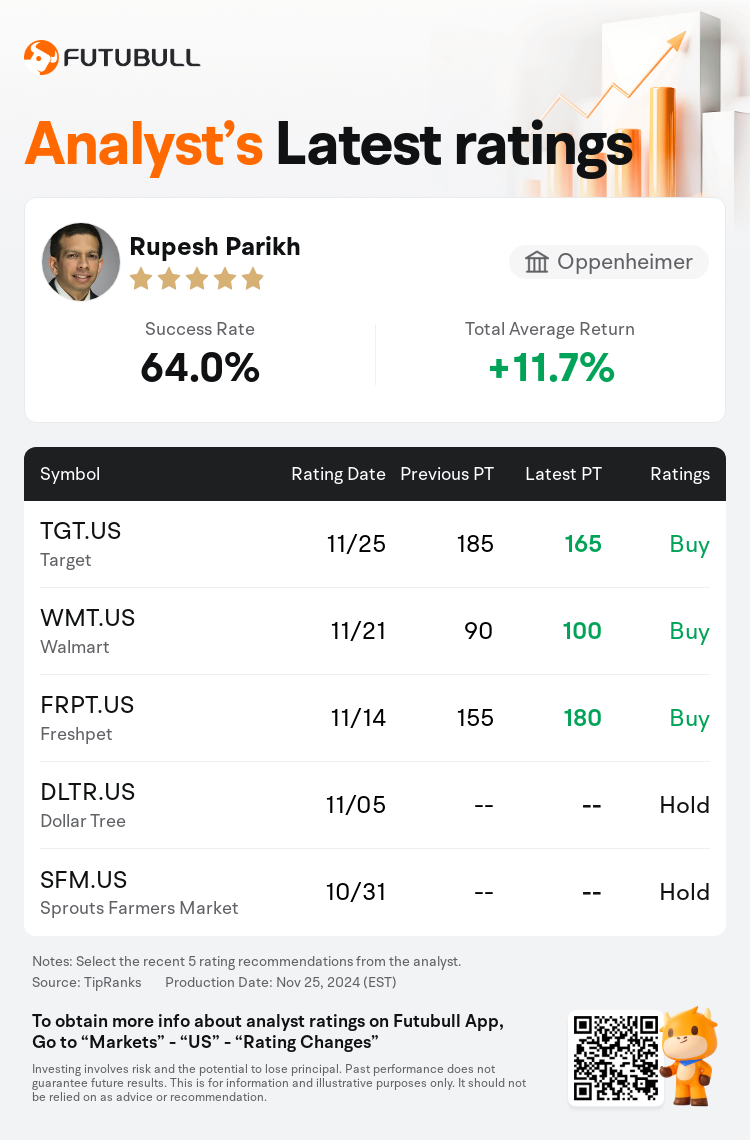

Oppenheimer analyst Rupesh Parikh maintains $Target (TGT.US)$ with a buy rating, and adjusts the target price from $185 to $165.

According to TipRanks data, the analyst has a success rate of 64.0% and a total average return of 11.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Target (TGT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Target (TGT.US)$'s main analysts recently are as follows:

Following the company's disappointing Q3 earnings and subdued forward guidance, expectations have been adjusted for ongoing challenges in Q4. The projection for a steady Q4 in sales underscores a persistent sluggishness in discretionary spending and calendar influences. It is anticipated that the cost challenges experienced in Q3 will continue to affect performance in the upcoming quarter.

Target's Q3 results underperformed in terms of margins, primarily due to an accumulation of inventories based on early receipts, and an intensified discounting strategy. This situation was further exacerbated by a higher proportion of sales occurring during promotional periods, coupled with challenges posed by unseasonably warm weather affecting apparel sales. Analysts acknowledge that while these may be mostly cyclical headwinds, the responsibility to demonstrate resilience lies with the company.

