Is There Now An Opportunity In Tronox Holdings Plc (NYSE:TROX)?

Is There Now An Opportunity In Tronox Holdings Plc (NYSE:TROX)?

Tronox Holdings plc (NYSE:TROX), might not be a large cap stock, but it saw a decent share price growth of 13% on the NYSE over the last few months. Shareholders may appreciate the recent price jump, but the company still has a way to go before reaching its yearly highs again. As a stock with high coverage by analysts, you could assume any recent changes in the company's outlook is already priced into the stock. However, could the stock still be trading at a relatively cheap price? Let's examine Tronox Holdings's valuation and outlook in more detail to determine if there's still a bargain opportunity.

Tronox Holdings plc(紐約證券交易所代碼:TROX)可能不是大盤股,但在過去幾個月中,紐約證券交易所的股價上漲了13%。股東們可能會對最近的價格上漲表示讚賞,但該公司在再次達到年度高點之前還有很長的路要走。作爲一隻受分析師高度關注的股票,你可以假設該公司前景的任何最近變化都已計入該股。但是,該股票還能以相對便宜的價格交易嗎?讓我們更詳細地研究Tronox Holdings的估值和前景,以確定是否還有討價還價的機會。

Is Tronox Holdings Still Cheap?

Tronox Holdings 還便宜嗎?

Tronox Holdings appears to be expensive according to our price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average. We've used the price-to-earnings ratio in this instance because there's not enough visibility to forecast its cash flows. The stock's ratio of 46.21x is currently well-above the industry average of 22.78x, meaning that it is trading at a more expensive price relative to its peers. But, is there another opportunity to buy low in the future? Given that Tronox Holdings's share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

根據我們的價格倍數模型,Tronox Holdings似乎很昂貴,該模型將公司的市盈率與行業平均水平進行了比較。我們在這個例子中使用市盈率是因爲沒有足夠的可見性來預測其現金流。該股的46.21倍比率目前遠高於行業平均水平的22.78倍,這意味着與同行相比,其交易價格更昂貴。但是,未來還有其他低價買入的機會嗎?鑑於Tronox Holdings的股票波動相當大(即其價格相對於其他市場的價格變動被放大),這可能意味着價格可能會下跌,從而爲我們提供未來又一次買入的機會。這是基於其高貝塔值,這是衡量股價波動的良好指標。

What does the future of Tronox Holdings look like?

Tronox Holdings的未來是什麼樣子?

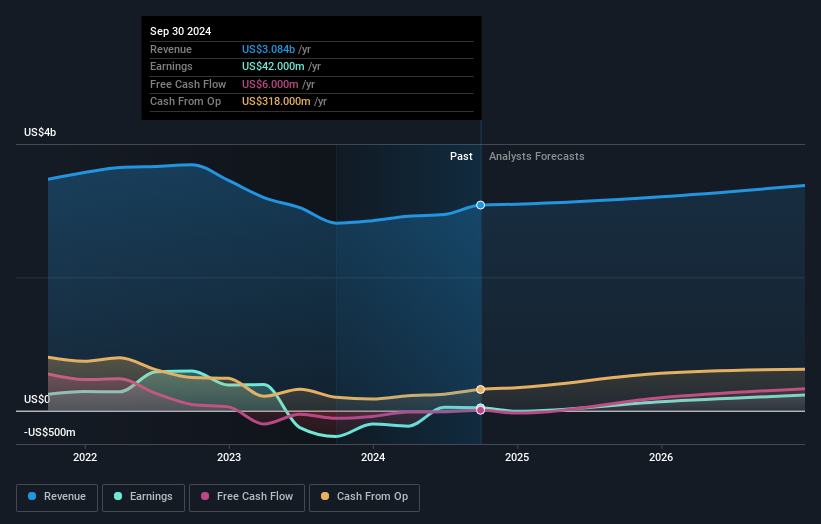

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it's the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. With profit expected to more than double over the next couple of years, the future seems bright for Tronox Holdings. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

尋求投資組合增長的投資者可能需要在購買公司股票之前考慮公司的前景。儘管價值投資者會爭辯說,最重要的是相對於價格的內在價值,但更有說服力的投資論點是以低廉的價格獲得高增長潛力。預計未來幾年利潤將增加一倍以上,Tronox Holdings的前景似乎一片光明。看來該股的現金流即將增加,這應該會促進更高的股票估值。

What This Means For You

這對你意味着什麼

Are you a shareholder? It seems like the market has well and truly priced in TROX's positive outlook, with shares trading above industry price multiples. At this current price, shareholders may be asking a different question – should I sell? If you believe TROX should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. But before you make this decision, take a look at whether its fundamentals have changed.

你是股東嗎?在TROX的樂觀前景下,市場的定價似乎確實不錯,股票的交易價格高於行業價格倍數。按照目前的價格,股東們可能會問另一個問題——我應該賣出嗎?如果您認爲TROX的交易價格應低於其當前價格,那麼高價賣出並在其價格跌至行業市盈率時再次回購可能會有利可圖。但是在做出這個決定之前,先看看它的基本面是否發生了變化。

Are you a potential investor? If you've been keeping an eye on TROX for a while, now may not be the best time to enter into the stock. The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. However, the optimistic prospect is encouraging for TROX, which means it's worth diving deeper into other factors in order to take advantage of the next price drop.

你是潛在的投資者嗎?如果你關注TROX已有一段時間了,那麼現在可能不是入股的最佳時機。該價格已經超過了業內同行,這意味着錯誤定價可能沒有更多的上行空間。但是,對於TROX來說,樂觀的前景令人鼓舞,這意味着值得深入研究其他因素,以便利用下一次價格下跌的機會。

If you want to dive deeper into Tronox Holdings, you'd also look into what risks it is currently facing. Case in point: We've spotted 2 warning signs for Tronox Holdings you should be aware of.

如果你想更深入地研究Tronox Holdings,你還需要研究它目前面臨的風險。一個很好的例子:我們已經發現了Tronox Holdings的兩個警告信號,你應該注意了。

If you are no longer interested in Tronox Holdings, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

如果您不再對Tronox Holdings感興趣,可以使用我們的免費平台查看我們列出的其他50多隻具有高增長潛力的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎?直接聯繫我們。或者,發送電子郵件給編輯組(網址爲)simplywallst.com。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

譯文內容由第三人軟體翻譯。