A Closer Look at Wells Fargo's Options Market Dynamics

A Closer Look at Wells Fargo's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Wells Fargo.

有很多资金的鲸鱼已经明显看好富国银行。

Looking at options history for Wells Fargo (NYSE:WFC) we detected 10 trades.

查看威尔斯法戈(纽交所:WFC)的期权历史,我们发现了10笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 40% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,50%的投资者以看好的预期进行交易,40%则是看淡的。

From the overall spotted trades, 4 are puts, for a total amount of $459,983 and 6, calls, for a total amount of $1,644,858.

从所有发现的交易中,有4笔看跌期权,总金额为459,983美元,6笔看涨期权,总金额为1,644,858美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $70.0 to $105.0 for Wells Fargo during the past quarter.

分析这些合约的成交量和未平仓合约,似乎大型玩家在过去一季度关注威尔斯法戈的价格区间为70.0美元至105.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

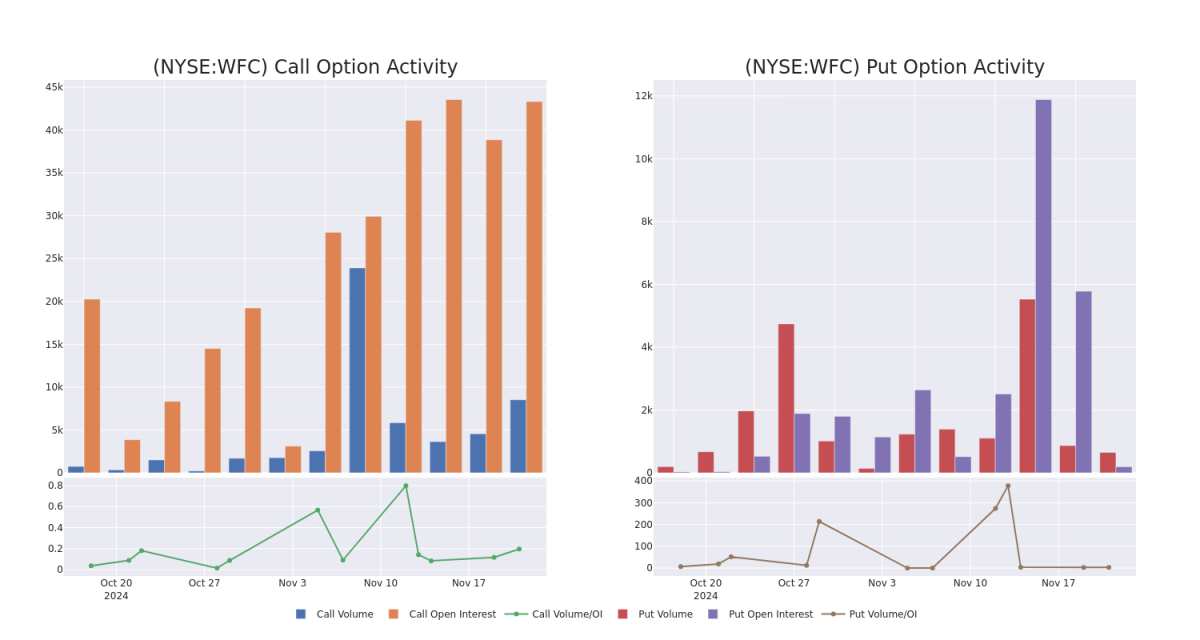

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Wells Fargo's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wells Fargo's whale trades within a strike price range from $70.0 to $105.0 in the last 30 days.