Target needs to address negative trends in home, apparel, and hardlines, improve digital channel profitability, and ensure consistency outside of seasonal or promotional periods.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

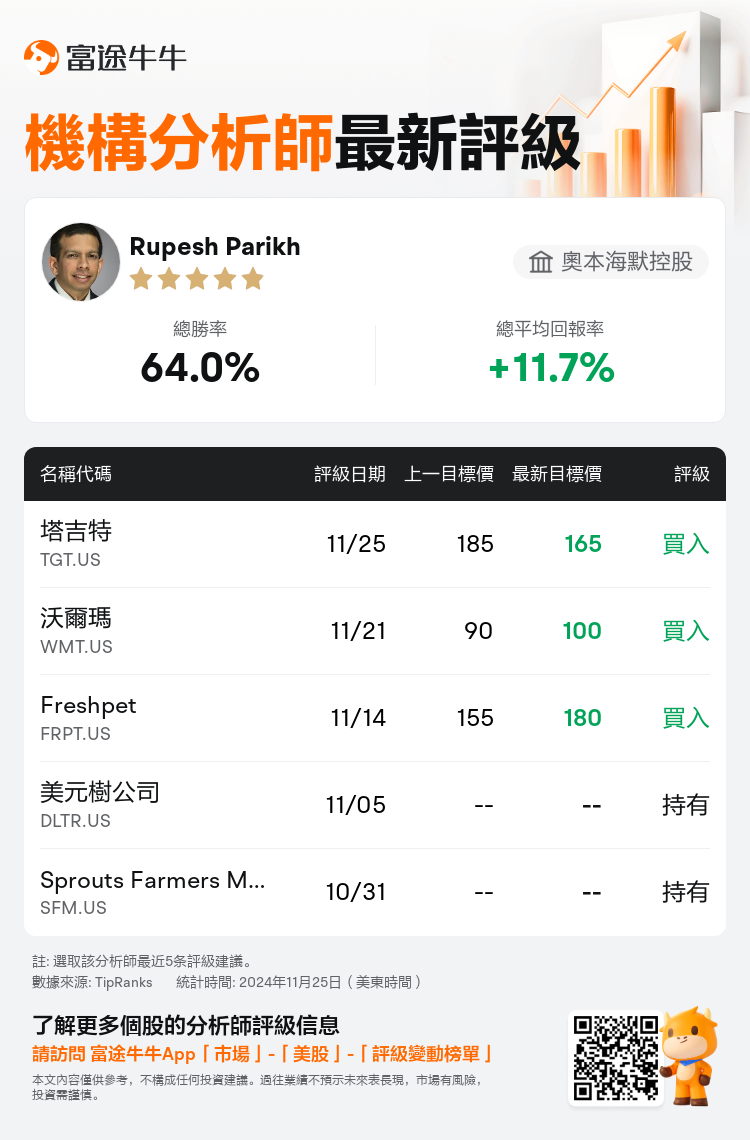

奧本海默控股分析師Rupesh Parikh維持$塔吉特 (TGT.US)$買入評級,並將目標價從185美元下調至165美元。

根據TipRanks數據顯示,該分析師近一年總勝率為64.0%,總平均回報率為11.7%。

此外,綜合報道,$塔吉特 (TGT.US)$近期主要分析師觀點如下:

此外,綜合報道,$塔吉特 (TGT.US)$近期主要分析師觀點如下:

在公司令人失望的第三季度業績和保守的未來展望之後,人們已經調整了對第四季度持續挑戰的預期。對銷售穩健的第四季度的預測凸顯出自由支出和日曆影響方面持續的蕭條。預計第三季度所經歷的成本挑戰將繼續影響未來一個季度的表現。

由於早期收據的庫存積累和加大折扣策略,Target的第三季度利潤率表現低於預期。這種情況進一步加劇了銷售主要發生在促銷期間的現象,加上不合時宜的溫暖天氣對服裝銷售造成的挑戰。分析師們承認,雖然這些問題可能主要是週期性的逆風,但公司有責任展現出韌性。

Target需要解決家居、服裝和硬裝品類的負面趨勢,提升數字渠道的盈利能力,並確保在非季節性或促銷期間保持一致。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$塔吉特 (TGT.US)$近期主要分析師觀點如下:

此外,綜合報道,$塔吉特 (TGT.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of