C3.ai Unusual Options Activity

C3.ai Unusual Options Activity

Financial giants have made a conspicuous bullish move on C3.ai. Our analysis of options history for C3.ai (NYSE:AI) revealed 22 unusual trades.

金融巨頭們在c3.ai上做出了明顯的看好舉動。我們對c3.ai(紐交所:AI)期權歷史的分析揭示了22筆飛凡的交易。

Delving into the details, we found 50% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $307,758, and 16 were calls, valued at $873,710.

深入細節,我們發現50%的交易者看好,而45%顯示出看淡的傾向。在我們發現的所有交易中,有6筆爲看跌期權,價值307,758美元,16筆爲看漲期權,價值873,710美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $55.0 for C3.ai over the recent three months.

根據交易活動,重大投資者似乎瞄準了c3.ai在最近三個月內的價格區間,從10.0美元到55.0美元。

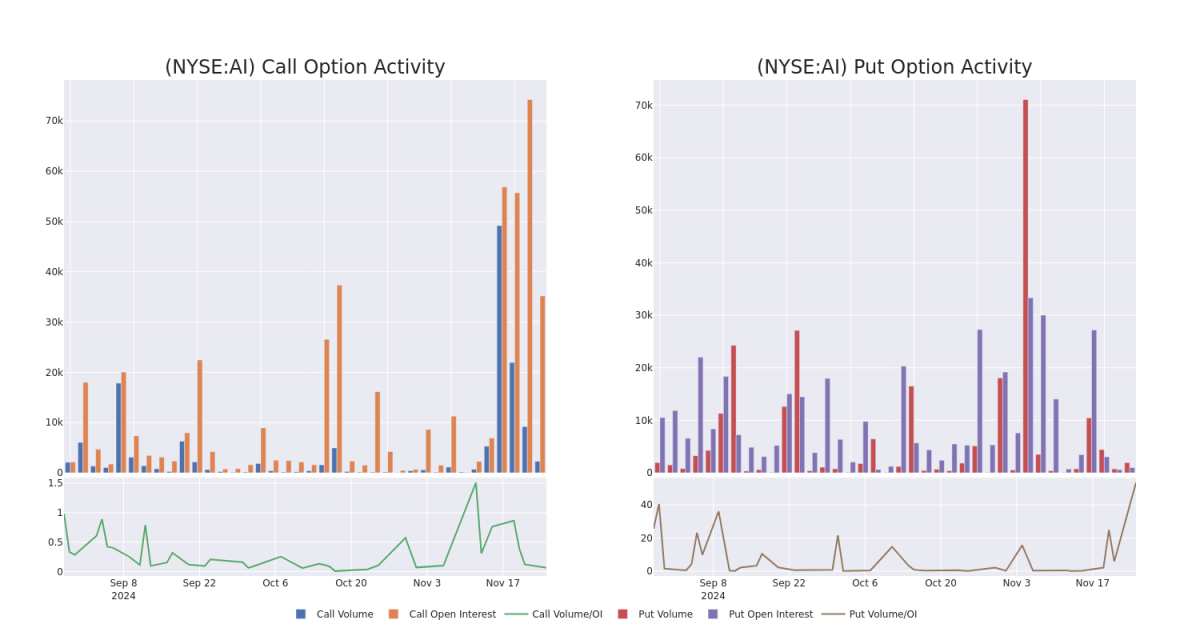

Volume & Open Interest Trends

成交量和未平倉量趨勢

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for C3.ai's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across C3.ai's significant trades, within a strike price range of $10.0 to $55.0, over the past month.