查看成交量和未平仓合约是进行期权交易的一个强有力的步骤。这些数据可以帮助您跟踪威尔斯法戈在特定执行价格的期权的流动性和兴趣。以下,我们可以观察到过去30天内威尔斯法戈所有鲸鱼交易在70.0美元到105.0美元的执行价格区间内的看涨和看跌期权的成交量和未平仓合约的演变。

Wells Fargo Option Volume And Open Interest Over Last 30 Days

富国银行过去30天的期权成交量和持仓量

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | TRADE | NEUTRAL | 01/17/25 | $2.62 | $2.58 | $2.6 | $77.50 | $1.0M | 10.1K | 4.1K |

| WFC | CALL | SWEEP | BULLISH | 01/17/25 | $1.65 | $1.63 | $1.65 | $80.00 | $430.2K | 15.4K | 2.6K |

| WFC | PUT | SWEEP | BULLISH | 01/15/27 | $9.25 | $9.05 | $9.05 | $72.50 | $161.9K | 793 | 179 |

| WFC | PUT | TRADE | BEARISH | 01/16/26 | $30.15 | $29.35 | $29.97 | $105.00 | $149.8K | 100 | 50 |

| WFC | PUT | TRADE | BULLISH | 12/06/24 | $5.1 | $4.9 | $4.92 | $80.00 | $98.4K | 222 | 200 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | 看涨 | 交易 | 中立 | 01/17/25 | $2.62 | $2.58 | $2.6 | $77.50 | $1.0M | 10.1K | 4.1千 |

| WFC | 看涨 | SWEEP | BULLISH | 01/17/25 | $1.65 | $1.63 | $1.65 | $80.00 | 430.2千美元 | 15.4K | 2.6千 |

| WFC | 看跌 | SWEEP | BULLISH | 01/15/27 | 9.25美元 | $9.05 | $9.05 | $72.50 | $161.9K | 793 | 179 |

| WFC | 看跌 | 交易 | 看淡 | 01/16/26 | $30.15 | $29.35 | $29.97 | $105.00 | 149.8K美元 | 100 | 50 |

| WFC | 看跌 | 交易 | BULLISH | 12/06/24 | $5.1 | $4.9 | $4.92 | $80.00 | $98.4K | 222 | 200 |

About Wells Fargo

关于富国银行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富国银行是美国最大的银行之一,资产负债表资产约为1.9万亿美元。该公司有四个主要业务板块:消费银行、商业银行、公司和投资银行以及财富和投资管理。它几乎完全专注于美国市场。

After a thorough review of the options trading surrounding Wells Fargo, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对富国银行期权交易的彻底审查,我们转而对公司进行更详细的研究。这包括对其当前的市场地位和表现的评估。

Wells Fargo's Current Market Status

Wells Fargo的当前市场状况

- Trading volume stands at 6,445,834, with WFC's price up by 1.14%, positioned at $75.68.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 54 days.

- 交易量为6,445,834,WFC的价格上涨了1.14%,现报75.68美元。

- RSI指示股票可能已超买。

- 预计将在54天内宣布盈利。

What Analysts Are Saying About Wells Fargo

关于Wells Fargo的分析师评论

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $79.5.

在过去一个月中,2位行业分析师分享了他们对这只股票的见解,提出了平均目标价为79.5美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Citigroup has decided to maintain their Neutral rating on Wells Fargo, which currently sits at a price target of $82. * Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Wells Fargo with a target price of $77.

Benzinga Edge的期权异动板块在市场动向发生之前发现潜在的市场动因。查看大资金在您喜欢的股票上的持仓。点击这里获取访问权限。* 花旗集团的一位分析师决定维持对富国银行的中立评级,当前目标价为82美元。* 来自evercore ISI集团的一位分析师在对富国银行的评估中保持跑赢市场评级,目标价为77美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wells Fargo options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。敏锐的交易者通过持续教育自己、调整策略、监控多种因子并密切关注市场走势来管理这些风险。通过Benzinga Pro实时警报,了解最新的Wells Fargo期权交易信息。

译文内容由第三方软件翻译。

From the overall spotted trades, 4 are puts, for a total amount of $459,983 and 6, calls, for a total amount of $1,644,858.

From the overall spotted trades, 4 are puts, for a total amount of $459,983 and 6, calls, for a total amount of $1,644,858.