfeed alerted to latest KSS news.

- 11月26日,科爾士的股票在公司公佈的第三季度業績差於預期,降低了2024財年的每股收益指導,並預計淨銷售額減少7%-8%後,股價下跌。科爾士首席執行官湯姆·金斯伯裏表示:「我們的第三季度業績未達到預期,因爲我們的服裝和鞋類業務銷售疲軟。儘管我們在包括Sephora、家居裝飾、禮品和衝動消費在內的關鍵增長領域表現強勁,並且還受益於在我們200家門店開設Babies "R" Us商店,但這些無法抵消我們核心業務的下降。」該公司股票在過去一個月下跌了約20%,52周低點爲$14.22。

- 相對強弱指數(RSI)值:26.35

- KSS價格動態:科爾士的股票在週二下跌17%,收盤價爲$15.22。

- Benzinga Pro的實時資訊提醒了最新的KSS資訊。

Honda Motor Co Ltd (NYSE:HMC)

本田汽車有限公司 (紐交所:HMC)

- On Nov. 6, Honda Motor reported a decline in the first-half profit and lowered its annual profit forecast. The company reported the first half of FY24 revenue growth of 12.4% year over year 10.798 trillion yen ($69.9 billion), while profits declined 19.7% to 494.6 billion Yen ($3.20 billion). The company's stock fell around 17% over the past month and has a 52-week low of $25.57.

- RSI Value: 25.03

- HMC Price Action: Shares of Honda fell 3% to close at $25.87 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in HMC stock.

- 11月6日,本田汽車報告了上半年的利潤下降,並下調了年度利潤預測。該公司報告2024財年上半年營業收入同比增長12.4%,達到10.798萬億日元($699億),而利潤下降19.7%,降至4946億日元($32億)。該公司股票在過去一個月中下跌了約17%,並且52周低點爲$25.57。

- 相對強弱指標值:25.03

- HMC價格走勢:本田股票週二下跌3%,收盤價爲$25.87。

- Benzinga Pro的圖表工具有助於識別HMC股票的趨勢。

PDD Holdings Inc – ADR (NASDAQ:PDD)

PDD Holdings Inc – ADR (納斯達克:PDD)

- On Nov. 21, PDD Holdings reported worse-than-expected third-quarter financial results. PDD reported fiscal third-quarter 2024 revenue growth of 44% year-on-year to $14.16 billion (68.84 billion Chinese yuan), missing the analyst consensus estimate of $14.47 billion. The company's stock fell around 21% over the past month and has a 52-week low of $88.01.

- RSI Value: 29.89

- PDD Price Action: Shares of PDD fell 1.4% to close at $99.31 on Tuesday.

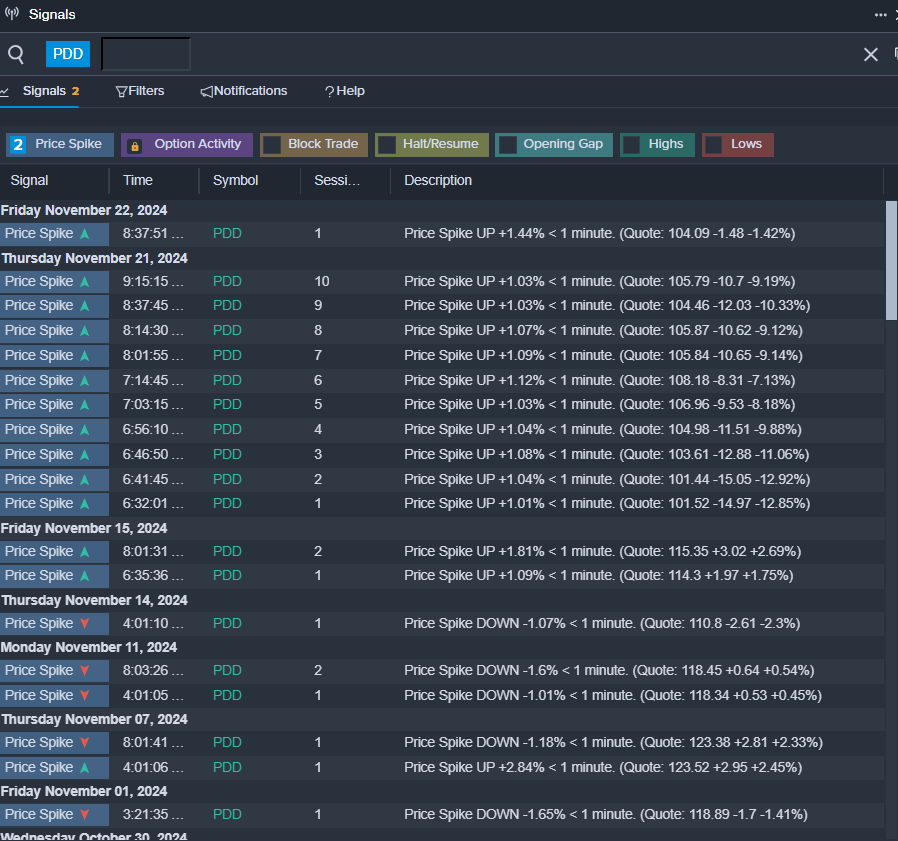

- Benzinga Pro's signals feature notified of a potential breakout in PDD shares.

- 在11月21日,pdd holdings報告了第三季度財務業績不如預期。pdd報告2024財年第三季度營業收入同比增長44%,達到141.6億(688.4億人民幣),未能達到分析師共識預測的144.7億。該公司的股票在過去一個月下跌了約21%,並且創下52周低點爲88.01美元。

- RSI 值:29.89

- pdd股價動態:pdd的股票在週二下跌1.4%,收於99.31美元。

- Benzinga Pro的信號功能提醒可能在pdd股票中出現突破。

Read More:

閱讀更多:

- Jim Cramer: Linde Is A 'Terrific' Company, Sees Another Stock Up 75% As 'Not Done'

- 吉姆·克萊默:linde是一家「優秀」的公司,認爲另一隻股票上漲75%還「沒有結束」

譯文內容由第三人軟體翻譯。