檢查成交量和未平倉合約提供了對股票研究的重要洞察。這些信息是評估c3.ai在某些行權價的期權流動性和興趣水平的關鍵。以下是過去一個月c3.ai重要交易中看漲期權和看跌期權的成交量和未平倉合約趨勢快照,行權價區間爲10.0美元到55.0美元。

C3.ai Call and Put Volume: 30-Day Overview

C3.ai的看漲和看跌期權成交量:30日概述

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AI | CALL | TRADE | BEARISH | 01/17/25 | $2.14 | $1.87 | $1.9 | $50.00 | $152.0K | 6.6K | 856 |

| AI | PUT | SWEEP | BEARISH | 04/17/25 | $4.3 | $4.25 | $4.3 | $35.00 | $126.4K | 367 | 332 |

| AI | CALL | TRADE | BULLISH | 01/17/25 | $29.05 | $28.35 | $28.88 | $10.00 | $115.5K | 436 | 40 |

| AI | CALL | SWEEP | BEARISH | 01/16/26 | $21.95 | $21.4 | $21.4 | $20.00 | $85.6K | 1.3K | 145 |

| AI | CALL | SWEEP | BEARISH | 01/16/26 | $21.55 | $21.2 | $21.2 | $20.00 | $80.5K | 1.3K | 65 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 人工智能 | 看漲 | 交易 | 看淡 | 01/17/25 | $2.14 | $1.87 | $1.9 | $50.00 | $152.0K | 6,600份 | 856 |

| 人工智能 | 看跌 | SWEEP | 看淡 | 04/17/25 | $4.3 | $4.25 | $4.3 | $35.00 | 126.4千美元 | 367 | 332 |

| 人工智能 | 看漲 | 交易 | BULLISH | 01/17/25 | $29.05 | $28.35 | $28.88 | $10.00 | 115.5千美元 | 436 | 40 |

| 人工智能 | 看漲 | SWEEP | 看淡 | 01/16/26 | $21.95 | $21.4 | $21.4 | $20.00 | $85.6K | 1.3千 | 145 |

| 人工智能 | 看漲 | SWEEP | 看淡 | 01/16/26 | $21.55 | $21.2 | $21.2 | $20.00 | $80.5K | 1.3千 | 65 |

About C3.ai

關於c3.ai

C3.ai Inc is an enterprise artificial intelligence company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. It provides solutions under three divisions namely, The C3 AI Platform, which is an end-to-end application development and runtime environment for designing, developing, and deploying AI applications: C3 AI Applications, which is a portfolio of pre-built, extensible, industry-specific, and application-specific Enterprise AI applications: and C3 Generative AI, which combines the utility of large language models. Geographically the company derives revenue from North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of the World.

c3.ai是一家企業人工智能公司。該公司提供軟件即服務應用程序,使客戶能夠在任何基礎設施上快速開發、部署和運營大規模企業人工智能應用。它在三個部門下提供解決方案,即c3.ai平台,這是一個端到端的應用程序開發和運行時環境,用於設計、開發和部署人工智能應用程序:c3 ai應用程序,這是一個預構建的、可擴展的、行業特定的和應用特定的企業人工智能應用程序組合:以及c3生成式人工智能,它結合了大型語言模型的實用性。從地理上看,該公司的營業收入來自北美、歐洲、中東和非洲、亞太地區以及其他地區。

After a thorough review of the options trading surrounding C3.ai, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對c3.ai周圍的期權交易進行全面審查後,我們開始更詳細地審查該公司。這包括對其當前市場狀況和業績的評估。

C3.ai's Current Market Status

c3.ai的當前市場狀況

- Trading volume stands at 5,276,663, with AI's price up by 5.29%, positioned at $39.4.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 14 days.

- 成交量爲5,276,663,人工智能的價格上漲5.29%,位於39.4美元。

- RSI指示股票可能已超買。

- 預計在14天內公佈收益聲明。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for C3.ai with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高收益的潛力。聰明的交易者通過持續的教育、戰略性的交易調整、利用各種因子以及緊跟市場動態來降低這些風險。通過Benzinga Pro獲取c3.ai的最新期權交易,以便實時獲取提醒。

譯文內容由第三人軟體翻譯。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for C3.ai's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across C3.ai's significant trades, within a strike price range of $10.0 to $55.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for C3.ai's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across C3.ai's significant trades, within a strike price range of $10.0 to $55.0, over the past month.