IBM Unusual Options Activity For November 26

IBM Unusual Options Activity For November 26

Financial giants have made a conspicuous bearish move on IBM. Our analysis of options history for IBM (NYSE:IBM) revealed 18 unusual trades.

金融巨頭在IBM上進行了明顯的看淡操作。我們分析了IBM(紐交所:IBM)期權歷史,發現18筆異常交易。

Delving into the details, we found 38% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $339,800, and 14 were calls, valued at $810,114.

深入細節,我們發現38%的交易者看漲,而50%顯示看淡傾向。在所有發現的交易中,有4筆看跌,價值339,800美元,有14筆看漲,價值810,114美元。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $185.0 to $300.0 for IBM over the last 3 months.

考慮到這些合約的成交量和未平倉合約數量,似乎大戶在過去3個月裏一直將IBM的價格區間鎖定在185.0至300.0美元之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for IBM's options for a given strike price.

這些數據可以幫助您追蹤IBM的期權在特定行權價的流動性和興趣。

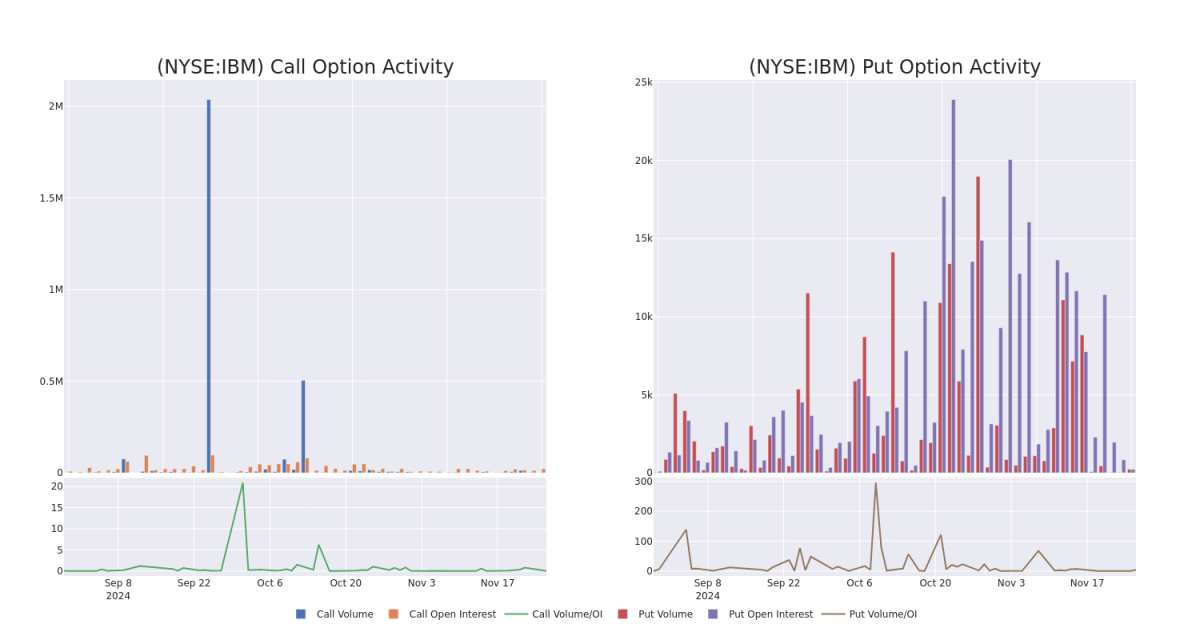

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of IBM's whale activity within a strike price range from $185.0 to $300.0 in the last 30 days.

下面,我們可以觀察過去30天內所有IBM大戶活動的看漲和看跌的成交量和未平倉合約數量的演變,行權價範圍從185.0美元到300.0美元。

IBM Call and Put Volume: 30-Day Overview

IBM看漲和看跌成交量:30天概覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | PUT | SWEEP | BEARISH | 01/16/26 | $27.75 | $27.7 | $27.75 | $240.00 | $249.7K | 119 | 104 |

| IBM | CALL | SWEEP | BULLISH | 01/16/26 | $41.45 | $40.95 | $41.0 | $200.00 | $196.8K | 2.5K | 1 |

| IBM | CALL | SWEEP | BEARISH | 03/21/25 | $23.7 | $23.7 | $23.7 | $210.00 | $85.3K | 655 | 48 |

| IBM | CALL | SWEEP | BEARISH | 11/29/24 | $6.65 | $6.25 | $6.25 | $220.00 | $62.5K | 576 | 144 |

| IBM | CALL | SWEEP | BEARISH | 01/17/25 | $6.05 | $5.85 | $5.9 | $230.00 | $59.0K | 2.9K | 26 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | 看跌 | SWEEP | 看淡 | 01/16/26 | $27.75 | $27.7 | $27.75 | $240.00 | $249.7K | 119 | 104 |

| IBM | 看漲 | SWEEP | BULLISH | 01/16/26 | $41.45 | $40.95 | $41.0 | $200.00 | $196.8K | 2.5K | 1 |

| IBM | 看漲 | SWEEP | 看淡 | 03/21/25 | $23.7 | $23.7 | $23.7 | $210.00 | $85.3K | 655 | 48 |

| IBM | 看漲 | SWEEP | 看淡 | 11/29/24 | $6.65 | 6.25美元 | 6.25美元 | $220.00 | $62.5K | 576 | 144 |

| IBM | 看漲 | SWEEP | 看淡 | 01/17/25 | $6.05 | $5.85 | $5.9 | $230.00 | 59.0千美元 | 2.9K | 26 |

About IBM

關於IBM:IBM是全球領先的混合雲、人工智能和諮詢專家提供商。我們幫助客戶在175多個國家利用自己的數據洞見,簡化業務流程,降低成本,並在各自的行業中獲得競爭優勢。超過4,000家金融服務、電信和醫療保健等重要基礎設施領域的政府和企業實體依靠IBM的混合雲平台和Red Hat OpenShift,快速、高效且安全地實現數字化轉型。IBM在人工智能、量子計算、行業專用的雲解決方案和諮詢方面的突破性創新爲客戶提供了開放和靈活的選擇。所有這些都得到IBM長期承諾的信任、透明、責任、包容和服務的支持。訪問ibm.com了解更多信息。

IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients, which includes 95% of all Fortune 500. While IBM is a B2B company, IBM's outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

IBM看起來是企業IT需求的重要組成部分。該公司主要銷售軟件、IT服務、諮詢和硬件。 IBM在175個國家開展業務,僱用了大約35萬人。該公司擁有強大的80000個商業夥伴陣容,服務於5200個客戶,其中包括所有財富500強企業的95%。儘管IBM是一家B2B公司,但其外部影響力巨大。例如,IBM每天處理全球90%的信用卡交易,並負責世界上50%的所有無線連接。

Where Is IBM Standing Right Now?

IBM目前處於什麼位置?

- With a trading volume of 1,344,450, the price of IBM is down by -0.06%, reaching $225.99.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 57 days from now.

- 交易量爲1,344,450股,IBM的價格下跌了-0.06%,達到225.99美元。

- 目前的RSI值表明該股票目前處於超買和超賣之間的中立狀態。

- 下一個業績將在57天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for IBM with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易者通過持續教育、戰略交易調整、利用各種因子以及保持對市場動態的敏感來減輕這些風險。通過Benzinga Pro實時警報,了解IBm的最新期權交易。

譯文內容由第三人軟體翻譯。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.